B3 Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B3 Bundle

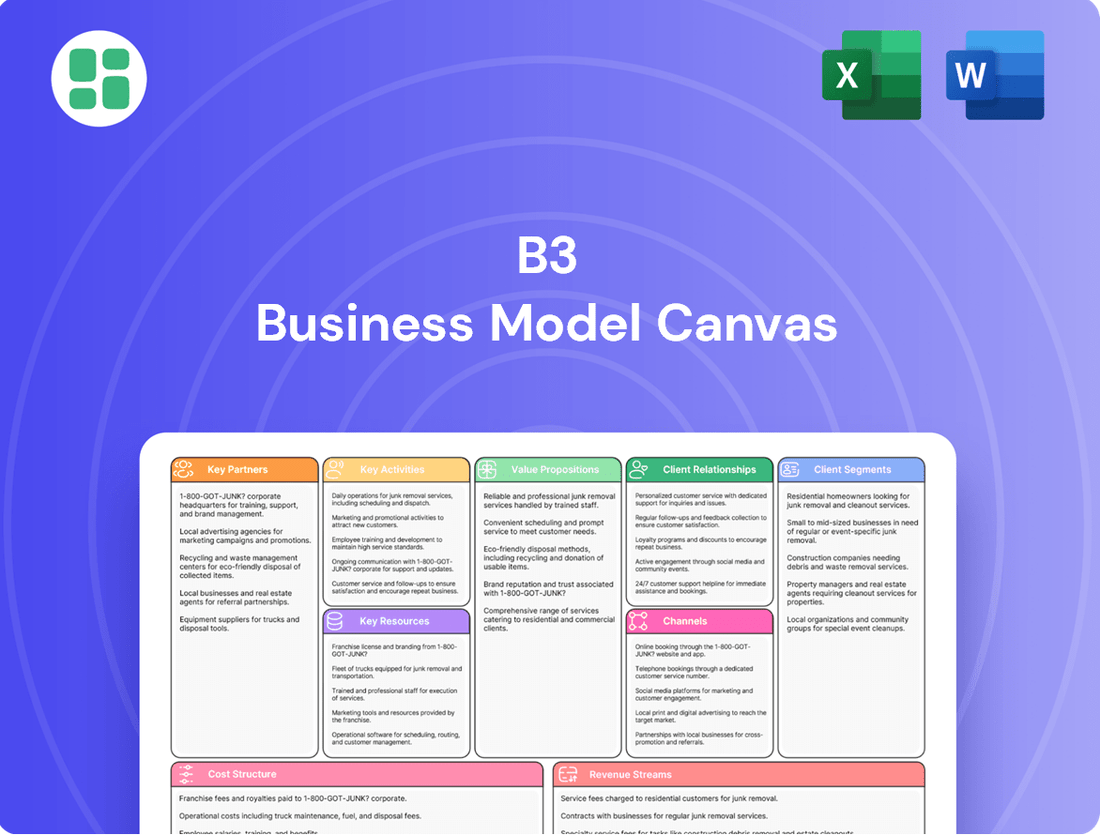

Curious about B3's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to gain a competitive edge and refine your own strategic vision.

Partnerships

B3 collaborates closely with banks, broker-dealers, and various financial institutions to facilitate seamless trading and provide access to its diverse markets. These vital partnerships act as conduits, channeling investor orders and ensuring the efficient distribution of financial products both within Brazil and on the global stage. For instance, in 2023, B3 reported a significant increase in retail investor participation, with over 5 million individual accounts, underscoring the importance of these intermediaries in onboarding new investors.

These financial intermediaries are indispensable for B3's clearing and settlement operations, which are fundamental to maintaining market integrity and reducing systemic risk. Their involvement ensures that transactions are processed accurately and securely, building confidence among market participants. In the first half of 2024, B3 processed an average daily trading volume of R$ 180 billion, a testament to the robust infrastructure supported by these key partnerships.

B3's strategic alliances with technology giants like Nasdaq are fundamental. These collaborations are crucial for upgrading and maintaining B3's sophisticated trading, clearing, and settlement systems, ensuring they remain cutting-edge.

These partnerships are key to B3's operational resilience and speed. They underpin B3's ability to handle high-frequency trading demands and drive its digital transformation, which is vital for staying competitive in the evolving financial landscape.

B3 actively collaborates with the Brazilian Securities Commission (CVM) and the Central Bank of Brazil. These partnerships are crucial for ensuring market integrity, fostering investor confidence, and adhering to evolving regulatory frameworks. For instance, B3's role in implementing programs like Desenrola, aimed at reducing household debt, highlights its alignment with government initiatives impacting the financial ecosystem.

Data and Information Vendors

B3’s key partnerships with data and information vendors are crucial for distributing vital market data, indices, and financial insights. These collaborations are fundamental to fostering transparency, empowering investors, and enabling financial professionals to make well-informed decisions. For instance, B3’s ongoing expansion into technology, data, and services underscores the strategic importance of effectively distributing this information.

These partnerships allow B3 to reach a wider audience with accurate and timely financial information. By working with specialized vendors, B3 can ensure its data is accessible and presented in formats that are easily digestible for various user segments, from individual investors to institutional players.

- Data Dissemination: Partnerships with vendors facilitate the widespread distribution of B3’s market data and indices.

- Informed Decision-Making: These collaborations enhance market transparency, aiding investors and professionals in making sound choices.

- Strategic Expansion: B3's growth in data and technology services highlights the critical role of these vendor relationships.

- Market Reach: Vendors help extend B3's reach, ensuring its data serves a diverse and global financial community.

Listed Companies and Issuers

B3's core partnerships are with the listed companies and issuers that choose its exchange. These companies gain vital access to capital for expansion and operations, while B3 benefits from the trading volume and fees generated. In 2024, B3 continued to be the primary venue for Brazilian companies seeking public funding, with numerous new listings across various sectors.

B3 offers a comprehensive suite of services to these issuers, including listing, registration, and ongoing compliance support. This ensures a regulated and transparent environment for both companies and investors. The exchange acts as a crucial intermediary, facilitating the flow of capital and information.

- Access to Capital: Companies can raise funds through initial public offerings (IPOs) and subsequent offerings.

- Listing Services: B3 provides the platform and regulatory framework for companies to become publicly traded.

- Ongoing Support: Issuers receive guidance on regulatory compliance and market best practices.

- Market Liquidity: B3's infrastructure ensures that shares can be traded efficiently, providing liquidity for investors.

B3's key partnerships extend to financial data and information vendors, crucial for disseminating market data, indices, and insights. These collaborations enhance market transparency and empower investors and professionals. B3's strategic focus on data and technology services highlights the critical role of these vendor relationships in reaching a diverse financial community.

These partnerships are vital for B3's ability to distribute accurate and timely financial information. By leveraging specialized vendors, B3 ensures its data is accessible and presented in easily digestible formats for all user segments, from individual investors to institutional players.

| Partner Type | Role | Impact on B3 |

|---|---|---|

| Financial Data Vendors | Data dissemination, market insights | Enhanced transparency, wider market reach |

| Technology Providers (e.g., Nasdaq) | System upgrades, maintenance | Operational resilience, cutting-edge infrastructure |

| Banks & Broker-Dealers | Facilitating trading, clearing & settlement | Efficient transaction processing, investor onboarding |

| Regulators (CVM, Central Bank) | Ensuring market integrity, compliance | Fostering investor confidence, regulatory alignment |

| Listed Companies & Issuers | Access to capital, trading volume | Revenue generation, market liquidity |

What is included in the product

A structured framework for visualizing and developing business models, breaking down strategy into nine interconnected building blocks.

The B3 Business Model Canvas helps alleviate the pain of unstructured thinking by providing a visual framework to map out and refine business strategies.

Activities

B3's central role in trading and execution services revolves around managing sophisticated platforms where a vast array of financial instruments are exchanged. This encompasses everything from equities and fixed income to foreign exchange and complex derivatives. The smooth operation of these markets, including efficient order matching and price discovery, is paramount.

In 2024, B3 continued to innovate by introducing new trading opportunities. For instance, the exchange expanded its offerings to include Bitcoin futures, catering to the growing demand for cryptocurrency-related financial products. Furthermore, the development and listing of new indices are ongoing efforts to provide investors with more diversified and specialized trading avenues.

B3's clearing, settlement, and custody services are foundational to market operations, ensuring that trades are executed reliably and assets are held securely. This includes managing counterparty risk, which is crucial for maintaining market stability. For instance, in 2023, B3 processed trillions of reais in transactions, highlighting the sheer volume and importance of these functions.

The efficiency of these services is paramount. B3 has been actively upgrading its clearing platform, often through strategic partnerships, to enhance speed and bolster risk management capabilities. These upgrades are vital for adapting to evolving market demands and regulatory requirements, ensuring B3 remains a trusted financial infrastructure provider.

B3's core activity involves collecting, processing, and distributing a vast array of market data, benchmarks, and indices. This information is crucial for market participants, from individual investors to large financial institutions, and also serves data vendors.

This data provision is a significant revenue driver for B3, fostering transparency and enabling robust investment analysis. In 2023, B3's Data and Technology segment demonstrated strong growth, contributing to the company's overall financial performance and highlighting the increasing value placed on financial intelligence.

The company is strategically investing in its technology and data capabilities, aiming to expand its offerings in financial intelligence. This focus aligns with the growing global demand for sophisticated data analytics and insights within the financial sector, positioning B3 for continued relevance and revenue generation.

Technology and Infrastructure Development

B3's key activities heavily rely on continuous investment in technology and infrastructure. This ensures the smooth operation of its trading platforms and the development of new features. For instance, in 2023, B3 invested R$ 1.3 billion in technology, a significant portion of its operating expenses, to maintain and upgrade its systems.

These efforts are crucial for enhancing B3's competitiveness and accessibility. By developing innovative solutions, such as exploring the potential of blockchain for post-trade processes, B3 aims to streamline operations and attract a wider range of participants. The company's commitment to technological advancement is reflected in its consistent performance and ability to handle high trading volumes.

- Maintaining Secure and High-Performance Trading Systems: B3's infrastructure must support millions of transactions daily with minimal latency.

- Developing New Functionalities: This includes creating tools for data analysis, risk management, and new trading products.

- Exploring Innovative Solutions: B3 actively researches and pilots technologies like blockchain to improve efficiency and transparency.

- Enhancing Accessibility and Efficiency: Investments aim to make trading easier and faster for all market participants.

Product Development and Innovation

B3, Brazil's stock exchange, is deeply invested in creating new financial products and services to keep pace with changing market needs and broaden its income sources. This commitment to innovation is crucial for maintaining its competitive edge.

Recent advancements showcase this dedication. B3 has launched innovative offerings such as derivatives tied to crypto-assets, including Bitcoin futures, and unique indices that combine Brazilian equities with international stocks. These products aim to attract a wider range of investors.

- Product Diversification: B3's strategy includes developing a variety of financial instruments to cater to different investor profiles and market trends.

- Crypto-Asset Derivatives: The introduction of Bitcoin futures demonstrates B3's move into emerging asset classes, offering new trading opportunities.

- Specialized Indices: Blending local and global stocks in indices provides investors with diversified exposure and tailored investment strategies.

- Revenue Stream Expansion: By innovating, B3 seeks to create new revenue streams and enhance its overall financial performance.

B3's key activities are centered around operating and enhancing its trading, clearing, and data dissemination platforms. This involves continuous technological investment to ensure efficiency, security, and the introduction of new financial products. For instance, B3's commitment to innovation was evident in 2024 with the expansion into Bitcoin futures, reflecting an adaptation to evolving market demands for digital asset exposure.

The exchange actively develops and lists new indices, offering investors more sophisticated tools for portfolio management and risk hedging. Furthermore, B3's core function of providing market data is a significant revenue driver, supporting transparency and analytical activities for a broad range of financial participants.

B3's operational backbone includes robust clearing, settlement, and custody services, ensuring the integrity of transactions and the security of assets. These services are critical for market stability and are constantly being upgraded to meet regulatory standards and enhance processing speeds.

In 2023, B3 reported a net revenue of R$ 10.2 billion, with its Data and Technology segment showing robust growth, underscoring the increasing importance of data and digital solutions. The company's strategic investments in technology, including R$ 1.3 billion in 2023, are crucial for maintaining its competitive edge and expanding its service offerings.

| Key Activity | Description | 2023/2024 Highlights |

|---|---|---|

| Trading and Execution | Managing platforms for diverse financial instruments. | Expansion into Bitcoin futures (2024). |

| Clearing, Settlement, and Custody | Ensuring reliable trade execution and asset security. | Processing trillions of reais in transactions (2023). |

| Data, Benchmarks, and Indices | Collecting, processing, and distributing market information. | Strong growth in Data and Technology segment revenue (2023). |

| Technology and Infrastructure Investment | Upgrading systems for efficiency and new product development. | R$ 1.3 billion invested in technology (2023). |

What You See Is What You Get

Business Model Canvas

The B3 Business Model Canvas you're previewing is the exact document you'll receive upon purchase. It's a direct, unedited snapshot of the final file, ensuring you know precisely what you're getting. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas, identical to the preview.

Resources

B3's advanced technology infrastructure is the backbone of its operations, encompassing high-speed trading systems, clearing platforms, and data centers. This robust IT framework ensures efficient and reliable processing of millions of transactions daily, a critical factor in maintaining market integrity. For instance, B3 invested approximately R$800 million in technology and innovation during 2023, a significant portion of its operational budget, underscoring its commitment to staying at the forefront of technological advancements in financial markets.

B3's skilled human capital is a cornerstone of its operations. A highly specialized workforce, encompassing IT professionals, financial experts, risk managers, and market analysts, represents an invaluable resource. This expertise is critical for innovation, system maintenance, and regulatory adherence.

The company's commitment to attracting top talent is evident in its goal to be a preferred career destination for software engineers. In 2024, B3 continued to invest in training and development programs to ensure its employees remain at the forefront of technological and financial advancements, a key factor in delivering high-quality client services.

B3 maintains significant financial reserves, crucial for its clearing and settlement operations which necessitate robust collateral. For instance, in the first quarter of 2024, B3 reported a net income of R$1.5 billion, demonstrating its strong profitability and ability to generate internal capital.

Access to capital is also vital for B3's strategic growth, funding investments in technology and potential acquisitions. In 2023, B3 invested R$1.2 billion in technology and innovation, underscoring its commitment to modernization and market development.

The company's financial health directly impacts market confidence and its operational resilience. B3's robust balance sheet, evidenced by its healthy liquidity ratios, ensures it can meet its obligations even during periods of market stress.

Intellectual Property and Market Data

B3's intellectual property, including sophisticated proprietary trading algorithms, forms a core component of its value. These algorithms are crucial for efficient market operation and are a key differentiator.

The extensive library of market data, encompassing both real-time feeds and historical records, is a significant asset. This data is not only foundational for B3's own operations but also a revenue-generating product, sold to various information vendors.

B3's market indices, such as the widely recognized Ibovespa, are prime examples of its intellectual property. These indices are vital benchmarks for investors and are actively used in the creation of new financial products, demonstrating their commercial importance.

- Proprietary Trading Algorithms: Enhance market efficiency and provide a competitive edge.

- Market Indices: The Ibovespa serves as a key benchmark, driving investment and product development.

- Extensive Market Data: Real-time and historical data are valuable assets sold to information vendors.

- New Product Development: Continuous innovation in indices and data services highlights the importance of this IP.

Brand Reputation and Trust

B3's brand reputation is a cornerstone of its business model, fostering trust among investors and issuers alike. This intangible asset is vital for its position as Brazil's primary stock exchange, attracting and retaining market participants.

In 2024, B3 continued to emphasize transparency and market integrity, crucial elements that underpin its strong brand. This commitment is essential for maintaining its central role in the Brazilian financial ecosystem.

Adherence to global best practices and a growing focus on ESG initiatives further solidify B3's reputation. For instance, B3 was recognized in 2024 for its sustainability efforts, reinforcing investor confidence.

- Trust and Transparency: B3's brand is built on a foundation of trust, essential for attracting and retaining listings.

- Market Integrity: Maintaining a fair and transparent trading environment is paramount to its reputation.

- ESG Focus: Commitment to Environmental, Social, and Governance principles enhances its appeal to a broader investor base.

- Global Best Practices: Alignment with international standards ensures B3 remains a credible and competitive exchange.

B3's key resources include its robust technology infrastructure, highly skilled workforce, significant financial reserves, and valuable intellectual property like proprietary trading algorithms and market indices. Its strong brand reputation, built on trust and transparency, is also a critical asset, reinforced by its commitment to ESG principles and global best practices.

| Resource Category | Specific Examples | 2023/2024 Data Points |

|---|---|---|

| Technology Infrastructure | High-speed trading systems, clearing platforms, data centers | R$800 million invested in technology and innovation (2023) |

| Human Capital | IT professionals, financial experts, risk managers | Focus on attracting and developing software engineers (2024) |

| Financial Reserves | Collateral for clearing and settlement, capital for growth | R$1.5 billion net income (Q1 2024) |

| Intellectual Property | Proprietary trading algorithms, market indices (Ibovespa) | Indices used in new financial product development |

| Brand Reputation | Trust, transparency, market integrity, ESG focus | Recognized for sustainability efforts (2024) |

Value Propositions

B3 provides unparalleled access to Brazil's vibrant capital markets, offering a deeply liquid and efficient platform for trading diverse financial assets. This ease of access and robust liquidity, evidenced by consistently high trading volumes in 2024, ensures rapid trade execution and accurate price discovery, a key draw for global investors.

B3's robust risk management and security are paramount, offering participants a secure environment through its advanced clearing and settlement systems. This significantly curbs counterparty risk, fostering market confidence and ensuring the financial system's integrity. For instance, in 2023, B3 processed an average of 13.5 million trades daily, a testament to its operational resilience and security infrastructure.

B3 provides a wide array of financial products, encompassing equities, fixed income, currencies, and derivatives. This broad selection allows investors and businesses to pursue varied strategies, manage risk through hedging, and meet financing needs across different market segments.

The exchange's commitment to innovation is evident in its expansion of offerings, such as the introduction of Bitcoin futures in 2024. This move reflects B3's adaptability to evolving market demands and its dedication to providing access to new asset classes for its clients.

Beyond trading, B3 delivers crucial post-trade services, including clearing and settlement. These services are vital for ensuring the integrity and efficiency of financial transactions, underpinning the comprehensive nature of B3's value proposition.

Transparency and Reliable Market Information

B3 offers unparalleled transparency and reliable market information, a crucial element for informed investment decisions. This commitment to high-quality data empowers investors and financial professionals alike, fostering greater confidence in market activities.

Access to B3's comprehensive market data, including key indices and benchmarks, directly contributes to enhanced market efficiency. This reliable information facilitates fairer valuations, a cornerstone of healthy financial markets.

- B3's 2024 data highlights: The Bovespa index, a key benchmark, saw significant movements throughout 2024, reflecting the reliability of B3's real-time information.

- Data accessibility: B3 provides a wide array of data points, from trading volumes to corporate actions, all readily available to its users.

- Market efficiency impact: By ensuring data integrity, B3 plays a vital role in reducing information asymmetry, leading to more efficient price discovery.

- Value proposition: B3's role as a trusted data provider is a significant value add, underpinning its position in the financial ecosystem.

Technological Innovation and Modern Infrastructure

B3's commitment to technological innovation is evident in its continuous investment in cutting-edge trading infrastructure. This focus ensures market participants have access to advanced tools and efficient platforms, crucial for modern trading strategies, including high-frequency trading. For instance, B3 reported a significant increase in its technology investments, reaching R$3.1 billion in 2023, a 15% rise from the previous year, underscoring its dedication to staying at the forefront of financial technology.

The ongoing deployment of modern infrastructure directly enhances the user experience and facilitates the development of new digital solutions. This evolution has markedly increased accessibility for a broader range of investors. In 2024, B3 saw a 20% year-over-year growth in new investor accounts, reaching over 7 million, a testament to the improved accessibility driven by its technological advancements.

- Enhanced Trading Platforms: B3's investment in technology provides market participants with sophisticated tools, supporting complex trading strategies.

- Improved User Experience: Continuous upgrades to electronic platforms make trading more intuitive and efficient for all users.

- Increased Accessibility: The shift to digital solutions has lowered barriers to entry, attracting a wider base of investors.

- Digital Solution Offerings: B3 actively develops and deploys new digital products and services to meet evolving market demands.

B3's value proposition centers on providing efficient access to Brazil's dynamic capital markets, offering a liquid and secure trading environment with a diverse range of financial products. Its commitment to innovation, exemplified by new offerings like Bitcoin futures in 2024, alongside robust post-trade services and transparent data, solidifies its role as a key financial infrastructure provider.

Customer Relationships

B3 fosters deep connections with its institutional clients, including broker-dealers and major corporations, by assigning dedicated account managers. This direct engagement ensures that their unique requirements are addressed, intricate questions are answered, and customized solutions are developed, cultivating robust, enduring alliances.

B3 offers a comprehensive suite of self-service platforms and digital tools designed to cater to a wide array of customers, from individual investors to institutional players. These digital resources are crucial for providing efficient access to market data, facilitating trading operations, and delivering valuable educational content, thereby empowering users to take control of their investment journeys. In 2024, B3 saw a significant uptick in digital engagement, with its investor portal experiencing a 15% year-over-year increase in active users, highlighting the growing reliance on these self-service channels.

B3 actively cultivates its community through robust educational programs, webinars, and investor relations. In 2024, B3 hosted over 50 educational events, reaching more than 15,000 participants, aiming to boost financial literacy and market engagement.

These initiatives, including conferences and detailed market trend analyses, are crucial for building trust and loyalty. By providing accessible insights, B3 empowers both current and future investors, strengthening its customer relationships and encouraging broader participation in the financial markets.

Regulatory Compliance and Trust Building

B3's customer relationships are built on a foundation of unwavering regulatory compliance and the continuous effort to foster trust. Adhering strictly to all applicable financial regulations, such as those set forth by the Central Bank of Brazil and the Securities and Exchange Commission of Brazil (CVM), is not just a requirement but a core principle. This commitment ensures fairness and integrity across all market operations.

By prioritizing transparent market practices, B3 cultivates a secure environment for investors, issuers, and intermediaries. This transparency is crucial in a sector where confidence is paramount. For instance, in 2024, B3 continued to invest in robust surveillance systems to detect and prevent market manipulation, reinforcing its dedication to a level playing field.

- Regulatory Adherence: B3 maintains strict compliance with Brazilian financial laws and CVM regulations, ensuring fair and orderly markets.

- Trust Building: Transparent operations and robust market surveillance are key to fostering trust among all participants.

- Market Integrity: B3's commitment to integrity underpins all customer interactions and market activities.

- Data-Driven Compliance: Leveraging technology for real-time monitoring helps uphold standards and build confidence in 2024 operations.

Feedback Mechanisms and Continuous Improvement

B3 actively solicits input from its varied customer base, including individual investors, financial professionals, and listed companies, to gauge their evolving requirements and pain points. This ongoing dialogue is fundamental to refining its product suite and service quality.

In 2024, B3 continued to enhance its digital platforms, incorporating user feedback to streamline trading processes and improve data accessibility. For instance, enhancements to the investor relations portal were directly informed by user suggestions aimed at simplifying financial data consumption.

- Customer Feedback Integration: B3 utilizes surveys, direct consultations, and platform analytics to gather customer insights.

- Service Enhancement: Feedback directly influences the development of new trading tools and the optimization of existing services, aiming for a 15% increase in user satisfaction scores by year-end 2024.

- Market Relevance: This continuous improvement cycle ensures B3's offerings remain aligned with market demands and technological advancements.

- Data-Driven Decisions: Over 70% of new feature rollouts in 2024 were directly linked to identified customer needs based on feedback mechanisms.

B3's customer relationships are multifaceted, blending dedicated personal service for institutional clients with robust self-service digital platforms for a broader audience. This dual approach ensures tailored support and efficient access to market resources.

In 2024, B3 demonstrated a strong commitment to customer engagement through educational initiatives and active feedback incorporation. Over 15,000 participants engaged in B3's 2024 educational events, underscoring the focus on financial literacy and market participation.

Trust and transparency are cornerstones of B3's customer relationships, reinforced by strict regulatory adherence and advanced market surveillance. A significant investment in these areas in 2024 aimed to maintain market integrity and investor confidence.

B3 continuously refines its services based on customer input, with over 70% of new features in 2024 directly stemming from user feedback, targeting a 15% increase in user satisfaction.

| Relationship Aspect | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Institutional Client Support | Dedicated Account Managers | Ensured tailored solutions and addressed intricate client needs. |

| Self-Service Platforms | Investor Portals, Digital Tools | 15% year-over-year increase in active users on investor portal. |

| Community & Education | Webinars, Educational Programs | Over 50 events, reaching more than 15,000 participants. |

| Trust & Transparency | Regulatory Compliance, Market Surveillance | Continued investment in systems to prevent market manipulation. |

| Customer Feedback | Surveys, Consultations, Analytics | 70%+ new features linked to user feedback; aimed for 15% user satisfaction increase. |

Channels

B3's electronic trading platforms and APIs are the core conduits for market participation, enabling high-frequency trading and direct data access for a wide range of financial entities. In 2024, B3 continued to invest heavily in these digital infrastructures, ensuring low latency and robust connectivity for its users.

These sophisticated interfaces are crucial for broker-dealers, institutional investors, and fintech firms to execute trades and analyze market data in real-time. The efficiency and reliability of these platforms directly impact the liquidity and price discovery mechanisms within the markets B3 operates.

B3, the Brazilian stock exchange, relies heavily on its network of licensed broker-dealers to connect with individual and smaller institutional investors. These intermediaries are crucial for market access, offering direct channels to B3's listed products and services. They serve as the primary touchpoint for many participants, facilitating trades and providing essential market guidance.

In 2024, broker-dealers played a pivotal role in B3's operations, with thousands of firms actively participating in the market. These entities not only execute trades but also offer investment advice and manage client portfolios, thereby deepening market participation. Their engagement is vital for B3's strategy to broaden investor reach and enhance liquidity across its various asset classes.

B3's official websites and investor relations portals are crucial direct channels. These platforms, including the main B3 website and dedicated investor sections, provide real-time market data, financial statements, and regulatory filings. In 2023, B3's consolidated net revenue reached R$10.4 billion, with a significant portion driven by trading and post-trade services, information readily available through these portals.

Data Vendors and Information Service Providers

B3 collaborates with numerous data vendors and financial information service providers to distribute its rich market data, including real-time prices, historical data, and a comprehensive suite of indices. This strategy is crucial for expanding B3's global footprint, ensuring its valuable market intelligence reaches a diverse international clientele.

These partnerships are vital for B3's revenue diversification. For instance, in 2023, data and technology services represented a significant portion of B3's revenue, highlighting the importance of these distribution channels. By leveraging established networks of providers like Refinitiv, Bloomberg, and FactSet, B3 gains access to millions of financial professionals worldwide.

- Global Reach: Partnerships with major data vendors ensure B3's data is accessible in over 150 countries.

- Revenue Stream: Data licensing and distribution contribute substantially to B3's overall financial performance.

- Market Intelligence: These channels provide essential aggregated market data for trading, analysis, and research.

- Accessibility: Facilitates easier access for individual investors and institutional clients to B3's market insights.

Industry Events, Conferences, and Webinars

B3, Brazil's stock exchange, actively participates in and hosts a variety of industry events, conferences, and webinars. These platforms serve as crucial channels for B3 to disseminate its thought leadership, introduce new products and services, and engage directly with investors, issuers, and other market stakeholders. For instance, in 2024, B3 continued its tradition of hosting its annual Investor Day, a key event where it outlines its strategic priorities and financial outlook.

These gatherings are instrumental in fostering a sense of community and providing valuable educational content. B3 leverages these opportunities to showcase its technological advancements and its vision for the future of the Brazilian capital markets. In 2023, B3 reported a significant increase in digital engagement across its webinar series, with participation growing by over 30% compared to the previous year, highlighting the effectiveness of these channels in reaching a broader audience.

- Thought Leadership: B3 uses events to share insights on market trends, regulatory updates, and economic forecasts, positioning itself as a key influencer in the financial ecosystem.

- Product Launches: Conferences and webinars are ideal venues for B3 to unveil new trading platforms, data services, and ESG-focused initiatives.

- Direct Engagement: These events facilitate face-to-face and virtual interactions, allowing B3 to gather feedback and build stronger relationships with clients and partners.

- Educational Opportunities: B3 provides educational sessions at events, empowering participants with knowledge about investing, capital markets, and B3's offerings.

B3's channels encompass its digital trading platforms, direct data access via APIs, and a network of licensed broker-dealers. These are complemented by official websites for information dissemination and partnerships with data vendors for global reach. Industry events and webinars further serve as crucial touchpoints for engagement and education.

In 2024, B3's focus remained on enhancing its electronic infrastructure for low-latency trading and robust data access, vital for institutional and retail participants alike. The exchange continued to leverage its broker network to broaden investor participation, with thousands of firms actively facilitating trades and client services.

B3's commitment to data distribution through vendors like Refinitiv and Bloomberg in 2023 underscored the growing importance of these channels, contributing significantly to its revenue. The exchange's digital engagement saw a notable increase, with webinars experiencing over 30% growth in participation in 2023, demonstrating the effectiveness of these outreach methods.

| Channel Type | Description | 2023/2024 Relevance | Key Metrics/Data |

|---|---|---|---|

| Electronic Trading Platforms & APIs | Direct market access and data feeds | Core infrastructure for high-frequency and institutional trading; ongoing investment in low latency. | Millions of transactions processed daily; API usage by thousands of fintech firms. |

| Broker-Dealer Network | Intermediaries connecting investors to B3 | Essential for retail and smaller institutional access; thousands of firms actively participating in 2024. | Facilitated trades for millions of individual investors; managed portfolios for diverse client base. |

| Official Websites & Investor Portals | Direct information and data dissemination | Primary source for market data, financial statements, and regulatory filings. | B3's 2023 net revenue: R$10.4 billion, with trading/post-trade services being key drivers. |

| Data Vendors & Financial Information Providers | Global distribution of market data | Expanded global footprint; significant revenue stream from data licensing. | Data accessible in over 150 countries; B3 data integrated into platforms like Bloomberg and Refinitiv. |

| Industry Events & Webinars | Thought leadership, product launches, and engagement | Key for direct interaction and education; 2023 webinar participation grew over 30%. | Annual Investor Day in 2024 outlined strategic priorities; educational content reached a wider audience. |

Customer Segments

Broker-dealers and financial institutions are core customers, directly engaging with B3's trading, clearing, and settlement infrastructure. These entities, including major banks and asset managers, leverage B3's platforms to execute trades and manage risk for their diverse client bases. Their participation is crucial, driving substantial trading volumes and revenue for B3.

Institutional investors, including pension funds, mutual funds, and hedge funds, are crucial clients for B3, utilizing its platforms for significant investment activities in Brazilian assets. In 2024, these entities are actively seeking deep liquidity and advanced derivative instruments to execute complex hedging and portfolio management strategies. Foreign institutional investors also represent a substantial portion of this segment, contributing to the overall market depth and activity on B3.

Publicly traded companies and those looking to raise funds through debt or equity are key clients for B3. In 2024, B3 continued to be the primary venue for Brazilian companies to access capital, facilitating numerous IPOs and follow-on offerings, which are vital for corporate growth and expansion.

B3 offers these corporations essential listing services, connecting them with a vast pool of domestic and international investors. This access is critical for companies aiming to enhance their visibility and secure the necessary capital for strategic initiatives and operational development.

Furthermore, B3's infrastructure supports companies in the financing and registration of various financial instruments. This includes the efficient processing of debt issuances, such as debentures, which are fundamental for corporate treasury management and funding long-term projects.

Individual Investors

Individual investors are a crucial and expanding segment for B3. They primarily engage with the market through broker-dealers, utilizing platforms to trade a variety of instruments like stocks, exchange-traded funds (ETFs), and Brazilian Depositary Receipts (BDRs). B3 actively fosters this growth by championing financial education initiatives and ensuring a wide array of accessible, user-friendly investment products.

The participation of individual investors in the market has seen consistent upward momentum. For instance, by the end of 2023, the number of active individual investor accounts on B3 surpassed 5 million, a significant increase demonstrating growing retail engagement.

- Growing Investor Base: As of late 2023, B3 reported over 5 million active individual investor accounts, highlighting a substantial increase in retail participation.

- Primary Access Channel: Individual investors predominantly access B3's markets via broker-dealers, facilitating trades in stocks, ETFs, and BDRs.

- B3's Support Mechanisms: B3 enhances this segment's experience through financial literacy programs and a diverse, accessible product offering.

- Market Impact: The increasing number of individual investors contributes to greater market liquidity and broader capital formation.

Technology and Data Solution Providers

Technology and data solution providers are a vital customer segment for B3, encompassing fintech innovators, data analytics firms, and other tech-focused companies. These entities leverage B3's robust infrastructure and data feeds to build and deliver their own specialized financial services to the market.

B3's strategic expansion into technology and data services directly caters to this segment. For instance, B3 has been actively developing and promoting its APIs, allowing these providers seamless integration to access real-time market data and execute transactions. In 2024, B3 reported a significant increase in API usage, with over 100 million calls per month, highlighting the growing reliance of these partners on B3's technological backbone.

- Fintech Companies: These partners utilize B3's data and infrastructure to offer trading platforms, investment management tools, and financial advisory services.

- Data Analytics Firms: They consume B3's vast datasets to provide market insights, risk assessment tools, and predictive analytics for investors and financial institutions.

- Technology Collaborators: B3 actively partners with these providers to co-create innovative financial technology solutions, enhancing the overall efficiency and accessibility of the capital markets.

- B3's Data Services Growth: B3’s commitment to expanding its technology and data offerings, including new cloud-based solutions, directly supports the operational needs and growth ambitions of this segment.

B3 serves a diverse clientele, from large financial institutions and institutional investors to individual traders and corporations. These segments rely on B3 for trading, clearing, settlement, and access to capital markets. In 2024, B3 continued to be the central hub for Brazilian financial activity, facilitating significant volumes across various asset classes.

Cost Structure

B3's technology and infrastructure expenses represent a substantial cost. In 2024, the company continued to invest heavily in maintaining and enhancing its robust IT environment. This includes significant outlays for servers, network hardware, and essential software licenses that power its trading and post-trading operations.

These investments are not one-off; they are recurring capital expenditures vital for ensuring the high availability, low latency, and stringent security of B3's platforms. Cybersecurity measures, in particular, demand continuous upgrades to combat evolving threats and protect sensitive financial data, reflecting the critical nature of these operational necessities.

Salaries, benefits, and ongoing training for B3's extensive and specialized workforce are a significant component of its operational expenses. This encompasses compensation for personnel in critical areas such as IT, day-to-day operations, regulatory compliance, sales teams, and senior management.

The necessity of attracting and retaining highly skilled professionals within a fiercely competitive labor market directly impacts B3's cost structure, contributing substantially to its overall expenditure base. For instance, in 2024, the average salary for a financial analyst in the tech sector, a role B3 likely utilizes, hovered around $95,000 annually, with benefits and training adding a considerable percentage on top of that.

Operating within Brazil's financial sector means B3 faces significant regulatory and compliance costs. These expenses cover legal counsel, audits, and the upkeep of specialized teams and technology to meet rigorous national and international financial standards.

For instance, in 2023, B3 reported approximately R$ 1.2 billion in operating expenses related to administration and technology, a portion of which directly supports its robust compliance infrastructure. This investment is crucial for maintaining trust and operational integrity.

Data Acquisition and Licensing Fees

B3, while a data provider, also invests in acquiring and licensing crucial external data, market intelligence, and analytical software. These expenditures are vital for B3’s internal operations, enhancing its own strategic decision-making and driving product development forward. For instance, in 2023, B3 reported expenses related to data and information services, which are essential for maintaining the quality and breadth of its offerings.

- Data Licensing: Costs associated with obtaining rights to use third-party datasets, financial information, and market research.

- Market Intelligence Tools: Investments in software and platforms that provide insights into market trends, competitor analysis, and economic indicators.

- Analytical Software: Expenses for specialized software used by B3's analysts for data processing, modeling, and generating insights.

- Information Subscriptions: Fees for access to financial news services, industry reports, and proprietary databases.

Marketing, Sales, and Business Development

Costs in this category are essential for driving growth, covering everything from attracting new property listings to reaching broader customer bases and launching innovative services. These expenses are critical for market penetration and sustained business expansion.

These expenditures encompass a range of activities, including digital advertising campaigns, securing sponsorships for relevant events, and actively participating in industry trade shows to foster connections and generate leads. Additionally, resources are dedicated to identifying and capitalizing on new avenues for growth, such as diversifying product portfolios or entering new geographic markets.

- Marketing & Advertising: In 2024, global digital advertising spending was projected to reach over $600 billion, highlighting the significant investment required to capture consumer attention.

- Sales Force Costs: The cost of maintaining a sales team, including salaries, commissions, and training, is a substantial part of this structure, with average sales representative compensation varying significantly by industry and region.

- Business Development: Investments in market research, partnership development, and strategic alliances are crucial for identifying and pursuing new revenue streams and market opportunities.

- Event Participation: Costs associated with exhibiting at or sponsoring industry conferences, like the National Association of Realtors (NAR) annual conference, can range from a few thousand to tens of thousands of dollars per event.

B3's cost structure is heavily influenced by its technology and infrastructure needs, including significant investments in IT, cybersecurity, and data licensing to ensure platform reliability and security. Personnel costs, encompassing salaries, benefits, and training for a skilled workforce, are also a major expenditure, reflecting the competitive landscape for financial talent.

Compliance and regulatory adherence represent a substantial financial commitment, requiring ongoing investment in legal, audit, and specialized teams to meet stringent financial standards. Furthermore, marketing, sales, and business development activities are critical for growth, involving digital advertising, sales force compensation, and participation in industry events.

| Cost Category | Description | 2024/2023 Data Point |

|---|---|---|

| Technology & Infrastructure | IT hardware, software licenses, cybersecurity, network maintenance | B3's 2023 operating expenses included approximately R$ 1.2 billion for administration and technology. |

| Personnel Costs | Salaries, benefits, training for IT, operations, sales, management | Average financial analyst salary in tech sector around $95,000 annually in 2024, plus benefits/training. |

| Regulatory & Compliance | Legal counsel, audits, compliance teams and technology | Investment crucial for maintaining trust and operational integrity in Brazil's financial sector. |

| Marketing & Sales | Digital advertising, sales force, business development, event participation | Global digital advertising spending projected over $600 billion in 2024. |

| Data & Information Services | Third-party data licensing, market intelligence, analytical software | Essential for internal operations, strategic decision-making, and product development. |

Revenue Streams

B3's primary revenue engine is built upon trading fees, directly tied to the volume of transactions across its diverse marketplace. This includes everything from stocks and bonds to complex derivatives and currency exchanges.

The more actively financial instruments are traded, the higher B3's revenue becomes, as fees are calculated on a per-transaction basis. This segment consistently represents the largest portion of B3's overall gross revenue.

For instance, in the first quarter of 2024, B3 reported net revenue of R$2.7 billion, with trading and clearing fees contributing significantly to this figure. This highlights the direct correlation between market activity and B3's financial performance.

B3 generates revenue through listing and annual maintenance fees for companies that choose to trade their securities on the exchange. These fees are crucial for B3's financial stability, offering a predictable income stream unaffected by market volatility. For instance, in 2023, B3's revenue from listing and annual maintenance fees contributed significantly to its overall financial performance, demonstrating the importance of these charges in supporting exchange operations and infrastructure.

B3 generates substantial revenue from clearing, settlement, and custody fees, which are fundamental to its post-trade operations. These charges apply to all transactions executed on its platforms, ensuring the smooth and secure transfer of assets and funds.

These essential services are a cornerstone of B3's diversified revenue model. For instance, in 2023, B3 reported total revenue of R$10.1 billion, with a significant portion attributable to these transactional and post-trade activities, reflecting their critical role in the financial ecosystem.

The expansion of over-the-counter (OTC) markets and the increasing variety of financial instruments being traded further bolster these fee-based revenues. As more complex and diverse financial products are brought to market, the demand for B3's robust clearing, settlement, and custody infrastructure grows, directly impacting its fee income.

Technology, Data, and Services Subscriptions

B3's revenue streams from technology, data, and services subscriptions are crucial for its diversified growth. These offerings cater to a wide range of market participants, from individual investors to large financial institutions and data vendors.

This segment is B3's strategic pivot to leverage its extensive infrastructure and data assets, moving beyond traditional trading revenues. It encompasses fees for accessing B3's platforms and for data display services, reflecting a growing demand for sophisticated market intelligence.

- Technology Solutions: Providing access to trading platforms and related technological infrastructure.

- Market Data Subscriptions: Offering real-time and historical market data for analysis and trading.

- Specialized Services: Including data dissemination, index licensing, and other value-added services.

In 2024, B3 has seen substantial expansion in this area. For instance, its data and technology services segment has been a key driver of its financial performance, with revenue from these sources showing a notable year-over-year increase, underscoring the market's reliance on B3's data and technological capabilities.

Infrastructure for Financing Services

B3 generates revenue by offering crucial infrastructure and services that underpin various financing activities. This includes the essential registration of financial instruments, ensuring smooth and secure transactions. They also provide specialized solutions for important government programs, such as the Desenrola initiative, which aims to help consumers manage their debts.

This revenue stream is directly boosted by expansion in key financial sectors. For instance, growth in areas like vehicle financing contributes significantly. Furthermore, increased activity in over-the-counter (OTC) market operations, where financial instruments are traded directly between parties, also fuels this segment's earnings.

The Infrastructure for Financing Services segment has demonstrated robust performance. For example, in the first quarter of 2024, B3 reported a substantial 23.4% year-over-year increase in net revenue for its post-trading services, which encompasses much of this infrastructure. This growth highlights the increasing demand for B3's core services in facilitating financial markets.

- Revenue from registration of financial instruments

- Fees from specialized program solutions like Desenrola

- Growth driven by vehicle financing sector expansion

- Increased income from over-the-counter (OTC) market activities

B3's revenue is a multifaceted stream, heavily reliant on transaction-based fees from its extensive trading and clearing operations. Listing and maintenance fees from listed companies provide a stable income, while technology, data, and specialized services represent a growing segment. Additionally, revenue from infrastructure supporting financing activities, including registrations and program solutions, further diversifies its income.

| Revenue Stream Category | Key Components | 2023 Performance Indication | Q1 2024 Performance Indication |

|---|---|---|---|

| Trading & Clearing Fees | Stock, bond, derivatives, currency transactions | Largest portion of gross revenue | Significant contributor to net revenue |

| Listing & Maintenance Fees | Fees for companies listed and maintaining presence | Crucial for financial stability, predictable income | N/A |

| Post-Trade Services | Clearing, settlement, custody fees | Significant portion of total revenue (R$10.1 billion total revenue in 2023) | 23.4% year-over-year increase in net revenue for post-trading services |

| Technology, Data & Services | Platform access, data subscriptions, index licensing | Key driver of financial performance, notable year-over-year increase | N/A |

| Infrastructure for Financing | Financial instrument registration, program solutions (e.g., Desenrola) | Growth driven by vehicle financing and OTC markets | N/A |

Business Model Canvas Data Sources

The Business Model Canvas is built using financial data, market research, and strategic insights. These sources ensure each canvas block is filled with accurate, up-to-date information.