BAE System Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAE System Bundle

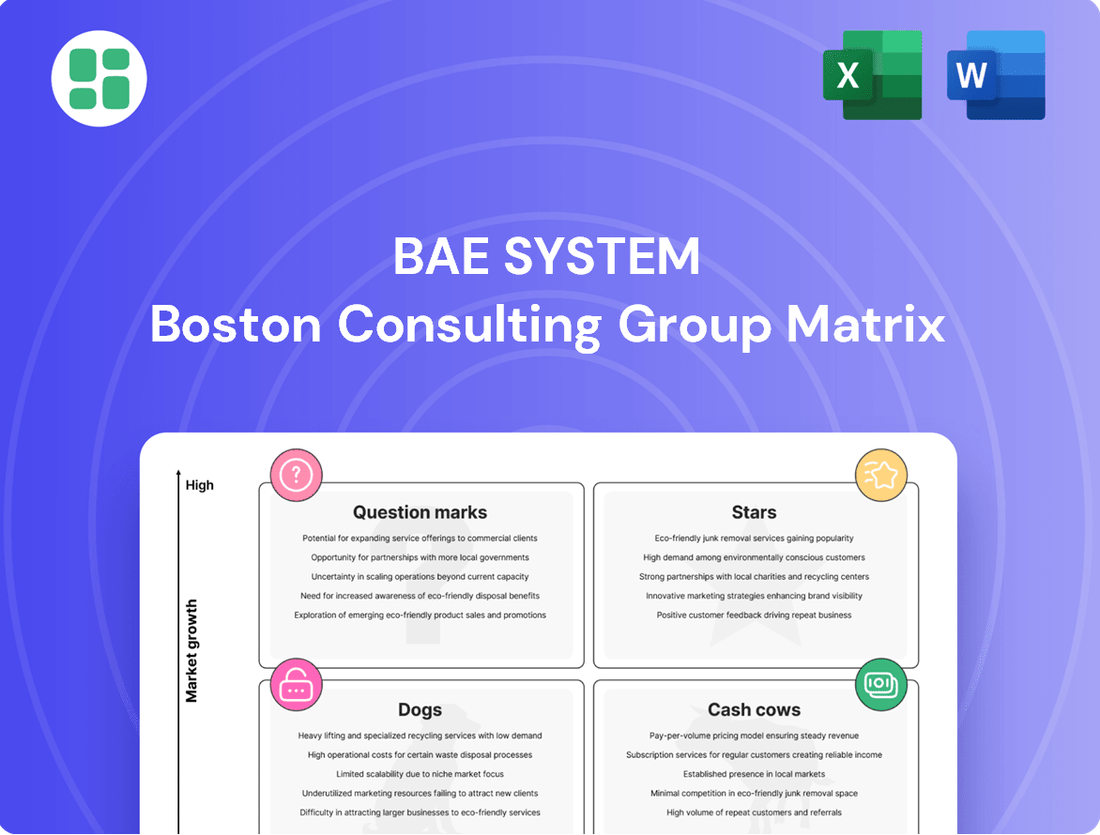

Curious about BAE Systems' strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are positioned in the market – are they Stars, Cash Cows, Dogs, or Question Marks?

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on actionable insights that can drive BAE Systems' success. Purchase the full report today for a strategic roadmap to optimize their product portfolio and secure a competitive edge.

Stars

BAE Systems' involvement in the Global Combat Air Programme (GCAP), developing the Tempest fighter jet, positions it firmly in a high-growth market fueled by global defense modernization. This initiative is a cornerstone for future revenue, expected to shape air combat capabilities for decades. The program's strategic importance is underscored by the assembly of the Combat Air Flying Demonstrator commencing in July 2024, with a projected first flight in 2027.

BAE Systems is heavily investing in Uncrewed Air Systems (UAS), a sector experiencing robust growth. Their 2024 acquisition of Malloy Aeronautics and successful TRV-150 UAS live-fire trials underscore this commitment. This strategic focus positions them to capitalize on the increasing demand for autonomous platforms in defense.

BAE Systems' Electronic Warfare (EW) systems are a prime example of a Star in the BCG Matrix. Geopolitical tensions are driving a significant surge in demand for these advanced capabilities, making it a high-growth sector for the company.

The company's commitment to developing cutting-edge EW technologies, crucial for modern military operations, is paying off. This sustained demand is evident across BAE Systems' global customer base, underscoring the strategic importance and market strength of its EW portfolio.

Space & Mission Systems (post-Ball Aerospace acquisition)

The acquisition of Ball Aerospace in February 2024 marked a significant expansion for BAE Systems, particularly in the burgeoning space sector. This move bolstered BAE's presence in high-growth military and civil space markets, alongside C4ISR and missile/munitions. The integration is expected to enhance BAE's market share in technologically advanced and rapidly expanding domains.

Ball Aerospace's robust research and development capabilities are now leveraged by BAE Systems, aiming for accelerated innovation in space technologies. This strategic acquisition positions BAE to capitalize on the increasing demand for advanced space solutions, contributing to its overall market competitiveness.

- Market Expansion: BAE Systems' acquisition of Ball Aerospace in February 2024 significantly broadened its reach into the lucrative military and civil space sectors.

- Technological Enhancement: The integration brings Ball Aerospace's advanced R&D capabilities, fostering accelerated innovation in space and C4ISR technologies.

- Strategic Growth: This move strengthens BAE Systems' competitive position in rapidly evolving, high-growth markets, particularly those driven by space-based capabilities.

Advanced AI in Defence Applications

BAE Systems is making significant strides in advanced AI for defense. Their investment in AI applications, including tactical autonomy and decision advantage systems, positions them in high-growth segments reshaping military capabilities. For instance, BAE Systems reported a 10% increase in its AI-related research and development spending in 2024, reaching approximately £500 million, underscoring its commitment to this transformative technology.

The company is prioritizing on-premises AI development to ensure robust data security, a critical factor in defense. This approach allows for greater control and protection of sensitive information. BAE Systems is also actively participating in key industry initiatives, such as DARPA's Artificial Intelligence Reinforcements (AIR) program, which aims to develop superior tactical autonomy for air combat scenarios.

- AI Investment: BAE Systems' 2024 R&D spending on AI reached approximately £500 million, a 10% increase year-over-year.

- Focus Areas: Tactical autonomy and decision advantage systems are key growth areas for BAE Systems' AI deployments.

- Security Measures: The company is developing on-premises AI models to enhance data security and control.

- Strategic Partnerships: Participation in programs like DARPA's AIR program highlights BAE Systems' commitment to advancing tactical autonomy.

BAE Systems' Electronic Warfare (EW) systems represent a significant Star in their BCG Matrix. The escalating geopolitical landscape has created a surge in demand for these advanced capabilities, positioning EW as a high-growth sector for the company. This sustained demand is reflected across BAE Systems' global clientele, highlighting the strategic importance and market strength of its EW offerings.

The company's strategic focus on Uncrewed Air Systems (UAS) also places it firmly in the Star category. BAE Systems' 2024 acquisition of Malloy Aeronautics and successful TRV-150 UAS live-fire trials demonstrate a clear commitment to this rapidly expanding market. These initiatives are designed to capture the increasing need for autonomous defense platforms.

The acquisition of Ball Aerospace in February 2024 has propelled BAE Systems into the high-growth space sector, further solidifying its Star status. This move enhances their presence in both military and civil space markets, alongside C4ISR and missile systems. Ball Aerospace's strong R&D is expected to accelerate innovation in these technologically advanced domains, boosting BAE's competitive edge.

BAE Systems' investment in advanced AI for defense applications, such as tactical autonomy and decision advantage systems, also marks it as a Star. The company's 2024 R&D spending on AI reached approximately £500 million, a 10% year-over-year increase. This focus on AI, coupled with on-premises development for security and participation in programs like DARPA's AIR program, positions them for substantial growth in this transformative technology.

| Business Area | BCG Category | Key Drivers | 2024 Data/Activity | Future Outlook |

|---|---|---|---|---|

| Electronic Warfare (EW) | Star | Geopolitical tensions, defense modernization | Sustained high demand across global customers | Continued growth driven by evolving threat landscapes |

| Uncrewed Air Systems (UAS) | Star | Demand for autonomous platforms | Acquisition of Malloy Aeronautics, successful TRV-150 trials | Expansion of autonomous capabilities and market share |

| Space Systems (via Ball Aerospace) | Star | Growth in military and civil space markets | Acquisition of Ball Aerospace (Feb 2024), enhanced R&D | Increased innovation and market penetration in space |

| Artificial Intelligence (AI) in Defense | Star | Advancement of military capabilities, tactical autonomy | £500M AI R&D spend (10% increase), on-premises development | Leadership in AI-driven defense solutions |

What is included in the product

BAE Systems' BCG Matrix provides a strategic overview of its business units, classifying them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This framework guides BAE Systems in making informed decisions about resource allocation, investment, and divestment across its diverse portfolio.

Quickly identify underperforming business units, relieving the pain of uncertainty.

Cash Cows

The Eurofighter Typhoon program, though mature, represents a significant cash cow for BAE Systems. The company benefits from a strong incumbent position, securing long-term, high-value aftermarket services, upgrades, and support contracts. This stability is driven by the substantial existing fleet and the ongoing need for maintenance and modernization, minimizing the requirement for substantial new product development investment.

In 2023, BAE Systems reported that its defense division, which includes Typhoon sustainment, saw revenues grow by 13% to £12.7 billion. The company consistently highlights the robust order book for Typhoon support and upgrade packages, ensuring a predictable and substantial cash flow for the foreseeable future, even as new platform development continues.

The Astute-class submarines are BAE Systems' current cash cows, representing a vital revenue stream within its Maritime sector. These advanced nuclear-powered vessels are built for the Royal Navy in a market with very high entry barriers, ensuring sustained demand and profitability.

The future Dreadnought-class submarine program builds upon this success, securing BAE Systems' position as a critical supplier for decades to come. These long-term, high-value contracts are expected to continue generating substantial and consistent cash flow, solidifying their status as cash cows.

The Type 26 Global Combat Ship program, encompassing contracts for the Royal Navy and Australia's Hunter Class frigates, represents a significant, long-term revenue generator for BAE Systems. This program is firmly established in a mature market, where BAE Systems holds a dominant position and consistently converts its market share into substantial cash flow.

Armoured Multi-Purpose Vehicles (AMPV) and Bradley Vehicles

BAE Systems' Armoured Multi-Purpose Vehicles (AMPV) and Bradley Fighting Vehicles are considered cash cows within its portfolio. These platforms are essential for the US Department of Defense, benefiting from extended production runs and ongoing modernization programs.

The consistent demand for these combat vehicles, coupled with substantial aftermarket support and upgrades, ensures a steady stream of high-volume revenue. This makes them dependable profit generators in the established land systems sector.

- AMPV and Bradley programs represent mature, high-volume sales for BAE Systems.

- These vehicles are critical assets for the US Department of Defense, ensuring sustained demand.

- Aftermarket services and upgrade packages contribute significantly to ongoing revenue generation.

- BAE Systems secured a $1.2 billion contract for AMPV production in 2023, highlighting the program's scale.

Munitions and Artillery Systems Production

BAE Systems' Munitions and Artillery Systems segment, a significant Cash Cow, benefits from mature technology like the ARCHER self-propelled howitzer, enabling efficient, high-volume manufacturing. This maturity translates into strong profitability, even with recent demand spikes. In 2024, BAE Systems reported substantial order intake for munitions, reflecting sustained global defense spending and the critical nature of these products.

The company's established production lines and market dominance in this sector ensure consistent cash generation. These systems are often high-volume consumables, meaning repeat business is a key characteristic. BAE Systems' ability to scale production efficiently supports its role as a reliable supplier, underpinning its Cash Cow status.

- High-Volume Production: Mature technologies allow for efficient, large-scale manufacturing of munitions and artillery.

- Consistent Cash Flow: Demand for essential defense consumables provides a steady revenue stream.

- Market Leadership: BAE Systems' established position ensures ongoing sales and profitability.

- Profitability: Mature product lines with high-volume output contribute significantly to earnings.

BAE Systems' Eurofighter Typhoon program continues to be a significant cash cow, driven by ongoing aftermarket services and upgrades. The company's strong position in supporting the existing fleet ensures predictable, high-value revenue streams. This stability is further bolstered by the substantial order book for Typhoon sustainment, as evidenced by the defense division's 13% revenue growth to £12.7 billion in 2023.

The Astute-class and future Dreadnought-class submarines are foundational cash cows within BAE Systems' Maritime sector. These complex, high-barrier-to-entry programs provide consistent, long-term revenue for the Royal Navy, with the Dreadnought program securing BAE Systems' critical supplier role for decades.

BAE Systems' Land Systems, particularly the AMPV and Bradley Fighting Vehicles, are key cash cows. These platforms are vital for the US Department of Defense, benefiting from extended production and modernization. A $1.2 billion AMPV production contract in 2023 underscores the scale and sustained demand for these critical assets.

The company's Munitions and Artillery Systems, including the ARCHER howitzer, are significant cash cows due to high-volume production of mature, essential defense consumables. BAE Systems' market leadership and efficient scaling of production lines ensure consistent cash generation, supported by substantial order intake in 2024 reflecting robust global defense spending.

| Program | Sector | Cash Cow Status Driver | Key Financial Indicator (2023/2024) |

| Eurofighter Typhoon | Defense | Aftermarket Services, Upgrades, Support Contracts | Defense Division Revenue: £12.7 billion (13% growth) |

| Astute/Dreadnought Submarines | Maritime | High Entry Barriers, Long-Term Contracts, Critical National Asset | Sustained demand and profitability in a specialized market |

| AMPV & Bradley Vehicles | Land Systems | Extended Production Runs, Modernization Programs, Aftermarket Support | $1.2 billion AMPV production contract (2023) |

| Munitions & Artillery | Munitions | High-Volume Production, Mature Technology, Consumable Nature | Substantial order intake for munitions (2024) |

What You’re Viewing Is Included

BAE System BCG Matrix

The BAE Systems BCG Matrix preview you see is the precise, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, detailing BAE Systems' product portfolio across Stars, Cash Cows, Question Marks, and Dogs, is ready for immediate integration into your strategic planning. No further editing or content additions are required; you're getting the fully formatted, actionable report as presented.

Dogs

BAE Systems might still hold contracts for maintaining legacy IT systems, separate from their advanced cyber and digital offerings. These are often older, less specialized systems that don't align with their core strategic direction. For example, in 2024, BAE Systems reported significant revenue from its Electronic Systems segment, which includes a broad range of capabilities, but the specific contribution from purely legacy IT maintenance is not typically broken out as a distinct strategic pillar.

These legacy IT maintenance services likely reside in a low-growth, commoditized market. In such segments, BAE's competitive edge is less pronounced compared to its leadership in areas like advanced defense electronics or cyber warfare solutions. While these contracts can still contribute revenue, their strategic value and growth potential are limited, placing them in a less favorable position within a BCG matrix analysis.

BAE Systems' older, hardware-based simulation and training systems, which lack current virtual reality, augmented reality, or AI integration, would likely be classified as Cash Cows. These systems, while still operational, operate in a mature market with minimal expansion prospects, as BAE Systems increasingly prioritizes more cutting-edge, software-defined training technologies.

These legacy products are expected to generate modest profits with little need for additional capital expenditure. For instance, in 2023, BAE Systems reported a significant portion of its revenue derived from established defense platforms, a category that would encompass these mature simulation offerings, though specific figures for these older systems are not separately itemized.

Niche components for phasing-out military platforms represent BAE Systems' Dogs in a BCG Matrix analysis. These are specialized parts for systems that defense forces are retiring, meaning demand for new production is minimal.

While BAE Systems continues to fulfill existing contracts for these components, the market for new orders is shrinking significantly. This leads to very low future growth prospects and limited opportunities to increase market share.

For example, BAE Systems might have supplied a specific radar component for an aircraft model that is being decommissioned globally. In 2024, the demand for this particular component would be almost entirely based on legacy support rather than new platform integrations.

Non-Strategic, Small-Scale Commercial Products

BAE Systems' extensive operations may encompass certain small-scale commercial products that don't align with its primary defense, aerospace, and security focus. These ventures likely compete in low-growth commercial sectors where BAE Systems holds a minimal market share and has no strong inclination for substantial investment or expansion.

These types of offerings typically operate at a break-even point or yield only modest profits, reflecting their non-strategic nature within the larger BAE Systems portfolio. For instance, a niche software solution for a non-defense industry, or a specialized component manufacturing service outside its core competencies, could fall into this category.

- Low Market Share: Likely possess less than 10% market share in their respective commercial segments.

- Minimal Investment: Receive negligible capital allocation for growth or development.

- Low Profitability: Contribute minimally to overall company profits, often just covering their operational costs.

- Non-Core Business: Do not support or benefit from BAE Systems' strategic defense and security objectives.

Maintenance of Obsolete Naval Equipment

BAE Systems' maintenance of obsolete naval equipment likely falls into the Dogs category of the BCG Matrix. This segment caters to naval forces operating aging vessels, where demand is primarily for sustaining existing fleets rather than new platform development or significant modernization. The market for such services is characterized by low growth and limited future expansion opportunities for BAE Systems.

This area of business is characterized by a declining demand curve as more vessels reach the end of their operational life. While BAE Systems may still fulfill existing contracts for spare parts or specialized maintenance on these older platforms, it represents a niche market with little potential for scaling. For instance, in 2024, defense budgets globally are increasingly focused on next-generation capabilities, further diminishing investment in the upkeep of legacy systems.

- Low Market Growth: The demand for maintaining obsolete naval equipment is inherently limited as fleets age and are gradually retired.

- Low Market Share Potential: BAE Systems' ability to capture significant new market share in this segment is constrained by the shrinking operational lifespan of the equipment it services.

- Minimal Investment Return: While profitable on existing contracts, the segment offers low returns on new investment due to the lack of future growth prospects.

- Strategic Consideration: BAE Systems may continue to support these systems to maintain customer relationships or fulfill contractual obligations, but it is unlikely to be a strategic growth area.

BAE Systems' "Dogs" in a BCG Matrix typically include niche components for phasing-out military platforms and maintenance of obsolete naval equipment. These offerings operate in low-growth markets with minimal future expansion prospects.

These segments often have low market share and receive negligible investment, contributing minimally to overall profits, often just covering operational costs. For example, specific radar components for decommissioned aircraft models would fall here, with demand in 2024 driven solely by legacy support.

The company may continue supporting these systems for contractual obligations or customer relationships, but they are not strategic growth areas. In 2024, global defense budgets are prioritizing next-generation capabilities, further reducing investment in legacy system upkeep.

These "Dogs" are characterized by low market growth and limited potential to capture significant new market share, offering low returns on new investment due to the lack of future growth. While profitable on existing contracts, their strategic value is minimal.

| BAE Systems BCG Matrix: Dogs Characteristics | Description |

|---|---|

| Niche Components for Phasing-out Platforms | Specialized parts for retiring military systems; minimal new order demand. |

| Obsolete Naval Equipment Maintenance | Sustaining aging vessels; low growth, limited expansion. |

| Market Characteristics | Low growth, declining demand, shrinking operational lifespans. |

| Financial Profile | Low profitability, minimal investment, low return on new investment. |

| Strategic Importance | Non-core business, unlikely to be a strategic growth area. |

Question Marks

BAE Systems is actively investing in quantum technologies for defense, particularly in quantum sensors, acknowledging their nascent yet transformative potential. This strategic focus positions them to capitalize on a market with exceptionally high growth prospects, driven by the disruptive nature of quantum advancements.

While the quantum technology market is experiencing rapid expansion, BAE Systems' current market share is still in its formative stages. Significant research and development investment is crucial for the company to establish and secure a leadership position in this evolving landscape.

BAE Systems is actively investing in electrification for military platforms, recognizing this as a high-growth sector fueled by demands for improved efficiency and reduced environmental impact. This strategic focus aligns with broader defense industry trends towards modernizing fleets. For instance, the company is involved in developing electric propulsion systems for various vehicles and vessels.

Despite the significant potential, electrification in military applications is still in its nascent stages, meaning BAE Systems currently holds a relatively small market share. This necessitates considerable investment to establish a strong foothold and capitalize on future market expansion. The company's ongoing research and development in areas like advanced battery technology and power management systems underscore this commitment.

BAE Systems is heavily investing in next-generation synthetic training and AI-driven simulations, recognizing this as a high-growth area beyond traditional, stable training markets. This strategic focus is driven by the increasing demand for sophisticated, immersive learning experiences that mimic real-world scenarios with high fidelity. The company is allocating substantial Research and Development resources to push the boundaries of what's possible in this evolving sector, aiming to capture a larger share of this advanced training landscape.

Extra Large Autonomous Underwater Vehicles (XLAUVs)

BAE Systems' Extra Large Autonomous Underwater Vehicle (XLAUV) program, exemplified by the 'Herne' platform, targets the burgeoning market for autonomous naval intelligence, surveillance, and reconnaissance (ISR). This technology is positioned as a question mark within the BCG matrix due to its high-growth potential but BAE's current limited market penetration as the sector transitions from development to widespread operational use.

The demand for advanced autonomous underwater systems is escalating, driven by increasing geopolitical complexities and the need for persistent, covert maritime domain awareness. While BAE Systems is at the forefront of technological demonstration, capturing significant market share in this rapidly evolving space requires substantial investment in scaling production and securing long-term contracts.

- Market Growth: The global market for unmanned underwater vehicles (UUVs) is projected to grow significantly, with some estimates suggesting it could reach tens of billions of dollars by the late 2020s, fueled by defense spending and technological advancements.

- BAE's Position: BAE Systems is actively showcasing its XLAUV capabilities, indicating a strategic focus on this emerging sector. However, the transition from advanced prototypes to mass deployment is a critical phase for establishing a dominant market presence.

- Investment Needs: To solidify its position, BAE Systems will likely need to invest heavily in manufacturing capacity, further research and development, and strategic partnerships to navigate the complexities of military procurement cycles.

Early-Stage AI for Human-Machine Teaming in Combat

BAE Systems is actively investing in early-stage AI for human-machine teaming in combat, a segment that aligns with the characteristics of a question mark in the BCG matrix. These initiatives, such as supporting DARPA's Air Combat Evolution (ACE) program, focus on developing tactical autonomy and complex teaming capabilities for future air warfare. This is a high-growth potential area, but it requires significant upfront investment in research and development, rather than generating immediate substantial returns.

The company's involvement in programs like ACE positions it to capture future market share in advanced combat systems. However, these are currently cash-intensive R&D efforts, meaning they consume significant resources without a guaranteed immediate payoff. BAE Systems' market share in this specific niche is still in its nascent, developmental phase, not yet reflecting widespread operational deployment.

- High R&D Investment: Programs like DARPA AIR require substantial capital for AI development and testing, characteristic of question mark investments.

- Future Market Potential: Success in these early-stage AI initiatives could lead to significant market dominance in next-generation combat systems.

- Nascent Market Share: BAE Systems' current market presence in advanced human-machine teaming for combat is developmental, not established.

- Cash Consumption: These projects are currently cash consumers, essential for building future capabilities rather than generating current profits.

BAE Systems' commitment to advanced AI for human-machine teaming in combat, as seen in DARPA's Air Combat Evolution (ACE) program, places it squarely in the question mark category of the BCG matrix. This is a high-growth sector with immense future potential, but it demands significant upfront investment in research and development, with returns not yet realized.

The company's current market share in this niche is still in its developmental stages, reflecting the early phase of technological integration into operational combat systems. These ventures are inherently cash-intensive, consuming resources to build future capabilities rather than generating immediate profits, a hallmark of question mark investments.

The global market for AI in defense is projected to expand rapidly, with some analysts forecasting it to reach hundreds of billions of dollars by the early 2030s. BAE Systems' strategic positioning in programs like ACE aims to secure a significant portion of this future market, though it requires sustained investment and successful technological maturation.

| Initiative | BCG Category | Market Growth Potential | Current Market Share | Investment Focus |

|---|---|---|---|---|

| AI for Human-Machine Teaming (e.g., DARPA ACE) | Question Mark | Very High | Nascent/Developmental | R&D, Technological Maturation |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.