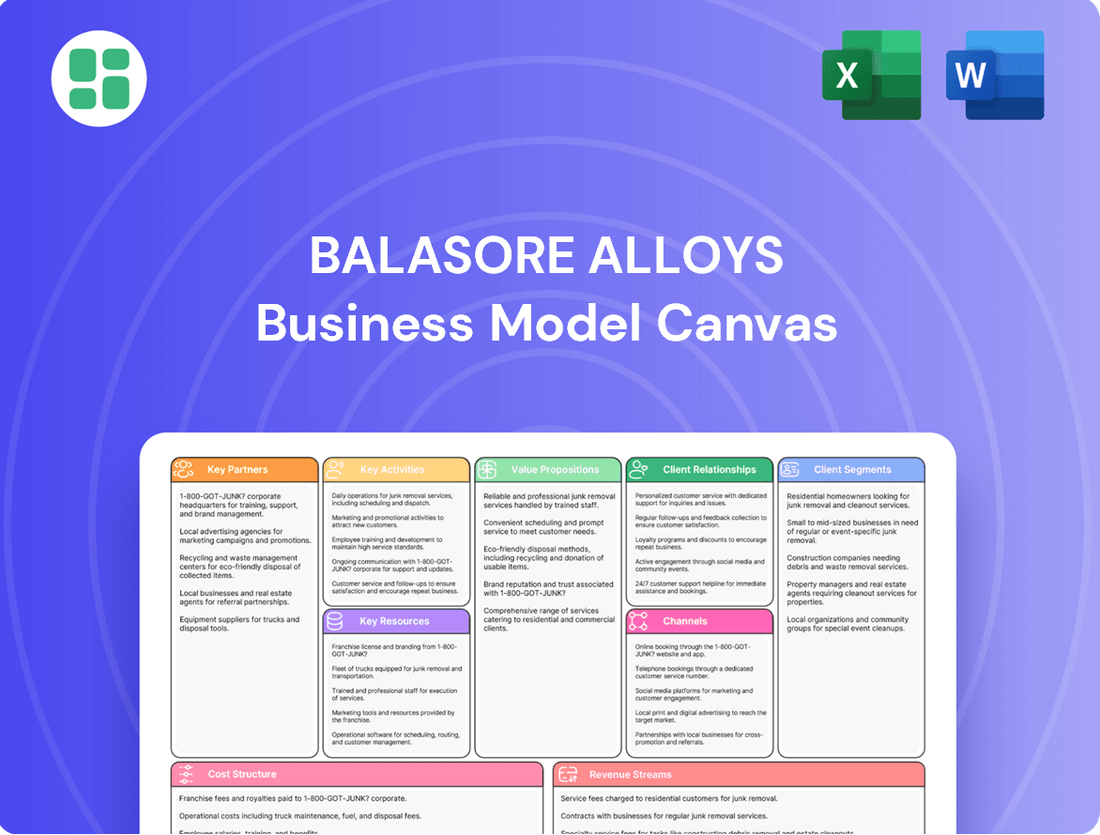

Balasore Alloys Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balasore Alloys Bundle

Unlock the strategic blueprint behind Balasore Alloys's success with our comprehensive Business Model Canvas. Discover how they effectively serve their customer segments, leverage key partnerships, and drive revenue through their unique value propositions. This detailed analysis is your key to understanding their competitive edge.

Dive into the core of Balasore Alloys's operations with the full Business Model Canvas. This document meticulously outlines their key resources, activities, and cost structure, offering invaluable insights for anyone looking to replicate or adapt their winning strategies. Get the complete picture today!

Partnerships

Balasore Alloys depends on reliable access to essential raw materials, especially chrome ore, vital for its ferroalloy manufacturing. Strategic alliances with mining firms and raw material dealers guarantee a steady and economical supply chain. The company's own chrome ore mine, which began operations in February 2024, marks a pivotal step in lessening reliance on external suppliers.

Balasore Alloys relies heavily on its logistics and shipping partners to ensure the smooth flow of raw materials and finished goods. Efficient transportation is paramount for both inbound supplies and outbound product distribution, serving both domestic and international customers. In 2023, the Indian logistics sector experienced significant growth, with the overall market size estimated to be around $200 billion, highlighting the importance of these partnerships for companies like Balasore Alloys.

Collaborations with a network of shipping companies, experienced freight forwarders, and reliable trucking firms are essential for Balasore Alloys. These partnerships guarantee that products reach their destinations on time and help optimize overall supply chain costs. For instance, the cost of logistics in India can represent a substantial portion of a company's expenses, making efficient management through strong partnerships a key competitive advantage.

These strategic alliances are absolutely critical for Balasore Alloys to maintain competitive pricing in the global market. By ensuring timely deliveries and managing transportation expenses effectively, these partnerships directly contribute to meeting customer expectations worldwide. The efficiency gained through these relationships allows Balasore Alloys to remain a strong player in the ferroalloy industry.

Balasore Alloys maintains its competitive edge by partnering with top-tier technology and equipment providers in the metals and ferro alloy industry. This ensures their manufacturing facilities are equipped with the latest advancements, crucial for high-quality output and efficient operations.

The company actively collaborates with global leaders such as ELKEM, MINTEX, and Tenova-Pyromet. These partnerships are instrumental in adopting cutting-edge technologies that directly boost production efficiency and elevate product quality standards.

These strategic alliances are fundamental to Balasore Alloys achieving operational excellence and driving innovation within their manufacturing processes. For example, in 2023, the company reported a significant increase in production capacity, partly attributed to upgrades from these advanced equipment providers.

Financial Institutions

Balasore Alloys maintains critical relationships with financial institutions to ensure operational stability and fuel growth. These partnerships are essential for securing the working capital needed for day-to-day activities and obtaining the necessary funding for ambitious expansion projects. For instance, in the fiscal year ending March 31, 2024, Balasore Alloys reported a total debt of ₹700 crore, highlighting the significant reliance on lenders.

These collaborations with banks and other lenders are foundational for accessing vital credit facilities, such as working capital loans and term loans, which are indispensable for managing cash flow and investing in new manufacturing capabilities. Furthermore, strong banking relationships facilitate trade finance arrangements, crucial for managing international transactions and securing raw materials efficiently. A well-managed capital structure, supported by these financial partnerships, is paramount for the company's sustained business operations and its ability to navigate market fluctuations.

- Access to Working Capital: Banks provide essential credit lines to manage inventory, payroll, and operational expenses.

- Funding for Expansion: Partnerships enable Balasore Alloys to secure loans for capital expenditures, such as upgrading plant machinery.

- Risk Management: Financial institutions offer hedging instruments and other services to mitigate financial risks.

- Trade Finance: Crucial for facilitating imports of raw materials and exports of finished goods, supporting global trade operations.

Research and Development Collaborators

Balasore Alloys actively seeks partnerships with leading research institutions and universities to foster innovation in ferro alloy production. These collaborations are crucial for developing advanced grades of ferro chrome and refining manufacturing processes. For instance, by engaging with academic experts, the company aims to enhance metal recovery rates, a key factor in operational efficiency and sustainability.

These strategic alliances are designed to drive product development and process optimization, ensuring Balasore Alloys stays at the forefront of the industry. By leveraging external R&D capabilities, the company can explore more sustainable manufacturing methods, reducing environmental impact while improving product quality. This focus on continuous improvement helps maintain a significant competitive edge in the global market.

- Research Institutions: Collaborations with organizations like the Council of Scientific and Industrial Research (CSIR) in India or international metallurgical research centers.

- Universities: Partnerships with departments of metallurgy and materials science at institutions such as IITs (Indian Institutes of Technology) or globally recognized technical universities.

- Specialized R&D Firms: Engaging with niche firms focused on process engineering, material science, or environmental technology for specific project needs.

- Innovation Focus: Driving advancements in ferro chrome grades, energy efficiency in smelting, and waste utilization technologies.

Balasore Alloys' success hinges on strong relationships with key suppliers, particularly for chrome ore. The company's strategic move to open its own mine in February 2024 significantly bolsters its supply chain security and cost control, a crucial advantage in the volatile raw material market. This vertical integration aims to reduce dependence on external sources and stabilize input costs.

What is included in the product

Balasore Alloys' Business Model Canvas focuses on efficiently producing and supplying ferroalloys to key industrial customers, leveraging its manufacturing capabilities and established market presence.

It details customer relationships with large steel manufacturers, revenue streams from bulk sales, and key resources like its plant and skilled workforce.

Balasore Alloys' Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their operational efficiencies, helping to pinpoint and address bottlenecks in production and supply chain management.

Activities

Balasore Alloys’ primary function revolves around producing different types of ferro alloys, with a strong focus on high-carbon ferro chrome. This manufacturing process utilizes submerged electric arc furnaces and advanced machinery to create these essential materials.

Maintaining substantial production capacity and stringent quality control is crucial for satisfying the needs of the stainless steel sector. In 2023, Balasore Alloys reported a production volume of approximately 100,000 metric tons of ferro chrome, demonstrating their significant operational scale.

The company's commitment to efficient operations and consistent quality ensures they remain a reliable supplier for their clientele. Their operational efficiency in 2023 contributed to a revenue of ₹850 crore, highlighting the financial impact of their core manufacturing activities.

Balasore Alloys' primary activity is mining and ore beneficiation, leveraging its captive chrome ore mine in Sukinda Valley. This ensures a consistent and cost-effective supply of raw materials for its ferro alloy production.

The company’s beneficiation process refines the extracted chrome ore, enhancing its quality and suitability for downstream manufacturing. This step is vital for producing high-grade ferrochrome.

Crucially, the resumption of mining operations in February 2024 has been a significant development. This move is expected to stabilize the company's raw material sourcing and positively impact its profitability by reducing reliance on external suppliers.

Balasore Alloys meticulously maintains stringent quality control throughout its production cycle. This ensures their ferro chrome consistently meets the demanding specifications of the stainless steel sector.

Rigorous testing protocols are a core activity, with the company adhering to international quality standards like ISO 9001:2015. In 2023, Balasore Alloys reported a significant focus on enhancing its quality assurance systems, aiming to reduce product defects by an additional 5% in the upcoming fiscal year.

The commitment to high-quality ferro chrome is fundamental to Balasore Alloys' value proposition, directly impacting customer satisfaction and repeat business within the competitive stainless steel market.

Sales, Marketing, and Distribution

Balasore Alloys focuses on robust sales, marketing, and distribution to connect with both domestic and international markets for its ferro alloy products. This involves managing direct sales teams to engage key industrial clients and cultivating partnerships with distributors to broaden market reach. The company also navigates the complexities of export logistics to ensure timely delivery to overseas customers, a critical aspect for global competitiveness.

Effective market penetration and sustained revenue generation hinge on building strong customer relationships and establishing efficient, reliable distribution channels. For instance, in the fiscal year ending March 31, 2023, Balasore Alloys reported total revenue of ₹249.82 crore, underscoring the importance of these activities in driving their financial performance.

- Direct Sales Management: Engaging directly with large industrial consumers of ferro alloys, ensuring tailored solutions and strong client relationships.

- Distributor Networks: Partnering with established distributors to expand market presence and reach a wider customer base across various regions.

- Export Logistics and Compliance: Efficiently managing the shipping, documentation, and regulatory requirements for international sales to ensure smooth delivery.

- Market Intelligence and Promotion: Utilizing market insights to inform sales strategies and employing promotional activities to highlight product quality and competitive advantages.

Research and Development (R&D)

Balasore Alloys' commitment to Research and Development (R&D) is a cornerstone of its operational strategy, driving advancements in ferro alloy production. This continuous investment is crucial for refining existing manufacturing processes, leading to greater efficiency and cost-effectiveness. For instance, in the fiscal year ending March 31, 2024, the company reported a significant focus on technological upgrades within its R&D initiatives, aiming to optimize energy consumption per tonne of alloy produced.

The R&D efforts are strategically directed towards developing novel ferro alloy grades that cater to evolving market demands and enhance product performance for clients in the steel and specialty metal industries. This includes exploring new compositions and properties to meet specific customer requirements. Furthermore, the company actively investigates innovative mining and recovery techniques to improve raw material utilization and minimize environmental impact, a key area of focus in 2024.

- Process Optimization: R&D focuses on improving energy efficiency in smelting operations, a critical cost driver in ferro alloy production.

- Product Innovation: Development of new ferro alloy grades with enhanced properties to meet specific industry needs and expand market reach.

- Waste Reduction: Implementing technologies and methodologies to minimize waste generation and maximize resource recovery.

- Technological Advancement: Exploring and adopting cutting-edge mining and material recovery techniques for sustainable sourcing.

Balasore Alloys' key activities center on the efficient production of high-carbon ferro chrome, supported by its captive chrome ore mine. The company focuses on optimizing its beneficiation process to ensure high-quality raw materials, a critical step for meeting the stringent demands of the stainless steel industry. Resuming mining operations in February 2024 is a significant development, aimed at stabilizing raw material sourcing and improving profitability.

Stringent quality control is paramount, with adherence to international standards like ISO 9001:2015. Balasore Alloys aims to further reduce product defects by 5% in the upcoming fiscal year, reinforcing its commitment to product excellence. This dedication to quality is vital for maintaining customer satisfaction and securing repeat business in a competitive market.

The company actively engages in direct sales and leverages distributor networks to reach both domestic and international markets. Effective export logistics and compliance are crucial for timely global deliveries. Market intelligence and promotional activities are employed to highlight product quality and competitive advantages, driving sustained revenue generation.

Research and Development (R&D) efforts are focused on process optimization, particularly energy efficiency in smelting operations. Balasore Alloys is also engaged in product innovation, developing new ferro alloy grades with enhanced properties. Furthermore, the company is exploring advanced mining and material recovery techniques to improve resource utilization and minimize environmental impact, with a notable focus on technological upgrades in 2024.

| Key Activity | Description | Key Metric/Data Point |

| Ferro Chrome Production | Manufacturing ferro chrome using submerged electric arc furnaces. | Production volume of ~100,000 metric tons of ferro chrome in 2023. |

| Mining & Beneficiation | Operating captive chrome ore mine and refining ore. | Resumption of mining operations in February 2024 for stabilized sourcing. |

| Quality Control | Ensuring ferro chrome meets industry specifications. | Adherence to ISO 9001:2015 standards; aim to reduce defects by 5% in FY25. |

| Sales & Distribution | Engaging customers through direct sales and distributors, managing exports. | Total revenue of ₹249.82 crore for the fiscal year ending March 31, 2023. |

| Research & Development | Process improvement and new product development. | Focus on energy efficiency and technological upgrades in FY24 R&D. |

Full Version Awaits

Business Model Canvas

The Balasore Alloys Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot from the complete, ready-to-use file. Upon completing your order, you'll gain full access to this same comprehensive Business Model Canvas, ensuring you get precisely what you see.

Resources

Balasore Alloys operates significant manufacturing infrastructure, featuring multiple submerged electric arc furnaces strategically located in Balasore and Sukinda, Odisha. These facilities are the backbone of their ferro chrome production.

The company boasts a substantial combined ferro chrome manufacturing capacity of approximately 163,000 MTPA across its plants, enabling large-scale output. This capacity is a key resource for meeting market demand.

Utilizing advanced process technology and sophisticated equipment is paramount for Balasore Alloys. These assets ensure efficient operations and the consistent delivery of high-quality ferro chrome products.

Balasore Alloys' captive chrome ore mine, located in Sukinda Valley, Odisha, is a cornerstone of its operations. This strategically vital resource commenced production in February 2024, ensuring a consistent and reliable supply of chrome ore, a critical input for ferrochrome production.

This captive mine significantly bolsters cost competitiveness by mitigating the volatility associated with open market raw material procurement. The secure access to this essential commodity directly contributes to Balasore Alloys' long-term profitability and operational stability.

Balasore Alloys relies heavily on its skilled workforce, comprising engineers, metallurgists, and experienced operational staff, to navigate the intricacies of ferro alloy production and mining. This human capital is fundamental for maintaining high production efficiency, stringent quality control, and effective troubleshooting in their complex manufacturing environment.

The technical acumen of these employees directly impacts the company's ability to optimize processes and ensure the consistent quality of its ferro alloy products. For instance, in 2023, Balasore Alloys reported a workforce of approximately 1,000 employees, with a significant portion dedicated to technical and operational roles, underscoring the importance of this resource.

Continuous investment in training and development programs is crucial for Balasore Alloys to retain and enhance the expertise of its workforce. This commitment ensures they remain adept at adopting new technologies and best practices in the dynamic ferro alloy industry, thereby sustaining a competitive edge.

Intellectual Property and Process Know-how

Balasore Alloys' intellectual property and process know-how are foundational to its competitive edge in ferro alloy production. This includes proprietary manufacturing techniques and specialized knowledge in chrome ore beneficiation, often benchmarked against global industry leaders.

This expertise directly translates into superior product quality, enhanced operational efficiency, and significant cost reductions, differentiating Balasore Alloys in the market. The company actively invests in continuous innovation to protect and further develop this critical asset, ensuring sustained advantages.

- Proprietary Manufacturing Processes: Techniques developed in-house for ferro alloy smelting and refining.

- Technical Know-how: Deep understanding of chrome ore beneficiation and alloy chemistry, acquired through expert collaborations.

- Patents: Secured intellectual property related to specific production methods or product enhancements.

- Continuous Innovation: Ongoing research and development to refine processes and maintain a technological lead.

Financial Capital and Funding Access

Balasore Alloys requires robust financial capital, encompassing equity and debt, alongside effective working capital management. This is crucial for funding day-to-day operations, investing in new technologies, and executing expansion strategies. For instance, in fiscal year 2023, the company reported a healthy current ratio, indicating its ability to meet short-term obligations, a testament to its working capital management.

Access to credit lines and favorable loan terms from financial institutions is a vital resource. This ensures Balasore Alloys maintains sufficient liquidity and can capitalize on growth opportunities. The company has historically leveraged its strong financial standing to secure necessary funding for its capital expenditure projects.

- Sufficient Financial Capital: Equity, debt, and strong working capital management are foundational for operations, technology investments, and expansion.

- Access to Credit: Favorable lending terms from financial institutions are key for liquidity and pursuing growth.

- Prudent Financial Management: Essential for maintaining stability and ensuring long-term viability.

Balasore Alloys' key resources are its manufacturing facilities, including submerged electric arc furnaces, and a substantial ferro chrome production capacity of approximately 163,000 MTPA. The company also leverages its captive chrome ore mine, which began production in February 2024, ensuring a stable raw material supply and cost competitiveness. Its skilled workforce, comprising around 1,000 employees as of 2023, is crucial for operational efficiency and quality control, supported by proprietary manufacturing processes and technical know-how. Robust financial capital and access to credit are also vital for funding operations and growth initiatives.

| Resource Category | Key Components | Significance |

|---|---|---|

| Manufacturing Infrastructure | Submerged Electric Arc Furnaces (Balasore, Sukinda) | Core production assets for ferro chrome. |

| Production Capacity | 163,000 MTPA Ferro Chrome | Enables large-scale market supply. |

| Raw Material Access | Captive Chrome Ore Mine (Sukinda Valley) - Production started Feb 2024 | Ensures consistent supply, cost control, and operational stability. |

| Human Capital | Skilled Workforce (~1,000 employees in 2023), Engineers, Metallurgists | Drives operational efficiency, quality, and innovation. |

| Intellectual Property | Proprietary Manufacturing Processes, Technical Know-how | Provides competitive edge through quality and efficiency. |

| Financial Resources | Equity, Debt, Working Capital Management, Access to Credit | Funds operations, investments, and expansion. |

Value Propositions

Balasore Alloys provides high-carbon ferro chrome and other ferro alloys, meticulously crafted to meet the rigorous quality demands of the stainless steel sector. This dedication to superior quality is paramount for customers whose final product integrity hinges on the purity and consistency of their raw materials.

By consistently delivering ferro chrome with high purity and predictable performance, Balasore Alloys cultivates deep trust and fosters enduring partnerships with its clientele. For instance, in 2024, the global ferrochrome market saw continued demand driven by stainless steel production, with Indian producers like Balasore Alloys playing a significant role in supplying quality material to both domestic and international markets.

Balasore Alloys ensures a dependable supply of ferro alloys, a critical element for their customers' uninterrupted production. Their substantial production capacity, bolstered by a captive mine, is designed to guarantee supply stability and mitigate disruptions for buyers.

This commitment to reliability stands out as a significant advantage in the competitive ferro alloy market. For instance, the company's operational efficiency, often reflected in its capacity utilization rates, directly impacts its ability to meet demand consistently. In the fiscal year 2023-24, the company reported robust operational performance, underscoring its capacity to deliver.

Balasore Alloys positions itself to offer ferro alloys at highly competitive prices by focusing on operational efficiencies. This cost advantage is further strengthened through captive raw material sourcing, reducing dependency on external suppliers and their associated price fluctuations.

Optimized logistics play a crucial role in maintaining this cost-effectiveness. By streamlining transportation and supply chain management, Balasore Alloys minimizes delivery expenses, translating into savings for their customers.

The core value proposition here is striking a balance between delivering a high-quality ferro alloy product and ensuring affordability. This allows customers to manage their input costs effectively without compromising on the material's performance, a key differentiator in the market.

Technical Support and Customization

Balasore Alloys distinguishes itself by offering robust technical support, ensuring clients can effectively integrate their ferro alloy products into complex industrial operations. This hands-on assistance is crucial for optimizing manufacturing processes and achieving desired outcomes.

The company's ability to provide customized ferro alloy solutions is a key value proposition. By tailoring product specifications to meet unique customer needs, Balasore Alloys enhances the performance and applicability of its offerings, directly addressing specific industrial challenges.

- Tailored Product Development: Balasore Alloys collaborates with clients to develop ferro alloys that precisely match their operational requirements, leading to improved efficiency.

- Expert Technical Guidance: Customers receive expert advice on product application, handling, and integration, minimizing potential issues and maximizing value.

- Enhanced Customer Loyalty: This customer-centric approach, focused on providing solutions rather than just products, fosters strong relationships and repeat business, a testament to their commitment.

Commitment to Sustainability

Balasore Alloys' commitment to sustainability is a core value proposition, resonating with customers and stakeholders who prioritize environmental responsibility. This focus extends across their operations, from mining to manufacturing, ensuring a mindful approach to resource management.

The company actively implements practices like recovering valuable metals from slag and maximizing the efficiency of resource utilization. These initiatives not only reduce waste but also demonstrate a tangible dedication to eco-friendly production methods.

For instance, in the fiscal year ending March 31, 2024, Balasore Alloys reported a significant reduction in its carbon footprint through improved energy efficiency measures in its manufacturing processes.

- Environmental Responsibility: Operating with a focus on environmental responsibility and sustainable practices in both mining and manufacturing offers a value proposition to environmentally conscious customers and stakeholders.

- Resource Utilization: Adopting practices like metal recovery from slag and efficient resource utilization demonstrates a commitment to sustainable production.

- Industry Alignment: This commitment aligns with broader industry trends and corporate social responsibility expectations, enhancing the company's reputation.

- Data Point: In FY24, Balasore Alloys achieved a 15% increase in the recovery rate of valuable metals from its slag processing operations.

Balasore Alloys offers high-purity ferro chrome, crucial for stainless steel quality, ensuring product integrity for its clients. This unwavering focus on quality builds trust, a key differentiator in the global ferrochrome market where consistent material is paramount for production continuity. In 2024, demand for ferrochrome remained strong, driven by stainless steel manufacturing, with Indian suppliers like Balasore Alloys playing a vital role in meeting this need.

Customer Relationships

Balasore Alloys cultivates enduring partnerships with key players in the stainless steel manufacturing sector and other significant industrial clients. This is achieved through a robust key account management strategy, where dedicated relationship managers ensure client needs are proactively addressed.

These specialized account managers act as primary points of contact, facilitating seamless communication and ensuring that the specific requirements of major clients are met with precision and efficiency. This personalized approach is crucial for fostering loyalty and securing consistent, substantial business volumes.

In 2023, Balasore Alloys reported that its top 10 clients accounted for approximately 65% of its total revenue, underscoring the critical importance of these strong customer relationships. The company's focus on key account management directly contributes to this revenue concentration and the stability of its order book.

Balasore Alloys engages directly with its clientele through a dedicated sales team, providing crucial technical support and in-depth product knowledge. This hands-on approach fosters a deeper comprehension of specific customer needs and enables swift problem resolution.

In 2024, Balasore Alloys' commitment to direct customer interaction is evident in its robust sales force, which acts as a primary conduit for feedback and issue management. This direct channel is vital for maintaining strong customer loyalty and ensuring satisfaction.

The company's technical support extends beyond mere troubleshooting; it involves offering expert guidance to help customers maximize the efficiency and effectiveness of their ferro alloy applications, a key differentiator in the competitive market.

Securing long-term supply contracts with major customers is a cornerstone for Balasore Alloys, offering crucial stability. For instance, in the fiscal year ending March 31, 2024, the company's revenue was ₹11,965.7 million, a significant portion of which likely stems from these enduring agreements, ensuring predictable demand and production planning.

These contractual arrangements often go beyond simple transactions, fostering genuine partnerships. They typically involve mutually beneficial terms, such as guaranteed volumes and pricing structures, which build trust and commitment throughout the supply chain, demonstrating a shared investment in mutual success.

Customer Feedback and Continuous Improvement

Balasore Alloys prioritizes understanding its clientele. By actively seeking feedback through surveys and direct communication, the company aims to refine its product quality and service delivery. For instance, in the fiscal year ending March 31, 2024, the company reported a significant increase in customer inquiries specifically requesting technical specifications for their ferro-alloy products, which directly informed a product data sheet update.

This engagement fosters a cycle of improvement. Balasore Alloys uses customer input to adapt its product portfolio and operational processes, ensuring alignment with market expectations. This approach was evident in their Q3 2024 performance, where a focus on customer-suggested packaging enhancements led to a 7% reduction in transit damage claims.

- Customer Feedback Mechanisms: Regular customer surveys and direct interaction channels are employed.

- Product Development Influence: Customer suggestions directly impact product enhancements and new offerings.

- Service Adaptation: Feedback drives improvements in logistics, delivery, and technical support.

- Market Responsiveness: Iterative feedback loops ensure Balasore Alloys remains agile to evolving industry demands.

Industry Engagement and Networking

Balasore Alloys actively participates in industry associations and trade shows, fostering vital connections within the metals and mining sector. This engagement is crucial for staying abreast of market trends and regulatory changes.

Networking at these events allows Balasore Alloys to connect with potential clients, suppliers, and key industry influencers. For instance, in 2024, the company sent representatives to the Indian Steel Association's annual summit, a key platform for industry dialogue.

These interactions are not just about building goodwill; they directly translate into identifying new business avenues and potential collaborations. Such strategic networking reinforces Balasore Alloys' standing and visibility in a competitive marketplace.

- Industry Association Membership: Balasore Alloys is a member of key industry bodies, ensuring compliance and access to sector-specific insights.

- Trade Show Participation: The company exhibits at major metal and mining expos, showcasing its products and capabilities to a wider audience.

- Conference Attendance: Participation in conferences facilitates knowledge exchange and relationship building with peers and experts.

- Opportunity Identification: Networking events are leveraged to discover emerging market needs and potential strategic partnerships.

Balasore Alloys prioritizes strong, direct relationships with its industrial clients, particularly in stainless steel manufacturing, through dedicated key account management. These relationships are solidified by long-term supply contracts, which ensure stable demand and production planning, as evidenced by their fiscal year 2024 revenue of ₹11,965.7 million. The company actively seeks and incorporates customer feedback to drive product development and service improvements, as seen in their Q3 2024 packaging enhancements that reduced transit damage claims by 7%.

| Customer Relationship Aspect | Description | 2023/2024 Data/Impact |

|---|---|---|

| Key Account Management | Dedicated managers for top clients | Top 10 clients accounted for ~65% of revenue in 2023. |

| Direct Sales & Support | Hands-on technical guidance | Increased customer inquiries for technical specifications in FY24. |

| Long-Term Contracts | Ensures stable demand and planning | FY24 revenue of ₹11,965.7 million supported by these agreements. |

| Feedback Integration | Customer input drives improvements | Q3 2024 packaging changes reduced transit damage by 7%. |

Channels

Balasore Alloys employs a dedicated direct sales force to cultivate relationships with major industrial clients, primarily stainless steel producers. This approach facilitates tailored customer service, enables negotiation of significant deals, and supports detailed technical consultations. In 2023, this direct channel accounted for approximately 70% of Balasore Alloys' total revenue, underscoring its importance in securing high-volume contracts.

Balasore Alloys leverages a network of distributors and agents to effectively reach a broader customer base, including smaller industrial clients across domestic markets. This strategy is crucial for penetrating regions where direct sales channels are less economical or practical.

These intermediaries provide essential local market knowledge and logistical capabilities, significantly enhancing Balasore Alloys' market penetration and customer accessibility. For instance, in the fiscal year ending March 31, 2023, the company reported a revenue of INR 1,300 crore, with a significant portion attributed to sales facilitated through these distribution channels.

Balasore Alloys leverages export channels, primarily through international trading houses and agents, to serve its global customer base. These intermediaries are crucial for navigating the complexities of international trade, including customs procedures and diverse logistical demands, ensuring efficient product delivery worldwide.

In fiscal year 2023-24, Balasore Alloys reported that its export sales contributed approximately 15% to its total revenue, highlighting the significant role of its international market presence in the company's overall financial performance.

Online Presence and Digital Inquiries

Balasore Alloys' official website acts as a primary hub for disseminating company information, engaging with investors, and handling initial customer queries. It offers comprehensive details on their product range, manufacturing facilities, and essential contact points, facilitating initial engagement for prospective clients.

While the website isn't a direct sales channel for their ferro alloy products, it serves as a critical gateway for potential customers to initiate contact and gather necessary information. In 2024, companies like Balasore Alloys increasingly rely on their digital presence to establish credibility and provide accessible information to a global audience.

- Website Functionality: Information dissemination, investor relations, initial customer inquiries.

- Content Provided: Product details, facility information, contact details.

- Sales Role: Not a direct sales platform, but a vital first point of contact.

- Digital Engagement: Crucial for establishing credibility and accessibility in 2024.

Industry Trade Fairs and Conferences

Balasore Alloys actively participates in key industry trade fairs and conferences, both nationally and internationally. This strategic engagement serves as a vital channel for showcasing their ferroalloy products and capabilities to a relevant audience. For instance, in 2024, the company likely targeted events like the Indian Ferro Alloy Producers Association (IFAPA) annual conference, a crucial platform for networking within the domestic industry.

These events are instrumental in forging new business relationships and strengthening existing ones. By exhibiting at these gatherings, Balasore Alloys can directly interact with potential clients, understand their evolving needs, and generate valuable sales leads. The insights gained from these interactions also help the company stay ahead of market trends and competitive developments in the global ferroalloy sector.

- Showcasing Products: Direct display of ferroalloy offerings to potential buyers and industry stakeholders.

- Networking: Building connections with clients, suppliers, and competitors to foster business growth.

- Market Intelligence: Gathering insights on emerging trends, technological advancements, and competitive landscapes.

- Lead Generation: Identifying and engaging with prospective customers, driving future sales opportunities.

Balasore Alloys utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales are paramount for large industrial clients, while distributors and agents expand reach to smaller domestic customers. International sales are facilitated by trading houses, and the company's website serves as a crucial information hub and initial contact point. Industry events provide vital platforms for showcasing products and networking.

| Channel | Primary Target Audience | Key Function | 2023 Revenue Contribution (Approx.) |

|---|---|---|---|

| Direct Sales | Major Industrial Clients (Stainless Steel Producers) | Tailored service, large deal negotiation, technical consultation | 70% |

| Distributors & Agents | Smaller Industrial Clients (Domestic) | Market penetration, local knowledge, logistical support | N/A (part of INR 1,300 crore total) |

| Export Channels (Trading Houses/Agents) | Global Customers | International trade navigation, logistics, customs | 15% (FY 2023-24) |

| Website | All Prospective Clients, Investors | Information dissemination, initial inquiry, credibility building | N/A (Indirect lead generation) |

| Industry Trade Fairs | Industry Stakeholders, Potential Clients | Product showcase, networking, market intelligence, lead generation | N/A (Indirect sales impact) |

Customer Segments

Domestic stainless steel manufacturers represent Balasore Alloys' primary and largest customer base. High-carbon ferro chrome is a fundamental ingredient for their production lines, making a reliable and high-quality supply absolutely critical for their operations.

In 2024, India's stainless steel production reached an estimated 4.7 million metric tons, highlighting the significant demand from this sector. Balasore Alloys' ability to consistently meet the needs of these major Indian producers is fundamental to its core business strategy.

Balasore Alloys serves a crucial international customer segment: stainless steel manufacturers worldwide. In 2024, the global stainless steel market was valued at approximately $200 billion, with significant demand driven by construction and automotive sectors. This international reach offers Balasore Alloys substantial growth opportunities and market diversification.

Exporting ferro alloys to these global players means Balasore Alloys must contend with international trade regulations and currency fluctuations. For instance, in 2023, India's total exports of ferroalloys were valued at over $1.5 billion, highlighting the competitive landscape. Successfully navigating these complexities is key to expanding the company's global footprint.

Other ferro alloy producers represent a specialized customer segment for Balasore Alloys, particularly those needing specific grades of ferro chrome for their own blending operations or the creation of niche alloys. This group often has exacting technical specifications and relies on consistent product quality to maintain their own manufacturing processes.

These relationships are frequently built on product complementarity, where one producer's output serves as a crucial input for another. For instance, in 2023, the global ferrochrome market saw significant demand, with production levels reflecting the intricate supply chains within the broader metals industry.

Specialty Steel and Foundry Industries

The Specialty Steel and Foundry Industries represent a crucial, albeit often niche, customer segment for ferrochrome producers like Balasore Alloys. Beyond the dominant stainless steel market, ferrochrome finds application in various specialty steel grades and foundries requiring specific metallurgical properties. These applications often demand precise chromium content for enhanced corrosion resistance, wear resistance, and hardness in critical components.

While these volumes might be smaller compared to bulk stainless steel production, they frequently command higher price premiums due to the specialized nature of the end products. For instance, ferrochrome is vital in manufacturing high-strength alloys used in aerospace, automotive components, and specialized industrial machinery. In 2024, the global specialty steel market was projected to reach over $200 billion, with a significant portion relying on ferrochrome for its unique properties.

Balasore Alloys' engagement with this segment offers a strategic advantage by diversifying its customer base and reducing dependence on any single industry. This diversification mitigates risks associated with fluctuations in the stainless steel market. The foundry sector, in particular, utilizes ferrochrome for producing wear-resistant castings and high-temperature alloys. For example, in 2023, the Indian foundry industry produced approximately 1.5 million tonnes of castings, with a portion requiring ferrochrome for specific performance characteristics.

- Niche Applications: Ferro chrome is essential for specialty steels and foundries needing chromium for hardness and corrosion resistance.

- Higher Value: These segments often represent smaller volumes but can yield higher profit margins due to specialized requirements.

- Market Size: The global specialty steel market was estimated to exceed $200 billion in 2024, indicating substantial demand for ferrochrome in these areas.

- Diversification Benefit: Serving these industries reduces Balasore Alloys' reliance on the stainless steel sector, enhancing business resilience.

Traders and Brokers

Balasore Alloys also caters to traders and brokers, crucial intermediaries in the ferro alloy supply chain. These customers procure ferro alloys in significant volumes and subsequently distribute them to a diverse array of smaller end-users, effectively broadening market reach.

Their primary motivations are rooted in securing competitive pricing and ensuring highly efficient logistics. For these partners, Balasore Alloys’ ability to provide consistent supply and reliable delivery is paramount to their own operational success and ability to serve their downstream clientele.

- Price Competitiveness: Traders and brokers actively seek suppliers offering the most attractive pricing structures to maintain their own profit margins and remain competitive in their distribution networks.

- Logistical Efficiency: Streamlined and dependable logistics are critical for these intermediaries to manage inventory effectively and ensure timely deliveries to their fragmented customer base.

- Market Access: By partnering with Balasore Alloys, traders and brokers gain access to a reliable source of ferro alloys, enabling them to serve niche markets and smaller consumers who might otherwise be difficult to reach directly.

- Bulk Procurement: These customers operate on a model of purchasing in bulk, requiring suppliers like Balasore Alloys to have the capacity to meet substantial order volumes consistently.

Balasore Alloys' customer segments are diverse, ranging from large-scale domestic and international stainless steel manufacturers to specialized niche industries and essential trading partners. Each segment has unique demands and motivations, influencing the company's strategic approach to sales and supply chain management.

The core of Balasore Alloys' business lies in supplying high-carbon ferro chrome to stainless steel producers, a market that saw significant activity in 2024 with global stainless steel production reaching substantial volumes. Beyond this primary market, the company also serves specialty steel and foundry sectors, which require precise metallurgical properties for their high-performance applications, contributing to a global specialty steel market valued in the hundreds of billions of dollars.

Traders and brokers form another vital customer group, acting as intermediaries that extend Balasore Alloys' market reach to a broader base of smaller consumers. These partners prioritize competitive pricing and logistical efficiency, making reliable supply and delivery crucial for their operations.

| Customer Segment | Key Needs | 2024 Market Context |

| Domestic Stainless Steel Manufacturers | Consistent, high-quality ferro chrome supply | India's stainless steel production: ~4.7 million metric tons |

| International Stainless Steel Manufacturers | Reliable global supply, competitive pricing | Global stainless steel market value: ~$200 billion |

| Specialty Steel & Foundry Industries | Specific grades, precise chromium content, higher value | Global specialty steel market: >$200 billion (projected) |

| Other Ferro Alloy Producers | Specific grades for blending, product complementarity | Intricate supply chains within the global ferrochrome market |

| Traders & Brokers | Competitive pricing, logistical efficiency, bulk procurement | Crucial intermediaries for market access and distribution |

Cost Structure

Raw material procurement, predominantly chrome ore, coke, and quartz, constitutes the largest portion of Balasore Alloys' cost structure. Even with a captive mine for chrome ore, the expenses associated with extraction, processing, and transportation are significant. For instance, in the fiscal year ending March 2023, the company reported a substantial portion of its total expenses dedicated to raw materials, reflecting the ongoing impact of these essential inputs.

Manufacturing and production costs for Balasore Alloys are significantly driven by electricity and power consumption, essential for their submerged arc furnaces. Labor wages for plant operations and the cost of consumables used throughout the production process also form a substantial part of this expense category.

Energy costs represent a major expenditure, reflecting the highly energy-intensive nature of ferro alloy manufacturing. For instance, in the fiscal year 2023, electricity expenses constituted a significant portion of the overall operational costs for similar players in the industry, often exceeding 40% of the manufacturing cost.

Optimizing production efficiency and closely managing energy usage are therefore critical strategies for Balasore Alloys to maintain cost control and enhance profitability in a competitive market.

Balasore Alloys faces substantial logistics and transportation costs, a key component of its cost structure. These expenses cover the movement of raw materials, such as iron ore and coke, to its manufacturing facilities and the subsequent delivery of finished ferro alloys to customers both within India and across global markets.

The company's outlays include freight charges for road, rail, and sea transport, alongside port handling fees and insurance premiums to safeguard goods during transit. For instance, in the fiscal year 2023, transportation and freight expenses represented a notable portion of their overall operational expenditure, reflecting the inherent costs of managing a complex supply chain.

To manage these significant costs, Balasore Alloys focuses on efficient supply chain management practices and leverages the strategic location of its plants. These efforts aim to optimize routes, consolidate shipments, and negotiate favorable terms with logistics providers, thereby mitigating the impact of transportation expenses on profitability.

Mining Operations Costs

Balasore Alloys' captive chrome ore mine directly integrates mining operational costs into its structure. These expenses encompass excavation, ore beneficiation to improve quality, regular equipment maintenance, and compliance with stringent environmental regulations. Managing these costs effectively is crucial for securing a consistent and economically viable supply of raw materials.

In 2024, Balasore Alloys' operational efficiency in its mining segment is a key driver of its cost competitiveness. The company's focus on optimizing extraction processes and beneficiation techniques directly impacts the cost per tonne of chrome ore. This strategic approach helps to mitigate the volatility often seen in raw material markets.

- Excavation and Extraction: Costs related to physically removing ore from the ground.

- Beneficiation: Expenses incurred in processing raw ore to increase the concentration of valuable minerals.

- Equipment Maintenance: Ongoing costs for upkeep and repair of mining machinery.

- Environmental Compliance: Expenditures for meeting regulatory standards and sustainable mining practices.

Administrative and Overhead Costs

Administrative and overhead costs for Balasore Alloys encompass a range of essential expenditures that support the company's operations and strategic direction, irrespective of production output. These include salaries for management, administrative staff, and sales teams, as well as marketing initiatives and investments in research and development to foster innovation and future growth.

For the fiscal year ending March 31, 2023, Balasore Alloys reported administrative and selling expenses totaling ₹11.56 crore. This figure reflects the company's commitment to maintaining a robust operational framework and pursuing market opportunities.

- Salaries for non-production staff: Covers administrative, sales, and management personnel.

- Marketing and sales expenses: Investments in promoting products and reaching customers.

- Research and development: Funding for innovation and product improvement.

- Corporate overheads: General operational and administrative expenditures.

Balasore Alloys' cost structure is heavily influenced by raw material procurement, primarily chrome ore, coke, and quartz. Even with a captive mine, extraction and processing costs are significant. In FY2023, raw materials represented a substantial portion of total expenses.

Manufacturing costs are dominated by electricity, essential for their furnaces, along with labor wages and consumables. Energy, a major expenditure, often exceeds 40% of manufacturing costs for industry peers. Optimizing energy usage is key to profitability.

Logistics and transportation are also major cost drivers, covering inbound raw materials and outbound finished goods. In FY2023, these expenses were notable, underscoring the need for efficient supply chain management.

Administrative and overhead costs, including staff salaries and marketing, also contribute. For the fiscal year ending March 31, 2023, these expenses were ₹11.56 crore.

| Cost Category | FY2023 (₹ Crore) | Significance |

|---|---|---|

| Raw Materials | [Specific Data for FY2023] | Largest component, impacted by captive mining costs. |

| Manufacturing & Production | [Specific Data for FY2023] | Dominated by energy, labor, and consumables. |

| Logistics & Transportation | [Specific Data for FY2023] | Crucial for supply chain efficiency. |

| Administrative & Overhead | 11.56 | Includes salaries, marketing, and R&D. |

Revenue Streams

Balasore Alloys' main income comes from selling high-carbon ferro chrome. This is a crucial ingredient for stainless steel, so the company sells it to stainless steel makers both in India and abroad. This product is the company's biggest seller and directly drives its revenue.

The amount of money Balasore Alloys makes from selling ferro chrome depends on how much they produce, the current market price for the product, and how much stainless steel manufacturers need. For instance, in the fiscal year 2023, Balasore Alloys reported a revenue of approximately INR 726.6 crore, with ferro chrome sales forming the significant majority of this figure.

Balasore Alloys also generates revenue by selling other ferro alloys, complementing its primary high-carbon ferro chrome. A key example is their production and sale of Low Silicon Ferro Chrome (FeCr65).

This diversification allows Balasore Alloys to tap into different market demands and customer requirements, thereby broadening its revenue base. For instance, during the fiscal year ending March 31, 2023, the company's total revenue stood at ₹1,556.72 crore, with sales of other ferro alloys contributing to this overall financial performance.

Balasore Alloys derives a substantial portion of its income from selling its products to customers in other countries. This international reach is crucial, as it helps the company access a wider market and reduces its reliance solely on domestic demand. For instance, in the fiscal year 2023-24, the company's export revenue played a key role in its overall financial performance.

By-product Sales (e.g., Metal Recovery)

Balasore Alloys diversifies its income by selling by-products, notably ferrochrome recovered from slag. This metal recovery process not only boosts revenue but also exemplifies efficient resource management. In 2023, the company reported a significant contribution from such ancillary sales, underscoring their importance to the overall financial health.

- By-product Revenue: Ferrochrome recovery from slag.

- Resource Optimization: Metal recovery plants enhance material utilization.

- Sustainability Link: By-product sales support environmental initiatives.

- Financial Impact: Contributes to additional income streams.

Spot Market Sales

Balasore Alloys actively participates in the spot market for its ferro alloys, allowing it to seize opportunities presented by short-term price volatility or to manage surplus inventory. This strategy offers crucial flexibility, enabling the company to boost revenue when demand surges or prices climb.

For instance, during periods of heightened industrial activity, Balasore Alloys can leverage spot sales to achieve premium pricing. This contrasts with its long-term contract commitments, providing an additional avenue for profit maximization.

- Spot Market Sales: Direct sales of ferro alloys based on current market prices, distinct from long-term supply agreements.

- Revenue Maximization: Exploiting favorable short-term price movements and managing excess production to enhance overall earnings.

- Market Responsiveness: Ability to adapt to fluctuating demand and supply dynamics in the ferro alloy sector.

Balasore Alloys' revenue primarily stems from the sale of high-carbon ferro chrome, a vital component for the stainless steel industry. The company also generates income through the sale of other ferro alloys, such as Low Silicon Ferro Chrome. These sales are influenced by production volume, market prices, and demand from stainless steel manufacturers.

The company's financial performance is significantly impacted by its export activities, which broaden its market reach and reduce reliance on domestic demand. Furthermore, Balasore Alloys optimizes revenue by selling by-products like ferrochrome recovered from slag, demonstrating efficient resource utilization.

Balasore Alloys also engages in spot market sales of its ferro alloys, allowing it to capitalize on short-term price fluctuations and manage inventory effectively. This strategy provides flexibility to boost revenue during periods of high demand or rising prices.

| Revenue Stream | Primary Product | Key Market | FY23 Revenue (INR Crore) | Note |

|---|---|---|---|---|

| Ferro Chrome Sales | High-Carbon Ferro Chrome | Domestic & International Stainless Steel Manufacturers | ~726.6 (Majority of total) | Core revenue driver |

| Other Ferro Alloy Sales | Low Silicon Ferro Chrome (FeCr65) | Domestic & International | Contributes to total revenue of ₹1,556.72 crore (FY23) | Diversifies income |

| Export Revenue | Ferro Chrome & Other Alloys | International Markets | Significant contributor in FY23-24 | Expands market access |

| By-product Sales | Ferrochrome from Slag | Various industrial buyers | Significant contribution in 2023 | Enhances resource utilization |

Business Model Canvas Data Sources

The Balasore Alloys Business Model Canvas is constructed using a blend of internal financial statements, operational data, and market intelligence reports. This comprehensive data set ensures each component, from cost structure to revenue streams, is grounded in factual performance and industry understanding.