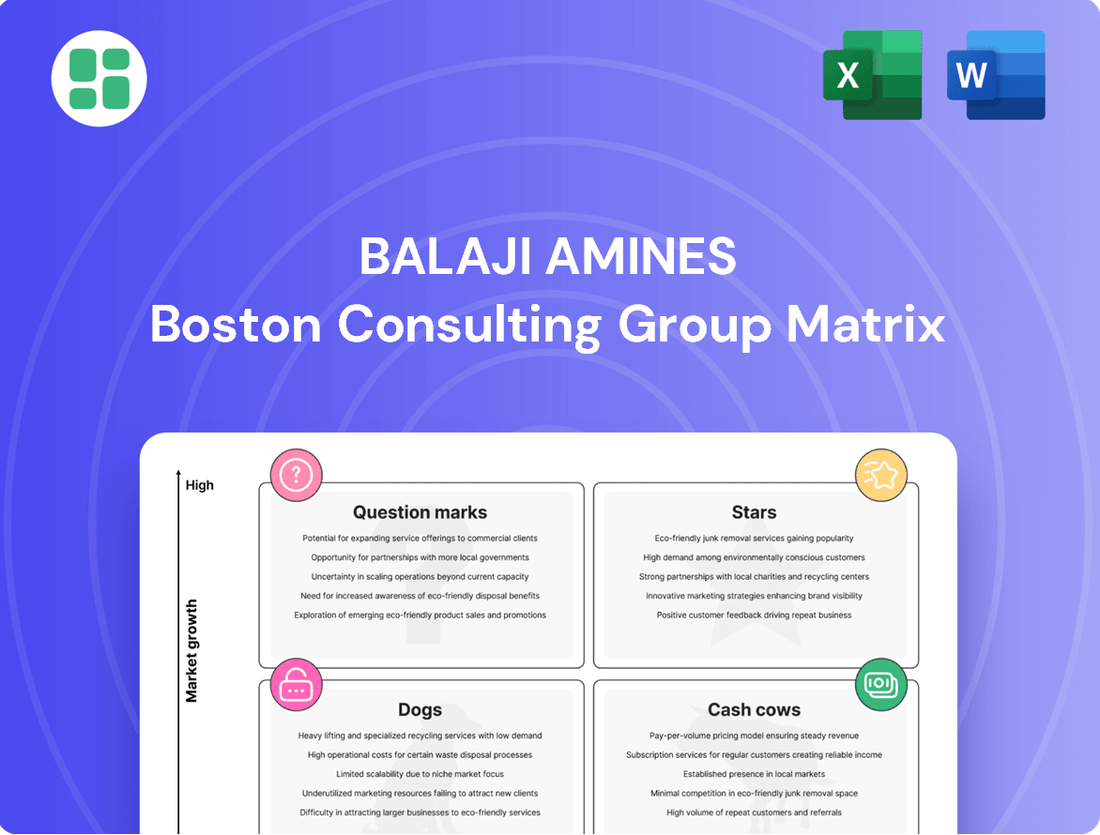

Balaji Amines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balaji Amines Bundle

Curious about Balaji Amines' market performance? This glimpse into their BCG Matrix highlights key product categories, but to truly unlock strategic growth, you need the full picture.

The complete BCG Matrix report for Balaji Amines provides a detailed quadrant-by-quadrant analysis, revealing which products are driving cash flow and which require careful consideration for future investment. Gain actionable insights and a clear roadmap for optimizing your portfolio.

Don't miss out on the strategic advantage. Purchase the full Balaji Amines BCG Matrix today to access data-backed recommendations and make informed decisions that will propel your business forward.

Stars

Balaji Amines' Electronic Grade Dimethyl Carbonate (DMC) is a prime example of a Star in the BCG Matrix. The company holds the exclusive position as India's sole manufacturer of this vital chemical, essential for the burgeoning electric vehicle (EV) battery sector.

The market for Electronic Grade DMC is experiencing robust growth, directly fueled by the accelerating adoption of EVs. Balaji Amines strategically entered this forward-looking segment by commissioning its Electronic Grade DMC plant in May 2025, positioning itself for significant market share capture and revenue expansion.

Balaji Amines is boosting its methylamines capacity with a new, high-output plant expected around Q3 FY2024-25. This move strengthens its already dominant position in this key segment.

The Indian aliphatic amines market is set for robust growth, with projections indicating a 10.5% CAGR between 2024 and 2034. This expansion aligns perfectly with the anticipated surge in demand.

By increasing its methylamines capacity, Balaji Amines is strategically positioned to capitalize on this market expansion, aiming to secure a greater market share and drive future profitability.

Balaji Amines' specialty chemicals for pharmaceuticals are a key driver in their BCG Matrix, positioned as Stars. India's pharmaceutical market is booming, expected to hit USD 174.31 billion by 2033, growing at an 11.32% CAGR from 2025-2033. This strong growth trajectory directly benefits Balaji Amines' offerings.

The company's strategic emphasis on high-margin specialty chemicals within this expanding pharmaceutical landscape is a significant advantage. Their established presence allows them to capture increasing market share in this rapidly growing segment, reinforcing their Star status.

Continued investment in research and development for these specialized pharmaceutical intermediates is crucial. This focus will ensure Balaji Amines maintains its competitive edge and further enhances the growth potential of its Star products.

N-Methyl Morpholine (NMM)

N-Methyl Morpholine (NMM) represents a new frontier for Balaji Amines as a specialty chemical. The company anticipates its new NMM plant to be operational by FY2024-25 or FY2025-26. This strategic move positions NMM within the burgeoning Indian specialty chemicals market, which is experiencing robust growth.

As a specialty chemical, NMM is designed for niche, high-value applications. The Indian specialty chemicals market is projected for significant expansion, with estimates suggesting a compound annual growth rate (CAGR) that could reach double digits in the coming years. For instance, reports from late 2023 and early 2024 indicated that the market size was already in the tens of billions of dollars.

While Balaji Amines' current market share for NMM is still in its early stages, the company's investment in a dedicated plant signals strong future potential. The high growth trajectory of the specialty chemicals sector, coupled with Balaji Amines' focus on this segment, suggests NMM could evolve into a significant contributor, fitting the profile of a future star in their product portfolio.

- Product Category: Specialty Chemical

- Projected Commissioning: FY2024-25 or FY2025-26

- Market Context: High-growth Indian specialty chemicals sector

- Strategic Positioning: Potential future star due to market potential and investment

N-(n-butyl) Thiophosphoric triamide (NBPT)

N-(n-butyl) Thiophosphoric triamide (NBPT) represents a new frontier for Balaji Amines in the specialty chemicals arena. The company is actively developing a dedicated plant for NBPT, with commissioning anticipated for the 2024-25 financial year or shortly thereafter. This strategic move positions Balaji Amines to capitalize on the agrochemical sector's ongoing evolution.

Despite some recent market fluctuations, the agrochemical industry remains a vital and dynamic end-market for specialty chemicals. NBPT's application in this sector suggests a strong growth trajectory for the product as it enters the market.

Balaji Amines' investment in NBPT production signifies its potential to become a significant contributor to the company's portfolio, aligning with the characteristics of a Question Mark in the BCG Matrix due to its nascent stage and high growth potential.

- Product: N-(n-butyl) Thiophosphoric triamide (NBPT)

- End Market: Agrochemicals

- Status: Plant under execution, expected commissioning FY2024-25

- BCG Classification: Question Mark (high growth potential, nascent offering)

Balaji Amines' Electronic Grade Dimethyl Carbonate (DMC) is a prime example of a Star. India's exclusive manufacturing position for this vital chemical, crucial for the expanding electric vehicle battery sector, highlights its strong market standing. The market for Electronic Grade DMC is experiencing robust growth, directly fueled by the accelerating adoption of EVs.

The company's strategic entry into this forward-looking segment with its Electronic Grade DMC plant commissioned in May 2025 positions it for significant market share capture and revenue expansion. Balaji Amines is also boosting its methylamines capacity with a new, high-output plant expected around Q3 FY2024-25, further strengthening its dominant position in this key segment.

The Indian aliphatic amines market is projected for robust growth, with an estimated 10.5% CAGR between 2024 and 2034, aligning perfectly with anticipated demand surges. By increasing its methylamines capacity, Balaji Amines is strategically positioned to capitalize on this market expansion, aiming for greater market share and future profitability.

Balaji Amines' specialty chemicals for pharmaceuticals are also key drivers, positioned as Stars. India's pharmaceutical market is booming, expected to reach USD 174.31 billion by 2033, growing at an 11.32% CAGR from 2025-2033. This strong growth directly benefits Balaji Amines' offerings, and their focus on high-margin specialty chemicals within this expanding landscape is a significant advantage.

| Product | BCG Category | Key Growth Drivers | Market Performance Indicator |

| Electronic Grade DMC | Star | EV battery demand, exclusive Indian manufacturing | Robust market growth, strategic plant commissioning May 2025 |

| Methylamines | Star | Growing Indian aliphatic amines market (10.5% CAGR 2024-2034) | Capacity expansion (Q3 FY2024-25), dominant market position |

| Specialty Chemicals (Pharma) | Star | Booming Indian pharmaceutical market (USD 174.31B by 2033, 11.32% CAGR 2025-2033) | High-margin focus, increasing market share capture |

What is included in the product

Balaji Amines' BCG Matrix analysis categorizes its product portfolio, offering clear strategic insights for investment and resource allocation.

Balaji Amines' BCG Matrix offers a clear strategic roadmap, alleviating the pain of resource allocation by highlighting growth opportunities and mature segments.

Cash Cows

Balaji Amines' established methylamines and ethylamines are its cash cows, reflecting its leading position in India's aliphatic amines sector. These products likely command a significant market share, benefiting from the company's operational expertise and strong brand recognition.

While the broader amines market continues to expand, these core offerings reside in a mature segment. This maturity translates into consistent, robust cash generation with minimal need for substantial new investments or aggressive marketing efforts to sustain their market standing.

For the fiscal year ending March 31, 2024, Balaji Amines reported a revenue of ₹3,434 crore, with its amines segment being a primary contributor. This segment’s stability and profitability underscore the cash cow status of its methylamines and ethylamines.

Balaji Amines' Morpholine (BIS Certified) is a prime example of a Cash Cow. The BIS certification signifies a robust, quality-assured product in a mature specialty chemicals market. This high market acceptance translates to stable demand and healthy profit margins.

As a well-established product in a low-growth market, Morpholine requires minimal investment for maintenance. This efficiency allows it to generate substantial free cash flow for Balaji Amines. For instance, in the fiscal year 2023-24, Balaji Amines reported strong performance in its specialty chemicals segment, where Morpholine plays a significant role, contributing to the company's overall profitability and cash generation capabilities.

Older derivatives of amines, such as methylamines and ethylamines, represent Balaji Amines' established product lines. These chemicals are foundational to a wide array of industries, including pharmaceuticals, agrochemicals, water treatment, and personal care products, indicating a broad and stable demand base.

In 2024, Balaji Amines continued to leverage its strong market position in these segments. The company's efficient manufacturing capabilities and long-standing customer relationships ensure these products act as consistent cash generators. For instance, the demand for methylamines in the pharmaceutical sector remained robust, contributing significantly to the company's overall revenue stream.

Solar Power Plant

The commissioning of Balaji Amines' 8 MW DC solar power plant in April 2025 is a key strategic move, functioning as a cash cow by directly cutting operational expenses. This investment in renewable energy significantly lowers power costs across its manufacturing facilities, enhancing profit margins through reduced utility outflows.

This solar plant represents a stable, recurring source of cost savings, effectively generating 'cash' by minimizing expenditure in a mature, internally focused optimization strategy. It’s a prime example of how infrastructure investments can act as cash cows by improving efficiency and profitability.

- Reduced Power Costs: The 8 MW DC solar plant is projected to deliver substantial savings on electricity bills for Balaji Amines' manufacturing units.

- Improved Profit Margins: By lowering a significant operating expense, the plant directly contributes to higher net profit margins.

- Stable Cash Generation: The consistent reduction in utility expenses provides a predictable and reliable stream of cost savings, akin to cash inflow.

- Strategic Investment: While not a product, this investment in self-generated power is a strategic asset that enhances overall financial performance.

Established Production Infrastructure (Unit I & Unit III)

Balaji Amines' Unit I and Unit III are classic examples of Cash Cows within their BCG Matrix. These established production facilities have seen significant investment in the past and are now highly efficient, requiring minimal additional capital expenditure for maintenance or incremental upgrades. Their optimized operations translate into consistent, high-margin cash generation for the company.

These units form the backbone of Balaji Amines' core product offerings, providing a stable and reliable supply chain. The mature nature of these assets means they have achieved economies of scale, allowing them to produce key amines at a competitive cost. This strong production base is crucial for maintaining market share and generating predictable profits.

- Established Infrastructure: Unit I and Unit III represent mature, highly efficient production assets.

- Low Investment Needs: These facilities require minimal ongoing capital expenditure compared to new projects.

- Stable Cash Flow: They provide a consistent and reliable source of high-margin cash flow for the company.

- Core Product Support: These units are vital for the production of Balaji Amines' key amine products.

Balaji Amines' established methylamines and ethylamines represent its cash cows, benefiting from a leading position in India's aliphatic amines market. These products, foundational to industries like pharmaceuticals and agrochemicals, ensure stable demand and consistent cash generation.

For the fiscal year ending March 31, 2024, Balaji Amines reported revenues of ₹3,434 crore, with its amines segment being a significant contributor, underscoring the cash cow status of these core products due to their maturity and consistent profitability.

The company's Morpholine, a BIS-certified product, also functions as a cash cow. Operating in a mature specialty chemicals market, it enjoys high acceptance and stable demand, requiring minimal investment while generating healthy profit margins.

Balaji Amines' Unit I and Unit III are classic examples of cash cows, representing mature, efficient production facilities with low capital expenditure needs. These units consistently generate high-margin cash flow, supporting the company's core product offerings.

| Product/Asset | Market Position | Cash Flow Generation | Investment Needs |

| Methylamines & Ethylamines | Leading in India's aliphatic amines sector | Consistent & Robust | Minimal |

| Morpholine (BIS Certified) | High acceptance in specialty chemicals | Stable & Profitable | Low |

| Unit I & Unit III Facilities | Mature, efficient production base | High-Margin & Reliable | Minimal |

Delivered as Shown

Balaji Amines BCG Matrix

The Balaji Amines BCG Matrix preview you are viewing is the precise, fully formatted document you will receive upon purchase. This comprehensive analysis, detailing Balaji Amines' product portfolio within the BCG framework, is ready for immediate strategic application without any watermarks or demo content. You'll gain access to an expertly crafted report designed to inform critical business decisions and enhance your understanding of the company's market positioning.

Dogs

Balaji Amines' commoditized offerings like Dimethylformamide (DMF) and Ethylenediamine (EDA) are positioned as Dogs in its BCG Matrix. These products are grappling with significant headwinds, including aggressive competition and what the company describes as 'dumping from China,' which directly impacts their profitability and leads to volatile margins.

The market for DMF and EDA, from Balaji Amines' perspective, represents a low-growth or even stagnant segment. In these categories, the company likely holds a smaller market share, and its ability to generate healthy returns is heavily constrained by these external market pressures.

These products can be capital intensive, tying up valuable resources without delivering commensurate returns. For instance, in 2023, Balaji Amines reported that its specialty chemicals segment, which includes some of these commoditized products, experienced margin pressures. This situation often signals a need for a thorough strategic review, with options ranging from revitalization efforts to potential divestiture to free up capital for more promising ventures.

Balaji Amines' older, less efficient ethylamines production lines, particularly those at Unit-I that have been modified for Isopropylamine, likely fall into the 'dog' category of the BCG Matrix. This repurposing suggests the original ethylamines capacity was either underperforming due to market conditions or technological obsolescence, making it a less attractive business segment.

If these older ethylamines facilities are not operating at high capacity utilization or are facing significant price competition, they represent a drain on resources. For instance, during FY23, Balaji Amines reported a revenue of INR 2,478 crore, with their amines segment forming a substantial part. However, specific profitability metrics for the older ethylamines units would clarify their 'dog' status, especially if their contribution to overall profit margins is low compared to newer, more efficient plants.

Balaji Amines has seen a significant decline in price realization for certain product categories, particularly impacting its performance in Q1 FY25 and Q4 FY25. This downturn, characterized by low volume growth and persistent price erosion, is largely attributed to increased competition from Chinese manufacturers and subdued market demand.

These struggling product lines, though not individually named, fit the profile of 'dogs' in the BCG matrix. Their low growth and market share, coupled with the inability to command favorable pricing, suggest that substantial, potentially unviable, investment would be required to revive their profitability.

Underperforming Specialty Chemical Volumes

Balaji Amines' specialty chemicals segment, despite operating in a growing market, shows signs of weakness in specific product lines. In Q4 FY25, volumes within this segment experienced a year-over-year decline of 2.5%. This follows a more pronounced contraction of 22% year-over-year in Q3 FY25 for certain specialty chemical products.

These underperforming products are characterized by their low market share within Balaji Amines' portfolio, even though they belong to a sector with generally robust growth prospects. Their inability to gain traction and contribute positively to the company's overall performance positions them as 'dogs' in the BCG matrix framework, necessitating a strategic review.

- Segment Performance: Specialty chemicals volumes declined 2.5% YoY in Q4 FY25 and 22% YoY in Q3 FY25 for specific products.

- Market Context: These products operate in a generally high-growth specialty chemicals market.

- Strategic Classification: Low market share and negative contribution classify these products as 'dogs'.

- Action Required: Re-evaluation of these underperforming product lines is necessary.

Non-Core, Non-Performing Hotel Segment

Balaji Amines' Hotel segment appears to fall into the 'Dogs' category of the BCG Matrix. This segment is characterized as non-core, meaning it is not central to the company's primary chemical manufacturing operations. Its contribution to overall revenue and growth is expected to be minimal, as confirmed by the limited public information available regarding its performance.

The hotel industry is highly competitive, and without significant market share or strong returns, this segment likely struggles to justify the resources allocated to it. Companies often classify such non-performing, non-core assets as 'dogs' because they can drain management focus and capital that could otherwise be invested in more promising business units. For instance, in 2023, Balaji Amines reported total revenue of ₹3,478.8 crore, with the hotel segment representing a negligible portion of this figure, highlighting its peripheral nature.

- Non-Core Business: The hotel segment operates outside of Balaji Amines' core chemical manufacturing business.

- Low Growth Potential: It is not anticipated to be a significant driver of future revenue or profit growth for the company.

- Resource Diversion: Such segments can divert valuable management attention and financial resources away from the primary, higher-potential chemical operations.

- Competitive Landscape: Operating in a service industry with low market share and potentially low returns further solidifies its 'dog' status.

Balaji Amines' commoditized products like DMF and EDA are classified as Dogs due to intense competition, particularly from China, which erodes profitability and creates volatile margins. These segments operate in low-growth markets where the company holds a smaller share, limiting its ability to generate substantial returns.

The company's older ethylamines production lines, especially those repurposed, also fit the Dog category. These facilities may suffer from low capacity utilization or face severe price competition, acting as a drain on resources. For instance, while the amines segment was a significant contributor to Balaji Amines' FY23 revenue of INR 2,478 crore, the profitability of these older units likely lags behind newer, more efficient plants.

Specific product lines within the specialty chemicals segment, experiencing volume declines like the 2.5% drop in Q4 FY25, also represent Dogs. These products, despite being in a growth sector, have low market share and struggle to command favorable pricing, indicating a need for strategic re-evaluation.

The company’s non-core Hotel segment is another clear Dog. It contributes negligibly to the overall revenue, which was ₹3,478.8 crore in 2023, and diverts management focus and capital from the core chemical business, further solidifying its status as an underperforming asset.

| Product Category | BCG Classification | Key Challenges | Financial Impact Indication (FY23 Revenue) |

| DMF & EDA | Dogs | Intense competition (China dumping), low growth, volatile margins | Part of overall amines segment (significant portion of ₹2,478 crore) |

| Older Ethylamines Lines | Dogs | Low capacity utilization, price competition, potential obsolescence | Part of overall amines segment |

| Specific Specialty Chemicals | Dogs | Volume decline (Q4 FY25: -2.5%), low market share, weak pricing | Part of specialty chemicals segment |

| Hotel Segment | Dogs | Non-core, low contribution, resource diversion, competitive landscape | Negligible portion of ₹3,478.8 crore total revenue |

Question Marks

Balaji Amines' Dimethyl Ether (DME) plant, with a substantial 100,000 TPA capacity, is slated for commissioning in late 2024 or early 2025. This positions DME as a potential future growth driver, particularly with its use in aerosols and as a promising LPG substitute, further bolstered by BIS standardization efforts for LPG blending.

Currently, DME represents a new venture for Balaji Amines, meaning its market share is nascent. This lack of established presence places it firmly in the Question Mark category of the BCG matrix, necessitating considerable investment and market penetration to transition into a Star product.

Hydrogen Cyanide (HCN) and Sodium Cyanide (NaCN) are slated to be significant additions to Balaji Amines' portfolio, originating from their mega greenfield expansion at Balaji Speciality Chemicals. This venture is anticipated to be operational by the close of FY26.

These products are characterized as premium offerings and import substitutes, entering a specialty chemicals market that is experiencing robust growth. The Indian specialty chemicals sector, for instance, has been a high-growth area, with projections indicating continued expansion driven by increasing domestic demand and global supply chain realignments.

As entirely new product lines for Balaji Amines, HCN and NaCN currently have no market share. Their success hinges on substantial investment and effective commercialization, positioning them as potential question marks in the BCG matrix, requiring careful management and strategic execution to transition into stars or cash cows.

Ethylene Diamine Tetra Acetic Acid (EDTA) and its derivatives are positioned as question marks for Balaji Amines within its specialty chemicals portfolio. These products are slated for commissioning by FY26E, representing a significant expansion into a segment with high growth potential, particularly as import substitutes in the burgeoning specialty chemicals market.

Currently, Balaji Amines holds a negligible or non-existent market share for these specific EDTA derivatives. This low market penetration necessitates substantial investment to establish market presence and prove their commercial viability, aligning with the characteristics of a question mark in the BCG matrix. The company's strategic focus on these products underscores their potential to become future stars if successful.

Isopropylamine (MIPA/DIPA)

Balaji Amines is strategically expanding its product portfolio by modifying its Ethylamines plant to produce Isopropylamine (MIPA/DIPA), with production slated to begin in FY26E. This move leverages existing infrastructure to tap into the amines market, aiming to diversify revenue streams. The company's current market share in Isopropylamine is minimal, making market penetration and demand a key factor for success.

- Strategic Repurposing: Balaji Amines is converting its Ethylamines facility to produce Isopropylamine, signaling a shift in asset utilization.

- Market Entry: The company is entering the Isopropylamine segment, which has distinct market dynamics and customer bases compared to Ethylamines.

- FY26E Commissioning: Production is anticipated to commence in the fiscal year ending March 2026, providing a timeline for this new venture.

- Market Share: Balaji Amines currently holds a low market share in Isopropylamine, presenting both an opportunity for growth and a challenge for market acceptance.

New Products under Customer Validation (e.g., NMP)

Newer products such as N-Methyl Pyrrolidone (NMP) are currently in the initial phases of customer validation and scaling up production, as management has indicated. These products are positioned within markets that show promising growth, like specialty chemicals and pharmaceutical excipients, but their current revenue contribution is minimal.

Their low market share and the uncertainty surrounding future demand classify them as question marks within the BCG matrix. These require ongoing investment and successful market penetration to potentially move into more lucrative categories.

- NMP is currently in customer validation and volume ramp-up stages.

- Target markets include specialty chemicals and pharma excipients, with significant growth potential.

- These products have minimal current revenue contribution due to low market share.

- Continued investment is necessary for successful market penetration and potential growth.

Products like Dimethyl Ether (DME), Hydrogen Cyanide (HCN), Sodium Cyanide (NaCN), Ethylene Diamine Tetra Acetic Acid (EDTA) derivatives, Isopropylamine, and N-Methyl Pyrrolidone (NMP) are all categorized as question marks for Balaji Amines. These represent new or nascent product lines with minimal current market share, requiring significant investment and strategic market penetration to achieve growth and potentially transition into star products.

| Product Category | Current Market Share | Projected Commissioning | Strategic Rationale |

|---|---|---|---|

| Dimethyl Ether (DME) | Nascent | Late 2024 / Early 2025 | Aerosols, LPG substitute potential |

| Hydrogen Cyanide (HCN) / Sodium Cyanide (NaCN) | None | FY26E | Specialty chemicals, import substitution |

| Ethylene Diamine Tetra Acetic Acid (EDTA) Derivatives | Negligible | FY26E | Specialty chemicals, import substitution |

| Isopropylamine (MIPA/DIPA) | Low | FY26E | Diversification, leveraging existing assets |

| N-Methyl Pyrrolidone (NMP) | Minimal | Ongoing scaling | Specialty chemicals, pharma excipients |

BCG Matrix Data Sources

Our Balaji Amines BCG Matrix is constructed using a blend of financial filings, industry research reports, and market growth projections to ensure a comprehensive view.