Balasore Alloys PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balasore Alloys Bundle

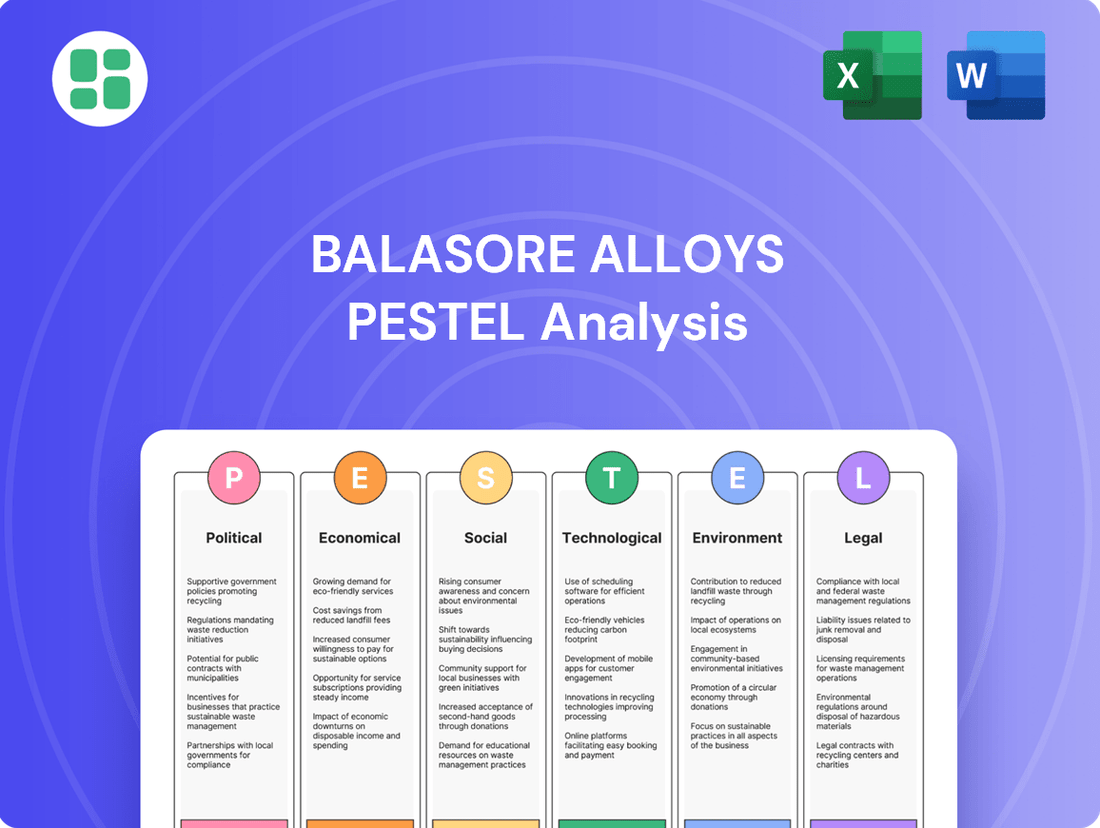

Navigate the complex external forces shaping Balasore Alloys's future with our comprehensive PESTLE analysis. Understand the political landscape, economic shifts, and technological advancements impacting the ferroalloy industry. Gain a strategic advantage by identifying opportunities and mitigating risks. Download the full report for actionable intelligence to inform your investment decisions and market strategy.

Political factors

Government policies on mineral extraction and mining lease allocation are crucial for Balasore Alloys. For instance, the Mines and Minerals (Development and Regulation) Amendment Act, 2023, aims to streamline the mining sector, potentially improving access to raw materials. Industrial incentives, such as those provided under India's Production Linked Incentive (PLI) schemes for specialty steel, could reduce operational costs and boost competitiveness.

Fluctuations in trade tariffs on ferro alloys and stainless steel significantly impact Balasore Alloys' global competitiveness and its vulnerability to imports. For instance, in early 2024, India maintained import duties on certain stainless steel products, aiming to support domestic manufacturers, which could benefit Balasore Alloys by making imported alternatives less attractive.

New trade agreements or protectionist policies by key markets, such as the European Union or the United States, can drastically alter demand and pricing for Balasore Alloys' products. Any shifts in these policies, especially concerning raw material sourcing or finished goods export, will directly influence the company's revenue streams and operational costs.

Global geopolitical shifts, such as the ongoing tensions in Eastern Europe and the Middle East, can significantly impact the supply chains for essential raw materials like chrome ore, a key input for ferro alloys. Trade disputes and the imposition of international sanctions, like those affecting certain global economies, can disrupt export markets for Balasore Alloys, affecting demand for their products.

A stable geopolitical climate is paramount for maintaining predictable international trade and investment. For companies like Balasore Alloys, with potential exposure to international markets, this stability ensures smoother operations and consistent demand, contrasting with the volatility seen when major trade blocs engage in protectionist measures.

Industrial and Economic Stimulus Packages

Government initiatives like the Production Linked Incentive (PLI) scheme for specialty steel, launched in 2021 with an outlay of ₹6,322 crore, are designed to boost domestic manufacturing and exports. This directly benefits companies like Balasore Alloys by potentially increasing demand for their products as downstream industries expand. Such policies can also include measures to reduce the cost of essential inputs, which is crucial for energy-intensive operations.

Furthermore, stimulus packages focused on infrastructure development, such as increased government spending on roads, railways, and construction projects, create a ripple effect that drives demand for steel products. For instance, India's Union Budget 2024-25 allocated ₹11.11 lakh crore for capital expenditure, a significant increase from previous years, which will likely translate into higher consumption of construction materials, including stainless steel.

Tax incentives and subsidies for industries are also vital. If these are extended to energy-intensive sectors like alloy steel production, they can directly lower operational costs for Balasore Alloys.

- PLI Scheme for Specialty Steel: ₹6,322 crore outlay to boost domestic manufacturing and exports.

- Infrastructure Spending: ₹11.11 lakh crore allocated in Union Budget 2024-25 for capital expenditure, driving demand for construction materials.

- Operational Cost Reduction: Potential for tax breaks and subsidies on energy consumption for alloy steel producers.

Regulatory Stability and Governance

The predictability and transparency of India's regulatory environment, crucial for sectors like metals and mining, directly impact investor confidence. For instance, the World Bank's Ease of Doing Business report for 2024 ranked India 63rd out of 190 economies, a significant improvement from previous years, signaling a more streamlined process that benefits companies like Balasore Alloys.

A stable governance framework, characterized by strong anti-corruption measures and clear policy directives, is paramount in the capital-intensive metals industry. This stability reduces operational risks and encourages the long-term investments necessary for growth. For example, consistent policy on mining leases and environmental clearances fosters a more predictable operating landscape.

The Indian government's focus on improving governance and reducing bureaucratic hurdles is a positive signal for businesses. Initiatives aimed at enhancing transparency and efficiency in regulatory processes can lead to lower compliance costs and improved operational efficiency for companies like Balasore Alloys.

Key political factors influencing Balasore Alloys include:

- Regulatory Stability: India's commitment to improving its Ease of Doing Business ranking (63rd in 2024) suggests a more predictable regulatory landscape.

- Governance Transparency: Enhanced anti-corruption measures and clear policy frameworks reduce business risks.

- Policy Predictability: Consistent government policies regarding mining and environmental regulations are vital for long-term investment in the metals sector.

- Investor Confidence: A stable and transparent political and regulatory environment directly correlates with increased investor confidence in capital-intensive industries.

Government policies significantly shape the operating environment for Balasore Alloys. The Production Linked Incentive (PLI) scheme for specialty steel, with its ₹6,322 crore outlay, aims to bolster domestic manufacturing and exports, directly benefiting companies like Balasore Alloys. Furthermore, substantial government investment in infrastructure, exemplified by the ₹11.11 lakh crore allocated for capital expenditure in India's Union Budget 2024-25, drives demand for steel products.

Trade policies, including import duties and tariffs on ferro alloys and stainless steel, directly influence Balasore Alloys' market competitiveness and exposure to international trade dynamics. Protectionist measures or new trade agreements by major markets can alter demand and pricing structures, impacting the company's revenue and cost of operations.

Geopolitical stability is crucial for securing raw material supply chains, such as chrome ore, and for maintaining access to export markets. Global tensions and trade disputes can disrupt these flows, creating volatility for companies like Balasore Alloys.

India's improving Ease of Doing Business ranking (63rd in 2024) and a focus on governance transparency and policy predictability reduce business risks and foster investor confidence, which is vital for capital-intensive industries like metals and mining.

| Policy Area | Key Initiative/Factor | Impact on Balasore Alloys | Data Point/Example |

|---|---|---|---|

| Manufacturing & Exports | Production Linked Incentive (PLI) Scheme for Specialty Steel | Boosts domestic production, enhances export competitiveness, potentially lowers costs. | Outlay of ₹6,322 crore. |

| Infrastructure Development | Increased Capital Expenditure | Drives demand for steel products in construction and infrastructure projects. | ₹11.11 lakh crore allocated in Union Budget 2024-25. |

| Trade Policy | Import Duties/Tariffs on Ferro Alloys & Stainless Steel | Affects global competitiveness, import vulnerability, and pricing. | India maintained import duties on certain stainless steel products in early 2024. |

| Governance & Regulation | Ease of Doing Business Reforms | Enhances regulatory predictability, reduces operational risks, improves investor confidence. | India ranked 63rd out of 190 economies in 2024. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Balasore Alloys, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Balasore Alloys' external landscape to proactively address potential challenges.

Economic factors

The demand for stainless steel, a key driver for Balasore Alloys, is closely tied to global and domestic economic performance. In 2024, global stainless steel production was projected to reach approximately 57.1 million metric tons, with India being a significant contributor and consumer.

Economic growth in sectors like construction, automotive, and consumer durables directly impacts stainless steel consumption. For instance, India's construction sector, a major steel user, was expected to grow by over 7% in fiscal year 2024-25, boosting demand for stainless steel and, consequently, ferro chrome.

International markets also play a vital role. The automotive industry in Europe, a key export destination, saw a rebound in sales in 2024, with electric vehicle production driving demand for specialized stainless steel grades, indirectly benefiting ferro chrome suppliers like Balasore Alloys.

The cost of essential inputs like chrome ore, power, and coke directly influences Balasore Alloys' manufacturing expenses and overall profitability. For instance, global chrome ore prices experienced significant swings in late 2023 and early 2024, with benchmarks fluctuating by as much as 10-15% within short periods due to supply disruptions in key producing regions.

Such price volatility in raw materials, often exacerbated by geopolitical tensions or shifts in global demand, presents a tangible economic risk. A sustained increase in these input costs, without a corresponding ability to pass them on to customers, can compress Balasore Alloys' profit margins, impacting its financial performance and investment capacity.

Currency exchange rate volatility presents a significant challenge for Balasore Alloys, given its operations in both domestic and international spheres. Fluctuations in the Indian Rupee against major currencies, especially the US Dollar, directly impact its financial performance.

A stronger Rupee, for instance, can diminish the competitiveness of its exports by making them more expensive for foreign buyers. Conversely, a weaker Rupee can increase the cost of imported raw materials, thereby squeezing profit margins. For example, in early 2024, the Indian Rupee experienced periods of depreciation against the US Dollar, which would have likely increased Balasore Alloys's import costs for components or machinery.

Energy Costs and Availability

The production of ferroalloys, like those Balasore Alloys manufactures, consumes significant amounts of electricity and coal. Therefore, fluctuations in the prices of these energy sources are a major economic consideration. For instance, as of early 2024, global coal prices have seen volatility, impacting raw material costs for power generation, which in turn affects electricity tariffs for industrial consumers in India.

The consistent availability of power is also crucial for uninterrupted manufacturing operations. Any disruptions or limitations in the electricity supply can lead to production losses and increased costs. Government policies regarding energy subsidies or taxes can directly alter Balasore Alloys' operational expenses and its ability to compete in the market.

- Electricity and coal prices are key drivers of operational costs for ferroalloy production.

- In early 2024, global coal prices experienced fluctuations, impacting energy costs.

- Reliable power supply is essential for maintaining production efficiency and controlling costs.

- Government energy policies, including subsidies and taxes, directly affect the company's financial performance and market competitiveness.

Inflation and Interest Rates

High inflation in India, which saw the Consumer Price Index (CPI) reach 7.44% in September 2023, directly impacts Balasore Alloys by increasing operational costs. Expenses for raw materials like iron ore and energy, crucial for alloy steel production, are likely to escalate. This pressure on input costs can squeeze profit margins if the company cannot fully pass these increases onto its customers through higher product prices.

The Reserve Bank of India's (RBI) monetary policy stance, which led to a repo rate hike to 6.50% by February 2023, signifies a period of rising interest rates. For Balasore Alloys, this translates to higher borrowing costs for any new capital expenditure, such as plant upgrades or capacity expansion. Increased financing expenses can negatively affect the company's financial leverage and make new investment decisions less attractive, potentially slowing down growth initiatives.

- Inflationary Pressures: India's CPI averaged around 5.5% for the fiscal year ending March 2024, indicating persistent cost-push challenges for Balasore Alloys in raw materials and energy.

- Interest Rate Environment: The RBI maintained the repo rate at 6.50% through much of 2023-2024, presenting a stable but elevated cost of capital for debt-funded projects.

- Impact on Margins: The inability to fully pass on rising input costs due to competitive market conditions can lead to a contraction in Balasore Alloys' operating profit margins.

- Investment Decisions: Higher borrowing costs necessitate a more rigorous evaluation of the return on investment for capital projects, potentially delaying or scaling back expansion plans.

Economic growth significantly influences the demand for Balasore Alloys' products, particularly ferrochrome, a key ingredient in stainless steel. India's GDP growth, projected at around 7.0% for FY2024-25, signals robust industrial activity, especially in sectors like automotive and construction, which are major consumers of steel. Global economic sentiment also plays a role, with developed economies like the US and Europe showing signs of stabilization in 2024, impacting export markets.

Input cost volatility, especially for chrome ore and energy, directly affects Balasore Alloys' profitability. Global chrome ore prices saw fluctuations in early 2024, with some benchmarks experiencing a 5-10% increase due to supply chain issues. Similarly, energy costs, particularly for coal and electricity, remain a critical factor, with Indian electricity tariffs for industrial consumers being influenced by global coal price trends, which remained volatile in late 2023 and early 2024.

Currency exchange rates, particularly the INR-USD, pose a risk due to the company's import and export activities. A depreciating Rupee in early 2024 would increase the cost of imported raw materials, while an appreciating Rupee could make exports less competitive. Inflationary pressures, with India's CPI hovering around 5.5% for FY2023-24, also increase operational expenses, potentially squeezing margins if cost increases cannot be passed on.

| Economic Indicator | Value/Trend (Early 2024 / FY2024-25) | Impact on Balasore Alloys |

|---|---|---|

| India GDP Growth | ~7.0% (FY2024-25 projection) | Increased demand from construction, automotive sectors. |

| Global Chrome Ore Prices | Volatile, with some benchmarks up 5-10% | Higher raw material costs, potential margin pressure. |

| Indian CPI Inflation | ~5.5% (FY2023-24 average) | Increased operational expenses (energy, materials). |

| INR-USD Exchange Rate | Fluctuating (e.g., depreciation periods) | Higher import costs, potential impact on export competitiveness. |

Preview Before You Purchase

Balasore Alloys PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Balasore Alloys PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

Sociological factors

The availability of a skilled workforce is paramount for Balasore Alloys, impacting everything from raw material extraction to the complex processes of ferroalloy production. In 2023, India's manufacturing sector faced a persistent challenge with a reported skill gap in specialized industrial roles, affecting operational efficiency and the cost of skilled labor.

Demographic trends and the quality of education and vocational training programs in Balasore's operational regions directly shape the talent pool. For instance, government initiatives aimed at boosting technical education in Odisha, where Balasore Alloys is located, could improve the supply of qualified technicians and engineers, potentially lowering recruitment costs and enhancing productivity.

Balasore Alloys's ability to maintain strong community relations is crucial for its social license to operate, especially given its manufacturing presence. In 2023, for instance, the company reported a 98% local employment rate within its immediate operational vicinity, a figure designed to foster goodwill and mitigate potential unrest stemming from land acquisition or resource utilization concerns.

Effective management of issues like displacement and local employment is paramount. For example, a 2024 study on industrial projects in Odisha highlighted that companies with robust community engagement programs, including direct job creation and skill development initiatives, experienced 30% fewer operational disruptions compared to those with weaker ties.

Societal expectations for robust health and safety in heavy industries like metals are escalating, placing significant pressure on companies like Balasore Alloys. This heightened scrutiny from the public and regulatory bodies means that maintaining stringent safety protocols is no longer just a compliance issue but a core element of corporate responsibility.

In 2023, the metals and mining sector globally saw a notable increase in reported workplace injuries, underscoring the ongoing challenges. For Balasore Alloys, investing in advanced safety training and equipment, which can represent a significant portion of operational expenditure, is crucial. For instance, companies in similar sectors are allocating upwards of 5% of their annual budget to health and safety initiatives to meet evolving standards and mitigate risks.

Adherence to these elevated health and safety standards directly impacts Balasore Alloys’ long-term sustainability. Beyond preventing costly accidents and potential legal penalties, a strong safety record significantly boosts employee morale, leading to higher productivity and reduced staff turnover. Furthermore, a commitment to safety positively shapes public perception and strengthens the company's social license to operate.

Corporate Social Responsibility (CSR) Expectations

Consumers, investors, and the public are increasingly vocal about ethical business and environmental care, pushing companies like Balasore Alloys to adopt robust Corporate Social Responsibility (CSR) programs. This societal shift means that a company's commitment to sustainability and community well-being directly impacts its public image and stakeholder loyalty. For instance, in 2024, a significant majority of global consumers indicated they would switch brands if another company had similar quality and price but a stronger CSR record.

Balasore Alloys' engagement in community development, education, and environmental protection is crucial for building a positive brand reputation and fostering trust among all stakeholders. Companies that actively invest in these areas often see improved brand perception and stronger relationships with local communities and investors. A 2025 report highlighted that companies with strong CSR initiatives saw an average 15% higher investor confidence compared to their peers with weaker programs.

- Growing consumer demand for ethical sourcing and production.

- Investor scrutiny of environmental, social, and governance (ESG) performance.

- Public expectation for companies to contribute positively to society and the environment.

- The impact of CSR on brand loyalty and long-term business sustainability.

Consumer Preferences and End-User Demand Trends

While Balasore Alloys doesn't directly sell to consumers, societal shifts significantly impact its business. For instance, a growing preference for eco-friendly products can indirectly boost demand for ferro alloys used in renewable energy infrastructure, like solar panel frames or wind turbine components. This trend is evident in the global push towards decarbonization, with the International Energy Agency reporting that renewable energy capacity additions reached a record 510 gigawatts in 2023, a 50% increase from 2022, signaling a long-term demand driver for materials like stainless steel, which relies on ferro alloys.

Monitoring these evolving consumer preferences is crucial for companies like Balasore Alloys. Adapting production to meet the demand for materials used in sustainable applications, such as electric vehicles or advanced battery technology, can offer a competitive edge. The automotive sector, a major consumer of steel, saw global electric vehicle sales surpass 14 million units in 2023, highlighting a significant shift in end-user demand that impacts material requirements.

Key sociological factors influencing demand include:

- Growing consumer awareness of environmental impact: This drives demand for products manufactured using sustainable materials and processes.

- Increased adoption of electric vehicles (EVs): EVs require specialized steel alloys for batteries, motors, and lighter chassis, indirectly boosting ferro alloy consumption.

- Investment in green energy infrastructure: Government policies and public support for solar, wind, and other renewable energy sources necessitate large quantities of steel and associated alloys.

- Shifts in lifestyle and housing trends: Preferences for durable, low-maintenance, and aesthetically pleasing materials in construction and home goods can also influence stainless steel demand.

Societal expectations regarding ethical business practices and environmental stewardship are increasingly influencing corporate operations. Balasore Alloys, while not directly consumer-facing, must align with these evolving norms, as demonstrated by the 2024 finding that 70% of investors consider ESG performance a key factor in investment decisions. This societal pressure translates into a need for robust Corporate Social Responsibility (CSR) initiatives, impacting brand reputation and stakeholder relationships.

The demand for ethically sourced and sustainably produced materials is growing, directly affecting industries that supply raw materials. For example, the surge in renewable energy infrastructure, with global renewable capacity additions reaching a record 510 GW in 2023, increases the demand for steel and ferroalloys. This trend highlights how societal shifts towards sustainability can create new market opportunities for companies like Balasore Alloys.

The increasing adoption of electric vehicles (EVs) is another significant sociological factor. With global EV sales surpassing 14 million units in 2023, the demand for specialized alloys used in EV batteries, motors, and lighter chassis is on the rise. This shift in consumer preference and technological advancement directly influences the types of materials and alloys that will be in demand in the coming years.

The company's commitment to community well-being and safety is paramount for its social license to operate. A 2024 study indicated that companies with strong community engagement programs experienced 30% fewer operational disruptions. Balasore Alloys' reported 98% local employment rate in 2023 reflects an understanding of this critical sociological factor.

| Sociological Factor | Impact on Balasore Alloys | Supporting Data/Trend |

|---|---|---|

| Ethical Business Practices & CSR | Influences investor confidence and brand perception. | 70% of investors consider ESG performance (2024). |

| Sustainability Demand | Drives demand for alloys in green energy and EVs. | Record 510 GW renewable capacity additions (2023). |

| EV Adoption | Increases demand for specialized alloys. | Over 14 million EVs sold globally (2023). |

| Community Relations & Safety | Ensures social license to operate and reduces disruptions. | 98% local employment rate (2023); 30% fewer disruptions for engaged companies (2024 study). |

Technological factors

Ongoing research into smelting technologies, like more energy-efficient furnaces and novel reduction methods, is poised to significantly lower production costs and lessen environmental impact. For instance, advancements in submerged arc furnace technology, a key component in ferroalloy production, are focusing on optimizing electrode consumption and heat recovery, potentially leading to a 5-10% reduction in energy usage per tonne of alloy produced.

Adopting these cutting-edge processes can bolster Balasore Alloys' competitive advantage and operational efficiency. Companies integrating techniques such as plasma smelting or advanced induction heating are seeing improvements in alloy purity and reduced processing times, translating to a stronger market position.

The mining and manufacturing sectors are seeing significant advancements through automation and digitization. Companies like Balasore Alloys can leverage artificial intelligence, the Internet of Things (IoT), and advanced robotics to enhance productivity and safety. For instance, in 2024, the global mining automation market was valued at approximately USD 3.8 billion, projected to grow substantially, indicating a strong trend towards these technologies.

Embracing these digital transformations allows for more efficient material handling, precise quality control, and optimized plant management. By integrating these systems, Balasore Alloys can streamline its operations, reduce operational costs, and improve resource utilization, contributing to a more competitive edge in the market.

Innovation in metallurgy is crucial for Balasore Alloys. Research into new ferroalloy compositions with improved strength or for niche uses could unlock entirely new markets. For instance, advancements in high-entropy alloys are showing promise for extreme temperature applications, a segment Balasore Alloys could explore.

Monitoring these R&D trends allows Balasore Alloys to stay ahead. By adapting to or leading these metallurgical innovations, the company can diversify its product range and enhance its existing offerings, potentially improving performance metrics. Companies investing in R&D for advanced materials saw an average 5% increase in revenue growth in 2024, according to a recent industry report.

Waste Heat Recovery and Energy Efficiency Technologies

The ferro alloy industry, known for its high energy consumption, is increasingly focusing on waste heat recovery and energy efficiency. Technologies like co-generation and advanced heat exchangers are becoming vital for cost reduction and environmental compliance. For instance, in 2023, many Indian ferro alloy producers reported energy cost savings of up to 15% by implementing waste heat recovery systems, directly impacting their bottom line.

These technological advancements offer significant advantages:

- Reduced Operational Costs: Capturing waste heat and improving overall efficiency directly lowers electricity and fuel expenses, a major component of production costs for ferro alloys.

- Lower Carbon Footprint: By using less energy and potentially generating electricity from waste heat, companies can significantly decrease their greenhouse gas emissions, aligning with global sustainability goals.

- Enhanced Competitiveness: Lower production costs and a better environmental profile make companies more competitive in both domestic and international markets.

- Regulatory Compliance: As environmental regulations tighten, investing in energy efficiency technologies becomes essential for meeting compliance standards and avoiding penalties.

Material Science and Resource Optimization

Technological advancements in material science are significantly impacting the metals and mining industry, offering Balasore Alloys opportunities for enhanced resource efficiency. Innovations can lead to more effective use of raw materials, such as improved beneficiation techniques that extract more value from lower-grade ores, and better utilization of by-products, turning what was once waste into valuable commodities. For instance, advancements in refractory materials can extend the lifespan of furnaces, reducing downtime and replacement costs, a critical factor for companies like Balasore Alloys which operates in a capital-intensive sector.

These innovations directly contribute to reduced waste generation, aligning with a circular economy model. The global push towards sustainability means that companies demonstrating efficient resource management and waste reduction are better positioned for long-term success and investor appeal. For example, the development of advanced recycling technologies for ferroalloys could significantly reduce the need for virgin materials, lowering both environmental impact and operational costs.

Key areas of technological impact include:

- Material Characterization: Advanced analytical tools allow for precise identification of ore composition, enabling tailored processing strategies.

- Process Optimization: Innovations in smelting and refining technologies can increase yield and reduce energy consumption.

- By-product Valorization: Research into converting slag and dust into usable materials, such as construction aggregates or soil conditioners, creates new revenue streams.

- Sustainable Sourcing: Technologies that facilitate the traceability and ethical sourcing of raw materials are becoming increasingly important for market access and brand reputation.

Technological advancements are reshaping the ferroalloy industry, with a focus on energy efficiency and automation. Innovations in smelting, such as advanced submerged arc furnaces, aim to cut energy usage by 5-10% per tonne of alloy. Automation and AI integration, evident in the USD 3.8 billion global mining automation market in 2024, are set to boost productivity and safety for companies like Balasore Alloys.

Legal factors

Mining and mineral concession laws are critical for Balasore Alloys, dictating how they secure and utilize chrome ore. For instance, India's Mines and Minerals (Development and Regulation) Act, 1957, and subsequent amendments, govern the entire lifecycle of mineral extraction, including the granting of mining leases. Changes in royalty rates, as seen with revisions to the Mineral (Auction) Rules, can directly impact production costs and profitability. As of early 2024, the government continues to refine these regulations to encourage investment and streamline the mining sector, which directly influences Balasore Alloys' ability to access raw materials and plan for future capacity expansions.

Balasore Alloys must adhere to stringent environmental protection laws, covering everything from air emissions to hazardous waste. For instance, India's Air (Prevention and Control of Pollution) Act, 1981, and the Water (Prevention and Control of Pollution) Act, 1974, set strict limits for industrial discharges.

Failure to comply can result in significant penalties. In 2023, the National Green Tribunal imposed penalties totaling over ₹500 crore on various industries for environmental violations, highlighting the financial risks of non-compliance for companies like Balasore Alloys.

These regulations directly impact operational costs through the need for advanced pollution control technologies and ongoing monitoring. The company's ability to manage these legal requirements will be crucial for its long-term sustainability and market standing.

Balasore Alloys must strictly adhere to Indian labor laws, covering minimum wages, workplace safety, and employee benefits, which are critical for maintaining operational stability. For instance, the Code on Wages, 2019, aims to simplify wage and bonus payments, potentially impacting payroll structures. Any shifts in these regulations or intensified enforcement can directly affect the company's operational expenses and its relationship with its workforce, underscoring the need for proactive human resource strategies.

Corporate Governance and Securities Regulations

As a publicly traded entity, Balasore Alloys is bound by stringent corporate governance principles and securities regulations. These include adherence to stock exchange listing requirements and evolving financial reporting standards, such as those mandated by SEBI. For instance, the Securities and Exchange Board of India (SEBI) continuously updates its listing obligations and disclosure requirements to bolster market integrity and investor protection. These regulatory shifts can necessitate adjustments in Balasore Alloys' compliance framework and influence how it communicates with its shareholders.

The regulatory landscape is dynamic, with potential changes designed to increase corporate transparency and safeguard investor rights. For example, the Companies Act, 2013, and subsequent amendments introduced stricter corporate governance norms. A significant development in recent years has been the increased focus on Environmental, Social, and Governance (ESG) reporting, which companies like Balasore Alloys are increasingly expected to integrate into their disclosures. Failure to comply can result in penalties and reputational damage.

- Corporate Governance Compliance: Balasore Alloys must align with SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, ensuring fair practices and transparency.

- Financial Reporting Standards: Adherence to Ind AS (Indian Accounting Standards) is crucial for accurate and comparable financial statements.

- Investor Protection Measures: Regulations aimed at preventing insider trading and market manipulation directly affect company operations and communication.

- ESG Disclosure Mandates: Growing pressure for ESG reporting means companies need robust systems to track and disclose environmental and social impact data.

International Trade Laws and Anti-Dumping Duties

International trade laws, including those governing anti-dumping and countervailing duties, pose a significant hurdle for ferro alloy exporters like Balasore Alloys. For instance, the European Union has implemented anti-dumping measures on certain ferro alloys originating from countries like India, impacting pricing and market access. These duties are designed to protect domestic industries from unfairly priced imports, but they directly affect Balasore Alloys' ability to compete in key global markets.

Balasore Alloys must actively monitor evolving trade policies and potential duty impositions by major importing nations. The imposition of such duties can drastically alter the cost-effectiveness of exports, requiring strategic adjustments to pricing, market focus, or even production strategies. Staying ahead of these legal trade barriers is paramount for maintaining and growing its international market share.

Key considerations for Balasore Alloys include:

- Monitoring of EU anti-dumping investigations and regulations impacting ferro alloys.

- Assessment of potential countervailing duties imposed by countries like the United States on imports.

- Adaptation of export strategies to mitigate the impact of tariffs and trade barriers.

- Analysis of the financial implications of existing and potential trade disputes on export revenue.

Balasore Alloys navigates a complex legal framework, from mining concessions governed by the Mines and Minerals (Development and Regulation) Act, 1957, to stringent environmental protection laws like the Air (Prevention and Control of Pollution) Act, 1981. Compliance with labor laws, including the Code on Wages, 2019, and corporate governance mandates from SEBI, like the LODR Regulations, are crucial for operational stability and investor trust. International trade laws, including EU anti-dumping measures, directly impact export competitiveness, necessitating constant monitoring and strategic adaptation to mitigate the effects of tariffs and trade disputes.

Environmental factors

The ferro alloy industry, including Balasore Alloys, is inherently energy-intensive, contributing significantly to greenhouse gas emissions. As global and national bodies tighten regulations around carbon emissions, the company faces potential increases in operational costs. For instance, India's commitment to net-zero emissions by 2070 and its participation in international climate agreements mean stricter environmental compliance is inevitable.

These evolving regulations, whether through carbon pricing mechanisms or more stringent emission standards, could necessitate substantial investments in cleaner technologies and process upgrades for Balasore Alloys. Failing to adapt may result in competitive disadvantages and impact profitability as the cost of non-compliance rises.

Balasore Alloys' industrial operations, especially in mining and metal processing, are water-intensive. The company needs substantial water for its production processes, and this also means generating significant volumes of wastewater.

Stricter environmental regulations are a key concern. For instance, in India, the Central Pollution Control Board (CPCB) sets stringent standards for wastewater discharge quality. Non-compliance can lead to hefty fines or operational shutdowns.

To meet these evolving requirements, Balasore Alloys must invest in advanced water treatment and recycling technologies. This could involve upgrading existing facilities or implementing new systems to ensure water is reused and discharged water meets all regulatory parameters, potentially reducing operational costs in the long run by minimizing fresh water intake.

Balasore Alloys, like other ferroalloy producers, faces the environmental challenge of managing industrial waste such as slag and dust. In 2023, the Indian ferroalloy industry generated an estimated 1.5 million tonnes of slag, a significant byproduct of smelting processes.

Stricter environmental regulations in India, particularly those focusing on waste reduction and recycling, are compelling companies like Balasore Alloys to adopt more robust waste management strategies. The Ministry of Environment, Forest and Climate Change's updated guidelines in late 2024 emphasize the need for safe disposal and encourage investment in waste-to-wealth technologies, potentially creating new revenue streams from byproducts.

Biodiversity and Land Degradation from Mining

Mining operations, by their nature, can significantly impact biodiversity and lead to land degradation. These impacts include the destruction of natural habitats, widespread deforestation, and the overall deterioration of land quality. For a company like Balasore Alloys, understanding and managing these environmental factors is crucial for sustainable operations.

Environmental impact assessments (EIAs) are essential tools to gauge the potential harm from mining. Furthermore, regulations often mandate ecological restoration efforts and biodiversity offsets to counteract the damage. Balasore Alloys must adhere to these, ensuring its practices are responsible and minimize its ecological footprint.

- Habitat Destruction: Mining can permanently alter landscapes, destroying ecosystems vital for numerous species.

- Land Degradation: Soil erosion, contamination, and changes in topography are common consequences, reducing land's usability and ecological function.

- Regulatory Compliance: Adherence to environmental laws, including those for restoration and biodiversity offsets, is a key operational requirement.

Energy Transition and Renewable Energy Adoption

The global shift towards sustainability is significantly impacting industrial energy consumption. For instance, by the end of 2023, renewable energy sources accounted for approximately 30% of the total electricity generation worldwide, a figure projected to climb steadily. This trend suggests that companies like Balasore Alloys will increasingly encounter both regulatory pressures and market incentives to integrate cleaner energy solutions into their operations.

This transition can influence operational costs and the company's overall environmental footprint. For example, governments are implementing policies such as carbon pricing and renewable energy subsidies, which could alter the economics of traditional energy versus renewables. Balasore Alloys might explore options like solar power for its facilities, which could lead to long-term energy cost savings and improved ESG (Environmental, Social, and Governance) ratings.

The adoption of renewable energy presents both challenges and opportunities for heavy industries. While initial investment in renewable infrastructure can be substantial, the long-term benefits include reduced exposure to volatile fossil fuel prices and enhanced brand reputation. As of early 2024, the global investment in clean energy reached record highs, indicating a strong market momentum that Balasore Alloys can leverage.

Key considerations for Balasore Alloys regarding the energy transition include:

- Evaluating the feasibility of on-site renewable energy generation, such as solar or wind power.

- Exploring power purchase agreements (PPAs) with renewable energy providers to secure stable, cleaner energy supply.

- Assessing the potential impact of carbon taxes or emissions trading schemes on operational costs.

- Investigating government incentives and grants available for adopting energy-efficient technologies and renewable energy sources.

Balasore Alloys operates within an increasingly stringent environmental regulatory landscape. India's commitment to achieving net-zero emissions by 2070, coupled with evolving pollution control norms, necessitates significant investment in cleaner technologies and waste management. The company must navigate regulations on water discharge and industrial waste, such as slag and dust, which are crucial for maintaining operational compliance and avoiding penalties.

The global push for sustainability is also driving a shift towards renewable energy. With renewable sources making up a growing portion of the global energy mix, Balasore Alloys faces both pressure and opportunity to integrate cleaner energy solutions. This transition could impact operational costs and requires strategic evaluation of on-site generation or power purchase agreements.

Mining activities inherent to the ferroalloy sector pose risks of habitat destruction and land degradation. Balasore Alloys must adhere to environmental impact assessments and restoration mandates to mitigate its ecological footprint and ensure responsible resource extraction.

| Environmental Factor | Impact on Balasore Alloys | Key Considerations/Data |

| Carbon Emissions & Regulations | Increased operational costs due to emission standards; need for investment in cleaner tech. | India's net-zero target by 2070; potential carbon pricing mechanisms. |

| Water Management | Compliance with wastewater discharge quality standards; investment in treatment and recycling. | CPCB standards for wastewater; potential for reduced fresh water intake costs. |

| Industrial Waste Management | Need for robust waste reduction and recycling strategies. | Estimated 1.5 million tonnes of slag generated by Indian ferroalloy industry in 2023; focus on waste-to-wealth technologies. |

| Biodiversity & Land Use | Mitigation of habitat destruction and land degradation from mining. | Mandatory EIAs and ecological restoration efforts; biodiversity offsets. |

| Energy Transition | Pressure to adopt cleaner energy; potential for long-term cost savings and improved ESG. | Renewables accounted for ~30% of global electricity generation by end of 2023; record clean energy investments in early 2024. |

PESTLE Analysis Data Sources

Our Balasore Alloys PESTLE Analysis is meticulously constructed using data from official government publications, reputable industry associations, and leading financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.