Babcock & Wilcox Enterprises Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Babcock & Wilcox Enterprises Bundle

Curious about Babcock & Wilcox Enterprises' strategic positioning? Our BCG Matrix analysis offers a snapshot, revealing which segments are driving growth and which may require a closer look. Don't miss out on the full picture; purchase the complete report for a detailed breakdown of their Stars, Cash Cows, Dogs, and Question Marks, empowering you with actionable insights.

Stars

Babcock & Wilcox's ClimateBright Decarbonization Platform is a standout performer, fitting squarely into the Stars category of the BCG Matrix. This platform represents a significant growth opportunity for B&W, driven by the increasing global demand for carbon reduction solutions.

The ClimateBright platform, which integrates a suite of decarbonization technologies like carbon capture, is positioned to capitalize on a rapidly expanding market. This growth is fueled by stricter environmental regulations and a strong corporate push towards sustainability, with many companies setting ambitious net-zero targets.

B&W is channeling substantial investment and strategic focus into developing ClimateBright, aiming to establish it as a leader in the decarbonization sector. For instance, in 2024, B&W announced several key projects and partnerships specifically related to its carbon capture technologies, underscoring its commitment to this high-growth area.

BrightLoop Hydrogen Generation Technology is a shining star for Babcock & Wilcox Enterprises (B&W). This proprietary technology produces hydrogen from solid fuels, a critical development in the booming clean energy sector and the expanding hydrogen economy.

B&W's commitment to BrightLoop is evident through significant investments and ongoing development, such as the Massillon BrightLoop project. This strategic focus underscores the technology's high growth potential within a rapidly emerging market.

Babcock & Wilcox Enterprises' advanced waste-to-energy (WTE) solutions are strategically placed within a burgeoning market. This growth is fueled by global urbanization and a strong push for sustainable waste management and renewable energy sources. The company is making significant strides in this area, including pioneering projects aimed at generating net-negative hydrogen from solid fuels.

The global waste-to-energy market is anticipated to experience substantial expansion, presenting a high-potential avenue for B&W. For instance, the market was valued at approximately $35.5 billion in 2023 and is projected to reach around $60.9 billion by 2030, growing at a compound annual growth rate (CAGR) of about 8.1% during this period. This robust growth trajectory underscores the strategic importance of B&W's WTE segment.

Biomass-to-Energy Solutions

Babcock & Wilcox's (B&W) biomass-to-energy solutions are positioned as a high-growth area within the BCG Matrix. The global biomass power generation market is expanding, with projections indicating continued strong performance. For instance, the market was valued at approximately $95.7 billion in 2023 and is expected to reach $154.2 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.1% during the forecast period.

B&W is actively capitalizing on this trend, particularly with its advanced Bubbling Fluidised Bed (BFB) technology. This technology is well-suited for converting existing coal-fired power plants to run on biomass, a significant market opportunity. The company has recently secured new contracts in Europe specifically for these coal-to-biomass conversion projects, demonstrating tangible market traction and B&W's competitive edge in this evolving energy landscape.

- Market Growth: Global biomass power generation market expected to grow significantly, reaching an estimated $154.2 billion by 2030.

- B&W's Technology: Bubbling Fluidised Bed (BFB) technology is a key offering for biomass conversion.

- Contract Wins: Recent European contracts for coal plant conversions to biomass highlight market demand and B&W's positioning.

- Strategic Advantage: B&W's expertise in plant conversion aligns with the global shift towards renewable energy sources.

Environmental Control Systems (New Generation)

Babcock & Wilcox Enterprises' (B&W) Environmental Control Systems, representing the new generation of their offerings, are strategically positioned within the BCG matrix. While Q1 2025 revenues for this segment experienced a dip, primarily due to the natural ebb and flow of project timelines, the underlying technological advancements and market focus are indicative of future growth potential.

B&W is actively investing in and promoting advanced emissions control technologies. This includes sophisticated solutions like industrial electrostatic precipitators, which are critical for meeting increasingly stringent environmental regulations worldwide. The company's emphasis on these next-generation systems signals a commitment to capturing market share in a rapidly evolving sector.

- Technological Advancement: Focus on next-generation emissions control, including advanced industrial electrostatic precipitators.

- Regulatory Tailwinds: Solutions are designed to address current and future environmental regulations, creating a strong market pull.

- Market Positioning: Aiming for leadership in high-growth segments of the environmental technology market.

- Revenue Dynamics: Q1 2025 revenue decrease attributed to project timing, not a fundamental decline in demand for their advanced solutions.

Babcock & Wilcox's ClimateBright Decarbonization Platform and BrightLoop Hydrogen Generation Technology are prime examples of Stars in their BCG Matrix. These innovations are in high-growth markets, driven by global sustainability initiatives and the burgeoning hydrogen economy.

B&W's advanced waste-to-energy and biomass-to-energy solutions also fall into the Star category, capitalizing on the increasing demand for renewable energy and sustainable waste management. The company's strategic investments and recent contract wins in these areas underscore their strong market position.

B&W's Environmental Control Systems, despite a recent dip in Q1 2025 revenue due to project timing, are positioned for future growth. Their focus on advanced emissions control technologies, like industrial electrostatic precipitators, addresses stringent environmental regulations, indicating a strong market pull.

| B&W Offering | BCG Category | Market Growth Driver | Key Technology/Focus | 2024/2025 Data Point |

| ClimateBright Decarbonization Platform | Star | Global demand for carbon reduction | Carbon capture integration | Key projects and partnerships announced in 2024 |

| BrightLoop Hydrogen Generation | Star | Clean energy sector expansion, hydrogen economy | Hydrogen from solid fuels | Massillon BrightLoop project development |

| Waste-to-Energy (WTE) Solutions | Star | Urbanization, sustainable waste management | Net-negative hydrogen from solid fuels | Global WTE market valued at ~$35.5B in 2023, projected to reach ~$60.9B by 2030 (8.1% CAGR) |

| Biomass-to-Energy Solutions | Star | Shift to renewable energy | Bubbling Fluidised Bed (BFB) technology for coal-to-biomass conversion | Global biomass power generation market valued at ~$95.7B in 2023, projected to reach ~$154.2B by 2030 (7.1% CAGR). Recent European contracts secured. |

| Environmental Control Systems | Star (potential) | Stricter environmental regulations | Advanced industrial electrostatic precipitators | Q1 2025 revenue dip attributed to project timing, not demand decline. |

What is included in the product

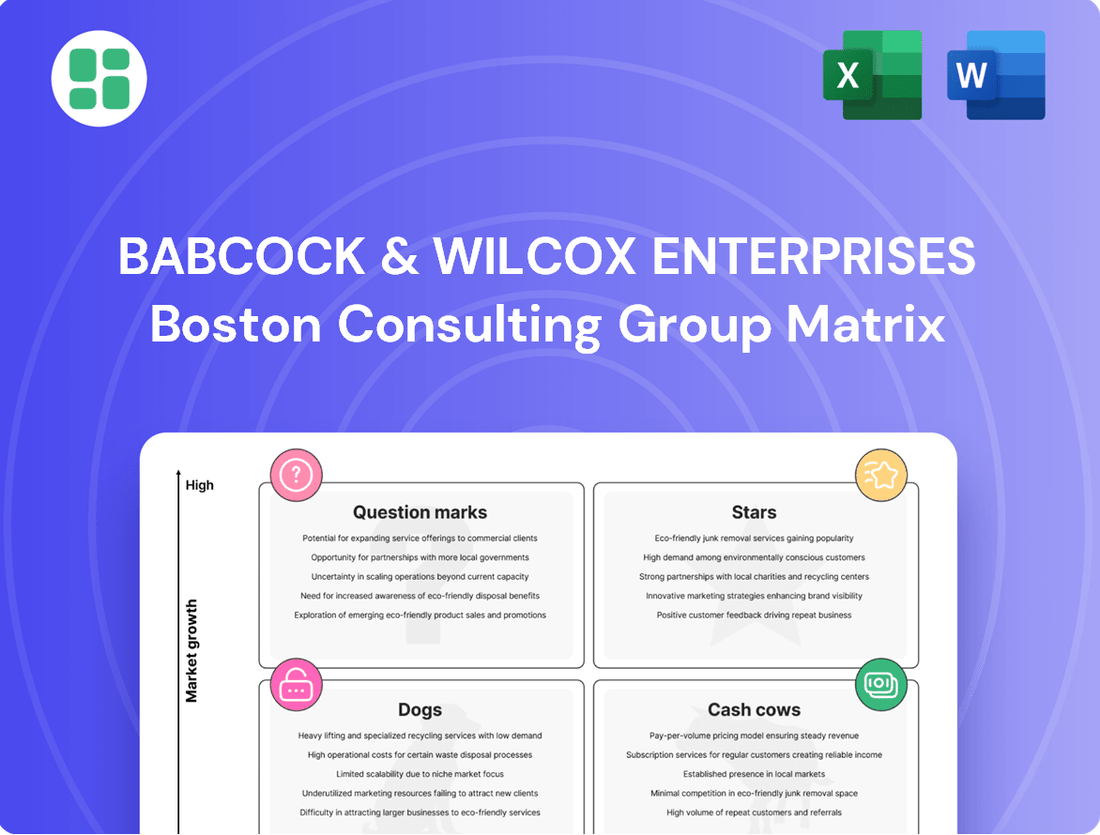

This BCG Matrix overview analyzes Babcock & Wilcox Enterprises' business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

The Babcock & Wilcox Enterprises BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis and alleviating the pain of information overload.

Cash Cows

Babcock & Wilcox Enterprises' Global Parts & Service division is a clear Cash Cow. This segment is foundational, offering critical aftermarket support for B&W's vast installed equipment base. It's a mature market, but its high-margin nature makes it a consistent performer.

In Q1 2025, this division truly shone, posting record bookings, revenue, gross profit, and EBITDA. This robust performance underscores its stability and profitability, solidifying its position as a reliable generator of cash for the company.

Babcock & Wilcox's Thermal segment, encompassing steam generation equipment and aftermarket services, stands as a significant revenue contributor and a stable cash flow generator for the company. This segment, while operating in a mature market for traditional thermal power, benefits from B&W's strong installed base, ensuring consistent demand for essential parts and services.

For instance, in the first quarter of 2024, B&W reported that its Thermal segment generated $162.6 million in revenue, highlighting its substantial contribution. The ongoing need for maintenance, upgrades, and replacement parts for existing thermal power plants solidifies its position as a reliable cash cow.

Babcock & Wilcox's (B&W) Utility and Industrial Boiler Upgrades & Maintenance segment firmly sits in the Cash Cows quadrant of the BCG Matrix. This is driven by the enduring need for services and parts for the vast installed base of boilers across utility and industrial sectors. In 2024, B&W reported significant revenue from its aftermarket and services business, which heavily relies on this segment, demonstrating its consistent contribution to the company's financial health.

The longevity of existing boiler systems, often in operation for decades, creates a perpetual demand for upgrades, retrofits, and essential maintenance. This ongoing requirement ensures a stable revenue stream, even as new boiler installations might be in a slower growth phase. B&W's expertise in providing these critical services and replacement parts solidifies its high market share in this segment.

Natural Gas Conversion Projects

Babcock & Wilcox Enterprises' natural gas conversion projects are currently performing as Cash Cows within their BCG Matrix. These projects are a significant revenue driver, with Q1 2025 reporting substantial increases attributed to this segment. The ongoing industrial shift from coal to natural gas fuels this demand.

B&W's established expertise in facilitating these conversions ensures a steady stream of income from loyal customers. This positions them favorably in a market where reliability and proven capability are paramount.

- Revenue Growth: Q1 2025 saw significant revenue increases from natural gas conversion projects.

- Market Demand: Strong and ongoing demand driven by industry transition from coal to natural gas.

- Client Base: Reliable revenue generated from established clients due to B&W's conversion expertise.

Pulp and Paper Industry Solutions

Babcock & Wilcox (B&W) offers essential solutions, such as black liquor systems, to the pulp and paper sector. This segment is characterized by its maturity, with B&W maintaining a significant market share.

These offerings, while not in a high-growth phase, are crucial for generating stable and predictable revenue streams for B&W. They act as a reliable source of cash flow, underpinning the company's financial stability.

- Mature Market: B&W's pulp and paper solutions operate in a well-established market.

- Consistent Revenue: These offerings provide a steady income, contributing to overall cash flow.

- Strong Position: B&W holds a robust presence in this sector, particularly with its black liquor systems.

- Cash Generation: The segment functions as a cash cow, supporting other business areas.

Babcock & Wilcox's Global Parts & Service division, along with its Thermal segment and Boiler Upgrades & Maintenance, are firmly established Cash Cows. These segments benefit from a large installed base, ensuring consistent demand for aftermarket support and services, even in mature markets. The natural gas conversion projects also exhibit Cash Cow characteristics due to ongoing industrial demand and B&W's expertise.

In Q1 2024, B&W's Thermal segment generated $162.6 million in revenue, showcasing its substantial contribution. The aftermarket and services business, which relies heavily on the Utility and Industrial Boiler Upgrades & Maintenance segment, also demonstrated strong performance in 2024, highlighting the stability of these revenue streams.

| Segment | BCG Classification | Key Drivers | 2024/2025 Data Point |

|---|---|---|---|

| Global Parts & Service | Cash Cow | Aftermarket support for installed base, high margins | Record bookings, revenue, gross profit, and EBITDA in Q1 2025 |

| Thermal Segment | Cash Cow | Installed base, demand for parts and services | $162.6 million revenue in Q1 2024 |

| Utility & Industrial Boiler Upgrades & Maintenance | Cash Cow | Longevity of existing systems, perpetual demand for upgrades and maintenance | Significant revenue from aftermarket and services in 2024 |

| Natural Gas Conversion Projects | Cash Cow | Industrial shift from coal, B&W's conversion expertise | Substantial increases in Q1 2025 attributed to this segment |

Delivered as Shown

Babcock & Wilcox Enterprises BCG Matrix

The Babcock & Wilcox Enterprises BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic analysis ready for immediate use. You can confidently download this report knowing it's the final, polished version designed for professional application in your business planning. It’s crafted to provide clear insights into B&W's product portfolio, enabling informed decision-making and effective strategy development.

Dogs

Babcock & Wilcox Enterprises (B&W) has strategically divested non-core assets, including Diamond Power International, LLC and the majority of its Denmark subsidiary. These actions indicate these businesses likely exhibited lower growth potential or were not central to B&W's long-term strategy. For instance, in 2023, B&W reported a net loss, highlighting the ongoing efforts to streamline operations and improve profitability by shedding underperforming units.

The market for new coal-fired power plant construction is shrinking globally. In 2024, the International Energy Agency reported that new coal power capacity additions are significantly slowing down, with many developed nations phasing out or having already phased out new coal projects entirely. This trend is driven by increasing environmental regulations and a strong push towards renewable energy sources.

Babcock & Wilcox (B&W) possesses considerable historical expertise in constructing coal-fired power plants. However, focusing on new builds in this sector in 2024 and beyond places the company in a segment characterized by low market growth and likely a smaller market share compared to its other business areas. This segment would represent a question mark or potentially a dog in the BCG matrix.

In 2024, several European renewable energy projects under Babcock & Wilcox Enterprises (B&W) saw reduced activity. This slowdown, which wasn't fully offset by new business in early 2025, directly impacted B&W's Renewable segment revenue. This situation suggests these projects may be in their final stages or haven't generated consistent, high-volume demand, placing them in a category with potentially limited or shrinking market influence.

Certain Legacy Emissions Control Systems

Certain legacy emissions control systems within Babcock & Wilcox Enterprises' portfolio might be categorized as Dogs in the BCG Matrix. This is because as environmental regulations tighten and new technologies emerge, the demand for older, less efficient systems could diminish. For instance, if a significant portion of B&W's revenue from these older systems is declining due to market shifts, they would fit this classification.

These legacy systems are characterized by low market growth and potentially shrinking market share as newer, more advanced solutions gain traction. If B&W's environmental segment is seeing a shift towards advanced scrubbers or carbon capture technologies, older electrostatic precipitators or fabric filters might represent a declining business line.

- Low Market Growth: The overall market for older, less efficient emissions control technologies is likely experiencing stagnation or decline.

- Shrinking Market Share: Newer, more effective systems are capturing a larger portion of the market, reducing the share held by legacy products.

- Potential for Divestiture: Companies often consider divesting or phasing out Dog products to reallocate resources to more promising areas.

- Focus on Modernization: B&W's strategy likely involves encouraging customers to upgrade from legacy systems to their more advanced offerings.

Highly Price-Sensitive, Low-Margin Project Areas

Babcock & Wilcox Enterprises (B&W) faces certain project areas characterized by intense competition and a strong emphasis on price, often resulting in thin profit margins. These are the segments where B&W might find itself in a 'Dogs' category within a BCG Matrix framework. Such areas can drain valuable resources without generating substantial returns, hindering overall company growth and profitability.

In these highly price-sensitive markets, B&W's ability to secure projects is often dictated by its ability to offer the lowest bid, rather than by the unique value or technological superiority of its offerings. This dynamic can significantly erode profitability. For instance, in the traditional power generation services sector, where many established players compete, margins can be squeezed considerably. B&W's 2024 performance, while not fully detailed here, reflects the ongoing challenges in markets where differentiation is difficult to achieve and cost leadership is paramount.

- Competitive Pressure: Markets with numerous established competitors, such as certain segments of aftermarket services for older power plants, often lead to price wars.

- Low Profitability: Projects in these areas typically offer single-digit profit margins, making it difficult to reinvest in innovation or expansion.

- Limited Growth Prospects: Without strong differentiation or a clear path to market leadership, these segments may exhibit stagnant or declining growth.

- Resource Drain: Continued investment in these low-margin areas can tie up capital and management attention that could be better allocated to more promising ventures.

Certain legacy emissions control systems within Babcock & Wilcox Enterprises' portfolio, particularly older electrostatic precipitators or fabric filters, are likely classified as Dogs. This is due to diminishing demand as environmental regulations tighten and newer, more efficient technologies like advanced scrubbers and carbon capture solutions gain prominence. For example, if revenue from these older systems shows a consistent decline, it signifies a shrinking market influence.

These legacy systems operate in a low market growth environment, and their market share is shrinking as newer, more effective systems capture greater market demand. B&W's strategy often involves encouraging clients to transition from these legacy systems to their more advanced offerings, indicating a move away from these less profitable segments.

Projects in highly price-sensitive markets, where B&W competes on cost rather than technological superiority, also fall into the 'Dogs' category. These segments often yield thin, single-digit profit margins, making it challenging to reinvest in innovation or expansion. The traditional power generation services sector, for instance, is characterized by intense competition and price wars, which can significantly erode profitability.

These 'Dog' segments, such as certain aftermarket services for older power plants, face significant competitive pressure leading to price wars. They offer limited growth prospects and can drain valuable resources and management attention that could be better allocated to more promising ventures.

| BCG Category | Market Growth | Market Share | B&W Examples |

|---|---|---|---|

| Dogs | Low / Declining | Low / Shrinking | Legacy emissions control systems (e.g., older precipitators), Price-sensitive traditional power services |

Question Marks

OxyBright, Babcock & Wilcox's (B&W) oxygen-fired biomass-to-energy technology, represents an advanced approach to cleaner incineration and enhanced thermal efficiency. This innovative solution is positioned to capitalize on the growing demand for sustainable energy sources.

As a newer entrant, OxyBright exhibits strong growth potential within the expanding biomass market. However, it currently commands a smaller market share as it works towards wider commercial adoption and scaling, aligning with the characteristics of a question mark in the BCG matrix.

Babcock & Wilcox's ClimateBright carbon capture pilot projects are positioned as question marks in the BCG matrix. These initiatives are targeting a high-growth market with significant future potential, reflecting substantial ongoing investments and active Front-End Engineering Design (FEED) studies.

Despite the promising market outlook, these carbon capture technologies are in the early stages of commercial deployment. This means they currently hold a low market share but necessitate considerable investment to achieve scalability and broader market penetration.

Babcock & Wilcox's (B&W) BrightLoop technology aims to produce hydrogen from solid fuels with a net-negative carbon footprint, positioning it within the Stars quadrant of the BCG Matrix due to its high growth potential in the emerging clean hydrogen market. This innovative approach addresses the growing demand for sustainable energy solutions, a sector projected for significant expansion in the coming years, with global hydrogen production expected to reach hundreds of millions of tons annually by 2030.

However, B&W's net-negative hydrogen production from solid fuels is currently in its early commercialization stages, requiring substantial capital investment to scale operations and capture market share. The company's significant R&D expenditures and pilot project costs reflect this investment, characteristic of a Question Mark in the BCG Matrix, where future success hinges on market adoption and technological refinement.

New Strategic Partnerships and Joint Ventures (e.g., Kanadevia Inova)

Babcock & Wilcox Enterprises (B&W) is actively pursuing new strategic partnerships, such as its joint venture with Kanadevia Inova, to expand into the North American waste-to-energy sector. This collaboration aims to leverage B&W's technological expertise with Kanadevia's market presence, targeting high-growth opportunities. The company is also co-developing BrightLoop technologies, indicating a focus on innovative solutions with substantial future potential.

These ventures are positioned as potential stars within B&W's portfolio, representing new markets or advanced applications where significant growth is anticipated. However, their current market share is nascent, and their ultimate success hinges on substantial upfront investment and careful strategic management. For instance, the waste-to-energy market in North America is projected to grow, with B&W's strategic moves aiming to capture a portion of this expansion.

- Strategic Focus: B&W is entering new markets and developing innovative technologies through partnerships like the Kanadevia Inova joint venture and BrightLoop co-development.

- Growth Potential: These ventures target high-growth areas, particularly in the North American waste-to-energy market, aiming for future market leadership.

- Investment and Risk: Significant upfront investment is required, and market share is not yet established, indicating a high-potential but also high-risk positioning.

- Market Context: The waste-to-energy sector presents a growing opportunity, with B&W strategically positioning itself to benefit from this trend through its new alliances.

Advanced Energy Storage Solutions

Babcock & Wilcox Enterprises (B&W) views advanced energy storage as a key component of its future clean energy portfolio, even if it's not a dominant revenue source today. This sector is experiencing significant expansion, positioning B&W's efforts here as a potential future Star in the BCG matrix, provided substantial investment is channeled into development and market penetration.

The global energy storage market is projected for robust growth, with various reports indicating compound annual growth rates well into the double digits through 2030. For instance, some analyses suggest the market could reach hundreds of billions of dollars by the end of the decade. B&W's current market share in this nascent but rapidly evolving space is likely minimal, necessitating a strategic commitment to innovation and scaling to capture a meaningful portion of this expanding market.

- Market Potential: The advanced energy storage sector is a high-growth area, with forecasts indicating substantial market expansion in the coming years.

- B&W's Position: Currently, B&W's market share in advanced energy storage is likely nascent, requiring significant investment to establish a strong foothold.

- Strategic Focus: B&W's strategic vision incorporates energy recovery and storage as part of its broader clean energy solutions, aiming for future growth.

- Investment Needs: To transition from a low market share to a Star, B&W will need to make considerable investments in research, development, and commercialization of its storage technologies.

Babcock & Wilcox's (B&W) various emerging technologies, such as advanced carbon capture solutions and innovative hydrogen production methods like BrightLoop, are currently classified as Question Marks in the BCG Matrix. These initiatives are characterized by their participation in high-growth, potentially lucrative markets, but they also require substantial investment to achieve commercial viability and gain significant market share.

The company's strategic focus on these nascent technologies reflects a forward-looking approach to the evolving energy landscape, aiming to capture future market opportunities. However, their current low market share and the significant capital expenditure needed for scaling and market penetration are key indicators of their Question Mark status.

For instance, B&W's climate technologies, including carbon capture pilots, are in early development stages, demanding considerable R&D and operational investment. Similarly, the BrightLoop technology, while promising for net-negative hydrogen, is still in its commercialization phase, necessitating further capital to expand its market presence.

The waste-to-energy sector, where B&W is forming strategic alliances, also presents a Question Mark scenario. While the market shows growth potential, B&W's current share is minimal, requiring significant investment to establish a dominant position.

BCG Matrix Data Sources

Our Babcock & Wilcox Enterprises BCG Matrix leverages a blend of financial statements, industry research reports, and market growth projections to accurately assess business unit performance and strategic positioning.