Babcock & Wilcox Enterprises SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Babcock & Wilcox Enterprises Bundle

Babcock & Wilcox Enterprises faces significant opportunities in the energy transition, but also grapples with the complexities of its legacy business. Understanding their unique strengths and potential weaknesses is crucial for navigating the evolving industrial landscape.

Want the full story behind Babcock & Wilcox's competitive edge and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Babcock & Wilcox (B&W) stands as a global leader in energy and environmental technologies, leveraging over 155 years of industry experience. This deep-rooted expertise, demonstrated by operations in more than 90 countries, solidifies its market position.

The company's strength lies in its comprehensive portfolio, which includes advanced steam generation equipment and critical environmental control systems. These offerings serve a broad spectrum of industrial and power generation sectors across the globe, highlighting its extensive reach and diverse capabilities.

Babcock & Wilcox Enterprises (B&W) is showing impressive momentum with its backlog and bookings. This growth signals a strong pipeline of future revenue, which is a key strength for any company.

Looking at the first quarter of 2025, B&W's backlog surged by a remarkable 47% to $526.8 million when compared to the first quarter of 2024. This figure represents the largest backlog the company has seen in recent history, providing a substantial foundation for future financial performance.

Furthermore, bookings from continuing operations also saw a healthy increase, rising by 11% year-over-year to $167.0 million. This consistent inflow of new orders reinforces the positive outlook for B&W's anticipated growth throughout 2025 and into the subsequent years.

Babcock & Wilcox Enterprises is making a significant strategic shift, focusing heavily on decarbonization and clean energy technologies. This pivot includes expanding its offerings in advanced waste-to-energy, biomass, hydrogen production, and carbon capture solutions.

Recent investments underscore this commitment. For example, B&W's investment in the BrightLoop™ hydrogen production facility in Ohio, expected to be operational in late 2024, positions the company to benefit from the burgeoning hydrogen economy. Furthermore, their work on coal-to-biomass conversion projects, often incorporating carbon capture, directly addresses the global need for lower-emission energy sources.

Resilient Global Parts & Service Business

Babcock & Wilcox's (B&W) Global Parts & Service business stands out as a core strength, demonstrating remarkable resilience. This segment achieved its strongest Q1 performance in 2025, setting new records for bookings, revenue, gross profit, and EBITDA. This consistent revenue generation is a significant advantage, particularly as it stems from the ongoing demand for essential boiler components and aftermarket support services.

The robust performance of the Parts & Service division is a key driver of B&W's overall financial health. In Q1 2025, this segment's growth was fueled by an uptick in demand for critical boiler parts and ongoing aftermarket services, showcasing its vital role in maintaining industrial operations. This stability is invaluable, helping to balance out the inherent fluctuations often seen in B&W's larger, project-centric business areas.

- Record Q1 2025 Performance: B&W's Global Parts & Service division achieved its highest Q1 bookings, revenue, gross profit, and EBITDA on record in Q1 2025.

- Consistent Revenue Stream: This segment provides a reliable source of income, underpinned by consistent demand for boiler components and aftermarket services.

- Profitability Contributor: The division significantly bolsters the company's profitability, demonstrating strong operational efficiency and market demand.

- Offsetting Volatility: The stability offered by this business unit helps to mitigate the cyclical nature and potential volatility associated with B&W's larger, project-based segments.

Improved Financial Performance and Debt Management Efforts

Babcock & Wilcox Enterprises (B&W) demonstrated a notable upturn in its financial performance during the first quarter of 2025. Revenues saw a healthy 10% increase, reaching $181.2 million, while Adjusted EBITDA experienced a significant surge of 27%, climbing to $14.3 million when compared to the same period in 2024. This improvement highlights the company's growing operational efficiency and market traction.

Furthermore, B&W has been proactively addressing its debt structure through a series of strategic maneuvers. These actions include successful bond exchanges and targeted asset sales, all designed to reduce the company's overall debt burden.

- Reduced Debt Load: Strategic bond exchanges and asset sales are actively lowering the company's total debt.

- Lowered Interest Expenses: These debt management efforts are expected to decrease annual interest payments.

- Extended Maturities: The company is working to push out debt maturities, improving its short-term financial flexibility.

- Strengthened Balance Sheet: These initiatives collectively contribute to a more robust and stable financial position.

Babcock & Wilcox's (B&W) Global Parts & Service business is a significant strength, achieving record Q1 2025 performance with increases in bookings, revenue, gross profit, and EBITDA. This segment provides a consistent revenue stream, vital for the company's financial stability by meeting ongoing demand for boiler components and aftermarket support.

The company's strategic focus on decarbonization and clean energy technologies, including waste-to-energy, biomass, and carbon capture, positions it well for future growth. Investments like the BrightLoop™ hydrogen facility underscore this commitment. B&W's backlog and bookings also show strong growth, with Q1 2025 backlog reaching $526.8 million, a 47% increase year-over-year, indicating a robust pipeline of future revenue.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Backlog | $358.4M | $526.8M | +47% |

| Bookings (Continuing Ops) | $150.5M | $167.0M | +11% |

| Global Parts & Service Revenue | $89.5M | $98.2M | +9.7% |

| Total Revenue | $164.5M | $181.2M | +10.4% |

| Adjusted EBITDA | $11.3M | $14.3M | +26.5% |

What is included in the product

Delivers a strategic overview of Babcock & Wilcox Enterprises’s internal and external business factors, highlighting its technological expertise and market position alongside competitive pressures and operational challenges.

Offers a clear, actionable framework to identify and address Babcock & Wilcox's strategic challenges and opportunities.

Weaknesses

Babcock & Wilcox Enterprises (BW) continues to grapple with persistent net losses, even as operational performance shows some positive movement. For the first quarter of 2025, the company reported a net loss of $7.8 million. While this represents an improvement from the $12.8 million net loss recorded in the same period of 2024, it underscores the ongoing struggle to achieve profitability.

These financial headwinds are significantly impacting the company's market perception, contributing to a notably low overall stock score. Key factors driving this low score include consistently negative net income, a substantial debt burden, and evident liquidity challenges. As of March 31, 2025, BW's total debt stood at a considerable $473.6 million, highlighting the financial strain the company is under.

Babcock & Wilcox Enterprises (BW) carries a substantial debt burden, with total debt reaching $473.6 million as of the first quarter of 2025. This level of indebtedness, reflected in a debt-to-equity ratio of 2.4 in Q1 2025, places BW in a more leveraged position compared to many of its industry counterparts.

This elevated financial leverage presents a significant risk, contributing to 'going concern' qualifications in its financial reporting. These qualifications signal potential doubts about the company's ability to continue operating in the long term unless it can effectively manage and reduce its debt obligations.

The company's path to debt reduction is heavily reliant on external factors, particularly the successful completion of planned asset sales. Without these divestitures, achieving a more sustainable debt structure remains a considerable challenge.

The Babcock & Wilcox Environmental segment is susceptible to revenue volatility, as evidenced by a 46% revenue drop in Q1 2025 compared to the prior year. This decline stemmed from the completion of substantial projects in 2024 without immediate replacements, highlighting a dependency on large, intermittent contracts. Such a pattern makes predictable revenue streams and consistent segment growth difficult to achieve.

Exposure to Macroeconomic Headwinds

Babcock & Wilcox Enterprises (B&W) faces significant vulnerability to broader economic shifts. Factors like rising inflation, increased interest rates, and global geopolitical instability can directly affect project expenses, the pace of project completion, and the company's general operational efficiency.

Management has specifically highlighted ongoing tariff discussions as a potential risk that could impact project scheduling and overall business performance throughout 2025. This uncertainty could lead to adjusted financial forecasts and potentially squeeze project profit margins.

- Inflationary Pressures: Rising costs for raw materials and labor can directly increase project budgets.

- Interest Rate Hikes: Higher borrowing costs can affect the financing of large capital projects undertaken by clients.

- Geopolitical Uncertainty: International conflicts or trade disputes can disrupt supply chains and create project delays.

- Tariff Negotiations: Specific trade policy changes, like those management has cited, pose a direct threat to project timelines and profitability in 2025.

Reliance on Traditional Thermal Business

Babcock & Wilcox Enterprises' significant dependence on its traditional Thermal segment poses a notable weakness. In Q1 2025, this segment was the primary revenue generator, accounting for $138.25 million, which represented approximately 70% of total sales in 2024. This heavy reliance on fossil fuel-based energy services, such as those for natural gas and coal, creates vulnerability as the global energy market increasingly prioritizes renewable sources. The limited revenue fluctuation in the Thermal segment during 2024, largely due to project scheduling, signals a mature market with constrained organic growth prospects unless new conversion initiatives are undertaken.

Babcock & Wilcox Enterprises faces significant challenges in achieving consistent profitability, as evidenced by a net loss of $7.8 million in Q1 2025, despite improvements over the prior year's $12.8 million loss. This ongoing financial strain is reflected in a low stock score, driven by persistent negative net income and a substantial debt burden of $473.6 million as of March 31, 2025. The company's high leverage, with a debt-to-equity ratio of 2.4 in Q1 2025, raises concerns about its long-term operational viability, leading to 'going concern' qualifications in financial reporting.

The Environmental segment exhibits revenue volatility, with a 46% year-over-year drop in Q1 2025 due to the completion of large projects without immediate replacements. This reliance on intermittent contracts hinders predictable revenue streams and consistent growth. Furthermore, the company's heavy dependence on its traditional Thermal segment, which accounted for approximately 70% of total sales in 2024, leaves it vulnerable to shifts in the energy market towards renewables and indicates limited organic growth prospects in this mature sector.

| Financial Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Net Loss | $7.8 million | $12.8 million |

| Total Debt | $473.6 million | $473.6 million |

| Debt-to-Equity Ratio | 2.4 | N/A |

| Environmental Segment Revenue Change | -46% | N/A |

| Thermal Segment Revenue (Approx.) | $138.25 million | N/A |

Preview the Actual Deliverable

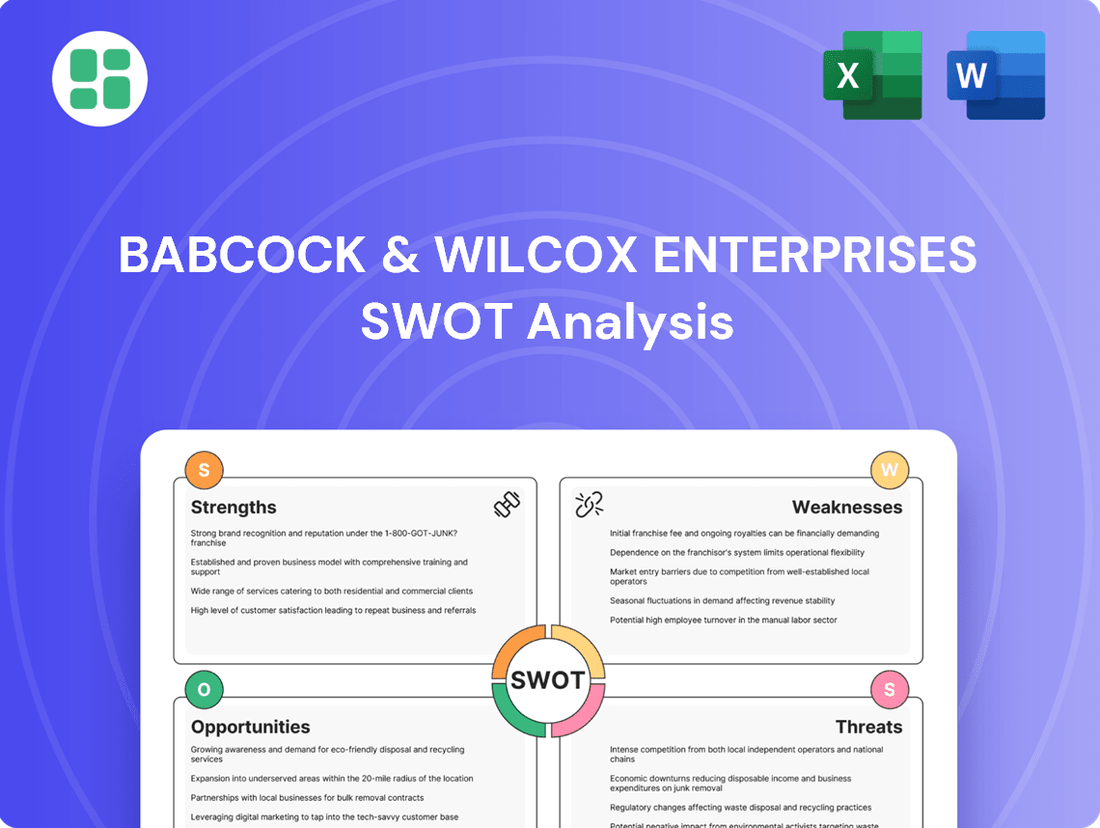

Babcock & Wilcox Enterprises SWOT Analysis

This is the actual Babcock & Wilcox Enterprises SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive report you'll download. Unlock the full, detailed insights into their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The world's increasing focus on sustainability and reducing carbon emissions is a major tailwind for Babcock & Wilcox (B&W). Governments and industries globally are pushing for net-zero targets, creating a robust market for clean energy and decarbonization technologies.

B&W is well-positioned to benefit from this trend, with its investments in innovative solutions like BrightLoop™ for hydrogen production, carbon capture technologies, and biomass-to-energy systems. These offerings directly address the growing demand for environmentally friendly energy sources, allowing B&W to capture a significant share of this expanding market.

The company's strategic alignment with these global initiatives is evident in its substantial pipeline of opportunities, which currently exceeds $7.6 billion. This strong backlog underscores the significant market potential for B&W's clean energy portfolio as the world transitions towards a lower-carbon future.

Babcock & Wilcox (B&W) is making significant strides in the renewable energy sector, evidenced by its successful bid for a 75 MW utility-scale solar project in Pennsylvania during 2024. This move highlights B&W's capacity to apply its established project management skills to the booming solar market.

This expansion into solar EPC services offers a strategic avenue for revenue diversification, lessening dependence on its traditional thermal energy business. The company's growing presence in renewable energy projects positions it to capitalize on the increasing global demand for clean energy solutions.

Babcock & Wilcox Enterprises (B&W) can capitalize on its extensive global reach, with an installed base in over 90 countries, to introduce its advanced clean energy and environmental solutions to its established utility and industrial customers. This presents a significant opportunity to leverage existing relationships and trust.

As regulatory pressures mount for emissions reduction and the adoption of sustainable practices, B&W is well-positioned to offer its expertise in upgrading and converting existing thermal infrastructure for its clientele. This strategic pivot transforms the challenges faced by its customers into avenues for new revenue streams.

For instance, B&W's recent advancements in technologies like carbon capture, utilization, and storage (CCUS) and advanced emissions control systems are directly applicable to the needs of utilities and industrial plants looking to decarbonize their operations. The company's strong track record in boiler and emissions control technology installation and servicing provides a solid foundation for offering these new solutions.

Strategic Partnerships and Asset Utilization

Babcock & Wilcox's strategic alliances, notably its work with Kanadevia Inova on BrightLoop™ projects utilizing waste and biomass, are key to faster technology adoption and market reach. These collaborations are vital for scaling innovative solutions.

The divestiture of non-core assets, such as the Danish subsidiary and Diamond Power International, serves a dual purpose: it strengthens the balance sheet by reducing debt and frees up capital. This financial flexibility enables B&W to concentrate investments on burgeoning sectors like hydrogen and carbon capture, refining its business focus for future growth.

- Strategic Partnership Acceleration: Collaboration with Kanadevia Inova for BrightLoop™ projects is expected to speed up the deployment of advanced waste-to-energy technologies.

- Asset Optimization for Growth: The sale of non-core assets, including the Danish subsidiary, generated proceeds that can be reinvested in high-growth areas.

- Debt Reduction and Resource Reallocation: Divestitures contribute to lowering the company's debt burden, allowing for a strategic shift of resources toward promising technologies like hydrogen and carbon capture.

Increased Demand from Data Centers and EVs

The burgeoning demand for electricity, driven by the rapid expansion of artificial intelligence data centers and the widespread adoption of electric vehicles (EVs), presents a substantial opportunity for Babcock & Wilcox (B&W). This trend directly translates into a greater need for robust and reliable power generation infrastructure, an area where B&W's core technologies and advanced solutions are well-positioned to contribute. For instance, B&W's expertise in natural gas conversion projects can help meet this escalating power requirement efficiently.

This burgeoning demand is not a fleeting trend but a foundational shift expected to underpin growth well into 2025 and beyond. The global EV market is projected to see significant expansion, with sales expected to reach tens of millions of units annually in the coming years. Similarly, the energy consumption of AI data centers is escalating, requiring substantial power upgrades.

- AI Data Centers: These facilities are becoming increasingly power-intensive, necessitating new and upgraded power generation capacity.

- Electric Vehicles: The growing EV fleet requires a more robust and accessible charging infrastructure, demanding more electricity.

- Natural Gas Conversion: B&W's ability to facilitate the conversion of existing power plants to natural gas offers a pathway to meet immediate power needs while supporting cleaner energy transitions.

- Reliable Power: The critical nature of these sectors underscores the need for dependable power solutions, a core strength of B&W's offerings.

The global push for decarbonization and net-zero emissions creates a significant market for Babcock & Wilcox's (B&W) clean energy technologies, including carbon capture and hydrogen production. B&W's substantial opportunity pipeline, exceeding $7.6 billion as of early 2024, reflects this demand. The company's strategic expansion into renewable energy EPC services, exemplified by its 2024 bid for a 75 MW solar project, diversifies revenue and capitalizes on the growing clean energy sector.

B&W can leverage its global presence in over 90 countries to introduce its advanced environmental solutions to existing customers, particularly as regulatory pressures drive emissions reductions. The company's expertise in upgrading thermal infrastructure and offering solutions like carbon capture and advanced emissions control systems positions it to convert customer needs into new revenue streams. Strategic partnerships, such as those for BrightLoop™ projects, accelerate technology adoption and market penetration.

The increasing demand for electricity from AI data centers and the widespread adoption of electric vehicles (EVs) present further opportunities for B&W's power generation solutions. B&W's ability to facilitate natural gas conversion projects can help meet this escalating power requirement efficiently, supporting cleaner energy transitions. The company's divestiture of non-core assets not only strengthens its balance sheet by reducing debt but also frees up capital for reinvestment in high-growth areas like hydrogen and carbon capture.

| Opportunity Area | Key Drivers | B&W's Role/Technology | Market Potential Indication | Timeline Focus |

| Decarbonization & Clean Energy | Net-zero targets, emission reduction mandates | Carbon capture, utilization, and storage (CCUS), hydrogen production (BrightLoop™), biomass-to-energy | Opportunity pipeline > $7.6 billion (early 2024) | Ongoing, accelerating through 2025 |

| Renewable Energy EPC | Growth in solar, wind, and other renewables | Project management, solar EPC services | Successful bid for 75 MW solar project (2024) | Expanding through 2025 |

| Power Generation for New Demands | AI data centers, EV charging infrastructure | Natural gas conversion, reliable power solutions | Escalating electricity demand | Increasing through 2025 |

| Existing Asset Modernization | Regulatory pressure, aging infrastructure | Emissions control upgrades, thermal plant conversion | Leveraging installed base in 90+ countries | Ongoing, driven by regulatory cycles |

Threats

Babcock & Wilcox Enterprises (B&W) navigates fiercely competitive energy and environmental sectors, where numerous domestic and international firms vie for market dominance. This includes established giants like Mitsubishi Power and General Electric Company, as well as specialized players in power generation and environmental control technology.

The pricing pressure stemming from this intense rivalry can significantly impact B&W's profit margins and ability to capture market share, especially in rapidly evolving clean energy markets. New entrants frequently emerge in these growth areas, further intensifying the competitive landscape.

Changes in environmental regulations and energy policies present a significant threat to Babcock & Wilcox Enterprises (B&W). For instance, the increasing global focus on decarbonization, as evidenced by the Biden administration's ambitious climate goals for the US, could accelerate the decline of traditional fossil fuel power generation, impacting B&W's thermal segment if new clean energy projects don't offset this decline.

Furthermore, the phasing out of older, less efficient power sources without a robust pipeline of new clean energy projects could create revenue gaps. Abrupt policy shifts or the uncertainty surrounding tariff negotiations, which can affect the cost of imported components for large projects, pose risks to project timelines and the overall profitability of B&W's contracts.

Babcock & Wilcox (B&W) faces significant execution risks with its new technologies, such as the BrightLoop™ hydrogen production system and advanced carbon capture solutions. The successful rollout and market adoption of these innovations are not guaranteed, and any delays in achieving commercial viability could hinder B&W's strategic growth objectives.

Furthermore, large-scale conversion projects, a key part of B&W's business, are inherently complex. These projects demand meticulous management and are susceptible to unforeseen challenges that can lead to project delays and cost overruns. For instance, in 2023, the company reported that its backlog included projects with varying degrees of execution risk, and managing these effectively is crucial for financial stability.

Sensitivity to Global Economic Conditions and Supply Chain Disruptions

Babcock & Wilcox Enterprises (B&W) faces significant headwinds from global economic volatility. For instance, persistent inflation in 2024 has driven up raw material and labor costs, directly impacting project margins. Interest rate hikes by central banks globally in 2024 and continuing into 2025 also increase the cost of capital for B&W and its customers, potentially slowing project pipelines.

Supply chain disruptions, a persistent issue since 2022 and expected to continue through 2025, pose another substantial threat. These disruptions, often stemming from geopolitical tensions and trade policy shifts, can lead to material shortages and increased shipping expenses. For B&W, this translates to potential project delays and higher operational expenditures, as seen in the extended lead times for critical components in late 2024.

- Inflationary Pressures: Rising costs for steel, components, and labor in 2024 and anticipated for 2025 directly squeeze B&W's profit margins on long-term projects.

- Interest Rate Sensitivity: Higher borrowing costs for B&W and its clients in 2024-2025 can dampen demand for new capital projects.

- Geopolitical Impact: Ongoing global conflicts and trade disputes in 2024-2025 continue to disrupt logistics and inflate material prices, creating project execution risks.

- Supply Chain Volatility: Unpredictable availability and cost of key materials, a challenge throughout 2024, are projected to persist into 2025, threatening project timelines.

Financial Stability and 'Going Concern' Doubts

Babcock & Wilcox Enterprises (B&W) has openly stated substantial doubt regarding its ability to continue as a going concern. This concern stems from a significant portion of its debt being classified as current, creating immediate repayment pressures. For instance, as of the first quarter of 2024, the company reported total debt of $641.3 million, with a notable portion maturing within the next year, highlighting the urgency of its refinancing efforts.

While B&W has been actively working on debt reduction and restructuring, its financial stability remains a key area of scrutiny for stakeholders. The successful refinancing or effective management of these near-term debt obligations is paramount. Failure to do so could precipitate considerable financial distress, impacting operations and investor confidence. The company’s ability to navigate these challenges will be a critical determinant of its future viability.

- Significant Debt Maturities: A substantial portion of B&W's total debt, reported at $641.3 million in Q1 2024, is due within the next twelve months.

- Going Concern Qualification: The company has formally acknowledged significant doubt about its ability to continue operating as a going concern.

- Refinancing Risk: The success of B&W's debt reduction strategies hinges on its ability to refinance or renegotiate its current debt obligations.

- Financial Distress Potential: Failure to manage its debt effectively could lead to severe financial difficulties and operational disruptions.

Babcock & Wilcox Enterprises faces intense competition from established players like Mitsubishi Power and General Electric, alongside emerging specialists, particularly in the clean energy sector. This rivalry puts pressure on pricing, potentially impacting B&W's profit margins and market share growth. The constant emergence of new competitors in high-growth clean energy markets further intensifies this challenge.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary to ensure a robust and accurate assessment of Babcock & Wilcox Enterprises.