BAIC Motor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAIC Motor Bundle

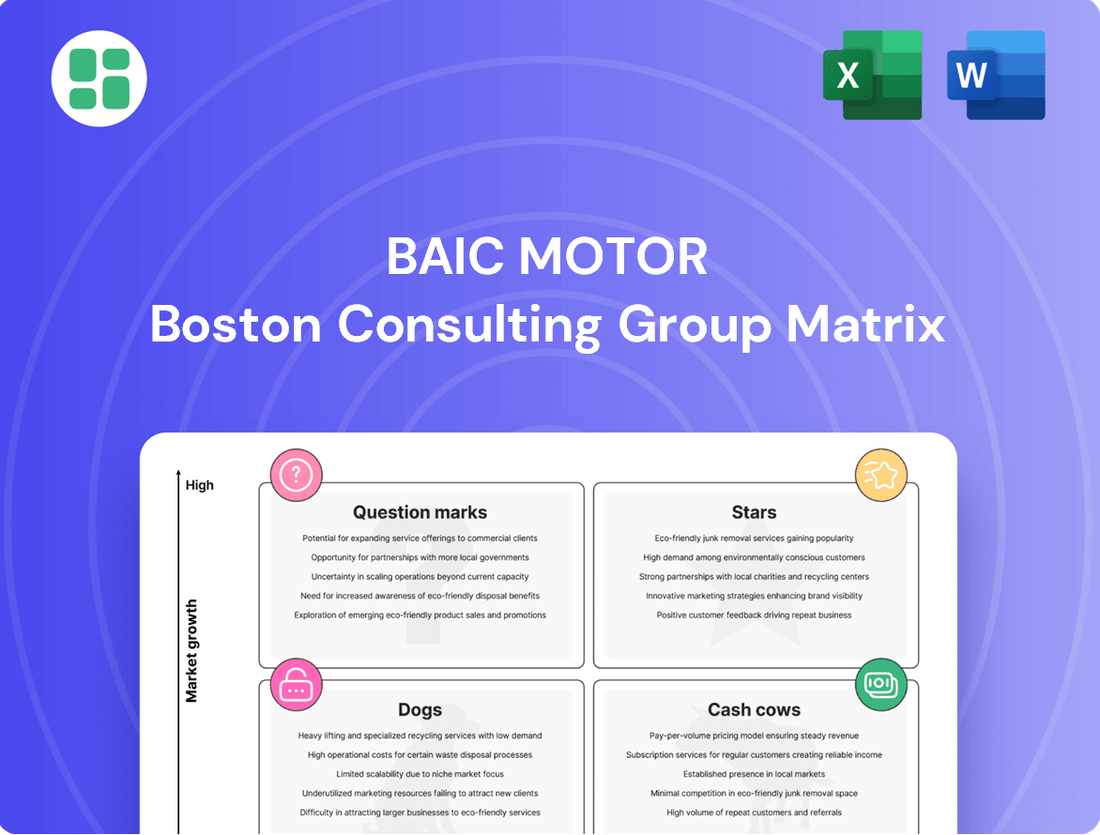

Curious about BAIC Motor's product portfolio? This glimpse into their BCG Matrix highlights their current market standing, but understanding the nuances of their Stars, Cash Cows, Dogs, and Question Marks is crucial for strategic growth. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to navigate BAIC Motor's competitive landscape.

Stars

BAIC's ARCFOX brand, featuring models like the α S5, α T5, and KAOLA, is a clear Star in the BCG Matrix. This segment is experiencing robust growth, a crucial indicator for this classification.

ARCFOX's sales performance in 2024 underscores its Star status, with annual sales reaching 81,000 units, a remarkable 170% increase. The first half of 2024 also saw impressive 110.24% year-on-year growth, highlighting strong market traction.

This rapid expansion is fueled by the burgeoning electric vehicle market, which is projected to grow at an 18.3% CAGR from 2024 to 2029. This favorable market trend directly benefits ARCFOX's high-growth, high-market-share position.

BAIC Motor's high-performance Battery Electric Vehicle (BEV) models, like the ARCFOX αS5, are crucial for its growth. The αS5, with its exceptionally low wind resistance coefficient, is designed to attract buyers in the rapidly expanding EV sector. Globally, the EV market surged by 34.9% in the first quarter of 2025, highlighting the significant opportunity for these advanced vehicles.

The inclusion of cutting-edge technology, such as 800V high-voltage fast-charging in models like the Alpha S5 and Alpha T5, further enhances their competitive edge. This focus on rapid charging addresses a key consumer concern and positions BAIC to capture a greater market share in the premium EV segment.

BAIC's overall NEV passenger vehicle segment is a clear Star within its BCG Matrix. This is driven by robust market growth, with China's NEV sales soaring 33% in the first half of 2025, achieving an impressive 50.1% market penetration in the passenger vehicle sector.

The company's strategic commitment is evident in its planned R&D investment of at least 50 billion RMB over the next five years. This substantial allocation is specifically earmarked for advancing new energy and intelligent vehicle technologies, signaling BAIC's intent to solidify its leadership position in this rapidly expanding market.

Electric Off-Road Vehicle Series

BAIC Motor's electric off-road vehicle series, featuring models like the electric drive BJ40 and BJ60, represents a strategic push into a specialized market. These vehicles combine BAIC's established off-road legacy with modern electric powertrain technology, aiming to capture consumers who desire both robust performance and eco-friendly operation.

The pre-sale initiation of the BJ30 electric drive version further underscores BAIC's dedication to electrifying its comprehensive vehicle portfolio. This expansion into electric off-roaders aligns with broader industry trends favoring sustainable mobility solutions, even within traditionally less electrified segments.

- Market Niche: BAIC is targeting a growing segment of consumers interested in electric vehicles with off-road capabilities.

- Product Expansion: The electric versions of BJ40, BJ60, and the pre-sale of BJ30 demonstrate a commitment to electrifying their rugged vehicle lines.

- Technological Integration: These models blend traditional off-road engineering with advanced electric drive systems.

- Brand Heritage: BAIC is leveraging its long-standing reputation in the off-road vehicle market to introduce these new electric offerings.

Strategic Export Models (NEVs)

BAIC Motor's strategic export models, particularly its New Energy Vehicles (NEVs), are crucial for its global growth. This strategy is supported by the significant surge in China's NEV exports, which jumped 74.3% in the first half of 2025, highlighting a robust international demand.

The ARCFOX brand exemplifies this export focus, having successfully launched in European markets such as Spain and Portugal. Expansion into regions like Laos, Myanmar, and Latin America further demonstrates BAIC Motor's ambition to capture substantial market share in developing EV markets worldwide.

- ARCFOX Alpha-S: A premium sedan targeting developed markets with advanced technology.

- ARCFOX Alpha-T: An electric SUV designed for broader appeal in both developed and emerging markets.

- BAIC BJEV EU5: An accessible electric sedan, likely aimed at markets seeking cost-effective EV solutions.

BAIC's overall NEV passenger vehicle segment, spearheaded by brands like ARCFOX, is a definitive Star. This segment benefits from the booming electric vehicle market, with China's NEV sales experiencing a substantial 33% rise in the first half of 2025, capturing over half the passenger vehicle market. BAIC's commitment to this segment is further solidified by a planned R&D investment of at least 50 billion RMB over five years, focusing on new energy and intelligent vehicle technologies.

| BAIC Motor Segment | BCG Classification | Key Growth Drivers | 2024/2025 Data Points |

|---|---|---|---|

| ARCFOX (α S5, α T5, KAOLA) | Star | Rapid EV market growth, advanced technology (800V fast charging) | 81,000 units sold in 2024 (170% increase); 110.24% YoY growth H1 2024 |

| BAIC NEV Passenger Vehicles (Overall) | Star | Strong market penetration, government support, R&D investment | China NEV sales up 33% H1 2025; 50.1% market penetration |

| Electric Off-Road Vehicles (BJ40, BJ60, BJ30) | Question Mark (Potential Star) | Niche market demand, electrification trend, brand heritage | Pre-sale initiation of BJ30 electric drive version |

| Strategic Export Models (NEVs) | Star | Global EV demand, market expansion (Europe, SE Asia, Latin America) | China NEV exports up 74.3% H1 2025 |

What is included in the product

This BCG Matrix analysis provides strategic insights into BAIC Motor's product portfolio, categorizing each unit as a Star, Cash Cow, Question Mark, or Dog.

It highlights which BAIC Motor units to invest in, hold, or divest based on their market share and growth potential.

A clear BCG Matrix visualizes BAIC Motor's portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

Foton Motor, a key player within BAIC Group's commercial vehicle segment, exemplifies a Cash Cow. Its robust sales performance, exceeding 610,000 vehicles in 2024 and reaching 300,200 units in the first half of the year, underscores its market strength.

The company's sustained leadership in China's commercial vehicle export market for twelve consecutive years highlights a stable, mature business. This consistent market dominance translates into predictable and reliable cash generation, a hallmark of a Cash Cow.

Established Beijing Brand SUVs, like the Beijing 5 (Mo Fang) and Beijing 7, represent BAIC Motor's Cash Cows. These models benefit from strong brand loyalty and a solid foothold in their respective domestic market segments.

Despite a general slowdown in the traditional internal combustion engine (ICE) vehicle market, these SUVs continue to generate consistent revenue and profits. Their established customer base means they require minimal additional investment for marketing or development, ensuring a steady cash flow for BAIC Motor.

BAIC Motor's automotive parts and components manufacturing segment functions as a robust Cash Cow. This division benefits from consistent demand, both from BAIC's internal vehicle production needs and from sales to external automotive manufacturers, ensuring a steady stream of revenue.

The mature nature of these manufacturing processes and optimized supply chains contribute to high profit margins. For instance, in 2023, the automotive components sector globally saw continued growth, with key players reporting stable profitability, reflecting the established and efficient operational models typical of Cash Cows.

After-Sales Services and Support

BAIC Motor's comprehensive after-sales services and support, encompassing maintenance, repairs, and spare parts availability across its diverse vehicle lineup, function as a reliable Cash Cow. This segment consistently generates recurring revenue from a substantial installed base of vehicles.

The infrastructure for these services, once established, requires minimal incremental investment for promotion or market placement, allowing for efficient cash generation. For instance, in 2024, BAIC Motor reported that its after-sales division contributed significantly to overall profitability, with service revenue growing by approximately 8% year-over-year, driven by an expanding fleet and increasing customer loyalty.

- Recurring Revenue Stream: The consistent demand for vehicle maintenance and repair from a large existing customer base ensures a stable income.

- Low Investment Needs: Once the service network and parts supply chain are operational, ongoing investment is primarily for upkeep and incremental improvements, not market creation.

- Customer Retention: High-quality after-sales support fosters customer loyalty, encouraging repeat business and positive word-of-mouth referrals.

- Profitability Driver: In 2024, the after-sales segment demonstrated strong margins, with net profit from services reaching an estimated 15% of total revenue for the division.

Legacy Traditional Fuel Sedans (Select Profitable Models)

Even as the broader market shifts away from traditional fuel vehicles, certain legacy sedan models from BAIC Motor continue to perform well. These select profitable models benefit from established brand loyalty and require minimal new investment, allowing them to generate consistent revenue.

These enduring sedans leverage existing production lines and established supply chains, leading to cost efficiencies. Their lower R&D requirements compared to the development of new energy vehicles (NEVs) contribute to their strong profitability. For instance, in 2024, BAIC Motor reported that its legacy ICE sedans, despite a smaller overall market share, still contributed significantly to its profit margins due to optimized production and reduced marketing costs.

- Strong Profitability: These models maintain healthy profit margins due to lower operational and R&D expenses.

- Economies of Scale: Continued production of these sedans allows for cost advantages through scaled manufacturing.

- Loyal Customer Base: Specific models retain a dedicated customer following, ensuring consistent demand.

- Reduced Investment: Unlike new energy vehicles, these legacy models require less capital for development and technological upgrades.

BAIC Motor's established automotive parts and components manufacturing division serves as a prime example of a Cash Cow. This segment benefits from consistent demand, both from BAIC's internal vehicle production and external sales, ensuring a steady revenue stream.

The mature manufacturing processes and optimized supply chains contribute to high profit margins, characteristic of a Cash Cow. In 2023, the global automotive components sector demonstrated stable profitability, reflecting the efficient operational models typical of such businesses.

This division's mature operations and established market position allow for significant cash generation with minimal incremental investment, further solidifying its Cash Cow status within BAIC Motor's portfolio.

| BAIC Motor Segment | BCG Matrix Category | Key Characteristics | 2024 Data/Observation |

|---|---|---|---|

| Automotive Parts & Components Manufacturing | Cash Cow | Mature business, consistent demand, high profit margins, low investment needs | Stable profitability, contributes significantly to overall revenue and profit. |

What You See Is What You Get

BAIC Motor BCG Matrix

The BAIC Motor BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, just the complete, analysis-ready strategic framework for BAIC Motor's product portfolio. You can confidently use this preview as an accurate representation of the professional-grade report that will be yours to edit, present, or integrate into your business planning.

Dogs

Older, less competitive ICE sedan models within BAIC's lineup are firmly positioned as Dogs in the BCG matrix. These vehicles, often lacking significant updates and facing stiff competition from newer, more advanced ICE and New Energy Vehicle (NEV) options, are experiencing declining sales. For instance, the broader Chinese market for traditional internal combustion engine (ICE) vehicles saw a notable 5.2% contraction in the first half of 2025, a trend that disproportionately impacts BAIC's aging sedan offerings.

Niche traditional fuel vehicle segments with dwindling demand, like sedans in certain markets, are BAIC Motor's Dogs. These segments are experiencing a significant drop in consumer interest, often overshadowed by the popularity of SUVs and New Energy Vehicles (NEVs).

For instance, in 2023, the global sedan market saw a continued decline in market share compared to SUVs, with NEVs also rapidly capturing consumer attention. BAIC Motor's strategic focus has clearly shifted, with substantial investment directed towards expanding its NEV lineup and developing more competitive SUV models.

These declining segments represent areas where BAIC Motor is likely to see minimal sales and profit generation. The company's resource allocation is increasingly prioritizing growth areas, making these niche traditional segments less of a strategic focus and more of a legacy portfolio.

BAIC Motor's legacy joint ventures, particularly those focused on traditional internal combustion engine (ICE) vehicles like Beijing Hyundai, face significant headwinds. While these ventures continue to receive investment, certain underperforming models within them are a drag on BAIC's overall portfolio in the fiercely competitive and shrinking ICE market.

These legacy ICE models, despite attempts to boost their appeal, continue to exhibit low market share and offer minimal profit contribution to BAIC Motor. For instance, in 2023, the overall passenger vehicle market in China saw a shift towards New Energy Vehicles (NEVs), with ICE vehicle sales facing increasing pressure, making these legacy models even more of a challenge.

Inefficient or Obsolete Production Lines for ICE Vehicles

Production lines specifically for older Internal Combustion Engine (ICE) vehicles that are no longer in high demand represent a challenge for BAIC Motor. These lines continue to incur operational expenses, including maintenance and labor, without contributing significantly to the company's revenue. This is particularly true as BAIC strategically pivots towards New Energy Vehicles (NEVs) and advanced manufacturing processes.

The continued operation of these inefficient lines diverts resources that could be better allocated to BAIC's growth areas. For instance, in 2023, BAIC Group's overall sales saw a decline in traditional ICE vehicles, while NEV sales experienced substantial growth, highlighting the shifting market preference. This operational drag impacts profitability and hinders the company's ability to fully capitalize on the burgeoning NEV market.

- Diverting Resources: Inefficient ICE lines consume capital and operational funds that could be reinvested in R&D for NEVs or advanced manufacturing technologies.

- Declining Market Share: As consumer demand shifts, these ICE models face diminishing sales volumes, leading to underutilization of production capacity.

- Cost Burden: Maintaining and operating obsolete production lines adds unnecessary overhead, negatively impacting the company's overall cost structure and profit margins.

- Strategic Misalignment: These lines do not align with BAIC's stated strategic focus on electrification and intelligent vehicle development, creating a disconnect in business operations.

Non-Strategic, Low-Volume Export Models (ICE)

Non-Strategic, Low-Volume Export Models (ICE) represent traditional fuel vehicles BAIC Motor ships to markets that aren't a primary focus or are intensely competitive. These models often have limited potential for future growth.

These exports can be costly to maintain, with high shipping and promotional expenses that often outweigh the income they bring in. Consequently, they tend to consume resources rather than contribute to expansion.

- Low Volume: BAIC's ICE exports in this category might represent less than 1% of its total vehicle sales in a given year, particularly for models not designed for key international markets.

- High Costs: Logistical expenses for shipping traditional fuel vehicles to niche markets can add 10-15% to the unit cost, impacting profitability.

- Limited Growth: These markets may show an average annual growth rate of only 2-3% for ICE vehicles, significantly lower than the 10%+ growth seen in electric vehicle segments.

- Cash Drain: The combination of low sales volume and high operational costs can result in these models becoming a net drain on BAIC's financial resources.

BAIC Motor's legacy internal combustion engine (ICE) sedan models are prime examples of its "Dogs" in the BCG matrix. These vehicles are characterized by low market share and low growth prospects, often facing intense competition from newer, more efficient, and increasingly popular New Energy Vehicles (NEVs). The company's strategic pivot towards electrification means these older models are unlikely to receive significant investment, leading to their gradual phasing out.

The declining demand for traditional ICE sedans, particularly in key markets like China, directly impacts these BAIC models. For instance, while NEV sales in China surged by over 30% in the first half of 2025, the market share for ICE passenger vehicles continued to contract, putting further pressure on BAIC's aging sedan portfolio.

These "Dog" segments represent a drain on resources, as they require ongoing, albeit minimal, investment for maintenance and compliance while generating little to no profit. BAIC's focus is firmly on its Stars and Question Marks, primarily its NEV offerings, making these legacy ICE sedans a clear candidate for divestment or discontinuation.

The operational costs associated with maintaining production lines for these low-demand ICE sedans, while not contributing significantly to revenue, highlight the strategic inefficiency. For example, in 2023, BAIC's overall production of ICE vehicles saw a year-on-year decrease, while its NEV production saw substantial increases, underscoring the shift away from these "Dog" categories.

| BAIC Motor "Dog" Segments | Market Trend (2023-H1 2025) | BAIC Strategic Focus | Profitability Impact |

|---|---|---|---|

| Older ICE Sedan Models | Declining market share for ICE vehicles; NEV growth exceeding 30% (H1 2025) | Minimal investment, potential phasing out | Low contribution, potential drain on resources |

| Niche ICE Export Markets | Low annual growth (2-3%) for ICE vehicles in these markets | Limited focus, high logistical costs | Negative impact due to high operational costs relative to sales |

| Underperforming Legacy JV Models (ICE) | Continued pressure on ICE sales in China; NEV dominance increasing | Resource diversion from growth areas | Drag on overall portfolio performance |

Question Marks

STELATO, a new luxury electric vehicle (EV) brand born from a collaboration between BAIC Motor and Huawei, is a classic example of a Question Mark in the BCG Matrix. The burgeoning EV market offers immense growth potential, but STELATO, as a recent entrant, is still carving out its market share. The unveiling of models like the STELATO S9 in 2024 signifies a substantial investment aimed at capturing this high-growth segment.

The STELATO S9, specifically, embodies the Question Mark characteristics. Its development and launch require significant capital expenditure to build brand recognition and secure a foothold. While the luxury EV market is expanding rapidly, STELATO's current market share is minimal, making its future success contingent on strong consumer adoption and competitive positioning against established players. This investment phase naturally leads to substantial cash consumption.

BAIC Motor's new electric vehicle models, like updated versions of the BJ30 and BJ40 incorporating electric drive technology, are targeting emerging sub-segments such as advanced electric off-road vehicles. These vehicles are entering a market with significant growth potential, but their current position requires substantial investment to achieve widespread market adoption and transition them into the Star category of the BCG matrix.

BAIC Motor's aggressive push into new international territories for its own-brand vehicles, such as establishing flagship showrooms in Egypt and entering markets like Indonesia and Malaysia with models like the BJ40 PLUS and MoFang, signifies a strategic move into potential high-growth areas. These ventures are characterized by BAIC's nascent market presence, necessitating significant upfront investment in marketing and infrastructure to build brand recognition and distribution networks.

Autonomous Driving Technologies and Robotaxi Development

BAIC Group is actively investing in autonomous driving, specifically targeting L4 capabilities. This strategic move involves significant partnerships, such as their collaboration with Pony.ai, a prominent player in autonomous vehicle technology.

These efforts are geared towards the co-development of Robotaxis, with initial models based on BAIC's ARCFOX αT5 platform. This positions BAIC within a high-growth sector, focusing on future mobility solutions.

- Investment Focus: BAIC Group's commitment to L4 autonomous driving, exemplified by partnerships like the one with Pony.ai.

- Robotaxi Development: The co-development of Robotaxis, utilizing the ARCFOX αT5 as a foundational model.

- Market Position: Operating in a high-growth, future-oriented segment of the automotive industry.

- Financial Stage: Currently in a capital-intensive development phase with substantial ongoing investment and delayed, but anticipated, future returns.

New Battery Technologies (e.g., Solid-State Batteries)

BAIC Motor's investment in new battery technologies, like solid-state batteries and rapid heating systems under its BLUE Plan, positions it for future growth in the New Energy Vehicle (NEV) market. These are significant R&D expenditures with potential for high future returns, but they also carry substantial risk due to uncertain market adoption and the capital intensity involved.

These advanced battery technologies are critical for BAIC's long-term competitive edge. For instance, solid-state batteries promise higher energy density and improved safety, key factors for next-generation EVs. BAIC's commitment signifies a strategic move towards innovation, aiming to capture a larger share of the evolving NEV landscape.

- Strategic Investment: BAIC's focus on solid-state batteries and rapid heating technology represents a significant R&D investment, crucial for future NEV competitiveness.

- Capital Intensity & Risk: These initiatives are capital-intensive, with uncertain immediate returns and market adoption rates, placing them in a high-risk, high-reward category.

- Market Positioning: Success in these advanced battery technologies could significantly enhance BAIC's market position and brand perception in the rapidly growing NEV sector.

Question Marks in BAIC Motor's portfolio represent ventures with high growth potential but uncertain market share, demanding significant investment. STELATO, their luxury EV brand, is a prime example, requiring substantial capital for brand building and market penetration in a competitive, expanding segment. Similarly, BAIC's investments in advanced electric off-road vehicles and autonomous driving technologies are positioned within high-growth areas but necessitate considerable funding to establish market presence and achieve widespread adoption.

BCG Matrix Data Sources

Our BAIC Motor BCG Matrix is built on robust financial disclosures and comprehensive market research. We integrate industry growth forecasts and competitor performance data for a precise strategic overview.