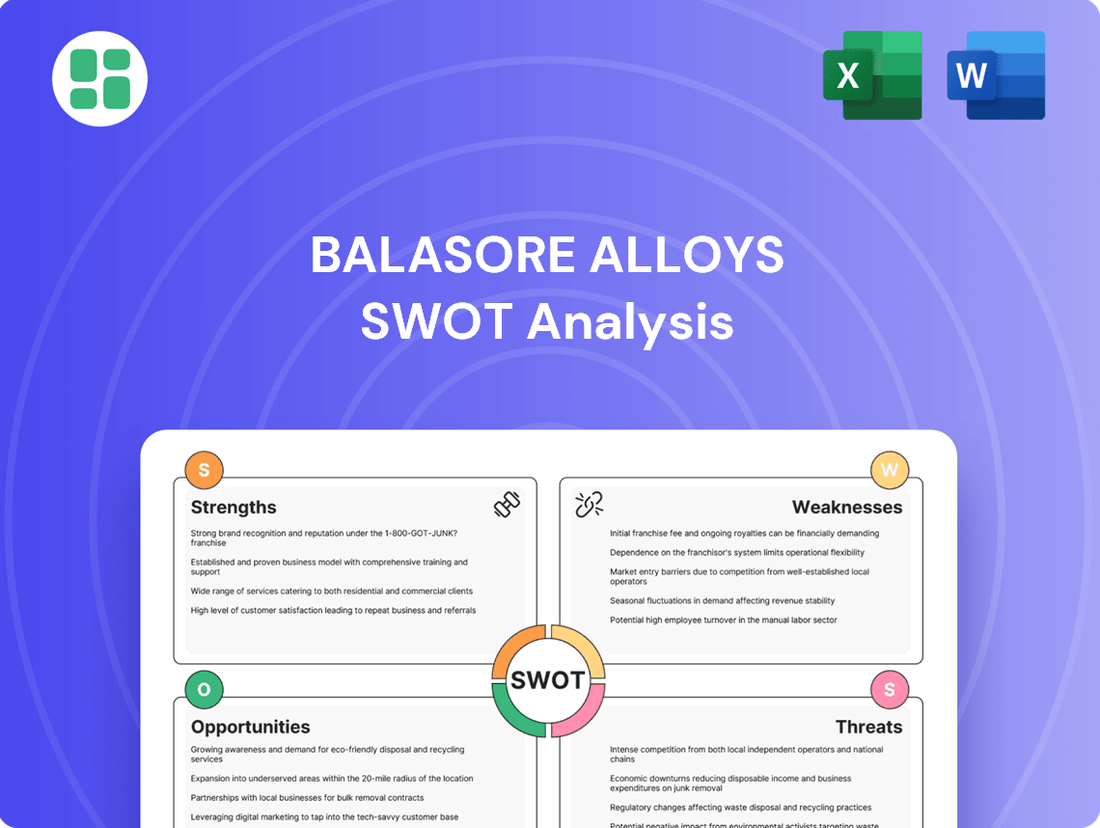

Balasore Alloys SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balasore Alloys Bundle

Balasore Alloys possesses strong production capabilities and a well-established market presence, but faces challenges from fluctuating raw material prices and intense competition. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Balasore Alloys' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Balasore Alloys' captive chrome ore mines in Sukinda Valley, Odisha, are a major strength. This direct control over a key raw material provides a significant competitive edge by ensuring a consistent and cost-efficient supply.

The company's ability to secure its chrome ore needs internally shields it from the price volatility and supply uncertainties prevalent in the external market. This strategic advantage is further amplified by the resumption of mining operations in February 2024, reinforcing their raw material security.

Balasore Alloys commands a robust market position, underscored by its status as a leading global producer of high-carbon ferro chrome. This strength is validated by its ISO 9001:2015 certification, a testament to its unwavering commitment to quality. The company's international reach is expanding, with export sales experiencing a notable surge in FY24, indicating growing global demand for its products.

Balasore Alloys boasts significant operational flexibility, a key strength derived from its multiple furnaces across two plants, each with varying capacities. This setup allows the company to efficiently produce a diverse range of ferro alloys, from high-carbon to low-carbon grades, catering to a broad spectrum of industrial needs.

This adaptability in production capacity and product mix is crucial for navigating market fluctuations. For instance, during periods of high demand for specific alloys, Balasore Alloys can optimize its furnace utilization to maximize output of those particular products, thereby maintaining a competitive edge and responding swiftly to customer requirements.

The company's product diversification strategy, enabled by its flexible manufacturing capabilities, ensures it is not overly reliant on a single product line. This resilience was evident in its performance, with the company reporting a notable increase in its revenue for the fiscal year ending March 31, 2024, reaching INR 1,123.5 crore, indicating strong market acceptance of its varied product offerings.

Improved Financial Performance (FY25)

Balasore Alloys has demonstrated a significant financial turnaround in fiscal year 2024-25. After experiencing losses in prior periods, the company reported a standalone net profit of INR 54.07 crore for FY25. This marks a substantial improvement from the net loss recorded in FY24.

This positive financial performance suggests enhanced operational efficiency and effective cost management strategies implemented by the company. The shift from a loss-making position to profitability highlights a stronger financial footing.

- Improved Profitability: Achieved a standalone net profit of INR 54.07 crore in FY25, reversing previous losses.

- Operational Efficiency: The turnaround indicates better cost control and streamlined operations.

- Financial Recovery: Demonstrates a successful recovery from a net loss in FY24.

Commitment to Quality and Business Excellence

Balasore Alloys demonstrates a strong commitment to quality, evidenced by its ISO 9001:2015 certification. This dedication to high standards makes it a preferred supplier for stainless steel manufacturers who prioritize product integrity.

The company actively employs business excellence initiatives, including Six Sigma and Total Productive Maintenance (TPM). These programs are designed to optimize operational efficiency and reduce waste, contributing to cost competitiveness.

Furthermore, Balasore Alloys' robust Supply Chain Management practices ensure reliable delivery and consistent product availability, a critical factor for its industrial clientele. This operational discipline strengthens its market position.

- ISO 9001:2015 Certified: Underscores a systematic approach to quality management.

- Six Sigma Implementation: Aims to improve processes and reduce defects.

- TPM Focus: Enhances equipment reliability and overall equipment effectiveness.

- Supply Chain Excellence: Ensures consistent and timely delivery to customers.

Balasore Alloys' captive chrome ore mines are a significant strength, ensuring a consistent and cost-effective raw material supply, especially with mining operations resuming in February 2024. The company's leading global position in high-carbon ferro chrome, backed by ISO 9001:2015 certification, highlights its quality commitment. This is further supported by a notable surge in export sales during FY24, indicating growing international demand.

The company achieved a standalone net profit of INR 54.07 crore in FY25, a substantial turnaround from the previous year's net loss. This financial recovery reflects enhanced operational efficiency and effective cost management.

Balasore Alloys' flexible manufacturing capabilities, with multiple furnaces across two plants, allow for the production of diverse ferro alloy grades, ensuring adaptability to market demands. This product diversification contributed to a strong revenue increase in FY24, reaching INR 1,123.5 crore.

Commitment to quality is evident through ISO 9001:2015 certification, alongside business excellence initiatives like Six Sigma and TPM, which optimize efficiency and reduce costs. Robust supply chain management further ensures reliable delivery, solidifying its market standing.

| Metric | FY24 | FY25 |

|---|---|---|

| Standalone Net Profit | (Loss) | INR 54.07 crore |

| Revenue | INR 1,123.5 crore | (Data not available for FY25 in this context) |

| Export Sales | Notable Surge | (Data not available for FY25 in this context) |

What is included in the product

Delivers a strategic overview of Balasore Alloys’s internal and external business factors, highlighting its competitive position and the opportunities and risks shaping its future.

Offers a clear framework to identify and address Balasore Alloys' operational weaknesses and external threats, thereby alleviating concerns about market competitiveness and production efficiency.

Weaknesses

Balasore Alloys' core product, high-carbon ferro chrome, is an essential component for stainless steel manufacturing. This direct link means the company's fortunes are closely tied to the stainless steel industry's demand, which can experience significant ups and downs due to economic cycles.

For instance, global stainless steel production, a key indicator for ferro chrome demand, saw fluctuations. While 2023 showed some recovery, the sector remains sensitive to global economic growth and trade policies, directly impacting Balasore Alloys' sales volumes and pricing power.

While Balasore Alloys benefits from captive mines for some raw materials, it still relies on external sourcing for other crucial inputs. This exposes the company to the unpredictable swings in prices for these externally procured materials, impacting overall cost structures.

Even with its own mining operations, fluctuations in chrome ore prices, a key component, can still affect profitability. This is particularly true if the company needs to purchase additional ore on the open market or if market prices for its finished ferroalloys don't keep pace with rising input costs.

The ferro alloy industry, including companies like Balasore Alloys, is inherently energy-intensive. In India, high electricity costs present a significant hurdle, directly impacting production expenses and, consequently, the company's bottom line. This challenge is widespread among Indian ferro alloy manufacturers.

For instance, electricity can account for as much as 40-50% of the total production cost for ferro alloys. In 2024, the average industrial electricity tariff in India remained a key concern, potentially placing Balasore Alloys at a competitive disadvantage compared to global peers with access to cheaper energy sources, thereby affecting their profit margins.

Historical Financial Losses and Credit Rating Concerns

Balasore Alloys has faced significant financial headwinds, reporting net losses in both FY23 and FY24. While FY25 marked a return to profitability, the company's past financial struggles are a notable weakness.

These historical challenges are underscored by credit rating concerns. For instance, the company received a CARE D rating in October 2024, signifying a default or high probability of default. Furthermore, being placed under Issuer Not Cooperating by another Credit Rating Agency (CRA) highlights ongoing issues with transparency and financial reporting, potentially impacting its ability to secure future funding.

- Net Losses: Reported net losses in FY23 and FY24.

- FY25 Profitability: Showed a profit in FY25, indicating a potential turnaround.

- Credit Rating: Received a CARE D rating in October 2024.

- Issuer Not Cooperating: Placed under this status by another CRA, raising concerns about financial cooperation and transparency.

On-going Disputes

Balasore Alloys faces significant challenges due to ongoing legal disputes. These include ongoing matters with mining authorities, the State Trading Corporation of India, NESCO, and the Bombay Stock Exchange, all currently pending resolution.

The potential ramifications of these protracted legal battles are substantial. They could manifest as increased legal expenses, disruptions to operational activities, and potential damage to the company's reputation among stakeholders and the broader market.

For instance, as of the latest available reports, the cumulative legal and professional fees associated with these disputes represent a notable expenditure for the company, impacting profitability.

- Ongoing legal battles with mining authorities, State Trading Corporation of India, NESCO, and Bombay Stock Exchange.

- Potential for significant legal costs and operational disruptions.

- Risk of reputational damage impacting investor confidence and market standing.

- These disputes could tie up management resources that could otherwise be focused on growth initiatives.

Balasore Alloys' reliance on the volatile stainless steel market makes it susceptible to demand fluctuations, directly impacting sales and pricing power. The company also faces cost pressures from its dependence on externally sourced raw materials, whose prices can swing unpredictably. High energy costs in India remain a significant hurdle, potentially affecting profit margins compared to international competitors.

Preview Before You Purchase

Balasore Alloys SWOT Analysis

This is the actual Balasore Alloys SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the company's Strengths, Weaknesses, Opportunities, and Threats with actionable insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of Balasore Alloys' strategic position.

Opportunities

India's stainless steel sector is poised for substantial expansion, with demand anticipated to climb by 7-8% annually for the next three years. This growth is largely fueled by ongoing infrastructure projects, a burgeoning housing market, and increased industrial activity across the nation.

This upward trend in stainless steel consumption directly translates into a significant opportunity for Balasore Alloys, as ferro chrome is a critical raw material in its production. The projected increase in steel output means a higher demand for the company's core product.

India's robust infrastructure development, fueled by government spending, is a significant tailwind for ferro alloy producers like Balasore Alloys. Initiatives such as the National Infrastructure Pipeline aim to invest ₹111 lakh crore ($1.4 trillion) by 2025, directly increasing demand for steel and, consequently, ferro alloys. This domestic demand surge, coupled with the 'Make in India' program encouraging local manufacturing, presents a substantial opportunity for Balasore Alloys to expand its market share and revenue streams within India.

Balasore Alloys can capitalize on technological advancements by adopting advanced smelting techniques and automation. For instance, the global industrial automation market was projected to reach $334.4 billion in 2024, indicating a strong trend towards efficiency. Implementing these can significantly boost production output and reduce operational costs.

Focusing on energy-efficient production processes and green technologies offers a dual benefit. Companies are increasingly prioritizing sustainability, and by investing in these areas, Balasore Alloys can improve its environmental footprint and potentially access green financing. The demand for sustainable manufacturing solutions is growing, with the global green technology and sustainability market expected to expand substantially in the coming years.

These innovations are crucial for gaining a competitive edge. By enhancing production efficiency and reducing costs through technology, Balasore Alloys can offer more competitive pricing and improve its profit margins. This strategic investment in the latest manufacturing technologies is key to staying ahead in the evolving ferroalloy industry.

Export Market Expansion

Balasore Alloys can capitalize on the growing global demand for specialized ferro alloys. India, as a net exporter of these materials, presents a favorable landscape for international market expansion, even amidst domestic economic fluctuations. The company's established international footprint provides a solid foundation to build upon.

Opportunities for export market expansion are significant:

- Leveraging Global Demand: International markets, particularly in regions like Southeast Asia and parts of Europe, show increasing appetite for higher-grade and specialized ferro alloys, a segment Balasore Alloys can target.

- Expanding Existing Reach: The company's current export activities can be scaled up by identifying new customer bases and strengthening relationships in existing international markets. For instance, in 2023, India's ferro alloy exports reached approximately 2 million tonnes, indicating a robust global market that Balasore Alloys can further penetrate.

- Product Diversification for Exports: Developing and promoting niche ferro alloy products tailored to specific international industrial needs can open new revenue streams and reduce reliance on domestic market conditions.

Focus on Value-Added and Specialty Ferro Alloys

The growing demand for specialty ferro alloys, driven by sectors like electric vehicles and renewable energy, presents a significant opportunity. For instance, the global specialty alloys market was valued at approximately USD 25 billion in 2023 and is projected to grow at a CAGR of over 6% through 2030. Balasore Alloys can capitalize on this by shifting its production focus.

By concentrating on higher-value products, Balasore Alloys can improve its profit margins and reduce reliance on commodity ferro alloys. This strategic move also allows for product portfolio diversification, making the company more resilient to market fluctuations.

- Expanding EV and Renewable Energy Markets: These sectors require specialized alloys with unique properties, creating a strong demand pull.

- Enhanced Profitability: Specialty alloys typically command higher prices than standard ferro alloys.

- Product Diversification: Moving into specialty products reduces dependence on traditional markets.

- Technological Advancement: Focusing on specialty alloys encourages investment in research and development.

The Indian stainless steel sector's projected 7-8% annual growth through 2027, driven by infrastructure and housing, directly boosts demand for Balasore Alloys' core product, ferro chrome.

India's National Infrastructure Pipeline, targeting ₹111 lakh crore ($1.4 trillion) by 2025, is a significant tailwind, increasing steel demand and thus ferro alloy consumption.

Balasore Alloys can also tap into the growing global demand for specialty ferro alloys, a market valued at approximately USD 25 billion in 2023, by focusing on niche products for sectors like EVs and renewable energy.

This strategic shift towards higher-value specialty alloys, which typically command premium pricing, can enhance profitability and diversify the company's revenue streams, reducing reliance on commodity markets.

| Opportunity Area | Key Driver | Market Data (2023-2027) | Impact on Balasore Alloys |

|---|---|---|---|

| Domestic Stainless Steel Growth | Infrastructure & Housing Demand | 7-8% annual growth | Increased demand for ferro chrome |

| Infrastructure Development | National Infrastructure Pipeline | ₹111 lakh crore ($1.4T) by 2025 | Higher steel output, more ferro alloy usage |

| Specialty Alloy Market | EV & Renewable Energy Sectors | USD 25 billion market (2023), 6%+ CAGR projected | Higher-margin product potential, diversification |

Threats

Even with its own mines, Balasore Alloys faces the risk of volatile global prices for chrome ore and other essential raw materials. For instance, international chrome ore prices saw significant swings in 2023, impacting producers worldwide. If these input cost increases aren't fully absorbed by captive production efficiencies or passed on through higher selling prices, the company's profit margins could shrink considerably.

Balasore Alloys operates within a highly competitive ferro alloy market, facing significant pressure from both domestic Indian producers and international suppliers. This intense rivalry can lead to price wars and a struggle to maintain market share, especially when combined with supply chain disruptions.

The Indian ferro alloy sector, including players like Balasore Alloys, saw its market size estimated at approximately USD 4.5 billion in 2023, with projections indicating steady growth. However, this growth is tempered by the fierce competition, which can squeeze profit margins for established companies.

Rising raw material costs, coupled with the influx of competitively priced imports, particularly from countries with lower production expenses, further intensifies the threat. This dynamic environment necessitates constant vigilance on cost management and operational efficiency to remain competitive.

Energy costs represent a substantial component of Balasore Alloys' operational expenses, particularly given the energy-intensive nature of ferroalloy production. In India, high power tariffs directly squeeze profit margins, making it harder for the company to remain competitive on a global scale.

The volatility of energy prices further exacerbates this challenge. For instance, during 2023-2024, coal prices, a key input for power generation in India, saw significant fluctuations, directly impacting electricity costs for industrial consumers like Balasore Alloys. This unpredictability makes long-term financial planning and cost management considerably more difficult.

Environmental Regulations and Compliance Costs

Environmental regulations are becoming stricter, particularly concerning pollutant emissions like air pollution, leading to increased compliance costs. For instance, in 2024, India’s Ministry of Environment, Forest and Climate Change continued its focus on improving air quality standards, which can impact industrial operations.

Balasore Alloys may face substantial capital expenditures and operational changes to meet these evolving environmental standards. The company's ability to adapt to new emission norms, such as those potentially related to particulate matter or greenhouse gases, will be crucial for its long-term sustainability and cost management.

- Increased regulatory scrutiny on air emissions.

- Potential for significant capital investment in pollution control technology.

- Operational adjustments to meet stricter environmental compliance.

Global Economic Slowdown and Stainless Steel Demand Weakness

A global economic slowdown presents a significant threat to Balasore Alloys. Such a downturn typically dampens overall industrial activity, leading to reduced demand for key materials like stainless steel. This directly impacts ferro chrome, a crucial ingredient in stainless steel production, potentially resulting in lower spot demand and weaker pricing for Balasore Alloys' products.

Furthermore, a worldwide slump in the stainless steel industry itself would exacerbate these issues. This could translate to fewer export opportunities for ferro chrome producers like Balasore Alloys, as major consuming nations scale back their own manufacturing and construction projects. For instance, if global stainless steel production, which stood at approximately 50 million metric tons in 2023, were to contract by, say, 5% in 2024, it would directly curtail the need for ferro chrome.

- Reduced Spot Demand: Economic slowdowns typically decrease industrial output, leading to less consumption of stainless steel and consequently, ferro chrome.

- Lower Pricing: Weakened demand often forces producers to lower prices to remain competitive, impacting revenue and profit margins.

- Diminished Export Opportunities: A global downturn in stainless steel manufacturing curtails international markets for ferro chrome suppliers like Balasore Alloys.

- Impact on Production: If stainless steel output shrinks, the demand for ferro chrome, a key raw material, will proportionally decrease.

Intense competition from domestic and international players, particularly those with lower production costs, poses a significant threat to Balasore Alloys' market share and profitability. This is compounded by the volatility of raw material and energy prices, such as the fluctuations in coal prices seen in 2023-2024, which directly impact operational expenses and competitiveness.

The company also faces increasing environmental compliance costs due to stricter regulations on emissions, potentially requiring substantial capital investment in pollution control technology. Furthermore, a global economic slowdown could significantly reduce demand for stainless steel, thereby impacting the demand and pricing for Balasore Alloys' ferro chrome products.

| Threat Category | Specific Threat | Impact on Balasore Alloys | Supporting Data/Trend (2023-2025) |

| Market Competition | Intense Rivalry | Price wars, reduced market share | Indian ferro alloy market size ~USD 4.5 billion (2023) with high competition. |

| Input Costs | Raw Material & Energy Price Volatility | Shrinking profit margins, increased operational expenses | Global chrome ore prices saw swings in 2023; Coal prices fluctuated 2023-2024. |

| Regulatory Environment | Stricter Environmental Regulations | Increased compliance costs, capital expenditure | Focus on air quality standards by Indian Ministry of Environment (2024). |

| Macroeconomic Factors | Global Economic Slowdown | Reduced demand for stainless steel & ferro chrome, lower prices | Global stainless steel production ~50 million metric tons (2023); potential contraction in 2024. |

SWOT Analysis Data Sources

This Balasore Alloys SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a robust and accurate strategic overview.