BAE System Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAE System Bundle

Unlock the strategic core of BAE Systems with our comprehensive Business Model Canvas. This detailed breakdown reveals how they build value, manage resources, and achieve market dominance. Gain actionable insights for your own strategic planning.

Partnerships

BAE Systems maintains crucial relationships with governmental agencies and militaries across the globe, serving as a key provider of advanced defense systems. These partnerships are vital for securing substantial, long-term contracts, such as the ongoing support for the UK's Typhoon fighter jets, which represents a significant revenue stream.

These collaborations are built on trust and a deep understanding of national security needs, allowing BAE Systems to co-develop and deliver tailored solutions. For instance, their work with the US Department of Defense on various naval and land systems underscores the strategic importance of these governmental ties.

The company's ability to meet stringent national defense requirements, including cybersecurity and interoperability standards, solidifies its position as a preferred partner. In 2023, BAE Systems reported that over 70% of its revenue was derived from government contracts, highlighting the sheer scale of these essential alliances.

BAE Systems actively collaborates with a diverse range of technology firms, universities, and innovative startups. These partnerships are vital for BAE Systems to push the boundaries in critical fields such as artificial intelligence, autonomous systems, and advanced materials science. For instance, in 2024, BAE Systems announced a significant collaboration with the University of Manchester to explore novel materials for future aerospace applications, aiming to enhance aircraft performance and reduce weight.

These R&D collaborations are fundamental to BAE Systems' strategy of continuous innovation and maintaining a competitive edge in the rapidly evolving defense and security landscape. By integrating cutting-edge solutions, the company ensures its offerings remain at the forefront of addressing complex and emerging threats. A prime example of this is their ongoing work with various technology partners on developing next-generation combat aircraft and advanced uncrewed aerial vehicles, leveraging breakthroughs in areas like sensor fusion and secure communication.

BAE Systems cultivates a robust network of global supply chain vendors, essential for sourcing everything from raw materials to highly specialized components across its defense and aerospace sectors. These partnerships are critical for maintaining production continuity and cost-effectiveness in its complex manufacturing operations.

In 2024, BAE Systems continued to emphasize strategic vendor relationships to ensure the quality and timely delivery of its advanced systems, such as the Eurofighter Typhoon and its naval platforms. The company's commitment to a diverse supplier base also supports local economies in the numerous countries where it operates.

Joint Venture Partners

BAE Systems frequently enters into joint ventures for significant international defense projects, pooling capabilities with other major aerospace and defense firms. This approach is vital for managing the immense costs and technical complexities involved in developing advanced military platforms.

These strategic alliances allow for the distribution of financial burdens and the leveraging of specialized knowledge, thereby enhancing the competitive edge in global defense markets. For instance, BAE Systems is a key partner in the Global Combat Air Programme (GCAP) alongside Italy and Japan, aiming to develop a next-generation fighter jet.

- Global Combat Air Programme (GCAP): A collaborative effort with Italy and Japan to develop a future combat air system, showcasing the strategic importance of international partnerships in advanced defense technology.

- Risk Sharing: Joint ventures allow BAE Systems to share the substantial financial and technical risks associated with developing and producing large-scale defense systems, making ambitious projects more feasible.

- Expertise Leverage: Partnering with other industry leaders enables BAE Systems to access complementary skills, technologies, and manufacturing capabilities, leading to more robust and innovative solutions.

Academic and Research Institutions

BAE Systems actively partners with academic and research institutions to cultivate a robust pipeline of talent and drive fundamental research. These collaborations are crucial for staying at the forefront of technological innovation, particularly in areas like advanced materials, artificial intelligence, and cybersecurity. For instance, in 2023, BAE Systems announced a significant expansion of its partnership with the University of Manchester, focusing on quantum technology research, a sector projected to see substantial growth in the coming years.

The company's commitment extends to nurturing future engineers and scientists through various educational programs and sponsored labs. This strategic investment ensures a continuous supply of skilled professionals essential for BAE Systems' long-term growth and technological advancements. A prime example is their sponsorship of university apprenticeship programs, which directly contribute to developing a workforce equipped with the specialized skills required in the defense and aerospace industries. In 2024, BAE Systems aimed to onboard over 1,000 apprentices across the UK, many of whom will engage with partner universities.

- Talent Development: Collaborations with universities and research bodies are key for talent development, fundamental research, and fostering a pipeline of innovation.

- Innovation Pipeline: BAE Systems supports various educational programs and labs to nurture future engineering and scientific talent, ensuring a skilled workforce and contributing to long-term technological advancements.

- Apprenticeship Programs: This includes sponsoring university apprenticeship programs, a critical element in building the next generation of defense and aerospace experts.

BAE Systems' key partnerships are foundational to its operational success and strategic growth, particularly with governmental bodies and prime defense ministries worldwide. These alliances are critical for securing large-scale, multi-year contracts, such as the continued development and support for advanced naval platforms and combat aircraft. In 2023, BAE Systems reported that approximately 70% of its revenue was generated from government contracts, underscoring the vital nature of these relationships.

The company also actively engages with a broad spectrum of technology firms, research institutions, and innovative startups to drive advancements in critical areas like artificial intelligence, autonomous systems, and advanced materials. These collaborations are essential for BAE Systems to maintain its technological edge and develop next-generation defense capabilities, as seen in their 2024 joint research initiatives with universities on quantum computing applications.

Furthermore, BAE Systems leverages joint ventures with other major aerospace and defense companies for complex, high-cost international projects, such as the Global Combat Air Programme (GCAP) with Italy and Japan. This strategy allows for risk sharing and the pooling of specialized expertise, enabling the development of cutting-edge military hardware.

| Partner Type | Key Focus Areas | Examples/Impact |

|---|---|---|

| Governmental Agencies & Militaries | Defense Systems, National Security | Long-term contracts for fighter jets (e.g., Typhoon), naval systems, land systems. Over 70% of 2023 revenue from government contracts. |

| Technology Firms & Startups | AI, Autonomous Systems, Advanced Materials | Co-development of next-gen combat aircraft, uncrewed aerial vehicles. Collaboration with University of Manchester (2024) on aerospace materials. |

| Aerospace & Defense Companies | Joint Ventures for Large Projects | Global Combat Air Programme (GCAP) with Italy and Japan for future combat air system development. Risk sharing and expertise leverage. |

What is included in the product

A strategic overview of BAE Systems' business model, detailing its key customer segments, value propositions, and revenue streams within the defense and security sectors.

This model highlights BAE Systems' integrated approach to delivering complex technological solutions and services to governments and defense organizations globally.

The BAE Systems Business Model Canvas acts as a pain point reliever by providing a clear, structured overview of their complex defense and aerospace operations, simplifying strategic understanding for diverse stakeholders.

It alleviates the pain of information overload by condensing BAE's multifaceted business into a single, digestible page, facilitating efficient communication and decision-making.

Activities

BAE Systems’ core activities heavily feature Research and Development (R&D) to drive innovation in defense, aerospace, and security. This commitment ensures the company stays at the forefront of advanced technologies. For instance, significant investment is directed towards areas like electronic warfare, autonomous systems, and next-generation weapon technologies, crucial for adapting to dynamic global security challenges.

The company's R&D focus is strategically aligned with anticipating and addressing future threat landscapes. BAE Systems made a record investment in R&D during 2024, underscoring its dedication to developing cutting-edge solutions. This forward-looking approach is vital for maintaining a competitive edge and ensuring long-term growth in its specialized markets.

BAE Systems excels at complex systems integration, a core activity involving the seamless combination of numerous technologies and components into advanced defense platforms like fighter jets, warships, and tanks. This intricate process demands exceptional engineering prowess and rigorous project management to ensure the final product is both highly functional and dependable.

In 2024, BAE Systems continued to demonstrate this capability by securing significant contracts, such as the ongoing work on the Tempest future combat air system, a multinational program requiring the integration of cutting-edge technologies across air, cyber, and space domains. Their expertise ensures these complex systems operate cohesively, delivering superior operational effectiveness for their customers.

BAE Systems' core activities revolve around the high-tech manufacturing and production of a diverse portfolio of defense and security solutions. This encompasses the intricate assembly of complex platforms like fighter aircraft and naval vessels, alongside the development and production of sophisticated electronic systems and ordnance.

The company operates a network of advanced manufacturing facilities across the globe, ensuring a robust production capability. For instance, in 2024, BAE Systems continued its significant role in producing components for the F-35 fighter jet, a program that underpins a substantial portion of its aerospace revenue.

A key focus for BAE Systems is the ongoing modernization and digitalization of its manufacturing operations. These investments aim to boost production efficiency, improve product quality, and enhance workplace safety through the adoption of Industry 4.0 technologies and advanced automation.

Global Logistics and Support Services

BAE Systems' global logistics and support services are a cornerstone of its business, ensuring customers' complex defense equipment remains operational. This involves providing comprehensive through-life support, maintenance, and spare parts management. These services are crucial for maintaining the readiness and extending the lifespan of systems fielded by defense forces across the globe.

These critical activities translate into significant financial contributions. For instance, BAE Systems reported its Platforms & Services sector, which heavily includes these support functions, generated £10.7 billion in revenue for 2023. The long-term nature of these support contracts, often spanning decades, offers BAE Systems a predictable and stable revenue stream, underpinning its financial resilience.

- Through-life Support: BAE Systems offers end-to-end lifecycle management for its products, from initial deployment to eventual decommissioning.

- Maintenance and Repair: This includes scheduled maintenance, unscheduled repairs, and upgrades to ensure optimal performance.

- Logistics and Supply Chain: Managing the complex global supply chain for spare parts and equipment is a key function.

- Training and Technical Services: Providing expert training and technical assistance to customer personnel is also integral to these services.

Program Management and Consulting

BAE Systems excels in managing extensive, multi-year defense programs. These initiatives frequently involve numerous international partners and intricate specifications, demanding sophisticated coordination. For instance, in 2024, the company continued its significant role in the F-35 program, a multinational endeavor with complex supply chains and evolving technological requirements.

The company also provides specialized consulting services. These focus on critical areas such as defense planning, overarching security strategies, and the effective implementation of advanced technologies. This advisory capacity is crucial for clients seeking to accurately define their needs and ensure the successful execution of their most ambitious projects.

- Program Management: Overseeing large-scale, long-term defense projects with international collaboration.

- Consulting Services: Offering expertise in defense planning, security strategies, and technology integration.

- Customer Empowerment: Assisting clients in clearly defining requirements and achieving successful project outcomes.

BAE Systems' key activities encompass advanced R&D, complex systems integration, high-tech manufacturing, global logistics and support, and program management. These core functions are essential for delivering cutting-edge defense and aerospace solutions to a global clientele. The company's commitment to innovation and operational excellence underpins its market leadership.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Research & Development | Innovating in defense, aerospace, and security technologies. | Record R&D investment in 2024; focus on electronic warfare, autonomous systems. |

| Systems Integration | Combining diverse technologies into complex defense platforms. | Continued work on the Tempest future combat air system. |

| Manufacturing & Production | Producing defense platforms, electronic systems, and ordnance. | Significant role in F-35 fighter jet component production. |

| Logistics & Support | Providing through-life support, maintenance, and supply chain management. | Platforms & Services sector revenue was £10.7 billion in 2023. |

| Program Management & Consulting | Managing large defense programs and offering strategic advice. | Continued involvement in multinational programs like the F-35. |

Full Document Unlocks After Purchase

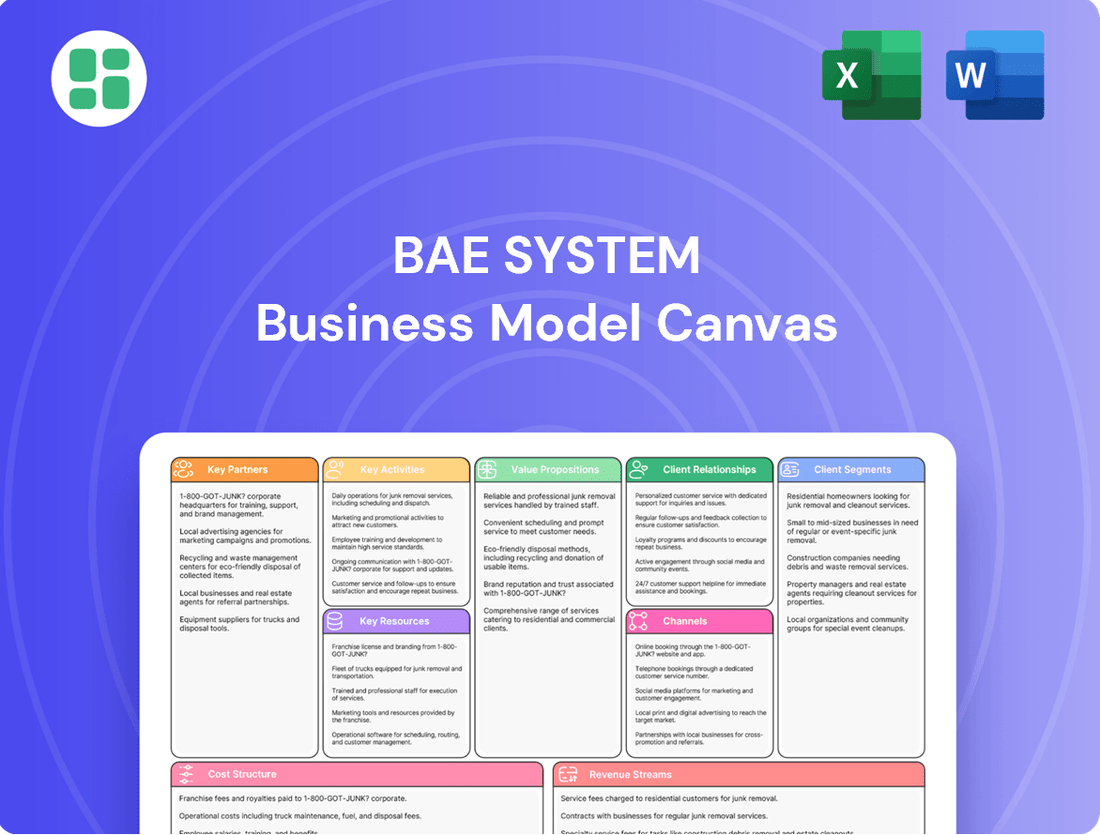

Business Model Canvas

The BAE Systems Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it represents the complete, ready-to-use analysis of BAE Systems' business model, ensuring full transparency and immediate utility for your strategic planning needs.

Resources

BAE Systems' most vital resource is its extensive global workforce, numbering around 107,000 dedicated individuals. This team comprises highly skilled engineers, scientists, technicians, and project managers who are the backbone of the company's operations.

The collective expertise of this workforce in intricate defense technologies, sophisticated systems integration, and cutting-edge advanced manufacturing is absolutely essential for BAE Systems to function and drive innovation forward.

To ensure its continued success, BAE Systems actively invests in developing its existing talent and attracting new professionals, including a strong focus on apprentices and recent graduates, thereby securing future capabilities.

BAE Systems' intellectual property, particularly its patents, is a cornerstone of its business model. These protected innovations, stemming from extensive research and development over many years, are vital for maintaining a competitive edge. For instance, the company holds numerous patents related to advanced combat aircraft technologies and sophisticated electronic warfare systems, ensuring its offerings remain at the forefront of defense capabilities.

BAE Systems operates a global network of advanced manufacturing facilities, including cutting-edge shipyards and specialized production lines. These are crucial for building complex defense systems like aircraft and naval vessels. For example, in 2023, the company continued significant investment in its shipbuilding capabilities, including the construction of new halls to enhance production capacity for its naval programs.

Global Supply Chain Network

BAE Systems relies on a vast and diversified global supply chain network as a fundamental resource. This network is essential for securing the critical components, raw materials, and specialized services needed to produce its advanced defense and aerospace systems. For instance, in 2024, BAE Systems continued to manage complex sourcing strategies across multiple continents to ensure the availability of everything from advanced electronics to specialized alloys.

This intricate web of suppliers allows BAE Systems to maintain consistent production schedules and fulfill its extensive contractual obligations worldwide. The company's commitment to a resilient supply chain was underscored by its efforts throughout 2024 to mitigate geopolitical risks and logistical disruptions, ensuring continuity of operations. This global reach provides significant operational flexibility.

- Component Sourcing: Access to a wide array of specialized electronic and mechanical components from various international suppliers.

- Material Procurement: Securing high-grade metals, composites, and other raw materials vital for manufacturing.

- Service Partnerships: Engaging with global partners for specialized testing, logistics, and maintenance services.

- Risk Mitigation: Diversifying suppliers to reduce reliance on any single region or entity, enhancing resilience against disruptions.

Strong Brand Reputation & Relationships

BAE Systems leverages a robust global brand reputation, a cornerstone of its success, built on decades of delivering reliable, technologically advanced solutions in defense and security. This reputation fosters trust among its key stakeholders.

The company cultivates and maintains deep, long-standing relationships with governments and armed forces across the globe. These relationships are critical, often translating into consistent repeat business and the formation of enduring strategic partnerships, a testament to their reliability.

These established connections and the trust they represent are invaluable intangible assets for BAE Systems. For instance, in 2023, BAE Systems secured a significant £3.5 billion contract for the next phase of the Dreadnought submarine program with the UK Ministry of Defence, highlighting the strength of these relationships.

- Global Trust: BAE Systems' brand is synonymous with trust and reliability in the demanding defense sector.

- Government Partnerships: Long-standing ties with national defense ministries ensure a stable customer base.

- Technological Leadership: A reputation for innovation and cutting-edge technology attracts and retains clients.

- Repeat Business: The strength of these relationships directly contributes to consistent revenue streams.

BAE Systems' financial resources, including substantial cash reserves and access to credit facilities, are fundamental to its operations and strategic growth initiatives. In 2023, the company reported revenues of approximately £25.2 billion, demonstrating its significant financial capacity. This financial strength enables continued investment in research and development, capital expenditures for advanced manufacturing, and strategic acquisitions.

The company's ability to secure large, long-term government contracts represents a critical financial resource, providing predictable revenue streams and underpinning its stability. For instance, BAE Systems secured a £3.5 billion contract for the Dreadnought submarine program in 2023, highlighting the value of these relationships.

BAE Systems' access to capital markets allows it to fund major projects and navigate economic fluctuations effectively. This financial agility is crucial for maintaining its position as a global leader in defense and aerospace.

| Financial Resource | 2023 Data (Approximate) | Significance |

|---|---|---|

| Revenue | £25.2 billion | Indicates operational scale and market penetration. |

| Contract Wins | £3.5 billion (Dreadnought program) | Secures future revenue and demonstrates client trust. |

| Access to Capital | Strong credit ratings and market access | Enables investment in R&D, infrastructure, and strategic growth. |

Value Propositions

BAE Systems delivers advanced, technology-driven defense solutions, equipping armed forces with superior capabilities to counter emerging threats. This focus includes breakthroughs in electronic warfare, autonomous systems, and advanced combat aircraft design.

The company's commitment to research and development is substantial, with BAE Systems investing billions annually to secure its technological advantage. For instance, in 2023, their R&D expenditure was a significant driver of their innovation pipeline.

BAE Systems' Integrated Security Solutions offer a comprehensive, multi-domain approach to safeguarding national security and critical infrastructure. These solutions blend hardware, software, and services, creating a holistic protection framework designed to tackle today's intricate security threats.

Customers deeply value BAE Systems' unwavering commitment to delivering highly reliable and mission-critical products. Their systems are designed to perform flawlessly in the most demanding defense environments, a crucial factor for operational success.

This dedication to quality is reinforced by rigorous testing protocols, ensuring BAE Systems' offerings consistently meet the stringent requirements of defense operations. For instance, in 2023, BAE Systems reported a strong order backlog, reflecting the sustained demand for their dependable defense solutions.

This consistent, high-level reliability is the bedrock upon which long-term trust is built with their global clientele. The company's track record in delivering complex, essential systems underpins its reputation as a trusted partner in national security.

Tailored Customer Solutions

BAE Systems excels at crafting highly customized solutions, meticulously designed to align with the unique operational requirements and strategic priorities of each government and armed force client. This bespoke approach ensures that defense systems are not just delivered, but optimized for specific mission sets and environments.

For instance, BAE Systems' recent contract wins, such as the significant agreement for advanced naval platforms in 2024, underscore their ability to adapt and deliver precisely what is needed, often involving intricate integration and specialized capabilities. This deep understanding of client needs is a cornerstone of their business model, enabling them to secure and execute complex, long-term defense projects.

- Customization: Solutions are tailored to meet the exact specifications and operational contexts of individual defense forces.

- Optimization: Clients receive systems specifically optimized for their unique defense needs and strategic priorities.

- Adaptability: The ability to modify and integrate systems ensures relevance across diverse and evolving defense landscapes.

- Contract Security: This bespoke approach is a critical factor in securing complex, high-value defense contracts.

Global Support & Sustainment

BAE Systems extends its value proposition far beyond the initial sale of defense platforms by offering comprehensive global support and sustainment services. This commitment ensures that critical assets remain operationally ready and effective throughout their entire lifecycle.

These through-life support services are crucial for maximizing the longevity and utility of defense equipment, providing customers with ongoing value and reliability. This focus on sustainment is a cornerstone of BAE Systems' customer relationships.

In 2023, BAE Systems reported that its Electronic Systems segment, which includes many sustainment-focused activities, generated revenues of $4.5 billion. This highlights the significant financial contribution of these long-term support offerings.

- Global Reach: BAE Systems operates a worldwide network of support facilities, enabling rapid response and maintenance for deployed assets.

- Through-Life Support: Services encompass everything from initial training and spares provision to complex maintenance, upgrades, and eventual decommissioning.

- Operational Readiness: The company's sustainment efforts directly contribute to maintaining high levels of operational readiness for customer forces.

- Long-Term Partnerships: This focus on support fosters enduring relationships with defense ministries, ensuring continued business and customer satisfaction.

BAE Systems' value proposition centers on delivering advanced, customized, and reliable defense solutions, backed by extensive global support. Their commitment to innovation ensures cutting-edge capabilities, while bespoke design meets specific client needs. This focus on quality and through-life support builds enduring trust and operational readiness.

Customer Relationships

BAE Systems cultivates long-term strategic alliances with key government and military clients, transforming customer interactions from simple transactions into deep, collaborative partnerships. This involves continuous engagement, shared strategic planning, and a mutual understanding of evolving defense needs, fostering sustained commitment and shared success.

BAE Systems leverages dedicated account management to cultivate robust partnerships with its most important clients. These teams offer tailored support, ensuring BAE Systems remains highly responsive to unique requirements.

This personalized approach is crucial for navigating the complexities of long-term, multi-year programs. It fosters clear communication channels and enables efficient problem resolution, ensuring client satisfaction and program success.

For instance, in 2024, BAE Systems continued to emphasize these relationships, particularly within its defense sector where contracts often span decades and involve intricate technical and logistical coordination.

BAE Systems places a strong emphasis on post-sale support and maintenance, offering comprehensive services throughout the entire lifecycle of its complex defense systems. This commitment is crucial for ensuring that customers maintain operational readiness and achieve long-term satisfaction with their investments. For example, in 2023, BAE Systems' Electronic Systems segment reported a significant portion of its revenue derived from services and support, reflecting the ongoing nature of these customer relationships.

This dedication to ongoing support frequently materializes as long-term service contracts, which not only guarantee continued operational capability for clients but also establish a stable, recurring revenue stream for BAE Systems. These contracts often encompass everything from routine maintenance and repairs to critical upgrades and training, fostering a deep and continuous partnership with their customer base.

Collaborative Development Programs

BAE Systems actively involves its customers in collaborative development programs, focusing on new technologies and defense systems. This co-creation strategy ensures that developed products directly address evolving operational needs and cultivates a shared sense of investment and commitment. For instance, the Global Combat Air Programme exemplifies this customer-centric approach to innovation.

This method not only refines product design but also strengthens customer loyalty by making them integral to the development lifecycle. By fostering these partnerships, BAE Systems can better anticipate future market demands and maintain a competitive edge. In 2024, BAE Systems continued to emphasize these collaborative efforts, with significant investments in joint research and development initiatives across multiple international defense projects.

- Customer-Centric Innovation BAE Systems prioritizes customer input in the development of new technologies and systems.

- Shared Ownership and Investment Collaborative programs foster a sense of mutual investment and commitment between BAE Systems and its clients.

- Meeting Evolving Requirements The co-creation approach ensures products are tailored to current and future operational needs.

- Global Combat Air Programme Example This initiative highlights BAE Systems' commitment to collaborative defense system development.

High-Level Government Engagement

BAE Systems cultivates deep relationships with high-level government entities, including defense ministries and policymakers, essential for navigating the complex defense landscape. This engagement is vital for aligning their offerings with national security strategies and influencing long-term procurement planning. In 2024, BAE Systems continued its active involvement in global defense dialogues, participating in key strategic reviews that shape future military capabilities.

Their interaction extends to defense attachés and international government representatives. This allows BAE Systems to gain insights into evolving geopolitical threats and customer needs, directly informing their product development and market focus. Such relationships are instrumental in securing substantial, multi-year contracts, which form the backbone of their revenue.

- Strategic Alignment: BAE Systems actively participates in government defense reviews to ensure its technological advancements and product roadmaps directly address national security priorities.

- Procurement Influence: High-level engagement allows BAE Systems to provide input on defense procurement specifications, increasing the likelihood of securing major contracts.

- Global Reach: Relationships with defense attachés and international government bodies facilitate understanding of diverse global defense requirements and opportunities.

- Contract Security: This sustained engagement is critical for maintaining a robust pipeline of major defense contracts, providing revenue stability and long-term visibility.

BAE Systems fosters enduring customer loyalty through comprehensive lifecycle support, ensuring clients maximize the value of their complex defense systems. This commitment translates into long-term service agreements and a significant portion of revenue, as seen in their Electronic Systems segment in 2023. These service contracts, covering maintenance, upgrades, and training, solidify partnerships and create predictable revenue streams.

Collaborative development programs are central to BAE Systems' customer relationships, ensuring products align with evolving defense needs. Initiatives like the Global Combat Air Programme exemplify this co-creation approach, fostering shared investment and commitment. In 2024, BAE Systems continued to invest heavily in joint R&D, reinforcing these client partnerships and anticipating future market demands.

BAE Systems actively engages with high-level government and defense officials to align its offerings with national security strategies and influence procurement. This strategic dialogue, including interactions with defense attachés, provides crucial insights into global threats and customer needs, underpinning their multi-year contract wins.

These deep relationships are critical for securing long-term contracts, providing revenue stability and market foresight. For example, BAE Systems’ sustained engagement in 2024 with key government stakeholders across multiple nations directly contributed to the pipeline of major defense programs.

| Customer Relationship Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Lifecycle Support | Comprehensive post-sale services, maintenance, and upgrades. | Electronic Systems revenue from services in 2023 highlights ongoing client commitment. |

| Collaborative Development | Involving customers in the design and enhancement of defense systems. | Global Combat Air Programme is a key example; continued R&D investment in 2024. |

| Strategic Government Engagement | Building relationships with ministries and policymakers for alignment. | Active participation in global defense dialogues in 2024 shapes future capabilities. |

| Geopolitical Insight | Engaging with defense attachés to understand evolving threats and needs. | Informs product development and secures multi-year contracts, crucial for revenue stability. |

Channels

BAE Systems predominantly employs direct sales channels, interacting directly with national governments and defense ministries for their procurement needs. This approach involves intricate bidding, negotiation, and contracting stages, all customized to align with specific national defense budgets and operational requirements.

These direct engagements are the primary avenue for securing substantial defense contracts, reflecting the specialized nature of BAE Systems' offerings and the critical relationships built with sovereign entities. For instance, BAE Systems secured a significant contract in early 2024 with the UK Ministry of Defence for the next phase of the Dreadnought submarine program, a clear example of this direct procurement model in action.

BAE Systems maintains a robust global presence with numerous international offices and subsidiaries strategically located in key markets. This network allows for direct customer engagement and a localized approach to business operations.

These regional entities are crucial for gathering market intelligence, tailoring sales strategies, and managing in-country operations. For instance, BAE Systems' presence in the United States, a major market, is significant, contributing substantially to its overall revenue. In 2023, the US accounted for approximately 45% of BAE Systems' total sales, highlighting the importance of its American subsidiaries.

This extensive global footprint ensures that BAE Systems can offer localized support and delivery of its products and services, adapting to the specific needs and regulatory environments of each region.

BAE Systems leverages major international defense and aerospace exhibitions, such as the Paris Air Show and Farnborough Airshow, as vital channels. These events are crucial for showcasing cutting-edge technologies and demonstrating capabilities to a global audience. In 2024, these shows continue to be pivotal for generating new business leads and fostering strategic partnerships.

Government-to-Government Sales

Government-to-Government Sales represent a critical channel for BAE Systems, often involving complex diplomatic and strategic engagements. These sales are typically embedded within larger defense cooperation frameworks between allied nations.

This channel is vital for facilitating large-scale defense procurements, where BAE Systems' offerings become integral to international security partnerships. For instance, recent Memoranda of Understanding (MoUs) signed for significant aircraft sales underscore the importance of these intergovernmental agreements in securing long-term business.

BAE Systems' involvement in these sales highlights its role in supporting national security objectives and fostering international defense relationships. The value of these transactions can be substantial, often running into billions of dollars, reflecting the strategic nature of the equipment involved.

- Facilitation through Intergovernmental Agreements: Sales are often structured via government-to-government pacts, integrating BAE Systems' products into broader defense cooperation initiatives.

- Strategic Alliances and Diplomacy: This channel relies heavily on strategic partnerships and diplomatic efforts to secure and execute deals.

- Recent Aircraft Sales MoUs: Exemplary recent Memoranda of Understanding for aircraft sales demonstrate the active utilization of this sales channel.

Specialized Consulting Teams

Specialized consulting teams at BAE Systems function as a crucial channel for delivering complex, integrated solutions and strategic advisory services. These expert groups engage directly with clients, offering deep dives into system design, operational analysis, and forward-looking strategic planning. Their work is instrumental in shaping the future of defense requirements and developing bespoke solutions for sophisticated client needs.

These high-value engagements are critical for BAE Systems' ability to address the most intricate challenges faced by its clientele. For instance, in 2024, BAE Systems continued to secure significant contracts for advanced defense systems, many of which necessitate this level of specialized consulting to ensure seamless integration and optimal performance. The consulting teams often work on projects valued in the hundreds of millions, directly influencing the technological roadmap for national security.

- Expertise Deployment: Teams offer specialized knowledge in system architecture, integration, and operational effectiveness.

- Client Collaboration: Direct engagement fosters deep understanding of client needs for tailored solutions.

- Strategic Influence: Consulting shapes long-term defense strategies and future technology roadmaps.

- Value Generation: These services represent a significant revenue stream through high-value, complex projects.

BAE Systems utilizes a multi-faceted channel strategy, heavily leaning on direct government engagement for its sophisticated defense products. This includes participation in major international airshows and leveraging government-to-government agreements to facilitate large-scale procurements.

Specialized consulting teams also act as a key channel, offering bespoke solutions and strategic advice, often leading to substantial, complex project contracts. The company's global network of offices ensures localized support and market intelligence, crucial for navigating diverse regulatory environments and client needs.

In 2023, BAE Systems reported total sales of approximately £25.2 billion, with North America (primarily the US) accounting for around 45% of this revenue, underscoring the effectiveness of its localized direct sales channels.

| Channel Type | Description | Key Activities | 2023 Revenue Contribution (Est.) | Example |

|---|---|---|---|---|

| Direct Sales | Engaging directly with national governments and defense ministries. | Bidding, negotiation, contracting, customized solutions. | High (Majority of revenue) | UK Dreadnought submarine program contract phase in early 2024. |

| Global Presence | Operating through international offices and subsidiaries. | Market intelligence, localized sales strategies, in-country operations. | Significant (Supports direct sales) | US operations contributing substantially to overall sales. |

| International Exhibitions | Showcasing technologies at major defense and aerospace events. | Demonstrating capabilities, lead generation, partnership building. | Lead generation and partnership focused | Paris Air Show and Farnborough Airshow in 2024. |

| Government-to-Government Sales | Facilitating sales through intergovernmental agreements. | Diplomatic engagement, defense cooperation frameworks. | Strategic and large-scale | Recent MoUs for significant aircraft sales. |

| Specialized Consulting | Providing expert advisory and integrated solutions. | System design, operational analysis, strategic planning. | High-value projects | Securing contracts for advanced defense systems in 2024. |

Customer Segments

National Governments and Defense Departments represent BAE Systems' most significant customer base. These entities, including ministries of defense and various government agencies, are tasked with ensuring national security and maintaining robust military capabilities. In 2024, global defense spending was projected to reach $2.4 trillion, highlighting the substantial market for BAE Systems' offerings.

These clients procure advanced platforms, sophisticated systems, and essential services to equip their armed forces and safeguard critical national infrastructure. Their purchasing decisions are heavily influenced by evolving geopolitical landscapes and stringent national security mandates, driving demand for cutting-edge defense technologies.

The armed forces, encompassing the Army, Navy, and Air Force globally, represent a critical customer segment for BAE Systems. These branches are not just users but also the primary decision-makers for the company's extensive range of defense products. For instance, armies depend on BAE Systems for robust combat vehicles, while navies rely on them for advanced warships and submarines. Air forces, in turn, look to BAE Systems for sophisticated fighter jets and cutting-edge electronic warfare systems.

The demand from these military branches is inherently specialized, driven by unique mission requirements and evolving geopolitical landscapes. In 2023, BAE Systems reported significant contributions from its defense intelligence and electronic warfare segments, reflecting the ongoing need for advanced capabilities by armed forces worldwide. The company's order book for naval and air systems also saw substantial growth, underscoring the commitment of global defense forces to modernize their fleets and air power.

International defense alliances like NATO are crucial customers, driving demand for interoperable systems and collective security solutions. BAE Systems supports these alliances by providing advanced platforms designed to meet stringent alliance standards and enhance operational effectiveness among member nations.

BAE Systems' involvement in programs like the Eurofighter Typhoon, utilized by several NATO countries, exemplifies its commitment to interoperability and collective defense capabilities. In 2023, NATO member states collectively spent over $1.2 trillion on defense, highlighting the significant market for alliance-specific procurement.

Commercial Aerospace Companies

BAE Systems engages with commercial aerospace companies, leveraging its expertise in advanced electronics, control systems, and specialized components. These clients often prioritize the robust reliability and cutting-edge technology honed through defense applications. The integration of Ball Aerospace in 2023 significantly bolstered BAE Systems' offerings for this sector, particularly in areas like space-based sensing and advanced avionics.

The company's approach targets segments within commercial aerospace that demand high-performance solutions, often mirroring the stringent requirements of defense programs. This includes suppliers for:

- Commercial aircraft manufacturers seeking sophisticated flight control systems and electronic warfare solutions.

- Satellite and space technology providers requiring advanced sensors, payloads, and communication systems.

- MRO (Maintenance, Repair, and Overhaul) providers looking for specialized electronic component upgrades and diagnostics.

Critical Infrastructure Operators

BAE Systems provides essential security and information technology solutions to operators of critical national infrastructure. This includes vital sectors like energy, transportation, and telecommunications, all of which are increasingly reliant on robust digital defenses.

These customers face ever-evolving cyber and physical threats, demanding advanced solutions to safeguard their operations. The importance of this segment is underscored by its direct impact on national resilience and economic stability. For instance, in 2024, the energy sector experienced a significant rise in sophisticated cyberattacks targeting operational technology, highlighting the urgent need for BAE Systems' expertise.

- Critical Infrastructure Focus: BAE Systems caters to energy, transportation, and telecommunications sectors.

- Security Demands: Customers require advanced cybersecurity and physical security to protect vital assets.

- National Resilience: This segment is crucial for maintaining national security and economic continuity.

BAE Systems serves a diverse customer base, with national governments and defense departments forming its primary market. These entities, responsible for national security, procure advanced military equipment and services. Global defense spending in 2024 was projected at $2.4 trillion, indicating a substantial market for BAE Systems.

The company also supplies commercial aerospace manufacturers and space technology providers, offering specialized components and systems. The acquisition of Ball Aerospace in 2023 enhanced BAE Systems' capabilities in this sector, particularly in avionics and space-based sensing.

Furthermore, BAE Systems provides critical cybersecurity and IT solutions to operators of essential national infrastructure, such as energy and telecommunications companies. These sectors face increasing cyber threats, driving demand for robust digital defenses to ensure national resilience.

| Customer Segment | Key Needs | 2023/2024 Relevance |

|---|---|---|

| National Governments & Defense Departments | Advanced defense platforms, systems, and services | Global defense spending projected at $2.4 trillion in 2024; significant order books for naval and air systems. |

| Armed Forces (Army, Navy, Air Force) | Specialized equipment for unique mission requirements | Ongoing modernization of fleets and air power; strong contributions from electronic warfare segments. |

| International Defense Alliances (e.g., NATO) | Interoperable systems and collective security solutions | NATO members' defense spending exceeded $1.2 trillion in 2023; BAE Systems supports alliance standards. |

| Commercial Aerospace | High-performance electronics, control systems, components | Ball Aerospace acquisition in 2023 boosted offerings in avionics and space technology. |

| Critical National Infrastructure Operators | Cybersecurity and IT solutions for vital sectors | Rising sophisticated cyberattacks in 2024 highlight the need for advanced digital defenses. |

Cost Structure

A substantial part of BAE Systems' cost structure is dedicated to research and development, which is vital for creating advanced technologies and staying ahead in the defense and security sectors. This funding supports new projects, the creation of prototypes, and ongoing innovation.

In 2024, BAE Systems reported a record investment in R&D, underscoring its commitment to technological advancement. This investment is key to developing next-generation capabilities and securing future contracts.

Manufacturing and production expenses are a significant component of BAE Systems' cost structure, encompassing the intricate processes of building complex defense systems. These costs include the procurement of specialized raw materials and advanced components, as well as the skilled labor required for assembly and integration. In 2023, BAE Systems reported revenues of £23.7 billion, with the cost of sales reflecting these substantial production outlays.

These operations are inherently capital-intensive, necessitating substantial investments in state-of-the-art manufacturing facilities and advanced technologies to maintain a competitive edge. BAE Systems is actively engaged in modernizing its production sites, a strategic move aimed at enhancing efficiency and capacity to meet global demand for its products.

As a technology-driven enterprise, BAE Systems' cost structure is significantly shaped by its substantial investment in labor and personnel. With a global workforce of approximately 107,000 employees, the company incurs considerable expenses related to salaries, comprehensive benefits packages, and ongoing professional development and training programs. Attracting and retaining highly specialized engineering and technical expertise is paramount to BAE Systems' innovation and operational success, but this also represents a significant and ongoing cost.

Supply Chain & Logistics Costs

BAE Systems manages a complex global supply chain, leading to substantial costs in logistics, transportation, and inventory. The defense sector's stringent security and compliance requirements further elevate these expenses. For instance, in 2024, BAE Systems continued to invest heavily in its robust logistics network to ensure the secure and timely delivery of critical components and finished defense systems across its international operations.

The company's reliance on a vast network, including approximately 210 local suppliers in various regions, adds layers of complexity and associated costs. These costs are directly tied to maintaining the flow of materials and services necessary for production and project completion, especially for intricate international defense projects.

- Logistics & Transportation: Costs related to shipping, freight, and warehousing of components and finished goods globally.

- Inventory Management: Expenses incurred in holding and managing stock of raw materials, work-in-progress, and finished products.

- Supplier Network Costs: Operational expenses associated with managing and coordinating with a large base of local and international suppliers.

- Compliance & Security: Additional costs for ensuring adherence to international regulations, customs, and security protocols for defense materials.

Compliance & Regulatory Costs

BAE Systems faces significant compliance and regulatory costs due to operating in the defense and security sectors. These expenses are a continuous overhead, encompassing adherence to national and international laws, stringent export controls, and various security regulations. For instance, in 2024, companies in similar defense sectors often allocate a substantial percentage of their revenue, sometimes ranging from 5% to 10%, to compliance activities, including legal counsel, administrative processes, and regular auditing to maintain necessary certifications and licenses.

These costs are essential for BAE Systems to operate legally and ethically, ensuring their products and services meet the rigorous standards demanded by governments and international bodies. The ongoing nature of these regulations means that investment in compliance is a permanent feature of their cost structure.

- Legal and Advisory Fees: Costs associated with legal experts ensuring adherence to international arms treaties and national defense legislation.

- Auditing and Certification: Expenses for internal and external audits to verify compliance with security protocols and quality standards.

- Export Control Management: Significant investment in systems and personnel to manage and comply with complex export licensing and trade regulations.

- Security Infrastructure and Training: Ongoing expenditure on safeguarding sensitive information and personnel, including specialized training to maintain security clearances.

BAE Systems' cost structure is heavily influenced by its extensive global operations and the specialized nature of its products. Key cost drivers include significant investments in research and development to maintain technological superiority, as well as substantial manufacturing expenses for complex defense systems. The company's large, skilled workforce also represents a major cost, alongside the complexities and security requirements inherent in managing a global supply chain and ensuring regulatory compliance.

| Cost Category | Description | 2023/2024 Relevance |

| Research & Development (R&D) | Investment in new technologies and product innovation. | Record R&D investment in 2024, crucial for future competitiveness. |

| Manufacturing & Production | Costs of building complex defense systems, materials, and labor. | Reflected in the cost of sales, supporting £23.7 billion revenue in 2023. |

| Labor & Personnel | Salaries, benefits, and training for a global workforce of ~107,000. | Essential for specialized engineering and technical expertise. |

| Supply Chain & Logistics | Costs for transportation, warehousing, and managing ~210 local suppliers. | Ensures timely delivery of critical components globally. |

| Compliance & Regulatory | Adherence to national/international laws, export controls, and security. | Estimated 5-10% of revenue for similar defense firms in 2024, vital for legal operation. |

Revenue Streams

BAE Systems primarily generates revenue through the sale of substantial defense platforms and intricate systems. This includes high-value items like combat aircraft, naval ships, armored vehicles, and sophisticated electronic warfare systems. These sales are typically secured through long-term contracts with governmental defense departments.

In 2024, BAE Systems saw a significant boost in its financial performance, with revenue climbing by 14%. This growth underscores the strong demand for its advanced defense products and solutions in the global market.

BAE Systems generates substantial revenue from long-term service, maintenance, and support contracts for its sold equipment. These agreements are crucial for ensuring the continuous operational readiness of military assets throughout their extended lifecycles, providing a reliable stream of recurring income.

For instance, in 2023, BAE Systems reported that its Electronic Systems segment, which includes significant service components, saw a revenue increase driven by strong demand for support and sustainment services. This highlights the ongoing financial importance of these contracts in maintaining customer relationships and securing future business.

BAE Systems generates revenue by upgrading and modernizing existing defense platforms, a crucial service for extending operational lifespans and boosting capabilities. This involves integrating cutting-edge technologies, implementing software enhancements, and performing hardware modifications.

This revenue stream is fueled by the persistent demand to adapt defense systems against ever-changing global threats. For instance, BAE Systems secured a significant contract in 2023 to upgrade the Royal Air Force’s Typhoon fighter jets, demonstrating the ongoing investment in modernization.

Software & Technology Licensing

BAE Systems leverages its extensive research and development to generate revenue by licensing its advanced software, cutting-edge technologies, and valuable intellectual property. This strategy enables broader implementation of their innovations across the defense sector and among allied nations, creating a significant revenue stream from non-physical products.

This licensing model can encompass a wide array of sophisticated offerings, such as specialized mission systems designed for complex operational environments or advanced artificial intelligence algorithms tailored for defense applications. For instance, BAE Systems' expertise in electronic warfare systems, which often involves proprietary software, presents a clear opportunity for technology licensing agreements.

- Software Licensing: Revenue from granting rights to use BAE Systems' proprietary software, including operating systems for defense platforms and specialized simulation tools.

- Technology Licensing: Income generated from allowing other entities to utilize BAE Systems' patented technologies, such as advanced sensor arrays or secure communication protocols.

- Intellectual Property (IP) Royalties: Earnings derived from licensing agreements where BAE Systems receives ongoing payments for the use of its intellectual property in third-party products or services.

Consulting & Training Services

BAE Systems generates revenue by offering expert consulting services focused on defense strategy, system integration, and security solutions. This segment also includes specialized training programs designed for military personnel, enhancing their operational capabilities and maximizing the value of defense investments. These offerings capitalize on BAE Systems' extensive industry knowledge and advanced technical expertise.

- Consulting Services: Provides strategic advice and implementation support for defense modernization and security enhancement.

- Training Programs: Delivers specialized education and skill development for military and security forces.

- System Integration: Offers expertise in integrating complex defense systems to ensure interoperability and efficiency.

- Revenue Contribution: Leverages deep industry knowledge to help clients optimize their defense spending and operational readiness.

BAE Systems' revenue is diversified across several key areas, reflecting its broad capabilities in the defense sector. The company's primary income comes from the sale of major defense platforms like aircraft, ships, and vehicles, often secured through long-term government contracts. In 2024, BAE Systems experienced a notable 14% revenue increase, highlighting robust global demand for its advanced defense products.

Recurring revenue is a significant component, generated through extensive service, maintenance, and support contracts for its sold equipment. These agreements ensure the ongoing operational readiness of military assets, providing a stable income stream. For example, BAE Systems' Electronic Systems segment saw revenue growth in 2023, partly due to strong demand for these sustainment services.

The company also profits from upgrading and modernizing existing defense platforms, a vital service for extending their operational life and enhancing capabilities. This includes integrating new technologies and performing hardware and software modifications. The demand for such upgrades is driven by evolving global threats, as seen in a 2023 contract to upgrade Royal Air Force Typhoon jets.

Furthermore, BAE Systems generates revenue by licensing its advanced software, technologies, and intellectual property. This allows for wider adoption of its innovations across the defense industry and among allied nations, creating income from non-physical assets. This can include specialized mission systems or AI algorithms for defense applications.

| Revenue Stream | Description | Example Contribution |

| Platform Sales | Sale of major defense assets (aircraft, ships, vehicles) | Long-term government contracts for combat systems |

| Services & Support | Maintenance, repair, and operational support for sold equipment | Recurring revenue from sustainment contracts, increasing in 2023 |

| Upgrades & Modernization | Enhancing existing defense systems with new technology | 2023 contract for Royal Air Force Typhoon jet upgrades |

| Licensing & IP | Granting rights to use proprietary software and technologies | Revenue from advanced electronic warfare system software |

Business Model Canvas Data Sources

The BAE Systems Business Model Canvas is informed by a robust combination of internal financial reports, extensive market intelligence on defense and aerospace sectors, and strategic analyses of global geopolitical trends. These diverse data sources ensure a comprehensive and accurate representation of the company's operational and strategic landscape.