BAIC Motor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAIC Motor Bundle

BAIC Motor, a significant player in the Chinese automotive market, boasts strong brand recognition and a robust domestic sales network, positioning it well to capitalize on evolving consumer preferences. However, it also faces intense competition and the growing challenge of transitioning to electric vehicles.

Want the full story behind BAIC Motor's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

As a significant state-owned enterprise in China's automotive sector, BAIC Motor enjoys considerable advantages from government backing and a solid financial standing. This support translates into a stable operational base and facilitates strategic expansion initiatives.

The group's performance underscores this strength, with over 1.71 million vehicles sold and revenue reaching more than 480 billion yuan in 2024, highlighting its established market presence and financial resilience.

BAIC Motor’s extensive and diversified product portfolio is a significant strength, encompassing traditional fuel vehicles, a growing range of New Energy Vehicles (NEVs) including sedans and SUVs, and commercial vehicles under its Foton brand. This broad offering caters to a wide spectrum of consumer needs and market segments. The company also manufactures automotive parts and components, further solidifying its position in the automotive value chain.

BAIC Motor's significant investment in Research and Development (R&D) and advanced technologies is a major strength. The parent BAIC Group has pledged a substantial 50 billion RMB for R&D over the next five years, with a notable 13 billion yuan already invested in 2024. This financial commitment underscores a strategic focus on pioneering areas like new energy vehicles, intelligent driving systems, and advanced smart cockpits.

This dedication to innovation extends to critical automotive components, including chips and batteries, positioning BAIC to lead in the rapidly evolving automotive landscape. By prioritizing these cutting-edge fields, BAIC Motor is building a strong foundation for future product development and technological competitiveness.

Accelerated International Expansion and Global Partnerships

BAIC Motor is aggressively pursuing international expansion, evident in its export growth. In 2024, exports reached 270,000 vehicles, marking a significant 44% year-on-year increase. This global push is supported by a substantial operational base, with BAIC established in over 130 countries and regions and operating 41 overseas factories.

The company's strategy includes targeted market launches in key regions such as Egypt, Indonesia, Malaysia, and the UAE. These expansions are crucial for diversifying revenue streams and building brand recognition on a global scale. BAIC's commitment to international markets is a core strength, enabling it to tap into new customer bases and mitigate risks associated with reliance on a single market.

Furthermore, BAIC is leveraging strategic partnerships to enhance its global competitiveness. Collaborations with leading technology firms like Huawei (under the STELATO brand), Pony.ai, and Horizon Robotics are vital. These alliances not only accelerate the development and integration of advanced automotive technologies but also strengthen BAIC's position in the increasingly competitive global electric vehicle and autonomous driving sectors.

- Global Footprint Expansion: Exports grew to 270,000 vehicles in 2024, a 44% YoY increase.

- Extensive Market Presence: Operations in over 130 countries and regions with 41 overseas factories.

- Key Market Launches: Entry into Egypt, Indonesia, Malaysia, and the UAE.

- Technology Alliances: Partnerships with Huawei, Pony.ai, and Horizon Robotics to boost international competitiveness.

Strong Performance in New Energy Vehicle Segment

BAIC's commitment to new energy vehicles (NEVs) is a significant strength, particularly with its premium brand, ARCFOX. In 2024, ARCFOX experienced an impressive 170% surge in sales year-over-year, fueled by the strong reception of models such as the α S5 and α T5. This robust performance directly addresses the rapidly expanding global market for electric vehicles.

The company is strategically investing in cutting-edge EV platforms and AI-powered cockpit systems, positioning itself to meet future consumer demands. This focus on technological advancement in the NEV sector is vital for BAIC's sustained growth and competitive standing in the automotive industry.

- ARCFOX sales growth: 170% year-on-year in 2024.

- Key models driving growth: α S5 and α T5.

- Strategic investments: Advanced EV platforms and AI-integrated cockpit systems.

- Market alignment: Capitalizing on surging global NEV demand.

BAIC Motor's substantial government backing as a state-owned enterprise provides a stable financial foundation and supports ambitious expansion plans. Its diversified product range, covering traditional and new energy vehicles, alongside automotive parts, caters to a broad market. Significant R&D investment, with 13 billion yuan allocated in 2024, fuels innovation in NEVs and intelligent driving, ensuring future competitiveness.

| Metric | 2024 Data | Significance |

| Total Vehicle Sales | 1.71 million+ | Demonstrates established market presence |

| Revenue | > 480 billion yuan | Highlights financial resilience |

| R&D Investment (2024) | 13 billion yuan | Underpins technological advancement |

| ARCFOX Sales Growth | 170% YoY | Indicates strong NEV market traction |

What is included in the product

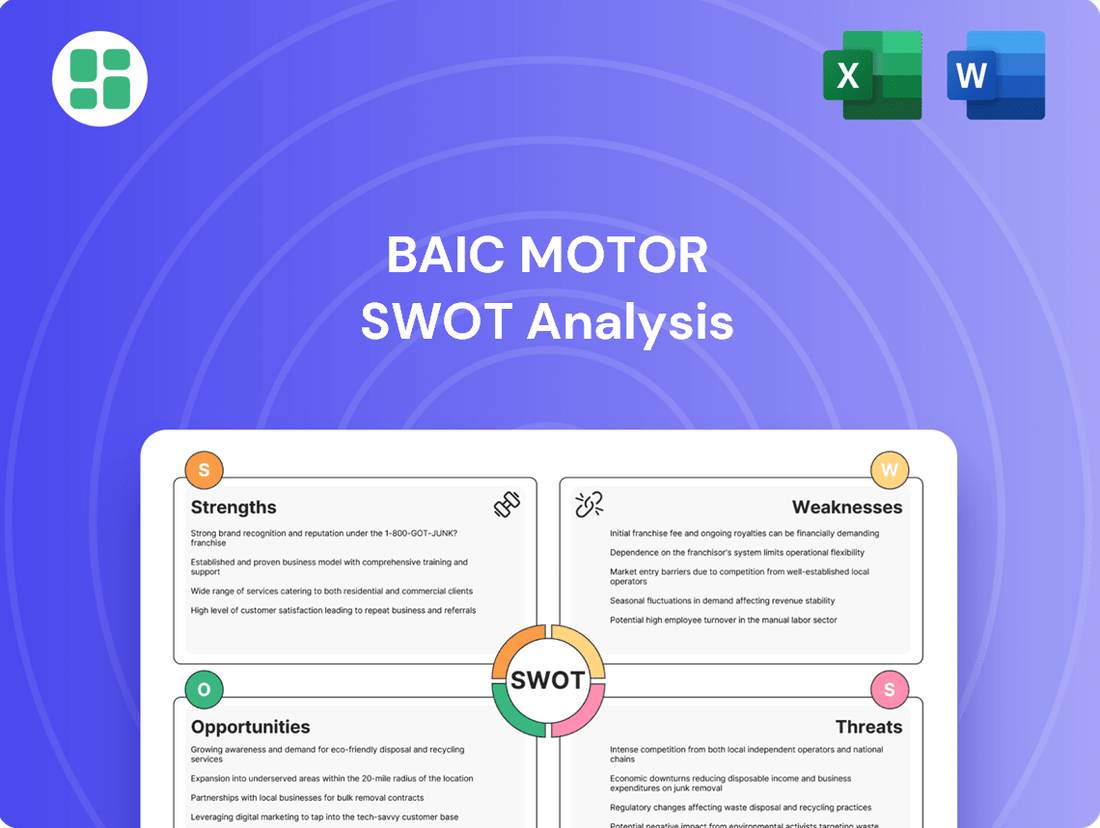

This SWOT analysis provides a comprehensive look at BAIC Motor's internal strengths and weaknesses, alongside external opportunities and threats, to understand its competitive standing and strategic direction.

Offers a clear breakdown of BAIC Motor's competitive landscape, identifying key threats and opportunities to inform strategic adjustments.

Weaknesses

BAIC Motor's financial performance in early 2025 shows some concerning trends. For instance, their Q1 2025 report indicated a dip in total assets, sales, and net income when compared to the same period in the prior year. This suggests a struggle to maintain growth across the board.

The new energy vehicle segment, BAIC BJEV, is particularly feeling the pressure. In the first half of 2024, BJEV saw its revenue drop by a significant 35.16% year-on-year. Further highlighting this weakness, July 2025 sales figures for BJEV also declined by 6.38% compared to the previous year, pointing to difficulties in key growth areas.

BAIC Motor faces significant headwinds from the intensely competitive Chinese automotive market. Both established manufacturers and newer electric vehicle (EV) startups are locked in aggressive price wars, eroding profit margins and making it difficult to gain market share. This dynamic forces a shift from simply competing on price to demonstrating superior value.

The pressure is immense, with some analysts predicting that up to 40% of Chinese auto brands could disappear by 2025 due to this brutal competition. For BAIC Motor, this means constant innovation and cost management are critical to survival and growth in such a challenging landscape.

BAIC Motor's significant reliance on joint ventures, particularly Beijing Benz and Beijing Hyundai, presents a key weakness. While these partnerships drove substantial sales in 2024, with Beijing Benz alone contributing significantly to BAIC Motor's overall revenue, this dependence highlights potential struggles for BAIC's own brands to achieve comparable market dominance and premium brand perception independently.

Challenges in Global Brand Recognition and Premium Positioning

While BAIC Motor has made strides in international markets, securing awards such as the Red Dot Design Award for its models, it still faces significant challenges in achieving widespread global brand recognition. Established automotive leaders like Toyota and Volkswagen have decades of brand building and consumer trust, making it difficult for BAIC to immediately command a premium perception.

Building this premium image requires substantial and consistent investment in marketing and product development tailored to diverse international tastes and expectations. For instance, while BAIC's sales in overseas markets have seen growth, they remain a smaller fraction of global automotive sales compared to established players.

Key challenges include:

- Limited Global Brand Awareness: BAIC's brand recognition outside of China is still developing, lagging behind established global competitors.

- Perception of Premium Quality: Convincing international consumers of BAIC's premium positioning requires overcoming ingrained perceptions and demonstrating superior quality and innovation consistently.

- Intense Market Competition: The global automotive market is highly saturated with strong brands, making it challenging to carve out a significant market share and premium identity.

Sustainability of High Growth Rates in a Maturing Market

BAIC Motor faces a significant challenge in maintaining the high growth rates seen previously. As the Chinese auto market matures, and with the fading impact of stimulus measures like the 'old-for-new' program, sustaining the explosive growth experienced in earlier periods, especially into the latter half of 2025, is unlikely. This suggests a shift towards a milder recovery trend rather than continued rapid expansion, potentially hindering BAIC's ambitious sales projections.

The market's trajectory indicates a normalization after periods of strong stimulus. For instance, while the overall Chinese auto market saw a notable rebound in 2023, the pace of growth is expected to moderate. This moderation directly impacts BAIC's ability to hit aggressive sales targets that were predicated on the continuation of exceptional market conditions.

- Sustaining Growth: The expectation is for the Chinese auto market to experience a mild recovery rather than a return to double-digit growth rates by late 2025.

- Stimulus Impact: Previous government incentives, such as the 'old-for-new' program, significantly boosted sales, creating a higher base for future comparisons.

- Market Maturation: A maturing market inherently leads to slower growth as demand saturation increases and competition intensifies.

BAIC Motor's reliance on its joint ventures, particularly Beijing Benz and Beijing Hyundai, presents a significant weakness. While these partnerships were major revenue drivers in 2024, this dependence indicates that BAIC's own brands struggle to achieve independent market dominance and premium brand perception.

The company faces intense competition in the Chinese automotive market, with aggressive price wars impacting profit margins. Analysts predict that up to 40% of Chinese auto brands could disappear by 2025 due to this fierce competition, underscoring the need for BAIC to constantly innovate and manage costs effectively.

BAIC Motor's new energy vehicle (NEV) segment, BAIC BJEV, is under considerable pressure. In the first half of 2024, BJEV's revenue fell by 35.16% year-on-year, and July 2025 sales figures showed a 6.38% decline compared to the previous year, indicating struggles in a key growth area.

Global brand awareness remains a challenge for BAIC, with its recognition outside China still developing and lagging behind established competitors. Overcoming ingrained perceptions and consistently demonstrating superior quality and innovation are crucial for achieving a premium positioning in international markets.

Full Version Awaits

BAIC Motor SWOT Analysis

This is the actual BAIC Motor SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full BAIC Motor SWOT report you'll get. Purchase unlocks the entire in-depth version, offering strategic insights for your business decisions.

Opportunities

The new energy vehicle (NEV) market in China is experiencing explosive growth, with NEV penetration surpassing 50% for the first time in July 2024. This rapid consumer adoption signals a profound shift, creating a substantial opportunity for BAIC Motor to capitalize on its established investments in electric and intelligent vehicle technologies by further expanding its NEV offerings.

BAIC Motor is strategically expanding its global footprint, with a notable focus on emerging markets. The company's export volumes have seen consistent growth, particularly in regions like Southeast Asia and Africa. For instance, BAIC established a production facility in Thailand in 2023, aiming to leverage the growing automotive demand in that region.

This international expansion is crucial for BAIC Motor to access new customer segments and diversify its revenue sources. By reducing its reliance on the saturated Chinese market, BAIC can mitigate risks and unlock significant growth potential. In 2024, BAIC reported a 15% increase in its overseas sales, with Southeast Asia and Africa accounting for a substantial portion of this growth.

BAIC Motor can significantly boost its technological capabilities by forging strategic partnerships. Collaborations with giants like Huawei for premium NEV brands, such as STELATO, and with autonomous driving specialists like Pony.ai and Horizon Robotics, provide access to advanced intelligent driving systems.

Furthermore, teaming up with battery technology leaders like CATL and potentially Xiaomi for battery cell innovation offers a pathway to enhance electric vehicle performance and range. These alliances are crucial for integrating state-of-the-art features, thereby sharpening BAIC's competitive edge in the rapidly evolving automotive market.

Favorable Government Policies and Subsidies

The Chinese government's ongoing commitment to the new energy vehicle (NEV) sector is a significant opportunity for BAIC Motor. Policies such as purchase tax exemptions and subsidies for NEV buyers, which were extended into 2027, directly stimulate demand. For instance, in 2023, China's NEV sales surpassed 9.5 million units, a testament to the effectiveness of these supportive measures.

These government initiatives create a fertile ground for manufacturers like BAIC to innovate and expand. Vehicle replacement programs, encouraging the switch from traditional fuel cars to NEVs, further bolster the market. This policy landscape not only drives sales but also incentivizes research and development in areas like battery technology and charging infrastructure.

- Policy Support: Continued purchase tax exemptions and subsidies for NEVs, extended through 2027, directly boost consumer adoption.

- Market Stimulation: Government-led vehicle replacement programs actively encourage consumers to transition to electric mobility.

- Demand Growth: China's NEV market, exceeding 9.5 million units sold in 2023, reflects the strong impact of these favorable policies.

Advancements in Intelligent and Connected Vehicle Technologies

China's rapid progress in intelligent and connected vehicles, including infrastructure for autonomous driving, presents a significant opportunity. BAIC's substantial R&D investments in areas like smart cockpits, ADAS, and AI are well-positioned to capitalize on this burgeoning market, potentially establishing the company as a leader in smart mobility.

This trend is supported by market data, with the global connected car market projected to reach over $200 billion by 2025, with China being a major contributor. BAIC's focus on these technologies allows it to tap into this growth.

- Market Growth: The global market for intelligent and connected vehicles is expanding rapidly, with China at the forefront of development and adoption.

- BAIC's Investment: BAIC's commitment to R&D in smart cockpits, ADAS, and AI directly addresses key growth areas within this sector.

- Strategic Alignment: The company's strategy aligns with national initiatives and consumer demand for advanced automotive features, creating a strong foundation for market penetration.

BAIC Motor is well-positioned to leverage the accelerating growth of China's new energy vehicle (NEV) market, which saw penetration exceed 50% in July 2024, presenting a significant opportunity to expand its electric and intelligent vehicle offerings.

The company's strategic global expansion, particularly into emerging markets like Southeast Asia and Africa, with a production facility established in Thailand in 2023, diversifies revenue and reduces reliance on the domestic market, evidenced by a 15% increase in overseas sales in 2024.

Strategic partnerships with technology leaders such as Huawei for premium NEV brands and with autonomous driving specialists like Pony.ai and Horizon Robotics are enhancing BAIC's technological capabilities, particularly in intelligent driving systems.

Government support, including NEV purchase tax exemptions and subsidies extended through 2027, along with vehicle replacement programs, continues to stimulate demand, as demonstrated by over 9.5 million NEVs sold in China in 2023.

BAIC's substantial R&D investments in intelligent and connected vehicle technologies, including smart cockpits and ADAS, align with the rapid development of China's smart mobility infrastructure, a sector projected to contribute significantly to the global connected car market exceeding $200 billion by 2025.

Threats

The Chinese auto market is a battlefield, with intense competition and brands being weeded out rapidly. This means BAIC faces a constant challenge to keep up and stay profitable, especially with ongoing price wars. For instance, in 2023, the Chinese passenger vehicle market saw a 5.6% year-on-year growth, reaching 21.69 million units, but this growth was accompanied by aggressive pricing strategies from numerous manufacturers, impacting margins across the board.

BAIC Motor, as a significant global automotive player, faces considerable threats from ongoing global supply chain vulnerabilities. For instance, the semiconductor shortage that heavily impacted the automotive industry throughout 2021 and 2022, with some estimates suggesting billions in lost revenue for manufacturers, continues to pose a risk, albeit with improving availability in late 2024.

Escalating geopolitical tensions, particularly those affecting key component sourcing regions or major markets, present another substantial threat. Trade disputes and the potential for increased tariffs, as seen in various international trade negotiations in 2023 and early 2024, could directly impact BAIC's cost of production and the competitiveness of its vehicles in international markets, potentially hindering its ambitious global expansion strategies.

The automotive sector, particularly in new energy vehicles (NEVs) and intelligent driving systems, is a hotbed of rapid technological change. This means companies like BAIC Motor must pour significant resources into research and development just to stay relevant. For instance, the global automotive R&D spending reached an estimated $200 billion in 2024, highlighting the intense pressure to innovate.

Failing to keep pace with these advancements, such as the integration of AI in vehicle systems or next-generation battery technology, can quickly render a company's offerings outdated. This technological obsolescence poses a direct threat, potentially eroding market share and profitability if BAIC Motor cannot adapt its product pipeline swiftly and effectively.

Economic Slowdown and Shifting Consumer Preferences

Economic uncertainties, both domestically and globally, pose a significant threat, potentially curbing consumer spending on major purchases like vehicles. For instance, in 2023, China's retail sales of consumer goods saw a growth of 7.1%, but the automotive sector's performance can be more volatile and sensitive to economic downturns.

Rapid shifts in consumer preferences present another challenge. A notable example is the recent slowdown in demand for hybrid vehicles in China. This trend necessitates agile product development and marketing strategies to adapt to evolving market tastes and technological adoption.

- Economic Headwinds: Global economic slowdowns can directly impact disposable income, leading to decreased demand for new vehicles.

- Shifting Consumer Tastes: A decline in hybrid vehicle sales in China highlights the need for BAIC Motor to monitor and respond quickly to evolving consumer preferences.

- Market Volatility: The automotive market is susceptible to economic cycles and rapid changes in consumer demand, requiring strategic flexibility.

Regulatory and Compliance Challenges in Diverse Markets

BAIC Motor faces significant hurdles due to the patchwork of regulations across its international operations. For instance, differing emissions standards in Europe versus China, alongside evolving safety mandates for electric and autonomous vehicles, necessitate constant adaptation and investment. A 2024 report indicated that compliance costs for automotive manufacturers operating in over 10 countries can increase overhead by as much as 15-20% due to varying legal and technical requirements.

Ensuring adherence to data privacy laws, especially concerning connected car technology, adds another layer of complexity. As of early 2025, countries like those in the EU are implementing stricter data localization and user consent protocols, which can impact the development and deployment of BAIC's smart vehicle features. This regulatory divergence directly affects product design and market entry strategies, potentially delaying launches and increasing R&D expenditure.

- Navigating diverse emissions standards: BAIC must comply with varying environmental regulations, such as Euro 7 in Europe and China VI in its home market, impacting powertrain development.

- Adapting to evolving safety mandates: Requirements for advanced driver-assistance systems (ADAS) and cybersecurity in new markets demand continuous technological upgrades.

- Meeting data privacy requirements: Strict data protection laws, like GDPR and similar frameworks emerging globally, necessitate careful management of user data collected by connected vehicles.

- Increased compliance costs: The need to meet these disparate regulations across multiple jurisdictions can add substantial operational expenses, estimated to be up to 20% higher for companies with a global footprint.

Intense competition within the Chinese auto market, characterized by aggressive pricing, poses a significant threat to BAIC Motor's profitability. The market saw 5.6% growth in 2023, reaching 21.69 million units, but this expansion was coupled with margin-eroding price wars. BAIC must navigate this challenging landscape to maintain its financial health.

BAIC Motor faces ongoing threats from supply chain disruptions, particularly concerning semiconductors, which impacted the industry heavily in prior years and could resurface. Geopolitical tensions and potential trade disputes also present risks, potentially increasing production costs and hindering international market competitiveness. These external factors demand strategic resilience and diversified sourcing.

Rapid technological advancements in areas like new energy vehicles and intelligent driving systems require substantial and continuous R&D investment. Failure to keep pace with innovations could lead to product obsolescence, impacting market share. Global automotive R&D spending was projected to reach $200 billion in 2024, underscoring the competitive pressure to innovate.

Economic uncertainties and shifts in consumer preferences, such as a recent slowdown in hybrid vehicle demand in China, create market volatility. BAIC must remain agile in its product development and marketing to adapt to these changing tastes and economic conditions, ensuring its offerings remain relevant and desirable.

SWOT Analysis Data Sources

This BAIC Motor SWOT analysis is built upon a foundation of credible data, including their official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a robust understanding of the company's performance and its operating environment.