Balaji Amines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balaji Amines Bundle

Unlock the secrets of Balaji Amines's market position with our comprehensive PESTLE analysis. Understand how evolving political landscapes, economic fluctuations, and technological advancements are creating both challenges and opportunities for the company. This expert-crafted report provides the critical intelligence you need to anticipate market shifts and refine your strategic approach.

Political factors

The Indian government's 'Make in India' initiative, coupled with Production-Linked Incentive (PLI) schemes, is actively promoting domestic manufacturing, with a significant focus on the chemical sector. These policies are designed to offer tangible incentives and cultivate a more supportive ecosystem for companies like Balaji Amines, thereby boosting their production capabilities and improving cost competitiveness.

For instance, the PLI scheme for bulk drugs and active pharmaceutical ingredients (APIs), which Balaji Amines serves, aims to reduce India's reliance on imports for critical chemical intermediates. This strategic push is vital for strengthening the domestic chemical industry and attracting substantial investments, fostering self-sufficiency and global competitiveness.

Global geopolitical shifts and the increasing emphasis on diversifying supply chains are prompting companies worldwide to explore manufacturing bases beyond China. This strategic pivot is positioning India favorably, particularly in the chemical sector. India’s competitive manufacturing costs, coupled with its commitment to international quality benchmarks, make it a compelling destination for chemical exports.

This evolving trade landscape presents a significant opportunity for Balaji Amines. By leveraging India's advantages, the company can tap into new export markets and solidify its standing in the global chemical industry. For instance, India's chemical exports reached approximately $25 billion in FY23, indicating a robust and growing sector ripe for expansion.

The Indian government's commitment to fostering the chemical sector is evident through initiatives like the establishment of Petroleum, Chemicals, and Petrochemical Investment Regions (PCPIRs) and Plastic Parks. These dedicated zones aim to streamline operations and attract investment by providing integrated infrastructure and a supportive ecosystem. While the Union Budget 2025 did not introduce targeted chemical industry incentives, its broader focus on simplifying tax compliance and enhancing the ease of doing business continues to create a more favorable operating environment for companies like Balaji Amines.

Stability of Government and Economic Planning

The stability of the Indian government, particularly with a continued emphasis on infrastructure and manufacturing, creates a predictable environment for companies like Balaji Amines. This continuity supports long-term investment as the government aims to boost domestic production and create jobs. For instance, the Make in India initiative, launched in 2014, has seen significant traction, with the manufacturing sector's contribution to GDP growing steadily, reaching approximately 17.7% in FY23. This sustained policy focus is crucial for capital-intensive industries.

India's long-term economic planning, including the ambition to become a global manufacturing and export hub by 2030, directly benefits chemical manufacturers. Policies designed to encourage exports and streamline business operations are particularly advantageous for companies involved in the production of specialty chemicals and amines, key components in various downstream industries. The Production Linked Incentive (PLI) scheme, extended to sectors like pharmaceuticals and chemicals, further underscores this supportive policy direction, with significant allocations made in the 2024-25 budget to bolster domestic manufacturing capabilities.

- Government stability fosters predictable policy environments for industrial growth.

- Focus on infrastructure development supports logistics and operational efficiency for chemical companies.

- Aspiration to become an export hub by 2030 signals opportunities for chemical manufacturers with global reach.

- The Production Linked Incentive (PLI) scheme provides direct financial support for manufacturing expansion.

Focus on Self-Reliance (Atmanirbhar Bharat)

The Indian government's push for 'Aatmanirbhar Bharat' (Self-Reliant India) directly benefits domestic chemical manufacturers like Balaji Amines. This initiative aims to decrease reliance on imported raw materials and boost domestic production, creating a more favorable environment for local players to grow and innovate.

This focus on self-sufficiency encourages companies such as Balaji Amines to invest in expanding their manufacturing capacities and broadening their product ranges to cater to the increasing local demand. The policy also incentivizes improvements in product quality and overall output efficiency.

- Increased domestic demand: The 'Aatmanirbhar Bharat' initiative is expected to drive demand for locally produced chemicals, benefiting companies that can scale their operations.

- Reduced import dependency: This policy encourages import substitution, potentially leading to cost savings and greater supply chain stability for companies like Balaji Amines.

- Government support for manufacturing: Policies promoting domestic manufacturing can translate into incentives, easier regulatory pathways, and access to funding for capacity expansion.

- Diversification opportunities: The drive for self-reliance prompts companies to explore new product lines and applications, fostering diversification and reducing reliance on specific markets or imports.

Government stability and a consistent focus on manufacturing, exemplified by the 'Make in India' initiative, provide a predictable operating landscape for Balaji Amines. The government's ambition to position India as a global manufacturing hub by 2030, supported by schemes like Production Linked Incentives (PLI) for chemicals, directly encourages capacity expansion and export competitiveness. The 'Aatmanirbhar Bharat' campaign further bolsters domestic players by aiming to reduce import reliance, fostering increased local demand and supply chain resilience.

| Government Policy | Impact on Balaji Amines | Key Data Point (FY23/FY25 Projections) |

| Make in India / PLI Schemes | Incentivizes domestic production, cost competitiveness, capacity expansion | PLI scheme allocations in Union Budget 2024-25 aim to boost chemical manufacturing. India's chemical exports reached ~$25 billion in FY23. |

| Aatmanirbhar Bharat | Drives domestic demand, reduces import dependency, encourages innovation | Focus on import substitution expected to increase demand for locally produced specialty chemicals. |

| Infrastructure Development (PCPIRs, etc.) | Streamlines operations, attracts investment, improves logistics | Continued government investment in industrial infrastructure supports operational efficiency. |

| Government Stability | Creates predictable environment for long-term investment | Manufacturing sector's contribution to GDP grew to ~17.7% in FY23, reflecting sustained policy support. |

What is included in the product

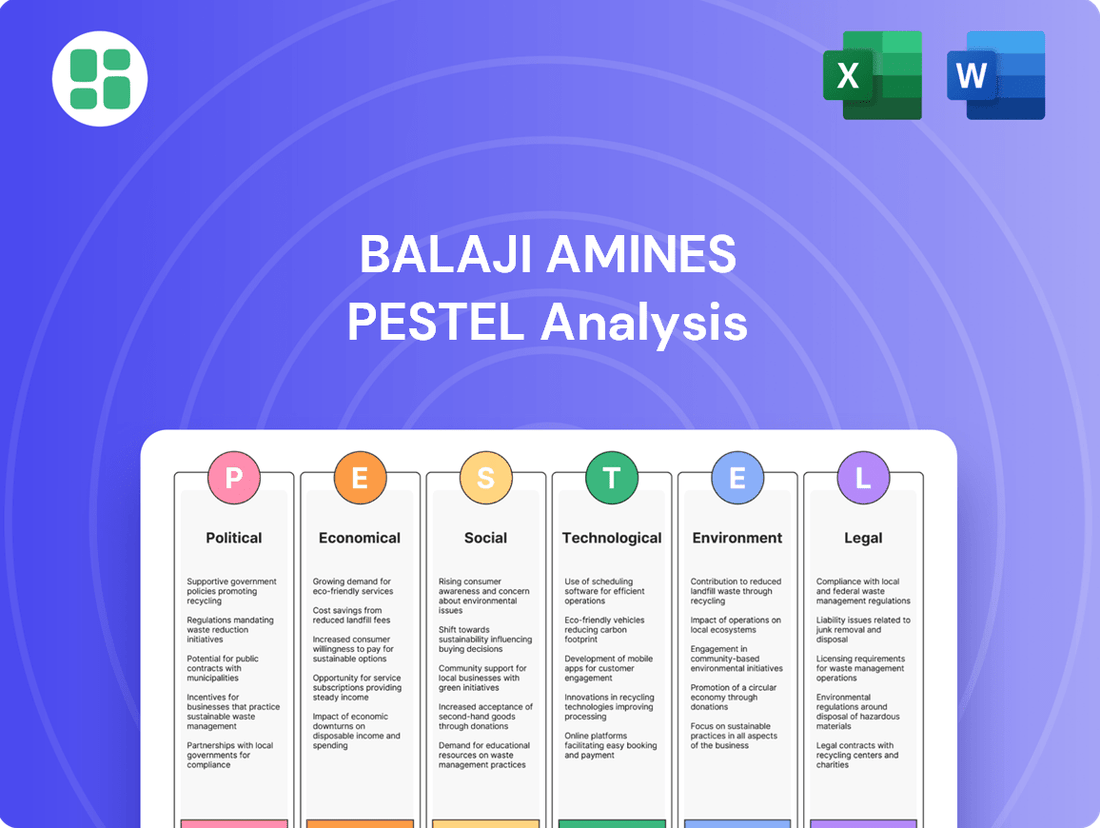

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Balaji Amines, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers strategic insights into how these global and regional trends create both opportunities and challenges for the company's growth and sustainability.

Offers a clear, concise PESTLE analysis of Balaji Amines, acting as a pain point reliever by simplifying complex external factors for strategic decision-making.

Economic factors

India's burgeoning population, projected to surpass 1.4 billion by 2025, coupled with rapid urbanization and industrialization, is fueling a significant surge in domestic chemical consumption. This expanding middle class, with increasing disposable income, directly translates to higher demand for products across various sectors.

Key end-user industries like pharmaceuticals, agrochemicals, and water treatment are critical growth engines for Balaji Amines. For instance, the Indian pharmaceutical market alone was valued at approximately $50 billion in 2023 and is expected to grow at a CAGR of over 12% through 2027, directly boosting demand for amine-based chemicals.

The specialty chemicals segment, where Balaji Amines has a strong presence, is particularly poised for robust expansion. With India aiming to become a global manufacturing hub, the demand for specialized chemicals across sectors like automotive, construction, and personal care is anticipated to see substantial year-on-year increases, creating a favorable environment for companies like Balaji Amines.

The Indian chemical industry is a significant engine for the nation's economic progress. Projections indicate its market size will reach substantial levels by 2025 and continue its upward trajectory. This expansion offers a positive environment for companies like Balaji Amines.

Despite Balaji Amines reporting a dip in net profit and revenue for FY2025, the broader chemical sector is anticipated to experience strong growth. For instance, the specialty chemicals segment, a key area for many players, is expected to grow at a CAGR of around 10-12% in the coming years, according to industry reports from early 2025.

This overall economic expansion and positive outlook for the chemical industry create a favorable backdrop for Balaji Amines' long-term prospects, suggesting potential for recovery and future growth as market conditions improve.

The chemical industry, including companies like Balaji Amines, is heavily reliant on the consistent availability and stable pricing of raw materials. For instance, the price of methanol, a key input for many amine products, saw significant fluctuations in 2023 and early 2024 due to global energy market dynamics and geopolitical events, directly impacting production costs.

These price swings can directly squeeze profit margins for Balaji Amines if they cannot pass on the increased costs to customers. In 2024, many chemical manufacturers are actively seeking to diversify their supplier base, with a growing trend towards nearshoring or reshoring to reduce exposure to international supply chain disruptions and trade policy uncertainties.

Investment and Capital Expenditure Trends

The Indian chemical sector is experiencing a surge in investment, with an estimated $87 billion slated for petrochemicals alone over the next ten years. This substantial capital inflow is a key driver for innovation and expansion within the industry.

Balaji Amines is actively participating in this growth trend, with significant capital expenditure plans. These include new manufacturing projects and enhancements to existing capacities, underscoring the company's commitment to future development and broadening its product portfolio.

- Investment Surge: India's chemical sector is projected to attract $87 billion in petrochemical investments by 2030.

- Balaji Amines' Strategy: The company is undertaking substantial expansion projects and capacity upgrades.

- Funding Sources: These investments are primarily financed through internal cash flows, with potential for debt financing for subsidiary initiatives.

- Growth Catalyst: Such capital expenditures are vital for Balaji Amines' long-term growth trajectory and diversification efforts.

Foreign Direct Investment (FDI) and Export Potential

India's chemical industry, including companies like Balaji Amines, benefits from a favorable environment for Foreign Direct Investment (FDI). The government permits 100% FDI through the automatic route in this sector, which significantly boosts investor confidence and facilitates capital inflow. This policy framework is crucial for expanding manufacturing capabilities and adopting advanced technologies.

The export potential of India's chemical sector is robust and growing. In fiscal year 2023-24, India's chemical exports reached an estimated USD 32 billion, with specialty chemicals showing particularly strong year-on-year growth. This upward trend is further amplified by global supply chain diversification efforts, as international companies seek reliable alternatives, presenting a substantial opportunity for Indian manufacturers to capture a larger global market share.

- FDI Policy: 100% FDI allowed via the automatic route in India's chemical industry.

- Export Growth: India's chemical exports were approximately USD 32 billion in FY 2023-24.

- Specialty Chemicals: This segment is experiencing significant annual export increases.

- Global Trends: Diversification of global supply chains enhances export opportunities for Indian chemical firms.

India's economic growth, with a projected GDP expansion of 7.0% for FY2025, directly fuels demand for chemicals. The expanding middle class, estimated to grow by 50 million in the next five years, increases consumption across various sectors that rely on amine-based products.

The specialty chemicals segment, a key focus for Balaji Amines, is expected to grow at a CAGR of 10-12% through 2028, driven by domestic manufacturing initiatives and increasing per capita income. This signifies a strong market opportunity for the company.

Despite a reported dip in net profit for FY2025, the overall positive economic outlook and government support for manufacturing, including initiatives like Make in India, provide a favorable environment for the chemical industry's recovery and long-term expansion.

Raw material price volatility, particularly for key inputs like methanol, impacted profitability in FY2025. However, strategic sourcing and potential for price pass-through in a growing demand environment are key mitigating factors for 2025.

| Economic Indicator | Value/Projection | Impact on Balaji Amines |

|---|---|---|

| India GDP Growth (FY2025) | 7.0% | Increased demand for chemicals from end-user industries. |

| Middle Class Expansion (Next 5 Years) | 50 million | Higher consumer spending, boosting demand for downstream products. |

| Specialty Chemicals CAGR (through 2028) | 10-12% | Significant growth potential for Balaji Amines' product portfolio. |

| Methanol Price Volatility (FY2025) | Fluctuating | Potential impact on production costs and profit margins. |

Preview the Actual Deliverable

Balaji Amines PESTLE Analysis

The preview you see here is the exact Balaji Amines PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Balaji Amines. You can trust that the insights and structure presented are precisely what you'll gain access to, enabling informed strategic planning.

Sociological factors

The chemical industry, including companies like Balaji Amines, critically depends on a skilled workforce. India boasts a significant scientific talent pool, but there's a noticeable gap in individuals possessing practical, industry-ready skills such as process engineering, safety management, and research and development.

Institutions like the Central Institute of Petrochemicals Engineering & Technology (CIPET) are actively working to bridge this gap by offering specialized training programs designed to equip graduates with the necessary competencies for the chemical sector. This focus on skill development is crucial for companies like Balaji Amines to maintain operational efficiency and drive innovation in their specialized chemical manufacturing processes.

The chemical industry, where Balaji Amines operates, places immense importance on health and safety due to inherent risks. Adherence to strict government regulations, such as those set by the Directorate General Factory Advice Service & Labour Institutes (DGFASLI) in India, is non-negotiable. These standards aim to protect workers and the environment from potential hazards.

Investing in advanced safety technologies and robust operational practices is crucial for companies like Balaji Amines. This includes implementing process safety management systems and providing comprehensive training to employees. For instance, in 2023, the chemical sector globally saw continued investment in automation, with companies reporting a focus on reducing manual handling of hazardous materials, thereby minimizing exposure risks.

The integration of automation and digitalization plays a significant role in enhancing safety. By reducing human intervention in critical processes, the potential for errors decreases. Real-time monitoring systems, often powered by AI and IoT, allow for immediate detection of anomalies, enabling prompt corrective actions and preventing accidents. This technological shift is a key factor in achieving a safer operational environment in chemical manufacturing.

Balaji Amines recognizes the growing societal expectation for businesses to contribute positively, actively engaging in Corporate Social Responsibility (CSR) across education, healthcare, and community services. These efforts bolster the company's standing and its social license to operate.

In 2023, Balaji Amines reported spending ₹1.45 crore on CSR activities, a significant increase from ₹0.87 crore in 2022, demonstrating a commitment to these initiatives. The company's CSR projects include supporting educational institutions, organizing free health camps, and contributing to orphanages and rural development projects, directly impacting local communities.

Changing Consumer Preferences and Demand for Sustainable Products

Consumer preferences are increasingly leaning towards products that are both sustainably produced and environmentally conscious. This global and domestic shift significantly impacts industries that supply raw materials, including the chemical sector. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for sustainable products, directly influencing demand for greener chemical intermediates.

This growing demand for eco-friendly end products compels industries that rely on chemical intermediates, such as pharmaceuticals, agrochemicals, and personal care, to seek out suppliers who can provide sustainable alternatives. Consequently, manufacturers like Balaji Amines are prompted to invest in cleaner production processes and develop bio-based or recycled chemical solutions to meet these evolving market needs.

- Growing Demand: Global consumer spending on sustainable goods is projected to reach over $150 billion by the end of 2025, a significant increase from previous years.

- Industry Pressure: End-user industries are actively seeking chemical suppliers with strong Environmental, Social, and Governance (ESG) credentials, impacting sourcing decisions.

- Market Opportunities: The development of biodegradable and low-emission chemical intermediates presents new avenues for growth and market differentiation for companies like Balaji Amines.

Urbanization and Industrial Development

India's rapid urbanization and burgeoning industrial sector are significant drivers for the chemical industry, directly benefiting companies like Balaji Amines. As more people move to cities and industries expand, the demand for chemicals as essential building blocks for various end products naturally increases. This trend creates a robust domestic market for Balaji Amines' specialty chemicals and amine derivatives.

The government's focus on developing industrial parks and special economic zones across the country further bolsters this growth. These zones often provide essential infrastructure, including reliable power, water, and logistics, which are crucial for chemical manufacturing. This supportive ecosystem facilitates easier and more efficient production and distribution for companies like Balaji Amines.

- Growing Domestic Demand: India's urbanization rate, projected to reach 43% by 2030, fuels demand for chemicals in sectors like pharmaceuticals, agrochemicals, and textiles, all key markets for Balaji Amines.

- Industrial Infrastructure Development: The establishment of numerous chemical industrial parks, such as those in Gujarat and Maharashtra, provides critical infrastructure that supports efficient manufacturing operations for companies like Balaji Amines.

- Increased Chemical Consumption: India's per capita chemical consumption, though lower than global averages, is steadily rising, indicating a growing market base for Balaji Amines' product portfolio.

Societal expectations for corporate responsibility are growing, pushing companies like Balaji Amines to actively engage in CSR. In 2023, Balaji Amines allocated ₹1.45 crore to CSR, a notable increase from ₹0.87 crore in 2022, funding projects in education, healthcare, and community development. This commitment not only enhances the company's reputation but also secures its social license to operate.

Technological factors

The Indian chemical sector is increasingly embracing Industry 4.0, integrating AI, IoT, robotics, and automation. This shift is driven by the need for greater efficiency and accuracy in manufacturing operations.

Balaji Amines, a key player in amine and specialty chemical production, is well-positioned to capitalize on these technological strides. By adopting advanced automation, the company can streamline its production lines, minimize manual intervention, and thereby reduce the likelihood of errors, ensuring a higher degree of product consistency and quality control.

For instance, the company's operational efficiency improvements, partly fueled by technological adoption, were reflected in its financial performance. In FY24, Balaji Amines reported a revenue of INR 2,456 crore, demonstrating a robust market presence enhanced by these technological upgrades.

Research and Development (R&D) is the engine for growth in the chemical industry, driving improvements in quality, efficiency, and cost reduction. Balaji Amines recognizes this, actively investing in new projects and expanding its product portfolio. This includes a strategic push into electronic-grade chemicals and novel amine derivatives, areas demanding substantial R&D investment.

This focus on innovation is crucial for Balaji Amines to tap into high-growth sectors. For instance, their development of new amine derivatives is directly aimed at serving emerging markets like electric vehicle (EV) battery production, a sector projected for significant expansion in the coming years. By staying at the forefront of chemical innovation, Balaji Amines aims to secure a competitive edge.

The ongoing digital transformation is a significant technological factor for Balaji Amines. By leveraging data analytics, the company can gain deeper insights into its operations, leading to more informed strategic decisions and improved process efficiency. This digital shift allows for better management of resources and a more proactive approach to problem-solving.

Implementing advanced analytics can optimize Balaji Amines' supply chain and manufacturing processes. For instance, predictive maintenance, powered by data, can reduce downtime and associated costs. In 2023, the chemical industry saw increased investment in digital solutions, with companies reporting an average of 15% improvement in operational efficiency post-digitalization, a trend Balaji Amines is likely to follow.

Green Chemistry and Sustainable Technologies

The chemical industry is increasingly prioritizing green chemistry and sustainable production methods to mitigate its environmental footprint. This global trend is evident in Balaji Amines' strategic moves, such as their investment in a greenfield solar power plant, which directly supports their commitment to reducing carbon emissions.

By embracing eco-friendly chemicals and robust recycling programs, Balaji Amines is not only aligning with international sustainability standards but also aiming to boost India's standing and the visibility of its chemical sector on the world stage. For instance, the company's solar power project is expected to contribute significantly to its renewable energy targets, potentially offsetting a substantial portion of its energy consumption from conventional sources by 2025.

- Growing Demand for Sustainable Chemicals: Global markets are showing a clear preference for products manufactured using environmentally responsible processes.

- Balaji Amines' Sustainability Initiatives: The company's investment in a solar power plant underscores its proactive approach to reducing its carbon footprint and operational costs.

- Enhanced Global Reputation: Adopting green chemistry principles and recycling can improve India's image as a responsible player in the global chemical supply chain.

- Regulatory Tailwinds: Governments worldwide, including India, are implementing policies that favor greener manufacturing practices, creating a favorable environment for companies like Balaji Amines.

Intellectual Property and Technology Transfer

The Patent Act of 2005 significantly elevated the importance of product innovation and intellectual property (IP) protection in India, directly impacting companies like Balaji Amines. This legal framework encourages investment in research and development by safeguarding novel inventions.

Foreign technology agreements and collaborations are vital for facilitating technology transfer and driving growth across Indian industries. These partnerships allow domestic firms to access cutting-edge processes and product designs, enhancing their competitive edge.

Balaji Amines can leverage these collaborations to acquire advanced technologies for developing new products and optimizing existing manufacturing processes. This strategic approach is crucial for staying ahead in the dynamic chemical sector.

For instance, in 2023-24, the Indian chemical industry saw significant FDI inflows, reflecting a growing interest in technology partnerships. Balaji Amines’ own R&D expenditure, which has been steadily increasing, underscores its commitment to innovation and potential future technology acquisitions.

- Increased IP Protection: The Patent Act 2005 strengthens the protection of intellectual property, driving innovation.

- Technology Transfer Importance: Foreign collaborations are key for accessing advanced technologies in India.

- Balaji Amines' Strategy: Potential for acquiring new technologies through partnerships for product and process development.

- Industry Context: India's chemical sector attracted substantial FDI in 2023-24, highlighting the value of technology transfer.

Technological advancements are reshaping the chemical industry, with a strong push towards Industry 4.0 principles like AI and automation. Balaji Amines is integrating these technologies to enhance production efficiency and product quality, as seen in its robust FY24 revenue of INR 2,456 crore.

The company's commitment to R&D, particularly in areas like electronic-grade chemicals and EV battery materials, is crucial for future growth. This innovation focus is supported by India's strengthened IP protection under the Patent Act of 2005 and the increasing trend of foreign technology collaborations, which saw significant FDI in the Indian chemical sector in 2023-24.

Legal factors

The chemical sector in India operates under a stringent regulatory environment covering the entire lifecycle of hazardous chemicals, from manufacturing to disposal. Balaji Amines must adhere to these rules, which include specific standards for storage and transportation, ensuring operational safety and environmental protection.

Compliance with Indian regulatory standards, such as the Bureau of Indian Standards (BIS) certification for key products like Morpholine, is non-negotiable for Balaji Amines. This adherence not only guarantees product quality and safety but also builds trust with customers and stakeholders, a critical factor in the competitive chemical market.

The Indian government is actively updating its regulatory framework for the chemical industry, aiming for enhanced safety protocols and environmental sustainability. For Balaji Amines, staying abreast of these evolving legal requirements, including potential new environmental impact assessments or chemical safety audits, is paramount for uninterrupted operations and future growth.

Environmental Protection Laws and Compliance are critical for Balaji Amines. Strict regulations governing waste management, hazardous emissions, and water/energy consumption directly affect chemical manufacturers. For instance, compliance with India's updated environmental protection acts and evolving sustainability reporting standards, like those potentially influenced by the National Chemical Policy, necessitates significant investment. Balaji Amines' commitment to investing in waste-to-value technologies and advanced emission control systems is paramount to meeting these legal obligations and mitigating operational risks.

Balaji Amines, like all businesses in India, must navigate a complex web of labor laws. These regulations cover everything from minimum wages and working hours to employee safety and social security contributions. For instance, the Code on Wages, 2019, aims to simplify and consolidate laws relating to wages, which could impact payroll and compensation structures.

While specific recent amendments directly targeting the chemical industry's labor practices weren't prominently noted for 2024-2025, the general framework of Indian labor laws significantly influences Balaji Amines' operational costs and human resource strategies. Adherence to these laws is crucial for maintaining a stable workforce and avoiding legal penalties.

Ensuring fair labor practices and maintaining safe working conditions are ongoing imperatives for Balaji Amines. This includes compliance with occupational safety and health standards, which are vital in the chemical manufacturing sector to prevent accidents and protect employees. The company's commitment to these areas directly affects its reputation and employee morale.

Product Liability and Quality Control Regulations

Balaji Amines' operations, particularly its supply of chemical intermediates to the pharmaceutical and agrochemical sectors, place significant emphasis on product liability and quality control regulations. Failure to meet stringent industry standards can lead to costly legal challenges and damage to its reputation, impacting its ability to serve these critical markets.

The company must maintain robust internal quality assurance systems to guarantee its products consistently adhere to required specifications. This commitment is vital for safeguarding against potential lawsuits and ensuring continued trust from its customer base, which relies on the purity and efficacy of its chemical inputs.

For instance, the pharmaceutical industry, a key customer segment for Balaji Amines, operates under strict Good Manufacturing Practices (GMP) guidelines. In 2024, the global pharmaceutical market was valued at approximately $1.6 trillion, with quality and compliance being paramount for all suppliers. Balaji Amines' adherence to these standards directly influences its market access and competitiveness within this high-stakes environment.

- Regulatory Compliance: Adherence to GMP and other industry-specific quality standards is non-negotiable for supplying pharmaceutical and agrochemical clients.

- Product Liability: Ensuring product integrity minimizes the risk of costly recalls, lawsuits, and reputational damage.

- Quality Assurance Investment: Significant investment in advanced testing equipment and skilled personnel is necessary for maintaining high-quality output.

- Market Access: Meeting rigorous quality benchmarks is a prerequisite for securing and retaining contracts with major players in the life sciences and agriculture sectors.

Government Incentives and Trade Compliance

While the Union Budget 2025 did not roll out new Production Linked Incentive (PLI) schemes specifically for the chemical sector, existing programs like the Remission of Duties and Taxes on Exported Products (RoDTEP) remain crucial. For the fiscal year 2023-24, RoDTEP benefits were extended to a wider range of sectors, indirectly supporting chemical exporters. Balaji Amines needs to stay abreast of these evolving trade policies and ensure strict adherence to all import-export regulations to capitalize on international market prospects.

Navigating the complexities of trade compliance is paramount for Balaji Amines to effectively leverage global market opportunities. This includes understanding and adhering to regulations concerning product standards, tariffs, and non-tariff barriers in different export markets. For instance, compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations in Europe is essential for market access.

- RoDTEP Scheme: Continues to provide remission of duties and taxes on exported products, enhancing export competitiveness for the chemical industry.

- Trade Policy Compliance: Balaji Amines must ensure adherence to all export-import regulations, including product-specific standards and documentation requirements.

- Market Access: Compliance with international chemical regulations, such as REACH in Europe, is critical for accessing key global markets.

- Government Support: While no new PLI schemes were announced in the Union Budget 2025 for chemicals, existing frameworks offer continued support for export-oriented businesses.

Balaji Amines must navigate India's robust legal framework, which includes stringent environmental protection laws and evolving safety standards for chemical manufacturing. Compliance with regulations like the Bureau of Indian Standards (BIS) for products such as Morpholine is essential for product quality and market acceptance.

The company is also subject to comprehensive labor laws, covering wages, working conditions, and employee safety, which impact operational costs and HR strategies. Adherence to these laws is crucial for maintaining a stable workforce and avoiding legal repercussions.

Furthermore, product liability and quality control are critical, especially when supplying to the pharmaceutical and agrochemical sectors, which operate under strict guidelines like Good Manufacturing Practices (GMP). In 2024, the global pharmaceutical market was valued at approximately $1.6 trillion, underscoring the importance of quality assurance for market access.

Trade compliance, including adherence to international regulations like REACH in Europe, is vital for Balaji Amines' export activities. While the Union Budget 2025 did not introduce new PLI schemes for chemicals, existing programs like RoDTEP continue to support export competitiveness.

| Legal Factor | Impact on Balaji Amines | Key Regulations/Considerations | 2024-2025 Relevance |

| Environmental Laws | Operational costs, risk of penalties, investment in sustainable practices | Hazardous waste management, emissions control, water/energy consumption | Increased focus on sustainability reporting and stricter emission norms |

| Labor Laws | Payroll, HR policies, employee relations, operational stability | Minimum wages, working hours, occupational safety, social security | Ongoing compliance with consolidated labor codes like the Code on Wages, 2019 |

| Product Quality & Liability | Market access, customer trust, risk of lawsuits, reputational damage | BIS certification, GMP (for pharma clients), quality assurance systems | Crucial for supplying to the $1.6 trillion global pharmaceutical market |

| Trade & Export Compliance | International market access, export competitiveness, tariff implications | REACH (Europe), import-export regulations, RoDTEP scheme | Continued importance of adhering to global chemical standards for market entry |

Environmental factors

The chemical industry, including companies like Balaji Amines, faces growing pressure regarding waste management and pollution control. Governments worldwide are implementing more stringent regulations on hazardous emissions and waste disposal, forcing manufacturers to adapt.

Balaji Amines needs to continue investing in sophisticated waste treatment technologies and strictly comply with evolving emission standards to reduce its environmental impact. This represents an ongoing operational and regulatory hurdle for the company, requiring constant vigilance and resource allocation.

For instance, India’s Central Pollution Control Board (CPCB) has been actively revising emission norms for various industries. While specific data for Balaji Amines' pollution control investments in 2024-2025 isn't publicly detailed, the broader trend shows a significant increase in compliance costs for chemical manufacturers. Companies are expected to adopt Zero Liquid Discharge (ZLD) principles where feasible, a costly but environmentally crucial step.

Water is a vital input for chemical processes, and environmental regulations governing its use and discharge are tightening. Balaji Amines, like its peers, faces increasing pressure to optimize water consumption and ensure effluent quality meets stringent standards. For instance, in India, the Central Pollution Control Board (CPCB) sets discharge limits for various parameters, and non-compliance can lead to penalties and operational disruptions.

To navigate these evolving environmental norms, Balaji Amines is compelled to invest in water conservation initiatives and advanced water treatment technologies. This proactive approach is crucial for maintaining operational continuity and demonstrating environmental responsibility. The company's commitment to sustainability likely involves implementing measures such as rainwater harvesting and recycling process water, aligning with broader industry trends and regulatory expectations as seen in the 2024-2025 period.

India's ambitious goal of achieving net-zero emissions by 2070, coupled with evolving global climate change policies, is significantly shaping the chemical industry. This regulatory landscape is pushing companies like Balaji Amines to prioritize decarbonization and actively reduce their carbon footprint.

Balaji Amines has proactively invested in a solar power plant, a tangible move to lessen its dependence on conventional fossil fuels. This initiative not only aims to lower the company's carbon emissions but also underscores its commitment to environmental, social, and governance (ESG) principles and sustainable operational practices.

Focus on Circular Economy and Resource Efficiency

The chemical industry, including companies like Balaji Amines, is increasingly embracing circular economy principles. This focus means prioritizing waste reduction and the recycling of materials, aiming to keep resources in use for as long as possible.

Adopting these practices involves redesigning manufacturing processes to be more efficient, minimizing waste generation, and maximizing the reuse of raw materials. For Balaji Amines, this shift could lead to significant sustainability improvements and potential cost savings through better resource management.

The push towards a circular economy is driven by growing environmental regulations and consumer demand for sustainable products. For instance, the global circular economy market size was valued at approximately USD 2.8 trillion in 2023 and is projected to grow significantly, indicating a strong market trend.

Balaji Amines can explore several avenues to integrate circular economy principles:

- Waste Valorization: Identifying and repurposing by-products or waste streams into valuable new materials or energy sources.

- Process Optimization: Implementing technologies that reduce energy and water consumption per unit of production.

- Sustainable Sourcing: Prioritizing raw materials that are recycled, bio-based, or produced with lower environmental impact.

- Product Lifecycle Management: Designing products with end-of-life recycling or reuse in mind.

Adoption of Green Technologies and Sustainable Practices

The chemical industry is increasingly focused on adopting green technologies and sustainable practices to mitigate its environmental footprint. This shift involves a move towards green chemistry principles and the implementation of eco-friendly manufacturing processes.

For Balaji Amines, this translates to a continuous assessment and adoption of cleaner production methods. The company is also focused on developing products that are environmentally benign, aligning with global sustainability trends.

- Growing Demand for Sustainable Chemicals: Global demand for sustainable chemicals is projected to reach USD 45.2 billion by 2027, indicating a significant market opportunity for companies like Balaji Amines that prioritize eco-friendly products.

- Regulatory Push for Greener Processes: Increasing environmental regulations worldwide are compelling chemical manufacturers to invest in technologies that reduce emissions and waste. For instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting chemical production.

- Balaji Amines' Sustainability Initiatives: Balaji Amines has been investing in improving its energy efficiency and waste management systems. In FY23, the company reported efforts to optimize its manufacturing processes to reduce environmental impact, though specific green technology investment figures are not yet detailed for 2024/2025.

Environmental regulations are becoming increasingly strict, impacting chemical manufacturers like Balaji Amines. The company must invest in advanced waste treatment and comply with evolving emission standards, which presents an ongoing challenge. India's net-zero goal by 2070 is also pushing for decarbonization, leading Balaji Amines to invest in renewable energy sources like solar power to reduce its carbon footprint and align with ESG principles.

Water usage and discharge are under tighter scrutiny, necessitating Balaji Amines to optimize consumption and ensure effluent quality meets stringent norms, as exemplified by Central Pollution Control Board (CPCB) regulations. The company is also adopting circular economy principles, focusing on waste reduction and material recycling, a trend supported by a global market valued at approximately USD 2.8 trillion in 2023.

| Environmental Factor | Impact on Balaji Amines | Key Initiatives/Trends (2024-2025 Focus) |

|---|---|---|

| Pollution Control & Emissions | Increased compliance costs, need for advanced technology investment. | Adherence to revised CPCB emission norms, potential adoption of Zero Liquid Discharge (ZLD). |

| Water Management | Pressure to optimize water use and meet strict discharge standards. | Investment in water conservation, advanced treatment, rainwater harvesting, and process water recycling. |

| Climate Change & Decarbonization | Mandate to reduce carbon footprint and embrace greener energy. | Investment in solar power plants, focus on energy efficiency, and alignment with India's net-zero targets. |

| Circular Economy | Opportunity for cost savings and sustainability through waste valorization and process optimization. | Exploring waste-to-value streams, efficient resource management, and sustainable sourcing. |

PESTLE Analysis Data Sources

Our Balaji Amines PESTLE analysis is grounded in a comprehensive review of data from reputable sources including government publications, financial reports from regulatory bodies, and leading industry research firms. We also incorporate insights from global economic trend analyses and environmental impact assessments to ensure a holistic view.