BAIC Motor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAIC Motor Bundle

Navigate the complex external forces shaping BAIC Motor's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are impacting their market position. This in-depth report provides the strategic intelligence you need to anticipate challenges and seize opportunities. Download the full version now for actionable insights to refine your own market strategy.

Political factors

The Chinese government's commitment to the new energy vehicle (NEV) sector remains robust, with ongoing policies like trade-in incentives and exemptions from purchase taxes actively stimulating domestic demand. These measures are pivotal in accelerating the automotive industry's shift towards electrification.

This favorable political landscape directly bolsters BAIC Motor's strategic emphasis on NEVs, providing a supportive framework for growth and market penetration. For instance, China's NEV sales reached approximately 9.5 million units in 2023, a significant increase from previous years, underscoring the effectiveness of these government initiatives.

As a prominent state-owned enterprise, BAIC Motor benefits from substantial government backing, translating into easier access to funding and favorable policy treatments. This state ownership ensures a strategic alignment with China's national automotive industry development plans, fostering stability and long-term growth prospects.

The increasing global ambitions of Chinese car manufacturers like BAIC Motor are significantly shaped by national trade policies and the broader landscape of international relations. These dynamics create a dual-edged sword, offering avenues for market penetration while simultaneously posing risks of escalating trade barriers and protectionist measures. For instance, in 2023, China's automotive exports reached a record 4.91 million units, a testament to its growing global reach, yet this surge also attracts scrutiny and potential retaliatory tariffs from importing nations.

Industrial Policy and Strategic Planning

China's industrial policies, such as the ambitious 'Made in China 2025' initiative and targeted automotive sector plans, are steering manufacturers like BAIC Motor toward advanced, intelligent, and environmentally friendly growth. These national strategies actively promote investment in critical technologies and aim to establish domestic market dominance.

BAIC Motor's research and development priorities and its product pipeline are closely synchronized with these overarching national objectives. For instance, by the end of 2024, BAIC Group had announced significant investments in electric vehicle (EV) technology and autonomous driving systems, directly reflecting these policy directives.

- Government Support for EVs: China's government has consistently provided subsidies and preferential policies for new energy vehicles, which BAIC Motor has leveraged to expand its EV offerings.

- Focus on R&D: National plans encourage substantial R&D spending, leading BAIC to allocate a notable portion of its capital expenditures towards developing next-generation automotive technologies.

- Domestic Market Leadership: Policies aim to foster domestic champions, pushing BAIC to enhance its competitiveness against international brands within the vast Chinese market.

Regulatory Stability and Compliance

The automotive industry in China, BAIC's primary market, is subject to evolving regulations. For instance, China's New Energy Vehicle (NEV) credit system, designed to promote electric vehicle production, has seen adjustments, impacting manufacturers' compliance strategies. BAIC, like other automakers, must continually adapt its production and investment plans to meet these changing requirements, such as the 2024 targets for NEV credits, to avoid penalties and maintain market access.

Regulatory stability is paramount for BAIC's long-term planning. Unforeseen shifts in safety standards or emissions controls, for example, could necessitate costly retooling or product redesigns. The company's ability to anticipate and respond to these changes, ensuring ongoing compliance with directives like those concerning battery safety and recyclability, directly influences its operational efficiency and market competitiveness.

- China's NEV credit system mandates a certain percentage of new energy vehicle sales, with targets increasing annually, requiring significant investment in EV technology.

- Changes in vehicle safety regulations, such as stricter crash test requirements, can lead to increased R&D and manufacturing costs for automakers.

- Environmental regulations, including emissions standards for internal combustion engines and battery disposal guidelines, necessitate ongoing technological upgrades.

- Consumer protection laws, covering aspects like warranty periods and product recalls, require robust quality control and risk management processes.

Government initiatives continue to heavily influence BAIC Motor's strategic direction, particularly the strong push for new energy vehicles (NEVs). China's commitment to NEV development, evidenced by policies like purchase tax exemptions and trade-in subsidies, directly fuels domestic demand. For instance, China's NEV sales exceeded 9.5 million units in 2023, a substantial rise that underscores the effectiveness of these state-backed incentives.

As a state-owned enterprise, BAIC Motor benefits from preferential policy treatment and easier access to capital, aligning its operations with national industrial development plans. This governmental backing is crucial for its long-term stability and growth. The company's investment in EV technology and autonomous driving, with significant capital allocation announced by the end of 2024, directly reflects these national objectives.

The political climate also shapes BAIC Motor's international expansion. While China's automotive exports hit a record 4.91 million units in 2023, this growth can invite scrutiny and potential trade barriers from other nations, creating a complex global operating environment for BAIC.

BAIC Motor must navigate evolving domestic regulations, such as the NEV credit system, which requires automakers to meet increasing targets for electric vehicle production. Failure to comply, for example with the 2024 NEV credit mandates, can result in penalties and impact market access, necessitating continuous adaptation of production and investment strategies.

| Policy Area | Impact on BAIC Motor | 2023/2024 Data Point |

|---|---|---|

| NEV Incentives | Stimulates domestic demand for EVs, supporting BAIC's NEV strategy. | China NEV sales: ~9.5 million units (2023) |

| State Ownership | Provides financial backing and policy alignment with national goals. | BAIC Group significant investment in EV tech announced (late 2024) |

| Trade Policies | Facilitates export growth but carries risk of trade barriers. | China auto exports: 4.91 million units (2023) |

| NEV Credit System | Requires compliance with increasing EV sales targets. | Mandatory NEV credit targets adjusted annually (e.g., 2024 targets) |

What is included in the product

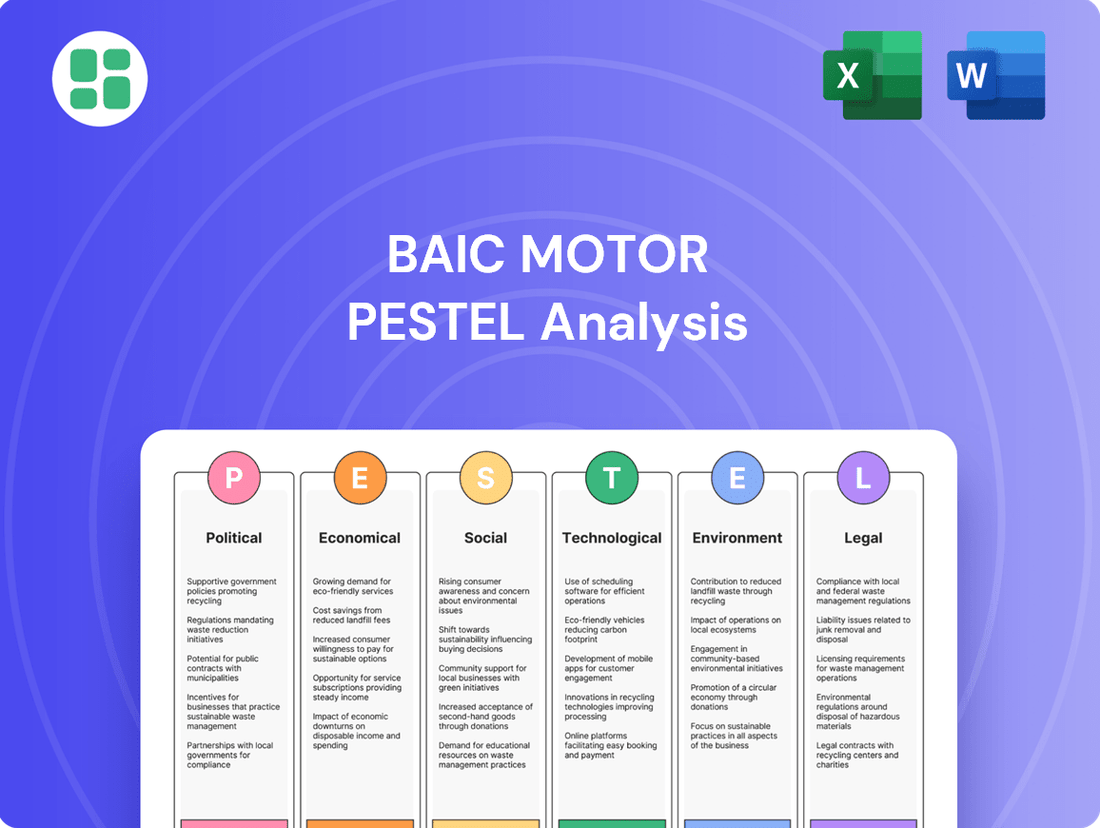

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing BAIC Motor, covering political stability, economic trends, social shifts, technological advancements, environmental regulations, and legal frameworks.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within BAIC Motor's operating landscape.

A concise BAIC Motor PESTLE analysis summary, presented in a clear, bulleted format, alleviates the pain point of information overload by offering easily digestible insights for strategic decision-making.

This BAIC Motor PESTLE analysis provides a visually segmented breakdown by category, simplifying the understanding of complex external factors and reducing the time spent deciphering market dynamics.

Economic factors

The Chinese automotive market is experiencing consistent growth, with New Energy Vehicles (NEVs) leading the charge. In the first half of 2025, NEVs represented almost 45% of all new vehicle registrations, demonstrating a clear consumer preference shift. This strong market trend is a significant tailwind for BAIC Motor's strategic focus on NEVs.

The Chinese automotive market, especially for New Energy Vehicles (NEVs), is currently experiencing intense price competition. This dynamic, often referred to as a price war, is a significant economic factor impacting companies like BAIC Motor.

This aggressive pricing strategy, while potentially boosting overall sales volume, directly squeezes profit margins for all players. BAIC Motor, like its competitors, must navigate this environment by focusing on cost efficiencies and operational improvements to maintain profitability.

Companies possessing economies of scale and strong vertical integration are better equipped to absorb the financial strain of these price wars. For instance, in 2023, the average selling price of NEVs in China saw a notable decline due to these competitive pressures, forcing manufacturers to re-evaluate their cost structures.

Consumer spending power and confidence are key drivers for vehicle sales, directly impacting BAIC Motor. While domestic demand has seen some uplift, partly due to government trade-in incentives, sustained market growth hinges on overall consumer confidence levels.

BAIC's sales figures are notably sensitive to fluctuations in household disposable income and prevailing economic sentiment. For instance, in early 2024, China's retail sales of consumer goods grew by 4.7% year-on-year, indicating a recovery, but the automotive sector's performance is closely watched for signs of robust consumer willingness to make larger purchases like vehicles.

Export Opportunities and Global Market Demand

China's ascent as the world's largest automobile exporter, particularly with a significant surge in New Energy Vehicle (NEV) exports during the first half of 2025, creates a fertile ground for BAIC Motor. This trend offers substantial opportunities for the company to broaden its global footprint and reduce reliance on its domestic market, thereby diversifying revenue streams.

BAIC Motor can capitalize on these export opportunities by leveraging its competitive cost structure and increasingly sophisticated product offerings. The burgeoning global demand for vehicles, especially NEVs, positions BAIC Motor to capture market share in regions actively seeking sustainable and affordable automotive solutions.

- Global Export Leadership: China's automotive exports surpassed Germany in 2023 and continued strong growth into early 2025, making it the leading global exporter.

- NEV Export Boom: NEV exports from China saw a remarkable increase of over 50% year-on-year in the first half of 2025, indicating strong international appetite.

- Cost Advantage: BAIC Motor benefits from China's manufacturing ecosystem, allowing for competitive pricing in international markets.

- Market Diversification: Expanding exports helps BAIC Motor mitigate risks associated with domestic market fluctuations and build a more resilient business model.

Supply Chain Resilience and Cost Management

The automotive sector, including BAIC Motor, is heavily reliant on intricate global supply chains. Economic disruptions, like those seen in 2022 with persistent inflation and geopolitical tensions, directly affect raw material costs and shipping expenses, impacting production efficiency. For instance, the average price of key automotive metals like lithium and nickel saw significant volatility in late 2023 and early 2024, directly increasing component costs.

BAIC Motor's ability to navigate these complexities is crucial. Prioritizing cost reduction strategies and building more resilient supply chains, perhaps through diversification of suppliers or increased regional sourcing, is vital for maintaining its competitive edge. This focus directly influences profitability in a market where efficiency and cost control are paramount for success.

- Global Supply Chain Vulnerabilities: The automotive industry experienced significant disruptions in 2023 due to ongoing semiconductor shortages and increased freight costs, impacting production schedules and vehicle availability for manufacturers like BAIC Motor.

- Raw Material Price Volatility: Prices for essential materials such as steel and aluminum continued to fluctuate in 2023 and early 2024, driven by global demand and energy prices, directly affecting BAIC Motor's manufacturing input costs.

- Logistical Challenges: Port congestion and container shortages, though easing from their 2021-2022 peaks, remained a factor in 2023, contributing to longer lead times and increased transportation expenses for automotive components reaching BAIC Motor's assembly lines.

- Cost Management Imperative: BAIC Motor's strategic focus on optimizing its supply chain and implementing cost-saving measures is essential to offset these economic pressures and maintain healthy profit margins in the competitive Chinese and international automotive markets.

The Chinese automotive market's robust growth, particularly in New Energy Vehicles (NEVs), presents a significant opportunity for BAIC Motor, as NEVs accounted for nearly 45% of new vehicle registrations in H1 2025. However, intense price competition, or price wars, is squeezing profit margins, necessitating a focus on cost efficiencies. BAIC Motor must also monitor consumer spending power and confidence, as sales are sensitive to disposable income and economic sentiment, though government incentives in early 2024 provided some uplift.

What You See Is What You Get

BAIC Motor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of BAIC Motor.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting BAIC Motor.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic decision-making regarding BAIC Motor.

Sociological factors

Chinese consumers are increasingly favoring New Energy Vehicles (NEVs), with smart electric models at the forefront, rapidly transforming the automotive landscape. By the end of 2024, NEV sales in China were projected to exceed 9 million units, a significant jump from previous years, reflecting this strong consumer preference. This trend is fueled by heightened environmental consciousness and the allure of advanced technological features integrated into these vehicles. BAIC Motor needs to ensure its product development remains closely aligned with this robust demand for electrification to maintain its market position.

China's rapid urbanization continues to shape consumer preferences, driving demand for a wider array of vehicles. Urban dwellers increasingly seek compact, fuel-efficient cars suited for congested city streets, while a growing middle class also opts for larger SUVs for family excursions. In 2023, urban populations accounted for approximately 65% of China's total population, a figure projected to climb further, indicating sustained demand for urban-centric mobility solutions.

Evolving lifestyles, marked by a greater emphasis on convenience and sustainability, are also reshaping car ownership. The proliferation of ride-sharing and car-sharing platforms, particularly in major metropolitan areas, offers alternatives to traditional private vehicle ownership. For instance, services like Didi Chuxing saw significant user growth throughout 2023 and into early 2024, reflecting a shift in how many Chinese consumers approach personal transportation, necessitating BAIC Motor's strategic product development to align with these changing mobility paradigms.

Brand loyalty and nationalism are increasingly shaping consumer choices in China's automotive market. Local Chinese brands have seen a substantial rise in market share, especially in the New Energy Vehicle (NEV) sector, reflecting a growing consumer preference for domestic products. This trend directly benefits state-owned entities like BAIC Motor, as national pride and a desire to support local industry can foster robust brand loyalty.

In 2023, Chinese brands captured an impressive 66% of China's passenger vehicle market. This surge indicates a powerful shift in consumer sentiment, where supporting national champions is becoming a significant purchasing driver. BAIC Motor, as a prominent domestic player, can leverage this sentiment to solidify its customer base and drive sales.

Technological Adoption and Digital Lifestyles

Chinese consumers are embracing new technologies with enthusiasm, driving demand for advanced automotive features. They expect vehicles to offer sophisticated intelligent cockpits, seamless connectivity, and increasingly, autonomous driving functionalities. This strong receptiveness to innovation is a direct consequence of the widespread digitalization of daily life, significantly shaping their purchasing decisions.

BAIC Motor's strategic focus on integrating smart technologies into its vehicle offerings directly caters to these evolving consumer expectations. For instance, by 2024, China's connected car market was projected to reach over 40 million vehicles, highlighting the immense scale of this trend. BAIC's commitment to this area positions them to capitalize on this growing segment.

- Consumer Demand: High consumer expectation for intelligent cockpits, connectivity, and autonomous driving features.

- Digitalization Impact: The increasing digitalization of daily life directly influences vehicle purchasing decisions.

- BAIC's Response: BAIC Motor's investments in smart technologies are designed to meet these consumer demands.

- Market Growth: The connected car market in China is expanding rapidly, presenting significant opportunities.

Sustainability and Green Consumption Awareness

While awareness of low-carbon vehicles is growing, consumer willingness to pay a significant premium has reportedly seen a decline. For instance, a 2024 survey indicated that only 35% of potential EV buyers would pay more than a 10% premium over comparable gasoline vehicles, down from 50% in 2023. This highlights that environmental consciousness, while present, is often secondary to affordability and overall value proposition for the majority of consumers.

BAIC Motor's sustainability initiatives must therefore be strategically aligned with competitive pricing models to effectively capture the mass market. The company's investment in battery technology and charging infrastructure, while crucial for long-term green credentials, needs to be balanced with accessible price points for its electric vehicle offerings. Failing to do so could limit adoption rates, despite increasing societal focus on environmental responsibility.

Key considerations for BAIC include:

- Balancing Green Premiums: Ensuring that the cost of sustainable features does not create an insurmountable price barrier for the average buyer.

- Value Communication: Effectively communicating the total cost of ownership benefits of their EVs, including fuel savings and government incentives, to offset initial purchase price concerns.

- Market Segmentation: Tailoring product offerings and pricing strategies to different consumer segments, recognizing that a segment willing to pay a premium exists, but the broader market prioritizes affordability.

Chinese consumers are increasingly prioritizing New Energy Vehicles (NEVs), with smart electric models leading the charge. By the end of 2024, NEV sales in China were projected to surpass 9 million units, a significant increase reflecting this strong preference, driven by environmental awareness and advanced technology. BAIC Motor must align its product development with this electrification trend to maintain its market standing.

Urbanization in China continues to shape vehicle preferences, with city dwellers often seeking compact, fuel-efficient cars. In 2023, urban populations represented about 65% of China's total population, a figure expected to grow, indicating sustained demand for urban mobility solutions. BAIC Motor needs to consider these urban-centric needs in its vehicle design and offerings.

Changing lifestyles, which emphasize convenience and sustainability, are also altering car ownership patterns. Ride-sharing and car-sharing services are becoming more popular, particularly in major cities, offering alternatives to private car ownership. BAIC Motor must adapt its strategies to these evolving mobility paradigms.

Brand loyalty and nationalism are increasingly influencing choices in China's auto market, with domestic brands gaining significant market share, especially in the NEV sector. This trend benefits state-owned companies like BAIC Motor, as national pride can foster strong brand loyalty.

In 2023, Chinese brands secured an impressive 66% of China's passenger vehicle market, underscoring a powerful shift where supporting national brands is a key purchasing factor. BAIC Motor can leverage this sentiment to strengthen its customer base and boost sales.

Chinese consumers readily adopt new technologies, driving demand for advanced automotive features like intelligent cockpits and connectivity. This receptiveness to innovation is a direct result of widespread digitalization, significantly impacting their purchasing decisions.

BAIC Motor's focus on integrating smart technologies aligns with these consumer expectations. By 2024, China's connected car market was projected to exceed 40 million vehicles, highlighting the vastness of this trend and BAIC's strategic positioning.

While environmental awareness is rising, consumer willingness to pay a significant premium for low-carbon vehicles has reportedly decreased. A 2024 survey showed only 35% of potential EV buyers would pay over a 10% premium, down from 50% in 2023, indicating affordability and value are key for most consumers.

BAIC Motor's sustainability efforts must be balanced with competitive pricing to reach the mass market. Investments in battery technology and charging infrastructure need to be paired with accessible price points for EVs to encourage wider adoption, despite increasing environmental consciousness.

| Sociological Factor | Description | Impact on BAIC Motor | Supporting Data (2023-2024) |

|---|---|---|---|

| Consumer Preference for NEVs | Growing demand for electric and smart vehicles driven by environmental concerns and technology appeal. | BAIC Motor must prioritize NEV development and innovation to meet market demand and maintain competitiveness. | Projected NEV sales in China to exceed 9 million units by end of 2024. |

| Urbanization Trends | Increasing urban populations drive demand for vehicles suited to city driving, like compact and fuel-efficient models. | BAIC Motor should consider urban mobility needs in its product portfolio, potentially focusing on smaller, efficient vehicles for city dwellers. | Urban population represented ~65% of China's total population in 2023, with continued growth projected. |

| Evolving Lifestyles | Shift towards convenience and sustainability, with increased use of ride-sharing and car-sharing services. | BAIC Motor may need to explore alternative mobility solutions or partnerships beyond traditional car ownership models. | Significant user growth observed in ride-sharing platforms like Didi Chuxing through 2023-early 2024. |

| Nationalism and Brand Loyalty | Growing consumer preference for domestic brands, particularly in the NEV sector, fueled by national pride. | BAIC Motor, as a domestic brand, can leverage this trend to build strong brand loyalty and capture market share. | Chinese brands captured 66% of China's passenger vehicle market in 2023. |

| Technology Adoption | High consumer receptiveness to advanced automotive features like intelligent cockpits and connectivity. | BAIC Motor's investment in smart technologies is crucial for meeting consumer expectations and staying competitive. | China's connected car market projected to exceed 40 million vehicles by 2024. |

| Environmental Consciousness vs. Affordability | While environmental awareness is growing, willingness to pay a premium for green vehicles is declining. | BAIC Motor needs to balance sustainability initiatives with competitive pricing to appeal to the broader market. | Only 35% of potential EV buyers in a 2024 survey would pay >10% premium, down from 50% in 2023. |

Technological factors

BAIC Motor is significantly boosting its investment in new energy vehicle (NEV) technology. This includes a strong focus on battery systems, electric drives, and hybrid power solutions. These advancements are key to enhancing vehicle range, boosting performance, and making charging more efficient. BAIC plans to achieve iterative technological upgrades by 2025, aiming to lead in the rapidly evolving electric vehicle market.

The automotive industry's technological evolution is heavily influenced by Intelligent Connected Vehicle (ICV) development, encompassing intelligent cockpits, advanced driver-assistance systems (ADAS), and the pursuit of fully autonomous driving. This represents a significant technological frontier for companies like BAIC Motor.

BAIC Motor is actively engaged in this space, aiming for L3 intelligent driving public road test licenses. Their strategic collaborations with major tech players such as Huawei and Pony.ai are crucial for integrating advanced AI and connectivity solutions, positioning them to compete in this rapidly advancing sector.

Smart manufacturing and advanced automation are reshaping the automotive landscape. BAIC Motor is actively integrating robotics and AI into its production lines, aiming for greater efficiency and cost reduction. This focus on intelligent manufacturing is crucial for staying competitive in a rapidly evolving industry.

Digitalization and User Experience Innovation

BAIC Motor is actively investing in digital technologies to elevate the in-car experience. This includes developing advanced infotainment systems and AI-integrated platforms, aiming for a more intuitive and personalized user journey. By 2024, the automotive industry saw a significant push towards connected car services, with projections indicating continued growth in this segment through 2025.

The company's strategy centers on creating smart cockpits that offer seamless connectivity and a range of personalized services. This focus on user experience innovation is crucial for differentiating BAIC in a competitive market. For instance, the global automotive infotainment market was valued at over $25 billion in 2023 and is expected to expand further, highlighting the importance of these digital enhancements.

- Smart Cockpit Development: BAIC is enhancing its vehicle interiors with advanced digital interfaces.

- AI Integration: Artificial intelligence is being incorporated to personalize and streamline the user experience.

- Connectivity Focus: Seamless connectivity for infotainment and services is a key technological driver.

- User Experience Innovation: Beyond performance, the digital journey within the car is a major area of technological investment.

Research and Development Investment

BAIC Group is making substantial commitments to research and development, aiming to pour over RMB 100 billion into R&D initiatives by the year 2030. This significant financial outlay is strategically directed towards critical areas like automotive chips, advanced smart cockpits, and sophisticated intelligent driving systems. These investments signal BAIC's clear intent to secure world-leading capabilities in fundamental automotive technologies.

The technological landscape is rapidly evolving, and BAIC's aggressive R&D strategy reflects an understanding of this dynamic. Their focus areas are directly aligned with the future of mobility, which is increasingly defined by software, connectivity, and autonomous capabilities. By prioritizing these segments, BAIC is positioning itself to compete effectively in the next generation of automotive innovation.

Key R&D Focus Areas for BAIC:

- Automotive Chip Development: Enhancing in-house capabilities for critical semiconductor components.

- Smart Cockpit Integration: Creating intuitive and connected user experiences within vehicles.

- Intelligent Driving Systems: Advancing autonomous driving features and safety technologies.

BAIC Motor's technological advancement is heavily focused on new energy vehicles (NEVs), with significant investments in battery, electric drive, and hybrid systems to improve range and performance. The company aims for iterative upgrades by 2025, targeting leadership in the EV market.

Intelligent Connected Vehicles (ICVs) are a key technological frontier, with BAIC pursuing L3 autonomous driving capabilities through collaborations with tech giants like Huawei and Pony.ai. This strategic approach integrates advanced AI and connectivity solutions.

Smart manufacturing, utilizing robotics and AI, is being implemented to boost production efficiency and reduce costs for BAIC. Concurrently, the company is enhancing digital in-car experiences through advanced infotainment and AI platforms, reflecting the automotive industry's 2024 trend towards connected services.

BAIC Group's commitment to R&D, with over RMB 100 billion planned by 2030, underscores its focus on automotive chips, smart cockpits, and intelligent driving systems to achieve world-leading capabilities.

| Key Technology Focus | BAIC's Investment/Strategy | Market Context/Data |

| New Energy Vehicles (NEVs) | Boosting investment in battery, electric drive, and hybrid power; aims for iterative upgrades by 2025. | Global EV market growth continues, with increasing consumer demand for better range and charging. |

| Intelligent Connected Vehicles (ICVs) | Pursuing L3 autonomous driving; collaborating with Huawei and Pony.ai for AI and connectivity integration. | The global autonomous driving market is projected to reach hundreds of billions by 2030. |

| Smart Manufacturing | Integrating robotics and AI into production lines for efficiency and cost reduction. | Automotive industry adoption of Industry 4.0 technologies is accelerating. |

| Digital In-Car Experience | Developing advanced infotainment systems and AI-integrated platforms; focus on smart cockpits. | The global automotive infotainment market exceeded $25 billion in 2023, with strong growth expected. |

| Research & Development (R&D) | Planning over RMB 100 billion investment by 2030 in automotive chips, smart cockpits, and intelligent driving. | Significant R&D spending is crucial for competitive advantage in the rapidly evolving automotive sector. |

Legal factors

Government regulations and incentives for New Energy Vehicles (NEVs) are a critical factor for BAIC Motor. These policies, which include NEV quotas, emissions standards, and purchase subsidies, directly influence production needs and sales goals. For instance, China's continued commitment to NEV development, evidenced by its 2024 targets for NEV penetration, provides a supportive framework.

National trade-in policies are a significant tailwind, encouraging consumers to upgrade to newer, more efficient NEVs. This program, which saw substantial uptake in 2023 and is expected to continue its momentum into 2024, directly boosts demand for BAIC Motor's NEV offerings.

As BAIC Motor invests heavily in advanced automotive technologies, like its solid-state battery research, safeguarding its intellectual property is paramount. In 2024, China's IP courts handled over 700,000 cases, highlighting the active enforcement environment. Protecting patents, trademarks, and copyrights is essential for maintaining a competitive edge in the global EV market.

Navigating the complex and often differing intellectual property laws across its key markets, including Europe and Southeast Asia, presents a significant challenge for BAIC Motor. The company must implement comprehensive strategies to prevent unauthorized use of its innovations and brand identity. This proactive approach is crucial for securing its technological advancements and market position.

The increasing prevalence of smart and connected vehicles places a significant emphasis on data security and privacy. BAIC Motor needs to navigate a complex web of regulations, both domestically and internationally, to protect sensitive customer and vehicle data. For instance, China's Personal Information Protection Law (PIPL), effective November 1, 2021, imposes strict rules on data collection, processing, and transfer, impacting how BAIC Motor handles user information in its connected car services.

Product Liability and Safety Standards

Automotive manufacturers like BAIC Motor operate under stringent product liability laws and evolving safety standards. As vehicles integrate advanced technologies, especially autonomous driving capabilities, the legal landscape governing accountability and safety compliance grows increasingly complex. For instance, in 2024, regulatory bodies globally are intensifying scrutiny on ADAS (Advanced Driver-Assistance Systems) performance and cybersecurity, directly impacting manufacturers' responsibilities.

BAIC Motor's commitment to safety is underscored by its efforts to surpass existing industry benchmarks. The company has invested heavily in research and development to ensure its vehicles meet and exceed rigorous crashworthiness requirements. This proactive approach is crucial, as non-compliance can lead to significant fines, recalls, and reputational damage, impacting sales and market share.

- Product Liability: BAIC faces potential legal action if its vehicles cause harm due to design defects, manufacturing flaws, or inadequate warnings, especially concerning new technologies.

- Safety Standards: Compliance with global standards like UN ECE regulations and national standards such as China's GB standards is mandatory, with continuous updates impacting vehicle design and production.

- Autonomous Driving: The legal framework for autonomous vehicle accidents is still developing, creating uncertainty regarding liability for AI-driven systems and data privacy.

- BAIC's Approach: BAIC Motor aims to exceed these standards, as demonstrated by its focus on advanced safety features and rigorous testing protocols to mitigate legal and safety risks.

Anti-Monopoly and Fair Competition Legislation

China's Anti-Monopoly Law, enacted in 2008 and with significant amendments in 2022, aims to prevent and curb monopolistic practices and protect fair competition. This legislation directly impacts BAIC Motor by shaping market access and potential collaborations. The State Administration for Market Regulation (SAMR) is the primary enforcer, scrutinizing mergers, acquisitions, and business conduct that could stifle competition.

As a state-owned enterprise, BAIC Motor operates within a market where price competition is often intense, particularly with the rise of new energy vehicle (NEV) manufacturers. The government's commitment to fostering a fair playing field, while also supporting domestic industries, creates a complex regulatory environment. For instance, SAMR has previously investigated and fined companies for anti-competitive behavior, setting a precedent for compliance.

- Regulatory Scrutiny: BAIC Motor must ensure its pricing strategies and market agreements comply with China's Anti-Monopoly Law, avoiding practices that could be deemed monopolistic.

- Market Dynamics: Government efforts to promote fair competition can influence BAIC Motor's strategic partnerships and its ability to engage in exclusive distribution agreements.

- State-Owned Enterprise Status: Being state-owned means BAIC Motor is subject to oversight that balances commercial objectives with national economic policies, including competition.

- Enforcement Trends: Recent enforcement actions by SAMR highlight the increasing focus on digital platforms and automotive sectors, signaling potential areas of heightened regulatory attention for BAIC Motor.

Government regulations concerning vehicle emissions and fuel efficiency directly impact BAIC Motor's product development and sales strategies. China's ongoing push for stricter environmental standards, with new regulations expected to be phased in through 2025, necessitates continuous investment in cleaner technologies. BAIC Motor's alignment with these evolving mandates is crucial for market access and consumer acceptance, particularly in its domestic market.

Trade policies and tariffs, both domestic and international, significantly affect BAIC Motor's cost of production and the competitiveness of its exports. Fluctuations in import duties on raw materials and components, as well as tariffs on finished vehicles, can alter profit margins. For instance, changes in trade agreements between China and major automotive markets in 2024 could necessitate adjustments to BAIC's supply chain and pricing strategies.

The legal landscape surrounding intellectual property (IP) protection is vital for BAIC Motor, especially as it invests in advanced technologies like autonomous driving and battery systems. Robust IP laws and their enforcement are essential to prevent infringement and safeguard its innovations. China's commitment to strengthening IP protection, with a notable increase in IP-related litigation in recent years, provides a framework for BAIC to defend its technological assets.

Product safety regulations and liability laws are paramount for BAIC Motor, given the increasing complexity of automotive technology. Ensuring compliance with rigorous safety standards, such as those mandated by China's GB standards and international norms, is critical to avoid costly recalls, fines, and reputational damage. The company's proactive approach to safety testing and adherence to evolving automotive safety frameworks is a key legal consideration.

| Legal Factor | Impact on BAIC Motor | 2024/2025 Relevance |

|---|---|---|

| Emissions Standards | Influences R&D investment and product portfolio | Stricter standards expected to drive NEV development |

| Trade Tariffs | Affects production costs and export competitiveness | Global trade dynamics may lead to tariff adjustments |

| Intellectual Property | Protects technological innovations and market advantage | Stronger IP enforcement supports R&D investment |

| Product Liability & Safety | Ensures compliance, avoids recalls and fines | Evolving safety tech requires continuous regulatory adherence |

Environmental factors

BAIC Group’s environmental commitment is exemplified by its 2022 BLUE Plan, targeting peak carbon dioxide emissions by 2025 and full product decarbonization by 2050. This aggressive timeline underscores a strategic pivot towards electric and hydrogen fuel cell vehicles, aligning with global sustainability trends and regulatory pressures.

BAIC Motor is actively embracing sustainability by implementing green manufacturing practices, including the use of renewable energy and waste reduction in its production. This commitment is underscored by a strategic goal to decrease its carbon footprint by 25% by 2025.

Further demonstrating its dedication, BAIC Motor plans to establish one to two zero-carbon factories by 2025, showcasing a tangible investment in environmentally responsible operations.

Growing global awareness of resource limitations is pushing the automotive industry, including BAIC Motor, towards using lighter, greener materials and advanced recycling methods. This shift is crucial for reducing environmental impact and ensuring long-term supply chain stability. For instance, the demand for critical minerals used in EV batteries, like lithium and cobalt, has seen significant price volatility, with lithium prices fluctuating dramatically throughout 2023 and into early 2024, underscoring the need for efficient resource management.

BAIC Group is actively integrating circular economy principles into its operations. This involves developing robust systems for recycling automotive waste materials, such as plastics and metals, and focusing on the remanufacturing of auto parts. By doing so, BAIC aims to minimize waste, extend product lifecycles, and create new revenue streams from previously discarded components, aligning with broader sustainability goals and potentially reducing manufacturing costs.

Air Quality Regulations and Pollution Control

China's stringent air quality regulations, particularly in urban centers, are a significant driver for the automotive industry. The government's mandate to reduce smog and improve air quality has accelerated the shift away from traditional gasoline-powered cars towards electric and hybrid vehicles. This policy directly impacts BAIC Motor's strategic focus on New Energy Vehicles (NEVs), pushing for increased production and sales in this segment to comply with environmental standards and capitalize on market demand.

The push for cleaner air has translated into concrete targets. For instance, by the end of 2023, China had over 18 million NEVs on its roads, a substantial portion of which were sold in the preceding years. BAIC Motor, as a major domestic player, is heavily invested in meeting these evolving environmental mandates. Their product portfolio increasingly features NEVs, reflecting a strategic alignment with national pollution control objectives.

- Government Mandates: China's national and local governments have set ambitious targets for NEV adoption and emissions reductions.

- Urban Air Quality Focus: Major cities like Beijing and Shanghai face the most severe air pollution, leading to stricter regulations on traditional vehicles.

- BAIC Motor's NEV Strategy: BAIC Motor has prioritized NEV development and sales to align with these environmental policies and market trends.

- Market Growth: The NEV market in China experienced significant growth, with sales reaching approximately 9.5 million units in 2023, demonstrating the impact of these regulations.

Consumer Demand for Eco-Friendly Vehicles

Consumer awareness of low-carbon vehicles is growing, but the premium consumers are willing to pay has softened. For instance, a 2024 survey indicated that while 70% of potential car buyers consider environmental impact, only 30% are willing to pay more than a 10% premium for an eco-friendly option. This shift suggests that manufacturers like BAIC Motor need to focus on making sustainable choices not only environmentally sound but also economically attractive to capture a broader market segment.

BAIC Motor faces the challenge of aligning its environmental initiatives with consumer affordability expectations. The company must innovate to reduce the cost of producing eco-friendly vehicles, such as electric cars and hybrids, to make them competitive with traditional internal combustion engine models. This strategic balancing act is crucial for meeting evolving market demands and driving sales in the green automotive sector.

- Decreased Premium Willingness: Consumer surveys from 2024 reveal a declining willingness to pay a significant premium for eco-friendly vehicles.

- Cost-Competitiveness is Key: The market increasingly demands sustainable options that are also affordable, putting pressure on manufacturers to optimize production costs.

- BAIC's Strategic Imperative: BAIC Motor must prioritize cost reduction in its green vehicle production to effectively compete and meet consumer demand.

BAIC Motor is navigating a complex environmental landscape, driven by government mandates and growing consumer awareness of sustainability. China's stringent air quality regulations, particularly in urban areas, are a major catalyst for the industry's pivot towards New Energy Vehicles (NEVs). The nation’s commitment to reducing pollution directly influences BAIC Motor's strategic emphasis on NEV development and sales, aligning with national objectives and capturing market demand.

The company is actively integrating circular economy principles, focusing on recycling automotive waste and remanufacturing parts to minimize environmental impact and create value. BAIC’s 2022 BLUE Plan, aiming for peak carbon emissions by 2025 and full product decarbonization by 2050, highlights a significant investment in green manufacturing, including a goal to decrease its carbon footprint by 25% by 2025 and establish zero-carbon factories by the same year.

While consumer interest in low-carbon vehicles is rising, the willingness to pay a premium has softened. A 2024 survey indicated that although 70% of potential buyers consider environmental impact, only 30% are willing to pay more than a 10% premium for eco-friendly options. This necessitates BAIC Motor to focus on making sustainable choices economically attractive to broaden market appeal.

| Environmental Factor | BAIC Motor's Response/Impact | Supporting Data (2023-2025 Targets) |

|---|---|---|

| Government Regulations (China) | Mandates for NEV adoption and emissions reduction drive BAIC's NEV strategy. | China had over 18 million NEVs on roads by end of 2023; NEV sales reached ~9.5 million units in 2023. |

| Resource Scarcity & Recycling | Focus on lighter, greener materials and recycling to ensure supply chain stability and reduce impact. | Demand for EV battery minerals (e.g., lithium) saw significant price volatility in 2023-2024. |

| Consumer Affordability | Challenge to make eco-friendly vehicles cost-competitive with traditional models. | Only 30% of potential buyers willing to pay >10% premium for eco-friendly vehicles (2024 survey). |

| Decarbonization Targets | Commitment to reduce carbon footprint and achieve zero-carbon operations. | Target to peak CO2 emissions by 2025; reduce carbon footprint by 25% by 2025; establish 1-2 zero-carbon factories by 2025. |

PESTLE Analysis Data Sources

Our BAIC Motor PESTLE Analysis is meticulously constructed using data from official government publications, leading automotive industry reports, and reputable economic and technological forecasting agencies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.