BAE System SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAE System Bundle

BAE Systems, a global defense giant, boasts significant strengths in its technological innovation and established market presence, yet faces challenges from intense competition and evolving geopolitical landscapes. Understanding these dynamics is crucial for anyone looking to navigate the defense sector.

Want the full story behind BAE Systems' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BAE Systems boasts a formidable global market leadership, operating in over 40 countries. This extensive reach, coupled with a diverse portfolio covering air, land, naval, electronic systems, and cybersecurity, significantly reduces its dependence on any single market or project, as seen in its robust performance across various defense sectors.

The company's strategic positioning on key international defense programs, such as the F-35 fighter jet and the Eurofighter Typhoon, underscores its market dominance. In 2023, BAE Systems reported revenues of £23.2 billion, with its Electronic Systems segment alone showing significant growth, highlighting the strength derived from its diversified offerings.

BAE Systems benefits from a robust order backlog, reaching a record £77.8 billion by the end of 2024. This significant figure provides exceptional visibility into future revenue streams, offering a stable foundation for the company's financial performance.

The substantial pipeline of long-term defense programs ensures consistent operational activity and financial predictability. Major contract awards in 2024 for advanced defense systems and vehicles further solidify this strong demand outlook.

BAE Systems demonstrated impressive financial strength in 2024, achieving a 14% revenue surge and posting profits exceeding £3 billion before tax and interest. This robust performance highlights the company's effective operational management and market positioning.

Looking ahead to 2025, BAE Systems anticipates continued growth, projecting a 7-9% increase in sales and an 8-10% rise in underlying earnings. This optimistic forecast is largely driven by the global trend of increased defense spending, which BAE Systems is well-positioned to leverage.

Advanced Technological Expertise and Innovation Investment

BAE Systems' strength lies in its deep technological expertise and substantial investment in innovation across defense, aerospace, and security. The company is at the forefront of developing and integrating advanced technologies like artificial intelligence, autonomous systems, and electronic warfare, positioning it for future market demands. For instance, in 2023, BAE Systems reported a 9% increase in its research and development spending, reaching £1.8 billion, underscoring its commitment to technological leadership.

This focus on cutting-edge solutions is further amplified by strategic collaborations. BAE Systems actively partners with leading universities and technology innovators, accelerating the development and deployment of next-generation capabilities. This approach ensures the company remains competitive and can quickly adapt to evolving technological landscapes, particularly in areas like uncrewed systems and space-based technologies.

- Leading Technology Integration: BAE Systems excels in integrating AI, autonomy, and electronic warfare into its product lines.

- Significant R&D Investment: The company allocated approximately £1.8 billion to research and development in 2023, demonstrating a strong commitment to innovation.

- Strategic Partnerships: Collaborations with academic institutions and tech firms accelerate the adoption of new technologies.

- Future-Ready Solutions: Focus on uncrewed systems and space solutions aligns with anticipated future defense and security needs.

Skilled Workforce and Operational Excellence

BAE Systems' strength lies in its substantial and highly skilled global workforce, numbering around 107,000 individuals as of early 2024. This extensive human capital is crucial for developing and delivering sophisticated defense systems and technologies.

The company actively cultivates operational excellence, a commitment demonstrated through rigorous contracting discipline and ongoing strategic investments in both its employees and its advanced facilities. This dedication ensures the reliable provision of critical defense capabilities.

This focus on people and infrastructure directly supports BAE Systems' ability to consistently deliver cutting-edge technologies and positions it for sustained growth in the competitive defense sector.

- Global Workforce: Approximately 107,000 skilled employees worldwide.

- Operational Focus: Emphasis on contracting discipline and operational excellence.

- Investment Strategy: Continuous investment in employee development and facility upgrades.

- Capability Delivery: Consistent delivery of complex defense technologies.

BAE Systems commands a dominant position in the global defense market, operating in over 40 countries with a diverse product range spanning air, land, naval, electronic systems, and cybersecurity. This broad market presence and varied portfolio significantly reduce reliance on any single sector, as evidenced by its strong performance across multiple defense segments. The company's involvement in major international programs like the F-35 and Eurofighter Typhoon further solidifies its market leadership, with 2023 revenues reaching £23.2 billion.

A key strength is BAE Systems' substantial order backlog, which hit a record £77.8 billion by the end of 2024. This provides exceptional revenue visibility and a stable financial outlook, supported by ongoing contract awards for advanced defense systems and vehicles in 2024, ensuring consistent operational activity.

BAE Systems' technological prowess is a significant advantage, with substantial investments in innovation across defense, aerospace, and security. The company is a leader in integrating advanced technologies such as AI, autonomous systems, and electronic warfare, exemplified by a 9% increase in R&D spending to £1.8 billion in 2023. Strategic partnerships with universities and tech firms further accelerate the development of future-ready solutions like uncrewed and space-based systems.

The company's workforce of approximately 107,000 skilled employees globally is a critical asset for delivering complex defense technologies. BAE Systems' commitment to operational excellence, demonstrated through rigorous contracting and ongoing investments in its people and facilities, ensures the reliable provision of advanced capabilities and positions it for sustained growth.

| Metric | 2023 Value | 2024 Outlook | Key Strength Indicator |

|---|---|---|---|

| Revenue | £23.2 billion | Projected 7-9% sales increase | Market leadership and diverse portfolio |

| Order Backlog | £77.8 billion (end of 2024) | Continued growth | Exceptional revenue visibility and stability |

| R&D Investment | £1.8 billion (2023) | Ongoing commitment | Technological leadership and innovation |

| Workforce Size | ~107,000 (early 2024) | Stable | Skilled global talent for complex delivery |

What is included in the product

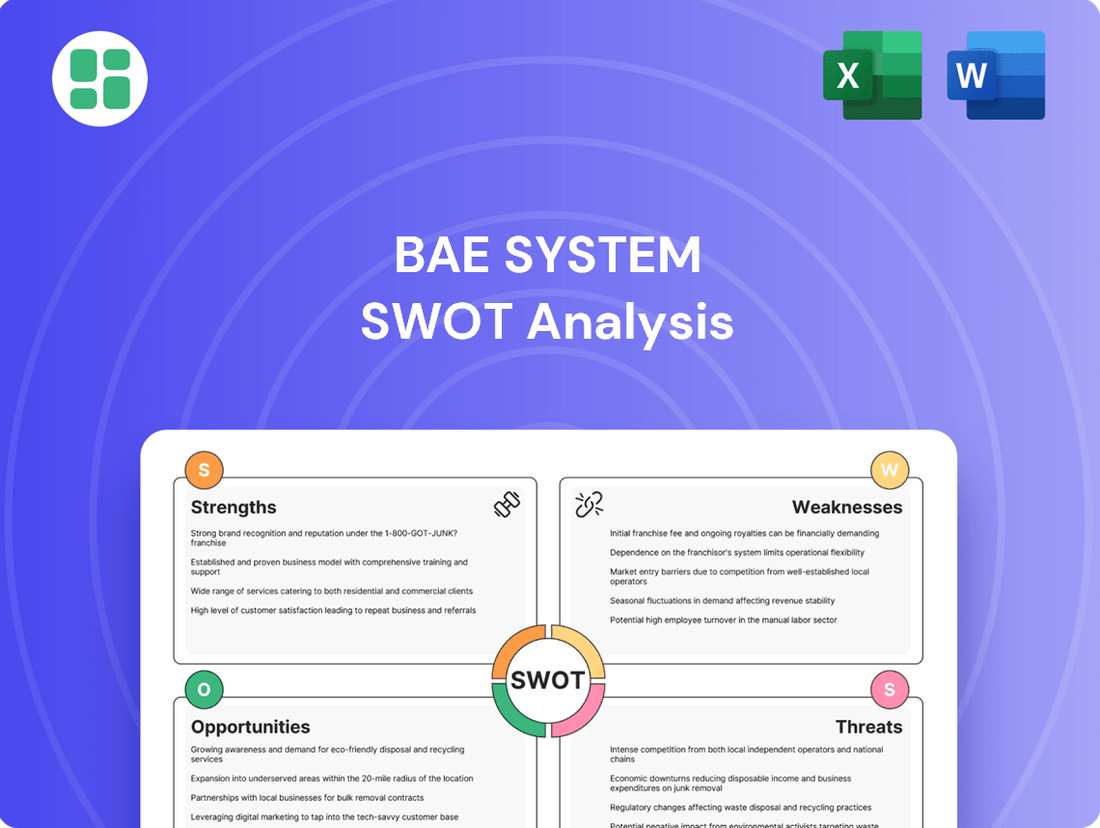

Delivers a strategic overview of BAE System’s internal and external business factors, highlighting its strong market position and technological capabilities while also considering competitive threats and potential market shifts.

Offers a clear visual representation of BAE Systems' strategic landscape, simplifying complex challenges into actionable insights.

Weaknesses

BAE Systems' significant reliance on government contracts, which accounted for around 92% of its revenue in recent reporting periods, presents a notable weakness. This heavy dependence exposes the company to the inherent volatility of political landscapes and shifts in national defense priorities. Changes in government spending or policy can directly impact BAE Systems' revenue streams, creating uncertainty.

BAE Systems navigates a labyrinth of international regulations, a significant weakness. Operating in over 40 countries means grappling with a constantly shifting patchwork of national laws, export controls, and ethical standards. Staying compliant across this diverse terrain is not only complex but also incurs substantial costs, with potential legal repercussions in various jurisdictions posing a direct risk to ongoing operations.

BAE Systems, as a leader in defense technology, handles highly sensitive data and operates complex, interconnected systems, making it a prime target for increasingly sophisticated cyberattacks. Despite its own advanced cybersecurity offerings, the company remains vulnerable to breaches that could compromise classified information, disrupt critical operations, or even impact national security. In 2023, the global cybersecurity market, which BAE Systems actively participates in, was valued at over $200 billion, highlighting the scale of the threat landscape.

Exposure to Long Product Cycles and High R&D Costs

BAE Systems faces challenges due to the extended timelines inherent in developing and manufacturing sophisticated defense equipment. These long product cycles mean significant capital remains invested for years before any revenue is realized, creating a substantial opportunity cost. The company's commitment to innovation necessitates high upfront research and development (R&D) spending, which can be a drain on financial resources. For instance, major platform developments like the Tempest future combat air system represent multi-billion-pound investments over decades.

The inherent risks associated with these lengthy projects, such as potential delays and budget overruns, can further impact financial performance. For example, in 2023, BAE Systems reported that its Electronic Systems segment saw revenue growth but also highlighted the ongoing investment in future capabilities. While essential for maintaining a competitive edge, these high operational costs associated with complex engineering and manufacturing processes can also put pressure on profit margins, especially if programs do not meet their projected financial targets.

- Long Product Cycles: Development of advanced defense systems can take 10-15 years or more from concept to full deployment.

- High R&D Investment: BAE Systems invested approximately £1.3 billion in R&D in 2023, a significant portion of which supports long-term programs.

- Capital Tie-up: Extended development periods mean substantial capital is locked into projects before revenue generation.

- Risk of Delays and Cost Overruns: Major defense programs are susceptible to unforeseen issues that can increase costs and push back delivery schedules.

Supply Chain and Geopolitical Volatility Impacts

BAE Systems' extensive global supply chain, while a strength, also presents a significant weakness. It's susceptible to disruptions from geopolitical tensions, trade disputes, and broader economic instability. For instance, in 2023, ongoing conflicts and trade policy shifts continued to create uncertainty in sourcing critical components, potentially impacting production timelines and cost structures.

These disruptions can manifest as delays in manufacturing and difficulties in meeting delivery schedules for key defense contracts. The unpredictable nature of international relations means BAE Systems must constantly adapt its sourcing strategies, which can introduce operational inefficiencies and increase overheads. The company's reliance on a complex network of international suppliers means that even localized issues can have cascading effects across its operations.

- Geopolitical Risks: Ongoing conflicts and trade policy shifts in 2023-2024 create persistent uncertainty in global supply chains.

- Production Delays: Disruptions can lead to extended lead times for critical components, impacting BAE Systems' ability to fulfill orders on schedule.

- Cost Increases: Supply chain volatility often results in higher raw material and logistics costs, squeezing profit margins.

BAE Systems faces the challenge of intense competition within the defense sector, particularly from state-backed enterprises and agile private firms. This rivalry can pressure pricing, limit market share expansion, and necessitate continuous innovation to maintain its leading position. The company's ability to secure new contracts is directly impacted by the competitive landscape, especially as defense budgets face scrutiny globally.

The company's significant reliance on a few major government customers, such as the UK and US, represents a concentration risk. While these relationships are strong, a downturn in spending or a shift in procurement strategies by these key clients could disproportionately affect BAE Systems' financial performance. For example, in 2023, the US Department of Defense remained a primary customer, underscoring this dependence.

BAE Systems' substantial workforce, numbering over 100,000 employees globally, presents a significant human capital challenge. Attracting, retaining, and developing specialized talent, especially in highly technical fields like AI and cybersecurity, is crucial but demanding. The cost of labor and the need for continuous training to keep pace with technological advancements add to operational expenses.

| Weakness | Description | Impact | 2023/2024 Data Point |

| Government Contract Reliance | High dependence on government spending (approx. 92% of revenue). | Vulnerability to political shifts and budget changes. | Revenue mix remained heavily skewed towards government contracts. |

| International Regulatory Complexity | Navigating diverse laws and export controls in over 40 countries. | Increased compliance costs and legal risks. | Ongoing efforts to manage compliance across multiple jurisdictions. |

| Cybersecurity Vulnerabilities | Target for sophisticated cyberattacks due to sensitive data. | Risk of data breaches, operational disruption, and national security impact. | Global cybersecurity market valued over $200 billion in 2023, indicating threat scale. |

| Long Product Cycles & High R&D | Extended development times for complex defense equipment. | Significant capital tie-up, opportunity cost, and R&D investment strain. | R&D investment around £1.3 billion in 2023. |

| Supply Chain Disruptions | Susceptibility to geopolitical tensions and trade disputes affecting global suppliers. | Production delays, cost increases, and operational inefficiencies. | Ongoing uncertainty in sourcing critical components due to global conflicts. |

Preview Before You Purchase

BAE System SWOT Analysis

This is the actual BAE Systems SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats, offering actionable insights for strategic planning.

Opportunities

Global defense spending is on a significant upward trajectory, driven by escalating geopolitical tensions and evolving security threats. For instance, NATO allies have pledged to increase defense investment, with many aiming for 2% of GDP, a commitment reinforced in recent years. This heightened focus on national security translates directly into increased demand for advanced defense capabilities.

This surge in military expenditure, particularly across Europe and the Asia-Pacific regions, presents a substantial opportunity for BAE Systems. The company's diverse portfolio, encompassing everything from combat vehicles and naval platforms to electronic warfare systems and cyber solutions, is well-positioned to capitalize on these expanding defense budgets. The projected global defense market size for 2024 is estimated to be in the hundreds of billions of dollars, offering a robust environment for growth.

The global defense market is witnessing a significant surge in demand for next-generation military technologies. This includes advancements in artificial intelligence (AI) for battlefield analysis, autonomous systems for reconnaissance and engagement, quantum sensing for enhanced detection, and sophisticated electronic warfare (EW) capabilities. For instance, the AI in defense market was projected to reach $18.2 billion by 2027, growing at a CAGR of 15.7%, according to a 2023 report by Mordor Intelligence.

BAE Systems is strategically positioned to benefit from this trend, having made substantial investments in research and development across these critical technology areas. The company's focus on integrating AI into its platforms, developing advanced unmanned aerial vehicles (UAVs), and enhancing its EW suites directly addresses the evolving needs of defense customers. In 2023, BAE Systems reported a 9% increase in its electronic systems business, driven by demand for advanced EW and cyber solutions.

This growing demand presents a clear opportunity for BAE Systems to develop and deploy cutting-edge solutions that meet the complex and rapidly changing threat landscapes faced by modern militaries. By leveraging its expertise in these emerging technologies, the company can secure new contracts and expand its market share, offering enhanced capabilities to its global customer base.

BAE Systems can leverage strategic partnerships to co-develop advanced defense technologies and expand its global reach. Collaborations with governments, academic institutions, and other industry leaders offer a pathway to share expertise and access cutting-edge innovations. For instance, its involvement in the Global Combat Air Programme (GCAP) alongside Italy and Japan exemplifies this strategy, aiming to create a next-generation fighter jet by 2035.

Engaging with innovation accelerators like MassChallenge provides BAE Systems with access to emerging technologies and disruptive business models. These partnerships allow for the pooling of resources and risk-sharing, fostering a dynamic environment for growth. Such alliances are crucial for staying ahead in the rapidly evolving defense sector, potentially leading to significant market penetration and long-term revenue streams.

Modernization of Existing Military Capabilities

Many countries are actively upgrading their military hardware, replacing older systems with advanced technology. This trend directly benefits BAE Systems, as it aligns with the company's core strengths in areas like combat aircraft, naval platforms, and nuclear deterrent systems. For instance, the UK's Dreadnought submarine program, a significant undertaking for BAE Systems, is expected to span decades, ensuring a steady stream of revenue.

These modernization efforts represent a substantial opportunity for BAE Systems, driven by global defense spending. In 2023, global military expenditure reached an estimated $2.44 trillion, a 6.8% increase in real terms from 2022, according to the Stockholm International Peace Research Institute (SIPRI). This sustained investment in defense capabilities creates a robust market for BAE Systems' offerings.

- Sustained Demand: Long-term modernization programs, such as the F-35 fighter jet program where BAE Systems plays a key role, offer predictable revenue streams.

- Technological Advancement: BAE Systems' expertise in advanced platforms like the Tempest future combat air system positions it to capture significant market share in next-generation defense.

- Global Reach: The company's ability to serve multiple international defense markets, including the US, UK, and Australia, diversifies its revenue base for modernization projects.

Expansion into Emerging Markets and Cybersecurity Solutions

BAE Systems has a significant opportunity to tap into emerging markets where defense budgets are expanding. For instance, countries in the Middle East and Asia are increasing their investment in advanced military technology, presenting BAE Systems with avenues for growth beyond its established customer base.

The escalating global threat landscape, particularly in cyber warfare, creates a robust demand for sophisticated cybersecurity solutions. BAE Systems can capitalize on this by offering its expertise in digital intelligence and secure communication systems, a sector projected for substantial expansion. In 2024, the global cybersecurity market was estimated to reach over $200 billion, with continued double-digit growth anticipated.

- Emerging Market Growth: Increased defense spending in regions like Asia-Pacific and the Middle East offers significant revenue potential.

- Cybersecurity Demand: The rising frequency and sophistication of cyberattacks fuel a strong need for advanced defense and intelligence solutions.

- Digital Intelligence Leverage: BAE Systems can apply its existing capabilities in digital intelligence to develop and market new cybersecurity offerings.

- Market Expansion: Diversifying into these growing sectors can mitigate risks associated with reliance on traditional defense markets.

The increasing global defense spending, projected to continue its upward trend through 2024 and beyond, provides a substantial tailwind for BAE Systems. Many nations are prioritizing military modernization, leading to robust demand for advanced platforms and systems. For example, the UK's commitment to modernizing its naval fleet and air capabilities, including the Dreadnought submarine program and the Tempest future combat air system, offers long-term, stable revenue opportunities.

BAE Systems is well-positioned to benefit from the growing demand for next-generation military technologies, particularly in areas like artificial intelligence, autonomous systems, and electronic warfare. The company's significant investments in R&D, evidenced by its strong performance in electronic systems in 2023, directly address these evolving needs. The global defense market's continued expansion, with total spending reaching an estimated $2.44 trillion in 2023 according to SIPRI, underscores the significant market potential.

Strategic partnerships and collaborations are key opportunities for BAE Systems to enhance its technological edge and market reach. Involvement in international programs like the Global Combat Air Programme (GCAP) with Italy and Japan showcases this approach, aiming to develop cutting-edge fighter jets. Furthermore, tapping into emerging markets with expanding defense budgets, such as those in the Middle East and Asia-Pacific, offers avenues for significant growth and diversification.

The escalating need for advanced cybersecurity solutions presents another major opportunity, driven by the increasing sophistication of cyber threats. BAE Systems can leverage its expertise in digital intelligence to develop and market new cybersecurity offerings, capitalizing on a market projected to exceed $200 billion in 2024. This diversification into cybersecurity strengthens its overall market position.

| Opportunity Area | Key Drivers | BAE Systems' Position | Market Data/Example |

|---|---|---|---|

| Global Defense Modernization | Geopolitical tensions, evolving threats | Strong portfolio in combat vehicles, naval, air systems | Global defense spending reached $2.44 trillion in 2023 (SIPRI) |

| Next-Gen Technologies | AI, autonomy, EW advancements | R&D investment, strong electronic systems growth | AI in defense market projected to reach $18.2 billion by 2027 (Mordor Intelligence) |

| Strategic Partnerships | Co-development, market access | GCAP program, innovation accelerators | Collaboration with Italy and Japan on Tempest fighter jet |

| Emerging Markets & Cybersecurity | Expanding budgets, cyber threats | Focus on Asia-Pacific, Middle East, digital intelligence | Cybersecurity market over $200 billion in 2024 |

Threats

The current geopolitical climate, marked by ongoing conflicts and rising global tensions, presents a dual-edged sword for BAE Systems. While these events often spur increased defense spending globally, they also introduce significant volatility. For instance, the ongoing conflict in Ukraine has led to a surge in defense budgets across NATO countries, with the UK increasing its defense spending to 2.3% of GDP in 2024, up from 2.2% in 2023, a trend that generally benefits defense contractors.

However, shifts in government foreign policies, such as changes in alliances or the outcomes of national elections, can rapidly alter defense procurement priorities. A change in administration in a key market, like the United States, could lead to a re-evaluation of existing contracts or a pivot in strategic focus, potentially impacting BAE Systems' long-term revenue streams and market access. This unpredictability directly affects the stability of major, multi-year defense contracts.

While defense budgets have seen increases, a significant threat to BAE Systems remains the potential for future government budget constraints or fiscal pressures. For instance, the UK's defense spending as a percentage of GDP has fluctuated, and any significant economic downturn could prompt a re-evaluation of these commitments, directly impacting BAE Systems' major revenue streams.

Economic downturns or shifts in national priorities can lead to contract cancellations or reduced order volumes for BAE Systems. This perennial concern for defense contractors means that BAE Systems must remain agile and adaptable to changing geopolitical landscapes and economic conditions to mitigate these risks.

BAE Systems operates within a defense sector characterized by fierce global competition. Major players like Lockheed Martin, Boeing, and Northrop Grumman consistently compete for significant government contracts, creating intense pressure on pricing and market share. This rivalry directly impacts BAE's ability to secure new business and maintain its profitability margins.

The landscape is further complicated by the emergence of specialized technology firms and potential new entrants who can disrupt established market segments with innovative solutions. For instance, advancements in areas like cyber security and artificial intelligence are creating new competitive fronts where BAE must prove its capabilities against agile, often more focused, competitors.

Rapid Technological Obsolescence and Disruption

The defense sector faces a significant threat from rapid technological obsolescence. Existing systems can become outdated quickly, necessitating substantial and ongoing research and development investments for BAE Systems. For instance, the increasing sophistication of cyber warfare capabilities and the rapid evolution of artificial intelligence in military applications mean that platforms developed even a few years ago may struggle to maintain relevance against emerging threats.

Failure to keep pace with or anticipate disruptive innovations from competitors, both established players and new entrants, poses a serious risk to BAE Systems' market position. Companies that successfully integrate advanced technologies like hypersonic missiles, directed-energy weapons, or AI-driven autonomous systems could gain a significant advantage. BAE Systems' commitment to R&D, which represented a substantial portion of its operating costs in recent years, is crucial for mitigating this threat.

- Defense spending priorities are shifting towards digital and AI capabilities, potentially leaving legacy platforms vulnerable.

- The pace of innovation in areas like quantum computing and advanced materials could render current defense technologies obsolete faster than anticipated.

- Competitors are investing heavily in emerging technologies, creating a constant need for BAE Systems to adapt or risk losing market share.

Public Scrutiny and Ethical Considerations

BAE Systems, as a major defense contractor, faces intense public scrutiny regarding its role in global conflicts and the ethical implications of its weaponry. This scrutiny can translate into reputational damage and impact its social license to operate.

Activism and growing calls for stricter arms control, particularly in light of recent geopolitical events, present a significant threat. For instance, in 2023, reports highlighted ongoing debates and protests concerning arms sales to regions experiencing conflict, directly impacting companies like BAE Systems.

Such public pressure can lead to several adverse outcomes:

- Increased regulatory oversight: Governments may impose more stringent export controls or operational restrictions.

- Investor divestment: Environment, Social, and Governance (ESG) focused investors may choose to pull their capital. For example, some pension funds have already divested from defense companies due to ethical concerns.

- Reputational damage: Negative media coverage and public campaigns can erode trust and make it harder to secure new contracts or attract talent.

BAE Systems faces intense competition from established global defense giants like Lockheed Martin and Boeing, as well as emerging tech firms, impacting its ability to secure contracts and maintain profitability. The rapid pace of technological advancement, particularly in AI and cyber warfare, poses a threat of obsolescence for current platforms, necessitating continuous, substantial R&D investment to stay competitive. Furthermore, increasing public scrutiny and ethical concerns surrounding defense operations, coupled with growing calls for arms control, can lead to reputational damage, stricter regulations, and potential investor divestment, as seen with ESG-focused funds divesting from defense companies.

SWOT Analysis Data Sources

This BAE Systems SWOT analysis is built on a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert analysis from reputable industry publications, ensuring a well-rounded and credible assessment.