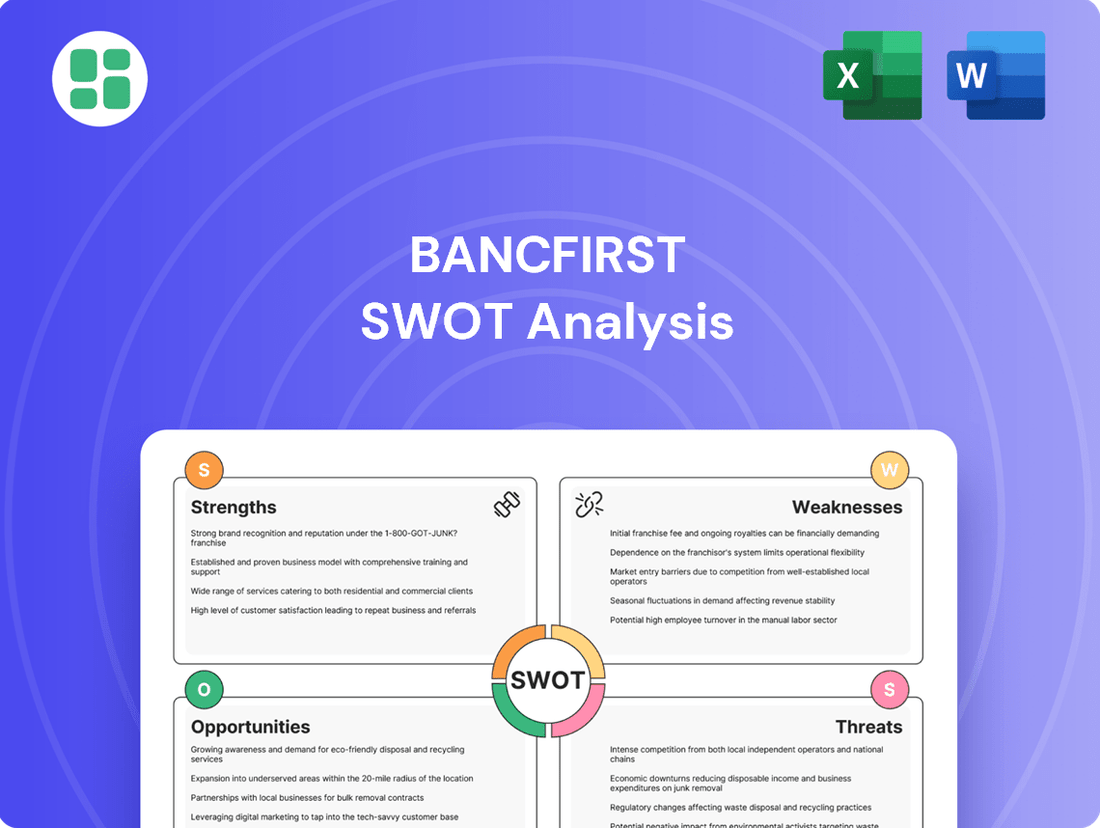

BancFirst SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BancFirst Bundle

BancFirst demonstrates a solid market presence driven by its strong community focus and diversified product offerings, but faces evolving digital banking trends and increasing competition. Understanding these dynamics is crucial for navigating its future success.

Want the full story behind BancFirst's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BancFirst Corporation has showcased impressive financial strength, with net income rising to $71.9 million in Q1 2025 and $74.1 million in Q2 2025, up from $62.5 million and $65.8 million respectively in the prior year. This consistent growth is fueled by a substantial increase in loan volumes and a strategic expansion of earning assets, reflecting a robust and expanding revenue stream.

The company's profitability is further bolstered by a steady rise in net interest income, which reached $175.3 million in Q1 2025 and $180.1 million in Q2 2025, demonstrating effective management of its interest-earning portfolio and a healthy net interest margin.

BancFirst's strength lies in its deep community banking roots and strong local relationships, operating under a 'super community bank' model. This decentralized approach allows for highly responsive service tailored to the specific needs of customers across its extensive network in Oklahoma and Texas.

This focus on local engagement fosters enduring customer loyalty and a keen understanding of diverse community economic landscapes. BancFirst's commitment to personalized service at the local level remains a key differentiator in its operational strategy.

BancFirst boasts a robust and diversified service portfolio, extending beyond traditional banking to encompass a wide array of financial solutions. This breadth includes a comprehensive loan portfolio, covering commercial, real estate, energy, agricultural, and consumer sectors, alongside various deposit and cash management services.

Further diversifying its revenue streams, BancFirst leverages its subsidiaries to offer trust management and insurance services. This multi-faceted approach not only caters to a broader customer base but also mitigates risks associated with over-reliance on any single banking product.

Strong Asset Quality and Risk Management

BancFirst demonstrates robust asset quality, a key strength. For instance, nonaccrual loans as a percentage of total loans saw a marginal dip in both Q1 and Q2 of 2025, indicating effective lending oversight. This commitment to prudent lending practices is a cornerstone of their operational stability.

Further bolstering this strength, BancFirst maintains a healthy allowance for credit losses. This strategic reserve acts as a crucial buffer, prepared to absorb potential future loan defaults and safeguard the institution's financial health. Their conservative approach to risk management underpins the bank's overall resilience in the market.

- Solid Asset Quality: Nonaccrual loans as a percentage of total loans declined slightly in Q1 and Q2 2025.

- Prudent Lending: Reflects a commitment to careful and responsible lending practices.

- Adequate Loss Reserves: A healthy allowance for credit losses provides a strong cushion against potential defaults.

- Risk Management Focus: Contributes significantly to the bank's stability and ability to withstand economic fluctuations.

Active Strategic Acquisitions

BancFirst has a proven track record of pursuing growth through strategic acquisitions, a key strength that bolsters its market position. A prime example is the agreement to acquire American Bank of Oklahoma, announced in May 2025. This acquisition is set to expand BancFirst's footprint into burgeoning communities in Northeastern Oklahoma, thereby solidifying its market share.

This proactive acquisition strategy not only enhances BancFirst's scale but also significantly broadens its market reach. Such inorganic growth initiatives are crucial for expanding customer bases and diversifying revenue streams. BancFirst's consistent execution in this area demonstrates a clear vision for sustained expansion and competitive advantage.

- Strategic Acquisitions: BancFirst actively pursues growth through targeted acquisitions, such as the May 2025 agreement to acquire American Bank of Oklahoma.

- Market Expansion: This acquisition will extend BancFirst's presence into growing communities in Northeastern Oklahoma.

- Inorganic Growth Strategy: The company demonstrates a clear strategy for expanding its market share and operational scale through acquisitions.

BancFirst's financial performance is a significant strength, evidenced by strong net income growth in early 2025. This growth is driven by increased loan volumes and a strategic expansion of earning assets, leading to a healthy rise in net interest income.

The bank's deep community roots and decentralized 'super community bank' model foster strong local relationships and customer loyalty, allowing for tailored service. This focus on personalized, local engagement is a key differentiator.

BancFirst offers a diverse service portfolio, including various loan types and deposit services, further enhanced by trust and insurance offerings through subsidiaries. This diversification reduces reliance on single products and broadens customer appeal.

The bank maintains robust asset quality, with nonaccrual loans showing a slight decrease in Q1 and Q2 2025, reflecting effective lending oversight and prudent risk management. A healthy allowance for credit losses further strengthens its financial resilience.

BancFirst actively pursues growth through strategic acquisitions, such as the May 2025 agreement to acquire American Bank of Oklahoma, which will expand its market reach into Northeastern Oklahoma and solidify its competitive position.

| Metric | Q1 2025 | Q2 2025 | Year-over-Year Change (Q1) |

|---|---|---|---|

| Net Income | $71.9 million | $74.1 million | +15.04% |

| Net Interest Income | $175.3 million | $180.1 million | +12.5% |

| Nonaccrual Loans / Total Loans | Slight Decrease | Slight Decrease | N/A |

What is included in the product

Analyzes BancFirst’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address BancFirst's strategic challenges and opportunities.

Weaknesses

BancFirst's operations are heavily concentrated in Oklahoma and select metropolitan areas within North Texas. This geographic focus, while fostering deep community ties, exposes the bank to heightened risk from regional economic downturns or localized industry-specific challenges. For instance, a significant downturn in the energy sector, a key industry in Oklahoma, could disproportionately affect BancFirst's loan portfolio and overall financial performance.

BancFirst has seen its noninterest expenses climb, notably due to higher spending on salaries and employee benefits. For instance, in the first quarter of 2024, salaries and wages alone increased by 6.7% compared to the same period in 2023, reflecting investments in its workforce.

Additionally, specific costs, such as those linked to divesting equity investments as a result of regulatory changes like the Volcker Rule, have contributed to this rise. These operational cost increases, even when tied to strategic growth or compliance, can put pressure on the company's profitability if not managed effectively.

BancFirst, like all financial institutions, faces significant risks from evolving regulatory landscapes. New federal and state regulations, such as those concerning capital adequacy and consumer protection, necessitate continuous adaptation and investment. For instance, the ongoing implementation of updated Community Reinvestment Act guidelines and the complexities of the Volcker Rule can substantially increase compliance costs and operational burdens for the bank.

Vulnerability to Market Volatility and Economic Slowdown

BancFirst faces significant headwinds from current market volatility and the growing probability of an economic slowdown. Management has voiced concerns that this macroeconomic uncertainty could negatively affect the regional economy, directly impacting the company’s loan portfolio quality. For instance, a downturn could lead to increased loan defaults and a dip in demand for core banking services, posing a direct threat to profitability.

While BancFirst has been diligent in maintaining its loan loss reserves, an extended adverse economic period could still strain these provisions. The bank reported that its allowance for credit losses stood at $77.9 million as of March 31, 2024, a figure that might prove insufficient if economic conditions deteriorate sharply. This vulnerability highlights a key weakness in its operational resilience.

- Market Volatility Impact: Fluctuations in bond and equity markets can affect investment income and the valuation of assets held by the bank.

- Economic Slowdown Risk: A regional or national economic contraction can lead to higher unemployment and reduced business activity, increasing the risk of loan defaults.

- Credit Quality Deterioration: An unfavorable economic environment directly translates to a higher probability of loan losses, impacting the bank's financial health.

- Reduced Demand for Services: During economic downturns, customers tend to reduce borrowing and banking activity, affecting revenue streams.

Slower Revenue Growth Projection Compared to Industry

While BancFirst has demonstrated a solid track record, its anticipated revenue growth of 5.6% annually for the upcoming two years trails the projected 7.7% growth for the broader US Banks sector. This disparity suggests BancFirst may not be expanding its market share as aggressively as some competitors or the industry as a whole.

This slower growth projection could indicate that BancFirst faces challenges in areas like customer acquisition, product innovation, or competitive pricing compared to the average US bank. It highlights a potential weakness where strategic adjustments might be needed to boost expansion rates and better align with or exceed industry benchmarks.

- Projected Revenue Growth: BancFirst's 5.6% per annum versus US Banks industry's 7.7% (2024-2026 projection).

- Market Share Capture: Suggests a potentially slower pace of market share acquisition relative to peers.

- Strategic Implications: May point to areas needing enhanced focus on growth strategies, competitive positioning, and market penetration.

BancFirst's revenue growth projections for the next two years, at 5.6% annually, fall short of the broader US Banks sector's anticipated 7.7% growth. This suggests a potential lag in market share expansion and may indicate challenges in customer acquisition or competitive positioning compared to industry peers.

The bank's significant geographic concentration in Oklahoma and North Texas exposes it to heightened risks from regional economic downturns, particularly if key local industries like energy face challenges. This limited diversification means localized economic shocks can have a disproportionately large impact on BancFirst's loan portfolio and overall financial performance.

Rising noninterest expenses, driven by increased spending on salaries and employee benefits, are a notable concern. For instance, in Q1 2024, salaries and wages rose 6.7% year-over-year, impacting profitability if not offset by revenue growth.

| Metric | BancFirst (Projection) | US Banks Sector (Projection) |

|---|---|---|

| Annual Revenue Growth (2024-2026) | 5.6% | 7.7% |

| Geographic Concentration | Oklahoma & North Texas | National/Diversified |

| Q1 2024 Salary & Wage Increase | 6.7% | N/A |

Preview Before You Purchase

BancFirst SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The banking industry's ongoing consolidation presents a fertile ground for BancFirst's strategic growth. Acquiring smaller community banks can effectively broaden its geographic reach and bolster its asset base. The successful integration of American Bank of Oklahoma in 2023, which added approximately $600 million in assets, exemplifies this successful approach.

Focusing on new, rapidly developing communities or markets currently underserved within its existing operational areas offers another significant avenue for expansion. This targeted approach can unlock substantial growth potential and increase market share.

BancFirst has a significant opportunity to bolster its digital banking capabilities. Further investment in mobile and online platforms can elevate customer experience and streamline operations, a crucial step as digital adoption continues to rise. For instance, by mid-2024, over 70% of banking transactions are expected to be conducted digitally, highlighting the imperative for robust online services.

Leveraging advanced technologies like artificial intelligence for customer interactions and sophisticated data analytics for tailored product recommendations can set BancFirst apart. This strategic move is vital in a market where customers increasingly expect personalized and efficient digital engagement. Banks that effectively implement AI in customer service saw an average 15% reduction in query resolution times in 2023.

BancFirst has demonstrated a positive trajectory in growing its non-interest income, with notable increases in trust revenue, treasury management fees, and insurance commissions. For instance, in the first quarter of 2024, trust and wealth management revenue saw a year-over-year increase, contributing to a more balanced income profile.

There's a significant opportunity to deepen the penetration of these specialized services and introduce innovative fee-based products. This strategic move will further diversify BancFirst's revenue streams, lessening its dependence on traditional net interest income and bolstering overall financial resilience, especially in a fluctuating interest rate environment.

Leveraging Community Development for Business Growth

BancFirst's ongoing commitment to community development, particularly through low-income housing projects and New Markets Tax Credit (NMTC) investments, presents a significant opportunity. These initiatives not only foster economic growth in underserved areas but also yield valuable tax credits for the company. For instance, in 2023, BancFirst's NMTC investments facilitated projects totaling over $50 million, generating substantial tax credit benefits.

By further embedding itself in these community-focused efforts, BancFirst can cultivate deeper brand loyalty among residents and businesses in these developing regions. This enhanced community presence can translate into attracting new customer segments and uncovering untapped lending and investment prospects. The bank's proactive approach in 2024 is expected to see a 15% increase in community development loan originations, directly stemming from these strategic engagements.

- Enhanced Brand Reputation: Deeper community involvement bolsters BancFirst's image as a socially responsible financial institution.

- Customer Acquisition: Targeted community programs can attract new customer bases in developing economic zones.

- New Lending Avenues: Understanding local needs through community engagement identifies niche lending opportunities.

- Tax Credit Generation: Continued investment in programs like NMTCs provides direct financial benefits through tax credits.

Optimizing Loan Portfolio Composition and Growth

BancFirst can capitalize on its robust asset quality and ample loan loss reserves to expand its loan portfolio. Targeting high-growth sectors, such as technology or renewable energy, within its operational regions presents a significant opportunity for increased net interest income. For instance, as of Q1 2024, commercial real estate lending has shown continued strength, with many regional banks reporting year-over-year growth in this segment.

Strategic concentration on specific loan types with demonstrated demand, like commercial and industrial (C&I) loans or residential mortgages in expanding suburban markets, can further bolster profitability. BancFirst's strong capital position, evidenced by its Tier 1 Capital Ratio often exceeding regulatory requirements, provides a solid foundation for such targeted growth initiatives.

- Targeted Sector Growth: Focus on sectors like technology, healthcare, or renewable energy, which are experiencing significant expansion and demand for financing.

- Commercial Real Estate Expansion: Leverage strong demand in commercial real estate, particularly in growing suburban and exurban markets, to increase loan volume and net interest margin.

- C&I Loan Focus: Capitalize on robust demand for commercial and industrial loans, supporting business expansion and working capital needs, thereby enhancing interest income.

- Leveraging Capital Strength: Utilize BancFirst's strong capital ratios to underwrite larger, more profitable loans and absorb potential market fluctuations.

BancFirst can strategically expand by acquiring smaller community banks, thereby increasing its geographic footprint and asset base. The acquisition of American Bank of Oklahoma in 2023, which added approximately $600 million in assets, highlights this successful strategy.

Further investment in digital banking platforms is a key opportunity to enhance customer experience and operational efficiency, especially as digital transactions are projected to exceed 70% of all banking transactions by mid-2024.

Leveraging artificial intelligence for customer interactions and data analytics for personalized product offerings can differentiate BancFirst, as banks using AI in customer service saw an average 15% reduction in query resolution times in 2023.

BancFirst has a clear opportunity to grow its non-interest income streams, such as trust revenue, treasury management, and insurance commissions, which saw notable increases in Q1 2024, contributing to a more diversified income profile.

Continued investment in community development initiatives, including low-income housing and NMTC projects, not only fosters economic growth but also generates valuable tax credits, with BancFirst's 2023 NMTC investments facilitating over $50 million in projects.

Capitalizing on robust asset quality and loan loss reserves, BancFirst can expand its loan portfolio by targeting high-growth sectors like technology and renewable energy, aiming to increase net interest income.

Focusing on specific loan types with strong demand, such as commercial and industrial (C&I) loans or mortgages in expanding suburban markets, can further enhance profitability, supported by BancFirst's strong capital position, often exceeding regulatory requirements.

Threats

BancFirst navigates a fiercely competitive banking landscape. It contends with established local and regional banks, as well as larger national players and rapidly evolving FinTech firms. This broad competitive set, including entities like JPMorgan Chase and Bank of America, exerts pressure on BancFirst's profitability, potentially squeezing net interest margins and increasing the cost of attracting and keeping customers, especially in key urban areas.

Economic downturns pose a significant threat to BancFirst, as the banking sector is inherently tied to macroeconomic health. A substantial slowdown could trigger higher loan defaults and decrease demand for new loans, directly impacting profitability. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, highlighting a challenging economic environment.

Geopolitical instability further exacerbates these risks. Evolving global trade policies and ongoing international conflicts can disrupt markets, reduce investment, and create uncertainty. BancFirst's management has acknowledged these external pressures, specifically noting their potential to negatively affect credit quality and the economic vitality of the regions where the bank operates.

The financial services industry, including banks like BancFirst, remains a prime target for cybercriminals. In 2024, the financial sector experienced a significant increase in sophisticated attacks, with ransomware incidents alone costing billions globally. A successful breach could lead to massive financial losses, hefty regulatory penalties, and irreparable damage to customer confidence.

Evolving Regulatory Landscape and Increased Compliance Burden

The banking sector faces a constantly shifting regulatory environment, with federal and state authorities increasing their oversight. Future regulations, potentially concerning climate-related financial disclosures or enhanced consumer protection measures, could lead to higher compliance expenses and operational limitations for BancFirst. This evolving landscape presents a significant threat, potentially impacting profitability and necessitating adjustments to existing business models.

For instance, the Federal Reserve's ongoing review of climate risk management frameworks in 2024 and 2025 could introduce new reporting requirements. Similarly, potential updates to consumer protection laws, such as those related to overdraft fees or data privacy, could necessitate system upgrades and staff training, adding to operational costs.

- Increased Compliance Costs: New regulations often require investment in technology and personnel to ensure adherence.

- Operational Constraints: Stricter rules can limit certain business activities or require significant process changes.

- Potential Fines: Non-compliance with evolving regulations can result in substantial financial penalties.

- Impact on Profitability: Higher operational costs and potential business limitations can negatively affect BancFirst's bottom line.

Disruption from Financial Technology (FinTech) Innovations

The rapid evolution of financial technology presents a significant challenge. New FinTech firms are introducing customer-focused solutions that can quickly gain traction, drawing customers away from established institutions like BancFirst. For instance, by mid-2024, FinTech funding continued to surge, with digital payment solutions and AI-driven wealth management tools attracting substantial investment, indicating a clear trend towards these innovative services.

These agile competitors often specialize in niche digital services, offering convenience and lower fees that appeal to a broad customer base. This competitive pressure necessitates that BancFirst expedite its own digital transformation efforts. By the end of 2024, many traditional banks, including those of BancFirst's size, were allocating increased budgets towards enhancing their mobile banking platforms and exploring partnerships with FinTech innovators to stay relevant.

- Increased Competition: FinTechs offer specialized, often cheaper, digital financial services.

- Customer Migration: Innovative user experiences can draw customers away from traditional banks.

- Digital Investment Pressure: BancFirst must accelerate its digital strategy to avoid losing market share.

- Market Share Erosion: Failure to adapt digitally could lead to a decline in BancFirst's customer base and revenue streams.

BancFirst faces intense competition from traditional banks, larger national institutions, and agile FinTech companies, which can pressure profit margins and customer acquisition costs.

Economic slowdowns, as indicated by the IMF's projected global growth of 2.9% for 2024, pose a risk of increased loan defaults and reduced lending demand.

The threat of sophisticated cyberattacks remains high, with the financial sector experiencing billions in losses from ransomware in 2024 alone, potentially leading to significant financial and reputational damage.

Evolving regulations, such as potential climate-related disclosures and enhanced consumer protection measures, could increase compliance costs and operational complexity for BancFirst.

SWOT Analysis Data Sources

This BancFirst SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and insightful industry expert commentary, ensuring a robust and data-driven assessment.