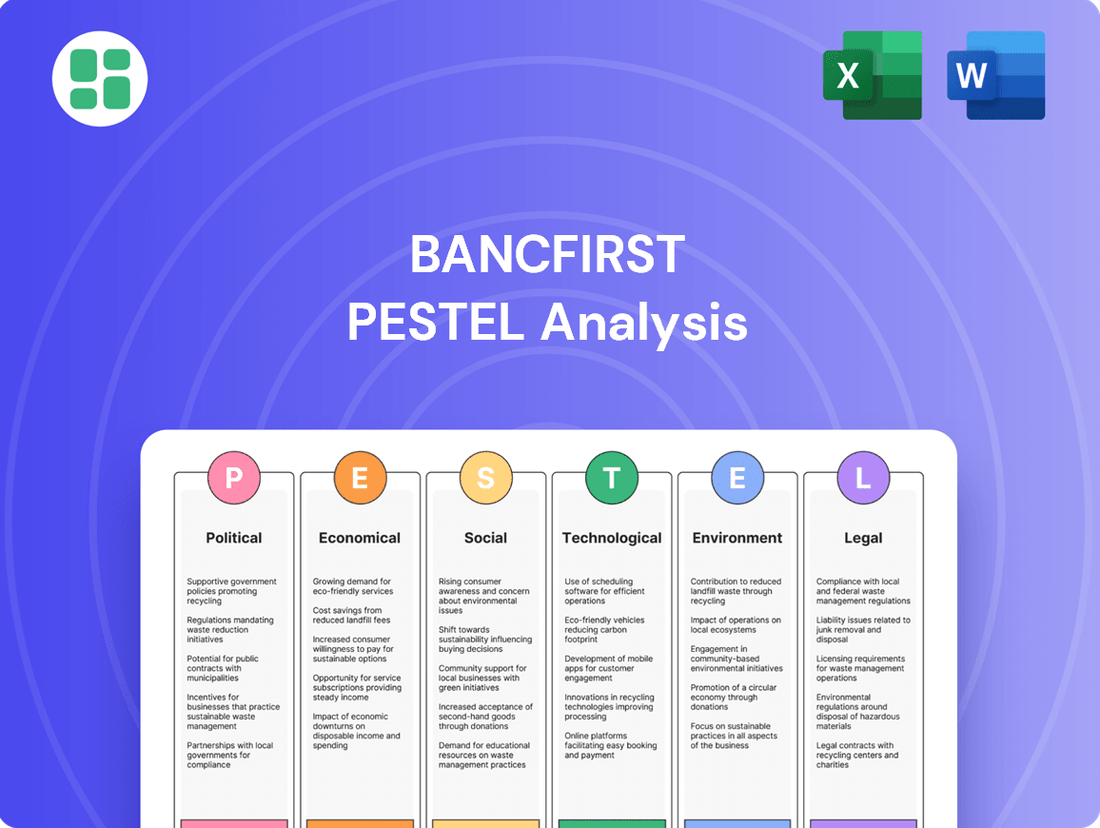

BancFirst PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BancFirst Bundle

Discover how political, economic, social, technological, legal, and environmental factors are shaping BancFirst's operational landscape. Our expertly crafted PESTLE analysis offers critical insights into the external forces impacting the bank's performance and future trajectory. Equip yourself with this essential market intelligence to refine your strategies and anticipate market shifts. Purchase the full PESTLE analysis now for actionable data and a competitive edge.

Political factors

BancFirst operates within a U.S. banking sector where regulatory stability is a constant consideration, but change is also afoot. Shifts in federal agency priorities, potentially influenced by new administrations, can alter the landscape. For instance, discussions around capital requirements or consumer protection rules are ongoing, impacting how banks like BancFirst manage their operations.

While a more permissive regulatory environment could theoretically emerge, significant changes to financial supervision tend to be gradual processes. This means banks must maintain a proactive stance, continuously adapting their governance, risk management, and compliance frameworks to stay ahead of evolving expectations and ensure continued competitiveness in the market.

Government fiscal policies, such as changes in government spending and tax rates, directly influence the overall economic climate, which in turn affects the demand for banking services. For instance, increased government infrastructure spending could stimulate business activity and loan demand.

Monetary policies, primarily interest rate decisions made by the Federal Reserve, have a substantial impact on BancFirst's profitability, particularly its net interest income and capacity for loan growth. The Fed's target for the federal funds rate, which influences borrowing costs across the economy, is a key variable.

Looking ahead to 2025, the Federal Reserve has signaled a potential for gradual interest rate reductions. This anticipated shift will necessitate strategic adjustments for BancFirst, influencing how the bank structures its lending products and manages its deposit-taking strategies to remain competitive and profitable in a changing rate environment.

BancFirst's operational landscape is significantly shaped by Oklahoma's state-level regulatory environment. A key development for 2025 is the approved reduction in assessments for Oklahoma state-chartered banks. This move is designed to lessen the regulatory burden, potentially freeing up capital for banks like BancFirst to invest in their operations or manage federal compliance expenses more effectively.

Increased Scrutiny on Bank Mergers

Anticipated increases in bank merger and acquisition activity in 2025, fueled by a more stable economic outlook, are likely to be met with intensified regulatory oversight. The Department of Justice has signaled a stricter approach to bank transactions, particularly concerning market concentration. This heightened scrutiny is a critical factor for institutions like BancFirst, whose acquisition of American Bank of Oklahoma, slated for completion in the third quarter of 2025, will undergo rigorous review.

The regulatory environment for bank consolidation is evolving, with a focus on ensuring fair competition and preventing undue market power. For BancFirst, this means proactively addressing potential concerns related to market concentration in its operational areas. The successful navigation of this increased scrutiny will be paramount for the successful integration of American Bank of Oklahoma.

- Increased DOJ Scrutiny: Expect the Department of Justice to apply more stringent market concentration tests to bank mergers in 2025.

- BancFirst's Acquisition: The closing of BancFirst's acquisition of American Bank of Oklahoma in Q3 2025 falls directly within this period of heightened regulatory attention.

- Strategic Importance: Successfully managing this regulatory hurdle is crucial for BancFirst's growth strategy and market positioning.

Consumer Protection Regulations

Consumer protection regulations remain a significant political factor for BancFirst. The banking sector is under constant scrutiny, with evolving rules designed to safeguard consumers. For instance, the Consumer Financial Protection Bureau (CFPB) in the US continues to enforce regulations like the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA).

These legal frameworks demand increased transparency in financial products and services, directly impacting how BancFirst communicates with its customers and structures its offerings. Data privacy laws, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), also impose strict requirements on how customer data is collected, stored, and utilized.

Compliance is not optional; failure to adhere to these consumer protection and data privacy mandates can result in substantial financial penalties and reputational damage. For example, in 2023, financial institutions faced billions in fines for various compliance failures, underscoring the critical need for robust adherence. BancFirst must therefore invest in systems and training to ensure ongoing compliance.

- Increased Transparency: Regulations require clear disclosure of fees, interest rates, and terms, impacting marketing and product design.

- Data Privacy Mandates: Laws like CCPA/CPRA govern how BancFirst handles sensitive customer information, necessitating secure data management practices.

- Enforcement and Penalties: Non-compliance can lead to significant fines, with the CFPB actively pursuing violations in the financial sector.

- Consumer Trust: Adherence to these regulations is vital for maintaining customer confidence and brand reputation in the competitive banking landscape.

Political factors significantly shape BancFirst's operating environment, particularly through federal and state regulations. The Federal Reserve's monetary policy, including anticipated rate adjustments in 2025, directly impacts BancFirst's profitability and lending strategies. Oklahoma's state-level regulatory changes, such as reduced assessments for state-chartered banks in 2025, aim to ease the burden on institutions like BancFirst.

Increased scrutiny from the Department of Justice on bank mergers, a trend expected to intensify in 2025, presents a critical challenge for BancFirst's acquisition of American Bank of Oklahoma. Consumer protection laws, enforced by bodies like the CFPB, mandate greater transparency and robust data privacy practices, requiring continuous investment in compliance systems.

| Regulation Area | Key Development (2024-2025) | Impact on BancFirst |

|---|---|---|

| Monetary Policy | Anticipated gradual interest rate reductions by the Federal Reserve. | Requires strategic adjustments in lending and deposit-taking to maintain profitability. |

| State Regulation (Oklahoma) | Approved reduction in assessments for state-chartered banks. | Potentially frees up capital for investment or compliance management. |

| Merger & Acquisition Oversight | Heightened DOJ scrutiny on market concentration. | Increases review intensity for BancFirst's acquisition of American Bank of Oklahoma. |

| Consumer Protection | Continued enforcement of transparency and data privacy laws (e.g., TILA, CCPA/CPRA). | Demands investment in compliance systems and impacts product design and communication. |

What is included in the product

This BancFirst PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors influence its operations and strategic planning.

A concise BancFirst PESTLE analysis, presented in a clear and simple language, removes the pain of sifting through complex data, making external risk and market positioning discussions accessible to all stakeholders.

Economic factors

The Federal Reserve's monetary policy significantly impacts BancFirst. While interest rates reached a peak in 2024, forecasts suggest a moderate easing trend through 2025. This shift could translate to reduced funding costs for BancFirst and potentially stimulate demand for loans, particularly in the mortgage sector.

BancFirst's financial performance in Q2 2025 demonstrated this dynamic. The bank reported an increase in net interest income, primarily fueled by higher loan volumes. Despite this growth, the net interest margin remained relatively stable, indicating a balanced response to the prevailing rate environment.

The economic growth rate is a crucial factor for BancFirst. In 2024, the U.S. economy showed resilience, and this trend is expected to continue, albeit at a more moderate pace into 2025. For BancFirst, operating primarily in Oklahoma and Texas, regional economic expansion directly fuels demand for loans and supports deposit growth, key drivers of its business.

Looking ahead to 2025, forecasts suggest a potential soft landing for the U.S. economy, with GDP growth expected to decelerate. This moderation could lead to a tempering of consumer spending and business investment, which might impact loan demand for BancFirst. However, the bank's performance in 2024, which included robust loan growth, demonstrates its ability to navigate various economic conditions effectively.

Inflation continues to be a significant concern for consumers, directly affecting how much money they have left to spend and how they manage their banking. While inflation is projected to approach the Federal Reserve's 2% target by 2025, a slowdown in consumer spending and an increase in consumer debt levels could strain the resilience of American households.

BancFirst's deposit growth in 2024, notably in interest-bearing accounts, offers insight into how consumers are reacting to these economic conditions, likely seeking better returns on their savings amidst persistent inflationary pressures.

Loan Demand and Credit Quality

Loan demand is anticipated to strengthen in 2025, with mortgages leading the way as interest rates are projected to ease. However, growth in credit card and auto loans might remain subdued due to ongoing consumer financial constraints.

BancFirst experienced a notable increase in loan volume throughout 2024 and into the second quarter of 2025. This growth was accompanied by consistently low levels of nonaccrual loans, a clear indicator of robust asset quality.

The bank's strategy for managing its provision for credit losses is directly tied to its loan growth trajectory and ongoing risk assessments. This proactive approach ensures capital adequacy in the face of evolving economic conditions.

- Mortgage Demand: Expected to rise in 2025 with declining interest rates.

- Credit Card/Auto Loans: May see slower growth due to consumer financial pressures.

- BancFirst Loan Volume: Increased in 2024 and Q2 2025.

- Asset Quality: Demonstrated by low nonaccrual loans.

Competition and Market Concentration

The banking sector in Oklahoma presents a robust competitive environment for BancFirst. It faces direct rivalry from numerous other banking institutions, as well as savings and loan associations and credit unions, all vying for market share. This intense competition necessitates continuous adaptation and strategic positioning to retain and grow its customer base.

Looking ahead to 2025, the banking industry anticipates a potential uptick in merger and acquisition (M&A) activity. Such consolidation could significantly reshape the competitive landscape, potentially leading to fewer, larger players or new entrants, which BancFirst must monitor closely.

BancFirst’s operational model as a ‘super community bank’ is designed to navigate this competitive pressure. By maintaining decentralized decision-making, it aims to foster agility and a deep understanding of local market dynamics, allowing for more responsive service to specific customer needs within its operating regions.

- Competitive Landscape: BancFirst operates in a highly competitive banking environment in Oklahoma, facing established banks, savings and loans, and credit unions.

- M&A Outlook: Increased bank merger and acquisition activity is anticipated in 2025, which could consolidate the market and alter competitive dynamics.

- Strategic Advantage: BancFirst's ‘super community bank’ model with decentralized decision-making enhances its ability to cater to local customer needs, a key differentiator in a competitive market.

The Federal Reserve's monetary policy, with interest rates expected to ease moderately through 2025 from 2024 peaks, will likely reduce BancFirst's funding costs and boost loan demand, particularly for mortgages. While inflation is projected to near the Federal Reserve's 2% target by 2025, consumer spending might slow due to persistent inflationary pressures and rising debt. Economic growth is anticipated to moderate in 2025, potentially impacting loan demand, though BancFirst's 2024 performance showed resilience in loan growth and asset quality, with nonaccrual loans remaining low.

| Economic Factor | 2024 Trend | 2025 Outlook | Impact on BancFirst |

|---|---|---|---|

| Interest Rates | Peaked in 2024 | Moderate easing | Lower funding costs, increased loan demand (especially mortgages) |

| Economic Growth (GDP) | Resilient | Moderate deceleration | Potential tempering of loan demand, but regional strength supports growth |

| Inflation | Persistent concern | Approaching 2% target | May strain consumer spending and debt, impacting deposit growth strategies |

| Consumer Spending/Debt | Mixed; some constraints | Potential slowdown in spending, increased debt | Subdued growth in credit card/auto loans, focus on deposit returns |

Same Document Delivered

BancFirst PESTLE Analysis

The BancFirst PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors affecting BancFirst.

Sociological factors

Customers now expect banking to be as personalized and convenient as their online shopping. This means tailored product recommendations and easy-to-use digital platforms, a trend that will only grow stronger by 2025. For instance, a 2024 survey revealed that 70% of consumers prefer digital banking channels for most transactions, highlighting the need for robust online and mobile services.

To meet these evolving demands, BancFirst needs to embrace data analytics and artificial intelligence. These tools can help create customized financial products and even anticipate customer needs before they arise. Banks that fail to adapt, perhaps by partnering with innovative fintech companies, risk losing ground with younger, more digitally inclined customers who are driving these changes.

Demographic shifts, such as an aging population and increasing urbanization, are reshaping the demand for banking services. For instance, the U.S. Census Bureau projected that by 2030, 20% of Americans will be 65 or older, influencing the need for retirement planning and wealth management services. This evolving landscape also highlights a significant opportunity in financial inclusion, with a growing emphasis on bringing underserved communities and small businesses into the formal financial system.

BancFirst's community-focused model is well-positioned to capitalize on these trends. By tailoring its offerings to local economic conditions and the specific needs of its customer base, the bank can effectively serve diverse demographic segments. This approach allows BancFirst to potentially expand its reach and services to previously excluded populations, fostering greater financial participation and strengthening its community ties.

BancFirst's strategy hinges on deep community ties, cultivating a trust that translates into customer loyalty. This localized approach, with its physical presence, creates a significant hurdle for customers contemplating a move to digital-only banks or fintech alternatives. For instance, in 2024, community banks generally reported higher customer retention rates compared to national banks, often exceeding 90% for established relationships.

Financial Literacy and Education Needs

As digital platforms increasingly mediate financial interactions, consumers are often left to navigate complex decisions on their own, highlighting a growing demand for accessible financial education directly from retail banks. BancFirst has an opportunity to address this by offering resources that boost financial literacy. For instance, a 2024 survey indicated that 65% of adults feel they need more education on managing their money effectively, a sentiment amplified by the shift to online banking where self-directed choices are paramount.

By proactively equipping its customers with better financial knowledge, BancFirst can foster stronger relationships, leading to increased cross-selling of products and services. This strategy not only meets a significant societal need but also cultivates greater customer loyalty and confidence. A study from early 2025 found that banks providing financial wellness programs saw a 15% increase in customer retention compared to those that did not.

- Growing reliance on digital channels necessitates enhanced financial self-sufficiency among consumers.

- A 2024 survey revealed 65% of adults desire more financial education.

- BancFirst can leverage financial literacy initiatives to drive cross-selling and boost customer loyalty.

- Banks offering financial wellness programs experienced a 15% rise in customer retention in early 2025.

Workforce Demographics and Talent Retention

As of December 31, 2024, BancFirst’s workforce stood at over 2,100 full-time equivalent employees, reflecting a commitment to fair compensation and robust training programs. The banking sector, however, grapples with significant challenges in attracting and retaining skilled talent, particularly as the labor market continues to transform.

BancFirst's ongoing investment in employee development and fostering a feedback-rich environment are crucial for maintaining high levels of customer service and solidifying its community-focused banking approach. These initiatives are designed to address the dynamic nature of the workforce and ensure continued operational excellence.

- Workforce Size: Over 2,100 full-time equivalent employees as of December 31, 2024.

- Talent Challenges: The banking industry faces ongoing difficulties in talent retention and development.

- BancFirst Strategy: Continued investment in employee training, development, and a feedback culture.

- Impact: Supports customer service and reinforces the community banking model.

Societal expectations are shifting towards hyper-personalized and convenient banking experiences, mirroring online retail. By 2025, this trend will intensify, making robust digital platforms and tailored product offerings essential. In 2024, a significant 70% of consumers favored digital banking channels for most transactions, underscoring BancFirst's need to prioritize its online and mobile services to meet these evolving demands.

Technological factors

The banking sector is undergoing a significant digital transformation, with mobile banking apps now a standard for customer interaction. BancFirst needs to prioritize enhancing its digital capabilities to satisfy customer expectations for fluid, mobile-centric services and to effectively challenge neobanks.

In 2024, global mobile banking users were projected to reach over 2.5 billion, highlighting the critical importance of robust mobile platforms. BancFirst's investment in modern technology is crucial for streamlining operations and ensuring customer loyalty in this increasingly digital landscape.

Artificial intelligence and automation are rapidly transforming banking. By 2025, it's projected that AI will handle over 90% of customer service interactions in some financial institutions, freeing up human staff for more complex tasks. Generative AI, specifically, offers BancFirst the opportunity to automate routine processes, boosting efficiency and potentially improving labor productivity by an estimated 15-20% in areas like data entry and report generation.

BancFirst can harness AI to streamline operations, leading to cost reductions and enhanced customer experiences. For instance, AI-powered fraud detection systems can analyze transactions in real-time, potentially reducing fraud losses by up to 30% compared to traditional methods. Furthermore, AI can enable personalized financial advice and product recommendations, fostering deeper customer relationships.

Fintech firms are significantly altering the financial landscape, particularly in embedded payments and digital lending. For community banks like BancFirst, this means facing heightened competition from digital-first providers offering novel services, a trend that accelerated in 2024.

The digital lending market, for instance, saw substantial growth, with fintechs capturing a larger share. By the end of 2024, fintechs were estimated to be involved in over 50% of all new digital loan originations in the US, a stark contrast to just a decade prior.

To counter this, strategic collaborations with fintech companies are increasingly vital for established banks. These partnerships allow traditional institutions to quickly integrate advanced digital tools, such as AI-powered customer service or streamlined onboarding processes, thereby enhancing their service offerings and maintaining market relevance through 2025.

Cybersecurity and Data Security

Cybersecurity and data security are critical for BancFirst, especially with the surge in digital banking. Financial institutions are under increasing pressure from regulators regarding cyber risk. For instance, in 2023, the financial sector experienced a significant rise in sophisticated cyberattacks, with ransomware incidents targeting banks becoming more prevalent, according to industry reports.

BancFirst must prioritize ongoing investment in advanced IT security infrastructure to safeguard sensitive customer information and uphold its reputation. This includes implementing multi-factor authentication, advanced threat detection systems, and regular security training for employees. The cost of data breaches can be substantial, with average financial industry breach costs reaching millions of dollars, underscoring the importance of proactive security measures.

- Regulatory Focus: Increased scrutiny from agencies like the OCC and FDIC on cyber resilience and data protection practices.

- Investment Needs: Continuous allocation of capital towards upgrading security protocols and employee training to combat evolving threats.

- Reputational Risk: Maintaining customer trust hinges on demonstrating robust data security, as breaches can lead to significant reputational damage and customer attrition.

Real-time Payments and Blockchain Technology

The financial sector is rapidly shifting towards real-time payments, a trend that presents both challenges and opportunities for BancFirst. While a decrease in interchange fees, partly due to the Durbin Amendment, affected BancFirst's Q1 2024 earnings, the bank can harness emerging technologies to offset these impacts.

Blockchain technology offers a significant avenue for innovation, particularly in streamlining cross-border transactions which are often slower and more complex. This can lead to increased efficiency and potentially new revenue streams for the bank.

The increasing adoption of systems like FedNow necessitates robust next-generation Know Your Customer (KYC), fraud detection, and identity management solutions. These advancements are critical to maintaining security and compliance in an accelerated payment environment.

- Real-time Payments Growth: Global real-time payments are projected to grow significantly, with transaction volumes expected to reach 250 billion by 2025, up from 110 billion in 2022, according to Statista.

- Blockchain for Cross-Border Payments: Blockchain-based solutions can reduce cross-border transaction costs by an estimated 10-20% and settlement times from days to minutes.

- KYC/AML Compliance: The global KYC/AML software market is expected to reach $10.6 billion by 2025, highlighting the increasing investment in these critical security measures.

- FedNow Adoption: As of early 2024, over 350 financial institutions were on track to join the FedNow service, indicating a broad industry shift towards instant payment capabilities.

Technological advancements are reshaping banking, demanding continuous adaptation from institutions like BancFirst. The widespread adoption of mobile banking, with over 2.5 billion global users projected for 2024, underscores the necessity for robust digital platforms. Furthermore, the integration of AI and automation is poised to revolutionize customer service, with projections suggesting AI could handle over 90% of interactions by 2025.

BancFirst can leverage AI to streamline operations, potentially boosting labor productivity by 15-20% in areas like data entry. AI-powered fraud detection systems offer the capability to reduce fraud losses by up to 30%. The competitive landscape is also being altered by fintech firms, particularly in digital lending, where they are estimated to be involved in over 50% of new digital loan originations in the US by the end of 2024.

Cybersecurity remains paramount, with financial institutions facing increasing regulatory scrutiny and a rise in sophisticated cyberattacks. Proactive investment in advanced IT security is crucial, as average financial industry breach costs can run into millions of dollars. The shift towards real-time payments, exemplified by the growing adoption of services like FedNow, necessitates enhanced KYC, fraud detection, and identity management solutions.

| Technology Area | 2024/2025 Projection/Data | Impact on BancFirst |

| Mobile Banking Users | 2.5 billion+ (2024) | Need for enhanced mobile-centric services |

| AI in Customer Service | >90% of interactions by 2025 | Opportunity for efficiency and complex task focus |

| Fintech Digital Lending Share | >50% of US digital loan originations (end of 2024) | Increased competition, potential for partnerships |

| Real-time Payments Adoption | 250 billion transactions by 2025 | Requirement for advanced KYC and fraud detection |

Legal factors

BancFirst operates under a rigorous framework of federal and state banking regulations, overseen by entities like the Federal Reserve Board, FDIC, and state banking departments. Adherence to these rules, including capital adequacy ratios and consumer protection mandates, is non-negotiable for maintaining operational integrity and public trust.

The banking sector's regulatory landscape is continually evolving. In 2024, for instance, continued emphasis on addressing supervisory concerns and proving effective, long-term solutions to identified issues remains a key focus for institutions like BancFirst. This dynamic environment necessitates constant vigilance and adaptation to new compliance demands.

BancFirst, like all financial institutions, operates under stringent anti-money laundering (AML) and Know Your Customer (KYC) regulations. These legal frameworks are designed to prevent financial crimes and ensure the integrity of the financial system. For instance, in 2023, regulatory bodies globally continued to emphasize the importance of robust AML/KYC programs, with significant fines levied against institutions for non-compliance.

The evolving landscape of financial technology, particularly the rise of faster payment systems, intensifies the need for advanced KYC and identity verification solutions. BancFirst must invest in next-generation tools to effectively manage fraud and identity risks in this accelerated environment. Reports from industry analysts in late 2024 highlighted a growing demand for AI-powered KYC solutions, with the market projected to reach billions of dollars by 2025.

Maintaining compliance with these legal mandates is not merely a procedural requirement but a critical operational imperative for BancFirst. Failure to implement and maintain effective systems to prevent financial crimes can result in substantial penalties, reputational damage, and loss of customer trust. The Financial Crimes Enforcement Network (FinCEN) in the US, for example, consistently updates its guidance and enforcement priorities, impacting how banks like BancFirst must adapt their compliance strategies.

Stringent privacy regulations like the California Consumer Privacy Act (CCPA) and its upcoming successor, the California Privacy Rights Act (CPRA), significantly impact financial institutions. These laws mandate enhanced transparency and robust protection for customer data, requiring BancFirst to carefully manage how personal information is gathered, stored, and utilized. Failure to comply can lead to substantial fines; for instance, the CCPA allows for civil penalties up to $7,500 per intentional violation, making adherence a critical business imperative.

Lending and Credit Regulations

Regulations governing lending practices, such as consumer credit laws and fair lending acts, directly shape BancFirst's loan portfolio and operational framework. The bank must diligently adhere to these intricate rules, designed to safeguard consumers and ensure fair access to credit. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces regulations like the Truth in Lending Act (TILA) and the Equal Credit Opportunity Act (ECOA), impacting how BancFirst structures and offers its loan products.

Compliance with these evolving regulations can significantly influence BancFirst's loan growth trajectory and necessitate adjustments to its risk management strategies. For example, shifts in capital requirements or new disclosure mandates could alter the cost of lending or the types of loans the bank can profitably originate. In 2024, the banking sector continued to navigate a landscape of evolving consumer protection measures, emphasizing transparency and fairness in credit offerings.

- Consumer Protection Laws: BancFirst must comply with regulations like the Fair Credit Reporting Act (FCRA) and the Truth in Savings Act (TISA), ensuring accurate reporting and transparent savings account terms.

- Fair Lending Acts: Adherence to the Equal Credit Opportunity Act (ECOA) is critical, prohibiting discrimination in credit transactions based on race, color, religion, national origin, sex, marital status, or age.

- Regulatory Scrutiny: Increased oversight from bodies like the Federal Reserve and state banking departments means BancFirst faces ongoing reviews of its lending policies and practices to ensure compliance.

- Impact on Loan Products: Changes in regulations, such as those affecting mortgage origination or small business lending, can directly impact the profitability and availability of specific loan products offered by BancFirst.

Corporate Governance and Reporting Requirements

BancFirst, as a publicly traded financial holding company, navigates a landscape shaped by stringent corporate governance and reporting mandates from the Securities and Exchange Commission (SEC). This includes the regular filing of comprehensive annual reports on Form 10-K, detailing financial performance and operational activities. For instance, BancFirst's 2023 10-K filing provided extensive data on its asset growth, reaching $11.9 billion by year-end, and its net income of $171.2 million.

The regulatory environment is dynamic, with the SEC continually proposing new rules that impact disclosure. Upcoming regulations focusing on enhanced disclosures for human capital management and board diversity will necessitate further adaptation by BancFirst. These changes aim to provide investors with more granular insights into a company's workforce and leadership composition, fostering greater accountability.

Adherence to these evolving legal and reporting standards is paramount for BancFirst. It underpins transparency, building trust and confidence among its shareholders and the broader investment community. This commitment to robust governance ensures that BancFirst operates with a high degree of accountability, crucial for maintaining its reputation and market standing.

Key reporting requirements and their implications include:

- Form 10-K Filings: Annual comprehensive reports detailing financial health and operational performance, crucial for investor analysis.

- SEC Proposed Rulemaking: Anticipation of new disclosure requirements, such as those for human capital management and board diversity, demanding proactive compliance strategies.

- Shareholder Accountability: The direct link between transparent reporting and maintaining investor confidence and market valuation.

- Regulatory Compliance Costs: The ongoing investment required to meet evolving SEC standards, impacting operational budgets.

BancFirst's legal obligations extend to consumer protection, requiring strict adherence to acts like the Fair Credit Reporting Act and Truth in Savings Act for accurate reporting and transparent terms. Fair lending is also paramount, with the Equal Credit Opportunity Act prohibiting discrimination in credit. Increased oversight from federal and state regulators means BancFirst faces ongoing reviews of its lending practices.

The bank's loan products are directly impacted by regulatory shifts, affecting profitability and availability, particularly in areas like mortgage and small business lending. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces rules like the Truth in Lending Act and the Equal Credit Opportunity Act, shaping how BancFirst structures its offerings.

BancFirst must also comply with robust corporate governance and reporting mandates from the SEC, including annual filings like Form 10-K. In 2023, BancFirst reported $11.9 billion in assets and $171.2 million in net income. Anticipated new SEC rules on human capital management and board diversity will require further adaptation and investment in compliance.

| Regulatory Area | Key Legislation/Act | Implication for BancFirst | Example Data/Focus |

| Consumer Protection | FCRA, TISA | Accurate reporting, transparent terms | Ensuring timely credit report accuracy |

| Fair Lending | ECOA | Prohibiting discrimination in credit | Adherence to non-discriminatory loan underwriting |

| Corporate Governance | SEC Rules (10-K) | Transparent financial reporting, investor confidence | 2023 Assets: $11.9B, Net Income: $171.2M |

| Data Privacy | CCPA/CPRA | Enhanced data protection, transparency | Potential fines up to $7,500 per intentional violation |

Environmental factors

The financial sector's embrace of Environmental, Social, and Governance (ESG) principles is rapidly transforming how institutions operate. What was once a niche consideration is now a significant driver of revenue, with the market for green, social, and sustainability-linked bonds experiencing substantial growth. For instance, the global sustainable bond market reached approximately $1.5 trillion in 2023, a notable increase from previous years.

BancFirst, like its peers, faces increasing pressure to showcase tangible ESG commitments. This includes developing and promoting sustainable financing options and embedding responsible lending practices throughout its operations. By 2024, regulatory bodies and investor expectations will likely mandate clearer reporting on environmental impact and social responsibility metrics.

Regulators are increasingly prioritizing consistent and accurate ESG reporting, with a particular focus on climate risk disclosure. This push directly influences how financial services firms, including BancFirst, shape their investment strategies and risk management frameworks. For instance, the SEC's proposed climate disclosure rules, expected to be finalized in 2024, aim to standardize reporting for publicly traded companies, impacting data availability and comparability for financial institutions.

As many companies prepare for mandatory disclosure mandates, anticipated to become more widespread by 2025, the demand for robust ESG data will surge. This heightened accountability means BancFirst must proactively invest in sophisticated systems and processes. Such investments are crucial for effectively tracking, measuring, and reporting on its environmental, social, and governance-related activities, ensuring compliance with evolving regulatory landscapes and investor expectations.

Banks are significantly increasing their investment in sustainable finance, with many setting net-zero financed emissions targets and committing substantial funds to environmental transition projects. For instance, the Net-Zero Banking Alliance, a UN-convened group, reported in early 2024 that its members representing over 40% of the global banking sector had set science-based targets for 2030.

BancFirst can leverage this trend by exploring green financing options and integrating Environmental, Social, and Governance (ESG) factors into its lending and product development strategies. This approach is becoming crucial as consumer and investor preferences increasingly favor eco-friendly financial solutions, with sustainable investments globally expected to reach $50 trillion by 2025, according to some projections.

Operational Environmental Footprint

Beyond their core business of lending and investment, banks like BancFirst are increasingly scrutinizing their own operational environmental footprint. This includes managing energy consumption within their branches and offices, as well as implementing robust waste management strategies. While specific data for BancFirst's operational footprint isn't publicly detailed, the broader financial sector is seeing a push towards sustainability.

Industry-wide, financial institutions are embracing principles of the circular economy, aiming to reduce waste and reuse resources wherever possible. This often translates into initiatives focused on sustainable supply chains, encouraging vendors and partners to adopt environmentally conscious practices. Such efforts are not just about compliance but are integral to enhancing corporate social responsibility.

For instance, many banks are setting targets for reducing carbon emissions from their operations. A 2023 report indicated that a significant percentage of large financial institutions have established net-zero commitments, with many focusing on Scope 1 and 2 emissions, which directly relate to their operational activities. These commitments often involve investments in energy-efficient technologies and renewable energy sources for their facilities.

- Energy Efficiency: Many banks are upgrading lighting, HVAC systems, and IT infrastructure to reduce electricity consumption.

- Waste Reduction: Initiatives include paperless banking options, enhanced recycling programs, and responsible disposal of electronic waste.

- Sustainable Procurement: Financial institutions are increasingly vetting suppliers based on their environmental performance and ethical standards.

- Water Conservation: Efforts are being made to reduce water usage in facilities through efficient fixtures and landscaping.

Community Investments and Social Impact

BancFirst actively contributes to community development through significant investments in low-income housing and New Market Tax Credit initiatives. These efforts directly address the social pillar of Environmental, Social, and Governance (ESG) criteria, aiming to boost financial inclusion and overall community welfare.

These strategic investments yield tangible benefits for BancFirst, including the generation of valuable tax credits. Furthermore, this commitment to social impact bolsters the bank's corporate image and reputation within the communities it serves.

- Community Development Investments: BancFirst's focus on low-income housing and NMTCs demonstrates a commitment to social impact.

- ESG Alignment: These investments directly support the 'Social' component of ESG, promoting financial inclusion.

- Financial Benefits: BancFirst benefits from tax credits generated by these community-focused investments.

- Reputational Enhancement: Active participation in community development strengthens BancFirst's corporate standing.

Environmental factors are increasingly shaping the banking landscape, with a growing emphasis on climate risk and sustainable finance. By 2025, regulatory bodies are expected to mandate more comprehensive ESG reporting, pushing institutions like BancFirst to enhance their data collection and disclosure practices. The global sustainable bond market, valued at approximately $1.5 trillion in 2023, highlights a significant shift towards environmentally conscious investment, a trend BancFirst can leverage.

PESTLE Analysis Data Sources

Our BancFirst PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial news outlets, and industry-specific market research reports. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to ensure a comprehensive and accurate assessment.