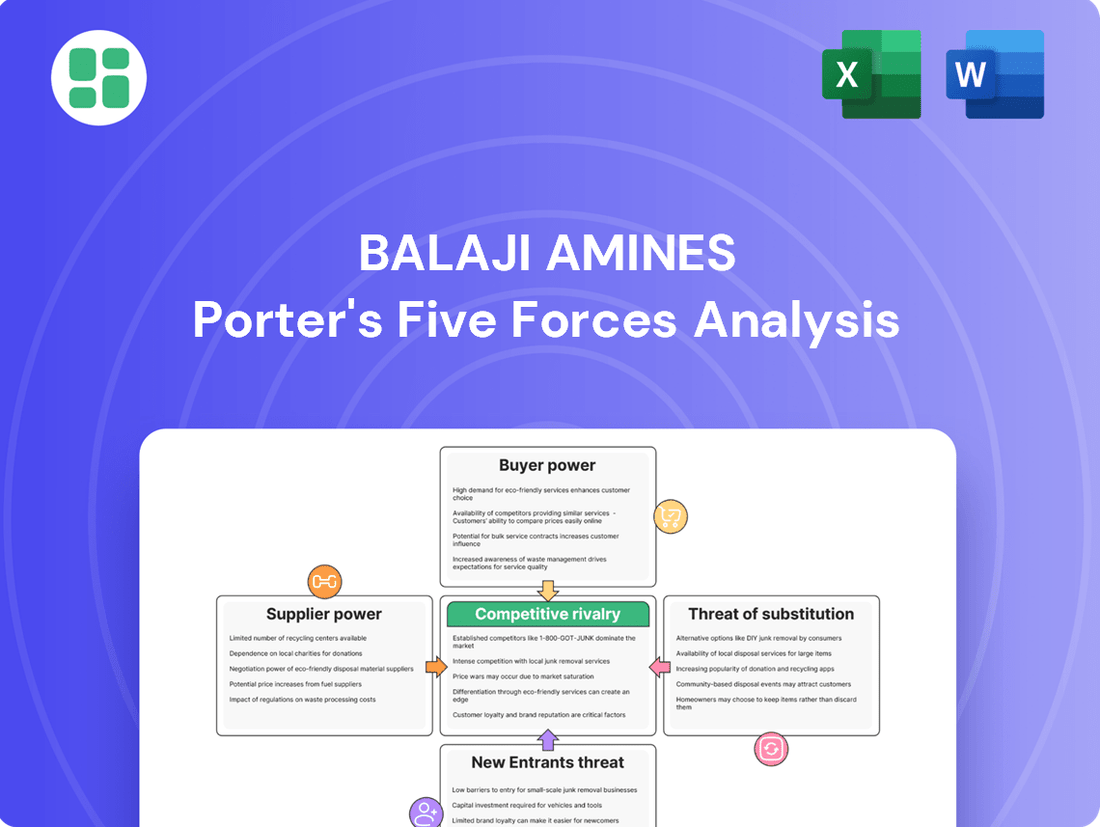

Balaji Amines Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balaji Amines Bundle

Balaji Amines faces moderate bargaining power from buyers due to product differentiation and strong customer relationships, while supplier power is influenced by the availability of key raw materials. The threat of new entrants is somewhat mitigated by capital requirements and established brand loyalty.

The complete report reveals the real forces shaping Balaji Amines’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Balaji Amines' reliance on essential raw materials like ammonia, methanol, and ethyl alcohol is a significant factor in its bargaining power with suppliers. The availability and price volatility of these inputs, particularly imported methanol, directly impact production costs and overall profitability.

Global crude oil prices have a ripple effect, influencing the cost of petrochemical derivatives that serve as key inputs for amine production. For instance, methanol prices can fluctuate based on crude oil market trends, adding another layer of complexity to Balaji Amines' cost management.

The market for certain critical raw materials essential for Balaji Amines' production, such as methylamines and ethylamines, is characterized by a limited number of key suppliers. This concentration means that if a few dominant players control the supply, they can exert significant influence over pricing and contract terms. For instance, in 2023, the global methylamines market was dominated by a handful of large chemical manufacturers, creating a situation where Balaji Amines might have fewer viable alternative sources if negotiations with existing suppliers become unfavorable.

Switching costs for raw materials can significantly impact a company’s bargaining power. For Balaji Amines, while some commodity chemicals might have multiple suppliers, specialized inputs, particularly those requiring stringent purity standards for pharmaceutical or agrochemical applications, present higher switching barriers. For instance, re-validating a new supplier for a critical amine derivative could involve extensive testing and regulatory approvals, potentially delaying production by months.

Supplier's Forward Integration Potential

The potential for suppliers of key intermediates to forward integrate into amine production is a consideration for Balaji Amines. If these suppliers were to enter the amine manufacturing space, it could directly compete with Balaji Amines, thereby increasing their bargaining power.

However, the chemical industry, particularly specialized areas like amine production, demands substantial capital investment and possesses a steep learning curve. This makes it challenging for many suppliers to undertake such a significant expansion. For instance, establishing a new chemical plant can easily run into hundreds of millions of dollars, a barrier that limits widespread forward integration.

- High Capital Requirements: The significant upfront investment for chemical manufacturing facilities acts as a deterrent to supplier forward integration.

- Technical Expertise: Specialized knowledge and operational experience in amine production are critical, which not all intermediate suppliers possess.

- Market Dynamics: The existing competitive landscape and potential returns on investment would need to be highly attractive for suppliers to consider this strategic move.

- Balaji Amines' Position: Balaji Amines' established market presence and operational efficiencies may also make direct competition from suppliers less viable.

Impact of Global Supply Chain Disruptions

Global supply chain disruptions, fueled by events like geopolitical tensions and logistical bottlenecks, significantly impact the bargaining power of suppliers for essential raw materials. These disruptions can cause sudden price increases and shortages, directly benefiting suppliers by allowing them to command higher prices. For Balaji Amines, this translates to absorbing increased costs or compromising on the quality or availability of necessary inputs.

The ongoing volatility in global markets, including the lingering effects of the COVID-19 pandemic and various geopolitical conflicts in 2024, has heightened the risk of supply chain interruptions. For instance, disruptions in the availability of key chemical precursors, often sourced from specific regions, can lead to substantial price fluctuations. Reports from early 2024 indicated that the cost of certain specialty chemicals, vital for amine production, saw double-digit percentage increases due to these supply-side pressures.

- Increased Input Costs: Suppliers can leverage shortages to demand higher prices for raw materials, directly impacting Balaji Amines' cost of goods sold.

- Reduced Availability: Disruptions can lead to scarcity of critical components, forcing Balaji Amines to secure supply from less favorable or more expensive sources.

- Supplier Leverage: In times of scarcity, suppliers gain significant leverage, dictating terms and potentially limiting the volume of materials available to Balaji Amines.

- Operational Uncertainty: The unpredictability of supply chains creates operational challenges, potentially affecting production schedules and order fulfillment.

The bargaining power of suppliers for Balaji Amines is influenced by the concentration of key raw material producers and the high capital investment required for chemical manufacturing. In 2024, the limited number of global suppliers for specialized amines means they can exert considerable pricing power. For example, the methylamines market, crucial for Balaji Amines, saw a few major players dictating terms, impacting procurement strategies.

Global supply chain volatility, exacerbated by geopolitical events and logistical challenges in 2024, significantly strengthens supplier leverage. This can lead to unpredictable price hikes and material shortages, directly affecting Balaji Amines' production costs and availability of critical inputs like methanol, which is sensitive to crude oil price fluctuations.

Switching costs for specialized inputs, such as those meeting stringent pharmaceutical purity standards, are high for Balaji Amines. Re-validating new suppliers can involve extensive testing and regulatory approvals, potentially delaying production by months and reinforcing the bargaining power of existing, qualified suppliers.

| Factor | Impact on Balaji Amines | 2024 Data/Trend |

| Supplier Concentration | Increased pricing power for limited suppliers | Methylamines market dominated by few key manufacturers |

| Capital Intensity | Deters new entrants, strengthening existing suppliers | New chemical plant investments can exceed hundreds of millions of dollars |

| Supply Chain Disruptions | Higher input costs and reduced availability | Double-digit percentage increases in some specialty chemical costs reported in early 2024 |

| Switching Costs | Reinforces supplier leverage for specialized inputs | Extended re-validation periods for critical amine derivatives |

What is included in the product

This analysis tailors Porter's Five Forces to Balaji Amines, dissecting industry rivalry, buyer and supplier power, the threat of new entrants and substitutes, and ultimately revealing the strategic levers influencing its profitability and market position.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Balaji Amines' Porter's Five Forces—perfect for strategic planning.

Customers Bargaining Power

Balaji Amines' diverse customer base, spanning pharmaceuticals, agrochemicals, and water treatment, significantly mitigates the bargaining power of individual customers. This broad reach means no single industry or buyer segment accounts for a disproportionately large share of their revenue, lessening the impact of any one customer attempting to exert undue pressure on pricing or terms. For instance, in fiscal year 2024, the company reported a robust revenue of INR 2,475 crore, with its diversified product portfolio serving a wide array of end-use sectors.

For customers in the pharmaceutical and agrochemical sectors, switching suppliers for essential chemical intermediates is a complex undertaking. This involves navigating stringent regulatory approvals, validating product efficacy, and managing potential disruptions to their own production lines. In 2024, the lengthy lead times for these approvals, often extending over several months, significantly increase the cost and effort associated with changing suppliers.

These considerable switching costs effectively diminish the bargaining power of customers. They are less likely to pressure Balaji Amines for lower prices or better terms when the process of finding and onboarding a new supplier is so resource-intensive and carries inherent risks to their operational continuity.

Balaji Amines produces chemical intermediates that are vital ingredients for their customers' finished goods. The specialized and essential nature of these amines means customers often focus on consistent quality and dependable delivery rather than small price variations, which reduces their leverage to push for lower prices.

Price Sensitivity vs. Quality Requirements

While customers are indeed price-sensitive, the critical nature of amines in sectors like pharmaceuticals and agrochemicals elevates quality, purity, and consistency to non-negotiable standards. This means customers are generally unwilling to sacrifice these crucial attributes for minor cost savings, thereby limiting their bargaining power.

For instance, in the pharmaceutical industry, the stringent regulatory requirements and the direct impact on patient safety mean that any compromise on amine quality could have severe consequences. This inherent need for high-quality inputs significantly reduces the leverage customers have to demand lower prices at the expense of product integrity.

- Price Sensitivity vs. Quality Demands: Customers in specialty chemical markets, like those for amines, often face a trade-off between price and essential product attributes.

- Critical Applications: The use of amines in pharmaceuticals and agrochemicals mandates high purity and consistent quality, making price a secondary concern for buyers.

- Mitigated Bargaining Power: This focus on quality over cost reduction inherently limits the bargaining power of customers, as they cannot easily switch suppliers without risking product efficacy and compliance.

- Industry Standards: For example, the global pharmaceutical market, a key consumer of amines, is projected to reach approximately $2.0 trillion by 2028, underscoring the immense value placed on quality inputs.

Customer's Backward Integration Potential

Customers, particularly large players in the pharmaceutical and agrochemical sectors, possess the potential to integrate backward by manufacturing amines internally. This capability could exert downward pressure on Balaji Amines' pricing power.

However, the substantial capital outlay required for setting up chemical production facilities, coupled with the need for specialized technical expertise and navigating stringent regulatory approvals, presents significant barriers. These challenges considerably diminish the likelihood of widespread backward integration by major customers.

- High Capital Investment: Establishing an amine manufacturing plant can cost tens to hundreds of millions of dollars, a prohibitive sum for most individual customers.

- Technical Expertise: Chemical synthesis and production require specialized knowledge and experienced personnel, which customers may not possess in-house.

- Regulatory Hurdles: Obtaining permits and complying with environmental and safety regulations for chemical manufacturing is a complex and time-consuming process.

- Economies of Scale: Balaji Amines, with its established infrastructure and production volumes, likely benefits from economies of scale that smaller, captive production units would struggle to match.

The bargaining power of Balaji Amines' customers is generally low due to several key factors. The company's diversified customer base across pharmaceuticals, agrochemicals, and water treatment means no single customer holds significant sway. Furthermore, the high switching costs associated with regulatory approvals and production validation in these sensitive industries make customers hesitant to change suppliers. In fiscal year 2024, Balaji Amines reported revenue of INR 2,475 crore, demonstrating its broad market penetration.

Customers often prioritize the critical quality and consistent supply of amines over minor price concessions, given the essential role these chemicals play in their end products. The complexity and expense of backward integration, including substantial capital investment and specialized expertise, also limit customers' ability to produce amines internally, further reducing their leverage.

| Factor | Impact on Customer Bargaining Power | Supporting Detail (FY24 Data/Context) |

| Customer Diversification | Lowers | Broad customer base across pharmaceuticals, agrochemicals, water treatment. |

| Switching Costs | Lowers | High costs and risks associated with regulatory approvals and supplier validation. |

| Product Criticality & Quality Demands | Lowers | Essential role of amines in end-products necessitates focus on quality over price. |

| Threat of Backward Integration | Lowers | Significant capital, technical, and regulatory barriers to internal production. |

Preview Before You Purchase

Balaji Amines Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Balaji Amines, detailing the competitive landscape and strategic positioning of the company. You are looking at the actual document, and once your purchase is complete, you’ll get instant access to this exact, professionally written analysis, ready for your immediate use.

Rivalry Among Competitors

The Indian amines market is characterized by the significant presence of established players, notably Balaji Amines and Alkyl Amines. This creates a highly competitive environment where these companies vie for market share, influencing pricing power and overall market dynamics. Their competition often centers on expanding production capacity, diversifying product portfolios, and securing a larger slice of the market.

Balaji Amines carves out a competitive edge by concentrating on specialty chemicals and derivatives, a strategy that includes producing certain chemicals where it holds a unique position as the sole manufacturer in India. This specialization shields the company from the intense rivalry faced by producers of more common chemicals, granting it enhanced pricing discretion.

Capacity expansion is a key battleground in the amine industry, with companies frequently increasing production to capture market share and meet anticipated demand. Balaji Amines itself is actively expanding, having commissioned new Methylamines and Electronic Grade DMC plants in FY2024-25. This strategic move, while aimed at growth, could escalate competitive rivalry if the market becomes saturated or if demand growth falters.

Global and Indian Market Dynamics

The global amines market is characterized by an oligopolistic structure, meaning a small number of large companies dominate production. This concentration of power means that a few key players significantly influence market dynamics and pricing. India, however, presents a different picture as a rapidly expanding market with increasing demand for amines.

Balaji Amines is strategically looking to boost its international sales, aiming to capture a larger share of the global market. Nevertheless, this ambition faces headwinds from established international competitors and the persistent issue of oversupply from China. This oversupply can exert downward pressure on prices within India, potentially affecting Balaji Amines' profitability.

- Global Amines Market: Oligopolistic structure with a few dominant producers.

- Indian Amines Market: Experiencing rapid growth and increasing demand.

- Balaji Amines Strategy: Focus on increasing export share.

- Competitive Threats: International players and Chinese oversupply impacting Indian pricing.

Industry Consolidation and Alliances

The chemical industry, including the specialty chemicals segment where Balaji Amines operates, frequently sees consolidation. In 2023, the global chemical industry experienced significant M&A activity, with deal values reaching hundreds of billions of dollars, driven by a desire for scale and market access. While specific recent alliances for Balaji Amines are not detailed, such strategic moves among competitors can reshape market dynamics.

These consolidations, whether through mergers, acquisitions, or strategic alliances, have the potential to either dampen competitive rivalry by creating larger, more dominant players or, conversely, intensify it if smaller entities band together to challenge incumbents. For instance, if a major competitor were to acquire a significant player in a similar product segment, it could lead to a more concentrated market structure, impacting pricing power and market share for all participants, including Balaji Amines.

- Industry Consolidation Trends: The global chemical sector has witnessed consistent M&A activity, with deal volumes often exceeding $100 billion annually in recent years, reflecting a strategic imperative for growth and efficiency.

- Potential Impact on Rivalry: Mergers and acquisitions can lead to fewer, larger competitors, potentially reducing direct rivalry but increasing the intensity of competition from these consolidated entities.

- Strategic Alliances: Competitors may form alliances for R&D, distribution, or market access, which can create stronger competitive units and alter the existing competitive landscape for companies like Balaji Amines.

- Market Dynamics: The formation of stronger, consolidated entities through these activities could lead to shifts in market share and pricing power, directly influencing the competitive intensity faced by all players in the sector.

The Indian amines market is intensely competitive, with Balaji Amines and Alkyl Amines being major players. This rivalry drives innovation and capacity expansion, as seen with Balaji Amines' new Methylamines and Electronic Grade DMC plants commissioned in FY2024-25. While Balaji Amines focuses on specialty chemicals for a competitive edge, the threat of oversupply from China and global competition for export markets remains significant, impacting pricing power.

| Metric | Balaji Amines (FY23-24 Est.) | Alkyl Amines (FY23-24 Est.) | Market Share (Est.) |

|---|---|---|---|

| Revenue (INR Cr) | ~3,000 | ~2,500 | N/A |

| Key Products | Methylamines, Ethylamines, Specialty Chemicals | Methylamines, Ethylamines, Derivatives | N/A |

| Capacity Expansion Focus | Specialty Chemicals, Electronic Grade DMC | Capacity Debottlenecking, New Products | N/A |

SSubstitutes Threaten

For many of Balaji Amines' key products, such as methylamines and ethylamines, there are few direct chemical substitutes that can match their specific functionalities and meet stringent regulatory requirements, particularly in sensitive sectors like pharmaceuticals and agrochemicals. This lack of readily available alternatives significantly diminishes the threat posed by substitutes for these essential chemical intermediates.

The long-term shift towards sustainability presents a potential threat from bio-based alternatives. While currently not a major concern for Balaji Amines, the development of eco-friendly amines or production methods could emerge. For instance, research into microbial fermentation for amine production is ongoing, and if these methods become cost-effective and scalable, they could capture market share from traditional petrochemical-based amines.

Customers developing their own amine intermediate production processes poses a threat of substitution. For instance, a large pharmaceutical company might invest in backward integration to control its supply chain for critical amine-based active pharmaceutical ingredients (APIs). This could reduce their reliance on external suppliers like Balaji Amines.

However, the high capital expenditure and technical expertise required for such process innovation, particularly in regulated sectors like pharmaceuticals, significantly dampen its immediate impact. The lengthy timelines for research, development, and regulatory approvals mean that such a shift is typically a multi-year endeavor, not a quick replacement strategy. For example, bringing a new API manufacturing process online can take upwards of five years and cost hundreds of millions of dollars.

Impact of End-Product Substitution

The threat of substitutes for Balaji Amines stems from alternatives to the end products that utilize amines. For example, a significant shift away from traditional agrochemicals towards biological pest control methods could reduce the demand for amines used in pesticide formulations. Similarly, advancements in pharmaceutical drug delivery systems that bypass the need for certain amine-based excipients would also present a substitution threat.

This indirect impact is crucial for understanding Balaji Amines' market position. Consider the agrochemical sector, a key consumer of amines. In 2024, the global biopesticides market was projected to reach approximately $10.5 billion, indicating a growing preference for more sustainable alternatives. If this trend accelerates, it could dampen the demand for conventional chemical pesticides, and by extension, the amines they contain.

- Agrochemical Sector: Growing adoption of biopesticides and integrated pest management (IPM) strategies could decrease reliance on amine-based chemical pesticides.

- Pharmaceutical Industry: Innovations in drug formulation and delivery, such as novel excipients or advanced biologics, might reduce the need for specific amine derivatives.

- Industrial Applications: Development of eco-friendly or bio-based alternatives in sectors like coatings, adhesives, or water treatment could offer substitutes for amine-based chemicals.

Cost-Performance Trade-offs of Alternatives

The threat of substitutes for Balaji Amines' products hinges on whether alternatives can match the cost-performance ratio of amines. For instance, in the pharmaceutical sector, where high purity and specific chemical properties are paramount, finding substitutes that deliver equivalent efficacy without a significant cost increase is difficult.

Industries relying on amines for their unique reactivity and functionality, such as agrochemicals and water treatment, present a similar challenge. While alternative chemical pathways or entirely different process technologies might exist, their adoption is often hindered by the established performance benchmarks and the cost of retooling or R&D. For example, in 2023, the global specialty chemicals market, which includes many amine applications, saw continued demand driven by innovation, indicating the difficulty for substitutes to gain significant traction without clear advantages.

- Cost-Effectiveness: Substitutes must compete on price while delivering comparable performance.

- Performance Parity: Alternatives need to meet or exceed the functional requirements of amines in specific applications.

- Industry Specificity: The challenge for substitutes is greater in sectors with stringent performance demands like pharmaceuticals.

- R&D Investment: Developing viable substitutes often requires substantial research and development, impacting their initial cost.

The threat of substitutes for Balaji Amines is generally low for its core products due to the specialized nature and performance requirements in key industries like pharmaceuticals and agrochemicals. However, broader market trends towards sustainability and alternative technologies in end-user industries can indirectly impact demand. For instance, the growing biopesticides market, projected to reach around $10.5 billion in 2024, highlights a shift that could reduce the need for traditional chemical pesticides and the amines they contain.

While direct chemical substitutes are scarce, the threat emerges from alternative end-products or processes that reduce the overall demand for amines. For example, advancements in drug delivery systems could bypass the need for certain amine-based excipients. Similarly, a significant move towards biological pest control methods in agriculture could decrease reliance on amine-containing chemical pesticides.

The viability of substitutes is heavily dependent on their ability to match the cost-performance ratio of amines. In sectors like pharmaceuticals, where purity and specific functionalities are critical, finding equally effective and cost-competitive alternatives is challenging. The specialty chemicals market, which includes many amine applications, continued to see demand driven by innovation in 2023, underscoring the difficulty for substitutes to gain traction without clear advantages.

| Threat Factor | Impact on Balaji Amines | Key Considerations |

| Direct Chemical Substitutes | Low | Specialized functionalities, stringent regulatory needs in pharma/agro. |

| Bio-based Alternatives | Emerging Potential | Ongoing R&D in microbial fermentation; scalability and cost are key. |

| Customer Backward Integration | Moderate Potential | High capital expenditure and technical expertise required, lengthy timelines. |

| End-Product Substitution | Indirect but Significant | Shift to biopesticides (e.g., $10.5B market in 2024) or alternative drug delivery systems. |

| Cost-Performance Parity | High Barrier for Substitutes | Amines offer unique reactivity; alternatives must match performance without significant cost increase. |

Entrants Threaten

Entering the specialty chemicals and amines sector, where Balaji Amines operates, demands significant upfront capital. Companies need to invest heavily in setting up manufacturing plants, acquiring advanced machinery, and funding crucial research and development initiatives. This substantial financial commitment acts as a formidable barrier, deterring potential new players from easily entering the market.

The chemical industry, especially segments catering to pharmaceuticals and agrochemicals, operates under rigorous environmental, health, and safety (EHS) regulations. These stringent rules, which are likely to continue evolving and tightening through 2024 and beyond, demand significant investment in compliance infrastructure and processes.

Newcomers must navigate a complex web of licensing, permits, and ongoing compliance requirements, a process that is both time-consuming and capital-intensive. For instance, obtaining necessary certifications for specialty chemicals can take years and cost millions, creating a substantial barrier to entry that protects established players like Balaji Amines.

Balaji Amines' proprietary technology for amine manufacturing acts as a significant barrier to new entrants. The company's in-house research and development capabilities have fostered unique, efficient production processes that are difficult to replicate.

Developing comparable expertise and establishing cost-effective manufacturing lines requires substantial investment in time and capital, deterring many potential competitors from entering the market.

For instance, Balaji Amines has consistently invested in R&D, with its R&D expenditure growing to INR 117.40 crore in FY24, demonstrating a commitment to technological advancement that creates a competitive moat.

Established Distribution Channels and Customer Relationships

Established players, including Balaji Amines, benefit from deeply entrenched distribution networks and robust, long-term relationships with a broad customer base across vital sectors. These existing connections are a significant barrier to entry.

Newcomers would face substantial capital outlays and a protracted timeline to replicate these established channels and cultivate the same level of customer loyalty and trust. For instance, in 2023, the specialty chemicals sector, where Balaji Amines operates, saw significant investment in supply chain optimization, highlighting the importance of existing infrastructure.

- Existing players possess extensive and efficient distribution networks.

- Long-standing customer relationships foster loyalty and repeat business.

- New entrants require significant investment in time and capital to build comparable infrastructure.

- Gaining customer trust is a lengthy and resource-intensive process for new market participants.

Economies of Scale and Cost Advantages

Large manufacturers like Balaji Amines leverage significant economies of scale. This translates to lower per-unit production costs, more favorable raw material procurement terms, and the ability to invest heavily in research and development, creating substantial cost advantages. For instance, in 2024, Balaji Amines' robust production capacity allows them to absorb fixed costs more effectively than a smaller, new entrant.

New players entering the methylamines and derivatives market would find it challenging to match these cost efficiencies without achieving comparable production volumes. This barrier makes it difficult for them to compete on price from the outset, as they would likely operate at a higher cost base.

- Economies of Scale: Balaji Amines benefits from large-scale production, reducing per-unit manufacturing costs.

- Procurement Power: Higher volume purchasing of raw materials leads to better pricing and supply chain advantages.

- R&D Investment: Significant R&D spending by established players drives innovation and efficiency, further widening the cost gap.

- Competitive Pricing Barrier: New entrants face difficulty matching existing cost structures, hindering their ability to compete on price.

The threat of new entrants in the specialty chemicals and amines sector, where Balaji Amines operates, is generally low. High capital requirements for manufacturing facilities and R&D, coupled with stringent environmental and safety regulations, create significant barriers. For example, Balaji Amines' R&D expenditure reached INR 117.40 crore in FY24, underscoring the investment needed to stay competitive.

Established players like Balaji Amines benefit from strong brand recognition, extensive distribution networks, and deep customer relationships built over years. Replicating these advantages requires substantial time and capital investment for newcomers. In 2023, the specialty chemicals sector saw increased focus on supply chain optimization, highlighting the value of existing infrastructure.

Economies of scale enjoyed by Balaji Amines, leading to lower per-unit costs and better procurement terms, present another formidable challenge for potential entrants. For instance, in 2024, Balaji Amines' production capacity allows for more efficient cost absorption, making it difficult for smaller new players to compete on price.

| Barrier Type | Description | Example for Balaji Amines (2023-2024 Data) |

|---|---|---|

| Capital Requirements | High investment needed for plants, machinery, and R&D. | INR 117.40 crore R&D expenditure in FY24. |

| Regulatory Hurdles | Strict EHS regulations, licensing, and permits. | Complex compliance processes for specialty chemicals. |

| Customer Relationships & Distribution | Entrenched networks and long-term customer loyalty. | Investment in supply chain optimization in 2023. |

| Economies of Scale | Lower production costs due to high volumes. | Robust production capacity in 2024 allows effective cost absorption. |

Porter's Five Forces Analysis Data Sources

Our Balaji Amines Porter's Five Forces analysis is built upon comprehensive data from annual reports, SEC filings, and industry-specific market research reports. This foundation ensures a robust understanding of the competitive landscape.