BAE System Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAE System Bundle

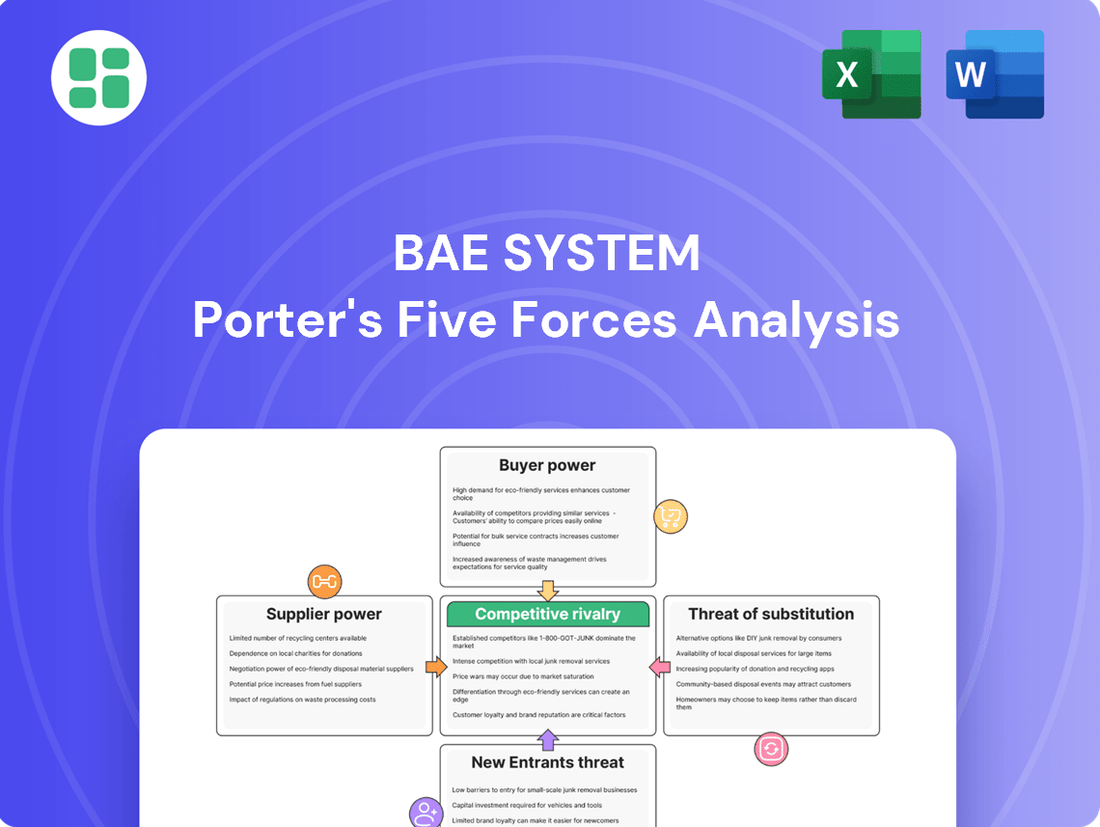

BAE Systems operates in a complex defense and aerospace landscape, facing significant pressures from powerful buyers and intense rivalry among established players. The threat of new entrants is somewhat mitigated by high barriers to entry, but the availability of substitutes, though often specialized, can still influence market dynamics.

The complete report reveals the real forces shaping BAE System’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BAE Systems' reliance on highly specialized components, especially for its advanced defense and aerospace platforms, is a key factor in supplier bargaining power. These are not off-the-shelf parts; they demand unique engineering and manufacturing capabilities.

The defense industry's stringent quality and technical specifications mean only a handful of suppliers can meet BAE Systems' needs. This limited supplier pool inherently gives these niche providers considerable leverage. For instance, in 2023, the defense sector saw significant supply chain disruptions, pushing up costs for specialized materials and components, a trend that likely continued into 2024.

Furthermore, the defense sector's rigorous qualification processes for new suppliers, often involving extensive testing and security clearances, create high switching costs and long lead times. This makes it difficult and expensive for BAE Systems to find alternative sources, further strengthening the bargaining power of its existing specialized suppliers.

BAE Systems might face concentrated supplier power in specialized areas where only a handful of firms offer critical components or advanced technologies. This limited supplier pool can translate into increased costs and less flexible contract terms for BAE Systems, especially given the high expenses associated with changing suppliers for such unique inputs. For instance, in 2024, the global defense sector continued to grapple with supply chain disruptions, making reliance on a few key suppliers a persistent challenge.

BAE Systems' reliance on suppliers with proprietary technology, especially in advanced electronics and software, significantly strengthens supplier bargaining power. These specialized suppliers can command higher prices or dictate terms because BAE Systems faces substantial costs and risks in replicating such critical components internally or sourcing alternatives. For instance, the defense sector's increasing demand for sophisticated AI-driven systems and secure communication hardware often means a limited pool of highly specialized suppliers.

High Switching Costs for BAE Systems

BAE Systems faces significant bargaining power from its suppliers due to the substantial costs associated with switching. The defense sector demands rigorous re-qualification, extensive testing, and intricate integration procedures for any new component or system. This makes moving from one supplier to another a costly and time-consuming endeavor for BAE Systems.

These high switching costs, combined with the potential for significant delays in crucial defense programs, inherently limit BAE Systems' negotiating flexibility. Consequently, established suppliers, who have already navigated these entry barriers, gain considerable leverage. The inherent complexity of military-grade systems further solidifies the position of incumbent suppliers, making them difficult to replace without substantial disruption and expense.

- High Re-qualification Costs: For example, a new supplier for a critical avionics component might require millions of dollars in testing and certification to meet stringent defense standards.

- Integration Complexity: Integrating a new supplier's product into existing BAE Systems platforms, like the F-35 fighter jet or the Eurofighter Typhoon, can involve extensive software and hardware modifications.

- Program Delays: A delay in sourcing a key component due to supplier change could postpone delivery of vital defense assets, incurring penalties and reputational damage.

- Supplier Lock-in: Specialized materials or proprietary technologies developed by a specific supplier can create a de facto lock-in, making alternatives scarce or non-existent.

Impact of Geopolitical Landscape

The current geopolitical landscape, characterized by escalating global defense expenditures and an immediate need for military hardware, significantly bolsters supplier leverage. This surge in demand for defense-related products can strain supply chains, leading to extended lead times and upward price pressure. Consequently, suppliers are in a stronger position to negotiate more advantageous terms with major defense contractors such as BAE Systems.

For instance, in 2023, global military spending reached an estimated $2.4 trillion, a 9% increase from 2022, marking the ninth consecutive year of growth. This heightened spending directly translates to increased demand for components and raw materials used in defense manufacturing.

- Increased Demand: Global conflicts and rising geopolitical tensions have driven a substantial uptick in defense procurement worldwide.

- Supply Chain Strain: The rapid increase in demand can outpace production capacity, creating shortages and longer lead times for critical components.

- Negotiating Power: Suppliers facing high demand and limited capacity can command higher prices and dictate more favorable contract terms.

- Impact on BAE Systems: BAE Systems, as a major defense contractor, must navigate these supplier dynamics, potentially facing increased costs and longer production schedules.

BAE Systems faces considerable supplier bargaining power due to the highly specialized nature of its components, particularly for advanced defense and aerospace platforms. These are not standard parts; they require unique engineering and manufacturing expertise, limiting the available supplier pool.

The defense industry's stringent quality and technical requirements mean only a select few suppliers can meet BAE Systems' needs. This scarcity of qualified providers grants them significant leverage, especially as global defense spending increased. For example, in 2023, global military spending reached an estimated $2.4 trillion, a 9% increase from the previous year, intensifying demand for specialized components.

The high costs and lengthy processes associated with qualifying new suppliers, including rigorous testing and security clearances, create substantial switching costs for BAE Systems. This makes it difficult and expensive to find alternative sources, thereby strengthening the negotiating position of incumbent, specialized suppliers.

BAE Systems must contend with concentrated supplier power in areas demanding proprietary technology, such as advanced electronics and software. Suppliers with unique capabilities can often dictate higher prices or stricter terms because BAE Systems faces significant risks and expenses in developing these components internally or finding viable alternatives.

| Factor | Impact on BAE Systems | Example/Data (2023-2024) |

|---|---|---|

| Supplier Specialization | Limited supplier options, higher costs | Unique components for fighter jets and naval systems require specialized manufacturing. |

| Switching Costs | Difficulty in changing suppliers, program delays | Re-qualification and integration of new avionics can take years and millions of dollars. |

| Proprietary Technology | Supplier lock-in, price leverage | Access to advanced AI or secure communication hardware often relies on a few key tech providers. |

| Geopolitical Demand | Increased demand, supply chain strain | Global defense spending growth in 2023 ($2.4 trillion) increased pressure on component availability. |

What is included in the product

This analysis dissects the competitive landscape for BAE Systems, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the defense and aerospace sectors.

Instantly identify and mitigate competitive threats by visualizing BAE Systems' Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

BAE Systems' customer base is highly consolidated, primarily consisting of governments and major defense organizations. This concentration grants these entities substantial bargaining power. For instance, the US Department of Defense, a key client, represents a significant portion of BAE Systems' revenue, allowing it to negotiate favorable terms.

These large governmental customers typically engage in long-term, high-volume procurement contracts. This purchasing scale gives them considerable leverage in price negotiations and the ability to dictate contract specifications, directly impacting BAE Systems' profitability and operational flexibility.

Defense procurement cycles are known for their lengthy, intricate nature, often involving extensive evaluation and negotiation phases. This prolonged process grants customers significant leverage, enabling them to precisely define specifications, insist on bespoke solutions, and consistently push BAE Systems on pricing, performance benchmarks, and delivery timelines.

Governmental contracts, a staple for BAE Systems, come with stringent oversight and compliance mandates. For instance, in 2023, the UK Ministry of Defence awarded BAE Systems a £3.5 billion contract for the Dreadnought submarine program, highlighting the substantial financial commitments and the detailed scrutiny involved in such long-term engagements.

Governments, as primary customers for BAE Systems, wield immense bargaining power due to the critical nature of defense products for national security. Their demands are exacting, with virtually zero room for error, leading to rigorous testing and severe penalties for any shortcomings. This elevates their position significantly in negotiations.

The imperative of national security often supersedes typical commercial considerations, meaning governments can dictate terms and pricing more forcefully. For instance, the UK's Ministry of Defence, a major BAE Systems client, awarded contracts in 2024 that reflect these stringent requirements and the government's leverage in securing critical capabilities.

Limited Number of Global Defense Contractors

The bargaining power of customers in the defense sector, particularly for companies like BAE Systems, is influenced by the limited number of global prime contractors. This scarcity of major players means customers, such as national governments, often have a restricted set of suppliers to choose from.

Despite this limitation, customers can still exert considerable influence. They frequently engage in competitive bidding processes, soliciting proposals from multiple major defense contractors. This allows them to compare offerings, including technological capabilities, delivery schedules, and crucially, pricing. For instance, in 2024, major defense procurement programs often see bids from giants like Lockheed Martin, Northrop Grumman, and Raytheon alongside BAE Systems, creating a competitive environment that pressures prices and ensures value for money.

- Limited Supplier Pool: Customers typically choose from a small number of global defense prime contractors.

- Competitive Bidding: Governments solicit bids from multiple companies, fostering price competition.

- Value-Driven Procurement: Customers prioritize receiving the best value, balancing cost with performance.

- Market Dynamics: The presence of key competitors like Lockheed Martin and Northrop Grumman reinforces customer leverage.

Influence of Geopolitical Spending Trends

Geopolitical events significantly shape defense spending, creating both opportunities and challenges for companies like BAE Systems. While global defense budgets have seen an uptick, with projections indicating continued growth through 2024 and beyond due to heightened international tensions, customers, primarily governments, remain astute in their expenditure. For instance, the UK's defense spending was projected to reach £57.5 billion in 2023-24, and similar increases are seen across NATO allies.

Despite these increased budgets, the bargaining power of customers does not necessarily wane. Governments are intensely focused on value for money, demanding not only cutting-edge technology but also competitive pricing and demonstrable return on investment for their defense outlays. This means BAE Systems must continually innovate and optimize its cost structures to remain competitive in a market where clients are sophisticated and have significant leverage due to the scale of their procurement needs.

- Increased Global Defense Budgets: Geopolitical tensions are driving higher defense spending worldwide.

- Customer Cost-Consciousness: Governments, despite higher budgets, remain focused on maximizing value and competitive pricing.

- Demand for Advanced Capabilities: Customers expect state-of-the-art technology alongside cost-effectiveness.

- BAE Systems' Competitive Landscape: The company must balance innovation with pricing to meet customer demands.

BAE Systems' customers, predominantly governments, possess significant bargaining power due to the consolidated nature of the defense industry and the critical importance of their procurements. This leverage is amplified by long-term, high-volume contracts and stringent oversight, allowing them to dictate terms, specifications, and pricing. The competitive bidding processes common in 2024, involving major players like Lockheed Martin and Northrop Grumman, further empower these governmental clients to secure optimal value, even as global defense budgets rise.

| Customer Type | Key Leverage Factors | BAE Systems' Response |

|---|---|---|

| Governments (e.g., US DoD, UK MoD) | Consolidated buyer base, high-volume contracts, national security imperative, competitive bidding | Focus on value for money, technological innovation, cost optimization |

| Major Defense Organizations | Long-term procurement cycles, bespoke solution demands, stringent oversight | Adherence to strict specifications, performance benchmarking, competitive pricing |

Same Document Delivered

BAE System Porter's Five Forces Analysis

You're previewing the final version of the BAE Systems Porter's Five Forces Analysis—precisely the same document that will be available to you instantly after buying. This comprehensive analysis delves into the competitive landscape of BAE Systems, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the defense and aerospace industry. What you see here is the complete, ready-to-use analysis file, professionally formatted and prepared for your immediate use.

Rivalry Among Competitors

The defense, aerospace, and security sectors are characterized by a concentrated market structure, with a handful of major global competitors vying for dominance. Companies like Lockheed Martin, Northrop Grumman, Raytheon Technologies, and Boeing, alongside BAE Systems, represent significant forces in this landscape.

These industry giants engage in fierce competition, particularly for lucrative government contracts. For instance, the U.S. Department of Defense's Fiscal Year 2024 budget request was $886 billion, highlighting the scale of opportunities and the intensity of competition for a share of these funds.

Competition transcends mere technological superiority and product offerings. It frequently involves leveraging political influence, cultivating strategic alliances, and demonstrating a capacity for complex global supply chain management, all of which contribute to the highly challenging competitive environment.

The defense sector, where BAE Systems operates, is defined by substantial fixed costs in manufacturing, research, and development, alongside a need for highly specialized personnel. This necessitates securing significant, long-term contracts to spread these expenses, fueling aggressive bidding and fierce competition for each major defense program. For instance, BAE Systems' 2023 annual report highlighted significant investments in R&D across its platforms, underscoring the ongoing need for technological advancement to maintain a competitive edge.

Competitive rivalry in the defense sector, including for BAE Systems, is intensely fueled by technological superiority and relentless innovation. Companies are locked in a perpetual race to develop next-generation systems, advanced digital intelligence, and cutting-edge electronics to secure a decisive advantage. This drive for innovation is evident in the substantial R&D investments made by major players; for instance, in 2023, the defense industry saw significant capital allocated to research and development, with leading companies reporting billions dedicated to future capabilities.

The capacity to seamlessly integrate emerging technologies such as artificial intelligence, autonomous systems, and robust cyber capabilities into defense solutions is not merely advantageous but absolutely critical for winning lucrative contracts. BAE Systems, for example, has been actively showcasing its advancements in areas like AI-driven situational awareness and autonomous platforms, underscoring the direct link between technological prowess and market success in securing defense orders.

Geopolitical Landscape Driving Demand and Competition

Current geopolitical tensions, such as the ongoing conflict in Eastern Europe and rising tensions in the Indo-Pacific, are significantly boosting global defense spending. This heightened demand directly fuels competitive rivalry within the defense sector, as companies like BAE Systems compete for substantial government contracts. For instance, in 2023, global military expenditure reached an estimated $2.44 trillion, a 6.8% increase from 2022, according to the Stockholm International Peace Research Institute (SIPRI).

This surge in spending creates lucrative opportunities but also intensifies competition. Major defense contractors are aggressively pursuing modernization programs in key allied nations, leading to fierce bidding wars for advanced platforms and systems. The drive for technological superiority means companies must constantly innovate to secure market share.

- Increased Global Defense Spending: Global military expenditure hit $2.44 trillion in 2023, up 6.8% from 2022.

- Focus on Modernization: Nations are prioritizing upgrading their defense capabilities, creating demand for advanced technologies.

- Intensified Competition: This demand leads to fierce competition among major defense players for new programs and contracts.

- BAE Systems' Position: BAE Systems, as a leading defense contractor, faces this heightened rivalry as it competes for a larger share of the expanding global defense market.

Strategic Mergers and Acquisitions

The defense sector is marked by frequent strategic mergers and acquisitions. Companies actively pursue these deals to consolidate their market presence, gain access to cutting-edge technologies, and strengthen their competitive standing. This consolidation aims to create larger, more capable entities better equipped to handle complex global defense needs.

BAE Systems has actively participated in this trend, notably acquiring Ball Aerospace in 2023 for $5.6 billion. This acquisition significantly expanded BAE Systems' capabilities in space systems, a critical growth area. Such moves are designed to broaden the company's technology portfolio and integrate vital components of the defense value chain, thereby reducing direct rivalry and enhancing operational control.

- Consolidation for Market Share: Defense companies merge or acquire others to increase their share of the global defense market, which is highly competitive.

- Technology Acquisition: Mergers and acquisitions are a primary method for defense contractors to quickly acquire new and emerging technologies, such as those in aerospace and cyber warfare.

- Strategic Fit: Companies like BAE Systems target acquisitions that offer synergistic benefits, expanding their product lines and service offerings to provide more comprehensive solutions to governments.

- Impact on Rivalry: By integrating acquired companies, BAE Systems can reduce the number of independent competitors, potentially leading to a more concentrated market structure and influencing pricing dynamics.

Competitive rivalry for BAE Systems is intense, driven by a few dominant global players vying for substantial government contracts. The sheer scale of defense budgets, like the US Department of Defense's FY2024 request of $886 billion, underscores the high stakes. Companies must excel not only in technology but also in political influence and supply chain management.

Innovation is paramount, with billions invested annually in R&D to develop advanced systems, AI, and cyber capabilities. For example, BAE Systems' 2023 R&D investments highlight this continuous pursuit of technological superiority. This arms race for the latest advancements is a core element of the fierce competition.

Geopolitical events significantly amplify this rivalry; global military expenditure reached $2.44 trillion in 2023, an increase of 6.8% from the previous year. This surge in spending creates opportunities but intensifies competition as nations prioritize defense modernization, leading to aggressive bidding for advanced platforms.

Consolidation through mergers and acquisitions, like BAE Systems' $5.6 billion acquisition of Ball Aerospace in 2023, is a key strategy to gain market share and technological access, thereby shaping the competitive landscape.

| Competitor | Key Areas of Operation | Estimated 2023 Revenue (USD Billions) | Notable 2023/2024 Activities |

|---|---|---|---|

| Lockheed Martin | Aerospace, Defense, Security, Aeronautics | ~186 | Secured major contracts for F-35 program, advanced missile systems. |

| Northrop Grumman | Aerospace, Defense, Information Systems, Technology Services | ~39 | Focus on advanced drones, cybersecurity, and space technology development. |

| Raytheon Technologies (RTX) | Aerospace, Defense, Intelligence, Cybersecurity | ~67 | Continued development of advanced radar and missile defense systems. |

| Boeing | Aerospace, Defense, Space, Security | ~81 | Expansion in military aircraft production and defense services. |

| BAE Systems | Defense, Aerospace, Security, Electronics, Information | ~27 (GBP 22.9bn) | Acquisition of Ball Aerospace, significant R&D in AI and autonomous systems. |

SSubstitutes Threaten

The increasing sophistication of autonomous systems and drones poses a significant threat of substitution for BAE Systems' traditional platforms. These unmanned systems can increasingly perform roles previously requiring manned aircraft or ground vehicles, such as intelligence, surveillance, and reconnaissance (ISR) and even combat operations. For instance, by 2024, the global military drone market was projected to reach over $15 billion, highlighting the rapid adoption and development in this area.

This shift means that while BAE's established manned platforms remain crucial, the demand for certain conventional assets could be impacted. Drones offer a compelling alternative, often at a lower acquisition and operational cost, and critically, with a reduced risk to human life. This cost-effectiveness is a major driver, as defense budgets worldwide face scrutiny, pushing for more efficient solutions.

The escalating sophistication of cyber warfare and digital intelligence solutions presents a potent substitute for traditional kinetic military actions in specific contexts. This trend can divert government spending, potentially impacting BAE Systems' reliance on conventional defense hardware.

The increasing emphasis on multi-domain operations (MDO) presents a significant threat of substitutes for BAE Systems. MDO integrates capabilities across air, land, sea, cyber, and space, meaning defense objectives can be met through a blend of diverse technologies and platforms, rather than a singular, traditional system. This creates indirect substitutes for specific product lines.

For instance, a cyber-based solution might substitute for a traditional electronic warfare system, or a networked drone swarm could perform tasks previously requiring manned aircraft. BAE Systems' 2023 annual report highlighted a growing portion of its R&D investment directed towards integrated and digital solutions, reflecting this shift. The company secured a £3.5 billion contract in 2024 for the Dreadnought submarine program, which inherently incorporates advanced cyber and electronic warfare capabilities, showcasing the integration that MDO demands.

Non-Traditional Disruptors and Niche Technologies

Smaller, agile companies are increasingly offering specialized solutions in areas like artificial intelligence and advanced materials. These niche technologies can substitute for specific functions traditionally handled by larger defense contractors. For instance, a startup specializing in AI-driven sensor fusion might offer a capability that reduces the need for certain hardware components on a larger platform.

While these disruptors may not replace entire defense systems, their innovations can chip away at market segments. The defense sector's reliance on integrated platforms means that a substitute often targets a specific subsystem rather than the whole. This modular approach to innovation allows smaller players to gain traction.

- Emerging Tech Focus: Companies concentrating on AI, quantum computing, and novel materials present viable alternatives for specific defense capabilities.

- Niche Solution Providers: These smaller firms offer specialized components or functionalities that can replace parts of larger, integrated systems.

- Market Segmentation: Disruptions occur as these niche technologies provide cost-effective or superior alternatives for particular defense applications.

Shifting Defense Priorities and Budget Allocation

Changes in national defense strategies and budget allocations can significantly alter the demand for BAE Systems' offerings, acting as a threat of substitutes. For example, a pivot towards asymmetric warfare or counter-terrorism initiatives might see governments reducing investment in traditional, large-scale conventional platforms like tanks or fighter jets. This strategic shift often favors more agile, adaptable, and digitally-enabled solutions, such as drones, cyber warfare capabilities, or specialized intelligence, surveillance, and reconnaissance (ISR) systems. These emerging technologies can effectively substitute for the roles previously filled by BAE's established product lines.

The implications for BAE Systems are clear: a need to adapt its product development and marketing to align with evolving defense priorities. As of early 2024, global defense budgets are seeing increased allocation towards cyber defense and artificial intelligence, reflecting this trend. For instance, the US Department of Defense's FY2024 budget request included substantial increases for AI and autonomous systems, signaling a potential reduction in spending on legacy platforms that BAE Systems heavily relies on. This reallocation represents a direct substitution threat.

- Shift in Defense Spending: National security strategies increasingly prioritize cyber, AI, and asymmetric warfare capabilities.

- Technological Substitution: Drones, cyber defense tools, and advanced ISR systems can replace the need for certain traditional platforms.

- Budgetary Realignment: For example, the US FY2024 defense budget proposed significant funding for AI and autonomous systems, potentially at the expense of conventional platforms.

- BAE's Adaptation Challenge: The company must innovate and pivot its offerings to meet these new, digitally-focused defense requirements to mitigate substitution risk.

The rise of advanced autonomous systems and sophisticated cyber capabilities presents a significant threat of substitution for BAE Systems' traditional manned platforms. These technologies can perform ISR and even combat roles more cost-effectively and with reduced risk. For example, the global military drone market was projected to exceed $15 billion in 2024, underscoring the rapid adoption of these alternatives.

Furthermore, evolving defense strategies increasingly favor cyber warfare, AI, and asymmetric tactics over large-scale conventional forces. This strategic shift, reflected in national defense budgets like the US FY2024 request which boosted AI and autonomous systems funding, can divert investment away from BAE's established product lines, acting as a direct substitution threat.

| Threat of Substitution Area | Description | Example/Data Point (2024) |

|---|---|---|

| Autonomous Systems & Drones | Unmanned systems performing ISR and combat roles | Global military drone market projected over $15 billion |

| Cyber Warfare & Digital Solutions | Cyber capabilities replacing kinetic actions | Increased global defense spending on cyber defense |

| Multi-Domain Operations (MDO) | Integrated capabilities reducing reliance on single platforms | BAE's £3.5 billion Dreadnought contract includes advanced cyber/EW |

| Niche Technology Providers | Smaller firms offering specialized AI, materials, etc. | Startups providing AI-driven sensor fusion |

Entrants Threaten

Entering the defense sector, where BAE Systems operates, demands substantial capital. Think billions for cutting-edge research, advanced manufacturing plants, and securing sophisticated technologies. For instance, developing a new fighter jet program can easily cost tens of billions of dollars, a sum far beyond the reach of most aspiring companies.

The defense sector's inherent complexity is amplified by stringent regulatory and certification processes, acting as a significant barrier to new entrants. Companies aiming to operate within this space must navigate a labyrinth of government standards, lengthy qualification procedures, and the absolute requirement for robust security clearances. For instance, in 2024, the lead times for obtaining necessary certifications for advanced defense technologies can easily extend over several years, involving rigorous testing and validation phases that demand substantial investment and specialized expertise.

The defense industry, particularly for complex systems like those BAE Systems produces, requires a workforce with highly specialized skills. This includes advanced engineering, materials science, and cybersecurity expertise, often coupled with stringent security clearances. For instance, the aerospace and defense sector in the UK faced a deficit of approximately 20,000 skilled workers in 2023, highlighting the difficulty for new players to quickly assemble a capable team.

Established Relationships and Trust with Governments

Established relationships and trust with governments represent a significant barrier for new entrants in the defense sector. Defense contracts are frequently awarded based on decades-long partnerships, demonstrated performance, and profound confidence between governments and incumbent contractors. New companies simply do not possess this established rapport or the inherent trust that risk-averse government procurement agencies require, especially for large-scale, critical programs.

For instance, BAE Systems, a major defense contractor, has a history of securing substantial contracts due to its long-standing relationships with governments worldwide. In 2023, BAE Systems reported £23.2 billion in revenue, a significant portion of which is derived from government contracts in key markets like the UK and the US. This deep-seated trust, built over many years, makes it exceedingly difficult for new players to displace incumbents and win these lucrative, long-term deals.

- Long-standing Partnerships: Incumbent defense contractors have cultivated relationships over decades, fostering trust and understanding with government agencies.

- Proven Track Records: Governments rely on the demonstrated reliability and performance history of established firms for critical defense systems.

- Risk Aversion: Government buyers are inherently risk-averse, preferring to award contracts to proven entities rather than untested newcomers for major programs.

- Incumbency Advantage: This deep trust and history translate into a significant competitive advantage, making it challenging for new entrants to gain initial traction.

Intellectual Property and Cybersecurity Barriers

The defense sector, including companies like BAE Systems, presents substantial intellectual property (IP) as a barrier to new entrants. Incumbent firms possess a wealth of proprietary technologies and designs, often developed over decades of research and development. For instance, BAE Systems invests billions annually in R&D, estimated at around £2.4 billion in 2023, to maintain its technological edge in areas like advanced avionics and cyber warfare.

Furthermore, stringent cybersecurity compliance requirements act as a significant hurdle. New companies must invest heavily to meet rigorous government standards, such as those mandated by the U.S. Department of Defense’s Cybersecurity Maturity Model Certification (CMMC). Failing to meet these requirements can prevent participation in lucrative government contracts, a critical revenue stream for established players like BAE Systems, which reported £23.1 billion in defense-related revenue in 2023.

- Intellectual Property: Defense incumbents hold extensive proprietary technologies.

- R&D Investment: Companies like BAE Systems invest billions annually in R&D to safeguard their IP.

- Cybersecurity Compliance: Meeting government cybersecurity standards (e.g., CMMC) requires substantial investment and expertise.

- Market Access: Non-compliance with cybersecurity regulations can block access to key government contracts.

The threat of new entrants in the defense sector, where BAE Systems operates, is considerably low due to immense capital requirements for research, development, and manufacturing. For instance, the development of a new fighter jet program alone can cost tens of billions of dollars, a prohibitive sum for most new companies. This high financial barrier effectively limits the pool of potential competitors.

Porter's Five Forces Analysis Data Sources

Our BAE Systems Porter's Five Forces analysis is built upon a robust foundation of data, drawing from BAE Systems' official annual reports, investor presentations, and SEC filings. We supplement this with insights from reputable industry analysis firms, defense sector market research, and government procurement databases to ensure a comprehensive understanding of the competitive landscape.