Baader Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baader Bank Bundle

Curious about the Baader Bank's strategic positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture – purchase the complete BCG Matrix to unlock detailed quadrant analysis and actionable insights for your own investment strategies.

Stars

Baader Bank's digital asset and crypto trading services are a rapidly growing area, acting as a financial trading agent and safekeeping provider for cryptoassets. This segment has seen substantial volume increases, driven by heightened investor interest and expanding B2B2C collaborations.

The bank is actively enhancing its crypto infrastructure, onboarding new B2B2C partners and adapting to evolving regulatory landscapes. This strategic focus positions Baader Bank for significant growth within the dynamic digital asset market, reflecting a commitment to innovation and client service in this emerging sector.

Baader Bank's B2B2C cooperation segment, particularly with neo-brokers and asset managers, is experiencing robust expansion. This growth is directly fueling a substantial rise in both managed securities accounts and customer assets, underscoring its strategic importance.

In 2024, the group saw a remarkable 34% surge in managed securities accounts, reaching 1,708,000. This upward trajectory continued into the first half of 2025, with the number climbing further to 1,846,000, highlighting Baader Bank's increasing market penetration in the burgeoning digital banking services sector.

Baader Bank is actively promoting its 'Baader Trading' platform, enhancing its market maker capabilities. The bank has extended its over-the-counter (OTC) trading hours to 07:30-23:00, a significant move that also covers gettex, where Baader Bank holds exclusive market maker status.

This expansion directly addresses the growing needs of its cooperation partners and clients, reinforcing Baader Bank's standing as a key market maker in Germany. The goal is to stimulate greater trading volumes, with increased trading business earnings being a crucial element for the bank's overall revenue growth.

Capital Markets Advisory for SMEs and Growth Companies

Baader Bank's capital markets advisory services are instrumental for German and European SMEs and growth companies looking to access public markets. While not a traditional BCG Matrix category, their focus on facilitating capital measures, including IPOs, for these dynamic businesses places them in a potentially high-growth segment. This advisory is vital for companies needing to raise capital to fuel expansion.

The bank's expertise in connecting issuers with a diverse investor base is a key differentiator. If Baader Bank holds a significant market share in advising innovative or fast-growing SMEs on their capital raising journey, particularly within the German and European contexts, this service line can be considered a Star. For instance, in 2024, the German IPO market saw a resurgence, with several SMEs successfully listing, highlighting the demand for such advisory.

- Capital Measures: Baader Bank assists SMEs in structuring and executing various capital raising activities, from private placements to public offerings.

- IPO Expertise: The bank provides comprehensive support for Initial Public Offerings, guiding companies through the complex listing process.

- Investor Access: A core strength is their ability to connect issuing companies with a broad spectrum of institutional and retail investors.

- Market Growth: The increasing need for growth capital among SMEs in Germany and Europe positions this advisory service in a favorable market environment.

Strategic Investments in Platform Functionalities and IT Infrastructure

Baader Bank's strategic investments in platform functionalities and IT infrastructure are key to its competitive positioning. These upgrades are essential for adapting to the rapidly changing financial technology sector, ensuring the bank can effectively support its expanding trading services and B2B collaborations. By prioritizing technological advancement, Baader Bank is well-positioned to capitalize on growth opportunities and increase its market presence.

These investments directly fuel the growth of Baader Bank's trading offerings and B2B partnerships. For instance, in 2023, Baader Bank reported a significant increase in its digital client onboarding process, streamlining the integration of new partners and traders. This focus on technological infrastructure underpins their capacity for scaling operations and fostering innovation within their service ecosystem.

- IT Infrastructure Enhancements: Baader Bank has committed substantial capital to modernizing its core IT systems, aiming for greater efficiency and security.

- Platform Functionality Expansion: Investments are directed towards developing and enhancing trading platforms, offering more sophisticated tools and a better user experience.

- B2B Partnership Support: Upgraded infrastructure facilitates seamless integration and service delivery for Baader Bank's growing network of business-to-business clients.

- Market Share Growth: By enabling scalability and innovation, these technological investments are designed to capture a larger share of the expanding financial technology market.

Baader Bank's capital markets advisory services for SMEs, particularly in facilitating IPOs and other capital measures, can be considered a Star within the BCG Matrix framework. This is due to the high growth potential of the market for growth capital among German and European SMEs, coupled with Baader Bank's demonstrated expertise in connecting these companies with investors. The resurgence in the German IPO market in 2024, with several successful SME listings, underscores the demand for such specialized advisory services.

The bank's role in structuring and executing capital raising activities, from private placements to public offerings, positions it favorably. Its core strength lies in providing investor access, a crucial element for companies seeking to fuel expansion through public markets. This segment is characterized by a growing need for capital among dynamic businesses, indicating a strong market opportunity.

| Service Area | Market Growth Potential | Baader Bank's Position | BCG Matrix Classification |

|---|---|---|---|

| Capital Markets Advisory (SMEs) | High (driven by SME capital needs) | Strong (IPO expertise, investor access) | Star |

| Digital Asset & Crypto Trading | High (growing investor interest) | Expanding (infrastructure, partnerships) | Potential Star/Question Mark |

| B2B2C Cooperation (Securities) | Moderate to High (asset growth) | Growing (managed accounts increase) | Cash Cow/Question Mark |

| IT Infrastructure & Platform Development | High (enabling innovation) | Strategic Investment (scaling, efficiency) | Supports Stars/Question Marks |

What is included in the product

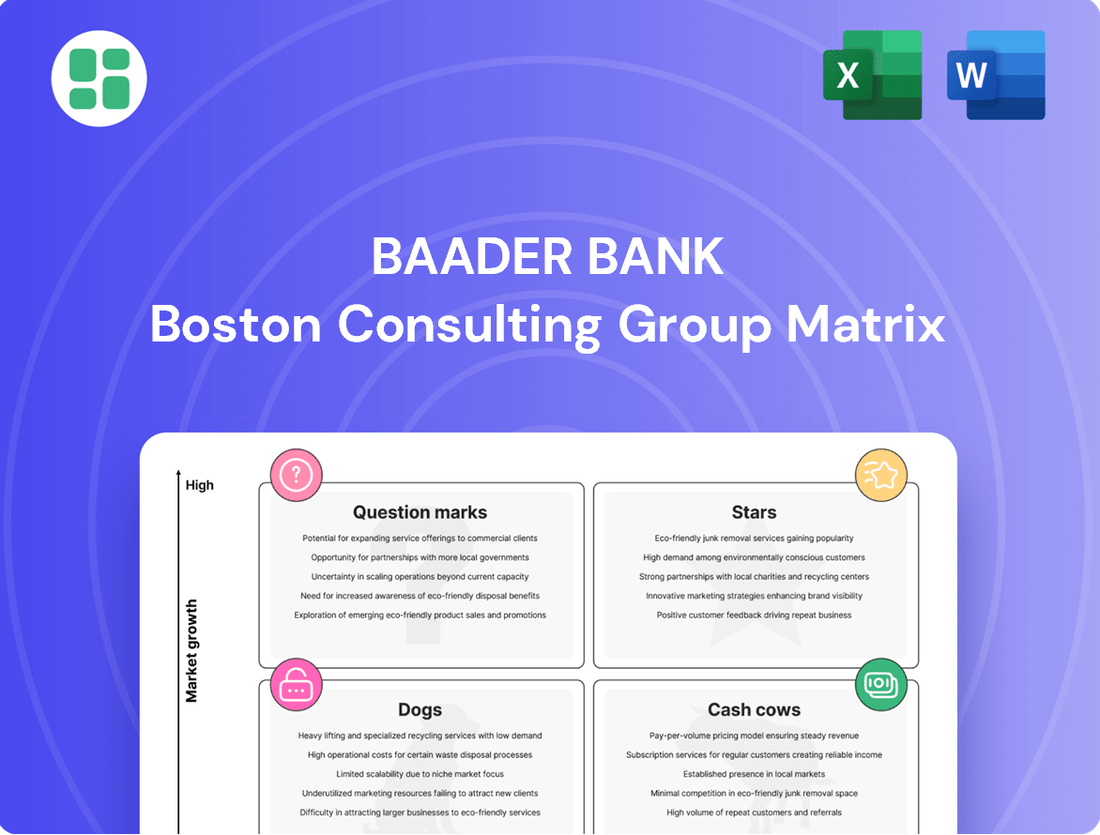

The Baader Bank BCG Matrix analyzes a company's portfolio by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

The Baader Bank BCG Matrix offers a clear, one-page overview, instantly clarifying the strategic position of each business unit.

Cash Cows

Baader Bank's traditional German equity market making is a classic cash cow. As a long-standing player, they provide essential liquidity across German exchanges, a mature but reliably profitable segment. This core business, especially their exclusive role on gettex, is a significant and stable income generator for the bank.

The firm has demonstrated consistent growth in this area, increasing its market share for three consecutive years. This sustained expansion underscores the strength and profitability of their market-making operations, solidifying its position as a key cash cow within their business portfolio.

Baader Bank's established institutional brokerage services in the secondary market, serving both domestic and international clients, are a significant cash cow. These long-standing relationships generate a reliable stream of commission income, which experienced robust growth in the first quarter of 2025, building on a strong performance in 2024.

This segment thrives on its loyal client base and the consistent volume of transactions it facilitates. The bank's deep market penetration and trusted reputation ensure a steady flow of business, contributing significantly to its overall financial stability and profitability.

Baader Bank's core asset management mandates, especially those serving institutional investors and significant private clients, act as reliable cash cows. These stable mandates generate consistent income through recurring management fees, providing a foundational revenue stream that is generally less impacted by market fluctuations.

The bank's subsidiaries, such as Baader & Heins Capital Management AG, also play a crucial role in bolstering earnings. For instance, in 2023, Baader Bank's asset management segment reported a significant contribution to the group's overall performance, with assets under management reaching substantial figures, underscoring the stability and profitability of these core mandates.

Interest Business Earnings

Interest business earnings represent a significant and growing component of Baader Bank's financial performance. These earnings are directly bolstered by prevailing interest rate environments and an expanding deposit base, showcasing the segment's resilience.

This area of the business consistently delivers a stable income stream, performing slightly better than the prior year. This reliability solidifies its position as a dependable cash generator for the bank.

- Stable Income: Interest earnings provide a consistent revenue source.

- Growth Trend: The segment has shown an increasing contribution to overall earnings.

- 2024 Performance: Interest earnings reached EUR 48.5 million in 2024.

- Influencing Factors: Performance is positively impacted by interest rate levels and deposit volumes.

Fund Services and Account Management

Baader Bank's Fund Services and Account Management division operates as a strong Cash Cow within its business portfolio. This segment focuses on providing essential fund administration and comprehensive account management services tailored for a diverse clientele, notably fintech companies and independent asset managers. The high volume and consistent demand for these services highlight their maturity and established profitability.

The stability and revenue-generating power of this unit are further evidenced by its continuous growth metrics. For instance, Baader Bank reported a significant increase in managed securities accounts and customer deposits, reflecting the trust and reliance clients place on these core offerings. This sustained expansion directly translates into a reliable, fee-based income stream for the bank.

- Mature Business: Fund Services and Account Management cater to a broad client base, including fintechs and independent asset managers, generating substantial transaction volumes.

- Consistent Income: The segment provides a predictable, fee-based revenue stream, bolstered by steady growth in managed securities accounts and customer deposits.

- Profitability Driver: This mature business unit contributes significantly to Baader Bank's overall profitability due to its high volume and stable demand.

Baader Bank's market-making activities, particularly on the gettex exchange, represent a classic cash cow. This mature business segment consistently generates reliable profits by providing essential liquidity across German equities. The bank's long-standing presence and exclusive role on gettex solidify this as a stable income generator.

The firm's institutional brokerage services in the secondary market are another significant cash cow. These services cater to both domestic and international clients, yielding a steady stream of commission income. This segment experienced robust growth in early 2025, building on a strong 2024 performance, driven by a loyal client base and consistent transaction volumes.

Baader Bank's core asset management mandates, especially those serving institutional and significant private clients, function as dependable cash cows. These mandates provide a foundational revenue stream through recurring management fees, demonstrating resilience against market volatility. For instance, in 2023, asset management significantly contributed to the group's performance, with substantial assets under management.

Interest business earnings are a growing and vital component of Baader Bank's financial health. Bolstered by favorable interest rate environments and an expanding deposit base, this segment consistently delivers stable income. In 2024, interest earnings reached EUR 48.5 million, a testament to its reliability and positive response to market conditions.

| Business Segment | BCG Category | Key Characteristics | 2024 Data/Notes |

|---|---|---|---|

| Market Making (gettex) | Cash Cow | Provides liquidity, mature, high volume, stable profits | Exclusive role on gettex, consistent income generator |

| Institutional Brokerage | Cash Cow | Loyal client base, consistent transaction volume, fee-based income | Robust growth in Q1 2025, building on 2024 strength |

| Asset Management Mandates | Cash Cow | Recurring management fees, stable income, institutional focus | Significant contribution in 2023, substantial AUM |

| Interest Business | Cash Cow | Driven by interest rates and deposits, stable earnings | EUR 48.5 million in interest earnings in 2024 |

What You’re Viewing Is Included

Baader Bank BCG Matrix

The Baader Bank BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after your purchase. This means you are viewing the exact file, ready for immediate strategic application, without any alterations or demo content.

Dogs

Underperforming niche trading strategies, like certain proprietary algorithms that once thrived but now struggle with evolving market conditions, fall into the Dogs category. These strategies often tie up valuable capital, generating minimal returns and presenting a drag on overall performance.

For instance, a strategy focused on a specific illiquid derivative, which may have yielded a 5% annual return in 2020, could be seeing that return shrink to below 1% by mid-2024 due to increased competition and reduced volatility in that niche. This decline in profitability makes such strategies prime candidates for divestiture or a complete overhaul.

Legacy IT systems in non-core operations, like outdated administrative software, can become a drain on resources. These systems, often expensive to maintain, offer no strategic advantage and divert funds from more promising ventures. For instance, if a bank still relies on a 20-year-old mainframe for customer data processing in its back office, it’s a prime example of a 'Dog' in the BCG matrix.

Such inefficiencies can significantly hinder a company's agility. Consider that in 2024, the average cost of maintaining legacy IT systems for large enterprises was estimated to be around 70% of their total IT budget, according to a report by Gartner. This highlights how much capital is tied up in systems that don't contribute to growth or competitive edge.

If Baader Bank were to operate a small-scale retail brokerage that is high-cost and yields low profits, it would likely be classified as a 'Dog' in the BCG Matrix. This segment would struggle with a minimal market share and contribute little to the bank's overall profitability, potentially becoming a financial burden.

This scenario is particularly relevant as Baader Bank's strategic direction emphasizes expanding its B2B2C partnerships over direct engagement with small-scale retail clients. For instance, in 2024, the bank reported a significant portion of its revenue stemming from its institutional client business, highlighting a clear strategic focus away from fragmented retail operations.

Illiquid or Outdated Securities Market Making

Market making in highly illiquid or niche securities, those experiencing a sharp drop in trading activity and investor engagement, can be categorized as a 'Dog' within the Baader Bank BCG Matrix. These specific market segments often demand a disproportionate commitment of capital and operational resources, yielding only minimal returns in contrast. For instance, in 2024, Baader Bank's reported increase in overall market share, reaching 1.8% in European equities by Q3 2024, indicates a strategic shift towards more liquid and actively traded assets. This suggests that any remaining highly illiquid securities within their portfolio could represent a 'Dog' – an area requiring significant investment for little strategic benefit.

Such 'Dog' segments are characterized by:

- Low Trading Volumes: Securities with significantly reduced daily or weekly trading turnover, making it difficult to execute trades efficiently.

- Declining Investor Interest: A noticeable lack of demand from institutional and retail investors, often due to outdated business models or a lack of perceived future value.

- High Operational Costs: The effort and expense required to maintain market presence, manage risk, and ensure compliance for these assets can outweigh the revenue generated.

Inefficient Manual Processes in Scalable Areas

Areas within Baader Bank that still rely heavily on manual processes, especially in functions with high growth potential, can be classified as Dogs. These inefficiencies lead to increased operational costs and limit the bank's ability to scale effectively. For instance, if customer onboarding or trade settlement processes remain largely manual, they become significant bottlenecks.

In 2024, many financial institutions, including those aiming for scale like Baader Bank, are actively seeking to automate repetitive tasks. However, any remaining manual touchpoints in scalable areas represent a drag on performance. These manual processes consume valuable employee time that could otherwise be dedicated to higher-value activities like client relationship management or strategic development.

Consider the impact on profitability. If, for example, a manual data entry process for client account updates takes 10 minutes per client and the bank serves 100,000 clients, this amounts to over 16,000 hours annually. If those hours were automated, the cost savings could be substantial, directly impacting the bottom line.

- Manual Trade Processing: Despite advancements, some complex or bespoke trades might still require manual intervention, slowing down settlement and increasing risk.

- Customer Due Diligence (CDD): While much of CDD is automated, edge cases or specific documentation reviews can still necessitate manual checks, hindering rapid client onboarding.

- Reporting and Reconciliation: Generating custom reports or reconciling disparate data sources manually can be time-consuming and prone to errors, especially as transaction volumes grow.

Dogs in the Baader Bank BCG Matrix represent business units or strategies with low market share and low growth potential, often consuming resources without generating significant returns. These are typically areas where Baader Bank has limited competitive advantage and faces stagnant or declining demand, such as niche trading desks for illiquid assets or outdated back-office systems. For instance, a segment of Baader Bank's operations focused on a specific, low-volume derivative market in 2024 might be classified as a Dog, given the minimal trading activity and Baader Bank's strategic shift towards higher-liquidity markets.

These 'Dogs' often require divestment or significant restructuring to avoid becoming a drain on capital and operational efficiency. In 2024, Baader Bank's reported efforts to streamline operations and divest non-core assets underscore the ongoing challenge of managing such units. For example, a legacy IT system for internal accounting that costs €500,000 annually to maintain but offers no scalability or competitive edge would be a prime example of a Dog.

The key characteristics of these 'Dog' segments include minimal market share, low profitability, and a lack of future growth prospects, making them candidates for strategic pruning. For example, if Baader Bank's market-making activities in a particular obscure bond class in 2024 generated only 0.1% of the bank's total trading revenue while consuming 2% of its trading capital, it would clearly fall into the Dog category.

The strategic imperative for Baader Bank is to identify these Dogs and make decisive choices, whether it's through divestiture, liquidation, or a radical overhaul to improve their market position or eliminate their resource drain.

Question Marks

Baader Bank's expansion into new niche European markets, like the Baltics or Eastern Europe, would be considered a Question Mark in the BCG Matrix. These regions often present high growth potential due to developing economies and increasing financial sophistication. However, Baader Bank's current market share in these areas is likely low, requiring significant investment to build brand recognition and establish a solid customer base.

Baader Bank's investment in advanced AI and machine learning for trading and analytics sits squarely in the question mark quadrant. While the potential for high growth is undeniable, with algorithms promising predictive trading and enhanced risk management, early-stage development and unproven market adoption mean a low current market share. This strategic bet requires significant research and development capital, positioning it as a key area for future growth if successful.

Developing highly specialized ESG investment products, like innovative structured products or thematic funds, falls into the Question Mark category for Baader Bank. The demand for ESG is booming, with the global sustainable investment market reaching an estimated $35.3 trillion in assets under management as of the end of 2022, according to the Global Sustainable Investment Alliance. However, breaking into niche ESG segments requires significant upfront investment in research, development, and marketing to gain traction against established players and capture market share.

Blockchain-based Post-Trade Solutions

Exploring and investing in blockchain or distributed ledger technology (DLT) for post-trade services like settlement and clearing presents a high-growth frontier in finance. For Baader Bank, this area likely falls into the 'Question Mark' category of the BCG Matrix. The market is still in its nascent stages, and widespread adoption, along with Baader Bank's potential market share, remains uncertain.

These initiatives are typically capital-intensive, requiring significant investment in technology and talent. The short-term returns on such ventures are often unpredictable, making them a strategic gamble rather than a guaranteed win. For instance, the global blockchain in finance market was valued at approximately USD 2.5 billion in 2023 and is projected to grow significantly, but the specific impact on post-trade services for a bank like Baader is still being defined.

- Market Uncertainty: Widespread adoption of blockchain for post-trade is not yet a certainty, making market share projections difficult.

- Capital Intensity: Significant upfront investment is required for developing and implementing DLT solutions.

- Uncertain Returns: The timeline and magnitude of financial returns are not clearly established, posing a risk.

- Technological Evolution: The rapid pace of DLT development means continuous adaptation and investment are necessary.

Hyper-Personalized Digital Wealth Management Solutions

Developing hyper-personalized digital wealth management for a specific, untapped affluent segment presents a classic Question Mark scenario for Baader Bank within the BCG framework. While the digital wealth management market is expanding, with global assets under management projected to reach $11.9 trillion by 2028, penetrating a niche requiring deep customization demands significant upfront investment in advanced AI, data analytics, and bespoke client onboarding technologies.

The challenge lies in balancing the potential for high returns from a dedicated client base against the considerable risk and capital expenditure needed to differentiate in a crowded digital space. For instance, a 2024 study indicated that while 65% of affluent investors are open to digital wealth solutions, only 20% feel their current digital offerings are truly personalized.

- Market Potential: Targeting an underserved affluent demographic offers substantial growth prospects.

- Investment Needs: Significant capital is required for cutting-edge technology and tailored client experiences.

- Competitive Landscape: Existing players already offer digital services, necessitating a unique value proposition.

- Risk vs. Reward: High potential returns are balanced by the uncertainty of market adoption and profitability.

Baader Bank's foray into developing innovative fintech solutions for emerging markets, such as those in Southeast Asia, represents a classic Question Mark. These regions often exhibit rapid economic growth and a burgeoning demand for financial services, indicating high market potential. However, Baader Bank's current market penetration in these areas is likely minimal, necessitating substantial investment to build brand awareness and establish a foothold.

| Initiative | BCG Category | Rationale | Key Considerations |

| Emerging Market Fintech Solutions | Question Mark | High growth potential in developing economies, but low current market share for Baader Bank. | Requires significant investment in market entry, localization, and regulatory navigation. |

| Advanced AI Trading Algorithms | Question Mark | Potential for significant competitive advantage and market disruption, but unproven efficacy and adoption. | High R&D costs, need for specialized talent, and regulatory scrutiny. |

| Niche ESG Investment Products | Question Mark | Growing demand for sustainable investing, but requires differentiation in a competitive landscape. | Investment in research, product development, and marketing to build brand recognition. |

| Blockchain for Post-Trade Services | Question Mark | Potential for increased efficiency and cost reduction, but market adoption and regulatory clarity are uncertain. | Significant upfront investment in technology and infrastructure. |

| Hyper-Personalized Digital Wealth Management | Question Mark | Tapping into an underserved affluent segment with high growth potential. | Requires substantial investment in technology, data analytics, and tailored client experiences. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial statements, industry growth rates, and competitor analysis, to accurately position business units.