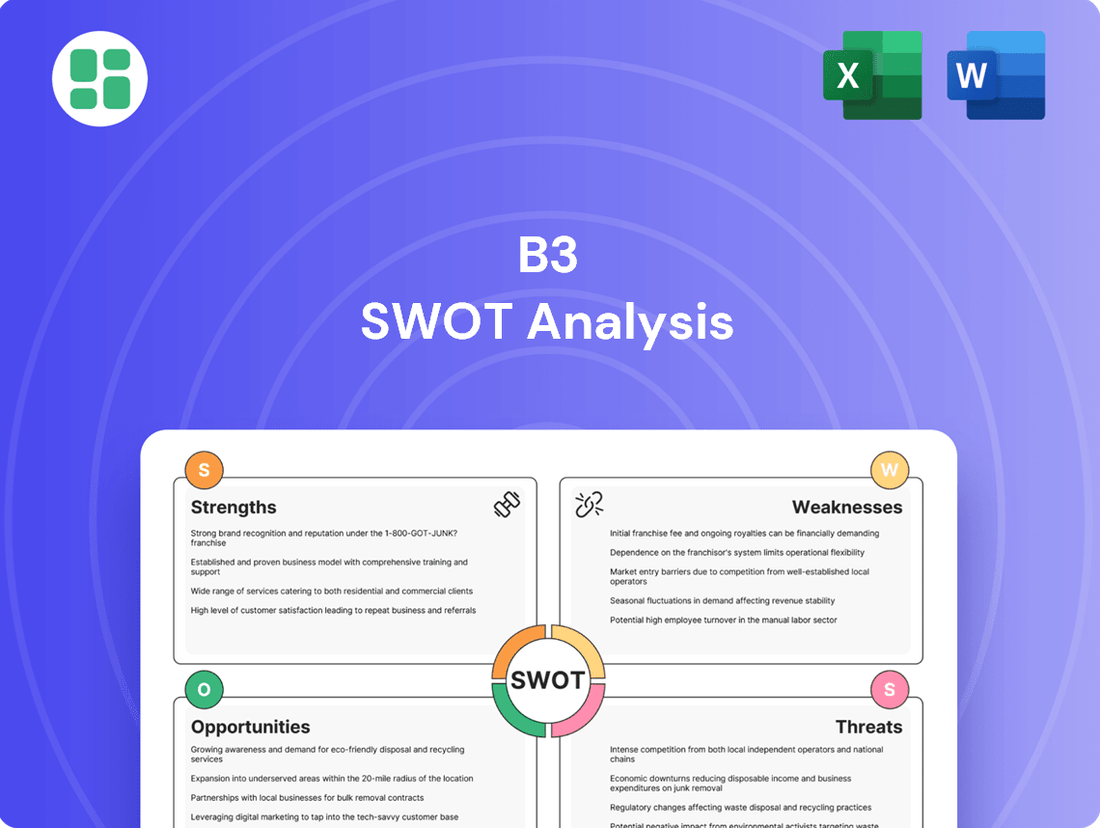

B3 SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B3 Bundle

You've seen the core elements of B3's strategic landscape. Now, unlock the full potential with our comprehensive SWOT analysis, revealing critical market dynamics and competitive advantages.

Dive deeper into actionable strategies and expert insights with the complete B3 SWOT analysis, designed to equip you for informed decision-making and future growth.

Ready to transform insights into action? Purchase the full B3 SWOT analysis for a detailed, editable report that empowers your strategic planning and investment decisions.

Strengths

B3's dominant market position in Brazil, acting as the sole stock exchange, grants it immense market power. This near-monopoly ensures substantial revenue from essential financial activities like trading, clearing, and settlement, solidifying its role as the backbone of Brazil's financial system.

B3 boasts a comprehensive service portfolio that extends far beyond traditional stock trading. Its offerings encompass fixed income, currencies, and derivatives, alongside crucial technology and infrastructure solutions for the financial market. This broad spectrum of services diversifies revenue streams, reducing B3's reliance on any single asset class and bolstering its financial stability.

B3's commitment to technology is a significant strength. The company consistently invests in advanced systems and a robust infrastructure, which are crucial for managing high volumes of trading and ensuring secure post-trade activities. This technological backbone allows for efficient operations and supports the integrity of the financial market.

A prime example of this focus is B3's ongoing development of a cloud-based Central Securities Depository (CSD) system. This new CSD is designed with elastic scalability, meaning it can readily adapt to accommodate substantial growth in the Brazilian market. Such an upgrade is vital for B3 to maintain its competitive edge and operational excellence as market activity expands.

Strong Financial Performance and Diversification

B3's financial performance remains robust, underpinned by a diversified revenue stream. In the first quarter of 2025, the company achieved total revenues of R$2.7 billion, marking a significant 7.7% increase from the same period in 2024. This growth reflects the successful execution of its strategy to bolster its core operations while simultaneously expanding into complementary sectors such as data and technology services.

The company's strategic focus on adjacent markets is yielding tangible results, contributing to its overall financial strength. B3 reported a recurring net income of R$1.3 billion for the second quarter of 2025. This consistent profitability demonstrates the effectiveness of its business model and its ability to generate value across its various segments.

- Revenue Growth: Q1 2025 total revenues reached R$2.7 billion, up 7.7% year-over-year.

- Profitability: Recurring net income stood at R$1.3 billion in Q2 2025.

- Strategic Expansion: Growth is fueled by strengthening core business and expanding into data and technology services.

ESG Leadership and Innovation

B3’s commitment to Environmental, Social, and Governance (ESG) principles positions it as a leader, actively driving best practices within the Brazilian financial market. This dedication is evident through initiatives like offering ESG-focused training programs and maintaining influential indices such as the S&P/B3 Brazil ESG Index, which saw its constituent companies outperform the broader market in certain periods of 2024.

Furthermore, B3’s strategic investment in the structure and accessibility of the market for CBIOs (Decarbonization Credits) directly links capital markets to crucial environmental objectives. This focus on sustainability not only enhances B3's reputation but also attracts environmentally conscious investors and corporations, fostering a more responsible and forward-thinking financial ecosystem.

B3's market dominance as Brazil's sole stock exchange provides significant pricing power and revenue stability. Its diversified service offerings, from fixed income to derivatives and tech solutions, reduce reliance on any single market segment. The company's ongoing investment in advanced, cloud-based infrastructure, like its new CSD system, ensures operational efficiency and scalability for future growth.

| Metric | Q1 2025 | Q1 2024 | YoY Growth |

|---|---|---|---|

| Total Revenue (R$ billion) | 2.7 | 2.51 | 7.7% |

| Recurring Net Income (R$ billion) | 1.3 (Q2 2025) | N/A | N/A |

What is included in the product

Analyzes B3’s competitive position through key internal and external factors, assessing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address strategic weaknesses, alleviating the pain of uncertainty and missed opportunities.

Weaknesses

B3's fortunes are intrinsically tied to Brazil's economic and political climate. When the Brazilian economy faces headwinds, such as high inflation or political uncertainty, B3's revenue streams can suffer significantly.

For instance, Brazil's inflation rate hovered around 4.62% in 2023, and while projected to moderate in 2024, persistent volatility can dampen investor sentiment. This directly translates to lower trading volumes on the exchange, impacting B3's core business and profitability.

B3's long-standing market dominance in Brazil is under increasing pressure. New entrants are gearing up to challenge B3's position, especially in crucial areas like asset clearing. For instance, ATG is targeting a late 2025 launch for its exchange and central counterparty services, while CSD BR has its sights set on a 2027 debut.

These upcoming competitors pose a direct threat to B3's revenue streams, particularly those derived from stock operations. The potential fragmentation of the market could lead to a reduction in B3's market share and, consequently, its profitability.

B3's performance is vulnerable to shifts in foreign investor sentiment. Despite periods of robust inflows, global economic uncertainties or domestic political instability can trigger significant capital outflows. For instance, in July 2025, B3 experienced foreign investors withdrawing R$6.3 billion, marking the largest monthly divestment since April 2024, highlighting this sensitivity.

Regulatory and Tax Rate Changes

B3 operates within a heavily regulated financial sector, making it susceptible to shifts in government policies. Changes in financial regulations or tax laws can directly affect B3's earnings and operational costs. For example, a proposed increase in the CSLL tax rate from 9% to 15% could significantly impact the company's overall tax burden if enacted.

The potential for adverse regulatory shifts presents a notable weakness. Such changes could necessitate costly adjustments to B3's business model or lead to reduced profitability.

- Exposure to Regulatory Shifts: B3's business model is inherently tied to the evolving regulatory landscape of the financial markets.

- Impact of Tax Rate Changes: A potential increase in the CSLL tax rate, for instance, could directly reduce net income.

- Compliance Costs: Adapting to new regulations often incurs significant compliance expenses.

Operational Costs and Cybersecurity Risks

B3 faces substantial operational costs associated with maintaining its advanced technological infrastructure. These expenses are amplified by the critical need for robust cybersecurity measures, as B3, being a vital financial hub, is a constant target for cyber threats.

The potential for significant financial losses, severe reputational damage, and erosion of market trust underscores the inherent cybersecurity risks. For instance, the global financial sector saw an estimated $1.5 trillion in losses due to cybercrime in 2023, highlighting the scale of these threats.

- High Infrastructure Investment: Continuous investment in technology upgrades and maintenance is essential for B3's operations.

- Cybersecurity Expenditure: Significant resources are allocated to cybersecurity defenses, including advanced threat detection and response systems.

- Reputational Impact of Breaches: A successful cyberattack could severely damage B3's standing and client confidence.

- Regulatory Compliance Costs: Meeting stringent regulatory requirements for data security and operational resilience adds to the overall cost burden.

B3's reliance on Brazil's economic stability makes it vulnerable to downturns. High inflation, as seen with the 4.62% rate in 2023, and political uncertainty can directly reduce trading volumes, impacting B3's core revenue. Furthermore, shifts in foreign investor sentiment, like the R$6.3 billion outflow in July 2025, highlight B3's sensitivity to global and domestic instability, potentially leading to reduced market activity and profitability.

What You See Is What You Get

B3 SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

B3 has a significant opportunity to broaden its financial product and service portfolio by venturing into new and evolving asset classes. The exchange has already made strides in this area, notably with the successful launch of futures contracts for cryptocurrencies such as Bitcoin, Ethereum, and Solana. This strategic move demonstrates B3's commitment to innovation and its ability to adapt to changing market demands.

Further expansion into emerging asset classes and the integration of novel financial instruments onto its platforms represent key growth avenues for B3. By continuously adding diverse and innovative offerings, B3 can attract a wider range of investors and participants, solidifying its position as a comprehensive financial marketplace. For instance, in 2023, B3 saw a notable increase in derivatives trading volume, signaling a strong appetite for sophisticated financial products.

B3's strategic expansion into data analytics and technology services presents a significant growth opportunity. By enhancing its data solutions, B3 aims to offer deeper market insights, thereby improving client decision-making and creating a robust new revenue channel.

The integration of companies like Neoway and the anticipated acquisition of Neurotech, effective April 2025, are pivotal. These moves bolster B3's capabilities in artificial intelligence and advanced data analytics, positioning it at the forefront of technological innovation in the financial sector.

Enhanced financial literacy and a push for greater financial inclusion in Brazil are poised to broaden the investor base, driving more participation in capital markets. This trend is supported by regulatory adjustments, such as those simplifying foreign investor access set to take effect in January 2025, which are expected to attract more international capital.

Strategic Partnerships and Regional Integration

B3 is actively pursuing international partnerships and strategic alliances to expand its global presence and capitalize on its technological advancements. The exchange is also exploring avenues to integrate novel asset classes and financial instruments, broadening its offerings.

Latin American stock exchanges are at the forefront of financial technology innovation, presenting a fertile ground for regional collaboration and the sharing of best practices. This technological leadership could foster greater integration within the region.

- Expanding Global Reach: B3's focus on international partnerships aims to extend its market access and influence beyond Brazil.

- Technological Synergies: Collaborations can leverage B3's technological expertise with that of other leading exchanges, driving innovation.

- Regional Integration: The advancement of fintech in Latin America creates opportunities for B3 to foster deeper regional market integration.

- New Asset Classes: Strategic alliances can facilitate the introduction and trading of new financial instruments, diversifying B3's portfolio.

Leveraging ESG and Sustainable Finance Trends

The growing global emphasis on Environmental, Social, and Governance (ESG) criteria offers B3 a significant avenue for growth. By expanding its sustainable finance offerings, B3 can tap into a rapidly expanding market driven by investor demand for responsible investments. For instance, in 2023, sustainable bond issuance globally reached record levels, signaling strong market appetite.

B3 is actively developing new ESG-related metrics for its listed companies, aiming to enhance transparency and encourage better performance in areas like diversity and inclusion. This strategic move positions B3 as a leader in promoting sustainable corporate practices within Brazil's capital markets. The exchange has also made strategic investments in structuring the market for Credit Rights Investment Funds (CBIOs), a key instrument for financing sustainable projects.

- Growing Investor Demand: Global ESG assets are projected to exceed $50 trillion by 2025, creating a substantial market for B3's sustainable products.

- Regulatory Tailwinds: Increasing regulatory focus on ESG disclosure worldwide encourages exchanges like B3 to develop relevant market infrastructure.

- Product Innovation: B3's work on ESG metrics and CBIOs demonstrates a commitment to innovation in sustainable finance, attracting both issuers and investors.

B3 has a significant opportunity to broaden its financial product and service portfolio by venturing into new and evolving asset classes. The exchange has already made strides in this area, notably with the successful launch of futures contracts for cryptocurrencies such as Bitcoin, Ethereum, and Solana. This strategic move demonstrates B3's commitment to innovation and its ability to adapt to changing market demands.

Further expansion into emerging asset classes and the integration of novel financial instruments onto its platforms represent key growth avenues for B3. By continuously adding diverse and innovative offerings, B3 can attract a wider range of investors and participants, solidifying its position as a comprehensive financial marketplace. For instance, in 2023, B3 saw a notable increase in derivatives trading volume, signaling a strong appetite for sophisticated financial products.

B3's strategic expansion into data analytics and technology services presents a significant growth opportunity. By enhancing its data solutions, B3 aims to offer deeper market insights, thereby improving client decision-making and creating a robust new revenue channel.

The integration of companies like Neoway and the anticipated acquisition of Neurotech, effective April 2025, are pivotal. These moves bolster B3's capabilities in artificial intelligence and advanced data analytics, positioning it at the forefront of technological innovation in the financial sector.

Enhanced financial literacy and a push for greater financial inclusion in Brazil are poised to broaden the investor base, driving more participation in capital markets. This trend is supported by regulatory adjustments, such as those simplifying foreign investor access set to take effect in January 2025, which are expected to attract more international capital.

B3 is actively pursuing international partnerships and strategic alliances to expand its global presence and capitalize on its technological advancements. The exchange is also exploring avenues to integrate novel asset classes and financial instruments, broadening its offerings.

Latin American stock exchanges are at the forefront of financial technology innovation, presenting a fertile ground for regional collaboration and the sharing of best practices. This technological leadership could foster greater integration within the region.

- Expanding Global Reach: B3's focus on international partnerships aims to extend its market access and influence beyond Brazil.

- Technological Synergies: Collaborations can leverage B3's technological expertise with that of other leading exchanges, driving innovation.

- Regional Integration: The advancement of fintech in Latin America creates opportunities for B3 to foster deeper regional market integration.

- New Asset Classes: Strategic alliances can facilitate the introduction and trading of new financial instruments, diversifying B3's portfolio.

The growing global emphasis on Environmental, Social, and Governance (ESG) criteria offers B3 a significant avenue for growth. By expanding its sustainable finance offerings, B3 can tap into a rapidly expanding market driven by investor demand for responsible investments. For instance, in 2023, sustainable bond issuance globally reached record levels, signaling strong market appetite.

B3 is actively developing new ESG-related metrics for its listed companies, aiming to enhance transparency and encourage better performance in areas like diversity and inclusion. This strategic move positions B3 as a leader in promoting sustainable corporate practices within Brazil's capital markets. The exchange has also made strategic investments in structuring the market for Credit Rights Investment Funds (CBIOs), a key instrument for financing sustainable projects.

- Growing Investor Demand: Global ESG assets are projected to exceed $50 trillion by 2025, creating a substantial market for B3's sustainable products.

- Regulatory Tailwinds: Increasing regulatory focus on ESG disclosure worldwide encourages exchanges like B3 to develop relevant market infrastructure.

- Product Innovation: B3's work on ESG metrics and CBIOs demonstrates a commitment to innovation in sustainable finance, attracting both issuers and investors.

B3 can expand its offerings by integrating new asset classes and financial instruments, such as tokenized assets and digital currencies, to meet evolving investor preferences. The exchange's investment in data analytics and AI, exemplified by acquisitions like Neurotech effective April 2025, will enable it to provide enhanced market insights and personalized services, attracting a broader client base. Furthermore, by fostering financial literacy and leveraging regulatory changes that simplify foreign investor access from January 2025, B3 can significantly increase market participation and attract international capital, driving growth.

| Opportunity Area | Description | Supporting Data/Examples |

|---|---|---|

| Expansion into New Asset Classes | Diversifying product offerings to include emerging assets like cryptocurrencies and tokenized securities. | Launch of Bitcoin, Ethereum, and Solana futures contracts; global ESG assets projected to exceed $50 trillion by 2025. |

| Data Analytics & AI Integration | Leveraging advanced technology for deeper market insights and enhanced client services. | Acquisition of Neurotech (effective April 2025); Neoway integration; notable increase in derivatives trading volume in 2023. |

| International Partnerships & Regional Integration | Expanding global reach and fostering collaboration within Latin American fintech landscape. | Latin American exchanges at forefront of fintech innovation; focus on international partnerships to expand market influence. |

| Sustainable Finance (ESG) | Developing and promoting ESG-compliant products and services to meet growing investor demand. | Global sustainable bond issuance reached record levels in 2023; B3 developing ESG metrics and investing in CBIOs. |

| Broadening Investor Base | Increasing financial literacy and simplifying access for domestic and international investors. | Regulatory adjustments simplifying foreign investor access (effective January 2025); growing investor demand for sustainable products. |

Threats

Brazil's economic landscape presents significant hurdles for B3. A sustained economic downturn, coupled with persistently high inflation, could significantly dampen investor sentiment and consequently, trading activity on the exchange. For instance, Brazil's inflation rate remained elevated in early 2024, impacting purchasing power and investment decisions.

Political uncertainty further exacerbates these economic concerns. Ongoing debates surrounding government fiscal policy, including public spending and taxation, can create apprehension among domestic and international investors. This uncertainty often translates into downward pressure on the Brazilian Real and broader asset valuations, directly affecting B3's performance.

B3 faces a growing threat from new entrants aiming to establish exchanges or central counterparties in Brazil, directly challenging its established position, especially in crucial asset clearing services. This intensified competition could fragment the market and pressure B3's revenue streams.

The rapid expansion of FinTech companies and the proliferation of alternative trading systems present another significant challenge. These innovative platforms offer potentially more agile and cost-effective solutions, attracting a segment of the market and threatening to chip away at B3's overall market share.

Adverse regulatory changes and taxation pose a significant threat to B3. Shifts in government policies, particularly concerning financial markets and digital assets, could curtail operational flexibility and reduce profitability. For instance, the evolving landscape of cryptocurrency regulations, with new frameworks being introduced globally and within Brazil, presents potential compliance burdens and increased operational costs for B3's involvement in this sector.

Cybersecurity Breaches and Technological Disruptions

B3, as a vital piece of financial infrastructure, is a prime target for increasingly sophisticated cyber threats. These range from traditional ransomware and phishing attempts to advanced AI-driven attacks designed to exploit vulnerabilities. A successful breach could halt trading operations, result in substantial financial penalties, and irrevocably damage B3's reputation among market participants.

The stakes are particularly high for a stock exchange. For instance, the average cost of a data breach globally in 2024 reached $4.73 million, according to IBM's Cost of a Data Breach Report. For B3, a disruption could mean not only direct financial losses but also a loss of confidence that takes years to rebuild.

The potential impacts are multifaceted:

- Operational Paralysis: System downtime can prevent trades, leading to market instability and significant economic consequences.

- Financial Losses: Beyond direct costs of recovery, B3 could face regulatory fines and compensation claims from affected parties.

- Reputational Erosion: A major security incident can severely undermine trust in B3's ability to provide a secure and reliable trading environment.

- Increased Investment in Security: The constant threat necessitates ongoing, substantial investment in advanced cybersecurity measures and personnel.

Global Economic Slowdown and Capital Flight

A global economic slowdown, particularly one impacting major economies, poses a significant threat to B3. Should international investment sentiment shift away from emerging markets, Brazil could experience substantial capital flight. This outflow would directly reduce foreign investment in Brazilian assets, impacting B3's liquidity and trading volumes.

The potential for asset price declines due to reduced foreign participation is a key concern. For instance, in early 2024, global economic uncertainty led to increased volatility in emerging market equities, a trend that could intensify if slowdowns persist.

- Reduced Foreign Investment: A global downturn can see foreign investors pull capital from riskier emerging markets, impacting B3's liquidity.

- Lower Trading Volumes: Capital flight directly translates to fewer transactions on the exchange, affecting B3's revenue streams.

- Asset Price Declines: Reduced demand from international buyers can pressure the prices of Brazilian stocks and other listed assets.

Intensified competition from new market entrants and the rise of FinTech platforms present a significant threat, potentially fragmenting the market and eroding B3's revenue. Regulatory shifts, particularly concerning digital assets, could also introduce compliance burdens and operational challenges. Furthermore, B3 remains vulnerable to sophisticated cyberattacks, which could lead to operational paralysis, financial losses, and severe reputational damage. A global economic slowdown could trigger capital flight from emerging markets, reducing liquidity and trading volumes on the exchange.

| Threat Category | Specific Threat | Potential Impact on B3 | 2024/2025 Data/Context |

|---|---|---|---|

| Competition | New Exchange/CCP Entrants | Market fragmentation, revenue pressure | Ongoing discussions and potential licensing for new financial infrastructure providers in Brazil. |

| Competition | FinTech & Alternative Trading Systems | Loss of market share, reduced trading volumes | Continued growth in digital investment platforms and P2P trading services. |

| Regulatory | Adverse Policy Changes | Reduced operational flexibility, profitability impact | Evolving regulations for digital assets and financial services in Brazil and globally. |

| Cybersecurity | Sophisticated Cyberattacks | Operational disruption, financial penalties, reputational damage | Global average cost of a data breach in 2024 was $4.73 million (IBM). |

| Macroeconomic | Global Economic Slowdown | Capital flight, reduced liquidity, lower trading volumes | Emerging markets experienced increased equity volatility in early 2024 due to global economic uncertainty. |

SWOT Analysis Data Sources

This B3 SWOT analysis is built upon a robust foundation of data, drawing from official B3 financial reports, comprehensive market intelligence, and expert industry analyses. These sources ensure a thorough and accurate assessment of B3's strategic position.