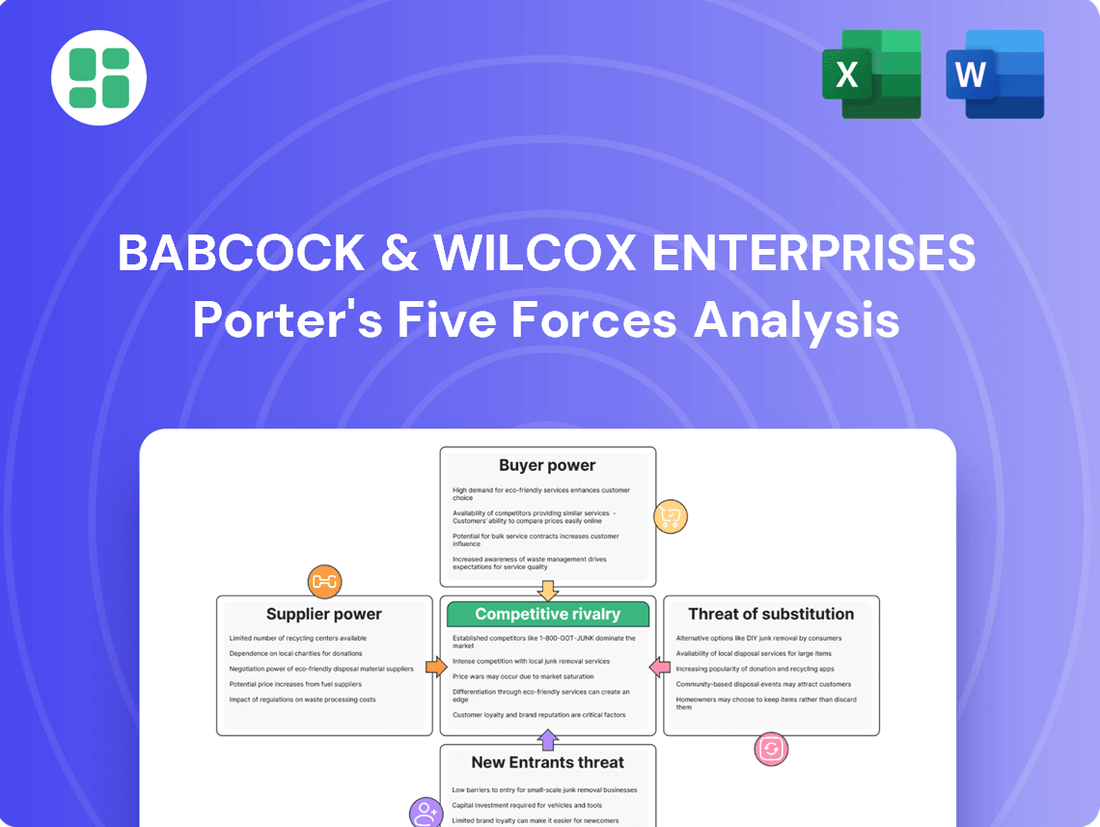

Babcock & Wilcox Enterprises Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Babcock & Wilcox Enterprises Bundle

Babcock & Wilcox Enterprises operates in an industry shaped by intense rivalry and moderate bargaining power from both suppliers and buyers. The threat of substitutes, while present, is somewhat mitigated by the specialized nature of their offerings.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Babcock & Wilcox Enterprises’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Babcock & Wilcox Enterprises (B&W) faces considerable bargaining power from specialized component suppliers crucial for its advanced energy and environmental solutions. These suppliers often possess unique, proprietary technologies or control access to essential raw materials, allowing them to command higher prices and potentially dictate terms. For instance, in 2024, B&W's reliance on highly specific alloys for its high-temperature boiler systems meant that a few key metallurgical firms held significant sway over pricing and availability.

The limited number of manufacturers capable of producing these highly engineered parts means B&W has fewer viable alternatives. This scarcity directly translates to increased leverage for these suppliers, who understand the critical nature of their components to B&W's product performance and delivery schedules. Consequently, B&W may experience higher input costs and face potential disruptions if these specialized suppliers encounter production issues or decide to prioritize other clients.

The cost and availability of crucial raw materials like specialized metals and chemicals directly influence Babcock & Wilcox Enterprises' (B&W) production expenses for steam generation and environmental control systems. For instance, in 2023, global nickel prices, a key component in some high-temperature alloys used by B&W, saw significant volatility, impacting input costs for manufacturers in the sector.

Disruptions in these global commodity markets, often triggered by geopolitical tensions or trade disputes, can cause price swings and supply chain interruptions. This scenario amplifies the leverage held by suppliers of these essential materials, potentially forcing B&W to absorb higher costs or face production delays.

To mitigate these risks, B&W's strategy likely involves cultivating robust relationships with its suppliers and actively pursuing diversified sourcing options. This proactive approach helps ensure a more stable and predictable supply chain, lessening the impact of external market shocks on their operations and profitability.

In the dynamic clean energy landscape, Babcock & Wilcox Enterprises (B&W) relies on specialized technology and intellectual property (IP) providers for critical advancements such as carbon capture and hydrogen production. Suppliers possessing essential patents or proprietary, state-of-the-art technologies can leverage this position to negotiate higher prices or enforce stringent licensing agreements. This dependence on external innovation amplifies supplier bargaining power, particularly when B&W's internal research and development efforts struggle to match the pace of these external breakthroughs.

Labor and Specialized Expertise

The bargaining power of suppliers, particularly those providing specialized labor, is a significant consideration for Babcock & Wilcox Enterprises (B&W). Companies like B&W rely heavily on engineers, technicians, and skilled tradespeople with unique expertise in complex energy and environmental technologies. When there's a scarcity of these highly specialized professionals, their ability to command higher wages and better benefits increases, directly impacting B&W's operational costs.

The demand for skilled labor in sectors like advanced manufacturing and renewable energy continues to grow. For instance, the U.S. Bureau of Labor Statistics projected a 6% growth in employment for mechanical engineers between 2022 and 2032, a rate faster than the average for all occupations. This trend underscores the potential for increased labor costs for B&W if they face competition for talent. Effective internal talent development and robust retention programs are therefore crucial for B&W to mitigate this supplier bargaining power.

- Skilled Labor Shortage: A limited pool of specialized engineers and technicians can drive up labor costs for B&W.

- Industry Demand: Sectors requiring advanced technical skills are experiencing growth, intensifying competition for talent.

- Talent Management: B&W's internal strategies for developing and retaining skilled employees are vital to managing supplier power.

- Cost Impact: Increased labor expenses directly affect project profitability and overall service delivery costs.

Aftermarket Parts and Service Providers

Babcock & Wilcox Enterprises (B&W) relies heavily on aftermarket parts and specialized service providers to maintain its installed base of equipment. The bargaining power of these suppliers can be significant, particularly when B&W's operations depend on a narrow set of vendors for critical components or proprietary repair tools. This dependence can allow suppliers to command higher prices and dictate terms, impacting B&W's service costs and operational efficiency.

The necessity of these aftermarket parts for ensuring the continued functionality and uptime of B&W's power generation and industrial equipment grants these suppliers considerable leverage. If B&W faces disruptions in its supply chain for these essential parts, it can directly affect customer satisfaction and its ability to fulfill service contracts. For instance, in 2023, the industrial services sector experienced an average increase in the cost of specialized components by approximately 6-8%, a trend that could directly influence B&W's cost structure if its suppliers pass on these increases.

- Supplier Concentration: The fewer the number of specialized aftermarket parts suppliers, the greater their bargaining power.

- Proprietary Nature of Parts: If parts are unique to B&W's technology and not easily substituted, suppliers gain leverage.

- Switching Costs: High costs associated with qualifying new suppliers or redesigning equipment to use alternative parts strengthen existing suppliers' positions.

- Importance of Parts: The criticality of specific parts for maintaining operational uptime directly correlates with supplier influence.

The bargaining power of suppliers for Babcock & Wilcox Enterprises (B&W) is amplified by the specialized nature of their offerings, particularly in advanced materials and proprietary technologies. In 2024, B&W's reliance on specific high-temperature alloys for its boiler systems meant that a concentrated group of metallurgical firms held significant pricing power due to limited alternatives. This scarcity allows these suppliers to command higher prices and influence delivery terms, impacting B&W's input costs and operational continuity.

Furthermore, the scarcity of highly skilled labor in advanced energy sectors, such as those requiring expertise in carbon capture or hydrogen production, grants specialized technical personnel and their employers considerable leverage. For instance, the U.S. Bureau of Labor Statistics projected a 6% growth in mechanical engineering roles between 2022 and 2032, indicating a competitive labor market. This can lead to increased labor costs for B&W, necessitating robust talent management strategies to mitigate supplier power.

The concentration of suppliers for critical aftermarket parts and proprietary repair tools also contributes to their bargaining strength. If B&W faces supply chain disruptions for essential components, it can affect customer satisfaction and service contract fulfillment. In 2023, the industrial services sector saw an average increase in specialized component costs of approximately 6-8%, a trend that suppliers could pass on to B&W.

| Factor | Impact on B&W | Example (2023-2024) |

|---|---|---|

| Specialized Materials | Higher input costs, potential supply disruptions | Limited suppliers of high-temperature alloys |

| Skilled Labor | Increased labor expenses, competition for talent | Projected 6% growth in mechanical engineering roles (2022-2032) |

| Aftermarket Parts | Elevated service costs, impact on operational uptime | 6-8% average increase in specialized component costs (2023) |

| Proprietary Technology | Higher licensing fees, dependence on external innovation | Patented carbon capture technologies |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Babcock & Wilcox Enterprises' position in the power generation and industrial sectors.

Babcock & Wilcox Enterprises' Porter's Five Forces analysis offers a clear, one-sheet summary of all five forces, perfect for quick decision-making and strategic planning.

Customers Bargaining Power

Babcock & Wilcox Enterprises (B&W) primarily serves large industrial and utility clients. These customers wield considerable bargaining power due to the sheer size of their projects and their influence over market demand. For instance, a major utility company commissioning a new power plant represents a significant portion of B&W's potential revenue, giving them leverage in negotiations.

This substantial purchasing power allows these large clients to negotiate favorable pricing, project specifications, and customization options. Such demands can directly impact B&W's profit margins, as the company may need to absorb higher costs to meet these client expectations. In 2023, B&W reported total revenues of $830.2 million, highlighting the scale of the projects involved with its key customer segments.

While these large customers are less inclined to switch suppliers frequently due to their significant investment in B&W's technologies, they can still exert pressure. They often demand long-term support contracts and competitive service agreements, which B&W must factor into its ongoing operational costs and pricing strategies.

Government regulations and incentives significantly shape customer choices in the energy and environmental sectors. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, provides substantial tax credits for clean energy projects, directly influencing customer demand for technologies that qualify for these benefits. This creates a scenario where customers, armed with knowledge of available incentives, can exert greater pressure on companies like Babcock & Wilcox Enterprises to offer solutions that maximize their financial advantages.

The increasing availability of alternative energy solutions like solar and wind power directly impacts customer bargaining power. As these renewables become more cost-competitive and accessible, customers have less need to rely solely on traditional steam generation and environmental control systems, which are core to Babcock & Wilcox Enterprises' offerings.

For instance, by the end of 2023, global renewable energy capacity additions were projected to reach nearly 510 gigawatts, a significant increase from previous years. This growing market share for alternatives means customers can more readily switch or integrate these options, strengthening their position when negotiating with B&W.

B&W's strategic imperative, therefore, lies in its capacity to effectively integrate its clean energy technologies with these burgeoning alternative sources. This integration is key to maintaining customer loyalty and mitigating the downward pressure on pricing that arises from increased customer choice.

High Switching Costs for Customers

While customers may exert significant bargaining power initially, Babcock & Wilcox Enterprises (B&W) benefits from high switching costs for its complex energy and environmental systems. These costs can significantly reduce customer leverage over time.

The substantial investment required to replace B&W's integrated steam generation or environmental control equipment with a competitor's offerings often proves prohibitive. This situation fosters customer lock-in, especially concerning ongoing aftermarket services.

- Customer Lock-in: B&W's specialized equipment necessitates significant retraining and integration efforts for new systems, making it costly for customers to switch.

- Aftermarket Services: Once installed, B&W's proprietary parts and maintenance expertise create a strong dependency, limiting customers' ability to source these services elsewhere.

- Long-Term Contracts: Many of B&W's agreements include long-term service and maintenance clauses, further solidifying customer relationships and reducing the immediate impact of initial bargaining power.

Customer Demand for Integrated Solutions and Services

Customers are increasingly looking for complete packages that bundle equipment, installation, and ongoing maintenance. This trend towards integrated solutions means clients can simplify their purchasing process and potentially secure more favorable pricing by dealing with fewer suppliers. For instance, in the energy sector, a utility company might prefer a single provider for boiler upgrades, emissions control systems, and a long-term service agreement, rather than managing multiple contracts.

Babcock & Wilcox Enterprises (B&W) is well-positioned to meet this demand. By offering a broad spectrum of products, from advanced boiler technology to environmental solutions and digital optimization tools, B&W can provide these comprehensive packages. This integrated approach directly addresses customer preferences for consolidated procurement and end-to-end service, enhancing B&W's competitive edge in securing large projects.

The bargaining power of customers is amplified when they can bundle their needs. For example, a large industrial client might negotiate a lower per-unit price on new equipment if they also commit to a multi-year service and performance optimization contract. In 2024, the market for industrial services, which includes maintenance and optimization, continued to grow, with some reports indicating an expansion of over 5% year-over-year, underscoring the value customers place on these integrated offerings.

- Integrated Solutions Demand: Customers prefer combined equipment, installation, and long-term service packages.

- Procurement Simplification: Bundled offerings allow clients to reduce vendor relationships and negotiate better overall terms.

- B&W's Value Proposition: B&W's ability to provide a full suite of products and services, including digital solutions, strengthens its appeal.

- Market Trend: The industrial services sector, crucial for integrated offerings, saw robust growth in 2024.

Babcock & Wilcox Enterprises (B&W) faces significant customer bargaining power, particularly from its large industrial and utility clients. These clients, often involved in massive projects, can leverage their purchasing volume to negotiate favorable terms, impacting B&W's profit margins. For instance, B&W's 2023 revenue of $830.2 million underscores the scale of these customer relationships.

While switching costs for B&W's complex systems are high, customers are increasingly seeking integrated solutions that bundle equipment, installation, and long-term maintenance. This trend, supported by the industrial services market's growth in 2024, allows customers to simplify procurement and exert greater pressure on pricing by consolidating their needs with fewer suppliers.

| Customer Type | Bargaining Power Drivers | Impact on B&W |

| Large Industrial/Utility Clients | High volume purchasing, project scale | Favorable pricing, specification demands, margin pressure |

| Clients seeking integrated solutions | Desire for bundled services (equipment, installation, maintenance) | Leverage for better overall terms, preference for consolidated procurement |

Full Version Awaits

Babcock & Wilcox Enterprises Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Babcock & Wilcox Enterprises provides an in-depth examination of the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. What you're previewing is the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

Babcock & Wilcox Enterprises (B&W) navigates highly specialized sectors within energy and environmental technology, focusing on areas like waste-to-energy, biomass, and emissions control. Even in these niche segments, competition is often fierce, with specialized firms and larger, more diversified industrial giants vying for market share.

The intensity of this rivalry is amplified by the growth potential in these markets. For instance, the global waste-to-energy market is anticipated to expand significantly, with a projected compound annual growth rate (CAGR) of 7.10% between 2025 and 2033, indicating a dynamic environment where companies are motivated to employ aggressive strategies to capture a larger portion of this expanding pie.

Babcock & Wilcox Enterprises (B&W) contends with substantial rivalry from larger, more diversified engineering and energy corporations. These giants often possess extensive product lines, deeper financial reserves, and a more established global footprint, allowing them to absorb market fluctuations more effectively. For instance, companies like Sinopec International Petroleum Exploration and Production, a major player in the energy sector, and Andritz AG, a diversified industrial group, represent formidable competition due to their scale and breadth of operations.

These diversified competitors can exploit economies of scale, reducing their per-unit costs and enabling more aggressive pricing strategies. Furthermore, their ability to cross-subsidize different business segments means they can offer competitive pricing or even invest heavily in specific areas where B&W operates, creating a significant competitive disadvantage. This broad market presence and financial muscle make them a persistent threat to B&W's market share and profitability.

Competitive rivalry in the clean energy and environmental sectors, where Babcock & Wilcox Enterprises operates, is intensely driven by continuous technological innovation. Companies must consistently invest in research and development to create differentiated offerings, such as advanced waste-to-energy, biomass, and carbon capture technologies. For instance, B&W's focus on emissions control solutions and advanced boiler technologies highlights the need to stay ahead in a rapidly evolving landscape.

Global Market Reach and Regional Dynamics

Babcock & Wilcox Enterprises (B&W) navigates a competitive global arena, facing off against both multinational corporations and specialized regional competitors. This international presence means B&W must adapt to diverse market conditions, from stringent environmental regulations in Europe to rapidly growing industrial demands in emerging economies.

The competitive intensity is further shaped by regional dynamics. Local market preferences, differing regulatory frameworks, and the entrenched presence of established regional players significantly impact B&W's market share and operational strategies. For example, the Asia-Pacific region, a key growth area for industrial emission control and waste-to-energy solutions, is characterized by robust local competition.

- Global Footprint, Local Challenges: B&W's operations span multiple continents, exposing it to a wide array of competitors, from large international conglomerates to niche regional specialists.

- Regulatory Influence: Varying environmental standards and government incentives across different regions directly affect the competitive landscape for B&W's technologies.

- Asia-Pacific Focus: This region represents a critical battleground, with strong local players vying for market dominance in emission control and waste-to-energy sectors.

- Market-Specific Demands: Tailoring solutions to meet unique regional industrial demands and economic conditions is paramount for B&W to remain competitive.

Aftermarket Service and Long-Term Relationships

Competitive rivalry in the power generation equipment sector is heavily influenced by aftermarket services and the cultivation of enduring customer relationships. Babcock & Wilcox Enterprises (B&W) faces intense competition from rivals who also leverage their installed base of operating boiler units to secure lucrative, long-term service contracts. This means that winning initial equipment sales is only the first step; ongoing maintenance, parts supply, and upgrade services are critical battlegrounds where loyalty and profitability are forged.

B&W's strategic focus on its aftermarket services segment, which historically contributes a substantial portion of its revenue, underscores the importance of this competitive dynamic. For instance, in 2023, B&W's Power Generation Services segment, heavily reliant on aftermarket offerings, generated approximately $528 million in revenue. This highlights how a company's ability to provide reliable, efficient, and cost-effective support for existing installations directly impacts its competitive standing and market share.

- Aftermarket services are a key differentiator, extending beyond initial equipment sales to encompass maintenance, parts, and upgrades.

- Long-term customer relationships are built on the reliability and cost-effectiveness of these ongoing services.

- B&W's established network of operating boiler units serves as a crucial asset for securing aftermarket business.

- In 2023, B&W's Power Generation Services segment, driven by aftermarket demand, achieved $528 million in revenue.

Babcock & Wilcox Enterprises (B&W) faces robust competition from both large, diversified industrial conglomerates and specialized niche players in the energy and environmental technology sectors. These rivals often leverage greater financial resources and broader market reach, enabling them to compete aggressively on price and innovation. For example, companies like Andritz AG and major energy service providers present significant competitive challenges due to their scale and established customer bases.

The intensity of rivalry is heightened by the ongoing technological advancements in areas like waste-to-energy and emissions control, requiring continuous investment in research and development. B&W's strategic focus on aftermarket services, which generated $528 million in revenue for its Power Generation Services segment in 2023, demonstrates the critical importance of customer retention and ongoing support in this competitive landscape.

| Competitor Type | Key Strengths | Impact on B&W |

|---|---|---|

| Diversified Conglomerates | Economies of scale, financial depth, broad product portfolios | Price competition, ability to cross-subsidize, market share pressure |

| Specialized Niche Firms | Deep technical expertise in specific segments, agility | Targeted competition in key B&W markets, innovation challenges |

| Aftermarket Service Providers | Established installed base, long-term customer relationships | Competition for service contracts, revenue stream vulnerability |

SSubstitutes Threaten

The most significant threat of substitutes for Babcock & Wilcox Enterprises (B&W) arises from the growing viability of renewable energy sources, particularly solar and wind power. These alternatives can produce electricity without requiring the steam generation equipment and complex environmental controls that are central to B&W's traditional offerings.

While B&W is also involved in renewable solutions, the swift progress and decreasing costs associated with solar and battery storage technologies pose a direct challenge. These advancements offer customers a compelling alternative for their energy generation needs, potentially bypassing the need for B&W's established technologies.

For instance, the global renewable energy capacity saw substantial growth in 2023, with solar PV and wind power leading the charge. In 2023, solar PV installations alone accounted for over 140 GW globally, a significant increase year-over-year, demonstrating the escalating competitiveness of these substitutes.

Improvements in industrial energy efficiency and demand reduction technologies present a significant threat of substitution for Babcock & Wilcox Enterprises (B&W). These advancements can directly lessen the need for B&W's traditional power generation and environmental control solutions. For instance, companies adopting advanced heat recovery systems or sophisticated energy management software can curtail their reliance on new or upgraded power infrastructure.

This shift is fueled by both economic incentives and growing sustainability mandates. In 2024, the global push for decarbonization continues to drive investments in energy-saving technologies. Many industrial sectors are actively seeking ways to reduce their operational energy consumption, with some reporting substantial savings. For example, advancements in process optimization can lead to a 10-20% reduction in energy usage for certain manufacturing operations, directly impacting the market for new equipment.

For Babcock & Wilcox Enterprises (B&W), the threat of substitutes in waste management is significant. Alternative methods like enhanced recycling programs, widespread composting, and the development of advanced, more environmentally sound landfill technologies directly compete with waste-to-energy (WtE) solutions. A strong push towards circular economy principles, which prioritize waste reduction and material reuse, could indeed lessen the perceived need for new WtE facilities.

While the global waste-to-energy market is projected to reach an estimated USD 55.7 billion by 2027, growing at a compound annual growth rate of 5.1% from 2020, these alternative waste management strategies remain a persistent factor. For instance, in 2023, the European Union reported a recycling rate of 48.7% for municipal waste, a figure that continues to climb and potentially reduces the volume of waste available for WtE processing.

Emerging Decarbonization Technologies

New and emerging decarbonization technologies present a significant long-term threat. Innovations like advanced nuclear power, green hydrogen for direct industrial use, and direct air capture could eventually offer alternatives to Babcock & Wilcox Enterprises (B&W) core business of carbon capture and traditional power generation solutions. While many of these are still in nascent stages of development, their potential to disrupt the market is real.

These evolving technologies could reduce demand for B&W's existing offerings. For instance, if green hydrogen becomes widely adopted for industrial processes, it might lessen the need for carbon capture on fossil fuel-based plants. Similarly, advancements in renewable energy storage or next-generation nuclear reactors could diminish the reliance on conventional power generation methods that B&W serves.

B&W is actively working to mitigate this threat through its own strategic investments. The company is developing technologies like BrightLoop™, which focuses on hydrogen generation and carbon capture, aiming to position itself at the forefront of these emerging solutions. This proactive approach seeks to transform potential substitutes into future business opportunities.

The competitive landscape is shifting, with significant global investment flowing into clean energy. For example, the US Department of Energy's Hydrogen Earthshot initiative aims to reduce the cost of clean hydrogen by 80% to $1 per kilogram in one decade. Such initiatives underscore the rapid pace of innovation in decarbonization, directly impacting the long-term viability of traditional technologies.

- Advanced Nuclear: Potential to provide low-carbon baseload power, directly competing with fossil fuel generation.

- Green Hydrogen Production: Offers a cleaner fuel source for industrial processes, potentially displacing fossil fuels and reducing the need for associated carbon capture.

- Direct Air Capture (DAC): Could become a more efficient or cost-effective method of carbon removal than point-source capture technologies.

- B&W's Response: Investments in BrightLoop™ hydrogen generation and carbon capture aim to leverage these emerging trends.

Electrification of Industrial Processes

The increasing adoption of electric boilers and industrial heat pumps powered by renewable electricity directly challenges Babcock & Wilcox's (B&W) traditional offerings. As electricity grids decarbonize, these electric solutions provide a cleaner alternative for industrial steam generation, directly substituting B&W's fossil fuel and biomass-fired boiler systems.

This shift is driven by the pursuit of zero combustion emissions at the point of use. For instance, in 2024, the global industrial heat pump market was projected to reach over $15 billion, indicating significant investment and growth in these alternative technologies.

- Growing renewable electricity penetration: As more renewable energy sources are integrated into grids, the operational cost and environmental benefits of electric heating solutions improve.

- Technological advancements: Innovations in electric boiler efficiency and heat pump capacity are making them viable for a wider range of industrial applications previously dominated by combustion.

- Regulatory pressures: Stricter emissions regulations globally are incentivizing industries to explore and adopt zero-emission heating technologies, further accelerating the threat of substitutes.

The threat of substitutes for Babcock & Wilcox Enterprises (B&W) is substantial, driven by advancements in renewable energy and energy efficiency. Solar and wind power, along with improved industrial energy efficiency technologies, directly reduce the demand for B&W's traditional steam generation and environmental control equipment.

Emerging decarbonization technologies like green hydrogen and advanced nuclear power also pose a long-term substitution threat, potentially displacing fossil fuel-based generation and carbon capture solutions. Furthermore, the increasing adoption of electric boilers and heat pumps, powered by cleaner grids, offers a direct alternative for industrial heating needs.

B&W is actively investing in solutions like its BrightLoop™ technology to address these evolving market dynamics and transform potential substitutes into future business opportunities. The company's strategic focus aims to capitalize on the transition towards cleaner energy sources and more efficient industrial processes.

Entrants Threaten

The energy and environmental technology sector, especially for large-scale steam generation and environmental control systems, demands massive capital outlays for manufacturing plants, research and development, and project execution. Newcomers must overcome substantial financial hurdles to build the required infrastructure and create competitive technologies, hindering rapid scaling.

New entrants face significant regulatory hurdles and compliance complexities, particularly in the energy and environmental technology sectors where Babcock & Wilcox Enterprises (B&W) operates. Navigating evolving environmental regulations, intricate permitting processes, and stringent safety standards across different jurisdictions demands substantial expertise and investment, acting as a formidable barrier to entry. For instance, compliance with emissions limits, such as those under the Clean Air Act in the US, requires specialized knowledge and advanced technological solutions that new players may lack initially.

The sheer complexity of ensuring adherence to these regulations, including waste management policies and operational safety protocols, creates a steep learning curve and significant upfront costs. Established companies like B&W have spent decades developing this compliance know-how and cultivating relationships with regulatory bodies, giving them a distinct advantage. This accumulated experience and established credibility are not easily replicated by newcomers, reinforcing the threat of new entrants.

Babcock & Wilcox Enterprises (B&W) operates in sectors demanding significant technological expertise, particularly in steam generation and environmental control. Their extensive portfolio, bolstered by decades of innovation, includes numerous patents covering critical aspects of energy production and emissions reduction. For instance, B&W holds patents related to advanced boiler designs and air quality control systems, which are vital for compliance with evolving environmental regulations.

The high cost and time required to develop comparable proprietary technologies present a substantial hurdle for potential new entrants. Acquiring existing intellectual property is an alternative, but it also involves considerable financial investment. This technological moat, reinforced by a strong patent portfolio, effectively limits the threat of new companies easily entering B&W's core markets.

Brand Reputation and Customer Relationships

In the industrial and utility sectors, a strong brand reputation and deep-rooted customer relationships act as significant barriers to entry. Companies like Babcock & Wilcox Enterprises (B&W), established in 1867, have cultivated decades of trust and proven reliability, essential for winning large, intricate projects. Newcomers face a considerable hurdle in replicating this established credibility, making it challenging to displace incumbents in securing major contracts.

B&W's long history translates into a significant advantage. For instance, in 2023, B&W secured several key projects, including a $170 million contract for emissions control equipment for a major utility client, underscoring the importance of these established relationships in securing substantial business.

- Brand Loyalty: Decades of consistent performance foster strong customer loyalty, making it difficult for new entrants to gain market share.

- Proven Track Record: A history of successfully delivering complex projects builds confidence, a critical factor in high-stakes industrial contracts.

- Switching Costs: For customers, the cost and risk associated with switching to an unproven new supplier for critical infrastructure are often prohibitive.

- Reputational Risk: The potential negative impact on a utility or industrial operator's own reputation by partnering with an unknown entity further deters new entrants.

Supply Chain and Distribution Network

Establishing a global supply chain for specialized components and a reliable distribution network presents a significant hurdle for new entrants looking to compete with Babcock & Wilcox Enterprises (B&W). B&W benefits from an extensive, long-established network of suppliers and a worldwide customer base, relationships that are incredibly difficult and time-consuming for newcomers to build and replicate.

The capital investment required to create a comparable infrastructure is immense. For instance, developing the logistical capabilities to handle complex industrial equipment and spare parts globally necessitates substantial upfront spending on warehousing, transportation, and specialized personnel. This financial barrier alone can deter many potential competitors.

Furthermore, existing trade barriers and the ever-present risk of supply chain disruptions, as seen with global events impacting shipping and material availability in 2024, add layers of complexity. New entrants must navigate these challenges without the established resilience and contingency planning that mature companies like B&W possess.

- High Capital Investment: New entrants face substantial costs in building global supply chains and distribution networks.

- Established Relationships: B&W's existing supplier and customer relationships are a significant competitive advantage, hard to replicate.

- Logistical Complexity: Managing specialized industrial equipment distribution globally requires advanced logistical expertise and infrastructure.

- Trade Barriers & Disruptions: Navigating international trade regulations and supply chain volatility in 2024 further complicates market entry.

The threat of new entrants for Babcock & Wilcox Enterprises (B&W) is generally low due to extremely high barriers. The massive capital required for manufacturing, R&D, and project execution in the energy and environmental technology sectors is a significant deterrent. For example, building a new facility capable of producing large-scale steam generation equipment would likely cost hundreds of millions of dollars, a prohibitive sum for most newcomers.

Navigating complex regulatory landscapes and obtaining necessary permits across various jurisdictions demands specialized expertise and substantial investment, further limiting new entrants. B&W's established track record and deep understanding of compliance requirements, honed over decades, provide a distinct advantage. The company’s significant patent portfolio, covering critical technologies in steam generation and emissions control, acts as a technological moat, requiring potential competitors to either develop equally advanced proprietary solutions or acquire costly licenses.

B&W's long-standing reputation, built since 1867, and its proven ability to deliver complex, large-scale projects create strong customer loyalty and high switching costs. Securing contracts in 2023, such as a $170 million deal for emissions control equipment, highlights the value placed on established relationships and reliability. Furthermore, the intricate global supply chains and distribution networks B&W has cultivated over many years are difficult and expensive for new players to replicate, especially considering the logistical complexities and potential disruptions faced in 2024.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment for manufacturing, R&D, and project execution. | Very High Deterrent |

| Regulatory Hurdles | Complex environmental and safety compliance, permitting. | High Deterrent |

| Technological Sophistication | Proprietary patents and decades of innovation in steam generation and emissions control. | High Deterrent |

| Brand Reputation & Relationships | Established trust, proven track record, high switching costs for clients. | High Deterrent |

| Supply Chain & Distribution | Extensive global networks, logistical expertise, high setup costs. | High Deterrent |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Babcock & Wilcox Enterprises is built upon a foundation of publicly available information, including their annual reports (10-K filings), investor presentations, and press releases. We also incorporate industry-specific market research reports and data from financial news outlets to provide a comprehensive view of the competitive landscape.