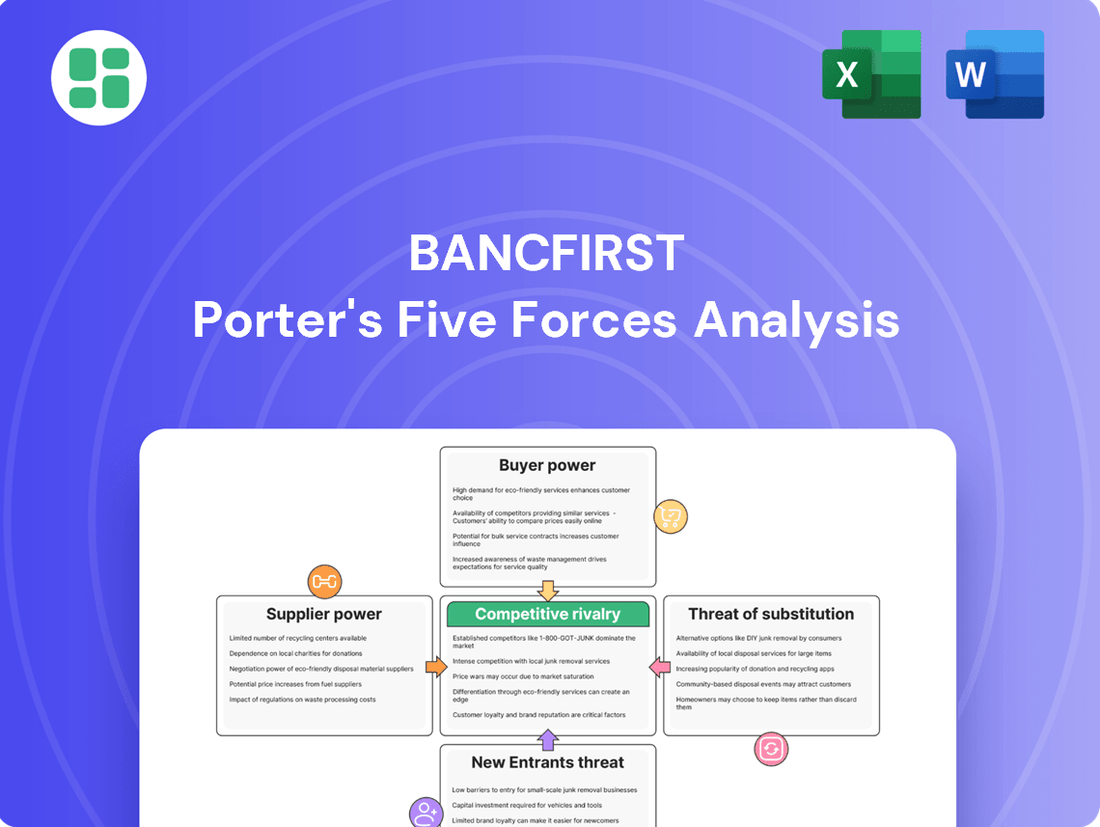

BancFirst Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BancFirst Bundle

Understanding BancFirst’s competitive landscape is crucial, and our Porter's Five Forces analysis unpacks the intricate dynamics at play. We've identified key pressures from rivals, buyers, and suppliers that shape the banking sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore BancFirst’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Depositors hold significant power over BancFirst because deposits are a crucial funding source for the bank. While individual depositors are many and dispersed, their collective ability to influence interest rates has grown due to fierce competition for funds. This means banks like BancFirst often need to offer competitive rates to attract and keep deposits, directly impacting their cost of doing business.

The banking sector, including institutions like BancFirst, consistently grapples with securing and keeping skilled employees, especially in niche areas. This demand often drives up compensation costs as banks vie for top talent.

For BancFirst, this labor market pressure was evident in the first and second quarters of 2025. The bank reported a notable increase in salaries and employee benefits, which directly impacted its noninterest expenses during these periods.

The increasing digitalization of financial services places BancFirst in a position of significant reliance on external technology providers. These vendors supply critical infrastructure, software, and cybersecurity solutions essential for digital transformation and operational resilience. For instance, the global financial technology market was projected to reach over $3.5 trillion by 2024, highlighting the scale of investment and dependence.

This dependence grants specialized technology vendors substantial bargaining power. Banks, including BancFirst, must invest in these advanced technologies to meet evolving customer demands and maintain competitiveness. The necessity of adopting solutions like artificial intelligence and automation further strengthens the leverage of these key suppliers in the market.

Capital Market Conditions

While BancFirst focuses on community banking, its access to broader capital markets for funding remains a consideration. In 2024, the Federal Reserve's monetary policy, including interest rate decisions, significantly shaped the cost and availability of wholesale funding and debt issuance. For instance, the Federal Funds Rate, which influences borrowing costs across the economy, saw fluctuations throughout the year, impacting BancFirst's cost of capital.

The economic climate directly affects the ease and expense of raising capital. Higher interest rates, as seen in periods of inflation control in 2024, generally increase the cost of debt and equity financing. This can limit a bank's flexibility for expansion or strategic investments, especially when compared to larger, more diversified financial institutions that may have more robust access to diverse funding sources.

- Interest Rate Environment: The average prime rate in the US hovered around 8.5% for much of 2024, impacting borrowing costs for banks.

- Debt Issuance Costs: The yield on 10-year Treasury notes, a benchmark for corporate debt, experienced volatility in 2024, influencing the pricing of new debt for financial institutions.

- Equity Market Performance: The S&P 500, a broad measure of equity performance, saw growth in 2024, potentially making equity financing more attractive but also subject to market sentiment.

- Wholesale Funding Availability: The interbank lending market, a source of short-term wholesale funding, saw varying liquidity levels influenced by regulatory changes and economic uncertainty in 2024.

Regulatory Body Influence

Regulatory bodies, while not direct suppliers in the traditional sense, exert significant influence over banks like BancFirst. Their mandates for compliance, operational standards, and capital requirements act as substantial costs, akin to supplier demands. For instance, the Federal Reserve's capital adequacy ratios directly impact how much capital BancFirst must hold, influencing its lending capacity and profitability.

The regulatory environment is constantly evolving, with anticipated shifts in 2025 expected to heighten these pressures. Focus areas such as artificial intelligence (AI) in financial services, cybersecurity enhancements, and data privacy regulations will likely necessitate increased investment in technology and specialized personnel. These evolving requirements can add significant operational expenses for banks, impacting their cost structures.

These regulatory burdens tend to disproportionately affect smaller financial institutions. Larger banks often have more resources to dedicate to compliance and technological upgrades. For example, a 2023 report indicated that compliance costs for community banks represented a higher percentage of their operating expenses compared to larger, national banks, highlighting this disparity in resource allocation.

- Regulatory Compliance Costs: Banks must invest heavily in systems and personnel to meet evolving compliance standards.

- Anticipated 2025 Focus: AI, cybersecurity, and data privacy are key areas expected to drive new regulatory demands.

- Disproportionate Impact: Smaller institutions often face a greater relative burden from regulatory requirements.

- Capital Requirements: Mandates from bodies like the Federal Reserve directly influence a bank's capital structure and operational flexibility.

BancFirst's reliance on external technology providers grants these specialized vendors significant bargaining power, as banks must invest in advanced solutions to remain competitive. The global financial technology market's projected growth to over $3.5 trillion by 2024 underscores this dependence and the leverage held by these critical infrastructure suppliers.

| Supplier Type | BancFirst Dependence | Bargaining Power Factor | 2024 Data Point |

|---|---|---|---|

| Technology Vendors | High (Critical infrastructure, software, cybersecurity) | Specialization, market concentration | FinTech market projected >$3.5T by 2024 |

| Capital Markets | Moderate (Wholesale funding, debt issuance) | Interest rate environment, economic climate | US Prime Rate ~8.5% in 2024 |

| Regulatory Bodies | High (Compliance, operational standards) | Mandated requirements, enforcement | Increased focus on AI and data privacy in 2025 |

What is included in the product

This analysis of BancFirst's competitive landscape examines the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly understand competitive pressures with a customizable, visual breakdown of BancFirst's Porter's Five Forces.

Customers Bargaining Power

For basic banking products like checking or savings accounts, customers often face low switching costs, especially with many digital and online-only banks offering competitive rates. This ease of movement allows customers to readily seek better deals, pressuring traditional banks to stay competitive.

The internet and readily available financial comparison tools have significantly boosted customer awareness. This means customers can easily see interest rates, fees, and service quality from various banks, directly impacting their ability to negotiate or switch providers. For instance, in early 2024, the average interest rate on savings accounts across major US banks remained relatively low, prompting many customers to actively seek out higher yields elsewhere, thereby increasing their bargaining leverage.

BancFirst caters to a wide array of customers, from individuals managing personal finances to businesses and government bodies. While no single client dominates, the combined expectations for user-friendly digital platforms, tailored financial advice, and competitive rates significantly shape BancFirst's operational strategies and product development.

Demand for Digital-First Experiences

Modern customers, especially younger demographics, are demanding digital-first banking. They expect intuitive, mobile-friendly interactions and personalized services, pushing banks to innovate or risk losing them. This shift significantly boosts customer bargaining power.

The demand for digital-first experiences is a major driver of customer bargaining power in the banking sector. For instance, a 2024 survey indicated that over 70% of banking customers prefer using mobile apps for most transactions. This preference forces financial institutions to prioritize digital investments.

- Digital Preference: A significant majority of customers now favor digital channels for their banking needs.

- Investment Pressure: Banks must invest heavily in technology to meet these digital expectations.

- Personalization Demand: Customers expect tailored experiences, including AI-driven support and integrated platforms.

- Market Share Impact: Failure to deliver on digital demands can lead to substantial customer attrition.

Availability of Alternative Financial Options

The increasing number of fintech companies, credit unions, and alternative financial service providers significantly broadens customer choices beyond traditional banks. This proliferation of options diminishes customer dependence on any single institution, thereby enhancing their bargaining power. Customers can readily switch to specialized providers or more economical alternatives, forcing established banks to compete more aggressively on price and service.

For instance, in 2024, the digital payments sector alone saw substantial growth, with transaction volumes continuing to rise year-over-year. This surge is largely driven by consumer adoption of mobile banking and payment apps, many of which are offered by non-traditional players. Such widespread availability of digital financial tools means customers are less tethered to their primary bank for everyday transactions, giving them leverage.

- Fintech Growth: The global fintech market was valued at over $11.5 trillion in 2023 and is projected to grow significantly by 2030, indicating a robust expansion of alternative financial options.

- Customer Choice: Customers now have access to a diverse range of services, including peer-to-peer lending, robo-advisors, and specialized digital banks, all competing for their business.

- Reduced Reliance: This diversification means customers are not solely reliant on traditional banks for loans, investments, or even basic account management, increasing their ability to negotiate better terms.

- Price Sensitivity: The ease of comparing services and switching providers makes customers more price-sensitive, pressuring banks to offer competitive rates and lower fees.

Customers hold significant bargaining power due to low switching costs for basic banking products and increased awareness driven by digital comparison tools. This allows them to readily seek better rates and services, pressuring BancFirst to remain competitive. For example, in early 2024, the average savings account interest rate was low, prompting customers to look for higher yields elsewhere, thus increasing their leverage.

| Factor | Impact on BancFirst | Customer Action |

|---|---|---|

| Low Switching Costs | Reduces customer loyalty for basic accounts | Easily move funds to higher-yield accounts |

| Digital Awareness | Forces transparency in pricing and services | Compare rates and fees across multiple institutions |

| Fintech Competition | Diversifies customer options beyond traditional banks | Utilize specialized digital providers for specific needs |

What You See Is What You Get

BancFirst Porter's Five Forces Analysis

This preview shows the exact BancFirst Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the banking industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, all presented in a professionally formatted and ready-to-use document. This detailed analysis will equip you with a strategic understanding of BancFirst's competitive landscape.

Rivalry Among Competitors

BancFirst navigates a banking sector teeming with rivals, from national giants to localized community banks and credit unions. This crowded field means constant pressure to attract and retain customers.

In Oklahoma alone, the first quarter of 2025 saw 175 distinct banking institutions operating, a clear sign of a fragmented market. This sheer volume of competitors amplifies the struggle for market share and necessitates continuous innovation and customer service excellence.

Large, diversified banks are increasingly dominating the U.S. banking landscape, holding a substantial portion of industry profits. For instance, as of the first quarter of 2024, the top five U.S. banks held over $10 trillion in assets, showcasing their immense scale. This dominance stems from their vast resources, ability to achieve economies of scale, and broad revenue generation across various financial services, making it a tough competitive field for community banks.

This environment presents a significant challenge for community banks like BancFirst. They must actively seek ways to stand out and offer unique value propositions to attract and retain customers when competing against these larger, more resource-laden institutions. Differentiating their services and customer experience becomes paramount for survival and growth.

The banking industry is witnessing a significant battle for customer deposits. Banks are increasingly offering higher interest rates and user-friendly digital platforms to draw in and keep funds. This aggressive competition directly impacts a bank's ability to maintain healthy profit margins, as the cost of acquiring these deposits rises.

In 2024, the Federal Reserve's monetary policy continued to influence deposit rates, with many banks adjusting their offerings to remain competitive. For instance, by mid-2024, average savings account rates had seen a notable increase compared to the previous year, reflecting this intensified competition. This dynamic forces institutions like BancFirst to constantly evaluate their deposit strategies to ensure they can attract the necessary funding without unduly compressing their net interest margins.

Differentiation through Community Focus

BancFirst differentiates itself by cultivating a strong community focus, which is a key competitive advantage. This approach emphasizes personalized customer service and deep local market knowledge, setting it apart from larger, less personal financial institutions.

This strategy allows BancFirst to build robust customer relationships, fostering loyalty and a distinct market position. For instance, in 2024, community banks nationwide continued to see strong deposit growth, with many reporting increases exceeding 5% year-over-year, reflecting the trust and connection they have with their local customer bases.

- Personalized Service: BancFirst prioritizes individual customer needs, offering tailored solutions.

- Local Market Expertise: Deep understanding of regional economic trends and customer demographics.

- Community Engagement: Active participation in local events and initiatives builds strong ties.

- Relationship Banking: Focus on long-term customer relationships over transactional interactions.

Accelerating Consolidation Trends

The U.S. community banking sector is poised for an increase in merger and acquisition (M&A) activity throughout 2025. This surge is largely fueled by the imperative for banks to achieve greater scale, enhance operational efficiency, and make necessary investments in evolving technology. For instance, in 2024, the banking sector witnessed a notable uptick in M&A deals, with reports indicating a 10% increase in announced transactions compared to the previous year.

This intensifying consolidation trend directly impacts the competitive rivalry BancFirst faces. As more community banks merge, the landscape will likely feature fewer, yet significantly larger, financial institutions. This shift necessitates a proactive approach to BancFirst's long-term competitive strategy, requiring adaptation to a market where scale and technological prowess become even more critical differentiators.

- Accelerating M&A: Expect increased consolidation in U.S. community banking in 2025.

- Drivers: Need for scale, efficiency, and technology investment are key motivators.

- Impact: Fewer, larger competitors will emerge, reshaping the market.

- Strategic Implication: BancFirst must adapt its strategy to this evolving competitive environment.

BancFirst operates in a highly competitive banking landscape, facing pressure from national banks, regional players, and local community institutions. The sheer number of banks, such as the 175 operating in Oklahoma in early 2025, intensifies the battle for customers and market share. This fragmented market demands continuous innovation and superior customer service to stand out.

Large banks, holding over $10 trillion in assets by Q1 2024, leverage economies of scale and broad service offerings, posing a significant challenge to community banks like BancFirst. The intense competition for deposits, evidenced by rising savings account rates in mid-2024 due to Federal Reserve policies, further squeezes profit margins.

BancFirst's strategy of personalized service and deep local market knowledge, which saw community banks achieve over 5% year-over-year deposit growth in 2024, helps build customer loyalty. However, the anticipated surge in M&A activity in 2025, with a 10% increase in banking M&A deals in 2024, signals a trend towards fewer, larger competitors, requiring BancFirst to adapt its long-term strategy.

SSubstitutes Threaten

Fintech companies represent a potent substitute threat to BancFirst. These digital disruptors offer specialized services like payments, lending, and investing, often at a lower cost and with greater convenience than traditional banks. For instance, by mid-2024, the global fintech market was projected to reach over $33 trillion, showcasing the scale of these alternatives.

These agile fintechs leverage technologies such as artificial intelligence to create highly personalized customer experiences, effectively bypassing traditional banking channels. This customer-centric approach, coupled with streamlined digital interfaces, directly challenges the established customer relationships banks like BancFirst have cultivated.

Credit unions and mutual organizations present a significant threat of substitution for BancFirst. These member-owned institutions often provide a compelling alternative by offering lower fees and more competitive interest rates, directly challenging traditional commercial banks. For instance, as of early 2024, credit unions reported an average interest rate on savings accounts that was notably higher than many large commercial banks, attracting depositors seeking better returns.

The increasing prevalence of embedded finance solutions poses a significant threat of substitutes for traditional banking services. Companies outside the financial sector are now integrating banking functionalities directly into their customer journeys, making it easier for consumers to access financial products without engaging with a bank. For instance, e-commerce platforms offering buy-now-pay-later options at checkout directly substitute traditional point-of-sale financing provided by banks.

This trend bypasses the need for direct customer interaction with banks, potentially eroding customer loyalty and reducing the perceived value of conventional banking relationships. By 2024, the global embedded finance market was projected to reach over $2.4 trillion, demonstrating the substantial shift towards these integrated financial experiences.

Digital-Only Banks (Neobanks)

The rise of digital-only banks, or neobanks, presents a significant threat of substitutes for traditional community banks like BancFirst. These neobanks leverage technology to offer banking services with much lower overhead, often passing those savings onto customers through lower fees and better interest rates. For instance, by mid-2024, several prominent neobanks reported customer bases in the millions, demonstrating their ability to attract a substantial portion of the market, particularly younger, tech-oriented demographics.

These digital alternatives bypass the need for physical branches, a major cost center for traditional institutions. This allows neobanks to compete aggressively on price and convenience, appealing to customers who prioritize seamless digital experiences over in-person interactions. The ease of account opening and management through mobile apps further enhances their attractiveness as a substitute for traditional banking services.

The threat is amplified by the continuous innovation in fintech, which constantly introduces new ways to manage money and access financial services outside the traditional banking framework. As of early 2024, the global neobank market was projected to reach hundreds of billions of dollars in valuation, indicating the scale of this disruptive force.

- Lower Cost Structure: Neobanks operate with significantly reduced overhead due to their lack of physical branches, enabling them to offer more competitive pricing.

- Digital Convenience: They provide seamless, mobile-first banking experiences that appeal to a growing segment of digitally native consumers.

- Rapid Customer Acquisition: Many neobanks have achieved substantial customer growth in short periods, demonstrating their ability to attract market share from incumbents.

- Fintech Innovation: Ongoing advancements in financial technology continue to expand the range and appeal of digital banking alternatives.

Direct Investment and Peer-to-Peer Lending Platforms

Customers seeking financing or investment opportunities increasingly turn to direct investment platforms, robo-advisors, and peer-to-peer (P2P) lending services. These alternatives empower individuals and businesses to circumvent traditional banking channels, directly impacting the demand for conventional bank loans and investment management. For instance, P2P lending platforms facilitated over $10 billion in loans globally in 2023, demonstrating a significant shift in borrowing behavior.

These substitute services offer competitive rates and streamlined processes, presenting a direct threat to BancFirst's traditional revenue streams. Robo-advisors, managing over $1.5 trillion in assets under management as of early 2024, provide automated investment advice, challenging the need for human financial advisors offered by banks. This accessibility and often lower fee structure make them attractive alternatives.

- Direct Investment Platforms: Offer access to stocks, bonds, and other securities, often with lower transaction fees than traditional brokerages.

- Robo-Advisors: Provide automated, algorithm-driven financial planning services and investment management, appealing to cost-conscious investors.

- Peer-to-Peer (P2P) Lending: Connect borrowers directly with individual lenders, bypassing banks for personal and business loans.

- Impact on Banks: These substitutes reduce the volume of traditional loan origination and investment management services that banks like BancFirst offer.

The threat of substitutes for BancFirst is significant, stemming from a variety of non-traditional financial service providers. Fintech companies, credit unions, embedded finance solutions, neobanks, and direct investment platforms all offer compelling alternatives that can siphon customers and revenue away from traditional banks.

These substitutes often compete on price, convenience, and technological innovation, directly challenging BancFirst's established business model. For instance, the global fintech market's projected growth to over $33 trillion by mid-2024 highlights the sheer scale of these disruptive forces.

| Substitute Type | Key Offerings | Competitive Advantage | Market Penetration (Illustrative, early 2024) |

|---|---|---|---|

| Fintech Companies | Payments, Lending, Investing | Lower cost, convenience, personalization | Global market projected over $33 trillion |

| Credit Unions | Banking services, loans | Lower fees, competitive rates, member focus | Higher savings account rates than many large banks |

| Embedded Finance | Point-of-sale financing, BNPL | Seamless integration into customer journeys | Global market projected over $2.4 trillion |

| Neobanks | Digital-only banking | Lower overhead, digital convenience, competitive pricing | Millions of customers for prominent players |

| Direct Investment Platforms/Robo-Advisors | Investing, wealth management | Accessibility, lower fees, automated advice | Robo-advisors managing over $1.5 trillion AUM |

Entrants Threaten

Launching a new bank demands immense capital, a formidable hurdle for potential competitors. For instance, BancFirst, with total assets reaching $14.0 billion as of June 30, 2025, demonstrates the significant financial resources needed to compete effectively.

The banking sector faces significant barriers to entry due to stringent regulatory oversight. These include extensive licensing procedures, rigorous compliance mandates, and strict capital adequacy requirements, all of which contribute to a lengthy and challenging entry process for aspiring new players.

While the regulatory landscape can see minor adjustments, the fundamental barriers remain robust. For instance, in 2024, the Federal Reserve continued to emphasize robust capital planning and stress testing for financial institutions, underscoring the high capital requirements that new entrants must meet to operate safely and soundly.

Established brand loyalty and trust represent a significant barrier for new entrants looking to compete with BancFirst. BancFirst has spent years building a strong reputation, especially within its local communities, fostering deep customer relationships. For instance, in 2024, community banks across the US continued to leverage their local ties, with many reporting high customer retention rates, often exceeding 90% for long-standing clients. This ingrained trust makes it difficult for newcomers to attract customers away, as switching financial institutions involves considerable effort and perceived risk for consumers.

Economies of Scale for Incumbents

Established banks like BancFirst leverage significant economies of scale in technology, marketing, and operations. This allows them to offer services at a lower cost than emerging competitors. For instance, in 2024, BancFirst's investment in centralized digital platforms streamlines customer onboarding and transaction processing, creating substantial cost advantages.

These efficiencies make it challenging for new, smaller financial institutions to match BancFirst's pricing or the breadth of services offered. The high fixed costs associated with building and maintaining a robust banking infrastructure act as a significant barrier to entry.

Consider these points regarding economies of scale:

- Technology Infrastructure: Centralized core banking systems and digital channels reduce per-customer IT costs for incumbents.

- Marketing Reach: Larger banks can afford broader advertising campaigns, increasing brand recognition and customer acquisition efficiency.

- Operational Efficiencies: Bulk processing of transactions and centralized back-office functions lower overhead for established players.

- Capital Requirements: The sheer scale of capital needed to operate a full-service bank, coupled with regulatory hurdles, deters many potential new entrants.

Extensive Distribution Networks

Developing a comprehensive distribution network, whether through physical branches or a robust digital platform, requires substantial investment and time. New entrants face the challenge of building out these extensive channels to reach a broad customer base and compete effectively with established players.

For instance, BancFirst operates 104 banking locations across Oklahoma and several in Texas, a significant physical footprint built over years. Replicating such an extensive network is a considerable barrier for newcomers looking to gain market share.

- Investment in Physical Infrastructure: Establishing and maintaining a physical branch network incurs high costs related to real estate, staffing, and operational overhead.

- Digital Platform Development: Creating a secure, user-friendly, and feature-rich digital banking platform requires significant upfront and ongoing technological investment.

- Brand Recognition and Trust: New entrants must invest heavily in marketing and building trust to overcome the established brand recognition of incumbents like BancFirst.

The threat of new entrants for BancFirst remains low, primarily due to the substantial capital requirements and extensive regulatory hurdles inherent in the banking industry. For example, as of June 30, 2025, BancFirst held total assets of $14.0 billion, illustrating the significant financial scale required to operate. Furthermore, in 2024, regulatory bodies like the Federal Reserve continued to enforce strict capital adequacy and compliance standards, making it difficult and costly for new banks to establish themselves.

Established brand loyalty and significant economies of scale also act as strong deterrents. BancFirst's long-standing community relationships, often resulting in over 90% customer retention for established clients in 2024, make it challenging for newcomers to gain traction. Moreover, BancFirst's investments in technology and operational efficiencies, like its centralized digital platforms, create cost advantages that new entrants struggle to match.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High initial investment needed to meet regulatory capital and operational expenses. | Significant financial barrier, deterring many potential entrants. |

| Regulatory Hurdles | Extensive licensing, compliance, and ongoing oversight from financial authorities. | Lengthens and increases the cost of market entry. |

| Brand Loyalty & Trust | Established reputation and customer relationships built over time. | Difficult for new players to attract and retain customers. |

| Economies of Scale | Cost advantages derived from large-scale operations in technology, marketing, and administration. | New entrants face higher per-unit costs, impacting pricing competitiveness. |

| Distribution Networks | Need for extensive physical branch networks or robust digital platforms. | Requires substantial investment and time to build comparable reach. |

Porter's Five Forces Analysis Data Sources

Our BancFirst Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, industry-specific market research reports from firms like IBISWorld, and regulatory filings from the FDIC and OCC.