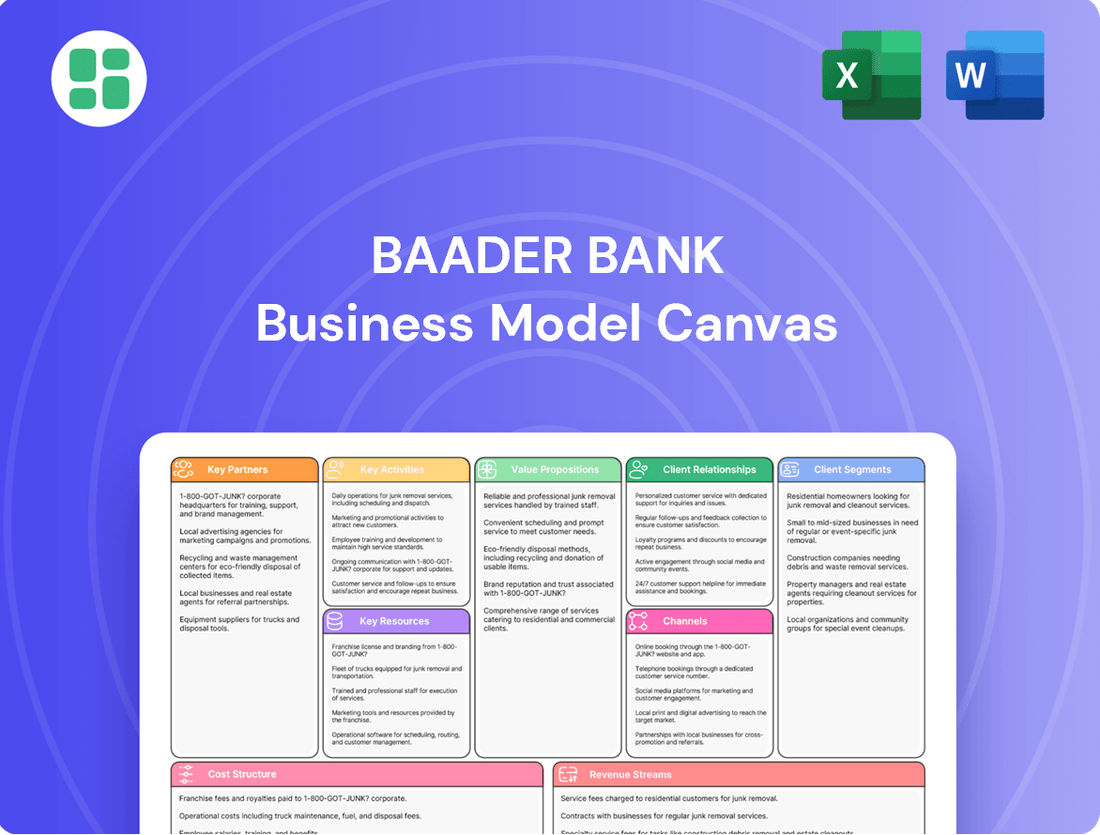

Baader Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baader Bank Bundle

Unlock the strategic blueprint behind Baader Bank's success with our comprehensive Business Model Canvas. This detailed analysis reveals their core customer segments, unique value propositions, and robust revenue streams, offering a clear picture of how they operate and thrive in the financial sector. Ideal for anyone seeking to understand or replicate their market-leading approach.

Partnerships

Baader Bank actively cultivates strategic B2B2C partnerships, notably with neobrokers like Smartbroker+. This collaboration allows Baader Bank to extend its services to a broader customer base by providing essential banking and trading platform infrastructure. For instance, in 2023, Smartbroker+ reported a significant increase in its customer base, directly benefiting Baader Bank's platform usage.

Baader Bank collaborates with technology providers like Objectway to drive key projects, such as its 'Road to Future' initiative. This program is designed to establish a core banking environment that is both highly scalable and operationally efficient.

These technology partnerships are essential for Baader Bank to optimize its IT infrastructure, boost platform capabilities, and maintain robust cybersecurity. For instance, in 2024, Baader Bank continued to invest heavily in digital transformation, with a significant portion of its IT budget allocated to modernizing its core systems and enhancing its cybersecurity defenses to meet evolving regulatory and market demands.

Baader Bank actively engages with exchange and trading venue operators, such as gettex, where it functions as a market maker. These vital relationships are crucial for ensuring the smooth execution of trades and providing liquidity across numerous securities. In 2024, Baader Bank's commitment to these partnerships underpins its strategy to grow its market presence and trading volumes.

Financial Institutions for Capital Markets

Baader Bank collaborates with financial institutions like Erste Group to bolster its equity capital markets activities. This strategic alignment allows Baader Bank to offer enhanced primary market sales and deal execution services across key European and North American markets.

These partnerships are crucial for expanding Baader Bank's reach to a wider investor base and strengthening its investment banking capabilities. For instance, in 2024, such collaborations enabled the bank to participate in a significant number of European IPOs and capital raises.

- Expanded Market Access: Partnerships provide access to a broader spectrum of institutional investors, crucial for successful capital market transactions.

- Enhanced Service Portfolio: Cooperation allows for the integration of specialized services, such as in-depth equity research for institutional clients.

- Deal Execution Capabilities: Alliances facilitate smoother and more efficient execution of primary market transactions across diverse geographies.

- Synergistic Growth: By leveraging the strengths of partners, Baader Bank can achieve greater scale and efficiency in its investment banking operations.

Specialized Service and Product Partners

Baader Bank strategically partners with specialized providers to broaden its product and service portfolio. A prime example is their collaboration with Wyden, enabling 24/7 cryptocurrency trading for customers of finanzen.net zero. This allows Baader Bank to quickly integrate innovative offerings and respond to shifting market needs, thereby strengthening its overall value proposition.

These targeted alliances are crucial for Baader Bank's growth strategy. By teaming up with experts in niche areas, the bank can efficiently expand its market reach and introduce cutting-edge solutions. For instance, in 2023, Baader Bank reported a significant increase in trading volumes, partly attributed to the expansion of its digital offerings, which are often facilitated by such specialized partnerships.

- Wyden Partnership: Facilitates 24/7 crypto trading for finanzen.net zero customers.

- Product Diversification: Enables the introduction of new and specialized financial products.

- Market Adaptability: Allows Baader Bank to respond swiftly to evolving customer demands and market trends.

- Enhanced Value Proposition: Strengthens the bank's competitive standing by offering a wider range of services.

Baader Bank's key partnerships are foundational to its business model, enabling it to extend its reach and enhance its service offerings. These alliances span technology providers, trading venues, and financial institutions, all crucial for delivering integrated financial solutions. In 2024, Baader Bank continued to prioritize these collaborations to drive innovation and market presence.

| Partner Type | Example Partner | Strategic Value | 2024 Impact/Focus |

|---|---|---|---|

| Neobrokers | Smartbroker+ | Customer acquisition, platform infrastructure | Continued growth in customer base and platform utilization |

| Technology Providers | Objectway | Core banking modernization, scalability | Investment in digital transformation and IT infrastructure |

| Trading Venues | gettex | Market making, liquidity provision | Strengthening market presence and trading volumes |

| Financial Institutions | Erste Group | Equity capital markets, deal execution | Participation in European IPOs and capital raises |

| Specialized Providers | Wyden | Product diversification (e.g., crypto trading) | Expansion of digital offerings and market adaptability |

What is included in the product

A detailed breakdown of Baader Bank's strategy, outlining its key customer segments, value propositions, and distribution channels for its financial services.

This canvas provides a strategic overview of Baader Bank's operations, highlighting its revenue streams, cost structure, and key partnerships within the financial sector.

Baader Bank's Business Model Canvas acts as a pain point reliever by offering a clear, structured overview that simplifies complex financial operations.

It streamlines the identification of key value propositions and customer segments, alleviating the pain of convoluted strategies.

Activities

Baader Bank's market making and liquidity provision is a cornerstone of its operations, actively quoting bid and ask prices across numerous stock exchanges and trading venues. This constant engagement ensures a broad spectrum of securities remains liquid, facilitating smoother trading for all participants.

In 2024, Baader Bank's commitment to this area was evident in its role as a key liquidity provider. For instance, as of Q1 2024, the bank reported a significant increase in its trading volume, directly attributable to its market-making activities. This function is a primary engine for the bank's trading income and bolsters its competitive market share.

Baader Bank offers a full suite of investment banking services, focusing on capital markets activities and the execution of complex financial transactions. This includes crucial support in the primary market, helping companies successfully issue new securities to raise capital.

These services are designed for corporate clients needing strategic financial advice and access to funding. For instance, in 2024, Baader Bank was active in advising on and executing equity capital market transactions, facilitating growth for its clients.

The bank's deep expertise in deal origination and execution ensures that clients can navigate the intricacies of capital raising, from initial structuring to final placement. This capability is vital for companies looking to expand or restructure through financial markets.

Baader Bank’s multi-asset brokerage is a cornerstone, allowing clients to trade everything from stocks and bonds to ETFs and increasingly, cryptocurrencies. This broad offering ensures they can access diverse investment opportunities through a single platform. In 2024, the digital asset trading segment saw significant growth, with Baader Bank reporting a substantial increase in transaction volumes for crypto-related products, reflecting a growing client demand for these newer asset classes.

Asset Management and Fund Services

Baader Bank actively manages assets and offers extensive fund services, catering to a diverse client base including individual and institutional investors focused on wealth management. This segment is crucial for providing professional investment administration and oversight.

The bank's commitment to robust fund services is underscored by its growing number of securities accounts, demonstrating increasing client trust and participation in managed investment vehicles. These services are foundational for clients seeking expert guidance in navigating financial markets.

In 2024, Baader Bank's focus on asset management and fund services is evident in its operational expansion and client growth. The bank aims to solidify its position by delivering tailored solutions and efficient administration for a wide array of investment products.

- Asset Management: Providing professional management for client investment portfolios.

- Fund Services: Offering comprehensive administration and support for investment funds.

- Client Base: Serving both individual and institutional investors seeking wealth management solutions.

- Account Growth: Managing an increasing volume of securities accounts, indicating client engagement.

Technology Development and Platform Optimization

Baader Bank's commitment to technology development is evident through its continuous investment in its proprietary platform. This focus on optimizing IT infrastructure, refining trading algorithms, and enhancing data analysis capabilities is crucial for staying ahead in the financial sector. The 'Road to Future' initiative underscores their dedication to creating a secure, automated, and scalable banking and trading ecosystem.

These technological advancements are not just about efficiency; they are foundational to maintaining a competitive edge. For instance, in 2024, Baader Bank continued to expand its digital offerings, aiming to streamline client onboarding and transaction processing through advanced technological solutions. This strategic investment ensures operational excellence and supports the bank's ability to adapt to evolving market demands and regulatory landscapes.

- Platform Optimization: Ongoing enhancements to IT infrastructure and trading algorithms.

- Data Analysis: Improving capabilities for better market insights and decision-making.

- 'Road to Future' Program: Building a secure, automated, and scalable banking and trading environment.

- Competitive Edge: Technological advancements are key to maintaining market leadership and operational efficiency.

Baader Bank's market making and liquidity provision ensures efficient trading across various asset classes, a core revenue driver. In 2024, this activity significantly contributed to their trading income, with reported increases in trading volumes supporting their market share.

The bank's investment banking services focus on capital markets, aiding corporate clients in raising capital through equity and debt issuances. In 2024, they were actively involved in executing these complex transactions, facilitating client growth and expansion.

Baader Bank's multi-asset brokerage platform offers access to diverse investment opportunities, including a notable expansion in digital assets in 2024. This reflects growing client demand for newer asset classes and broadens their service offering.

Asset management and fund services cater to both individual and institutional investors, with an increasing number of securities accounts in 2024 indicating growing client trust. The bank is solidifying its position by offering tailored solutions and efficient administration for investment products.

Continuous investment in technology, exemplified by the 'Road to Future' initiative, enhances operational efficiency and competitive advantage. In 2024, this focus led to expanded digital offerings and streamlined client processes.

| Key Activity | Description | 2024 Relevance |

|---|---|---|

| Market Making & Liquidity Provision | Quoting bid/ask prices across exchanges for securities. | Drove trading income; increased trading volumes. |

| Investment Banking | Advising on and executing capital market transactions. | Facilitated client capital raising and growth. |

| Multi-Asset Brokerage | Enabling trading across stocks, bonds, ETFs, and digital assets. | Saw growth in digital asset trading volumes. |

| Asset & Fund Services | Managing investment portfolios and administering funds. | Experienced growth in securities accounts; client trust. |

| Technology Development | Investing in proprietary platforms and IT infrastructure. | Enhanced digital offerings and operational efficiency. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of Baader Bank's strategic framework. This is not a sample or mockup; it's a direct representation of the complete, ready-to-use analysis. Once your order is processed, you will gain full access to this identical, professionally structured document, enabling you to understand and leverage Baader Bank's business strategy.

Resources

Baader Bank's highly skilled human capital is a cornerstone of its operations, comprising around 650 dedicated employees. This team includes financial experts, seasoned traders, IT professionals, and client relationship managers, all contributing to the bank's success.

The collective expertise of these individuals is vital for Baader Bank's ability to offer sophisticated financial services, create cutting-edge solutions, and nurture robust client partnerships. Their deep knowledge ensures the delivery of high-quality services tailored to diverse client needs.

The bank's recent staff growth, reflecting its expansion and strategic investments, underscores the importance placed on human capital. This investment in talent directly supports Baader Bank's ongoing development and its commitment to innovation in the financial sector.

Baader Bank's advanced technology platform, including its gettex trading system, is a cornerstone resource. This robust, secure, and automated IT infrastructure underpins high-performance banking operations and supports a wide array of services.

Continuous investment in platform functionality is crucial for scalability and maintaining a competitive edge. In 2024, ongoing development efforts focused on enhancing trading systems and data analysis tools, ensuring Baader Bank can effectively serve its diverse client base.

Baader Bank's robust financial capital and equity base are fundamental to its business model, providing the essential resources for daily operations, strategic investments, and sustained growth. This financial bedrock allows the bank to effectively manage risks and seize expansion opportunities.

As of the first quarter of 2024, Baader Bank reported a significant equity base, underpinning its capacity for further strategic initiatives and investments. This financial strength is crucial for maintaining client confidence and supporting the bank's diverse service offerings.

Regulatory Licenses and Compliance Expertise

Baader Bank's regulatory licenses are foundational to its operations, with its MiCAR license from BaFin being a prime example of its commitment to operating within the evolving digital asset regulatory landscape. This license is crucial for offering compliant crypto-related financial services, building client trust and ensuring market integrity.

Possessing deep expertise in regulatory compliance is not just a legal necessity but a strategic advantage. It allows Baader Bank to navigate complex financial regulations effectively, minimizing risks and fostering a secure environment for its clients and partners. This expertise is a key differentiator in the competitive financial services sector.

- MiCAR License: Enables compliant operation within the EU's digital asset framework.

- BaFin Supervision: Demonstrates adherence to stringent German financial regulations.

- Compliance Expertise: Facilitates navigation of complex and evolving regulatory requirements.

- Client Trust: Underpins the bank's reputation and ability to attract and retain customers.

Established Brand Reputation and Market Share

Baader Bank's established brand reputation as a premier European partner for investment and banking services is a cornerstone of its business model. This strong market presence, evidenced by its growing market share on key trading platforms, acts as a significant intangible asset. In 2024, Baader Bank continued to solidify its position, attracting new clients and fostering strategic partnerships that drive sustained growth.

- Leading European Partner: Baader Bank is recognized across Europe for its comprehensive investment and banking solutions.

- Growing Market Share: The bank has demonstrated an upward trend in its market share on relevant trading platforms throughout 2024.

- Client and Partner Attraction: Its strong brand and market standing are key drivers for acquiring new business and collaborators.

- Distinct Identity: The bank's family-run heritage contributes to a unique and trusted identity in the financial sector.

Baader Bank's key resources encompass its substantial financial capital, a robust technology infrastructure including the gettex trading system, a dedicated team of approximately 650 employees, and crucial regulatory licenses like its MiCAR license. These elements collectively enable the bank to provide sophisticated financial services, maintain operational efficiency, and build client trust within the evolving financial landscape.

| Resource Category | Specific Resource | Key Aspects | 2024 Data/Relevance |

|---|---|---|---|

| Human Capital | Employees | Financial experts, traders, IT, client relations | ~650 employees; ongoing talent investment |

| Technology | gettex Trading System | Robust, secure, automated IT infrastructure | Continuous platform enhancement in 2024 |

| Financial Capital | Equity Base | Resources for operations, investments, growth | Significant equity base reported Q1 2024 |

| Regulatory Licenses | MiCAR License, BaFin Supervision | Compliant digital asset services, regulatory adherence | Crucial for crypto services; builds client trust |

Value Propositions

Baader Bank's 'High Performance Banking' is built on a foundation of rapid technology adoption and continuous service innovation. This approach ensures clients have secure, automated, and scalable access to capital markets, facilitating swift and efficient execution of trades and financial transactions. For instance, in 2024, Baader Bank continued to invest heavily in its digital infrastructure, aiming to reduce transaction settlement times by an additional 5% by year-end.

Clients experience the tangible benefits of this high-performance model through reliable and quick processing, a crucial advantage in today's fast-paced and dynamic market environments. This efficiency translates directly into improved client outcomes, particularly for institutional investors and trading firms who rely on speed and accuracy. In the first half of 2024, Baader Bank reported a 99.9% uptime for its trading platforms, underscoring the reliability of its execution services.

Baader Bank's comprehensive capital market access and liquidity are central to its value proposition. As a significant market maker, the bank offers clients access to numerous German and international stock exchanges, ensuring efficient trading and competitive pricing for a broad spectrum of securities. This deep market participation is crucial for maintaining robust liquidity, benefiting all market participants by providing depth and ease of execution.

Baader Bank crafts bespoke financial solutions for institutional investors, corporate clients, and private individuals. This tailored approach ensures each segment receives precisely what it needs, whether it's complex investment banking for institutions or user-friendly trading platforms for retail clients.

For instance, in 2024, Baader Bank continued to refine its offerings, with its institutional client services focusing on sophisticated trading execution and capital markets access, while its private client segment emphasized accessible digital platforms and personalized wealth management advice.

Expertise in Investment and Wealth Management

Baader Bank's expertise in investment and wealth management is a core value proposition, offering clients specialized solutions for capital market activities and wealth preservation. This deep industry knowledge translates into a broad spectrum of services designed to help individuals and institutions navigate complex financial landscapes.

Clients gain access to comprehensive offerings that include sophisticated brokerage services, efficient fund administration, and insightful market research. For instance, Baader Bank reported a net profit of €37.8 million for the fiscal year 2023, underscoring its operational strength and capacity to deliver value.

- Brokerage Services: Facilitating seamless trading across various asset classes.

- Fund Services: Providing administration and custody for investment funds.

- Research: Delivering in-depth analysis to inform investment decisions.

Technological Innovation and Digital Access

Baader Bank's dedication to technological advancement is evident through its continuous investment in IT infrastructure and digital solutions. This focus ensures clients benefit from modern, user-friendly access to financial services.

The launch of the new Baader Trading website and enhanced API capabilities exemplifies this commitment, offering clients cutting-edge tools for their trading and investment activities. These upgrades are central to providing a seamless digital experience.

The strategic 'Road to Future' program further solidifies Baader Bank's drive for innovation, aiming to equip clients with the latest platforms and functionalities. This forward-thinking approach is crucial in the rapidly evolving financial landscape.

For instance, Baader Bank reported a significant increase in digital transaction volumes in early 2024, highlighting client adoption of their enhanced digital offerings.

- Continuous IT Investment: Ongoing capital allocation to technology infrastructure.

- Digital Access Enhancement: Launch of new trading website and API capabilities.

- Client-Centric Innovation: Providing cutting-edge tools for trading and investment.

- 'Road to Future' Program: Strategic initiative for future digital development.

Baader Bank offers comprehensive capital markets access, acting as a key market maker that provides clients with efficient trading and competitive pricing across numerous German and international exchanges. This deep market participation ensures robust liquidity, benefiting all participants by offering depth and ease of execution for a wide array of securities.

The bank's value proposition is further strengthened by its bespoke financial solutions, meticulously crafted for institutional investors, corporate clients, and private individuals. This tailored approach ensures that each client segment receives precisely the financial tools and services they need, from complex investment banking for institutions to accessible digital platforms for retail clients.

Baader Bank's commitment to technological advancement is a cornerstone of its client offering, demonstrated by continuous investment in IT infrastructure and digital solutions. This focus ensures clients benefit from modern, user-friendly access to financial services, exemplified by their enhanced API capabilities and new trading website. For instance, in early 2024, Baader Bank saw a significant increase in digital transaction volumes, reflecting strong client adoption of these improved digital offerings.

| Value Proposition | Description | Key Data/Initiatives (2024 focus) |

| High-Performance Banking | Rapid technology adoption and service innovation for secure, automated, and scalable capital markets access. | Investment in digital infrastructure to reduce settlement times by an additional 5% by year-end 2024; 99.9% platform uptime reported in H1 2024. |

| Capital Markets Access & Liquidity | Significant market making, providing access to numerous exchanges for efficient trading and competitive pricing. | Facilitating deep market participation to ensure robust liquidity and ease of execution. |

| Bespoke Financial Solutions | Tailored offerings for institutional investors, corporate clients, and private individuals, meeting specific segment needs. | Refined institutional services for trading execution and capital markets access; enhanced digital platforms and wealth management for private clients. |

| Technological Advancement | Continuous investment in IT and digital solutions for modern, user-friendly financial service access. | Launch of new Baader Trading website and enhanced API capabilities; significant increase in digital transaction volumes in early 2024. |

Customer Relationships

Baader Bank assigns dedicated relationship managers to its institutional and corporate clients, providing a highly personalized service. This direct engagement ensures that complex financial needs are understood and proactively met, fostering deep trust and long-term partnerships.

For private investors, Baader Bank is enhancing relationships through digital channels, including a user-friendly online trading platform and a new dedicated Baader Trading website. These platforms provide essential information, advanced tools, and robust self-service capabilities, making engagement convenient and accessible for a wide retail client base.

Baader Bank's customer relationships heavily leverage B2B2C cooperation partnerships, especially for private clients. This means they provide the essential banking and trading infrastructure to partners who then manage the direct interaction with the end consumer, like neobrokers.

This indirect approach is key to scaling customer acquisition efficiently. For instance, in 2024, the fintech sector saw continued growth in user acquisition through embedded finance models, a trend Baader Bank actively participates in by enabling these partnerships.

By outsourcing the direct client interface, Baader Bank significantly reduces its customer acquisition costs per individual account. This strategy allows them to focus on their core competencies in providing robust financial technology and services, fostering a more sustainable and scalable growth trajectory.

Conferences and Networking Events

Baader Bank actively cultivates relationships through industry conferences and networking events. A prime example is their flagship Baader Investment Conference, which directly connects institutional investors with management teams of listed companies. This strategic engagement fosters deeper ties and opens doors to new business opportunities.

These events are crucial for Baader Bank's client outreach. They not only solidify existing partnerships but also serve as a vital channel for attracting new clientele. By sharing market insights and facilitating direct interaction, Baader Bank positions itself as a key facilitator in the financial ecosystem.

- Baader Investment Conference: A cornerstone event for direct investor-company interaction.

- Relationship Strengthening: Facilitates deeper connections with institutional investors and corporate clients.

- New Client Acquisition: Acts as a platform to attract and onboard new business.

- Market Insight Dissemination: Offers a venue for sharing valuable market intelligence.

Transparent Communication and Information Provision

Baader Bank prioritizes transparent communication, a cornerstone of its customer relationships. This is evident through its comprehensive financial reports, regular press releases, and specialized research portals, ensuring clients have access to crucial market insights and performance data.

By providing timely and relevant information, the bank cultivates trust and keeps its clientele well-informed about evolving market dynamics and its own operational progress. This open approach is vital for fostering strong, lasting relationships.

- Financial Reports: Baader Bank's commitment to transparency is reflected in its detailed financial reports, offering clients a clear view of the bank's performance and stability. For instance, in 2024, the bank consistently published quarterly earnings reports, detailing key financial metrics and strategic developments.

- Research Portals: The bank maintains dedicated research portals that provide clients with in-depth market analysis, investment recommendations, and economic outlooks, empowering them with knowledge to make informed decisions.

- Press Releases: Timely press releases ensure that clients and the wider market are kept abreast of significant news, regulatory updates, and strategic initiatives undertaken by Baader Bank.

- Official Channels: Emphasizing accuracy and security, Baader Bank directs all official communication through designated channels, safeguarding client information and ensuring the integrity of the information provided.

Baader Bank's customer relationships are a blend of personalized service for institutional clients and scalable digital engagement for retail investors, often facilitated through B2B2C partnerships. Key events like the Baader Investment Conference directly connect investors with companies, fostering deeper ties and new business. Transparency is paramount, with comprehensive financial reports and research portals keeping clients informed.

| Relationship Type | Engagement Method | Key Initiatives/Data (2024) |

|---|---|---|

| Institutional & Corporate Clients | Dedicated Relationship Managers | Baader Investment Conference (facilitates direct interaction) |

| Private Investors | Digital Platforms (Online Trading, Baader Trading Website) | Enhanced self-service capabilities, user-friendly interface |

| B2B2C Partnerships (e.g., Neobrokers) | Indirect Client Interface | Enabling embedded finance models for efficient user acquisition |

Channels

Baader Bank operates proprietary online trading platforms like gettex and the new Baader Trading website, directly engaging both private and professional clients. These digital hubs offer comprehensive market data, seamless trading execution, and robust account management features.

The introduction of the new Baader Trading website specifically targets private investors, providing them with tailored information and a more accessible entry point into the trading world. This strategic digital expansion reflects Baader Bank's commitment to enhancing client experience and broadening its digital reach within the financial markets.

Baader Bank leverages B2B2C cooperation partner platforms, like the neobroker Smartbroker+, as a crucial channel to access private clients. Essentially, Baader Bank provides the robust technological backbone and operational services, allowing these partners to present trading and banking solutions directly to their end customers under their own brand identity.

This strategic approach significantly broadens Baader Bank's market penetration, enabling it to tap into a wider spectrum of retail investors who might not directly engage with Baader Bank's own brand. For instance, in 2024, Smartbroker+ reported a substantial increase in its customer base, directly attributable to this partnership model, demonstrating the effectiveness of Baader Bank's infrastructure in facilitating growth for its B2B2C clients.

Direct sales and dedicated institutional client teams are crucial for Baader Bank, acting as the primary touchpoint for institutional investors, asset managers, and corporate clients. These teams engage in direct outreach, offering tailored presentations and continuous consultation to foster strong relationships.

This high-touch model is particularly vital for distributing Baader Bank's complex financial products and specialized services, ensuring clients receive expert guidance. For instance, in 2024, Baader Bank continued to expand its institutional client base, with these direct teams playing a pivotal role in onboarding new mandates and deepening existing partnerships, contributing significantly to the bank's revenue streams.

Stock Exchanges and Trading Venues

Baader Bank's stock exchange presence is crucial for its market-making function. As a key participant on German exchanges like Xetra and regional exchanges, alongside international venues, Baader Bank facilitates trading and ensures liquidity. In 2024, the bank continued to actively pursue market share growth across these essential trading platforms.

These exchanges are the backbone of Baader Bank's trading operations, enabling the efficient execution of buy and sell orders. Their role extends beyond mere transaction processing; they are vital for price discovery and maintaining orderly markets.

- Xetra: A primary electronic trading platform for German equities, where Baader Bank actively makes markets.

- Regional German Exchanges: Such as Börse München and Börse Stuttgart, also serve as important trading venues for Baader Bank.

- International Exchanges: Participation on selected international exchanges broadens Baader Bank's reach and client base.

Industry Conferences and Events

Industry conferences and events are crucial for Baader Bank's business model, acting as key channels for client acquisition and relationship building. These gatherings offer a direct avenue to showcase the bank's expertise and services to a concentrated audience of potential and existing clients. For instance, the Baader Investment Conference itself serves as a prime example, facilitating direct engagement and fostering new business opportunities.

These events are not just about sales; they are vital for establishing thought leadership and reinforcing Baader Bank's standing within the financial sector. By participating and presenting at these forums, the bank can share valuable industry insights, demonstrating its analytical capabilities and strategic foresight. This positions Baader Bank as a trusted advisor and a significant player in the market, attracting further interest and partnerships.

Furthermore, conferences provide an invaluable platform for networking across the financial ecosystem. Baader Bank can connect with peers, industry influencers, and potential strategic partners, opening doors for collaboration and innovation. In 2024, the bank actively participated in numerous industry events, aiming to expand its client base and solidify its market presence.

- Client Acquisition: Conferences directly expose Baader Bank to a targeted audience of investors and corporations, facilitating the acquisition of new clients.

- Networking Opportunities: Events allow for crucial interactions with industry professionals, fostering partnerships and expanding the bank's professional network.

- Thought Leadership: Presenting at conferences positions Baader Bank as an expert, sharing market insights and enhancing its reputation.

- Brand Visibility: Active participation in major industry events significantly boosts Baader Bank's brand recognition and market presence.

Baader Bank utilizes a multi-channel strategy, encompassing direct digital platforms like gettex and the new Baader Trading website for retail and professional clients. It also leverages B2B2C partnerships, such as with Smartbroker+, to reach a broader private investor base. Direct sales teams cater to institutional clients, while active participation on stock exchanges like Xetra ensures market liquidity and presence.

Industry conferences and events serve as vital channels for client acquisition, networking, and establishing thought leadership, with Baader Bank actively participating in these forums to enhance its market position and brand visibility.

| Channel | Target Audience | Key Functionality | 2024 Focus |

|---|---|---|---|

| Proprietary Platforms (gettex, Baader Trading) | Private & Professional Clients | Trading, Market Data, Account Management | Enhancing User Experience, Digital Expansion |

| B2B2C Cooperation Partners (e.g., Smartbroker+) | End Private Clients (via Partner) | Technology & Operations Backbone | Broadening Market Penetration, Client Growth |

| Direct Sales Teams | Institutional Investors, Asset Managers | Tailored Solutions, Consultation, Relationship Building | Expanding Institutional Base, Deepening Partnerships |

| Stock Exchanges (Xetra, Regional, International) | Market Participants | Market Making, Liquidity Provision, Price Discovery | Market Share Growth |

| Industry Conferences & Events | Potential & Existing Clients, Industry Professionals | Client Acquisition, Networking, Thought Leadership, Brand Visibility | Client Base Expansion, Market Presence Solidification |

Customer Segments

Institutional investors, such as major investment funds and pension plans, represent a crucial customer segment for Baader Bank. These entities demand advanced trading infrastructure, access to capital markets, and detailed analytical research to manage substantial portfolios. For instance, in 2024, global pension fund assets were projected to exceed $50 trillion, highlighting the immense scale of this market.

Baader Bank addresses the specific needs of these sophisticated clients by offering high liquidity and efficient trade execution, essential for navigating large-volume transactions. Their ability to handle complex financial instruments and provide deep market intelligence is paramount. The bank’s services are designed to facilitate the intricate strategies employed by asset management firms aiming for optimal returns.

Corporate Clients, ranging from burgeoning startups to established enterprises, leverage Baader Bank's expertise for critical financial operations. In 2024, the bank facilitated numerous capital raises and advised on significant merger and acquisition deals, demonstrating its commitment to empowering businesses through strategic financial solutions and seamless access to capital markets.

Baader Bank's investment banking division actively engages with these clients, offering bespoke services for primary market sales and the meticulous execution of complex transactions. This segment relies on the bank for tailored strategies that navigate the intricacies of financial markets, ensuring optimal outcomes for their corporate finance objectives.

Private clients, or individual investors, are a cornerstone for Baader Bank. They seek robust brokerage services, secure securities accounts, and user-friendly trading platforms to manage their investments. This segment is crucial for driving retail trading volumes and asset growth.

The bank serves these individual investors both directly and indirectly. A substantial portion of this client base is reached through strategic B2B2C partnerships, particularly with neobrokers. This approach allows Baader Bank to tap into a wider pool of retail investors who prefer a streamlined, digital-first experience.

Notably, the managed accounts sub-segment within private clients has experienced considerable expansion. This trend highlights a growing demand for professional investment management among individual investors, indicating a shift towards more hands-off wealth accumulation strategies.

Asset Managers and FinTech Companies

Asset managers and FinTech companies represent a crucial customer segment for Baader Bank, utilizing its sophisticated banking and trading infrastructure to enhance their own service portfolios. These businesses tap into Baader Bank's scalable platforms and extensive market access, enabling them to offer a broader range of financial products and services to their end clients.

This strategic B2B cooperation is a significant driver of growth for Baader Bank. For instance, in 2024, Baader Bank reported a notable increase in its B2B partnerships, with a particular focus on enabling FinTechs to integrate Baader's trading and custody solutions directly into their digital offerings. This allows these partners to bypass the complexities of building their own infrastructure, thereby accelerating their time to market.

- Infrastructure as a Service: FinTechs and asset managers gain access to Baader Bank's licensed banking and trading capabilities, including custody, settlement, and execution services.

- Market Access: Partners benefit from Baader Bank's broad access to various European and international exchanges and trading venues.

- Scalability: The bank's technology infrastructure is designed to scale, accommodating the growth of its partners without requiring them to invest heavily in their own backend systems.

- Partnership Growth: Baader Bank's B2B cooperation business, heavily reliant on this segment, saw a continued upward trend in client onboarding and transaction volumes throughout 2024.

Portfolio Managers and Fund Advisors

Portfolio managers and fund advisors are crucial clients for Baader Bank. These professionals leverage the bank's robust fund services, including administration and custody, to streamline their operations. In 2024, Baader Bank continued to enhance its digital offerings, aiming to provide seamless access to a broad spectrum of investment products, from traditional equities to alternative investments, catering to diverse client needs.

Their reliance on Baader Bank extends to the bank's in-depth market research and analytical tools. These resources are vital for informed decision-making, enabling portfolio managers to identify opportunities and manage risks effectively. The bank's commitment to providing comprehensive market analysis supports their fiduciary duty to clients.

- Fund Administration: Baader Bank offers efficient and compliant administration services for various fund structures.

- Market Research: Access to detailed market analysis and reports aids investment strategy development.

- Product Access: A wide range of investment products, including equities, fixed income, and alternatives, are available.

- Digital Tools: Enhanced digital platforms support operational efficiency and client interaction.

Baader Bank serves a diverse client base, encompassing institutional investors, corporate clients, private individuals, asset managers, FinTechs, and portfolio managers. Each segment has unique requirements, from sophisticated trading infrastructure for large funds to user-friendly platforms for retail investors and robust back-office solutions for FinTech partners.

The bank's strategy in 2024 focused on strengthening its B2B relationships, particularly with FinTechs and asset managers, by providing scalable infrastructure and market access. This B2B segment is critical, as demonstrated by Baader Bank's reported growth in client onboarding and transaction volumes within these partnerships during the year.

Institutional investors, managing trillions in assets globally, rely on Baader Bank for high liquidity and efficient trade execution. Corporate clients, meanwhile, benefit from capital raising and M&A advisory services. The private client segment is reached both directly and through B2B2C partnerships, with a notable rise in demand for managed accounts.

| Customer Segment | Key Needs | Baader Bank's Offering | 2024 Relevance |

|---|---|---|---|

| Institutional Investors | Advanced trading, capital markets access, research | High liquidity, efficient execution, complex instruments | Global pension fund assets projected over $50 trillion |

| Corporate Clients | Capital raises, M&A advisory | Bespoke services, primary market sales | Facilitated numerous capital raises and M&A deals |

| Private Clients | Brokerage, trading platforms | Direct services, B2B2C partnerships, managed accounts | Growing demand for managed accounts |

| Asset Managers & FinTechs | Banking/trading infrastructure, market access | Scalable platforms, custody, settlement, execution | Increased B2B partnerships, FinTech integration |

| Portfolio Managers & Fund Advisors | Fund administration, custody, research | Digital offerings, broad product access, market analysis | Enhanced digital tools and product access |

Cost Structure

Personnel expenses represent a substantial cost for Baader Bank, encompassing salaries, benefits, and performance-based bonuses for its expanding team. The bank's growth strategy, which involves increasing headcount, directly fuels this expenditure.

In the first half of 2025, Baader Bank saw a notable rise in personnel costs. This increase was primarily driven by the expansion of its workforce and a higher allocation towards variable remuneration, reflecting the bank's performance and employee incentives.

Baader Bank's cost structure heavily features IT infrastructure and technology investments, reflecting a commitment to innovation and efficiency. These ongoing expenditures are vital for maintaining a competitive edge in the financial sector.

Significant funds are allocated to enhance platform functionality, refine trading algorithms, and bolster cybersecurity, ensuring robust and secure operations. For instance, the 'Road to Future' program represents a substantial part of these investments, aiming to modernize the bank's technological backbone.

These technological advancements are not merely operational necessities but strategic imperatives. They directly contribute to operational efficiency, enabling faster transaction processing and improved service delivery, which are critical for client satisfaction and market responsiveness.

General operating expenses at Baader Bank encompass a broad spectrum of costs, including essential elements like office administration, rent, utilities, and marketing efforts. These overheads are fundamental to the bank's daily functioning and support the diverse departments and services offered.

In 2024, Baader Bank experienced an increase in its operating expenditure. This rise was primarily driven by strategic investments made in information technology (IT) infrastructure and other key strategic projects aimed at enhancing the bank's capabilities and future growth.

Regulatory and Compliance Costs

Baader Bank faces substantial regulatory and compliance costs due to the stringent oversight of the financial sector. These expenses are crucial for maintaining operational licenses and adhering to evolving supervisory requirements, including those related to new frameworks like MiCAR. In 2024, financial institutions globally continued to see significant investment in compliance, with reports indicating that regulatory and compliance spending by banks can represent a considerable percentage of their operating expenses.

These costs encompass various areas, such as licensing fees, the implementation of robust risk management systems, and ongoing legal counsel to navigate complex financial regulations. Furthermore, Baader Bank allocates resources for general banking risks, which are also subject to regulatory scrutiny and capital requirements.

- Licensing and Authorization: Costs associated with obtaining and maintaining necessary licenses to operate in various financial markets.

- Risk Management Systems: Investment in technology and personnel for credit, market, and operational risk management to meet regulatory standards.

- Legal and Advisory Fees: Expenses incurred for legal expertise to ensure compliance with national and international financial laws and directives.

- Reporting and Auditing: Costs related to regulatory reporting, internal audits, and external audits to verify compliance.

Marketing and Business Development Costs

Baader Bank's cost structure includes significant outlays for marketing and business development. These expenses are crucial for attracting new customers and growing the company's presence in the financial markets. For instance, in 2024, Baader Bank continued to invest in its digital platforms, such as the Baader Trading website, to enhance user experience and onboard new clients more efficiently.

Key cost drivers in this area involve:

- Brand Building Initiatives: Costs associated with advertising campaigns and public relations efforts to strengthen Baader Bank's brand recognition and reputation.

- Digital Platform Development: Investments in launching and improving digital trading platforms, including website upgrades and mobile application enhancements, to attract and retain tech-savvy clients.

- Business Development Partnerships: Expenses incurred in establishing and nurturing relationships with business partners, covering both direct business-to-business (B2B) and business-to-business-to-consumer (B2B2C) collaborations.

- Client Acquisition Programs: Marketing spend dedicated to attracting new retail and institutional clients through various channels, aiming to expand market share.

Baader Bank's cost structure is significantly influenced by its investment in technology and personnel. In the first half of 2025, personnel expenses rose due to workforce expansion and increased variable remuneration. Simultaneously, substantial investments in IT infrastructure, including the 'Road to Future' program, are ongoing to enhance efficiency and security.

| Cost Category | 2024 Impact | 2025 (H1) Impact | Key Drivers |

|---|---|---|---|

| Personnel Expenses | Increased due to hiring | Further rise from workforce expansion and performance bonuses | Growth strategy, employee incentives |

| IT & Technology | Significant investment | Continued strategic allocation for modernization and platform enhancement | Innovation, efficiency, cybersecurity, 'Road to Future' program |

| Operating Expenses | Overall increase | Ongoing costs for administration, rent, utilities, marketing | Daily functioning, strategic projects |

| Regulatory & Compliance | High ongoing investment | Continued adherence to evolving financial regulations (e.g., MiCAR) | Licensing, risk management, legal counsel, reporting |

| Marketing & Business Development | Investment in digital platforms | Focus on digital platform enhancement and client acquisition | Brand building, digital presence, partnerships, client acquisition programs |

Revenue Streams

Trading income is a core revenue source for Baader Bank, stemming from its market-making and proprietary trading operations. This segment’s performance is closely tied to trading volumes and how much markets are moving, or volatility.

The bank has seen significant expansion in this area, notably on platforms like gettex, which has bolstered its earnings. This trading activity is a major contributor to Baader Bank’s financial results.

Demonstrating this growth, earnings from trading activities nearly doubled in the first quarter of 2025, highlighting its increasing importance to the bank's overall profitability.

Baader Bank generates significant revenue through its commission business, which includes fees and commissions from brokerage services and securities transactions. This revenue stream is directly tied to the volume and value of client trades executed on its platforms. For the first half of 2025, this segment saw a modest uptick, reflecting continued client activity.

Baader Bank's interest business is a core revenue generator, stemming from activities like managing customer deposits and its own treasury operations. This income is directly tied to prevailing market interest rates, meaning it can fluctuate. For instance, in 2023, the interest business played a substantial role in the bank's overall financial performance.

Fund and Account Services Fees

Baader Bank generates revenue through fees charged for the administration and management of various funds. These fees are a direct reflection of the assets under management, meaning as the pool of capital Baader Bank oversees expands, so does the income from these services. This stream is a fundamental part of their operational model, providing a steady revenue base.

Furthermore, the bank earns income from maintaining customer securities accounts and deposits. This involves the operational costs associated with holding and managing client assets, for which a fee is levied. The growth in the number of active accounts and the total value of customer assets directly correlates with increased revenue from this segment.

The account and securities account business is a key growth area for Baader Bank. For instance, in 2024, the bank reported a significant increase in customer assets, demonstrating the expanding client base and the continued trust placed in their services. This growth underpins the increasing importance of these fee-based revenue streams.

- Fund Administration Fees: Revenue derived from managing investment funds, often calculated as a percentage of assets under management.

- Account Maintenance Fees: Charges for holding and servicing customer securities accounts and deposits.

- Growth Indicator: The increasing volume of managed accounts and customer assets directly boosts revenue from these services.

- 2024 Performance: Baader Bank's continued expansion in its account and securities business highlights the robustness of this revenue stream.

Investment Banking and Advisory Fees

Baader Bank generates significant revenue through investment banking and advisory services. This includes advising companies on capital market transactions, such as initial public offerings (IPOs) and secondary offerings, as well as mergers and acquisitions (M&A). These fees are typically structured as success fees, meaning Baader Bank earns a percentage of the deal value upon successful completion of the mandate.

In 2024, the investment banking sector saw a notable rebound in deal activity. For instance, global M&A volume experienced a substantial increase compared to the previous year, with European markets showing particular strength. This uptick directly benefits advisory fee income for institutions like Baader Bank.

- Capital Market Advisory: Fees from guiding clients through equity and debt issuances.

- M&A Advisory: Revenue generated from advising on mergers, acquisitions, and divestitures.

- Deal Execution: Income from managing and facilitating the closing of transactions.

- Project-Based Fees: Revenue tied to the successful completion of specific advisory mandates.

Baader Bank's revenue streams are diverse, encompassing trading income from market-making and proprietary trading, as well as commissions from brokerage services and securities transactions. The bank also earns interest from its treasury operations and customer deposits, alongside fees for fund administration and account maintenance. Additionally, investment banking and advisory services, including M&A and capital markets, contribute significantly, with fees often tied to successful deal completion.

| Revenue Stream | Description | Key Drivers | 2024 Data Point |

| Trading Income | Market-making and proprietary trading | Trading volumes, market volatility | Nearly doubled Q1 2025 earnings from trading activities |

| Commissions | Brokerage services, securities transactions | Client trading volume and value | Modest uptick in H1 2025 |

| Interest Income | Treasury operations, customer deposits | Market interest rates | Substantial role in 2023 performance |

| Fund Administration Fees | Management of investment funds | Assets under management | Steady revenue base |

| Account Maintenance Fees | Servicing customer securities accounts | Number of active accounts, asset values | Significant increase in customer assets in 2024 |

| Investment Banking & Advisory | Capital markets, M&A | Deal activity, transaction value | Benefited from rebound in global M&A volume in 2024 |

Business Model Canvas Data Sources

The Baader Bank Business Model Canvas is constructed using a blend of internal financial statements, customer feedback surveys, and competitive analysis reports. These diverse data sources ensure a comprehensive and accurate representation of the bank's strategic framework.