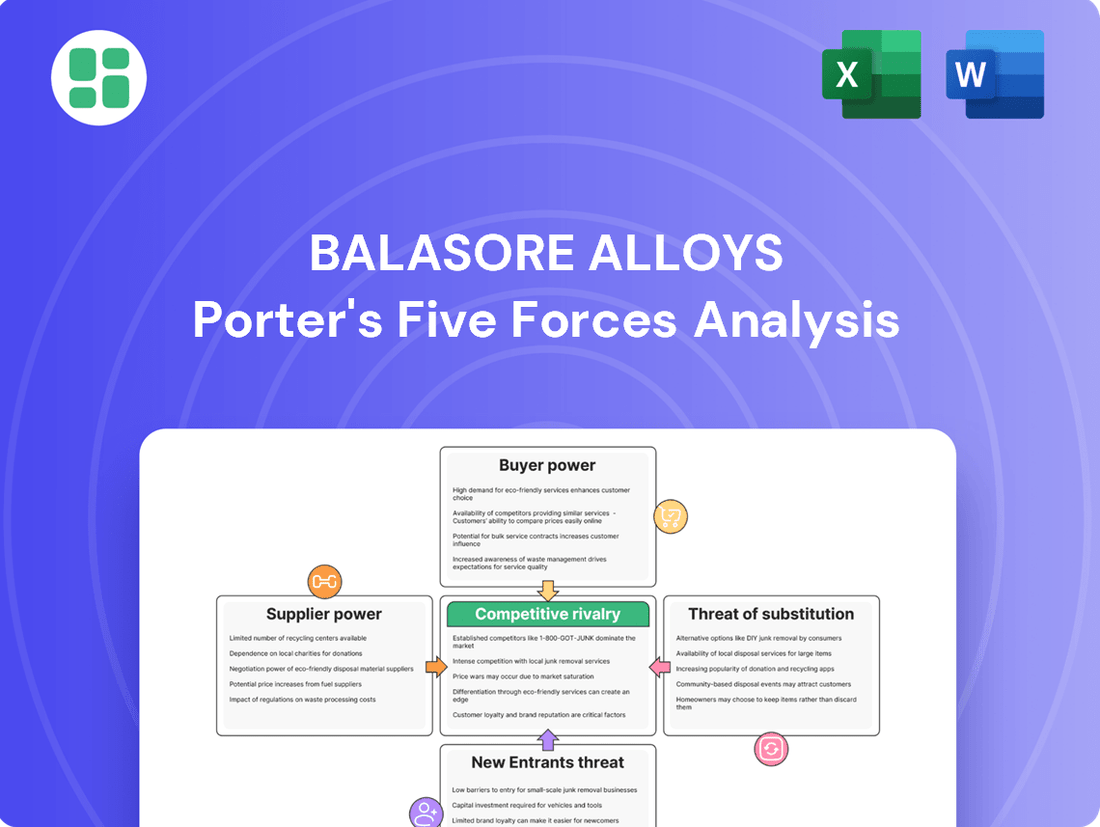

Balasore Alloys Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balasore Alloys Bundle

Balasore Alloys faces moderate buyer power due to a fragmented customer base, but intense rivalry among existing players significantly shapes its competitive landscape.

The full Porter's Five Forces Analysis reveals the strength and intensity of each market force affecting Balasore Alloys, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

The global chrome ore market, essential for ferro chrome production, is highly concentrated. Key suppliers are primarily located in South Africa, Kazakhstan, and India, giving these nations considerable leverage.

This limited geographic sourcing means a few mining entities can significantly impact chrome ore prices and supply conditions. For Balasore Alloys, this concentration translates to a substantial dependency on these few sources for its critical raw material.

In 2023, South Africa alone accounted for approximately 70% of global chrome ore reserves, underscoring the supplier power Balasore Alloys faces. This reliance exposes the company to potential supply chain disruptions and price fluctuations in the international chrome ore market.

Beyond chrome ore, Balasore Alloys faces considerable risk from the fluctuating prices of other essential inputs. The cost of power, a critical component for ferroalloy production in India, can swing dramatically. In 2024, energy expenses represented a significant 20-25 percent of total production costs for companies in this sector.

Similarly, the prices of reductants like coke and coal are prone to volatility. These price swings directly impact Balasore Alloys' operational expenses. If the company cannot effectively pass these increased input costs onto its customers, its profit margins could be significantly squeezed, impacting overall financial performance.

Balasore Alloys, like other Indian ferro chrome producers, contends with the scarcity of high-grade domestic chrome ore. This limited supply forces a greater reliance on imported ore or the utilization of lower-grade domestic material.

This dependency on imports or lower-grade ore directly impacts production costs, as imported ore often carries higher freight and handling charges. Furthermore, using lower-grade ore can necessitate more intensive processing, further escalating expenses and potentially affecting the consistent quality of the ferro chrome produced.

In 2023, India's chrome ore production was approximately 3.5 million tonnes, but a significant portion of this is of lower grades, making high-grade ore a premium commodity. This supply-demand imbalance for high-quality ore grants considerable bargaining power to the few domestic suppliers and international ore exporters.

Switching Costs for Balasore Alloys

Switching suppliers for key raw materials like chrome ore and metallurgical coal presents significant hurdles for Balasore Alloys. These switching costs aren't just financial; they encompass the time and resources needed for new supplier qualification, reconfiguring logistics, and potentially adapting production processes to accommodate different raw material specifications. For instance, a change in chrome ore quality could necessitate adjustments in furnace operations, impacting efficiency and output.

These substantial switching costs inherently limit Balasore Alloys' flexibility in sourcing, thereby bolstering the bargaining power of its existing suppliers. The specialized nature of ferrochrome production means that even minor deviations in raw material composition can have a cascading effect on the final product's quality and the manufacturing process. This reliance on consistent, specific inputs makes it challenging and costly to pivot to new suppliers without a thorough and potentially disruptive evaluation period.

In 2023, the global ferrochrome market experienced price volatility due to supply chain disruptions and fluctuating demand. Companies like Balasore Alloys often secure long-term contracts for critical raw materials to ensure stability, which further entrenches the position of established suppliers. The ability of suppliers to dictate terms is amplified when the cost and complexity of finding and integrating alternatives are high.

- High Qualification Costs: New suppliers require rigorous testing and approval, consuming time and financial resources.

- Logistical Reconfiguration: Adapting transportation and handling procedures for different suppliers adds complexity and expense.

- Production Process Adjustments: Changes in raw material quality may necessitate costly modifications to smelting and refining operations.

- Contractual Commitments: Existing long-term agreements can lock Balasore Alloys into relationships, reducing immediate flexibility.

Potential for Supplier Forward Integration

The potential for supplier forward integration represents a significant, albeit less common, threat to Balasore Alloys. Large, integrated chrome ore miners could theoretically move into ferrochrome production, directly challenging existing players like Balasore Alloys. This possibility, even if currently in its early stages, could impact future pricing and supply stability.

This looming threat necessitates strategic foresight for Balasore Alloys. Proactive measures, such as securing long-term supply agreements with key chrome ore suppliers, become crucial to mitigate the potential disruption. For instance, by 2024, global chrome ore prices saw fluctuations, making stable supply contracts even more valuable.

- Supplier Integration Threat: Large chrome ore miners may enter ferrochrome production, competing directly with Balasore Alloys.

- Market Impact: This integration could influence pricing and supply dynamics, potentially squeezing profit margins for ferrochrome producers.

- Strategic Response: Balasore Alloys may need to pursue long-term supply contracts to ensure raw material availability and price stability.

- 2024 Context: Volatility in chrome ore markets during 2024 underscores the importance of securing reliable supply chains against potential upstream competition.

Suppliers of critical raw materials like chrome ore and metallurgical coal wield significant power over Balasore Alloys due to market concentration and high switching costs. The limited number of key chrome ore suppliers, primarily in South Africa, coupled with the expense and complexity of finding and qualifying new sources, strengthens their position. This leverage allows suppliers to influence pricing and supply terms, directly impacting Balasore Alloys' operational costs and profitability.

The bargaining power of suppliers is further amplified by the specialized nature of ferrochrome production, where raw material consistency is paramount. High qualification costs, logistical challenges, and potential production process adjustments make it difficult and costly for Balasore Alloys to switch suppliers. In 2023, for example, securing long-term contracts was a common strategy for ferrochrome producers to ensure stability, reinforcing the influence of established suppliers.

In 2024, energy costs represented a substantial 20-25 percent of production expenses for Indian ferroalloy producers, highlighting another area where input providers exert considerable influence. Similarly, volatility in the prices of reductants like coke and coal directly affects Balasore Alloys' bottom line, especially if these increased costs cannot be fully passed on to customers.

| Factor | Impact on Balasore Alloys | 2023/2024 Data Point |

| Chrome Ore Supply Concentration | High dependence on few global suppliers | South Africa accounted for ~70% of global chrome ore reserves in 2023. |

| Switching Costs | Limits flexibility, strengthens supplier position | Includes qualification, logistics, and production adjustments. |

| Energy Costs | Significant operational expense | Represented 20-25% of total production costs in 2024 for sector. |

| Reductant Price Volatility | Directly impacts operational expenses | Coke and coal prices are prone to fluctuations. |

What is included in the product

This Porter's Five Forces analysis for Balasore Alloys evaluates the industry's competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes, providing a strategic overview of its market position.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Balasore Alloys.

Gain immediate clarity on the strategic leverage points impacting Balasore Alloys, enabling proactive responses to market pressures.

Customers Bargaining Power

Balasore Alloys' primary customers are stainless steel manufacturers, a sector populated by large, globally recognized companies. The purchasing power concentrated within these few major stainless steel mills allows them to significantly influence ferro chrome prices and negotiate favorable terms.

This buyer concentration translates into substantial bargaining power, as demonstrated by the fluctuating bidding prices for high-carbon ferrochrome from mainstream stainless steel mills. These fluctuations frequently exert downward pressure on ferrochrome prices, impacting producers like Balasore Alloys.

The stainless steel industry is inherently price-sensitive due to its exposure to global economic fluctuations and volatile commodity prices. This means buyers are constantly looking for cost advantages.

As high-carbon ferro chrome is a significant cost component in stainless steel production, customers, often large manufacturers, exert considerable pressure to negotiate favorable prices. For instance, in 2024, the price of ferro chrome can fluctuate significantly based on global demand for stainless steel, directly impacting the bargaining power of stainless steel producers who are the customers of ferro chrome suppliers like Balasore Alloys.

Furthermore, periods of weak demand for stainless steel, whether domestically or internationally, empower customers even more. When stainless steel producers face sluggish sales, they become more aggressive in seeking lower input costs, intensifying the bargaining power they hold over their suppliers.

The bargaining power of customers is significantly amplified when the product is standardized and switching costs are low. High-carbon ferro chrome, the primary product of Balasore Alloys, is largely a commodity. This means there's not much to distinguish one producer's output from another's.

Because the product is so similar across suppliers, customers face minimal hurdles in switching from one ferrochrome producer to another. Their purchasing decisions often come down to the most competitive price and the most reliable delivery schedule. This ease of switching directly empowers customers.

For Balasore Alloys, this dynamic intensifies competition. Customers can readily shift their business if they find a better deal elsewhere, putting pressure on Balasore Alloys to remain price-competitive and ensure consistent, timely deliveries to retain their client base. In 2023, global ferrochrome prices saw fluctuations, influenced by factors like energy costs and demand from the stainless steel industry, highlighting the price sensitivity customers exhibit.

Customer Backward Integration Potential

The potential for large stainless steel manufacturers to integrate backward into ferrochrome production significantly enhances customer bargaining power. This move allows them to secure a stable supply of a critical raw material and gain better control over production costs.

While the initial investment in ferrochrome facilities is substantial, it represents a tangible threat, particularly for major consumers of ferrochrome. This capability directly increases their leverage over suppliers like Balasore Alloys.

Evidence of this trend is seen in global developments, such as the Tsingshan Group in Indonesia initiating ferrochrome projects. Such actions by major industry players underscore the growing customer capacity for backward integration.

- Customer Leverage: Large stainless steel producers can exert greater influence on ferrochrome pricing and supply terms due to their potential to produce it themselves.

- Cost Control: Backward integration offers consumers a direct method to manage and potentially reduce their ferrochrome input costs.

- Supply Security: By producing ferrochrome internally, large steel companies can mitigate risks associated with supply chain disruptions.

- Industry Examples: The development of ferrochrome projects by significant steel conglomerates, like Tsingshan Group, demonstrates the practical application of this strategy.

Demand Fluctuation from End-Use Sectors

The demand for ferro chrome, a key ingredient in stainless steel, is heavily tied to the performance of sectors like construction, automotive, and consumer goods. When these industries slow down, the demand for stainless steel, and consequently ferro chrome, weakens. This creates a situation where buyers of ferro chrome have more leverage, especially during downturns.

For example, in early 2025, the Indian ferro-chrome market experienced pressure due to sluggish stainless steel consumption, leading to muted spot demand. This directly translates to increased bargaining power for customers who can negotiate better prices when demand is not robust.

- Construction Sector Impact: A slowdown in construction projects directly reduces the need for stainless steel in applications like architectural elements and fittings, thereby lowering ferro chrome demand.

- Automotive Industry Influence: Reduced vehicle production or a shift towards lighter materials can decrease the use of stainless steel in cars, impacting ferro chrome purchasing power.

- Consumer Goods Demand: Lower consumer spending on appliances and electronics, which often use stainless steel, can also lead to a dip in ferro chrome orders.

- Market Volatility: Fluctuations in these end-use sectors create demand volatility for ferro chrome producers, giving buyers more negotiating strength during periods of oversupply or reduced consumption.

Balasore Alloys faces significant customer bargaining power due to the consolidated nature of the stainless steel industry. Major stainless steel producers, often global entities, have the leverage to negotiate favorable pricing and terms for ferro chrome, a key input. This power is amplified by the commodity nature of ferro chrome, leading to low switching costs for buyers and a focus on price competitiveness.

| Factor | Impact on Customer Bargaining Power | 2024/2025 Relevance |

| Buyer Concentration | High; few large stainless steel manufacturers dominate purchases. | In 2024, the top 5 global stainless steel producers accounted for approximately 60% of global output, giving them substantial negotiating clout. |

| Product Differentiation | Low; ferro chrome is largely a commodity. | Customers can easily switch suppliers based on price, as product quality is generally comparable. |

| Switching Costs | Low; minimal investment needed for buyers to change suppliers. | This ease of switching places continuous pressure on Balasore Alloys to offer competitive pricing to retain customers. |

| Threat of Backward Integration | Moderate to High; large consumers can potentially produce ferro chrome internally. | Companies like China Baowu Steel Group are exploring vertical integration, signaling a potential shift in supplier-customer dynamics. |

| Demand Sensitivity | High; customer purchasing power increases during industry downturns. | A projected slowdown in global construction and automotive sectors in late 2024 could heighten customer leverage for ferro chrome. |

Same Document Delivered

Balasore Alloys Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Balasore Alloys Porter's Five Forces Analysis meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the ferro-alloy industry. This comprehensive assessment provides actionable insights for strategic decision-making.

Rivalry Among Competitors

The commodity nature of high-carbon ferro chrome intensifies competition, forcing producers like Balasore Alloys to vie primarily on price. With minimal product differentiation, success hinges on cost efficiency, consistent quality, and reliable delivery. This dynamic often squeezes profit margins, particularly when the market experiences oversupply, as it did with global ferrochrome prices seeing significant volatility throughout 2023 and early 2024 due to shifts in demand from key consuming industries like stainless steel.

The ferro alloy market, especially in India, is crowded with many strong companies. Established domestic names like Indian Metals & Ferro Alloys (IMFA) and Tata Steel Mining compete directly with global powerhouses, intensifying rivalry.

This dense competitive landscape, featuring both local champions and international players, naturally leads to a highly competitive environment for companies like Balasore Alloys.

Furthermore, India's role as a significant exporter means it must also contend with producers from other nations, adding another layer of competitive pressure on domestic firms.

The ferro chrome industry is characterized by substantial capital outlays and high fixed costs, creating a significant barrier to entry and influencing competitive dynamics. Producers often feel compelled to maintain operations even when demand falters, aiming to spread these fixed costs over a larger production volume and avoid steeper per-unit expenses.

This operational imperative can exacerbate oversupply situations, leading to intense price competition. For instance, in 2024, the market experienced production cutbacks as a direct response to oversupply, yet the underlying production capacity remains substantial, suggesting ongoing pressure on pricing.

Export Market Challenges and Global Oversupply

Balasore Alloys faces significant competitive rivalry in its export markets due to a global oversupply of ferro chrome. China's substantial increase in domestic production, exceeding its own consumption, has flooded the international market. This situation intensifies competition for Indian producers like Balasore Alloys.

The oversupply is further exacerbated by rising freight rates, which increase the cost of exporting. Additionally, Indian producers must contend with competition from lower-cost materials, such as ferro chrome from Kazakhstan entering markets like Europe. This dynamic puts downward pressure on prices and margins for Indian exporters.

- Global Ferro Chrome Oversupply: China's production outstrips its domestic demand, leading to increased exports.

- Increased Freight Costs: Higher shipping expenses impact the competitiveness of Indian exports.

- Competition from Low-Cost Producers: Kazakh ferro chrome, for instance, offers a cheaper alternative in key export regions.

Focus on Cost Efficiency and Vertical Integration

Competitive rivalry in the ferroalloys sector, particularly for companies like Balasore Alloys, is intensely fueled by a relentless pursuit of cost efficiency. This often manifests through strategic vertical integration, such as securing captive mines for essential raw materials like chrome ore. Companies that control their ore supply chains gain a substantial cost advantage, as they are less exposed to the price volatility of the open market.

For instance, in 2023, the global average price for chrome ore ranged significantly, impacting producers without captive sources. Those with captive mines can better manage their input costs, enabling them to offer more competitive pricing. This cost leadership strategy is a primary driver of rivalry, as it directly influences market share and profitability.

- Vertical Integration Advantage: Companies with captive chrome ore mines in 2024 benefit from predictable input costs, unlike competitors who must purchase ore on the open market, which saw price fluctuations throughout the year.

- Energy Efficiency as a Differentiator: Investment in energy-efficient technologies is another key area of rivalry, as electricity constitutes a major operational expense in ferroalloy production.

- Cost Leadership Impact: The ability to achieve cost leadership through these means directly pressures competitors to either adopt similar strategies or accept lower margins.

- Market Dynamics: This focus on cost efficiency creates a challenging environment for players not possessing integrated operations or advanced energy-saving measures.

The competitive rivalry for Balasore Alloys is fierce, driven by a globally oversupplied ferro chrome market, particularly due to China's increased production. This oversupply, coupled with rising freight costs and competition from lower-cost producers like Kazakhstan, exerts downward pressure on prices and margins for Indian exporters.

Companies like Balasore Alloys must prioritize cost efficiency, often through vertical integration like securing captive chrome ore mines, to gain a competitive edge. Energy efficiency is also a key differentiator, as electricity is a major production cost.

| Metric | 2023 Data | 2024 Outlook | Impact on Rivalry |

|---|---|---|---|

| Global Ferro Chrome Price (Avg. per tonne) | $1,500 - $1,800 (approx.) | Volatile, potential for further decline due to oversupply | Intensifies price competition |

| China Ferro Chrome Production | Increased significantly | Continued high levels expected | Exacerbates global oversupply |

| Indian Ferro Chrome Exports | Facing pressure from global competition | Continued challenges anticipated | Requires cost leadership for market share |

SSubstitutes Threaten

Chromium is crucial for stainless steel, giving it its signature corrosion resistance. Finding a direct replacement that perfectly mimics chromium's unique properties across most standard stainless steel grades is extremely difficult.

This makes the threat of direct substitution for high-carbon ferrochrome, a key ingredient, quite low for its primary use in stainless steel production.

While direct substitution for ferro chrome in stainless steel production is currently limited, the threat of substitutes can emerge from advancements in metallurgy. For instance, the development of new stainless steel grades or alternative alloys that require less ferro chrome or utilize different alloying elements for specific applications could pose a future challenge. This could impact demand for traditional ferro chrome suppliers like Balasore Alloys.

The feasibility of these substitutes is often tied to significant research and development investments and substantial retooling costs for steel manufacturers. For example, a major shift to a new alloy might require recalibrating furnaces and altering production processes, which can be a considerable barrier to entry for new materials. The global ferrochrome market was valued at approximately $15.5 billion in 2023, indicating the scale of investment in current production methods.

The increasing adoption of recycled stainless steel scrap presents a significant threat of substitutes for Balasore Alloys. Driven by a global push for sustainability and circular economy models, the use of recycled materials is on the rise. For instance, in 2023, the global stainless steel recycling rate was estimated to be around 60%, indicating a substantial volume of material being reintroduced into the production cycle.

While recycled stainless steel still necessitates chromium, its growing prevalence can reduce the overall demand for primary ferrochrome, a key input for stainless steel production. This trend, while positive for market sustainability, could potentially temper the demand for newly produced ferrochrome, impacting companies like Balasore Alloys that are significant producers.

Technological Advancements in Steelmaking

Innovations in steelmaking, such as advancements in chromium recycling or the development of alternative alloys, could potentially reduce the demand for high-carbon ferrochrome. For instance, if new steel formulations can achieve desired properties with less chromium input, it would lessen the reliance on ferrochrome. However, the significant capital expenditure required for these new steelmaking technologies and the inherent inertia in adopting such processes across the industry suggest that the threat from these substitutes will likely materialize gradually.

The adoption rate of new steelmaking technologies is a critical factor. For example, the global steel industry's capital expenditure for decarbonization and modernization was estimated to be in the hundreds of billions of dollars annually leading up to 2024. This indicates that widespread implementation of radically different steelmaking processes, which might reduce ferrochrome demand, will take considerable time and investment.

- Technological Shifts: Innovations reducing chromium intensity in steel or enabling lower-grade ferroalloy use pose a threat.

- Investment Barriers: High capital costs for new steelmaking processes slow the adoption of substitutes.

- Adoption Pace: The gradual nature of technological diffusion in the steel industry limits the immediate impact of substitutes.

- Market Dynamics: While alternative alloys exist, their widespread acceptance depends on cost-effectiveness and performance parity with traditional steel.

Cost-Effectiveness of Alternative Materials

The cost-effectiveness of alternative materials presents a significant threat. For applications where the unique properties of stainless steel aren't essential, substitutes like aluminum, plastics, or coated carbon steel offer more budget-friendly options. This indirect substitution can dampen overall demand for stainless steel, and by extension, for ferrochrome, a key input for stainless steel production.

For instance, in the automotive sector, while stainless steel offers corrosion resistance, aluminum alloys are increasingly favored for their lighter weight, contributing to fuel efficiency. In 2024, the global aluminum market was projected to reach over $200 billion, reflecting its widespread adoption across various industries as a cost-effective alternative.

- Material Substitution: Aluminum, plastics, and coated carbon steel serve as viable, often cheaper, alternatives to stainless steel in many applications.

- Demand Impact: These substitutes reduce the overall demand for stainless steel, indirectly affecting the demand for ferrochrome, a key raw material for Balasore Alloys.

- Market Dynamics: The growing adoption of lighter materials like aluminum in industries such as automotive, driven by fuel efficiency goals, highlights the competitive pressure from substitutes.

While direct substitutes for ferrochrome in stainless steel are limited due to chromium's unique properties, the threat of alternatives is growing. Recycled stainless steel scrap is increasingly used, reducing the need for primary ferrochrome, with recycling rates around 60% in 2023. Additionally, other materials like aluminum, plastics, and coated carbon steel offer cost-effective alternatives for applications not requiring stainless steel's specific benefits, impacting overall demand.

| Threat of Substitutes | Description | Impact on Balasore Alloys | Key Data Point |

| Recycled Stainless Steel | Increasing use of recycled materials reduces demand for virgin ferrochrome. | Potential decrease in demand for primary ferrochrome production. | Global stainless steel recycling rate ~60% in 2023. |

| Alternative Materials (e.g., Aluminum) | Cost-effective substitutes for applications not requiring stainless steel's properties. | Reduced overall demand for stainless steel, indirectly affecting ferrochrome. | Global aluminum market projected >$200 billion in 2024. |

| Metallurgical Advancements | New alloys or steel grades requiring less ferrochrome or different alloying elements. | Future challenge if new materials gain traction, impacting traditional ferrochrome demand. | Global ferrochrome market valued ~$15.5 billion in 2023. |

Entrants Threaten

The ferrochrome industry, particularly for players like Balasore Alloys, presents a formidable threat of new entrants due to extremely high capital requirements. Setting up a modern ferrochrome plant involves massive upfront investment, often running into hundreds of millions of dollars, for specialized furnaces, mining leases, and supporting infrastructure.

For instance, new plants in India, as of 2024, are estimated to cost upwards of $150-200 million for a medium-sized facility. This significant financial barrier, coupled with the imperative to achieve substantial economies of scale to compete on cost, effectively deters most potential new competitors from entering the market.

The threat of new entrants for Balasore Alloys, specifically concerning access to chrome ore resources, is moderate to high. Securing consistent, high-quality chrome ore is paramount for ferrochrome production, and captive mines provide a substantial competitive edge. For instance, in 2023, the global chrome ore market was dominated by a few key players, with South Africa holding approximately 70% of the world's reserves, making it challenging for newcomers to establish reliable supply chains.

New companies entering the ferrochrome industry would likely struggle to secure long-term supply contracts or obtain mining leases. This is particularly true given the concentrated nature of global chrome ore reserves and the existing relationships between established producers and mining entities. The capital investment required for mine development and the lengthy approval processes pose significant barriers.

The ferrochrome industry demands highly specialized metallurgical knowledge and intricate furnace operations. New entrants face a steep learning curve to master this complex technology and achieve the consistent product quality that established players like Balasore Alloys possess. This significant expertise and accumulated experience act as a formidable barrier, deterring potential competitors from entering the market.

Environmental Regulations and Permitting

The ferro alloy industry, being energy-intensive, carries significant environmental implications. This translates into increasingly stringent environmental regulations and a complex web of permitting requirements that new entrants must navigate. For instance, in 2024, India, a major player in the ferro alloy market, continued to emphasize stricter emission standards for industries, impacting operational costs and technology choices.

Complying with these environmental mandates and securing the necessary clearances presents a substantial barrier to entry. New companies would need to invest heavily in pollution control technologies and undergo lengthy approval processes, adding considerable upfront costs and time delays. This regulatory landscape can deter potential competitors by raising the capital investment required to establish a viable operation.

- Stringent Emission Standards: Compliance with evolving air and water quality norms necessitates advanced abatement technologies.

- Permitting Complexity: Obtaining environmental clearances involves multiple agencies and can be time-consuming.

- Increased Capital Expenditure: Investments in eco-friendly infrastructure add to the initial cost for new players.

- Operational Compliance Costs: Ongoing monitoring and adherence to environmental regulations contribute to operating expenses.

Established Customer Relationships and Market Saturation

Established players like Balasore Alloys benefit from deep-rooted relationships with major stainless steel manufacturers, often cemented by long-term supply agreements. These existing partnerships create a significant barrier for newcomers seeking to penetrate the market.

The global stainless steel market has faced oversupply challenges in recent years, intensifying competition. For instance, in 2023, global stainless steel production reached approximately 57.4 million metric tons, indicating a highly competitive landscape where new entrants might resort to unsustainable pricing to gain traction.

- Established relationships: Balasore Alloys has secured long-term contracts with key stainless steel producers, ensuring consistent demand.

- Market saturation: The global stainless steel market, producing over 57 million metric tons in 2023, is often characterized by oversupply.

- Aggressive pricing: New entrants may need to offer heavily discounted prices to compete, potentially impacting profitability.

- Barriers to entry: The combination of existing relationships and market saturation makes it difficult for new companies to establish a significant market presence.

The threat of new entrants in the ferrochrome industry, impacting Balasore Alloys, is significantly mitigated by the immense capital required for plant setup. Estimated costs for new, medium-sized facilities in India as of 2024 range from $150-200 million, covering specialized equipment and infrastructure. This high financial barrier, alongside the need for economies of scale, deters potential new competitors.

| Barrier Type | Description | Estimated Impact (2024) |

| Capital Investment | High cost of specialized plants and infrastructure | $150-200 million for medium facility |

| Resource Access | Securing chrome ore supply chains | Dominated by few players; South Africa holds ~70% reserves |

| Technical Expertise | Mastery of metallurgical processes and furnace operations | Steep learning curve for new entrants |

| Environmental Regulations | Compliance with stringent emission standards and permits | Adds significant upfront and operational costs |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Balasore Alloys leverages data from the company's annual reports, BSE/NSE filings, and industry-specific market research reports. This blend of primary and secondary sources provides a comprehensive view of the competitive landscape, including supplier and buyer power.