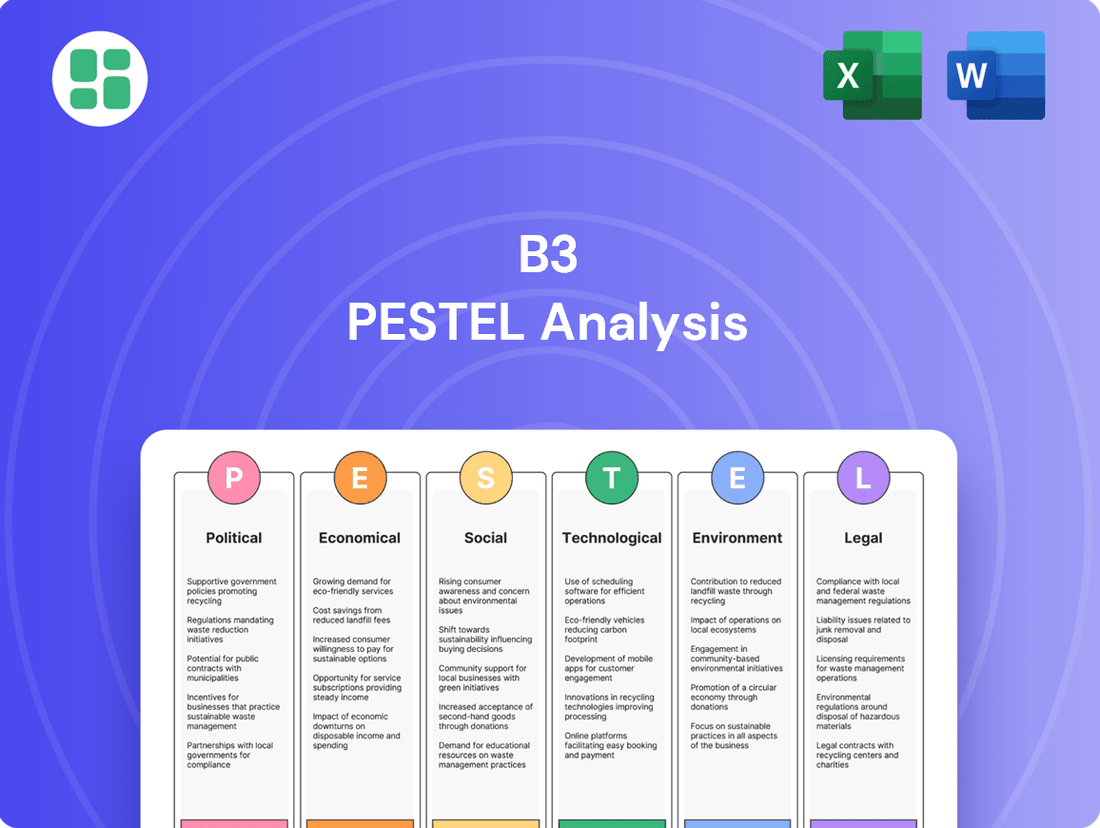

B3 PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B3 Bundle

Unlock critical insights into the external forces shaping B3's trajectory. Our comprehensive PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that could impact its future. Gain a strategic advantage by understanding these dynamics. Purchase the full analysis now to equip yourself with the intelligence needed for informed decision-making and to stay ahead of the curve.

Political factors

Brazil's political stability is a key determinant of investor confidence. The current administration's fiscal policies and approach to managing public debt are under scrutiny, with any perceived instability potentially leading to market volatility on B3. For instance, concerns over fiscal discipline can impact currency exchange rates and interest rates, directly affecting B3's performance.

The Brazilian Securities and Exchange Commission (CVM) is actively shaping the capital market landscape. For 2025, its regulatory agenda is a key determinant of B3's future. Recent CVM initiatives, like those proposed to simplify market entry for smaller businesses, are designed to foster growth and can significantly influence B3's listing volumes.

Anticipated reforms targeting debentures and Private Equity Investment Funds are also crucial. These updates aim to streamline processes and attract more investment, potentially boosting B3's trading activity and the diversity of financial instruments available on its platform. The CVM's focus on reducing regulatory burdens is expected to stimulate broader market participation.

Global economic uncertainties, including potential shifts in major economies' interest rates and protectionist trade policies, can have a ripple effect on Brazil's financial markets. For instance, the US Federal Reserve's interest rate decisions in 2024 directly impacted emerging market capital flows, with higher rates in developed economies often drawing investment away from countries like Brazil. This can lead to increased volatility on B3.

As the primary stock exchange, B3 is exposed to these external dynamics, which can influence foreign investment flows into Brazil and the stability of the Brazilian Real. In early 2025, for example, concerns over trade disputes between major global players led to a depreciation of the Real against the US Dollar, affecting the cost of imported goods and the repatriation of profits for foreign investors on B3.

Geopolitical tensions can heighten market risk perception, directly impacting B3's performance. For example, increased tensions in Eastern Europe during 2024 led to a global flight to safety, causing a temporary dip in emerging market equities, including those traded on B3, as investors sought more stable assets.

Fiscal Policy and Public Debt Management

Brazil's fiscal health remains a key concern, with public debt hovering around 78% of GDP in 2024. This substantial debt burden necessitates careful fiscal policy and debt management by the government.

The government's decisions regarding spending, taxation, and borrowing directly influence interest rates and the Brazilian Real's value. These economic conditions are vital for B3's operational environment, affecting everything from trading volumes to investor confidence.

- Public Debt: Approximately 78% of GDP in 2024.

- Fiscal Policy Impact: Influences interest rates and currency valuation.

- Market Stability: Directly tied to government's fiscal management.

- Operational Context for B3: Shaped by the broader economic environment created by fiscal policy.

Corruption and Governance Standards

While not always a direct daily impact, the perception of corruption and the strength of governance standards within Brazil's political system can deeply affect investor trust and the integrity of the financial markets. B3, as Brazil's stock exchange, plays a crucial role in this by promoting high standards of corporate governance among its listed companies. A strong governance framework is vital for attracting and retaining both domestic and international capital, directly impacting B3's market liquidity and valuation.

For instance, Brazil's ranking in Transparency International's Corruption Perception Index (CPI) provides a barometer for governance quality. While Brazil's CPI score has seen fluctuations, maintaining or improving this score is critical for investor confidence. In 2023, Brazil scored 36 out of 100, ranking 104th out of 180 countries surveyed, indicating ongoing challenges but also areas for potential improvement that directly influence foreign direct investment and the overall economic climate B3 operates within.

- Investor Confidence: Perceived corruption can deter foreign investment, impacting capital flows into Brazilian companies listed on B3.

- Market Integrity: Strong governance standards on B3 ensure fair trading practices and protect investors, bolstering market integrity.

- Regulatory Environment: Political stability and effective governance contribute to a predictable regulatory environment, which is crucial for B3's operations and growth.

- Capital Attraction: Countries with robust governance and lower corruption perceptions tend to attract more foreign direct investment, benefiting B3's listed companies.

Brazil's political landscape directly shapes the environment for B3. Government fiscal policies, particularly concerning public debt management, are under constant observation. For instance, in 2024, Brazil's public debt stood at approximately 78% of GDP, a figure that necessitates careful fiscal management. Any perceived instability in these policies can lead to currency fluctuations and affect interest rates, impacting B3's performance.

The regulatory framework, spearheaded by the CVM, is pivotal for B3's evolution. For 2025, the CVM's agenda, focusing on initiatives like simplifying market access for smaller firms and reforming debenture regulations, is expected to boost listing volumes and the diversity of financial instruments. These efforts aim to reduce regulatory burdens and encourage broader market participation.

Global political and economic shifts also cast a long shadow. In 2024, interest rate decisions by major economies like the US Federal Reserve influenced capital flows into emerging markets, including Brazil. Geopolitical tensions can further heighten risk perception, leading to market volatility on B3 as investors seek safer havens.

Governance and corruption perception are also key political factors influencing B3. Brazil's 2023 Corruption Perception Index score of 36 out of 100, ranking 104th globally, highlights the importance of strong governance for investor confidence. Improved governance standards are crucial for attracting foreign investment and ensuring market integrity on B3.

| Factor | 2024/2025 Relevance | Impact on B3 |

|---|---|---|

| Fiscal Policy | Public debt ~78% of GDP (2024) | Influences interest rates, currency, investor confidence |

| Regulatory Environment | CVM agenda for 2025 (market simplification, debenture reform) | Affects listing volumes, instrument diversity, market participation |

| Governance & Corruption | CPI Score 36/100 (2023) | Impacts investor trust, foreign investment, market integrity |

| Global Geopolitics | Interest rate shifts, trade tensions | Affects capital flows, market volatility, currency stability |

What is included in the product

The B3 PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the B3 across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This analysis offers forward-looking insights and data-backed evaluations to help stakeholders identify opportunities and threats for strategic planning.

Provides a clear, actionable framework by dissecting complex external factors into manageable Political, Economic, Social, Technological, Legal, and Environmental components, easing the burden of comprehensive market understanding.

Economic factors

Brazil's economy demonstrated robust growth, expanding by 3.4% in 2024. This upward trend is crucial for B3, as it typically correlates with increased trading volumes and overall market activity.

Looking ahead, a slight slowdown is projected for 2025, with growth expected to moderate. Nevertheless, the sustained recovery from previous periods fuels corporate expansion and bolsters investor confidence, directly benefiting B3's infrastructure.

Brazil's inflation trajectory and the Central Bank's response through monetary policy, specifically the Selic rate, are critical economic factors for B3. As of late 2024, inflation has shown signs of moderation, but remains a key concern for policymakers. The Central Bank's decisions on the Selic rate directly impact borrowing costs across the economy.

The Selic rate, which stood at 10.50% per annum as of early May 2024, influences the cost of capital for businesses and individuals. Higher interest rates can make fixed-income investments more appealing than equities, potentially shifting investor sentiment and affecting trading volumes on B3. This dynamic is crucial for understanding the attractiveness of B3's various financial instruments.

Fluctuations in the Brazilian Real's value against the USD, often driven by fiscal concerns and global economic shifts, directly impact foreign investor returns on the B3 exchange. For instance, in early 2024, the Real experienced periods of depreciation against the dollar, making investments denominated in BRL less attractive to dollar-based investors due to the currency conversion loss.

This currency volatility can significantly deter international capital inflows. When the Real weakens, the purchasing power of foreign currency decreases, potentially reducing the overall profitability of Brazilian assets for overseas investors. This apprehension can lead to lower trading volumes on the B3 and diminish its attractiveness as a prime destination for foreign direct investment and portfolio allocations.

Foreign Investment Inflows/Outflows

Foreign investment plays a pivotal role in shaping the Brazilian stock market's dynamics, directly impacting B3's performance. In early 2025, Brazil witnessed a notable surge in foreign capital, reversing a prior trend of outflows and injecting optimism into the market.

This influx of foreign funds is instrumental in bolstering market liquidity, providing essential support for asset valuations, and ultimately contributing to B3's robust business performance. For instance, during the first quarter of 2025, foreign investors were net buyers of approximately R$25 billion in Brazilian equities, a significant shift from the R$10 billion net outflow observed in the same period of 2024.

- Increased Liquidity: Higher foreign participation typically translates to more active trading and a deeper pool of buyers and sellers.

- Asset Price Support: Inflows often drive demand for equities, leading to upward pressure on stock prices.

- Economic Confidence Indicator: Strong foreign investment can signal growing international confidence in Brazil's economic outlook and market stability.

- Capital for Growth: Foreign capital provides crucial funding for Brazilian companies, enabling expansion and innovation.

Commodity Price Fluctuations

Brazil's economy is heavily influenced by global commodity prices, given its status as a major producer and exporter. Fluctuations in these prices directly impact the financial health of numerous B3-listed companies, shaping investor sentiment and trading volumes across diverse industries.

For instance, in early 2024, the price of iron ore, a key Brazilian export, saw volatility. While prices generally remained robust, influenced by demand from China and global supply chain adjustments, any significant downturn could directly affect the earnings of major mining companies like Vale, a prominent B3 constituent.

- Iron Ore Prices: Averaged around $130-$140 per tonne in early 2024, showing resilience despite some global economic uncertainties.

- Soybean Prices: Remained strong, supported by robust demand from Asia, benefiting Brazil's agricultural sector and related B3 companies.

- Oil Prices: Global oil price movements, influenced by geopolitical events and OPEC+ decisions, directly impact Petrobras, Brazil's state-owned oil giant, and its share performance on B3.

Brazil's economic growth is projected to moderate in 2025 after a strong 2024, impacting B3's trading volumes. Inflation remains a key concern, with the Central Bank's Selic rate decisions, currently at 10.50% as of May 2024, influencing borrowing costs and investor preferences between fixed income and equities.

The Brazilian Real's volatility against the USD in early 2024 affected foreign investor returns, potentially deterring capital inflows. However, early 2025 saw a significant reversal with foreign investors becoming net buyers of R$25 billion in Brazilian equities, boosting liquidity and asset prices.

Global commodity prices, particularly iron ore and soybeans, remained strong in early 2024, benefiting key B3-listed companies like Vale and the agricultural sector. Oil prices also influenced Petrobras' performance on the exchange.

| Economic Factor | 2024 Data/Trend | 2025 Projection/Trend | Impact on B3 |

|---|---|---|---|

| GDP Growth | 3.4% (2024) | Moderating growth | Influences trading volumes and market activity |

| Inflation | Moderating but a concern | Key policy focus | Affects Central Bank's monetary policy and Selic rate |

| Selic Rate | 10.50% (May 2024) | Subject to inflation trends | Impacts cost of capital and investment attractiveness |

| BRL/USD Exchange Rate | Periods of depreciation (early 2024) | Continued volatility expected | Affects foreign investor returns and capital inflows |

| Foreign Investment | Net outflow (Q1 2024: R$10bn) | Net inflow (Q1 2025: R$25bn) | Boosts liquidity, asset prices, and market confidence |

| Commodity Prices | Robust (Iron Ore, Soybeans) | Continued demand support | Impacts earnings of major listed companies (e.g., Vale, Petrobras) |

Same Document Delivered

B3 PESTLE Analysis

The preview shown here is the exact B3 PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting B3. It will be delivered exactly as shown, no surprises.

The content and structure of this comprehensive B3 PESTLE Analysis shown in the preview is the same document you’ll download after payment, providing you with immediate actionable insights.

Sociological factors

Brazil's population is projected to reach approximately 218 million by 2025, with a notable shift towards an aging populace. This demographic evolution, coupled with ongoing efforts to broaden financial inclusion, is expected to expand the pool of potential retail investors. For instance, initiatives like the Pix instant payment system have facilitated greater access to financial services, potentially drawing more Brazilians into the investment ecosystem.

Changes in wealth distribution are also critical. While Brazil has historically faced significant income inequality, recent trends suggest a growing middle class with increasing disposable income. This segment represents a key opportunity for B3, as these individuals are more likely to seek investment avenues beyond traditional savings accounts, thereby influencing B3's customer acquisition and product development strategies.

The level of financial literacy in Brazil is a significant driver for market participation. A higher degree of financial understanding among the population directly correlates with more informed investment choices, which in turn deepens the overall market.

B3, the Brazilian stock exchange, plays a crucial role by actively promoting investor education. These initiatives are essential for nurturing a more diverse and knowledgeable investor community, thereby increasing the sophistication and liquidity of the market.

Data from 2023 indicated that while financial literacy is growing, a substantial portion of Brazilians still require further education to confidently engage with investment products. B3's programs aim to bridge this gap, fostering greater confidence and participation in the capital markets.

Consumer confidence is a significant driver for B3-listed companies. In late 2024, Brazil's FGV Consumer Confidence Index showed a notable uptick, indicating a more optimistic outlook among households. This improved sentiment often translates into increased discretionary spending, directly boosting sales for sectors like retail and services, thereby influencing company revenues and stock performance.

Labor Market Trends and Employment

A robust labor market, marked by low unemployment and rising real wages, directly fuels consumer spending and investment capacity. For instance, in the US, unemployment stood at a historically low 3.9% in April 2024, with average hourly earnings increasing by 3.9% year-over-year in the same month, indicating a healthy environment for increased disposable income and savings.

This increased financial capacity translates to a greater propensity for individuals to engage with financial markets, whether through direct investments, savings accounts, or demand for financial advisory services. Such a trend would indirectly benefit B3 by broadening its customer base and increasing the overall volume of transactions and assets under management.

- Low Unemployment: A strong labor market typically sees unemployment rates below 4%, signifying ample job opportunities and economic stability.

- Real Income Growth: When wages outpace inflation, individuals have more purchasing power, boosting savings and investment potential.

- Increased Disposable Income: Higher real incomes lead to more money available for discretionary spending and financial planning, benefiting sectors like B3.

- Consumer Confidence: A healthy job market often correlates with higher consumer confidence, encouraging greater participation in financial markets.

Social Equity and ESG Investing Trends

Societal expectations are increasingly steering investment towards companies demonstrating strong Environmental, Social, and Governance (ESG) principles. This isn't just a niche interest anymore; it's a mainstream movement influencing capital allocation. For instance, the global ESG assets under management were projected to reach $50 trillion by 2025, showcasing the immense financial power behind this trend.

B3, the Brazilian stock exchange, is keenly aware of this shift and is actively fostering ESG integration. They are developing specific indices, like the ISE B3 (Corporate Sustainability Index), to highlight companies with superior sustainability performance. In 2023, the ISE B3 portfolio companies collectively achieved a 15% higher ESG score on average compared to the broader B3 index, demonstrating tangible differences.

This societal push for responsible investing directly shapes B3's strategic direction. The exchange is investing in educational programs and tools to help market participants understand and implement ESG criteria. This includes offering ESG-related training and data services, which in turn influences the types of financial products and services B3 develops and promotes to meet investor demand for sustainable options.

- Growing ESG Investment: Global ESG assets are on track to exceed $50 trillion by 2025, indicating a significant capital shift.

- B3's ESG Initiatives: The ISE B3 index showcases companies with strong sustainability, with its constituents outperforming broader market ESG scores by 15% in 2023.

- Market Influence: Societal demand for responsible investing directly impacts B3's product development and service offerings.

- Education and Data: B3 is enhancing market understanding through ESG training and data provision to facilitate sustainable finance.

Societal shifts toward greater financial inclusion and evolving wealth distribution are key drivers for B3. Brazil's population growth, projected to reach around 218 million by 2025, coupled with expanding access to financial services like Pix, is broadening the investor base. A growing middle class with increased disposable income presents significant opportunities for B3 to attract new retail investors.

Financial literacy remains a crucial factor, directly impacting market participation and investment sophistication. B3's commitment to investor education aims to bridge knowledge gaps, fostering greater confidence and deeper engagement with capital markets.

Consumer confidence, influenced by labor market strength and rising real wages, directly fuels spending and investment capacity. A strong job market, with low unemployment and wage growth, encourages greater participation in financial markets, benefiting B3 through increased transaction volumes and assets under management.

Societal expectations are increasingly prioritizing Environmental, Social, and Governance (ESG) principles in investment decisions. Global ESG assets are projected to exceed $50 trillion by 2025, highlighting a significant capital shift towards sustainable investing. B3 actively promotes ESG integration through initiatives like the ISE B3 index, which in 2023 saw its constituent companies achieve, on average, 15% higher ESG scores than the broader B3 index.

| Sociological Factor | 2024/2025 Projection/Data | Impact on B3 |

|---|---|---|

| Population Growth | Est. 218 million by 2025 | Expands potential investor pool |

| Financial Inclusion Initiatives | Pix adoption expanding | Increases access to financial services |

| Middle Class Growth | Growing disposable income | Drives demand for investment products |

| Financial Literacy | Ongoing educational focus | Enhances market sophistication and participation |

| Consumer Confidence | Uptick in late 2024 (FGV Index) | Boosts discretionary spending and investment capacity |

| ESG Investment Trend | Global ESG assets > $50 trillion by 2025 | Shapes product development and market focus |

| ISE B3 Performance | Constituents +15% ESG score vs. broad index (2023) | Highlights sustainable investment opportunities |

Technological factors

Brazil's digital transformation is accelerating, with fintech adoption soaring. The instant payment system, Pix, launched in late 2020, has become a dominant force, processing over 42 billion transactions in 2023, a significant leap from its initial launch. This widespread digital payment infrastructure creates opportunities for B3 to further integrate its services.

B3 is actively investing in digital innovation and acquiring fintech companies to bolster its technological capabilities. For instance, B3's acquisition of a stake in the fintech company NuPay in 2022 aimed to expand its digital payment solutions. This strategic move is essential for B3 to stay competitive and modernize its market operations in an increasingly digital financial landscape.

B3, as a critical financial market infrastructure, is under constant siege from evolving cybersecurity threats. Protecting sensitive financial data is not just a technical challenge but a fundamental requirement for maintaining market integrity and investor confidence.

The General Data Protection Law (LGPD) in Brazil mandates stringent data protection measures, and B3 must adhere strictly to these regulations. Failure to comply could result in significant penalties and damage to its reputation, impacting trust in the trading and settlement systems.

In 2023, the financial sector globally experienced a significant increase in cyberattacks. While specific B3 data for 2024 is still emerging, the trend suggests a heightened need for advanced security protocols and continuous vigilance to safeguard against breaches and ensure the smooth operation of the exchange.

B3 is actively integrating artificial intelligence and automation to boost market efficiency. For instance, AI capabilities are being deployed to significantly reduce latency in the execution of over-the-counter derivatives, a critical step in modernizing financial markets.

The strategic adoption of AI and machine learning promises to unlock more advanced trading algorithms, thereby improving predictive accuracy and execution speed. This technological leap also enhances risk management frameworks and streamlines complex operational processes within B3's ecosystem.

Blockchain and Distributed Ledger Technology (DLT)

Brazil's financial sector is witnessing a significant surge in blockchain and distributed ledger technology (DLT) adoption. In 2024, investment in crypto solutions continued to grow, with B3 itself launching new crypto futures products. This clearly indicates the increasing relevance of DLT for Brazilian financial infrastructure.

The potential for DLT to transform B3's operations is substantial. Areas like clearing and settlement could see enhanced efficiency and security. Furthermore, the issuance of tokenized assets on blockchain platforms presents new avenues for capital raising and trading.

- Increased Investment: Continued growth in venture capital funding for Brazilian blockchain startups in 2024.

- B3's Crypto Futures: B3's expansion into crypto-related derivatives signals market acceptance and demand.

- Operational Efficiency: DLT's promise to streamline post-trade processes, potentially reducing settlement times and counterparty risk.

- Tokenization Potential: The ability to tokenize real-world assets, creating new liquidity and investment opportunities on the exchange.

Infrastructure Modernization and Latency Reduction

B3's commitment to infrastructure modernization, including significant investments in cloud technologies and system upgrades, directly addresses the critical need for latency reduction. These enhancements are designed to boost the speed and dependability of its trading platforms, a key factor in attracting and retaining high-frequency trading participants. For instance, B3's ongoing projects aim to achieve sub-millisecond latency for critical trading operations, a benchmark increasingly demanded by sophisticated market players.

This focus on technological advancement is crucial for B3 to maintain its competitive edge in the rapidly evolving global financial landscape. By ensuring faster transaction processing and greater system resilience, B3 can better accommodate the increasing volume and complexity of trades. This directly supports its goal of being a preferred venue for institutional investors and algorithmic traders alike.

The benefits of reduced latency extend beyond just speed. It also enhances the overall user experience and reliability of B3's services, contributing to market integrity and efficiency. As of early 2024, B3 reported a substantial portion of its IT budget allocated to these infrastructure upgrades, underscoring the strategic importance of this technological factor.

- Infrastructure Modernization: B3 continues to invest in upgrading its core trading systems and embracing cloud-native architectures to improve performance and scalability.

- Latency Reduction Goals: The exchange targets further reductions in trading latency, aiming to provide some of the fastest execution speeds globally for its participants.

- High-Frequency Trading (HFT) Attraction: Enhanced infrastructure and lower latency are critical for attracting and supporting the demanding requirements of HFT firms, a significant user base.

- Market Competitiveness: These technological upgrades are essential for B3 to remain competitive against other global exchanges that are also prioritizing speed and reliability.

B3's technological evolution is marked by significant advancements in AI and automation, aimed at enhancing market efficiency. The deployment of AI in reducing latency for over-the-counter derivatives is a prime example, streamlining operations and improving execution speed. This strategic adoption of machine learning promises more sophisticated trading algorithms and robust risk management.

Brazil's financial sector is increasingly embracing blockchain and DLT, with B3 launching crypto futures in 2024, reflecting growing market demand. The potential for DLT to revolutionize B3's clearing and settlement processes, alongside tokenized assets, offers new avenues for capital and trading.

B3 is heavily invested in infrastructure modernization, including cloud technologies, to achieve sub-millisecond latency by early 2024. This focus on speed and reliability is crucial for attracting high-frequency trading firms and maintaining global competitiveness.

| Technology Area | B3's Action/Focus | Impact/Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Digital Payments | Pix Integration | Increased transaction volume, enhanced user convenience | Over 42 billion Pix transactions in 2023 |

| Fintech Acquisition | Stake in NuPay | Expansion of digital payment solutions | Acquisition in 2022 |

| Cybersecurity | Data Protection Measures | Maintaining market integrity, investor confidence | Increased global cyberattacks in 2023 |

| AI & Automation | Latency Reduction in OTC Derivatives | Improved execution speed, operational efficiency | AI deployed for critical operations |

| Blockchain & DLT | Crypto Futures Launch | New trading opportunities, market acceptance | B3 launched crypto futures in 2024 |

| Infrastructure Modernization | Cloud Adoption & Latency Reduction | Faster trading, system resilience | Targeting sub-millisecond latency by early 2024 |

Legal factors

The Brazilian Securities and Exchange Commission (CVM) and the Central Bank (BCB) are the primary architects of the regulatory landscape for B3. Their mandates shape everything from trading rules to listing requirements, directly impacting market operations and B3's compliance obligations.

Recent CVM resolutions, particularly those enacted in 2024 and anticipated for 2025, are streamlining processes like Public Tender Offers. This regulatory evolution aims to foster greater market efficiency and transparency, requiring B3 to adapt its systems and procedures to align with these updated frameworks.

Brazil's Lei Geral de Proteção de Dados (LGPD) significantly impacts B3's operations by mandating strict rules for handling personal and financial data. Failure to comply can result in substantial fines, with penalties potentially reaching up to 2% of a company's revenue in Brazil, capped at R$50 million per infraction, as of 2024.

B3 must invest heavily in its IT infrastructure and refine operational protocols to ensure full adherence to LGPD. This includes robust data security measures and transparent data processing practices to safeguard client information and maintain trust within the financial ecosystem.

B3's operations are heavily influenced by stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are critical for preventing financial crimes and safeguarding B3's integrity. For instance, in 2023, Brazilian financial institutions reported a significant increase in suspicious transaction alerts, underscoring the importance of robust compliance frameworks.

Corporate Governance Laws and Compliance

B3, the Brazilian stock exchange, operates under stringent corporate governance laws, particularly due to its listing on the Novo Mercado segment. This segment requires companies to adhere to elevated standards of transparency, accountability, and shareholder rights. For instance, Novo Mercado companies must have at least 20% of their shares in free float and elect at least two independent board members, fostering better oversight.

Compliance with these regulations is paramount for B3 to maintain investor confidence and attract capital. In 2023, B3 reported a net income of R$5.1 billion, underscoring the importance of robust governance in ensuring financial stability and market integrity. Adherence to these legal frameworks is not just a regulatory requirement but a strategic imperative for sustained growth and market leadership.

Key aspects of corporate governance compliance for B3 include:

- Adherence to Novo Mercado Listing Rules: Ensuring continuous compliance with enhanced transparency and governance requirements.

- Board Independence and Diversity: Maintaining a board composition that includes a significant proportion of independent directors.

- Shareholder Rights Protection: Upholding the rights of all shareholders, including minority investors.

- Disclosure and Transparency: Providing timely and accurate financial and operational information to the market.

Taxation Policies on Financial Transactions

Changes in government taxation policies directly influence the attractiveness of financial instruments and investments traded on B3, affecting trading volumes and demand for various products. For instance, adjustments to capital gains taxes or the introduction of new levies can alter investor behavior and the overall market landscape.

New legislative initiatives are actively shaping market dynamics. Law 14,801/2024, for example, implemented tax incentives specifically for infrastructure bonds. This move aims to boost investment in this crucial sector by making these instruments more appealing to a wider range of investors.

- Impact of Tax Changes: Alterations in tax rates on capital gains and financial transactions can lead to significant shifts in investor sentiment and trading activity on B3.

- Infrastructure Bond Incentives: Law 14,801/2024's tax incentives for infrastructure bonds are designed to channel capital towards development projects.

- Stimulating Market Segments: Targeted tax policies can effectively stimulate specific segments of the financial market, encouraging capital inflow and product innovation.

- Attracting Investment: Favorable tax regimes are crucial for attracting both domestic and international investment, enhancing liquidity and market depth on B3.

The legal framework governing B3 is dynamic, with regulatory bodies like the CVM and BCB continuously updating rules. For example, recent CVM resolutions in 2024 have streamlined Public Tender Offers, impacting B3's operational compliance. Furthermore, Brazil's LGPD imposes strict data protection mandates, with potential fines up to 2% of revenue, capped at R$50 million per infraction, compelling B3 to invest in robust data security. The exchange also adheres to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, crucial given the reported increase in suspicious transaction alerts by Brazilian financial institutions in 2023.

Corporate governance is another critical legal aspect, with B3's listing on the Novo Mercado segment demanding high standards of transparency and shareholder rights, including a minimum 20% free float and independent board members. Recent tax legislation, such as Law 14,801/2024, introduces incentives for infrastructure bonds, aiming to redirect capital and stimulate specific market segments. These legal and tax adjustments directly influence investor behavior and B3's market attractiveness.

Environmental factors

Brazil is increasingly aligning with global trends in Environmental, Social, and Governance (ESG) integration, with significant advancements in disclosure practices. The Comissão de Valores Mobiliários (CVM) has mandated climate-related disclosures for listed companies, adopting the International Sustainability Standards Board (ISSB) standards, effective from fiscal year 2026.

This regulatory shift is a pivotal moment, compelling companies to enhance their transparency and reporting on climate risks and opportunities. For instance, by 2026, companies will need to report on Scope 1 and Scope 2 greenhouse gas emissions, with Scope 3 to follow, creating a more standardized and comparable framework for investors.

B3, the Brazilian stock exchange, plays a proactive role in fostering ESG principles. It actively promotes best practices through various initiatives, including the B3's Corporate Sustainability Index (ISE B3), which tracks the performance of companies committed to sustainability. Furthermore, B3 offers training programs to equip companies with the knowledge needed to navigate the evolving landscape of sustainability reporting, reflecting both regulatory pressure and growing market demand for responsible investment.

Climate change poses significant physical risks like extreme weather events and transition risks from shifting to a low-carbon economy, impacting investment strategies and asset valuations. For instance, the increasing frequency of climate-related disasters in 2024 has already led to billions in economic losses globally, forcing businesses and investors to re-evaluate their exposure.

B3's active participation in green finance is a key strategy to address these challenges. By facilitating the listing of green, social, and sustainability bonds, B3 aims to direct investment towards environmentally sound projects. In 2024, the global market for sustainable bonds reached over $1.5 trillion, highlighting a growing demand for such instruments.

Furthermore, B3's emphasis on promoting climate-related financial disclosures, aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD), enhances transparency. This allows stakeholders to better understand and manage climate risks, fostering a more resilient financial system and channeling capital towards sustainable development initiatives.

Brazil's economy leans heavily on its rich natural resources, particularly in agriculture and mining. This dependence makes the B3 market sensitive to environmental shifts and fluctuating global commodity prices. For instance, a drought impacting soybean yields or a drop in iron ore prices can directly affect the financial health of major Brazilian companies and investor confidence.

In 2023, Brazil was the world's largest exporter of soybeans, beef, and coffee, highlighting its significant commodity-driven economy. Fluctuations in the prices of these goods on international markets, often influenced by weather patterns and geopolitical events, directly impact the revenue streams of companies listed on the B3, such as Vale and JBS, and consequently, the broader market sentiment.

Pollution Control and Environmental Regulations

Evolving environmental regulations, particularly those concerning pollution control, are increasingly shaping business operations on the B3 stock exchange. For instance, Brazil's National Solid Waste Policy (PNRS) and the ongoing discussions around carbon pricing mechanisms are compelling companies to re-evaluate their waste management and emission reduction strategies. These shifts can translate into significant compliance costs for industries that are historically heavy polluters, potentially impacting their profit margins.

The drive towards sustainability, spurred by these regulations, is not merely a cost center but also an opportunity. Companies proactively investing in cleaner technologies and circular economy models, such as those seen in the renewable energy and sustainable agriculture sectors on B3, are often viewed more favorably by investors. For example, as of early 2024, companies demonstrating strong ESG (Environmental, Social, and Governance) performance are showing a tendency to attract capital more readily, reflecting a growing market preference for environmentally responsible businesses.

- Increased Compliance Costs: Stricter emission standards and waste disposal regulations can lead to higher operational expenditures for B3-listed companies.

- Investment in Sustainable Practices: Regulations incentivize adoption of cleaner production, potentially boosting long-term financial resilience and attractiveness.

- Market Differentiation: Companies meeting or exceeding environmental benchmarks can gain a competitive edge and attract ESG-focused investors.

- Sectoral Impact: Industries like mining, manufacturing, and energy face more direct and immediate impacts from evolving pollution control mandates.

Sustainable Investment Product Demand

Investor appetite for sustainable and responsible investment products is surging, reshaping market dynamics. This growing preference directly influences B3's strategic direction, pushing for an expanded suite of Environmental, Social, and Governance (ESG) offerings. For instance, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, according to the Global Sustainable Investment Alliance, a substantial increase from previous years.

B3 is responding by developing and promoting specialized indices and Exchange Traded Funds (ETFs) that align with ESG principles. This move caters to a rapidly expanding segment of the investor base that prioritizes ethical and sustainable considerations alongside financial returns. In 2024, assets in ESG-focused ETFs in Brazil saw significant growth, with several new products launched to meet this demand.

- Growing Investor Demand: A significant portion of global assets under management now incorporates ESG factors, reflecting a fundamental shift in investor priorities.

- B3's ESG Expansion: The exchange is actively developing ESG-linked indices and ETFs to capitalize on this trend and attract a wider range of investors.

- Market Growth: The sustainable investment market continues its upward trajectory, with projections indicating sustained growth through 2025 and beyond.

Brazil's environmental landscape presents both challenges and opportunities for B3-listed companies, driven by increasing global awareness and regulatory shifts. The nation's reliance on natural resources makes its market particularly susceptible to climate impacts and commodity price volatility, as seen in the 2023 agricultural export figures.

Stricter environmental regulations, such as those concerning pollution control, are compelling businesses to invest in cleaner technologies, potentially increasing operational costs but also fostering market differentiation and long-term resilience. This push for sustainability aligns with a growing investor preference for ESG-compliant assets, with the global sustainable investment market reaching an estimated $35.3 trillion in early 2024.

| Environmental Factor | Impact on B3 Companies | Data Point/Example |

| Climate Change & Extreme Weather | Physical risks to operations, supply chain disruptions, asset devaluation. | Billions in global economic losses from climate disasters in 2024. |

| Natural Resource Dependence | Sensitivity to commodity price fluctuations, impact on revenue streams. | Brazil's 2023 status as the world's largest exporter of soybeans, beef, and coffee. |

| Environmental Regulations (Pollution Control) | Increased compliance costs, incentive for cleaner production, potential for market advantage. | National Solid Waste Policy (PNRS) influencing waste management strategies. |

| Green Finance & Sustainable Investment | Attraction of ESG-focused capital, growth in green bond listings, demand for ESG ETFs. | Global sustainable investment market valued at $35.3 trillion in early 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from official government publications, reputable economic institutions like the IMF and World Bank, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors.