Balaji Amines SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balaji Amines Bundle

Balaji Amines demonstrates strong growth potential driven by its diversified product portfolio and expanding market reach, yet faces challenges related to raw material price volatility and increasing competition. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on its opportunities while mitigating risks.

Want the full story behind Balaji Amines' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Balaji Amines is a frontrunner in India's aliphatic amines sector, particularly strong in methylamines and ethylamines. This leadership is built on a robust and diverse product range. For instance, in the fiscal year 2023-24, the company reported strong revenue growth, underscoring its market dominance and the demand for its core products.

The company's extensive product catalog extends beyond amines to include crucial specialty chemicals and derivatives such as dimethylamine hydrochloride and morpholine. This diversification allows Balaji Amines to serve a broad spectrum of vital industries, including pharmaceuticals, agrochemicals, and water treatment, creating multiple revenue streams and reducing reliance on any single market segment.

Balaji Amines is demonstrating strong strategic foresight by heavily investing in capital expenditure for several new projects, with commissioning targeted for FY2024-25 and FY2025-26. This proactive expansion includes new facilities for methylamines, electronic-grade Dimethyl Carbonate (DMC) vital for the burgeoning electric vehicle battery market, and Dimethyl Ether (DME) for aerosol and LPG applications.

The company's commitment to these new plants, also covering N-Methyl Morpholine (NMM), N-(n-butyl) Thiophosphoric triamide (NBPT), and Isopropylamine, is poised to significantly fuel future revenue streams. This strategic capacity expansion is designed not only to increase output but also to diversify its product portfolio, shifting towards higher-margin and specialized chemical offerings.

Balaji Amines' focus on import substitution aligns perfectly with the 'Make in India' initiative, targeting high-barrier products that reduce reliance on foreign suppliers. This strategic direction is further bolstered by government support.

The company's subsidiary, Balaji Speciality Chemicals, has been granted 'Mega Project Status' by the Government of Maharashtra. This designation is tied to a substantial proposed investment of Rs. 750 crores aimed at producing critical chemical products, underscoring significant governmental backing for its expansion plans.

Indigenous Technology and Certifications

Balaji Amines benefits significantly from its self-developed indigenous technology for producing amines. This internal capability often translates into lower manufacturing costs and a stronger competitive position compared to rivals relying on licensed technologies. It also provides greater control over the production process and quality.

The company's adherence to international standards is demonstrated by certifications like BIS for Morpholine and REACH. These accreditations are crucial for market access, especially in highly regulated regions like Europe. For instance, REACH compliance is a prerequisite for exporting chemicals to the European Union, opening up substantial growth opportunities.

- Indigenous Technology: Balaji Amines has developed proprietary manufacturing processes for key amine products, potentially reducing production costs and enhancing operational efficiency.

- BIS Certification: The Bureau of Indian Standards (BIS) certification for Morpholine signifies adherence to quality and safety standards within India.

- REACH Compliance: Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) compliance is vital for exporting to the European Union, a major global market.

- Market Access: These certifications enable Balaji Amines to compete effectively in international markets, particularly in Europe, by meeting stringent regulatory requirements.

Improving Financial Trajectory and Strong Balance Sheet

Balaji Amines demonstrates a strengthening financial position, evidenced by a sequential improvement in its Q4 FY24 performance. This growth was fueled by increased sales volumes and better margins, a direct result of more stable input costs.

The company's commitment to financial health is further highlighted by its robust balance sheet and active debt reduction strategies. Notably, its standalone operations have achieved a zero-debt status, underscoring financial prudence.

- Sequential Revenue Growth: Q4 FY24 saw an uptick in revenue compared to the previous quarter.

- Margin Improvement: Stabilized input costs contributed to enhanced profitability.

- Zero-Debt Standalone Operations: Balaji Amines has successfully eliminated debt in its core standalone business.

- Strong Balance Sheet: The company maintains a healthy financial structure, supporting future growth initiatives.

Balaji Amines' proprietary indigenous technology for amine production is a significant strength, potentially leading to cost efficiencies and a competitive edge over rivals using licensed methods. This internal capability also ensures greater control over product quality and manufacturing processes.

The company's commitment to quality is validated by certifications such as BIS for Morpholine and REACH compliance. These accreditations are crucial for market access, particularly in regulated markets like Europe, opening up substantial international growth opportunities.

Balaji Amines' standalone operations have achieved a zero-debt status, reflecting strong financial discipline and a robust balance sheet. This financial prudence underpins the company's ability to fund its ambitious expansion plans and navigate market fluctuations effectively.

The company's strategic focus on import substitution, aligned with the 'Make in India' initiative, targets high-value, difficult-to-manufacture products. This not only strengthens its domestic market position but also reduces reliance on foreign suppliers, a strategy further supported by government initiatives.

What is included in the product

Offers a full breakdown of Balaji Amines’s strategic business environment, detailing its internal capabilities and external market dynamics.

Offers a clear view of Balaji Amines' competitive advantages and areas for improvement, enabling targeted strategic interventions to mitigate risks and capitalize on opportunities.

Weaknesses

Balaji Amines has shown a degree of volatility in its financial results. For instance, in the fiscal year 2025, the company saw its consolidated revenue decrease by 14.9% compared to the previous year. This trend continued with net profit experiencing a more significant decline of 31.7% year-on-year in the same period.

Balaji Amines has experienced a notable squeeze on its profitability, evidenced by contracting gross and EBITDA margins. This downturn is largely attributed to a combination of falling price realizations for its products and a rise in employee expenses, which directly impact the bottom line.

The company's manufacturing operations are intrinsically linked to the cost and availability of key raw materials such as methanol and ammonia. Global price fluctuations for these essential inputs create significant volatility in production costs, posing a continuous challenge to maintaining stable and healthy profit margins.

Balaji Amines faces execution risk with its numerous new projects. Delays in commissioning and slower-than-expected take-off for new products, as acknowledged by management, create uncertainty regarding their contribution to revenue. For instance, as of early 2024, some key projects were still awaiting crucial environmental or regulatory approvals, directly impacting their operational launch and revenue generation timelines.

Underutilized Capacity

A significant challenge for Balaji Amines is the underutilization of its production capacity, which has impacted recent financial performance. This means the company isn't operating its plants at full potential, leading to higher per-unit costs and reduced profitability. For instance, in the fiscal year ending March 31, 2024, while the company has expanded its capacity, the actual output did not fully absorb these fixed costs, contributing to the observed decline in net profit margins.

This underutilization points to potential inefficiencies in production planning or demand forecasting. It suggests that Balaji Amines might be carrying the burden of idle capacity, which directly affects its bottom line. The company's strategy may need to focus on optimizing its operational efficiency to better leverage its existing infrastructure.

- Underutilization of Capacity: Several plants are not operating at their full potential, increasing fixed costs per unit.

- Impact on Profitability: This inefficiency has been a contributing factor to the recent decline in net profit and profitability margins for the fiscal year ending March 31, 2024.

- Operational Inefficiencies: Suggests potential issues in production planning or demand management, leading to suboptimal use of installed capabilities.

Intense Competition and Import Pressures

Balaji Amines faces significant headwinds from intense competition, both from established domestic manufacturers and increasingly from international players. This competitive pressure is particularly acute in product segments where foreign entities engage in what are often termed 'dumping' practices. For instance, the chemical markets for Dimethylformamide (DMF) and Ethylenediamine (EDA) have seen considerable price erosion due to these import dynamics, impacting profitability and market share for domestic producers like Balaji Amines.

The impact of these import pressures is substantial. In 2023, for example, the Indian specialty chemicals sector, where Balaji Amines operates, experienced growth but also noted increased competition from imports, particularly from China. This has led to a situation where domestic companies must constantly innovate and optimize their cost structures to remain competitive. The downward pressure on prices directly affects revenue realization and can hinder capital expenditure plans for expansion and R&D.

- Intense Domestic and International Competition: Balaji Amines operates in a highly competitive environment, facing pressure from both local and global chemical manufacturers.

- Impact of Import Dumping: Practices like 'dumping' from countries such as China, particularly in DMF and EDA segments, significantly disrupt market pricing and reduce the competitiveness of domestic players.

- Price Erosion and Market Share Challenges: These import pressures lead to downward price trends, directly impacting Balaji Amines' revenue and its ability to maintain or grow market share in key product categories.

- Need for Cost Optimization and Innovation: To counter these challenges, the company must focus on operational efficiency and product innovation to differentiate itself and manage pricing pressures effectively.

Balaji Amines' profitability is vulnerable to fluctuations in raw material prices like methanol and ammonia. For example, during the fiscal year 2024-25, increased global prices for these inputs directly squeezed the company's gross and EBITDA margins, making it harder to maintain consistent profit levels.

The company is also navigating the complexities of new project execution. Delays in commissioning or slower market adoption of new products, as acknowledged by management, introduce uncertainty. As of early 2024, some critical projects were awaiting regulatory approvals, impacting their planned revenue contributions.

Furthermore, Balaji Amines is grappling with the underutilization of its expanded production capacity. This means that despite increased capacity, the actual output in fiscal year 2023-24 did not fully absorb fixed costs, leading to higher per-unit expenses and a decline in net profit margins.

Intense competition, particularly from imports engaging in price dumping in segments like DMF and EDA, poses a significant threat. This has led to price erosion, impacting revenue realization and challenging the company's market competitiveness.

| Metric | FY24 (Approximate) | Impact |

|---|---|---|

| Consolidated Revenue Growth | -14.9% (FY25 vs FY24) | Revenue decline |

| Net Profit Growth | -31.7% (FY25 vs FY24) | Significant profit contraction |

| Raw Material Volatility | Methanol, Ammonia prices | Margin squeeze |

| Capacity Utilization | Below optimal levels | Increased per-unit costs |

| Competitive Pressure | DMF, EDA segments | Price erosion, market share risk |

Preview Before You Purchase

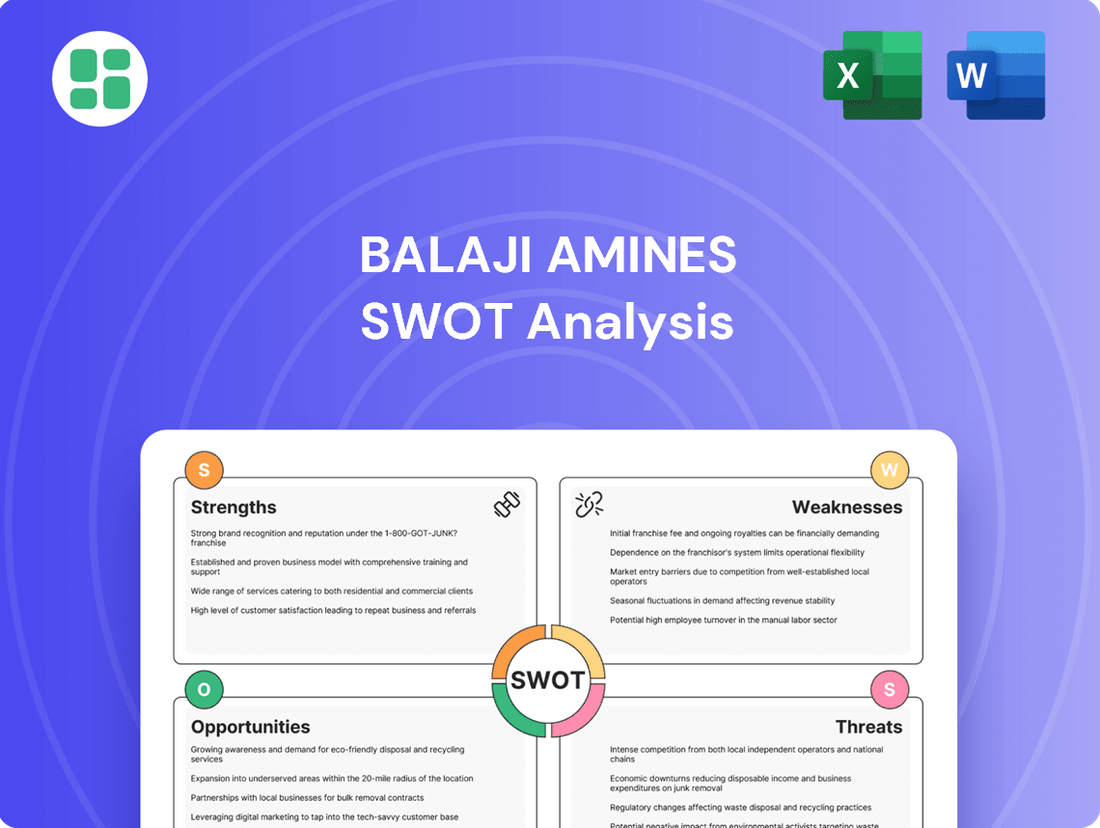

Balaji Amines SWOT Analysis

This is the actual Balaji Amines SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering strategic insights into Balaji Amines' market position and future potential.

Opportunities

Balaji Amines' products are crucial for sectors like pharmaceuticals and agrochemicals, both of which are seeing significant expansion within India. This domestic demand is a key opportunity for the company.

The broader Indian chemical industry is on a strong growth trajectory, expected to reach over USD 300 billion by 2025. This expansion directly translates into a larger and more stable market for Balaji Amines' chemical intermediates, ensuring sustained demand.

Balaji Amines is strategically investing in new projects for electronic-grade Dimethyl Carbonate (DMC), N-Methyl Morpholine (NMM), N-(n-butyl) Thiophosphoric triamide (NBPT), and Isopropylamine. This move signals a clear focus on expanding into higher-margin specialty chemicals. These products are designed for advanced applications, allowing the company to climb the value chain and tap into more profitable market segments.

Balaji Amines is exploring the clean energy sector, notably with the development of Dimethyl Ether (DME) as a potential substitute for LPG. This move diversifies its product portfolio and taps into a growing market for cleaner fuel alternatives.

The commissioning of an 8 MW DC solar power plant in April 2025 is a significant step towards cost efficiency. This plant is projected to substantially lower power expenses across its manufacturing facilities, directly impacting profitability and operational competitiveness.

This strategic focus on clean energy and cost reduction through solar power not only enhances Balaji Amines' financial performance but also strengthens its commitment to environmental, social, and governance (ESG) principles, a key consideration for many investors and stakeholders in 2024 and 2025.

Leveraging Government Incentives and Domestic Manufacturing Push

Balaji Amines stands to benefit significantly from the government's push for domestic manufacturing. The 'Mega Project Status' granted to its subsidiary, Balaji Speciality Chemicals, under the Packaged Scheme of Incentives (PSI), 2019, highlights substantial government backing. This policy framework is designed to foster local production and innovation, often translating into tangible advantages like tax breaks and other financial concessions.

This strong government support creates a favorable environment for companies like Balaji Amines to expand their operations and capitalize on the growing demand for domestically produced chemicals. The incentives can directly impact the company's cost structure and profitability, making it more competitive in the market.

Key opportunities arising from this include:

- Enhanced Competitiveness: Tax benefits and other incentives reduce operational costs, allowing Balaji Amines to offer more competitive pricing for its products.

- Facilitated Expansion: Government support can streamline regulatory processes and provide access to funding, accelerating capacity expansion plans.

- Market Share Growth: A focus on domestic production aligns with national priorities, potentially leading to increased market share as import substitution gains traction.

- Innovation Boost: The supportive policy environment encourages investment in research and development, fostering innovation in chemical manufacturing processes and product development.

Untapped Export Market Potential

The global aliphatic amines market is a significant opportunity, currently valued at approximately $4.9 billion. Balaji Amines can leverage this by expanding its reach into international territories. A substantial portion of Indian amine manufacturers' export revenue already flows from Europe, indicating a strong existing demand that Balaji Amines can capitalize on further.

The company's proactive approach to obtaining crucial certifications, such as REACH, is a key enabler for accessing these highly regulated and lucrative export markets. This strategic advantage allows Balaji Amines to navigate complex international trade requirements more smoothly.

- Global Market Size: The aliphatic amines industry is valued at around $4.9 billion.

- European Demand: Europe represents a major export destination for Indian amine manufacturers.

- Regulatory Advantage: Balaji Amines holds certifications like REACH, facilitating access to key export markets.

Balaji Amines is well-positioned to capitalize on the burgeoning Indian chemical sector, projected to exceed $300 billion by 2025. The company's strategic investments in specialty chemicals like electronic-grade Dimethyl Carbonate (DMC) and N-Methyl Morpholine (NMM) are expected to drive growth in higher-margin segments. Furthermore, its exploration into clean energy with Dimethyl Ether (DME) and the commissioning of a solar power plant in April 2025 for cost efficiency highlight a forward-looking approach.

Government initiatives supporting domestic manufacturing, such as the 'Mega Project Status' for its subsidiary Balaji Speciality Chemicals, provide significant advantages, including potential tax benefits and streamlined expansion. The company is also targeting the global aliphatic amines market, valued at approximately $4.9 billion, with Europe being a key export destination, facilitated by certifications like REACH.

| Opportunity Area | Key Metric/Fact | Impact |

|---|---|---|

| Domestic Chemical Market Growth | India's chemical industry to exceed $300 billion by 2025 | Increased demand for Balaji Amines' products |

| Specialty Chemicals Expansion | Focus on high-margin products like electronic-grade DMC | Enhanced profitability and value chain progression |

| Clean Energy Venture | Development of DME as LPG substitute | Diversification and tapping into green fuel market |

| Cost Efficiency | 8 MW DC solar power plant commissioned April 2025 | Reduced operational costs and improved competitiveness |

| Government Support | 'Mega Project Status' for Balaji Speciality Chemicals | Facilitated expansion, potential tax benefits |

| Global Aliphatic Amines Market | Market valued at ~$4.9 billion | Significant export potential, especially to Europe |

Threats

Balaji Amines faces significant threats from the fluctuating prices of its core raw materials like methanol, ethanol, and ammonia. These commodities are subject to global market dynamics, and any sharp increases can directly squeeze the company's profit margins. For instance, in early 2024, global methanol prices saw upward pressure due to supply chain disruptions, potentially impacting Balaji Amines' cost of goods sold.

The Indian chemical sector is experiencing fierce competition, with domestic companies and international imports vying for market share. This intense rivalry puts pressure on pricing and margins for all players.

Import dumping, particularly from countries like China, poses a significant threat. In 2023, India's chemical imports, especially from China, saw a notable increase in certain categories, potentially leading to price undercutting. This practice can severely impact companies like Balaji Amines by eroding their market share and profitability.

Balaji Amines operates in a sector heavily influenced by evolving environmental standards. Stricter regulations on emissions, waste disposal, or chemical handling could necessitate significant capital expenditure for compliance, potentially increasing operational costs. For instance, if new environmental impact assessment guidelines are introduced in 2024 or 2025, it might delay the commissioning of planned capacity expansions, such as the proposed methylamines and derivatives facility.

Delays in securing essential environmental and regulatory approvals for ongoing or future projects represent a considerable threat. Such postponements can disrupt production schedules and hinder the company's ability to meet market demand, impacting revenue streams and overall growth trajectory. For example, a delay in obtaining clearance for a new manufacturing unit could push back the projected revenue contribution from that segment, affecting financial forecasts for the 2024-2025 fiscal year.

Economic Slowdown in End-User Industries

An economic slowdown in crucial sectors like pharmaceuticals and agrochemicals poses a significant threat to Balaji Amines. A contraction in these end-user industries directly impacts demand for its amine derivatives. For instance, if the global pharmaceutical market, which grew at an estimated 7.5% in 2023, experiences a significant slowdown in 2024-2025 due to recessionary pressures, it could lead to reduced orders for Balaji Amines' products.

This reduced demand can manifest as lower sales volumes and increased pricing pressure, directly affecting the company's revenue and profit margins. With the agrochemical sector also sensitive to economic cycles, a downturn could further exacerbate these challenges, impacting Balaji Amines' overall financial performance.

- Reduced Demand: Economic downturns in pharmaceuticals and agrochemicals directly decrease the need for Balaji Amines' chemical intermediates.

- Pricing Pressure: Slower economic activity can force companies to lower prices to remain competitive, squeezing profit margins.

- Lower Sales Volumes: A contraction in end-user industries leads to fewer units of Balaji Amines' products being sold.

- Profitability Impact: The combination of reduced demand and pricing pressure can significantly dent the company's profitability.

Technological Obsolescence and Innovation Pace

The chemical industry is rapidly evolving, with new production methods and substitute chemicals constantly appearing. For Balaji Amines, failing to keep up with these technological shifts or invest sufficiently in R&D could render its current processes and products outdated, diminishing its market position.

The pace of innovation means that companies must be agile. For instance, advancements in green chemistry or bio-based production routes could challenge traditional chemical manufacturing. Balaji Amines' ability to integrate these new technologies will be crucial for its long-term competitiveness.

In 2023, the specialty chemicals sector saw significant R&D investment globally, with companies focusing on sustainable and efficient processes. Balaji Amines' own R&D expenditure, which was approximately 2.1% of its sales in FY23, needs to remain competitive to avoid technological obsolescence.

- Technological Obsolescence: Risk of existing manufacturing processes becoming outdated due to faster, cheaper, or more environmentally friendly alternatives.

- Innovation Pace: The need for continuous investment in R&D to develop new products and improve existing ones to meet evolving market demands and regulatory standards.

- Competitive Disadvantage: Failure to adopt new technologies could lead to higher production costs and less attractive product offerings compared to competitors.

- Market Share Erosion: If competitors embrace innovation more effectively, Balaji Amines could lose market share to those offering superior or more cost-effective solutions.

Balaji Amines faces substantial threats from volatile raw material prices, particularly methanol and ethanol, which can significantly impact its profitability. Intense competition within the Indian chemical market, coupled with the risk of import dumping, especially from China, puts considerable pressure on pricing and margins.

Evolving environmental regulations and the potential for delays in obtaining necessary approvals for new projects pose operational and financial risks, potentially hindering capacity expansions and revenue growth. Furthermore, an economic slowdown in key sectors like pharmaceuticals and agrochemicals directly reduces demand for Balaji Amines' products, leading to lower sales volumes and increased pricing pressure.

The company must also contend with the threat of technological obsolescence, requiring continuous investment in R&D to stay competitive and avoid losing market share to innovators. For instance, global R&D spending in specialty chemicals saw substantial growth in 2023, highlighting the need for Balaji Amines to maintain its R&D expenditure, which was around 2.1% of sales in FY23, to remain relevant.

SWOT Analysis Data Sources

This Balaji Amines SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and insights from industry experts to ensure a well-rounded and accurate strategic assessment.