Baader Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baader Bank Bundle

Unlock critical insights into Baader Bank's operating environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its strategic direction and market position. This expert-crafted analysis is your key to identifying opportunities and mitigating risks. Download the full version now to gain a decisive advantage.

Political factors

Germany's political stability, coupled with the ongoing integration within the European Union, forms a bedrock for Baader Bank's operational landscape. Predictable regulatory frameworks, like those established by the Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD VI) which are being implemented across the EU, provide a stable environment for financial planning. For instance, the EU's continued efforts to harmonize banking regulations aim to reduce compliance costs and foster a more unified market, benefiting institutions like Baader Bank.

Global geopolitical tensions, such as ongoing conflicts and shifting alliances, directly influence international capital markets. For Baader Bank, these tensions can lead to increased market volatility, impacting trading volumes and asset valuations across its investment banking operations. For instance, the ongoing geopolitical instability in Eastern Europe has contributed to significant fluctuations in energy and commodity prices throughout 2024, affecting investor sentiment and cross-border investment flows.

Specific trade policies, including tariffs and trade agreements, further shape the financial landscape. Changes in these policies can alter market access and create new opportunities or risks for Baader Bank's clients and its own trading desks. The renegotiation of trade deals or the imposition of new tariffs, as seen in global trade disputes during 2024, can disrupt supply chains and affect the profitability of companies operating internationally, thereby influencing investment banking advisory services.

Baader Bank's diversified international exposure necessitates a strong risk management framework to navigate these geopolitical and trade-related uncertainties. The bank must actively monitor shifts in global trade relations and political conflicts to mitigate potential impacts on its trading activities and investment strategies. For example, a sudden imposition of sanctions on a major trading partner could necessitate rapid adjustments to portfolio holdings and risk exposures, highlighting the need for agile risk mitigation strategies.

Government support for the financial sector, including measures to stabilize markets and provide liquidity during crises, is a crucial political consideration. Baader Bank's robust capitalization offers a strong foundation, but government interventions, such as those seen during the 2008 financial crisis or more recent pandemic-related liquidity injections, can significantly enhance market confidence and reduce systemic risks.

Policies actively fostering a robust domestic financial sector, like Germany's commitment to its banking industry, are generally advantageous. For instance, the German government's continued investment in digital infrastructure and fintech initiatives, with a reported €10 billion allocated to digital transformation across various sectors in 2024, indirectly benefits financial institutions like Baader Bank by creating a more dynamic and technologically advanced operating environment.

Anti-Money Laundering (AML) and Sanctions Enforcement

The political commitment to combating financial crime directly translates into more rigorous anti-money laundering (AML) and sanctions enforcement. This means Baader Bank, like other financial institutions, faces increasing pressure to fortify its compliance measures against illicit financial flows and terrorism financing.

Baader Bank must continually update its internal policies and technological infrastructure to align with evolving national and European Union AML directives, as well as international sanctions regimes. For instance, the EU's 6th Anti-Money Laundering Directive (AMLD6), which came into effect in December 2020, broadened the scope of predicate offenses for money laundering, requiring significant adjustments for banks. Adapting to these changes incurs substantial operational costs, including investments in technology and personnel, but it also bolsters the bank's standing as a trustworthy and compliant entity in the financial sector.

- Stricter Regulatory Landscape: The political will to curb financial crime necessitates ongoing updates to AML and sanctions regulations, impacting operational requirements for banks like Baader Bank.

- Compliance Costs: Adherence to evolving directives, such as those stemming from the EU's AML framework, leads to significant investments in compliance systems and expertise.

- Reputational Benefits: Robust AML and sanctions compliance enhances Baader Bank's reputation for integrity, a crucial asset in attracting and retaining clients in the global financial market.

- International Alignment: Baader Bank must navigate a complex web of international sanctions, requiring constant vigilance and adaptation to global political and economic shifts.

Data Protection and Digital Sovereignty Policies

Government policies on data protection and digital sovereignty, especially within the EU, significantly shape how financial institutions like Baader Bank handle client data. Regulations such as GDPR continue to mandate strict data privacy measures, while newer frameworks like the Digital Operational Resilience Act (DORA) impose rigorous cybersecurity and operational resilience standards. These evolving requirements necessitate substantial investments in IT infrastructure and can influence Baader Bank's approach to service delivery.

The DORA regulation, which came into full effect in January 2025, aims to harmonize ICT risk management requirements across the financial sector. This includes extensive provisions for incident reporting, third-party risk management, and resilience testing. For Baader Bank, compliance means a continuous evaluation and upgrade of its systems to meet these heightened expectations, potentially impacting operational costs and the speed of digital innovation.

- GDPR fines: In 2023, EU data protection authorities issued fines totaling over €300 million for GDPR violations, highlighting the financial penalties for non-compliance.

- DORA scope: DORA applies to a broad range of financial entities, including banks, investment firms, and critical ICT third-party providers, emphasizing the widespread impact of these regulations.

- Cybersecurity spending: Global cybersecurity spending by financial services firms is projected to reach over $100 billion by 2025, reflecting the significant resources dedicated to data protection.

Political stability within Germany and the broader EU provides a predictable environment for Baader Bank, reinforced by regulations like CRR and CRD VI. Geopolitical tensions, however, introduce market volatility, impacting trading and asset values, as seen with energy price fluctuations in 2024. Trade policies and government support for the financial sector, including digital infrastructure investments, also shape Baader Bank's operational landscape and opportunities.

What is included in the product

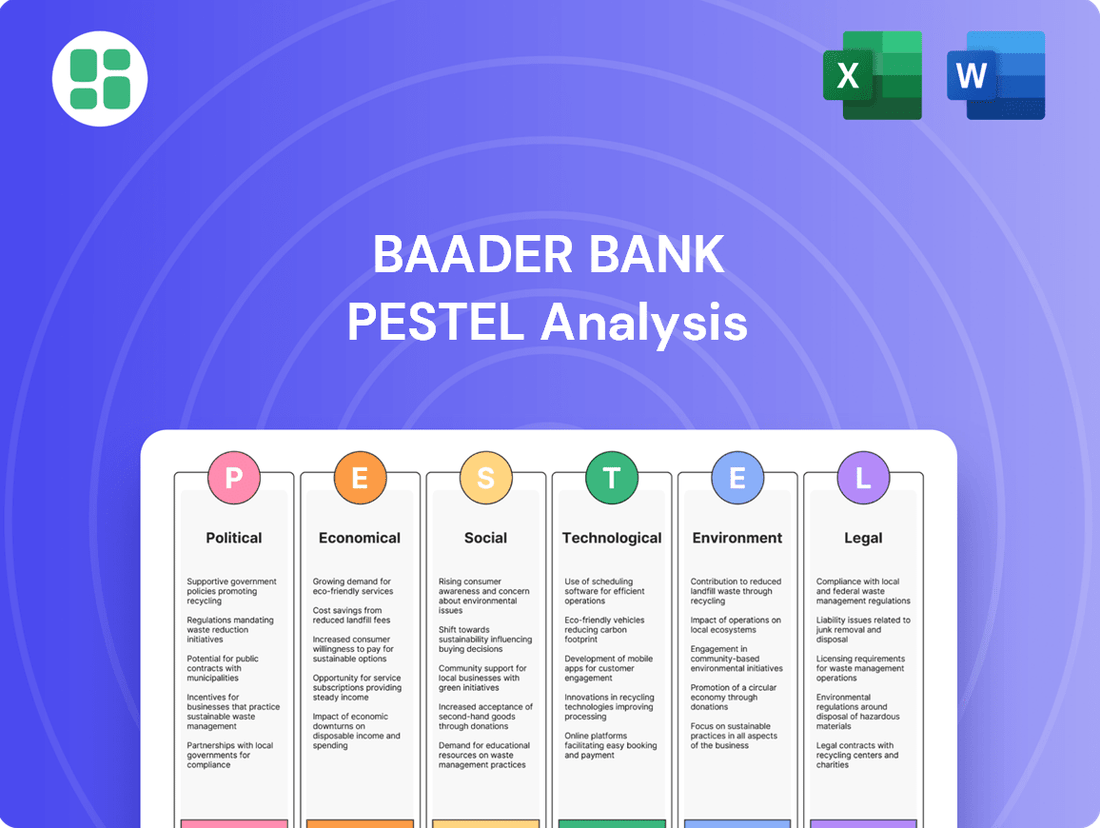

This PESTLE analysis delves into how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—uniquely influence Baader Bank's operations and strategic positioning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Baader Bank.

Economic factors

The European Central Bank (ECB) maintained its key interest rates steady in early 2024, with the deposit facility rate at 4.00% and the main refinancing operations rate at 4.50%. This environment directly influences Baader Bank's net interest income, as it balances lending yields against funding costs.

While stable rates offer some predictability, the ECB's forward guidance signals potential rate cuts later in 2024, contingent on inflation trends. Baader Bank must remain agile, adjusting its balance sheet management and hedging strategies to navigate potential shifts in market liquidity and borrowing expenses.

The bank's profitability is sensitive to changes in interest rate differentials. For instance, a continued high-rate environment could boost interest income on its loan portfolio, but also increase funding costs for its wholesale operations, requiring careful margin management.

Germany's economic growth is projected to be modest in 2024, with the Bundesbank forecasting 0.3% GDP growth, a slight uptick from 2023's estimated 0.1%. This subdued growth environment in the EU impacts trading volumes, as investor confidence often wanes during periods of economic uncertainty.

Market volatility, while potentially challenging, can also present opportunities for Baader Bank. For instance, increased price swings in equity markets in early 2024, driven by geopolitical tensions and inflation concerns, led to higher trading income for many financial institutions as clients sought to hedge or capitalize on market movements.

Baader Bank's investment banking activities, such as M&A advisory and capital raising, are directly influenced by the economic outlook. A stronger economic climate typically fuels corporate expansion and investment, thereby boosting demand for these services. Conversely, economic slowdowns can dampen these activities.

Inflation directly impacts Baader Bank's clients by diminishing their purchasing power, meaning their money buys less. For the bank itself, rising inflation can increase operational costs, from salaries to technology. For instance, if inflation remains elevated in 2024, it could force Baader Bank to re-evaluate its fee structures or investment product pricing.

While a moderation in inflation, as seen in some economies moving towards the 2-3% targets in late 2024 and early 2025, can encourage consumer spending and investment, sustained high inflation erodes the real value of assets held by clients and the bank. This necessitates careful management of the bank's cost base and strategic adjustments to investment portfolios to preserve capital.

Investor Confidence and Capital Flows

Investor confidence is a critical driver of capital flows, directly influencing the health of securities markets. When institutional and private investors feel optimistic about economic prospects, they are more likely to deploy capital, boosting trading volumes and asset prices. This positive sentiment is particularly beneficial for financial institutions like Baader Bank, as it fuels demand for their market-making and brokerage services.

Conversely, a decline in investor confidence can trigger a significant pullback in capital. During periods of uncertainty, investors tend to become risk-averse, leading to asset outflows and reduced market activity. For Baader Bank, this translates to lower trading revenues and potentially decreased demand for its investment products and services. For instance, the Villeroy & Boch AG share price saw a notable dip in early 2024 amidst broader market volatility, reflecting a cautious investor sentiment that can impact trading volumes for such securities.

- Investor Sentiment Impact: High investor confidence typically correlates with increased capital inflows into equities and other securities, directly benefiting Baader Bank's trading and advisory operations.

- Market Activity: In 2024, the German stock market, as represented by the DAX, experienced fluctuations influenced by geopolitical events and inflation concerns, impacting overall trading volumes and investor participation.

- Asset Outflows: Periods of low confidence can lead to significant asset outflows from investment funds, a trend that can reduce the assets under management for financial service providers like Baader Bank.

- Revenue Streams: Baader Bank's revenue streams are closely tied to market liquidity and trading volumes, both of which are sensitive to shifts in investor confidence.

Competitive Landscape and Market Share Shifts

The German and European financial sectors are experiencing dynamic shifts, with fintechs increasingly challenging traditional players and altering market share distribution across trading venues. Baader Bank's strategic focus on platforms like gettex highlights its proactive approach to this evolving landscape.

Baader Bank has successfully expanded its market share, particularly on the gettex exchange, showcasing its ability to adapt and compete effectively. For instance, in 2023, Baader Bank was the leading trading partner for gettex, facilitating a significant portion of the exchange's trading volume. This growth underscores their competitive positioning and strategic adaptation to new market structures.

- Market Share Growth: Baader Bank's increasing participation on gettex demonstrates a successful strategy to capture market share in a competitive environment.

- Fintech Influence: The rise of fintechs necessitates continuous innovation and adaptation from established institutions like Baader Bank.

- Trading Venue Evolution: Shifts in trading venue popularity, such as the growth of gettex, directly impact competitive dynamics and require strategic alignment.

Economic factors significantly shape Baader Bank's operating environment. The European Central Bank's monetary policy, including its key interest rates, directly impacts the bank's net interest income and funding costs. Germany's modest economic growth projections for 2024 influence trading volumes and corporate investment, which in turn affect Baader Bank's advisory and capital-raising services.

Full Version Awaits

Baader Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Baader Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a thorough understanding of the external forces shaping Baader Bank's strategic landscape.

Sociological factors

The financial landscape is seeing a surge in private investors, with global retail trading volumes showing significant growth. For instance, in 2024, many platforms reported a substantial increase in new account openings, particularly among younger demographics eager to engage with digital finance and self-directed investment strategies. This shift means Baader Bank must continue to enhance its digital offerings and user-friendly platforms to attract and retain this growing segment.

Baader Bank's strategic push into the B2B2C model, serving as a white-label provider for other financial institutions and fintechs, directly addresses the increasing demand for digital access and self-directed investing. This approach allows them to reach a broader audience of private clients indirectly, catering to their preference for streamlined, technology-driven financial solutions. By facilitating these partnerships, Baader Bank is adapting to a market where clients expect seamless online experiences and greater control over their investments.

Public trust is a cornerstone for any financial institution, and Baader Bank is no exception. Events like the 2008 financial crisis continue to cast a long shadow, making customers highly sensitive to perceived reliability and ethical practices. A strong reputation for security and integrity directly influences Baader Bank's ability to attract and keep clients in a competitive market.

In 2024, maintaining this trust is paramount. Surveys consistently show that financial institutions with higher public trust ratings tend to experience greater customer loyalty and are more resilient during market downturns. For Baader Bank, demonstrating transparency in its operations and adhering to stringent ethical standards are not just good practice, but essential business imperatives for sustained growth and client acquisition.

Societal expectations are increasingly steering investment decisions towards sustainability. This growing demand for Environmental, Social, and Governance (ESG) considerations is directly impacting client mandates and driving product innovation within the financial sector.

While German investors might exhibit some initial caution, the overarching European trend clearly favors ESG integration. Consequently, Baader Bank must actively incorporate these factors into its asset management strategies and advisory services, which includes robust reporting on principal adverse impacts to meet evolving client and regulatory needs.

Workforce Trends and Talent Acquisition

Sociological shifts are profoundly reshaping the workforce, with employees increasingly prioritizing work-life balance, diversity, and flexible work arrangements like remote or hybrid models. These evolving expectations directly impact how financial institutions, including Baader Bank, approach talent acquisition and retention in a highly competitive market. Attracting top talent now requires more than just competitive salaries; it demands a forward-thinking human resources strategy that acknowledges and accommodates these changing employee values.

Baader Bank, like many in the financial sector, is navigating this landscape as it continues to grow its workforce. For instance, in 2024, the financial services industry saw a significant demand for roles in digital transformation and cybersecurity, areas where work-life balance and flexible schedules are often key differentiators for candidates. To stay ahead, Baader Bank must continually refine its HR strategies to not only attract but also retain skilled professionals who are seeking more than traditional employment structures.

- Employee Expectations: A 2024 survey indicated that over 60% of finance professionals consider work-life balance a critical factor when choosing an employer.

- Diversity and Inclusion: Financial firms are increasingly judged on their commitment to diversity, with 70% of job seekers stating that a diverse workforce is important in their decision-making process.

- Remote Work Impact: The adoption of remote and hybrid work models has expanded the talent pool, allowing companies like Baader Bank to access expertise beyond geographical limitations.

- Talent Competition: The demand for specialized skills in areas like FinTech and data analytics has intensified competition, making employee retention a strategic imperative for Baader Bank.

Financial Literacy and Investor Education

The general level of financial literacy significantly influences how readily people engage with and adopt sophisticated financial products. In 2024, a substantial portion of the population still requires enhanced investor education to confidently navigate markets. This gap directly impacts the potential customer base for Baader Bank's offerings.

Baader Bank is actively addressing this by investing in initiatives like its revamped website, launched in late 2023, which features extensive market content specifically designed for private investors. This strategic move aims to demystify securities trading and empower individuals with the knowledge needed for successful investment decisions.

- Financial Literacy Gap: Surveys in early 2024 indicated that only around 55% of adults felt confident managing their finances, highlighting the need for broader education.

- Digital Education Platforms: Baader Bank's new website aims to reach a wider audience, offering accessible market insights and educational resources to improve financial understanding.

- Product Adoption: Higher financial literacy is directly correlated with increased uptake of investment products, including those offered by Baader Bank.

- Market Participation: Efforts to educate investors can lead to greater participation in capital markets, benefiting both individuals and financial institutions.

Shifting societal values are increasingly emphasizing work-life balance and flexible working arrangements, impacting talent acquisition and retention within the financial sector. In 2024, a significant portion of finance professionals, over 60% according to one survey, prioritize work-life balance when selecting an employer. Baader Bank must adapt its human resources strategies to attract and retain skilled individuals seeking these modern employment structures.

The growing demand for diversity and inclusion is also a critical sociological factor, with 70% of job seekers indicating its importance in their decision-making. Furthermore, enhanced financial literacy is essential for broader market participation, as only about 55% of adults felt confident managing their finances in early 2024, underscoring the need for educational initiatives by firms like Baader Bank.

| Sociological Factor | Impact on Baader Bank | 2024/2025 Data/Trend |

|---|---|---|

| Work-Life Balance | Talent attraction & retention | Over 60% of finance professionals prioritize it. |

| Diversity & Inclusion | Employer branding & talent pool | 70% of job seekers consider it important. |

| Financial Literacy | Customer acquisition & product adoption | 55% of adults felt confident managing finances (early 2024). |

Technological factors

Digitalization is fundamentally reshaping how Baader Bank operates, pushing it to become a robust platform for a wide array of investment and banking services. This strategic shift is heavily reliant on technological advancements.

Significant investments in IT infrastructure and platform capabilities are essential. These investments enable secure, automated, and scalable access to capital markets, which is crucial for Baader Bank's expansion into areas like neo-brokerage, digital asset management, and cryptocurrency trading.

In 2023, Baader Bank reported a notable increase in its IT spending to support these digital initiatives. The bank's focus on platform development is a direct response to the accelerating pace of technological change across the financial sector.

The escalating complexity of cyber threats demands Baader Bank to maintain advanced cybersecurity defenses and resilient operational frameworks. This is crucial given that in 2024, the financial sector experienced a significant rise in sophisticated ransomware attacks, with some reports indicating a 70% increase in targeted attacks against financial institutions compared to the previous year.

Regulatory mandates such as the Digital Operational Resilience Act (DORA) are now imposing strict obligations on financial entities like Baader Bank. DORA requires comprehensive IT risk management, timely incident reporting, and guarantees for service continuity, making continuous investment in these critical areas a paramount strategic imperative for the bank heading into 2025.

Blockchain and crypto assets are reshaping financial markets, creating new avenues for trading and investment. Baader Bank's proactive approach, including its integration of crypto trading services and preparation for the Markets in Crypto-Assets (MiCA) regulation, highlights its commitment to this evolving landscape. This strategic move allows Baader Bank to cater to growing client interest in digital assets and capture opportunities in emerging market segments, with the global crypto market cap fluctuating but showing sustained interest, reaching over $2.5 trillion in early 2024.

Artificial Intelligence (AI) and Data Analytics

Artificial Intelligence (AI) and advanced data analytics are fundamentally reshaping the financial services landscape. These technologies are driving the development of more sophisticated trading algorithms, improving the accuracy of risk assessments, and enabling the creation of highly personalized client experiences. For instance, by Q1 2025, many leading financial institutions reported a 15-20% increase in trading efficiency due to AI-powered execution platforms.

Baader Bank's strategic focus on data analysis underscores its commitment to leveraging technological expertise for a competitive edge. This investment aims to unlock operational efficiencies and enhance service offerings. The bank's ongoing initiatives in 2024 and projections for 2025 indicate a significant allocation towards AI-driven solutions to optimize back-office processes and client advisory services.

The impact of AI extends to several key areas within financial operations:

- Algorithmic Trading: AI enhances algorithmic trading strategies, leading to faster execution and potentially higher returns.

- Risk Management: Advanced analytics improve the identification and mitigation of financial risks through predictive modeling.

- Customer Experience: AI-powered tools offer personalized financial advice and tailored product recommendations.

- Operational Efficiency: Automation of routine tasks through AI reduces costs and minimizes human error.

Open Banking and API Connectivity

The push towards open banking, exemplified by evolving regulations like PSD3, fundamentally elevates the importance of robust API connectivity. This allows for smooth data sharing and collaboration with external fintech firms.

For Baader Bank, this translates into a strategic imperative to upgrade its internal systems. The goal is to enable easier integration with a growing ecosystem of fintech partners, ultimately offering a more connected financial experience for its B2B2C clients.

By embracing API-first strategies, Baader Bank can unlock new revenue streams and enhance customer value through embedded finance solutions. For instance, by mid-2024, the European fintech market saw continued growth in API adoption, with over 70% of surveyed banks reporting active API strategies to foster innovation and partnerships.

- API Connectivity: Essential for seamless data exchange with third-party providers.

- Open Banking: Driven by regulatory mandates, fostering collaboration.

- Fintech Integration: Key to Baader Bank's strategy for B2B2C clients.

- Embedded Finance: A potential growth area enabled by strong API infrastructure.

Technological advancements are central to Baader Bank's strategy, driving its digital transformation and expansion into new financial services like crypto trading. Significant investments in IT infrastructure are crucial for secure, automated operations, especially as cyber threats escalate, with financial institutions facing a notable increase in targeted attacks in 2024.

Regulatory frameworks like DORA are mandating enhanced IT risk management and operational resilience, requiring continuous investment. Emerging technologies such as AI and blockchain are being leveraged to improve trading efficiency, risk assessment, and customer experience, with AI-driven platforms showing significant performance gains by early 2025.

The bank is also prioritizing API connectivity to facilitate open banking and fintech collaborations, aiming to embed financial services and unlock new revenue streams. This strategic focus on technology is essential for Baader Bank to remain competitive and adapt to the rapidly evolving financial landscape.

| Technology Area | Impact on Baader Bank | Key Trends/Data (2024-2025) |

|---|---|---|

| Digitalization & Platform Development | Enabling neo-brokerage, digital asset management, crypto trading | Increased IT spending in 2023; focus on platform capabilities for scalability |

| Cybersecurity | Protecting against escalating threats, ensuring operational resilience | 70% increase in targeted ransomware attacks against financial institutions in 2024 |

| Blockchain & Crypto Assets | Offering new trading and investment avenues, preparing for MiCA | Global crypto market cap over $2.5 trillion (early 2024); Baader Bank integrating crypto services |

| Artificial Intelligence (AI) & Data Analytics | Improving trading algorithms, risk assessment, client personalization | 15-20% increase in trading efficiency via AI platforms (Q1 2025); AI for back-office optimization |

| Open Banking & APIs | Facilitating data sharing, fintech integration, embedded finance | Over 70% of European banks actively using APIs for innovation (mid-2024); PSD3 driving API importance |

Legal factors

Baader Bank operates under stringent European and German banking regulations, such as the Capital Requirements Regulation (CRR III) and Capital Requirements Directive (CRD VI). These frameworks, which align with Basel III standards, mandate higher capital buffers and more rigorous risk management practices.

The implementation of CRR III, for instance, requires banks to hold more capital against their risk-weighted assets, directly influencing Baader Bank's lending capacity and profitability. For example, as of early 2024, European banks are navigating the final stages of Basel III implementation, with a focus on reducing variability in risk-weighted assets, a key area for institutions like Baader Bank.

MiFID II and MAR are foundational regulations for financial markets, focusing on transparency and investor protection. Baader Bank, operating as a market maker and brokerage, must meticulously comply with these directives. This includes stringent requirements for order execution, detailed transaction reporting, and robust systems to prevent market abuse. For instance, MiFID II's transparency obligations have led to significant increases in pre- and post-trade data availability, impacting how firms like Baader Bank operate and report their activities.

The Digital Operational Resilience Act (DORA), set to take full effect in January 2025, imposes stringent legal obligations on financial entities like Baader Bank regarding their IT and cybersecurity infrastructure. This landmark regulation mandates comprehensive testing of IT systems, standardized incident reporting, and rigorous oversight of third-party technology providers to bolster overall operational resilience across the financial sector.

Markets in Crypto-Assets (MiCA) Regulation

The Markets in Crypto-Assets (MiCA) regulation, set for full implementation in 2025, establishes a unified legal landscape for crypto-assets and associated services across the European Union. This comprehensive framework aims to foster innovation while safeguarding investors and ensuring market stability within the rapidly evolving digital asset space.

For Baader Bank, its involvement in crypto trading necessitates strict adherence to MiCA's new licensing and operational mandates. These requirements are designed to bolster investor confidence and uphold the integrity of crypto markets, a crucial step as this asset class continues to mature.

- Licensing: Crypto-asset service providers (CASPs) like Baader Bank will need specific authorization to operate within the EU, ensuring they meet stringent operational and prudential standards.

- Investor Protection: MiCA mandates clear disclosure requirements, rules on marketing, and safeguards against market abuse, directly impacting how Baader Bank interacts with its crypto clients.

- Market Integrity: The regulation addresses issues like insider dealing and market manipulation in crypto markets, requiring Baader Bank to implement robust compliance and surveillance systems.

- Asset Classification: MiCA categorizes crypto-assets, including utility tokens and asset-referenced tokens, each with distinct regulatory treatment that Baader Bank must navigate.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Laws

Baader Bank operates under increasingly stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. New EU AML packages and updated European Banking Authority (EBA) guidelines on sanctions, for instance, significantly elevate compliance burdens. These regulations necessitate advanced transaction monitoring systems and rigorous customer due diligence to combat financial crime effectively.

The evolving nature of financial crime presents a continuous legal challenge for Baader Bank. The bank must invest in sophisticated technology and robust internal processes to conduct thorough risk analyses and diligently screen customers. Failure to comply can result in substantial fines and reputational damage, underscoring the critical importance of robust AML/CTF frameworks.

- Enhanced Regulatory Scrutiny: Expect continued updates to AML/CTF directives, such as the upcoming EU AML Package expected to be fully implemented by 2025, which includes centralized beneficial ownership registers and stricter rules for crypto-asset service providers.

- Increased Compliance Costs: The implementation of advanced monitoring software and dedicated compliance personnel can add significant operational expenses, with industry estimates suggesting compliance costs for financial institutions are in the billions annually across Europe.

- Cross-Border Cooperation: International collaboration on AML/CTF is intensifying, requiring Baader Bank to navigate diverse regulatory landscapes and information-sharing protocols with global authorities.

Baader Bank's operations are heavily shaped by evolving legal frameworks, particularly concerning digital assets and operational resilience. The Markets in Crypto-Assets (MiCA) regulation, fully effective in 2025, mandates specific licensing and investor protection rules for crypto-asset service providers, directly impacting Baader Bank's engagement in this sector.

Furthermore, the Digital Operational Resilience Act (DORA), also effective from January 2025, imposes stringent cybersecurity and IT risk management requirements. This legislation demands comprehensive testing and robust oversight of third-party technology providers, a critical consideration for Baader Bank's digital infrastructure.

Compliance with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations remains a significant legal factor. Updates to EU AML directives, expected by 2025, will likely increase compliance burdens, necessitating advanced monitoring systems and rigorous customer due diligence to mitigate financial crime risks.

Environmental factors

Baader Bank, like all financial institutions, faces escalating demands for robust Environmental, Social, and Governance (ESG) reporting. This is driven by both regulatory bodies and increasingly environmentally conscious stakeholders. The bank is actively working to enhance its transparency and accountability in these crucial areas.

New EU regulations are particularly impactful. The Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy, for instance, mandate detailed disclosures regarding environmental impacts. Baader Bank is integrating these requirements into its non-financial statements, ensuring alignment with evolving European sustainability standards.

Financial regulators are increasingly mandating the integration of climate-related and environmental risks into banks' risk management frameworks. For instance, the European Central Bank (ECB) has been pushing for this, with its 2022 guide on climate-related and environmental risks highlighting expectations for banks to incorporate these factors into their governance, risk management, and disclosure processes.

While Baader Bank's direct environmental footprint is likely less significant than that of heavy industry, its financial intermediation role necessitates a thorough assessment of climate risks within its investment and lending portfolios. This includes evaluating the exposure of its clients and assets to transition risks, such as policy changes or technological shifts, and physical risks, like extreme weather events. For example, by 2024, many financial institutions are expected to have robust methodologies in place to quantify these portfolio-level climate impacts.

The surge in sustainable finance is significantly reshaping the financial landscape, directly impacting Baader Bank's strategic decisions. By 2024, global sustainable investment assets were projected to exceed $50 trillion, a clear indicator of this powerful trend. This growing investor preference for environmentally and socially responsible options necessitates a pivot in product development and asset management, pushing banks to integrate ESG (Environmental, Social, and Governance) criteria more deeply into their operations.

Baader Bank can capitalize on the escalating demand for green financial instruments, such as green bonds and sustainability-linked loans. For instance, the green bond market alone saw issuance reach an estimated $600 billion in 2023, demonstrating robust investor appetite. By actively developing and marketing investment vehicles that champion environmental goals, Baader Bank can attract a growing segment of environmentally conscious investors seeking to align their portfolios with their values.

Operational Environmental Footprint

While Baader Bank is an investment bank, its operational environmental footprint, including energy use and waste, is still a consideration. Managing these aspects contributes to its overall sustainability. For instance, in 2023, many German companies, including financial institutions, are increasingly reporting on their Scope 1 and Scope 2 emissions, with a growing focus on reducing these by implementing energy-efficient technologies and renewable energy sourcing.

Adopting greener operational practices can bolster Baader Bank's corporate image and demonstrate alignment with global environmental objectives. This includes initiatives like reducing paper consumption through digitalization and optimizing resource efficiency in office spaces. Such efforts are becoming more important as investors and stakeholders place a higher value on Environmental, Social, and Governance (ESG) performance.

- Energy Consumption: Focus on reducing electricity usage in offices and data centers.

- Waste Generation: Implement robust recycling programs and minimize single-use materials.

- Resource Efficiency: Promote digital workflows to reduce paper and other material needs.

- Sustainable Procurement: Prioritize suppliers with strong environmental credentials.

Reputational Risk from Environmental Controversies

Baader Bank faces reputational risk if it fails to adequately address environmental concerns or engages in activities linked to environmental controversies, such as financing projects with substantial negative ecological footprints. This could damage its brand image and customer trust.

To counter this, a robust environmental due diligence policy is essential for Baader Bank's investment banking and asset management operations. This proactive approach helps mitigate the potential for negative publicity and financial repercussions stemming from environmental missteps.

For instance, a significant portion of investors, particularly in 2024, are increasingly scrutinizing financial institutions' environmental, social, and governance (ESG) performance. A 2024 report indicated that over 70% of institutional investors consider ESG factors when making investment decisions, highlighting the critical nature of environmental stewardship for financial firms like Baader Bank.

- Reputational Impact: Association with environmentally damaging projects can lead to public backlash and loss of investor confidence.

- Due Diligence Necessity: Implementing stringent environmental checks on all financed activities is paramount.

- Investor Scrutiny: Growing investor demand for ESG compliance means environmental controversies can directly affect capital access.

- Mitigation Strategy: A clear and consistently applied environmental policy is key to safeguarding Baader Bank's reputation.

Baader Bank must navigate evolving environmental regulations and a growing demand for sustainable finance. The bank's direct operational footprint, while smaller than industrial firms, requires attention to energy, waste, and resource efficiency, with many German companies focusing on Scope 1 and 2 emissions reduction by 2023.

The rise of sustainable investment, projected to exceed $50 trillion globally by 2024, presents an opportunity for Baader Bank to develop green financial instruments, capitalizing on the robust investor appetite seen in the estimated $600 billion green bond market of 2023.

Environmental risks within investment portfolios are a key concern, with regulators like the ECB expecting banks to integrate climate risk management by 2024. Over 70% of institutional investors in 2024 consider ESG factors, making robust environmental due diligence crucial to mitigate reputational damage and maintain investor confidence.

| Factor | 2023 Data/Projection | Impact on Baader Bank | Action/Mitigation |

|---|---|---|---|

| Sustainable Investment Growth | Projected >$50 trillion by 2024 | Increased demand for ESG-aligned products | Develop and market green financial instruments |

| Green Bond Market | Estimated $600 billion issuance in 2023 | Opportunity for capital raising and client service | Expand offerings in green debt financing |

| Investor ESG Scrutiny | >70% of institutional investors consider ESG (2024) | Reputational risk for non-compliance | Strengthen environmental due diligence and reporting |

| Regulatory Focus (ECB) | Expectation for climate risk integration by 2024 | Mandatory risk management adjustments | Enhance climate risk assessment in portfolios |

PESTLE Analysis Data Sources

Our Baader Bank PESTLE Analysis draws from a robust blend of official government publications, reputable financial news outlets, and leading economic research institutions. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in accurate, current data.