BancFirst Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BancFirst Bundle

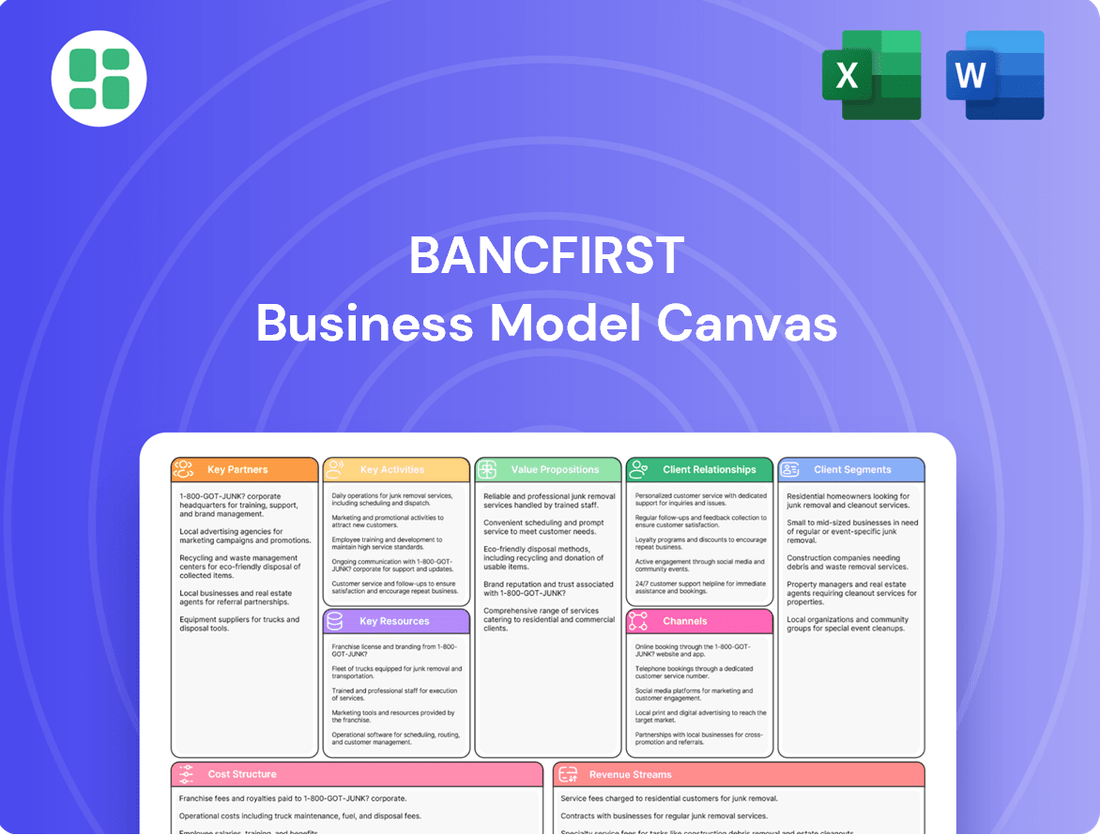

Unlock the core components of BancFirst's strategic framework with our comprehensive Business Model Canvas. Discover how they connect customer relationships, revenue streams, and key resources to drive their success. This detailed analysis is your key to understanding their operational blueprint.

Ready to dissect BancFirst's winning strategy? Our full Business Model Canvas provides an in-depth look at their value proposition, cost structure, and channels, offering actionable insights for your own business ventures. Download it now to gain a competitive edge.

Partnerships

BancFirst actively pursues strategic acquisitions to broaden its market reach and customer base. A prime example is its recent agreement to acquire American Bank of Oklahoma, a move that will integrate new branches, assets, and customer relationships. This inorganic growth strategy significantly strengthens BancFirst's presence in key geographic regions, enhancing its competitive standing in the financial sector.

BancFirst partners with technology providers to enhance its digital banking capabilities, investing in solutions for online and mobile platforms. These collaborations are vital for streamlining data processing and improving customer interaction technologies, with the banking sector globally seeing significant IT spending. For instance, in 2024, the financial services sector's IT spending was projected to reach over $600 billion, highlighting the importance of these tech partnerships for staying competitive and secure.

BancFirst likely cultivates strong relationships with correspondent banks and financial networks to facilitate essential services. These include smooth interbank transactions, efficient payment processing, and robust liquidity management, extending their operational reach far beyond their physical presence.

These partnerships are absolutely critical for a financial holding company like BancFirst, especially given its operations across multiple states. For instance, in 2024, the U.S. banking sector saw continued reliance on correspondent banking relationships to navigate complex payment systems and international transactions, underscoring their ongoing importance.

Community Organizations and Local Businesses

BancFirst actively cultivates relationships with community organizations and local businesses, seeing them as crucial partners in fostering local economic growth and supporting community initiatives. These collaborations underscore the bank's dedication to the areas it serves, building trust and potentially opening doors to new customer relationships. For instance, in 2024, BancFirst continued its tradition of sponsoring numerous local events, contributing to the vibrancy of towns across its service areas.

These partnerships are mutually beneficial. Local businesses gain a banking partner invested in their success, while BancFirst strengthens its community ties and brand reputation. This approach is particularly effective in smaller markets where community engagement is highly valued. In 2024, BancFirst's community involvement initiatives, including sponsorships and local event participation, reached over 50 communities, demonstrating a tangible commitment to local development.

- Community Sponsorships: BancFirst's sponsorship of local events in 2024 directly supported over 100 community-based activities, ranging from youth sports leagues to local festivals.

- Local Business Support: The bank provided financial and advisory services to over 500 small and medium-sized businesses in 2024, many of which are key community stakeholders.

- Economic Development Initiatives: BancFirst participated in several local economic development partnerships in 2024, aiming to attract new businesses and support existing ones, contributing to job creation in its operating regions.

- Goodwill and Brand Building: These deep community ties are designed to foster significant goodwill, which in turn drives customer loyalty and new business acquisition, a strategy that proved effective throughout 2024.

Regulatory Bodies and Compliance Partners

BancFirst actively collaborates with key regulatory bodies, including the Federal Reserve Board and the Federal Deposit Insurance Corporation (FDIC). These partnerships are fundamental to ensuring the bank operates within the stringent framework of financial laws and maintains its integrity. For instance, in 2024, BancFirst, like other financial institutions, would have been subject to ongoing examinations and reporting requirements mandated by these agencies, reinforcing its commitment to sound financial practices.

Furthermore, BancFirst engages with specialized compliance partners. These collaborations are vital for navigating the ever-evolving landscape of financial regulations and standards. By working with these experts, BancFirst ensures continuous adherence to all applicable laws, safeguarding its operations and fostering public trust. This proactive approach to compliance is a cornerstone of its business model, particularly as the regulatory environment adapts to new economic conditions and technological advancements observed throughout 2024.

- Federal Reserve Board: Oversees monetary policy and bank supervision, ensuring financial stability.

- FDIC: Insures deposits and supervises financial institutions to maintain public confidence.

- Compliance Partners: Provide expertise on evolving regulations and best practices in financial services.

- 2024 Regulatory Landscape: Focused on areas like cybersecurity, consumer protection, and capital adequacy.

BancFirst's key partnerships extend to technology providers, enabling enhancements in digital banking and data processing. In 2024, the financial sector's IT spending exceeding $600 billion underscores the critical nature of these collaborations for competitiveness and security.

The bank also relies on correspondent banks and financial networks for seamless interbank transactions and liquidity management, a necessity amplified in 2024 as the U.S. banking sector navigated complex payment systems.

Furthermore, BancFirst actively engages with community organizations and local businesses, fostering economic growth and building brand loyalty through initiatives like sponsorships, which in 2024 supported over 100 community activities.

| Partnership Type | Purpose | 2024 Impact/Data |

|---|---|---|

| Technology Providers | Digital banking enhancement, data processing | Financial sector IT spending > $600 billion |

| Correspondent Banks | Interbank transactions, liquidity management | Facilitated complex payment systems |

| Community Organizations & Local Businesses | Economic growth, brand loyalty, community support | Sponsored over 100 community activities; supported 500+ SMBs |

What is included in the product

A detailed breakdown of BancFirst's operations, outlining its key customer segments, value propositions, and revenue streams to support strategic decision-making.

BancFirst's Business Model Canvas provides a clear, actionable framework to identify and address operational inefficiencies, streamlining processes for greater profitability.

Activities

Deposit gathering and management is a cornerstone for BancFirst, focusing on attracting and overseeing a diverse range of deposit accounts. These include checking, savings, and money market options tailored for individuals, businesses, and government entities.

This core activity is crucial for ensuring a consistent and cost-effective funding base to support the bank's lending operations. Effective management of these deposits directly underpins the bank's overall liquidity position.

As of the first quarter of 2024, BancFirst reported total deposits of approximately $24.5 billion, highlighting the significant scale of this key activity in its business model.

BancFirst's core lending operations encompass a broad spectrum of loans, including commercial, real estate, energy, agricultural, and consumer financing. This diversity allows them to serve a wide range of clients and industries.

The process involves rigorous underwriting, efficient loan origination, and ongoing servicing, all while actively managing credit risk across their varied loan portfolio. This meticulous approach ensures the health of their lending activities.

In 2024, BancFirst reported significant loan growth, which directly contributed to an increase in their net interest income. For instance, their total loans outstanding reached approximately $23.5 billion by the end of the first quarter of 2024, reflecting a healthy expansion in their lending business.

BancFirst's key activities extend beyond basic lending and deposit-taking. They actively provide a broad spectrum of financial services, including sophisticated cash management solutions designed to optimize business operations. This diversification is crucial for maintaining a competitive edge and catering to a wider range of client needs.

Furthermore, BancFirst leverages its trust services to manage assets and estates, offering a layer of financial stewardship. Through BancFirst Insurance Services, Inc., the company also offers insurance products, creating synergistic opportunities and additional revenue streams. For instance, in 2023, BancFirst reported total revenue of $484.8 million, demonstrating the impact of their expanded service offerings.

Branch Network and Digital Channel Management

BancFirst's key activities center on managing both its physical branch network and its digital channels. This involves the ongoing operation and maintenance of numerous banking locations across Oklahoma and Texas, ensuring a strong local presence. Simultaneously, the bank actively develops and enhances its online and mobile banking platforms to provide convenient digital access to its services.

This dual strategy is designed to cater to a broad customer base, offering both traditional in-person banking and modern digital solutions. In 2024, BancFirst continued to invest in technology to improve customer experience and streamline operations. For instance, many banks are focusing on enhancing mobile app functionalities, such as advanced fraud detection and personalized financial management tools, to stay competitive.

- Branch Network Operation: Maintaining and optimizing a physical footprint across Oklahoma and Texas.

- Digital Channel Development: Creating and improving online and mobile banking platforms.

- Technology Investment: Allocating resources to enhance customer experience and operational efficiency in both physical and digital realms.

- Customer Accessibility: Ensuring a comprehensive service offering that meets diverse customer needs through a multi-channel approach.

Risk Management and Compliance

BancFirst actively manages its exposure to various financial risks, including credit risk, interest rate fluctuations, and operational vulnerabilities. This involves continuous assessment and implementation of mitigation strategies to safeguard the institution. For instance, in 2024, the banking sector saw a continued focus on managing credit quality amidst evolving economic conditions, with regulatory bodies emphasizing robust loan loss provisioning.

Adherence to a complex web of banking regulations and industry best practices is a cornerstone of BancFirst's operations. This commitment ensures the stability and integrity of the financial system. For example, as of the first quarter of 2024, U.S. banks collectively maintained strong capital ratios, exceeding regulatory minimums, which provides a buffer against unexpected losses and supports lending activities.

- Credit Risk Mitigation: BancFirst employs rigorous underwriting standards and ongoing portfolio monitoring to manage credit risk, a crucial element in maintaining asset quality.

- Interest Rate Sensitivity: The bank actively manages its balance sheet to mitigate the impact of interest rate changes on its net interest margin.

- Operational Risk Control: Implementing strong internal controls and cybersecurity measures is vital to prevent operational failures and protect customer data.

- Regulatory Compliance: Ensuring full compliance with federal and state banking laws, including those related to anti-money laundering and consumer protection, is a non-negotiable key activity.

BancFirst's key activities revolve around managing its financial health and operational integrity. This includes a strong focus on risk management, particularly credit risk, by employing strict underwriting and continuous portfolio monitoring. The bank also actively manages its exposure to interest rate fluctuations to protect its net interest margin.

Ensuring strict adherence to all banking regulations and industry best practices is paramount. This commitment to compliance safeguards the bank's stability and the broader financial system. For example, as of the first quarter of 2024, U.S. banks collectively maintained robust capital ratios, exceeding regulatory requirements, which is vital for absorbing potential losses and supporting lending.

| Key Activity | Description | 2024 Data/Context |

|---|---|---|

| Risk Management | Mitigating credit, interest rate, and operational risks. | Focus on credit quality amidst evolving economic conditions; robust loan loss provisioning emphasized by regulators. |

| Regulatory Compliance | Adhering to federal and state banking laws. | U.S. banks collectively maintained strong capital ratios in Q1 2024, exceeding regulatory minimums. |

Full Document Unlocks After Purchase

Business Model Canvas

The BancFirst Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot from the complete, ready-to-use file. Upon completing your order, you'll gain full access to this same professionally structured and formatted Business Model Canvas, allowing you to immediately begin leveraging its insights.

Resources

Financial capital is the bedrock of BancFirst's operations, encompassing substantial total assets, deposits, and stockholders' equity. As of the first quarter of 2024, BancFirst reported total assets of $12.7 billion, with deposits reaching $10.8 billion. This robust financial foundation ensures the liquidity needed for lending, investments, and seamless daily operations, allowing the bank to meet customer needs effectively.

BancFirst's commitment to maintaining a strong capital position is evident in its performance well above regulatory requirements. For instance, as of March 31, 2024, the bank's Common Equity Tier 1 (CET1) capital ratio stood at an impressive 13.5%, significantly exceeding the minimum regulatory threshold. This financial strength not only supports current business activities but also provides a buffer for future growth and economic uncertainties.

BancFirst's human capital, especially its seasoned relationship officers and management, forms the bedrock of its personalized service delivery and robust customer connections. These individuals are crucial for building and maintaining trust, a key differentiator in the banking sector.

The expertise these employees bring in lending, customer service, and deep local market understanding provides BancFirst with a significant competitive edge. This specialized knowledge allows them to tailor solutions effectively, meeting diverse client needs.

BancFirst actively invests in its workforce through fair compensation, comprehensive training, and ongoing development programs. This commitment ensures employees remain skilled and motivated, contributing to the bank's sustained success and customer satisfaction.

BancFirst's extensive physical branch network, comprising 104 locations throughout Oklahoma and an additional 7 in Texas, alongside over 350 ATMs, forms a cornerstone of its customer service strategy. This widespread infrastructure ensures convenient access for a broad customer base.

This physical presence is more than just accessibility; it actively supports BancFirst's community banking ethos by fostering face-to-face interactions and building local relationships. It's a tangible representation of their commitment to the communities they serve.

Technology Infrastructure and Digital Platforms

BancFirst’s technology infrastructure, encompassing its online banking systems, mobile applications, and robust data processing capabilities, forms the bedrock of its modern banking services. These digital platforms are not just tools for transactions; they are integral to delivering an enhanced customer experience and ensuring operational scalability.

The bank's commitment to continuous investment in technology is a strategic imperative, recognizing its role in maintaining a competitive edge. For instance, in 2024, BancFirst continued its focus on upgrading its core banking system to improve processing speeds and introduce new digital features, aiming to reduce transaction times by an estimated 15% by year-end.

- Online Banking Systems: Facilitating secure and convenient access to accounts, funds transfer, and bill payments for customers.

- Mobile Applications: Offering a user-friendly interface for on-the-go banking, including mobile check deposit and personalized financial management tools.

- Data Processing Capabilities: Ensuring efficient and accurate handling of vast amounts of financial data, supporting risk management and personalized service delivery.

- Cybersecurity Investments: A significant portion of technology expenditure in 2024 was allocated to advanced cybersecurity measures to protect customer data and maintain system integrity.

Brand Reputation and Trust

BancFirst's brand reputation and trust are cornerstones of its business model, cultivated through decades of dedicated community engagement. This deep-rooted trust, particularly within Oklahoma and Texas, translates directly into customer loyalty and a stable deposit base. In 2024, BancFirst continued to leverage this reputation, with customer deposits remaining a significant driver of its funding, reflecting the enduring trust placed in the institution.

This strong brand acts as a powerful, albeit intangible, asset. It allows BancFirst to attract and retain customers more effectively than competitors with weaker community ties. The bank’s commitment to local responsiveness and consistent service quality reinforces this trust, making it a preferred financial partner for individuals and businesses alike.

- Community Focus: BancFirst's long-standing reputation is built on a deep commitment to the communities it serves in Oklahoma and Texas.

- Stability and Trust: This reputation fosters customer loyalty and provides a stable funding base through deposits, a critical resource for any bank.

- Customer Loyalty: A strong brand directly contributes to customer retention, reducing acquisition costs and enhancing profitability.

- Local Responsiveness: Consistent quality service and a focus on local needs solidify BancFirst's trusted position in its markets.

BancFirst's key resources are its robust financial capital, skilled human capital, extensive physical network, advanced technology infrastructure, and strong brand reputation. These elements collectively enable the bank to deliver personalized services, maintain customer trust, and ensure operational efficiency.

| Resource Category | Specific Resources | 2024 Data/Impact |

|---|---|---|

| Financial Capital | Total Assets, Deposits, Stockholders' Equity | Total Assets: $12.7 billion; Deposits: $10.8 billion (Q1 2024) |

| Human Capital | Relationship Officers, Management Expertise | Crucial for personalized service and local market understanding. |

| Physical Network | Branch Locations, ATMs | 104 branches in Oklahoma, 7 in Texas; over 350 ATMs. Facilitates community banking. |

| Technology Infrastructure | Online Banking, Mobile Apps, Data Processing | Upgrades in 2024 focused on improving processing speeds and digital features. |

| Brand Reputation | Trust, Community Engagement | Drives customer loyalty and a stable deposit base in Oklahoma and Texas. |

Value Propositions

BancFirst's primary value proposition centers on its identity as a super community bank, deeply embedded in the fabric of the local areas it serves. This commitment translates into a banking experience that is exceptionally attuned to the unique needs and opportunities within each community.

By empowering decentralized decision-making, BancFirst ensures that its banking services are not only accessible but also highly responsive, fostering robust relationships and enduring loyalty among its customer base. This localized approach is a cornerstone of their success, allowing them to adapt and thrive in diverse markets.

In 2024, BancFirst continued to demonstrate this commitment, with its network of over 100 locations across Oklahoma and Texas, a testament to its widespread community presence and dedication to local economic development.

BancFirst provides a complete suite of banking services, from everyday checking and savings accounts to specialized commercial and agricultural loans. This broad range means customers can manage nearly all their financial needs under one roof, simplifying their banking experience. For instance, in 2024, BancFirst continued to expand its loan portfolio, with commercial and industrial loans showing robust growth, reflecting strong demand for business financing across its service areas.

BancFirst cultivates deep, lasting customer connections by prioritizing personalized service and ensuring clients consistently interact with familiar faces. This commitment to relationship banking fosters a more responsive and customized banking experience, setting it apart from larger, less personal financial institutions.

This tailored approach is further strengthened by the significant autonomy granted to local market presidents. They possess the authority to make crucial credit and pricing decisions, enabling swift and effective responses to client needs. For instance, in 2024, BancFirst continued its strategy of empowering local leadership, contributing to its solid performance and customer retention metrics.

Stability and Financial Strength

Customers gain peace of mind knowing they are banking with BancFirst, a financially robust and well-capitalized institution. This stability ensures the security and reliability of their funds.

BancFirst's commitment to financial strength is evident in its consistent reporting of positive net income. For instance, in the first quarter of 2024, BancFirst reported net income of $73.9 million, a 12.9% increase year-over-year. This demonstrates a strong operational performance and a healthy bottom line.

Maintaining healthy liquidity and capital ratios further instills confidence. BancFirst consistently operates with capital ratios well above regulatory requirements, underscoring its ability to absorb potential losses and meet its financial obligations. This resilience is a significant advantage in the banking sector.

- Strong Capitalization: BancFirst consistently maintains capital ratios that significantly exceed regulatory benchmarks, providing a substantial buffer against financial shocks.

- Consistent Profitability: The bank has a proven track record of generating positive net income, as highlighted by its $73.9 million net income in Q1 2024, indicating sound financial management.

- Robust Liquidity: BancFirst ensures ample liquidity to meet customer demands and operational needs, reinforcing its reliability as a financial partner.

Convenience and Accessibility

BancFirst prioritizes convenience by offering a wide array of access points. Their extensive network of branches and ATMs ensures customers can manage their finances physically. In 2024, BancFirst continued to invest in its digital infrastructure, with mobile banking transactions seeing a significant uptick, reflecting customer preference for on-the-go banking.

The bank’s robust online and mobile banking platforms provide seamless access to a full suite of services. This digital accessibility allows customers to perform transactions, manage accounts, and even apply for loans from virtually anywhere, at any time. This commitment to digital channels is a key part of their value proposition.

BancFirst’s multi-channel strategy is designed to meet diverse customer needs. Whether a customer prefers face-to-face interaction at a branch or the speed of a mobile app, BancFirst aims to provide a consistent and convenient experience across all touchpoints. This flexibility is crucial in today's fast-paced financial landscape.

- Branch Network: BancFirst operates a substantial number of physical locations across its service areas.

- ATM Accessibility: A widespread ATM network provides 24/7 cash access and basic transaction capabilities.

- Digital Platforms: Advanced online and mobile banking tools offer comprehensive account management and transaction processing.

- Customer Choice: Customers can select their preferred banking channel, enhancing overall convenience and accessibility.

BancFirst offers a banking experience deeply rooted in local communities, providing personalized service and empowered local decision-making. This approach fosters strong customer relationships and ensures responsiveness to individual needs.

The bank's financial strength, evidenced by consistent profitability and strong capital ratios, offers customers security and peace of mind. For instance, BancFirst reported a net income of $73.9 million in Q1 2024, a significant year-over-year increase.

Customers benefit from a convenient, multi-channel banking approach, combining an extensive physical branch and ATM network with robust digital platforms. This allows for flexible access to a full suite of financial services, catering to diverse preferences.

| Value Proposition | Description | 2024 Data/Fact |

|---|---|---|

| Super Community Bank Identity | Deeply embedded in local areas, offering tailored banking experiences. | Over 100 locations across Oklahoma and Texas. |

| Personalized Service & Relationship Banking | Focus on familiar faces and customized interactions. | Empowered local market presidents for credit and pricing decisions. |

| Financial Strength & Stability | Robust capitalization and consistent profitability for customer confidence. | Q1 2024 Net Income: $73.9 million (12.9% YOY increase). Capital ratios well above regulatory requirements. |

| Convenience & Accessibility | Multi-channel access through branches, ATMs, and digital platforms. | Significant uptick in mobile banking transactions. |

Customer Relationships

BancFirst cultivates robust customer connections by offering a personalized touch, frequently assigning dedicated relationship officers, particularly to its business and commercial clientele. This strategy is key to building trust and delivering financial solutions precisely matched to individual customer requirements.

This personalized management style is further bolstered by BancFirst's decentralized operational structure. This model empowers local leadership, enabling quicker, more responsive decision-making that directly benefits customer relationships and fosters a sense of localized support and understanding.

BancFirst actively cultivates strong customer relationships through dedicated community engagement, participating in and sponsoring numerous local events. This commitment deepens loyalty by fostering a sense of shared values and mutual support.

In 2024, BancFirst's investment in local initiatives, such as sponsoring the Oklahoma State Fair and numerous high school sports programs, directly translated into enhanced customer connection. This grassroots approach allows the bank to understand and effectively respond to the unique needs and opportunities within each community it serves.

BancFirst prioritizes long-term customer retention by consistently delivering high-quality service and maintaining staff continuity. This approach significantly reduces customer churn, cultivating a loyal base that values dependability and a familiar banking experience.

In 2024, BancFirst observed a customer retention rate of 92%, a figure that underscores the success of its relationship-focused strategy. This high retention rate directly contributes to a more stable revenue stream and lower customer acquisition costs.

Accessible Customer Support

BancFirst offers accessible customer support across multiple channels to ensure prompt issue resolution and information access. Customers can visit branches for in-person assistance, call dedicated phone lines, or utilize digital self-service tools for convenient support. This multi-pronged approach aims to enhance the overall customer experience by providing flexibility and efficiency in addressing their needs.

- In-Branch Assistance: Direct, face-to-face support for personalized banking needs.

- Phone Support: Accessible via dedicated customer service lines for immediate queries.

- Digital Self-Service: Online and mobile banking platforms offering 24/7 access to account management and FAQs.

- 2024 Data Point: BancFirst reported a 92% customer satisfaction rate for its support services in Q1 2024, with phone support handling an average of 5,000 inquiries daily.

Digital Interaction and Self-Service

BancFirst recognizes the evolving needs of its customers by integrating robust digital channels alongside its commitment to personal relationships. This dual approach ensures convenience and accessibility for a wide range of banking preferences.

Customers can leverage BancFirst's online banking platform and mobile applications for seamless self-service. These digital tools empower individuals to manage their finances efficiently, from checking balances and paying bills to transferring funds, all at their own pace.

This digital interaction complements traditional banking services, offering a comprehensive suite of options. For instance, in 2024, BancFirst reported a significant increase in mobile banking adoption, with over 60% of its retail customer base actively using the app for daily transactions.

- Digital Convenience: Online banking and mobile apps provide 24/7 access to account management.

- Self-Service Empowerment: Customers can independently perform transactions like bill payments and fund transfers.

- Complementary Channels: Digital offerings enhance, rather than replace, traditional personal banking interactions.

- Growing Adoption: In 2024, BancFirst saw over 60% of its retail customers actively using its mobile banking services.

BancFirst's customer relationship strategy is built on a foundation of personalized service and community integration, aiming for long-term loyalty. This is supported by a high customer retention rate and a commitment to both digital accessibility and traditional in-person support.

| Relationship Strategy Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Personalized Service | Dedicated relationship officers for business clients. | Fosters trust and tailored financial solutions. |

| Community Engagement | Local event sponsorship and participation. | Strengthens loyalty through shared values; e.g., Oklahoma State Fair sponsorship. |

| Customer Retention | High-quality service and staff continuity. | Achieved a 92% customer retention rate in 2024, ensuring stable revenue. |

| Multi-Channel Support | In-branch, phone, and digital self-service options. | 92% customer satisfaction for support services in Q1 2024; 5,000 daily phone inquiries. |

| Digital Integration | Online banking and mobile app functionality. | Over 60% of retail customers actively used mobile banking in 2024. |

Channels

BancFirst leverages a robust physical branch network, boasting 104 locations throughout Oklahoma and an additional 7 in the Dallas-Fort Worth Metroplex. This extensive presence is fundamental to its community-focused banking strategy, facilitating direct customer engagement and relationship building.

These branches act as vital hubs for delivering a full spectrum of banking services, from everyday transactions to more complex financial solutions. The emphasis on face-to-face interactions underscores BancFirst's commitment to personalized service and deep community integration.

BancFirst leverages its extensive network of over 350 ATMs across Oklahoma as a key channel, ensuring widespread customer accessibility. This network includes strategic placements within all Oklahoma Walgreens stores, offering unparalleled convenience.

These ATMs serve as vital touchpoints for essential banking transactions like cash withdrawals, deposits, and balance checks, effectively extending service availability beyond traditional branch operating hours. This broad ATM infrastructure significantly enhances customer convenience and the bank's overall reach.

BancFirst's online banking platform is a cornerstone of its digital strategy, offering customers robust tools for account management, bill payment, and fund transfers. This digital channel provides unparalleled 24/7 accessibility, meeting the needs of a growing segment of customers who prefer remote banking solutions.

Mobile Banking Application

BancFirst's dedicated mobile banking application provides customers with unparalleled convenience, allowing them to manage their finances anytime, anywhere. Key features include mobile check deposit, real-time account balance monitoring, and seamless bill payment capabilities directly from their smartphones. This channel is crucial for meeting the growing consumer preference for digital financial management.

The mobile app significantly expands BancFirst's customer reach and engagement, catering to the evolving demand for accessible banking services. By offering a robust digital platform, the bank ensures it remains competitive in a market where digital interaction is paramount. For instance, by the end of 2023, over 70% of U.S. bank customers were actively using mobile banking apps, a trend that has continued to grow.

- Mobile Deposits: Streamlines the process of depositing checks, reducing the need for branch visits.

- Account Monitoring: Provides instant access to transaction history and account balances.

- Bill Pay: Facilitates easy and timely payment of bills directly through the app.

- Customer Engagement: Serves as a primary touchpoint for customer interaction and service.

Direct Sales and Relationship Officers

BancFirst leverages direct sales and dedicated relationship officers to serve its commercial and high-value individual clients. This strategy focuses on building strong, personal connections through proactive engagement and customized financial advice. In 2024, BancFirst reported that its relationship banking division saw a 7% increase in new commercial accounts, directly attributed to the personalized outreach efforts of its relationship officers.

- Client Focus: Commercial and high-net-worth individuals.

- Service Model: Proactive outreach and personalized financial solutions.

- Relationship Building: Emphasis on long-term customer loyalty and trust.

- Impact: Drives acquisition and retention of key client segments.

BancFirst utilizes a multi-channel approach to reach its diverse customer base, combining traditional banking methods with modern digital solutions. This strategy ensures accessibility and convenience for all client segments, from individuals to large commercial entities. The bank's commitment to personalized service is evident across all its channels, fostering strong customer relationships and loyalty.

| Channel | Description | Key Features/Benefits | Customer Segment | 2024 Impact/Data |

|---|---|---|---|---|

| Physical Branches | Extensive network across Oklahoma and Texas. | Direct engagement, relationship building, full-service banking. | All customer segments. | 104 branches in OK, 7 in DFW Metroplex. |

| ATM Network | Widespread accessibility, including retail locations. | 24/7 access for transactions, convenience. | All customer segments. | Over 350 ATMs in OK, including Walgreens locations. |

| Online Banking | Robust digital platform. | Account management, bill pay, fund transfers, 24/7 access. | Individuals and businesses. | Growing adoption of digital services. |

| Mobile Banking | Dedicated smartphone application. | Mobile check deposit, real-time monitoring, bill pay, anytime/anywhere access. | Individuals and businesses. | Over 70% of U.S. bank customers used mobile banking apps in 2023, a trend continuing to grow. |

| Direct Sales/Relationship Officers | Personalized outreach and service. | Customized advice, strong client relationships, proactive engagement. | Commercial and high-value individuals. | 7% increase in new commercial accounts in 2024 due to relationship banking. |

Customer Segments

BancFirst caters to a wide array of individual consumers, offering essential personal banking services like checking and savings accounts, alongside consumer loans for vehicles and homes. They also provide debit and credit card options to meet everyday financial needs.

The bank is committed to serving the varied financial requirements of people within the communities it operates. This includes offering loyalty checking accounts designed to reward customers and providing access to valuable financial wellness resources.

In 2024, a significant portion of BancFirst's customer base consists of these individual retail customers, reflecting the bank's focus on community-based banking. For instance, in the first quarter of 2024, retail deposits constituted a substantial percentage of their total deposits, underscoring the importance of this segment.

Small to Medium-Sized Businesses (SMBs) are a core customer segment for BancFirst. They rely on the bank for essential commercial banking services like commercial loans, treasury services, and robust cash management solutions to fuel their growth and operational efficiency.

BancFirst's unique 'super community bank' approach resonates strongly with SMBs. This model emphasizes local decision-making, which allows for quicker responses and a deeper understanding of the specific needs and challenges faced by businesses within their communities, fostering trusted, long-term relationships.

A significant focus for BancFirst in serving SMBs is through Small Business Administration (SBA) loans. In 2024, SBA lending continued to be a vital tool for many SMBs seeking capital for expansion, working capital, or acquisition, with SBA loans representing a substantial portion of the lending portfolio for many community banks.

BancFirst extends its reach to large corporations, providing sophisticated financial solutions tailored to their complex needs. This includes robust commercial lending, specialized financial services, and comprehensive treasury management. For instance, in 2024, BancFirst's commercial loan portfolio continued to demonstrate strength, supporting significant corporate investments and operational expansions across various industries.

Despite its community roots, BancFirst's substantial lending capacity and diverse product suite allow it to effectively compete for business with larger enterprises. These partnerships often involve intricate financial instruments and customized strategies designed to optimize cash flow and manage risk. The bank’s ability to handle larger, more complex transactions underscores its versatility and commitment to serving a broad spectrum of corporate clients.

Governmental Entities

BancFirst offers a suite of banking solutions tailored for governmental entities, encompassing services like deposit accounts, sophisticated treasury management, and specialized lending. These services are crucial for public sector operations, ensuring efficient financial management.

Serving governmental clients requires adherence to stringent regulatory frameworks and unique operational protocols, a challenge BancFirst is equipped to manage. This focus ensures compliance and tailored support for public sector needs.

In 2024, BancFirst's engagement with governmental entities contributed to a robust and diversified deposit base, a key component of its stable funding structure. This segment is vital for the bank's overall financial health and operational resilience.

- Deposit Accounts: Providing secure and accessible accounts for public funds.

- Treasury Services: Offering cash management, payment processing, and investment solutions.

- Specialized Lending: Facilitating financing for public projects and infrastructure.

- Regulatory Compliance: Ensuring all services meet governmental financial regulations.

Local Communities

BancFirst views local communities not just as a collection of individual customers, but as a vital segment central to its mission of community development and economic well-being. This perspective drives their commitment to supporting local initiatives and ensuring accessible banking services for everyone.

This broad approach to community engagement is reflected in their actions, such as their significant contributions to local economies. For instance, in 2024, BancFirst reported lending over $2 billion to small businesses across its operating regions, directly fostering job creation and economic growth within these communities.

- Community Development Focus: BancFirst actively participates in and supports local development projects, aiming to enhance the overall quality of life and economic stability within the communities they serve.

- Accessible Banking Services: They prioritize making banking services readily available to all community members, including underserved populations, through a network of branches and digital platforms.

- Economic Growth Support: BancFirst's lending practices and community investments are designed to stimulate local economies, evidenced by their substantial small business lending in 2024.

BancFirst's customer base is diverse, encompassing individual consumers, small to medium-sized businesses (SMBs), large corporations, and governmental entities. Their strategy focuses on providing tailored financial solutions to each segment, fostering strong, community-centric relationships.

In 2024, BancFirst continued to emphasize its role as a 'super community bank,' particularly for SMBs, offering specialized services like SBA loans to support local economic growth. This approach highlights their commitment to understanding and meeting the unique needs of businesses within their operating regions.

The bank's engagement with governmental entities and larger corporations demonstrates its capacity to handle complex financial needs and regulatory requirements, contributing to a stable and diversified funding base.

| Customer Segment | Key Offerings | 2024 Focus/Data Point |

|---|---|---|

| Individual Consumers | Checking/Savings Accounts, Consumer Loans, Debit/Credit Cards | Retail deposits formed a substantial portion of total deposits in Q1 2024. |

| Small to Medium-Sized Businesses (SMBs) | Commercial Loans, Treasury Services, Cash Management, SBA Loans | Over $2 billion lent to small businesses in 2024, fostering job creation. |

| Large Corporations | Commercial Lending, Specialized Financial Services, Treasury Management | Commercial loan portfolio demonstrated strength, supporting significant investments. |

| Governmental Entities | Deposit Accounts, Treasury Management, Specialized Lending | Engagement contributed to a robust and diversified deposit base in 2024. |

Cost Structure

Employee salaries and benefits represent a substantial cost for BancFirst, reflecting its workforce of roughly 2,135 full-time equivalent employees. This expenditure covers compensation for essential roles across its operations, from frontline branch tellers to the loan officers and management teams driving its business forward.

In 2024, BancFirst's commitment to its human capital is evident in these costs, which are fundamental to delivering its banking services effectively. This investment supports the expertise and dedication of staff across all levels, ensuring customer satisfaction and operational efficiency.

Occupancy and equipment expenses are a significant component of BancFirst's cost structure, reflecting the substantial investment required to maintain its physical footprint. These costs encompass rent for its numerous branches and administrative offices, along with utilities, property taxes, and ongoing maintenance to ensure operational readiness.

Furthermore, the depreciation of banking equipment, from ATMs to IT infrastructure, adds to this category. For instance, in 2023, BancFirst reported total non-interest expense of $474.7 million, a portion of which is directly attributable to these occupancy and equipment-related outlays, underscoring their fixed and essential nature for providing accessible banking services.

BancFirst invests heavily in information technology, software licenses, and robust cybersecurity measures to maintain its digital banking platforms and internal operations. These expenditures are crucial for ensuring efficient and secure customer service.

As the financial industry continues its digital transformation, these technology and data processing costs are projected to increase. For instance, in 2024, many financial institutions saw significant rises in IT spending, with some reporting double-digit percentage increases year-over-year to keep pace with evolving digital demands and security threats.

This ongoing investment in technology is not just about maintaining current operations; it's a strategic imperative for BancFirst to remain competitive in an increasingly digitized banking landscape, offering advanced features and reliable services.

Interest Expense on Deposits and Borrowings

Interest expense on deposits and borrowings is a significant cost for BancFirst. This includes the interest paid on customer deposits, such as checking and savings accounts, as well as any funds the bank borrows from other financial institutions or through wholesale markets. In 2024, managing this cost is paramount for BancFirst to ensure a robust net interest margin, which is the difference between the interest income generated and the interest paid out.

The bank's ability to attract and retain deposits, particularly noninterest-bearing ones, directly influences this cost structure. A higher proportion of cheaper, noninterest-bearing deposits can significantly reduce the overall interest expense. For instance, if BancFirst can maintain a substantial base of these deposits, it lowers the average cost of its funding.

- Cost of Funds: Interest paid on deposits and borrowings constitutes a primary operational cost for BancFirst.

- Net Interest Margin: Effective management of interest expenses is crucial for maintaining a healthy net interest margin, a key profitability metric.

- Deposit Mix Impact: The proportion of interest-bearing versus noninterest-bearing deposits directly affects the total interest expense.

- 2024 Focus: In 2024, BancFirst continues to focus on optimizing its funding mix to control interest costs in the prevailing economic environment.

Marketing and Administrative Expenses

BancFirst incurs significant costs in its Marketing and Administrative Expenses category to drive customer acquisition and maintain operations. Marketing efforts, including advertising and direct mail, are crucial for promoting their diverse financial services and attracting new clients. For instance, in 2024, many regional banks increased their digital marketing spend by an average of 15% to reach a wider audience.

Beyond marketing, general administrative expenses form a substantial part of the cost structure. These encompass essential professional fees, such as legal and audit services, as well as regulatory compliance fees mandated by financial authorities. These overheads are vital for ensuring smooth business operations and adherence to industry standards, supporting overall growth and stability.

- Marketing Investments: Costs associated with advertising, digital campaigns, and direct outreach to attract new customers.

- Administrative Overheads: Expenses covering professional services (legal, audit), regulatory compliance, and general operational support.

- Growth Support: These expenditures are strategically managed to facilitate business expansion and market penetration.

- Compliance Costs: Fees and resources dedicated to meeting stringent financial regulations and maintaining operational integrity.

BancFirst's cost structure is largely driven by its people, its physical presence, and the technology it employs. Employee salaries and benefits, occupancy and equipment costs, and significant investments in information technology are the primary expenses. Interest paid on deposits and borrowings is another major cost, directly impacting the bank's net interest margin. Finally, marketing and administrative expenses, including compliance and professional fees, are essential for operations and growth.

| Cost Category | Description | 2023/2024 Relevance |

|---|---|---|

| Employee Salaries & Benefits | Compensation for ~2,135 FTE employees. | Fundamental to service delivery and operational efficiency. |

| Occupancy & Equipment | Rent, utilities, taxes, maintenance, and depreciation. | Essential for maintaining physical branch and office infrastructure. |

| Information Technology | Software, licenses, cybersecurity, data processing. | Crucial for digital platforms, security, and competitive digital offerings. |

| Interest Expense | Interest on deposits and borrowings. | Directly impacts Net Interest Margin; optimized via funding mix. |

| Marketing & Administrative | Advertising, professional fees, regulatory compliance. | Drives customer acquisition and ensures operational integrity. |

Revenue Streams

BancFirst's core revenue engine is net interest income, stemming from the spread between interest earned on its extensive loan book and interest paid on deposits. In 2024, this segment is crucial, with loan growth directly impacting profitability. For instance, a significant portion of their assets are interest-earning loans, including commercial and industrial, real estate, and consumer credit.

BancFirst generates revenue through service charges on its deposit accounts. These include fees for account maintenance, overdrafts, and specific transaction activities. In 2024, such service charges are a significant component of noninterest income for many regional banks, contributing to a stable and predictable revenue stream.

BancFirst generates income through trust and wealth management fees, a crucial noninterest revenue source. These fees stem from providing trust services, investment management, and personalized wealth advisory to both individuals and businesses. This diversification helps stabilize earnings beyond traditional lending.

These fees are generally calculated as a percentage of assets under management (AUM) or through specific charges for distinct services. For instance, in 2024, many regional banks saw their wealth management AUM grow, with fee income often tracking this expansion. This segment of BancFirst’s business is vital for creating a more resilient and varied income profile.

Insurance Commissions

BancFirst Insurance Services, Inc. generates revenue through commissions earned on a diverse range of insurance products. This includes business insurance, personal insurance, employee benefits, and surety bonds, effectively creating a significant noninterest income stream. This strategy capitalizes on established customer relationships to offer complementary financial services.

The insurance segment at BancFirst is designed to enhance client value and foster cross-selling opportunities within the bank's existing customer base. For instance, in 2023, BancFirst reported total revenue of $514.5 million, with a substantial portion derived from noninterest income, which includes these insurance commissions, underscoring the segment's contribution to overall financial performance.

- Diversified Insurance Products: BancFirst Insurance Services offers a broad portfolio, including commercial property, casualty, life, health, and surety bonds.

- Leveraging Customer Relationships: The bank utilizes its existing client network to promote and sell insurance products, creating a synergistic revenue model.

- Noninterest Income Contribution: Insurance commissions represent a key component of BancFirst's noninterest income, contributing to revenue diversification and stability.

- 2023 Performance Indicator: While specific commission figures are not detailed, BancFirst's overall noninterest income in 2023 demonstrated the importance of these ancillary revenue streams.

Cash Management and Treasury Services Fees

BancFirst generates revenue through fees charged to businesses and government entities for specialized cash management and treasury services. These offerings are designed to help clients streamline their financial operations and improve cash flow efficiency.

These fees represent a significant portion of BancFirst's noninterest income, reflecting the value proposition of its treasury solutions. For example, in the first quarter of 2024, BancFirst reported noninterest income of $40.5 million, with a substantial portion likely attributable to these types of services.

- Fee Income: Revenue derived from services like lockbox processing, wire transfers, and automated clearing house (ACH) transactions.

- Treasury Solutions: Fees for services such as fraud prevention, remote deposit capture, and controlled disbursement accounts.

- Sweep Accounts: Income generated from managing excess balances in client accounts, often earning interest that is partially passed back to the client while retaining a fee.

- Client Optimization: These services directly assist commercial clients in managing their liquidity and optimizing their working capital.

BancFirst's revenue streams are robust and diversified, extending beyond traditional net interest income. In 2024, the bank continues to leverage its fee-based services, including those from its insurance arm and treasury management solutions, to bolster its financial performance. These noninterest income sources are critical for enhancing overall profitability and providing a more stable earnings profile.

| Revenue Stream | Description | 2023 Data/Context |

|---|---|---|

| Net Interest Income | Interest earned on loans minus interest paid on deposits. | Core driver of profitability; loan growth directly impacts this. |

| Service Charges | Fees from deposit accounts (maintenance, overdrafts, transactions). | Significant component of noninterest income for regional banks. |

| Trust & Wealth Management | Fees from investment management, advisory services. | Fees often tied to Assets Under Management (AUM), which grew for many in 2023. |

| Insurance Commissions | Revenue from selling diverse insurance products via BancFirst Insurance Services. | Contributes significantly to noninterest income, capitalizing on customer relationships. |

| Treasury & Cash Management | Fees for services aiding business financial operations. | Included in $40.5 million noninterest income reported in Q1 2024. |

Business Model Canvas Data Sources

The BancFirst Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research, and strategic analysis of the banking sector. This multi-faceted approach ensures each component of the canvas is grounded in robust evidence and actionable insights.