Baader Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baader Bank Bundle

Baader Bank navigates a complex financial landscape, where the bargaining power of buyers and the threat of new entrants significantly shape its competitive environment. Understanding these forces is crucial for any strategic investor or industry analyst.

The complete Porter's Five Forces Analysis reveals the real forces shaping Baader Bank’s industry—from supplier influence to substitute threats. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Baader Bank’s dependence on specialized technology and data providers grants these suppliers considerable leverage. The bank’s core operations as a market maker and its provision of diverse financial services hinge on sophisticated IT infrastructure, advanced trading algorithms, and real-time market data. These essential components are often supplied by a limited number of specialized firms.

The high switching costs associated with changing critical IT systems and data feeds mean Baader Bank faces significant disruption and expense if it were to change suppliers. This reliance, coupled with the vital nature of these services for maintaining operational efficiency and a competitive edge, strengthens the bargaining power of these technology and data providers.

For example, Baader Bank’s strategic partnership with Broadridge Financial Solutions for regulatory reporting highlights this dependency. Such partnerships underscore the critical role external technology providers play in Baader Bank’s ability to meet compliance requirements and operate effectively in the financial markets.

The financial services sector, particularly investment banking and asset management, thrives on expertise. Baader Bank, like its peers, relies heavily on professionals skilled in trading, IT, compliance, and analysis. The demand for these specialized individuals often outstrips supply, giving them significant leverage in salary negotiations and demanding better working conditions.

In 2024, Baader Bank's personnel expenses saw an increase. This rise was attributed to both an expansion of its workforce and the inclusion of performance-based compensation. This financial data underscores the competitive landscape for attracting and retaining top-tier talent, directly impacting supplier bargaining power.

Regulatory bodies like BaFin, while not direct suppliers, exert significant influence by setting the operational landscape and imposing compliance costs on banks such as Baader Bank. The growing intricacy of regulations, including the Digital Operational Resilience Act (DORA) and the Markets in Crypto-Assets Regulation (MiCAR), directly affects banking operations and necessitates substantial investment.

These evolving regulatory demands compel Baader Bank to invest in enhancing its IT infrastructure to support strategic banking initiatives and ensure adherence to new rules. This requirement effectively elevates the bargaining power of regulatory compliance service providers and associated software vendors, as banks become reliant on their expertise and solutions to navigate this complex environment.

Liquidity and Capital Providers

Baader Bank, as an investment bank and market maker, relies heavily on consistent access to funding and capital to operate. In this context, large institutional lenders and central banks can be seen as indirect suppliers of capital. While Baader Bank generally maintains a solid financial standing and a healthy equity base, the need for external funding, when it arises, could expose it to supplier pressure, particularly influenced by prevailing market conditions and interest rate fluctuations.

German banks, in general, are anticipated to uphold strong funding and liquidity metrics throughout 2024. This resilience is largely attributed to the advantage of a stable and robust domestic deposit market, which provides a reliable source of funds.

- Supplier Influence: Institutional lenders and central banks can exert pressure through capital provision terms.

- Market Sensitivity: External funding costs are directly tied to market conditions and interest rates.

- German Banking Strength: Forecasts for 2024 indicate sustained strong funding and liquidity for German banks.

- Deposit Market Advantage: A deep domestic deposit market offers a stable funding base for German institutions.

Exchange and Clearing Houses

Exchange and clearing houses wield significant bargaining power over participants like Baader Bank, as they provide the fundamental infrastructure for trading and settlement. Baader Bank, a key market maker on German and international exchanges, relies entirely on these entities for its operations. While multiple trading venues may exist, the essential nature of clearing and settlement services grants these institutions considerable leverage. For instance, in 2024, the Deutsche Börse Group, a major European exchange operator, reported a significant increase in trading volumes, highlighting the indispensable role of such infrastructure providers.

The indispensable nature of these services means that Baader Bank, like other financial institutions, has limited alternatives for executing trades and managing risk. This dependence allows exchanges and clearing houses to set terms and fees, influencing the cost of doing business for market makers. The complexity and regulatory requirements of these functions further consolidate power, as establishing alternative clearing mechanisms would be prohibitively expensive and time-consuming.

- Essential Infrastructure: Exchanges and clearing houses offer critical services for trading and settlement, making them non-negotiable for market participants.

- Limited Alternatives: While multiple trading venues exist, the core functions of clearing and settlement are concentrated, reducing options for firms like Baader Bank.

- Fee Structures: The bargaining power of these entities is reflected in their ability to set transaction fees and service charges.

- Regulatory Dependence: The highly regulated nature of financial markets reinforces the position of established exchanges and clearing houses.

Baader Bank's reliance on specialized technology and data providers, coupled with high switching costs, grants these suppliers significant leverage. The bank's core operations depend on sophisticated IT infrastructure and real-time market data, often sourced from a limited number of specialized firms. For instance, Baader Bank's partnership with Broadridge for regulatory reporting exemplifies this dependency, highlighting the critical role of external technology in meeting compliance and operating effectively.

The financial services sector's demand for specialized talent, such as skilled traders and IT professionals, outstrips supply. This scarcity empowers these individuals, increasing their bargaining power in salary negotiations and demands for better working conditions. Reflecting this trend, Baader Bank's personnel expenses increased in 2024 due to workforce expansion and performance-based compensation, underscoring the competitive environment for talent acquisition and retention.

Exchanges and clearing houses, as providers of essential trading and settlement infrastructure, wield considerable bargaining power over participants like Baader Bank. Given that Baader Bank, as a market maker, entirely relies on these entities, their ability to set terms and fees significantly impacts the bank's operational costs. The Deutsche Börse Group's reported increase in trading volumes in 2024 further emphasizes the indispensable role of such infrastructure providers.

| Supplier Category | Key Dependence | Impact on Baader Bank | 2024 Data/Trend | Supplier Bargaining Power |

| Technology & Data Providers | Sophisticated IT, trading algorithms, real-time data | High switching costs, operational efficiency | Continued investment in IT infrastructure | High |

| Skilled Personnel | Trading, IT, compliance, analysis expertise | Talent acquisition & retention costs | Increased personnel expenses in 2024 | High |

| Exchanges & Clearing Houses | Trading, settlement, risk management infrastructure | Transaction fees, operational reliance | Increased trading volumes on major exchanges | High |

What is included in the product

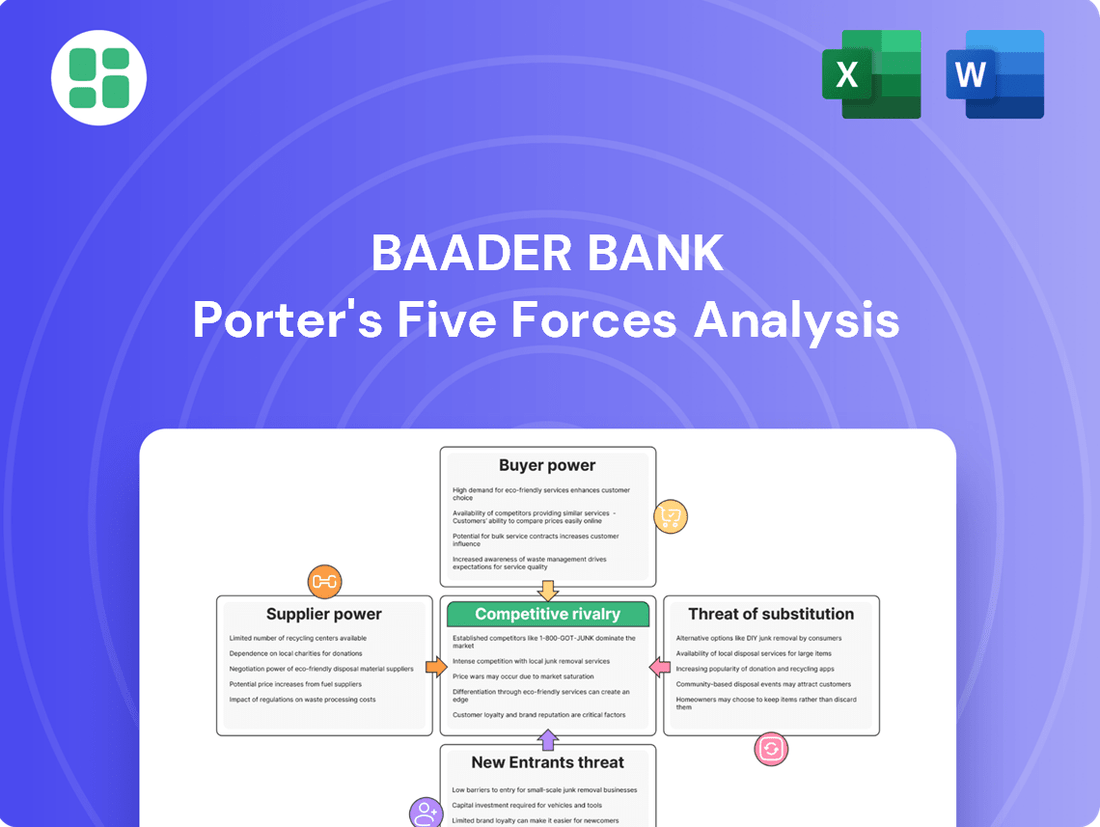

Analyzes the competitive intensity and profitability potential of Baader Bank's market by examining industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Instantly visualize competitive pressures with a dynamic spider chart, simplifying complex market dynamics for informed strategic choices.

Customers Bargaining Power

Large institutional investors and corporate clients hold significant sway due to their substantial transaction volumes and intricate demands in capital markets and wealth management. These sophisticated clients often negotiate for customized solutions, aggressive pricing, and superior service standards, directly influencing Baader Bank's operational costs and profit margins.

The ability of these powerful clients to shift large portions of their business to competing financial institutions presents a constant pressure on Baader Bank. For instance, in 2024, the average trading volume for institutional clients in European equities saw significant fluctuations, highlighting the competitive landscape where client retention is paramount.

Baader Bank's strategic push into B2B and B2B2C partnerships, including collaborations with Smartbroker+ and Finanzen.net ZERO, amplifies the bargaining power of these cooperation partners. As these entities serve as crucial gateways to diverse end-customer segments, they can leverage their market reach to negotiate more advantageous terms and service level agreements.

These partners, by aggregating a significant volume of transactions through Baader Bank's infrastructure, possess the leverage to demand continuous improvements in platform functionality and user experience. Failure to meet these evolving needs could prompt them to explore alternative banking relationships, thereby increasing Baader Bank's pressure to remain competitive and responsive to partner requirements.

While individual private clients typically hold limited bargaining power due to smaller transaction volumes, their collective influence is growing. This is driven by an increasing number of private investors and accounts, with Baader Bank reporting a 51% rise in accounts in 2023 and onboarding 430,000 new accounts in 2024. This expanding client base, coupled with greater digital literacy, demands efficient and cost-effective access to capital markets, pushing service providers to adapt.

Access to Information and Switching Costs

Customers today have unprecedented access to information about financial products, making it simple to compare services from various institutions like Baader Bank. This transparency significantly shifts power towards the consumer.

While switching banks traditionally involved some effort, the proliferation of digital banking and fintech solutions has dramatically reduced these barriers. For example, many neobanks offer seamless account opening and fund transfer services, making it easier than ever for customers to move their business.

- Increased Information Availability: In 2024, consumers can easily access detailed product comparisons, fee structures, and customer reviews online, empowering them to make more informed choices.

- Lowered Switching Costs: Digital onboarding processes and open banking initiatives have streamlined the transition between financial providers, reducing the time and effort required to switch.

- Rise of Fintech Alternatives: The growing fintech sector offers specialized, often lower-cost, alternatives to traditional banking services, further intensifying competitive pressure and customer leverage.

Demand for Diversified and Innovative Products

Customers today are looking for a wide array of investment options, from traditional stocks and bonds to newer avenues like cryptocurrency trading and sustainable investment products. This demand for diversity means clients are less likely to be satisfied with a limited selection.

Baader Bank is actively addressing this by broadening its product range and refining its trading platform. For instance, in 2024, the bank continued to enhance its digital offerings, aiming to provide a more comprehensive suite of financial instruments.

The ability of customers to switch providers is reduced when a bank offers a unique or particularly extensive product portfolio. This diversification strategy directly counters the bargaining power of customers by making Baader Bank a more indispensable partner for their varied investment needs.

- Increased demand for crypto trading: Baader Bank reported a significant uptick in interest and trading volumes for digital assets in early 2024, reflecting customer desire for crypto exposure.

- Expansion into sustainable investments: The bank has been actively listing and facilitating trading in ESG-focused ETFs and bonds, catering to the growing ethical investment trend among its client base.

- Bond trading growth: In 2024, Baader Bank saw a notable increase in bond trading activity, indicating customer demand for fixed-income diversification.

- Platform optimization for user experience: Continuous improvements to the Baader Bank trading platform in 2024 focused on making it easier for users to access and manage a wider range of products.

The bargaining power of customers is a significant factor for Baader Bank, particularly with large institutional clients who wield considerable influence due to their transaction volumes and specific demands. These clients can negotiate for customized solutions and competitive pricing, directly impacting Baader Bank's profitability. The ease with which these clients can switch to other financial institutions, especially in a fluctuating market like European equities in 2024, underscores the pressure on Baader Bank to retain them.

Baader Bank's strategic partnerships, such as those with Smartbroker+ and Finanzen.net ZERO, also amplify the bargaining power of these partners. As these entities act as key access points to end-customers, they can leverage their market reach to secure more favorable terms and service agreements. This necessitates continuous improvement in platform functionality and user experience to prevent partners from seeking alternative banking relationships.

While individual private clients historically had less power, their collective influence is growing, evidenced by Baader Bank's substantial account growth, with 430,000 new accounts onboarded in 2024. This expanding base, coupled with increased digital literacy, demands efficient and cost-effective market access, compelling service providers to adapt. The readily available information on financial products and services in 2024, alongside reduced switching costs due to digital banking and fintech, further empowers consumers to compare and move between providers, intensifying competitive pressure.

Customers increasingly seek diverse investment options, from traditional assets to cryptocurrencies and sustainable products. Baader Bank's efforts to broaden its product range, including increased crypto trading interest and expansion into ESG-focused investments in 2024, aim to counter this by making the bank a more indispensable partner. This diversification strategy directly addresses customer demand and reduces their propensity to switch, thereby mitigating their bargaining power.

| Customer Segment | Bargaining Power Drivers | Impact on Baader Bank | 2024 Data/Trends |

| Institutional Clients | High transaction volume, customized needs, ability to switch | Pressure on pricing, service levels, and profit margins | Fluctuations in institutional equity trading volumes |

| B2B/B2B2C Partners | Market reach, aggregated transaction volume, demand for platform improvements | Negotiation of terms, service level agreements, and platform development priorities | Strategic partnerships driving client acquisition |

| Retail Clients (Collective) | Growing account numbers, digital literacy, demand for cost-effectiveness | Need for efficient platforms, competitive pricing, and accessible products | 51% rise in accounts (2023), 430,000 new accounts (2024) |

Preview Before You Purchase

Baader Bank Porter's Five Forces Analysis

This preview showcases the complete Baader Bank Porter's Five Forces analysis, offering an in-depth examination of competitive forces within its industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The German banking landscape is dominated by large, established universal banks like Deutsche Bank and Commerzbank. These giants possess vast branch networks, substantial capital reserves, and a broad customer appeal, directly challenging Baader Bank across key areas such as investment banking and asset management. For instance, in 2023, Deutsche Bank reported total assets of €547 billion, highlighting its immense scale compared to niche players.

The German financial landscape is seeing a significant shift with the rise of agile fintechs and neobrokers. These digital-first players often provide specialized services, boast lower fee structures, and offer a more intuitive user experience, directly challenging traditional institutions.

While Baader Bank strategically collaborates with some of these disruptive forces, such as its partnership with Smartbroker+, these entities simultaneously pose a competitive threat. This is particularly evident in the retail segment and the increasingly digitalized trading arena, where agility and cost-effectiveness are paramount.

Baader Bank's success as a market maker hinges on its ability to generate trading volumes and secure market share. In 2024, German stock exchanges experienced a notable uptick in trading activity, with Baader Bank successfully growing its market share within this dynamic environment. This growth underscores the fierce competition to attract and retain trading business across a diverse range of financial instruments.

Regulatory Compliance and Technology Investment Race

The banking sector's competitive rivalry is intensified by the substantial investments required in IT infrastructure, cybersecurity, and adherence to evolving regulations such as the Digital Operational Resilience Act (DORA) and the Markets in Crypto-Assets Regulation (MiCAR). This creates a dynamic where technological adaptability directly translates to competitive advantage.

Banks that can efficiently integrate and utilize new technologies are better positioned to streamline operations and enhance customer service, while those that fall behind risk increased operational costs and potential penalties for non-compliance. For instance, in 2024, European banks are projected to spend billions on digital transformation initiatives, with a significant portion allocated to regulatory compliance and cybersecurity upgrades.

- IT Infrastructure Investment: Banks are channeling significant capital into modernizing core banking systems and cloud adoption to improve agility and efficiency.

- Cybersecurity Focus: With the rise of sophisticated cyber threats, cybersecurity spending has become a critical area of investment for all financial institutions.

- Regulatory Technology (RegTech): The adoption of RegTech solutions is accelerating to manage the complexity and cost of complying with new financial regulations like DORA and MiCAR.

- Competitive Advantage: Early adopters of advanced technology and robust compliance frameworks are likely to outperform competitors through lower operating costs and enhanced market trust.

Consolidation and Strategic Partnerships

The German banking landscape is experiencing ongoing discussions about consolidation, with potential mergers like the one between UniCredit and Commerzbank being a prime example. Such moves could significantly reshape the competitive environment, creating fewer, but more formidable players. This trend suggests a heightened intensity of rivalry as entities aim to achieve greater scale and market power.

In response to these shifts, strategic partnerships have become a crucial element of competitive strategy. Baader Bank, for instance, actively pursues B2B and B2B2C collaborations. These alliances are designed to broaden its service offerings and customer base, acting as a vital mechanism for growth and market penetration in an increasingly concentrated sector.

- Consolidation Trends: Reports in 2023 and early 2024 highlighted potential consolidation within the German banking sector, aiming for greater efficiency and market share.

- Strategic Partnerships: Baader Bank's focus on B2B and B2B2C models allows it to leverage external networks and expand its reach without direct acquisition.

- Impact on Rivalry: Consolidation can lead to increased pricing pressure and a more aggressive competitive stance from larger, merged entities.

- Diversification Strategy: Partnerships offer a less capital-intensive way to diversify revenue streams and access new customer segments compared to organic growth alone.

Baader Bank operates in a highly competitive German banking sector. The presence of large universal banks, agile fintechs, and the ongoing trend of consolidation intensifies rivalry. Success increasingly depends on technological investment and strategic partnerships to maintain market share and offer diverse services.

| Metric | Baader Bank (2023/2024 Est.) | Key Competitors (2023) | Significance |

|---|---|---|---|

| Total Assets | Not directly comparable due to niche focus | Deutsche Bank: €547 billion Commerzbank: €504 billion |

Highlights scale advantage of universal banks. |

| Market Share (Trading Volume) | Growing in specific segments | Dominant players in retail and institutional trading | Fierce competition for trading business. |

| IT/Digital Transformation Spend | Significant investment | European Banks (Projected 2024): Billions | Crucial for operational efficiency and compliance. |

SSubstitutes Threaten

Individual investors are increasingly bypassing traditional financial institutions by utilizing direct investment and DIY platforms. These online tools, including robo-advisors, offer cost-effective and efficient ways to manage investments. For instance, the European ETF market saw significant growth, with net inflows reaching €137 billion in 2023, indicating a strong shift towards self-directed investing.

The rising popularity of ETF savings plans and direct equity investments among retail investors acts as a significant substitute for traditional wealth management and brokerage services. Platforms providing secure, low-cost access are attracting a growing user base. In 2024, the number of retail investors actively trading on major European exchanges continued to climb, demonstrating this trend.

Corporate clients increasingly turn to alternative financing avenues, such as crowdfunding and peer-to-peer lending, as substitutes for traditional investment banking services. In 2024, the global crowdfunding market was projected to reach over $20 billion, demonstrating a significant shift in capital raising strategies.

While Baader Bank's market-making activities are less directly impacted, these alternative channels pose a threat to its capital markets advisory business. The ease of access and lower perceived costs of these platforms can divert clients who might otherwise seek advisory services for more complex financing needs.

Large corporations are increasingly building robust in-house treasury departments, acting as a significant substitute for Baader Bank's services. These internal teams can handle capital markets activities like trading, hedging, and asset management, directly competing with the bank's core offerings.

For instance, many multinational corporations now possess the expertise and technology to execute complex financial transactions independently. This trend reduces their need for external financial intermediaries, thereby diminishing the market share available to investment banks like Baader Bank for these specific services.

Robo-Advisors and Digital Asset Management

Robo-advisors and purely digital asset management platforms present a significant threat of substitution to traditional asset management. These platforms offer automated, low-cost investment advice and portfolio management, directly competing with established players by providing a more accessible and often cheaper alternative for investors. The increasing sophistication and adoption of these digital solutions mean they can fulfill many of the core needs previously met by human advisors.

While Baader Bank partners with some fintechs and robo-advisors, the proliferation of independent digital wealth managers still poses a competitive challenge. These independent entities, unburdened by legacy infrastructure, can innovate rapidly and capture market share. For instance, the global robo-advisory market was projected to reach over $2.4 trillion in assets under management by 2024, highlighting the scale of this disruptive force.

- Digital platforms offer automated, low-cost investment solutions.

- This directly substitutes traditional asset management services.

- Baader Bank's partnerships mitigate some risk, but independent growth is a threat.

- The robo-advisory market is expanding rapidly, reaching significant AUM levels.

Cryptocurrency Exchanges and Decentralized Finance (DeFi)

The growing accessibility of direct cryptocurrency exchanges and decentralized finance (DeFi) platforms presents a significant threat of substitutes for traditional banking services. These platforms enable individuals to trade, lend, and borrow crypto assets, bypassing intermediaries like Baader Bank. For instance, by mid-2024, the total value locked (TVL) in DeFi protocols had surged past $100 billion, demonstrating a substantial shift in financial activity away from traditional systems.

While Baader Bank is actively developing its own cryptocurrency trading and custody solutions, the inherent nature of these decentralized alternatives offers a compelling substitute. They often boast lower fees and greater user control, directly challenging the value proposition of established financial institutions. The continued innovation in DeFi, including yield farming and non-custodial wallets, further solidifies their position as a potent substitute threat.

Key aspects of this substitute threat include:

- Direct Peer-to-Peer Trading: Cryptocurrencies can be traded directly between users on various exchanges, reducing reliance on traditional banking infrastructure for settlement.

- DeFi Lending and Borrowing: Protocols allow users to earn interest on their crypto holdings or borrow against them without needing a bank, with total DeFi lending volume reaching hundreds of billions of dollars in 2024.

- Automated Market Makers (AMMs): AMMs facilitate liquidity provision and token swaps, offering an alternative to traditional order-book exchanges and bank-managed trading desks.

- Decentralized Autonomous Organizations (DAOs): DAOs are emerging to govern DeFi protocols, offering a community-driven alternative to centralized financial management.

The rise of digital platforms offering automated, low-cost investment solutions directly substitutes traditional asset management services. Baader Bank's partnerships with some fintechs help mitigate this risk, but the independent growth of these digital wealth managers poses a significant competitive challenge. The global robo-advisory market was projected to manage over $2.4 trillion in assets by 2024, underscoring the scale of this disruptive force.

Direct cryptocurrency exchanges and decentralized finance (DeFi) platforms offer a potent substitute threat to traditional banking services by enabling peer-to-peer trading and lending. By mid-2024, the total value locked in DeFi protocols surpassed $100 billion, indicating a substantial shift of financial activity away from conventional systems. While Baader Bank is developing its own crypto solutions, the lower fees and greater user control of decentralized alternatives directly challenge established financial institutions.

| Substitute Threat | Description | Key Data Point (2024 Projections/Mid-2024) | Impact on Baader Bank |

| Digital Wealth Management/Robo-Advisors | Automated, low-cost investment advice and portfolio management. | Projected $2.4 trillion in Assets Under Management (AUM). | Direct competition for asset management clients; potential diversion from advisory services. |

| Decentralized Finance (DeFi) and Crypto | Peer-to-peer trading, lending, and borrowing without intermediaries. | Over $100 billion Total Value Locked (TVL) in DeFi protocols. | Bypasses traditional banking for financial transactions; challenges value proposition of intermediaries. |

Entrants Threaten

Entering the German investment banking and market making arena demands significant capital investment. For instance, establishing the necessary infrastructure and meeting initial operational costs can easily run into tens of millions of euros, making it a daunting prospect for smaller firms or startups.

Furthermore, the regulatory environment in Germany, overseen by the Federal Financial Supervisory Authority (BaFin), presents formidable hurdles. New entrants must secure various licenses and meticulously comply with directives such as the Digital Operational Resilience Act (DORA) and the Markets in Crypto-Assets Regulation (MiCAR), which impose strict operational and security standards. These stringent requirements effectively deter many potential competitors.

In the financial services sector, especially when dealing with institutional and corporate clients, an established reputation and trust are absolutely critical. Newcomers face a steep uphill battle in building this credibility. Consider Baader Bank, which has been a trusted name since its founding in 1994; this long history directly translates into a level of confidence that new entrants would find incredibly difficult to replicate quickly. This inherent trust barrier significantly deters potential competitors.

The threat of new entrants in the banking sector, particularly concerning technological infrastructure and expertise, is significantly mitigated by the sheer scale of investment required. Developing and maintaining the sophisticated IT systems, high-frequency trading platforms, and robust cybersecurity necessary for modern financial services demands immense capital. For instance, major banks often spend billions annually on technology upgrades and maintenance. A new entrant would need to replicate this, facing a substantial barrier to entry.

Acquiring specialized technical talent is another considerable hurdle. The financial industry relies on highly skilled professionals in areas like quantitative analysis, AI development, and cybersecurity. The competition for this talent is fierce, driving up recruitment costs and making it difficult for newcomers to assemble a competitive team. This expertise gap, coupled with the capital expenditure, makes it challenging for new players to challenge established institutions like Baader Bank.

Talent Acquisition and Retention

The financial services industry, particularly for institutions like Baader Bank, faces a significant threat from new entrants concerning talent acquisition and retention. The sector demands highly specialized and experienced professionals, making it challenging for newcomers to build a competitive team quickly.

New entrants would likely encounter intense competition for skilled talent in what is often a tight labor market. This competition can drive up personnel costs and complicate recruitment efforts. For instance, in 2023, the average compensation for financial analysts in Germany, a key market for Baader Bank, continued its upward trend, reflecting the demand for expertise.

- High Demand for Specialized Skills: The financial sector requires expertise in areas like quantitative analysis, risk management, and regulatory compliance, which are not easily replicated.

- Competitive Salary Environment: Established firms often offer attractive compensation packages and benefits, making it difficult for new entrants to lure top talent away.

- Talent Scarcity: Certain niche areas within finance experience persistent talent shortages, further exacerbating recruitment challenges for any new player.

- Brand Reputation and Employee Loyalty: Experienced professionals may prefer to join or remain with well-established institutions that have a strong brand reputation and a history of employee development.

Network Effects and Ecosystem Development

Established financial institutions like Baader Bank thrive on robust network effects, cultivating deep relationships with a wide array of cooperation partners, institutional clients, and critical market venues. These established connections create a significant barrier to entry for newcomers.

For instance, Baader Bank's extensive network might involve hundreds of institutional clients and dozens of strategic partnerships, each contributing to its operational efficiency and market reach. Replicating this intricate web of relationships and trust is a formidable task for any new entrant aiming to gain traction in the competitive financial landscape.

- Network Effects: Baader Bank's established relationships with numerous cooperation partners and institutional clients create a strong competitive advantage.

- Ecosystem Challenge: New entrants face substantial hurdles in building a comparable ecosystem of market venues and client bases from the ground up.

- Scale and Competition: The difficulty in achieving critical scale and matching the breadth of services offered by established players significantly hinders new entrants' ability to compete effectively.

The threat of new entrants into Baader Bank's market is significantly low due to substantial capital requirements and stringent regulatory compliance. For example, setting up the necessary technological infrastructure and obtaining licenses from BaFin can cost tens of millions of euros. This financial barrier, coupled with the need to build trust and reputation, makes it incredibly difficult for new players to gain a foothold.

The intense competition for highly skilled talent further limits new entrants. Financial institutions like Baader Bank attract top professionals through competitive salaries, which, for instance, saw a continued upward trend for financial analysts in Germany in 2023. Newcomers struggle to match these compensation packages and the established brand loyalty, creating a significant talent acquisition hurdle.

Established network effects also act as a major deterrent. Baader Bank’s deep-rooted relationships with numerous clients and partners are difficult to replicate. Building a comparable ecosystem of market venues and client bases from scratch presents a formidable challenge for any new competitor seeking to achieve critical scale and offer a broad range of services.

| Barrier Type | Description | Example Impact on New Entrants |

|---|---|---|

| Capital Requirements | High initial investment for infrastructure and operations. | Costs can easily exceed tens of millions of euros. |

| Regulatory Hurdles | Licensing and compliance with directives like DORA and MiCAR. | Requires meticulous adherence to strict operational and security standards. |

| Brand Reputation & Trust | Established history and credibility built over time. | Difficult for new entrants to quickly replicate the trust Baader Bank has held since 1994. |

| Talent Acquisition | Competition for specialized skills in quantitative analysis, AI, and cybersecurity. | Newcomers face high recruitment costs and difficulty assembling competitive teams. |

| Network Effects | Deep relationships with clients, partners, and market venues. | Challenging to build a comparable ecosystem of hundreds of clients and dozens of partnerships. |

Porter's Five Forces Analysis Data Sources

Our Baader Bank Porter's Five Forces analysis is built upon a robust foundation of data, drawing from the bank's annual reports, investor presentations, and financial disclosures. We supplement this with industry-specific market research and economic data to provide a comprehensive view of the competitive landscape.