Babcock & Wilcox Enterprises PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Babcock & Wilcox Enterprises Bundle

Navigate the complex external forces impacting Babcock & Wilcox Enterprises with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping their operational landscape. This expert-crafted report provides critical insights for strategic planning and investment decisions. Download the full version now to gain a competitive advantage.

Political factors

Global governments are increasingly prioritizing renewable energy and decarbonization, a trend that directly benefits Babcock & Wilcox (B&W) by bolstering demand for its clean energy solutions. For instance, the European Union's ambitious net-zero emissions targets by 2050, coupled with the U.S. Industrial Demonstrations Program offering substantial funding for clean energy and industrial decarbonization projects, create a favorable policy environment.

These governmental pushes translate into significant financial support and regulatory incentives for technologies like waste-to-energy, biomass, and carbon capture, which are core to B&W's strategic focus. In 2024, the U.S. Department of Energy announced over $2 billion in funding for carbon capture projects, underscoring the scale of these supportive policies.

International climate agreements, like the Paris Agreement, underscore the necessity of carbon capture and storage (CCS) for achieving net-zero emissions by 2050. This global push for emission reduction directly fuels demand for Babcock & Wilcox Enterprises' (B&W) environmental control systems and carbon capture technologies.

As nations and industries work to meet stringent environmental regulations, B&W's solutions become increasingly vital. For instance, in 2024, the global carbon capture market is projected to reach approximately $7.1 billion, with significant growth expected as more countries implement ambitious climate policies.

Governments globally are channeling significant financial support into clean technologies. For instance, the U.S. Inflation Reduction Act of 2022, with its substantial tax credits for clean energy projects, is a prime example of how policy directly boosts the economic feasibility of waste-to-energy and carbon capture solutions. This makes investments in companies like Babcock & Wilcox, which offer these very technologies, far more attractive.

These subsidies and incentives are not just theoretical; they translate into tangible investment. In 2024, projections suggest that global investment in clean energy could surpass $2 trillion, with a significant portion directed towards advanced waste management and carbon reduction technologies. This robust financial backing from public entities de-risks projects and encourages private capital, directly benefiting B&W's market position.

Trade Policies and Global Market Access

Global trade policies, including tariffs and trade tensions, directly influence the cost of imported components and equipment, which can affect Babcock & Wilcox Enterprises (B&W) supply chain efficiency and overall project expenditures. For instance, ongoing trade disputes can lead to unpredictable price fluctuations for critical materials. B&W's reported revenue from international operations was approximately 30% of its total revenue in 2023, highlighting the significance of global market access.

However, B&W strategically mitigates these risks through established partnerships and a concentrated focus on North American markets, which often feature more stable trade agreements. Simultaneously, the company's international technology licensing agreements provide avenues for global market penetration, ensuring continued revenue streams and access to diverse markets even amidst geopolitical trade uncertainties. This dual approach allows B&W to navigate the complexities of international trade effectively.

- Tariff Impact: Increased tariffs on steel and other raw materials, common in recent years, can raise B&W's production costs for boilers and environmental equipment.

- North American Focus: B&W's significant presence and project pipeline in the United States and Canada provide a degree of insulation from certain global trade disruptions.

- International Licensing: Technology licensing agreements, particularly in regions with strong demand for emissions control and energy solutions, offer a consistent revenue stream and market reach.

- Supply Chain Diversification: B&W's efforts to diversify its supplier base across different regions aim to reduce reliance on any single country or trade bloc.

Geopolitical Stability and Energy Security

Geopolitical shifts and the drive for energy security are spurring a global move towards varied energy sources, notably waste-to-energy and biomass. This pivot away from unpredictable fossil fuel markets places Babcock & Wilcox Enterprises (B&W) in a strong position to offer dependable, localized energy generation technologies.

Nations are actively seeking to bolster their energy independence, which directly benefits companies like B&W that offer solutions contributing to a more diversified and resilient energy infrastructure. For instance, the European Union's REPowerEU plan, aiming to phase out Russian fossil fuels, underscores this trend, with significant investment anticipated in renewable and alternative energy technologies through 2025 and beyond.

- Increased Investment: Global investment in clean energy technologies, including waste-to-energy, is projected to reach new highs in 2024-2025, driven by energy security concerns.

- Policy Support: Government incentives and mandates for renewable energy adoption are expanding, creating a more favorable market for B&W's offerings.

- Diversification Strategy: B&W's focus on waste-to-energy aligns with national strategies to reduce reliance on imported fossil fuels, enhancing energy security.

Governmental focus on decarbonization and energy security strongly favors Babcock & Wilcox (B&W). Policies supporting clean energy, like the U.S. Inflation Reduction Act of 2022, offer substantial tax credits, making B&W's waste-to-energy and carbon capture solutions more economically viable. In 2024, the U.S. Department of Energy allocated over $2 billion to carbon capture projects, reflecting this supportive policy environment.

International climate agreements and national energy independence goals further drive demand for B&W's environmental control systems. The projected growth of the global carbon capture market to approximately $7.1 billion in 2024, fueled by stringent environmental regulations and climate commitments, directly benefits the company.

Trade policies, while posing potential cost risks for imported components, are being navigated by B&W through a strategic North American focus and international licensing agreements. B&W's international operations accounted for about 30% of its total revenue in 2023, demonstrating the importance of global market access and diversified revenue streams.

Geopolitical shifts and the pursuit of energy security are accelerating the adoption of waste-to-energy and biomass technologies, aligning with B&W's core offerings. The EU's REPowerEU plan, aimed at reducing reliance on fossil fuels, exemplifies this trend, with significant investment anticipated in alternative energy through 2025.

| Factor | Impact on B&W | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Decarbonization Push | Increased demand for clean energy solutions | EU net-zero targets; U.S. funding for clean energy projects |

| Carbon Capture Funding | Direct financial benefit and market expansion | $2+ billion U.S. DOE funding for carbon capture projects (2024) |

| Climate Agreements | Boosts demand for environmental controls | Global carbon capture market projected at $7.1 billion (2024) |

| Trade Policies | Potential cost fluctuations, mitigated by regional focus | 30% of B&W revenue from international operations (2023) |

| Energy Security | Favors localized, diversified energy sources | EU REPowerEU plan; increased investment in alternative energy |

What is included in the product

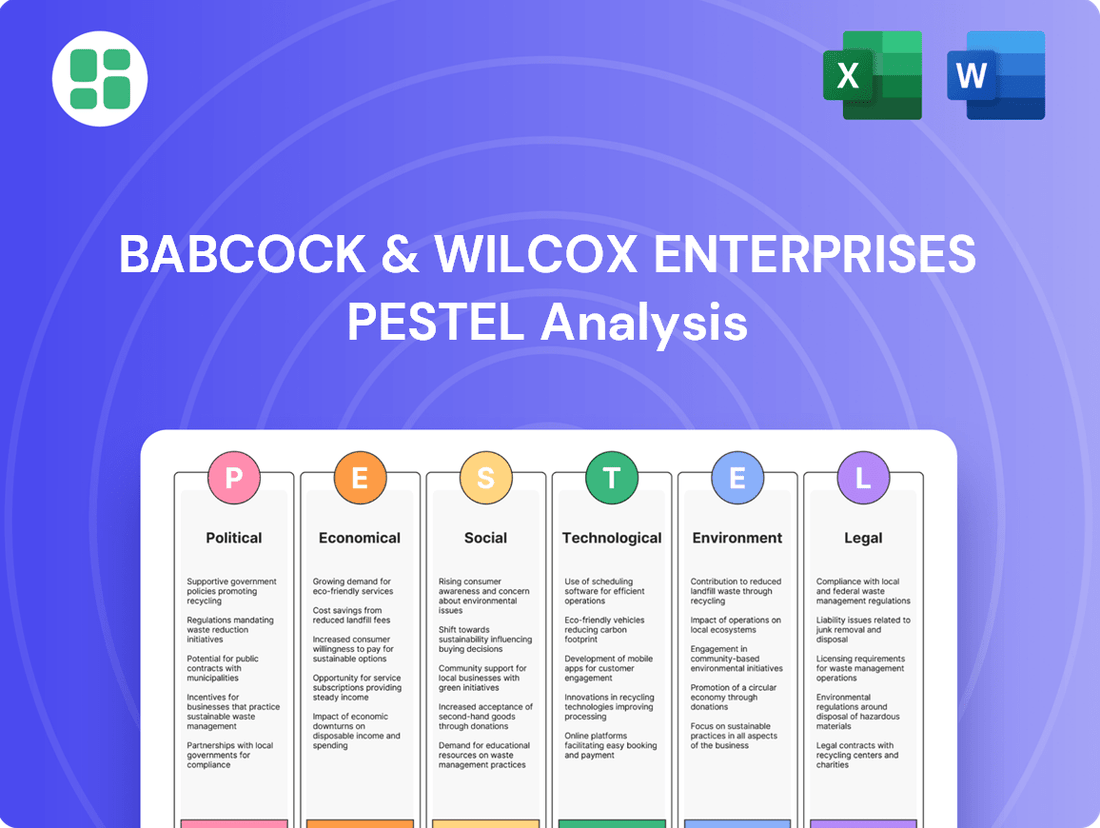

This PESTLE analysis examines the external macro-environmental factors influencing Babcock & Wilcox Enterprises across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive understanding of how these forces shape the company's strategic landscape and competitive positioning.

This PESTLE analysis for Babcock & Wilcox Enterprises acts as a pain point reliever by providing a clear, summarized version of external factors, making it easy to reference and discuss market positioning during strategic planning.

Economic factors

Global energy price volatility directly impacts the economic feasibility of renewable energy projects, yet the overarching trend towards decarbonization is fueling substantial investment. The demand for clean energy solutions is a powerful economic driver, creating a favorable climate for companies like Babcock & Wilcox Enterprises.

The decarbonization sector has seen remarkable growth, with investments reportedly tripling in recent years, reaching hundreds of billions of dollars globally. This surge in capital demonstrates a strong economic commitment to cleaner energy sources, directly benefiting businesses positioned to capitalize on this transition.

Investment in industrial decarbonization is experiencing a significant surge. Between 2018 and 2023, annual investments in these projects more than tripled, reaching over $48 billion. Projections indicate this figure will climb past $250 billion annually by 2030.

This robust growth, fueled by both public and private funding, creates a favorable environment for companies like Babcock & Wilcox (B&W). As heavy industries increasingly focus on reducing their carbon emissions, B&W's solutions for cleaner energy and emissions control are in high demand.

The global waste-to-energy market is poised for substantial expansion, with projections indicating it could reach $77.30 billion by 2030. This growth is largely fueled by increasing urbanization and a pressing need for more sustainable waste management solutions worldwide.

Concurrently, the biomass electricity market is also anticipating robust growth. These trends signal a widening landscape of opportunities for companies like Babcock & Wilcox Enterprises (B&W) whose core technologies are central to both waste-to-energy and biomass power generation.

Availability of Project Financing

The availability of capital for large-scale energy and environmental projects directly impacts Babcock & Wilcox Enterprises (B&W). A robust financing environment allows B&W's customers to undertake significant investments, thereby driving demand for B&W's technologies and services. This access to capital is particularly important as the global energy landscape shifts towards cleaner solutions.

Global investment in clean energy surged past $1.7 trillion in 2023, a significant increase that directly benefits companies like B&W. This substantial capital infusion means B&W's clients, whether in traditional or renewable energy sectors, have more readily available funds to finance projects that incorporate B&W's advanced environmental and energy solutions. This trend is a positive indicator for B&W's potential revenue growth as more projects move from conception to execution.

- Increased Customer Project Funding: Higher global clean energy investments translate to greater financial capacity for B&W's clientele.

- Support for B&W's Revenue: Enhanced project financing directly fuels demand for B&W's technologies and services, boosting revenue streams.

- Energy Transition Momentum: The strong investment in clean energy aligns with and supports B&W's strategic focus on environmental solutions.

Inflation and Interest Rates

Inflation and rising interest rates present a dual challenge for Babcock & Wilcox Enterprises (B&W). Increased project costs and a higher cost of capital can directly impact B&W's project execution and profitability, potentially leading to extended timelines for its clients and a reduced appetite for new capital-intensive projects. For instance, as of early 2024, global inflation remained a concern, with central banks continuing to monitor price pressures, which directly influences borrowing costs.

B&W has been strategically addressing its financial structure to mitigate these pressures. The company has actively engaged in managing its debt, notably through private bond exchanges and tender offers. These actions are designed to reduce overall interest expenses and push out debt maturities, thereby improving its financial flexibility in a rising rate environment.

- Inflationary Pressures: Global inflation rates, while showing some moderation in late 2023 and early 2024, continued to influence input costs for B&W's projects.

- Interest Rate Hikes: Central banks, including the Federal Reserve, maintained or cautiously adjusted interest rates throughout 2023 and into 2024, impacting the cost of borrowing for both B&W and its customers.

- Debt Management Strategy: B&W's proactive approach to debt management, including bond exchanges, aims to lower its weighted average interest rate and extend its debt maturity profile.

- Impact on Project Viability: Higher interest rates can make financing for large-scale energy and environmental projects more challenging for B&W's clients, potentially slowing demand for its services.

Economic factors are increasingly favorable for Babcock & Wilcox Enterprises (B&W) due to the global push for decarbonization and clean energy, driving significant investment in sectors where B&W operates. The waste-to-energy and biomass markets, in particular, are experiencing robust growth, projected to reach substantial figures by 2030, creating a widening landscape of opportunities for B&W's core technologies.

However, inflation and rising interest rates present challenges by increasing project costs and the cost of capital, potentially impacting project execution and client demand. B&W is actively managing its financial structure through debt management strategies to mitigate these pressures and enhance financial flexibility in the current economic climate.

| Economic Factor | Impact on B&W | Key Data/Trend (2023-2024) |

|---|---|---|

| Clean Energy Investment | Drives demand for B&W's solutions; increases client project funding. | Global clean energy investment surpassed $1.7 trillion in 2023. |

| Waste-to-Energy Market Growth | Expands opportunities for B&W's waste-to-energy technologies. | Projected to reach $77.30 billion by 2030. |

| Biomass Electricity Market Growth | Enhances demand for B&W's biomass power generation solutions. | Anticipates robust growth, aligning with B&W's strategic focus. |

| Inflation | Increases input costs and project expenses for B&W. | Global inflation remained a concern in early 2024, influencing borrowing costs. |

| Interest Rates | Raises the cost of capital for B&W and its clients, potentially slowing project adoption. | Central banks maintained cautious interest rate policies through 2023 and into 2024. |

Preview the Actual Deliverable

Babcock & Wilcox Enterprises PESTLE Analysis

The preview you see here offers a comprehensive PESTLE analysis of Babcock & Wilcox Enterprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company.

What you’re previewing here is the actual file—fully formatted and professionally structured, providing an in-depth examination of B&W's strategic landscape.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, giving you immediate access to valuable market insights.

Sociological factors

Public acceptance of waste-to-energy (WtE) technologies is on the rise, driven by growing awareness of landfill environmental concerns and the advantages of energy recovery. This evolving perception is a positive development for companies like Babcock & Wilcox Enterprises, which specialize in WtE solutions.

As communities increasingly prioritize sustainable waste management, the demand for WtE facilities is expected to grow. For instance, in 2024, the global WtE market was valued at approximately $37.5 billion, with projections indicating continued expansion as environmental regulations tighten and landfill capacity diminishes.

Societal expectations are increasingly prioritizing sustainable and clean energy. This growing environmental consciousness, fueled by concerns over climate change, directly impacts industries. For instance, in 2024, the global renewable energy market was projected to reach over $1.9 trillion, demonstrating this significant shift. This trend aligns perfectly with Babcock & Wilcox's core business of providing emission-reduction technologies and clean power generation solutions.

The energy and environmental sectors, where Babcock & Wilcox Enterprises (B&W) operates, are heavily reliant on a skilled workforce for the design, construction, and ongoing maintenance of sophisticated technologies. This demand is particularly acute for roles in engineering, advanced manufacturing, and specialized technical services.

B&W, as a significant player in providing advanced energy and environmental control solutions, must secure a pipeline of qualified personnel to support its global operations. For instance, the company's backlog in 2023 included projects requiring specialized installation and commissioning expertise, highlighting the critical need for readily available skilled labor.

Corporate Social Responsibility (CSR) Initiatives

Societal expectations around Corporate Social Responsibility (CSR) are significantly influencing business operations, pushing companies towards cleaner technologies and sustainable practices. Babcock & Wilcox Enterprises (B&W) is responding to this trend by engaging in initiatives that demonstrate a commitment to environmental stewardship and social impact.

B&W's participation in frameworks like the United Nations Global Compact underscores its dedication to aligning its business with broader global sustainability objectives. This alignment is crucial for attracting investors and customers who prioritize ethical and environmentally conscious partners. For instance, in 2023, B&W reported on its sustainability progress, highlighting efforts to reduce its environmental footprint and enhance community engagement.

- Global Shift: Over 90% of companies globally now report on CSR or ESG metrics, reflecting a strong societal demand for accountability.

- B&W's Commitment: B&W's adherence to the UN Global Compact principles guides its operational decisions and stakeholder relations.

- Customer Preference: A significant percentage of consumers, particularly younger demographics, state they are more likely to purchase from brands with strong CSR programs.

- Investor Focus: ESG investments continue to grow, with assets under management in sustainable funds reaching trillions globally, indicating a financial incentive for robust CSR.

Urbanization and Waste Generation

Rapid urbanization and industrialization worldwide are significantly increasing municipal solid waste. This surge creates a pressing demand for advanced waste management solutions, directly benefiting companies like Babcock & Wilcox (B&W) that specialize in waste-to-energy technologies.

Cities are increasingly turning to waste-to-energy (WTE) plants to manage growing waste volumes and generate power. For instance, global municipal solid waste generation was projected to reach 3.40 trillion tons annually by 2050, up from 2.01 trillion tons in 2016, highlighting the scale of the challenge and opportunity. B&W's expertise in combustion and emissions control positions them well to capitalize on this trend.

- Growing Waste Volumes: Global municipal solid waste generation is on a steep upward trajectory, necessitating innovative disposal and energy recovery methods.

- Demand for WTE: Cities are actively seeking waste-to-energy solutions to address landfill capacity issues and create sustainable energy sources.

- B&W's Role: Babcock & Wilcox's advanced technologies are crucial for converting this increasing waste stream into usable energy, aligning with urban environmental goals.

- Market Opportunity: The escalating waste problem presents a substantial market for B&W's waste-to-energy equipment and services.

Societal demand for sustainable practices is a significant driver for Babcock & Wilcox Enterprises (B&W). Growing environmental consciousness, fueled by climate change concerns, directly boosts demand for B&W's emission-reduction technologies and clean power generation solutions. For example, the global renewable energy market was projected to exceed $1.9 trillion in 2024, underscoring this powerful societal shift.

The increasing acceptance of waste-to-energy (WtE) technologies, driven by landfill concerns and energy recovery benefits, positively impacts companies like B&W. As communities prioritize sustainable waste management, the demand for WtE facilities is rising; the global WtE market was valued at approximately $37.5 billion in 2024, with continued expansion anticipated.

Corporate Social Responsibility (CSR) is increasingly influencing business operations, pushing companies towards cleaner technologies. B&W's commitment to sustainability, exemplified by its adherence to UN Global Compact principles, is crucial for attracting investors and customers who prioritize ethical partners. In 2023, B&W reported on its sustainability progress, highlighting efforts to reduce its environmental footprint.

| Societal Factor | Impact on B&W | Supporting Data (2023-2025) |

|---|---|---|

| Environmental Consciousness | Increased demand for clean energy and emission reduction solutions. | Global renewable energy market projected over $1.9 trillion in 2024. |

| Waste Management Trends | Growing acceptance and demand for Waste-to-Energy (WtE) technologies. | Global WtE market valued at ~$37.5 billion in 2024. |

| Corporate Social Responsibility (CSR) | Emphasis on sustainable operations and ethical partnerships. | Over 90% of companies globally report on CSR/ESG metrics. B&W adheres to UN Global Compact principles. |

| Skilled Workforce Demand | Critical need for specialized engineering and technical talent. | B&W's 2023 project backlog required specialized installation expertise. |

Technological factors

Technological progress in waste-to-energy (WtE) and biomass conversion is significantly boosting operational efficiency. Innovations in gasification and advanced thermal processes are key drivers, making these methods more viable for energy generation.

Babcock & Wilcox (B&W) is a leader in this space, developing cutting-edge combustion technologies. Their OxyBright system, for instance, enhances thermal efficiency and promotes cleaner incineration within WtE facilities, contributing to a more sustainable energy landscape.

Significant advancements are occurring in carbon capture technologies, with new projects achieving key milestones. There's a growing emphasis on developing advanced materials and more efficient, modular systems for CCUS. These innovations are crucial for meeting global emissions reduction targets.

Babcock & Wilcox (B&W) is strategically positioning itself in this dynamic sector through the development and deployment of its proprietary CCUS solutions. Technologies like SolveBright™ and BrightLoop™ are particularly noteworthy, especially B&W's focus on integrating them into hydrogen production processes, capturing CO2 as a byproduct. This positions B&W to capitalize on the increasing demand for low-carbon energy solutions.

The power generation industry is rapidly embracing digitalization and automation. This shift is driven by the need for enhanced operational efficiency and reliability, with automated monitoring systems playing a crucial role in reducing unexpected outages and optimizing energy production. For instance, the global industrial automation market, which includes power systems, was projected to reach $315.4 billion in 2024, highlighting the significant investment in these technologies.

Babcock & Wilcox Enterprises (B&W) is positioned to benefit from this trend. By integrating smart technologies, such as advanced sensors and predictive maintenance software, into its boiler and emissions control equipment, B&W can offer solutions that improve performance and lower operating costs for its clients. The company's focus on modernizing existing power plants and developing new, efficient technologies aligns directly with the industry's move towards smarter, more automated operations.

Development of Net-Negative Emission Technologies

Babcock & Wilcox (B&W) is heavily invested in developing technologies that achieve net-negative emissions, a critical step in combating climate change. Their BrightLoop™ and ClimateBright™ initiatives are at the forefront of this effort, aiming to produce hydrogen from solid fuels while actively removing carbon dioxide from the atmosphere. This strategic focus positions B&W not just as a participant, but as a leader in the burgeoning field of carbon removal and clean energy solutions.

The market for these advanced environmental technologies is experiencing significant growth, driven by global decarbonization targets. For instance, the global carbon capture, utilization, and storage (CCUS) market was valued at approximately $2.5 billion in 2023 and is projected to reach over $10 billion by 2030, indicating a strong demand for B&W's innovative solutions. This growth highlights the increasing economic viability and necessity of net-negative emission technologies.

- Hydrogen Production: B&W's BrightLoop™ technology is designed for efficient hydrogen generation from various feedstocks, including biomass and waste, with integrated carbon capture.

- Carbon Removal: The ClimateBright™ project specifically targets the capture and permanent sequestration of CO2, making the entire process carbon-negative.

- Market Opportunity: The increasing global focus on net-zero commitments and the development of a hydrogen economy create substantial market opportunities for B&W's net-negative emission solutions.

- Investment Trends: Venture capital funding in climate tech, including carbon removal and advanced hydrogen, saw significant inflows in 2023 and is expected to continue its upward trajectory in 2024 and 2025, underscoring investor confidence in these areas.

Emerging Energy Storage Solutions

The rapid advancement of energy storage technologies, especially long-duration systems, is crucial for grid stability and the seamless integration of renewable energy sources like solar and wind. These technologies are key to overcoming the intermittency of renewables, ensuring a consistent power supply. For instance, by mid-2025, the global energy storage market is projected to reach over $200 billion, driven by significant investments in battery and other advanced storage solutions.

Babcock & Wilcox Enterprises' (B&W) strategic focus on developing and deploying these emerging energy storage solutions directly enhances its clean energy portfolio. This integration allows B&W to offer more robust and comprehensive solutions to its customers, addressing the evolving demands for reliable and sustainable energy. Their work in this area positions them to capitalize on the growing need for grid modernization and decarbonization efforts worldwide.

Key developments in energy storage relevant to B&W include:

- Advancements in battery chemistries: Beyond lithium-ion, research into sodium-ion and flow batteries is yielding higher energy densities and longer lifespans, critical for grid-scale applications.

- Growth in long-duration storage: Technologies like compressed air energy storage (CAES) and thermal energy storage are gaining traction, offering storage capabilities for 8-12 hours or more, essential for grid balancing.

- B&W's role in integrated solutions: B&W's expertise in boiler technology and emissions control can be synergistically combined with energy storage to create hybrid power generation systems, improving overall efficiency and environmental performance.

Technological advancements in waste-to-energy (WtE) and biomass conversion are significantly improving efficiency, with innovations in gasification and advanced thermal processes driving viability. Babcock & Wilcox (B&W) is a leader, developing cutting-edge combustion technologies like their OxyBright system, which enhances thermal efficiency and promotes cleaner incineration in WtE facilities.

Legal factors

Governments globally are increasingly tightening regulations on industrial emissions, focusing on pollutants like nitrogen oxides (NOx), sulfur oxides (SOx), and particulate matter. For instance, the U.S. Environmental Protection Agency (EPA) continues to enforce and update standards for power plants and industrial facilities, pushing for lower emission levels. This trend directly benefits Babcock & Wilcox Enterprises (B&W) as it drives demand for their advanced emissions control technologies.

The push to decarbonize and combat climate change is also a significant legal factor. Many jurisdictions are setting ambitious greenhouse gas reduction targets, creating a strong market for technologies that improve energy efficiency and reduce carbon footprints. B&W's solutions, designed to meet these evolving environmental mandates, are therefore positioned to capitalize on this regulatory landscape.

Legal frameworks and policies encouraging landfill diversion are significantly boosting the waste-to-energy (WtE) market. For instance, the European Union's Landfill Directive aims to reduce the amount of waste sent to landfills, directly driving demand for WtE solutions. This regulatory push supports companies like Babcock & Wilcox Enterprises (B&W) whose expertise lies in advanced WtE technologies.

Governments worldwide are implementing stricter regulations to curb landfill use, creating a favorable environment for WtE plants. By 2023, the U.S. Environmental Protection Agency reported that waste-to-energy facilities processed approximately 34 million tons of municipal solid waste, diverting a substantial portion from landfills. These policies not only promote sustainability but also create a clear market demand for B&W's combustion and emissions control systems.

The permitting processes for new energy and industrial facilities are often intricate and lengthy, directly influencing the project development schedules for Babcock & Wilcox Enterprises' (B&W) clients. These delays can add significant cost and uncertainty to major infrastructure projects.

Conversely, any movement towards streamlined permitting or the introduction of specific incentives designed to accelerate the approval of clean energy projects could provide a substantial boost to B&W's business prospects. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine regulations impacting emissions, which can affect the permitting requirements for B&W's equipment and services.

International Environmental Standards and Treaties

Babcock & Wilcox Enterprises (B&W) operates globally, necessitating compliance with a wide array of international environmental regulations and treaties. For instance, the European Union's ambitious Green Deal, aiming for climate neutrality by 2050, sets stringent standards for emissions and waste management that impact B&W's operations and product development in the region. Failure to align with these evolving mandates, such as the EU's Circular Economy Action Plan, could restrict market access and damage B&W's international standing.

Adherence to these global environmental benchmarks is not merely a compliance issue but a strategic imperative for B&W. For example, the company's commitment to developing advanced emissions control technologies is directly influenced by international agreements like the Paris Agreement, which drives demand for cleaner industrial processes. B&W's ability to meet or exceed standards related to recycling and net-zero emissions, as championed by bodies like the European Commission, is critical for maintaining its reputation and securing partnerships in environmentally conscious markets.

- Global Compliance: B&W must navigate diverse international environmental laws, including those from the EU regarding emissions and recycling.

- Market Access: Adherence to standards like the EU's net-zero targets by 2050 is vital for operating and selling within key global markets.

- Reputation Management: Demonstrating commitment to international environmental treaties enhances B&W's brand image and stakeholder trust.

- Technological Alignment: B&W's innovation in areas like carbon capture is driven by the need to meet global climate goals and treaty obligations.

Health and Safety Regulations

Babcock & Wilcox Enterprises (B&W) operates within a landscape governed by stringent health and safety regulations, particularly critical in industrial operations and power generation. These regulations are designed to protect workers, the public, and the environment from potential hazards associated with energy technologies. For instance, in 2023, the Occupational Safety and Health Administration (OSHA) in the United States continued to enforce its comprehensive standards, with penalties for serious violations often reaching tens of thousands of dollars, underscoring the financial implications of non-compliance.

B&W's proactive approach to health and safety is central to its operational philosophy. This commitment extends beyond mere compliance; it's about fostering a culture that prioritizes the well-being of its employees, customers, and the communities where it operates. This dedication not only ensures regulatory adherence but also bolsters B&W's reputation as a reliable and responsible entity in the energy and environmental technology sector. In 2024, the company is expected to continue investing in advanced safety training and technology, aiming to further reduce incident rates.

Key aspects of B&W's health and safety focus include:

- Rigorous safety protocols for all manufacturing and project sites.

- Continuous training programs for employees on hazard identification and mitigation.

- Adherence to international safety standards such as ISO 45001.

- Investment in safety technology to monitor and improve workplace conditions.

Stricter environmental regulations, particularly concerning emissions and waste management, directly influence Babcock & Wilcox Enterprises' (B&W) market opportunities. For example, the U.S. Environmental Protection Agency (EPA) continues to update standards for industrial facilities, driving demand for B&W's emissions control technologies. Furthermore, global decarbonization efforts and landfill diversion policies, such as the EU's Landfill Directive, create a strong market for B&W's waste-to-energy solutions.

Environmental factors

The global push to combat climate change is a major environmental force driving demand for Babcock & Wilcox Enterprises (B&W). As nations and industries work to reduce greenhouse gas emissions, there's a growing need for the very technologies B&W specializes in, such as those for cleaner energy generation and emissions control.

B&W's strategic focus on decarbonization, carbon capture, and renewable energy solutions directly aligns with this global imperative. For instance, the company's advanced emissions control systems are crucial for industries needing to meet increasingly stringent environmental regulations, a trend expected to accelerate through 2025 and beyond.

The increasing global demand for resources, coupled with mounting waste volumes, underscores the critical need for effective waste valorization. Babcock & Wilcox (B&W) is positioned to address this challenge with its advanced waste-to-energy technologies, which transform municipal and industrial solid waste into usable energy. This not only alleviates pressure on landfills but also actively contributes to fostering a more circular economy.

In 2024, the global municipal solid waste generation is projected to reach 2.24 billion metric tons, highlighting the scale of the problem. B&W's solutions, like their advanced boiler systems, are designed to efficiently process diverse waste streams, turning what would be a disposal issue into a source of power. For instance, their thermal treatment technologies have demonstrated the capability to recover significant energy content from various waste materials, supporting sustainability goals.

The global push for circular economy models, focusing on reducing, reusing, and recycling, directly benefits Babcock & Wilcox Enterprises (B&W). Their waste-to-energy and biomass technologies are key enablers of this shift, allowing for energy capture from materials that would otherwise be discarded. This approach supports sustainable resource management and aligns with growing regulatory and consumer demands for environmental responsibility.

Biodiversity and Sustainable Biomass Sourcing

Environmental concerns surrounding biodiversity and sustainable land use are increasingly shaping biomass sourcing practices for companies like Babcock & Wilcox Enterprises (B&W). As B&W engages in biomass energy projects, ensuring these resources are obtained sustainably is crucial for both long-term environmental health and gaining public trust for these energy solutions.

B&W's commitment to sustainable biomass sourcing directly impacts the viability and acceptance of its renewable energy offerings. For instance, the global renewable energy sector, which includes biomass, saw significant investment in 2023, with projections for continued growth, underscoring the market's demand for environmentally sound practices. Failure to adhere to strict sourcing guidelines could lead to reputational damage and regulatory challenges.

- Biodiversity Impact: Unsustainable biomass harvesting can lead to habitat destruction and species loss, affecting ecological balance.

- Sustainable Land Use: Practices must ensure that biomass cultivation does not compete with food production or lead to deforestation, promoting responsible land management.

- Regulatory Scrutiny: Governments and international bodies are tightening regulations on biomass sourcing to protect ecosystems, requiring companies like B&W to demonstrate compliance.

- Market Demand: Investors and consumers are increasingly favoring companies with strong environmental, social, and governance (ESG) credentials, making sustainable sourcing a competitive advantage.

Water Management in Energy Production

Water scarcity is a significant environmental challenge, especially for water-intensive sectors like energy production. Babcock & Wilcox Enterprises (B&W) is navigating this by focusing on technologies that minimize water usage and even produce clean water.

B&W's waste-to-energy (WTE) plants offer a compelling solution. These facilities not only process waste but can also generate clean water as a byproduct. This dual benefit addresses both waste management and water resource challenges. For instance, advanced WTE technologies can recover significant amounts of water from the combustion process, contributing to a circular economy model.

- Water Scarcity Impact: Global freshwater availability is projected to decline, impacting industrial operations, including energy generation.

- B&W's WTE Advantage: B&W's WTE technologies can reduce reliance on external water sources by recovering process water.

- Clean Water Generation: Some B&W systems are designed to capture and purify water vapor from flue gases, turning a potential emission into a resource.

- Regulatory Pressure: Increasing environmental regulations worldwide are pushing energy producers towards more sustainable water management practices.

The intensifying global focus on decarbonization and emissions reduction directly fuels demand for Babcock & Wilcox Enterprises' (B&W) core technologies. As regulatory pressures mount and climate goals become more ambitious, B&W's expertise in cleaner energy generation and advanced emissions control systems is increasingly vital for industries worldwide. For example, the company's solutions are critical for meeting stringent air quality standards, a trend that is expected to see continued strengthening through 2025.

B&W's waste-to-energy (WTE) solutions are a significant environmental advantage, addressing both waste management and the need for sustainable energy. With global municipal solid waste generation projected to reach 2.24 billion metric tons in 2024, B&W's ability to convert this waste into usable energy offers a dual benefit. Their thermal treatment technologies efficiently process diverse waste streams, transforming disposal challenges into power generation opportunities.

The company's strategic alignment with circular economy principles is evident in its biomass and WTE offerings, enabling energy recovery from materials typically destined for landfills. This approach supports sustainable resource management and appeals to growing consumer and regulatory demands for environmental responsibility. In 2023, the renewable energy sector, including biomass, attracted substantial investment, indicating a strong market appetite for environmentally sound energy solutions.

Water scarcity presents another key environmental consideration, particularly for energy producers. B&W is addressing this by developing technologies that minimize water consumption and even generate clean water as a byproduct. Their WTE plants, for instance, can recover significant amounts of water from the combustion process, contributing to water resource conservation and a more circular approach to industrial operations.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Babcock & Wilcox Enterprises is built on a foundation of credible data from government agencies, international organizations, and leading industry publications. We meticulously gather information on regulatory changes, economic indicators, technological advancements, and socio-cultural shifts to provide a comprehensive overview.