B3 Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B3 Bundle

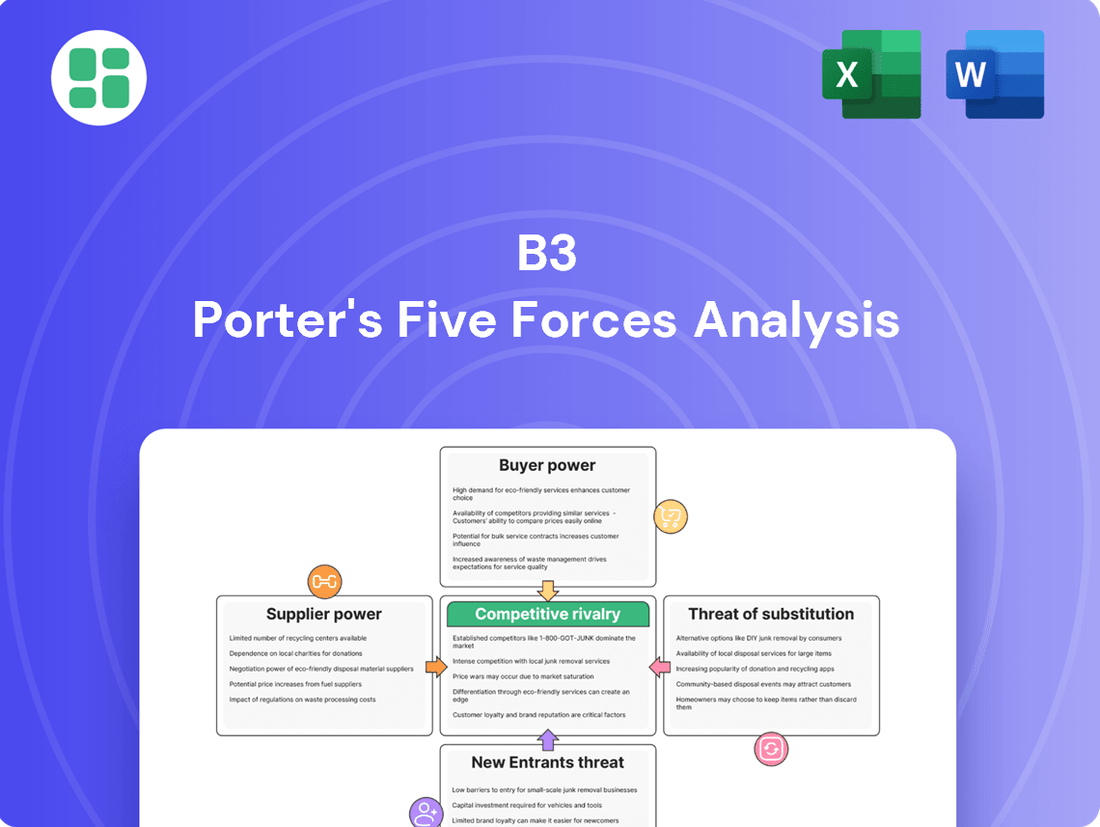

Porter's Five Forces Analysis provides a powerful lens to understand B3's competitive landscape, revealing the underlying pressures that shape its profitability and strategic options. By dissecting the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the danger of substitutes, we gain a clearer picture of B3's market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore B3’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

B3's reliance on specialized technology for its trading, clearing, and settlement systems means that providers of these critical solutions hold considerable sway. The intricate and often proprietary nature of these systems, coupled with the substantial costs associated with switching vendors, typically grants these technology suppliers a moderate to high level of bargaining power.

In 2024, B3 continued its strategic push into advanced technologies, notably investing in AI and data analytics. These investments are designed not only to sharpen B3's competitive edge but also to gradually lessen its dependence on external technology infrastructure providers, potentially mitigating their future bargaining power.

Data and connectivity service providers wield significant bargaining power over B3. Their services are the lifeblood of the exchange, ensuring reliable and secure high-speed data transmission that connects all market participants. Any interruption, even a brief one, can have substantial financial repercussions.

In 2024, the demand for robust digital infrastructure continues to surge, with global spending on IT services projected to reach trillions. Providers with established, secure, and high-capacity networks are indispensable for B3's continuous operation, making it difficult for B3 to switch providers easily without risking operational disruption.

The financial exchange industry relies heavily on professionals with specialized skills in areas such as cybersecurity, quantitative analysis, regulatory compliance, and advanced IT. The scarcity of this talent, especially in a highly competitive global landscape, can drive up B3's operational expenses and impact its capacity for innovation.

Regulatory Bodies and Compliance Tools

While not traditional commercial suppliers, regulatory bodies such as the Central Bank of Brazil and the CVM (Brazilian Securities and Exchange Commission) significantly influence B3's operations. Their mandates establish the rules of engagement, requiring B3 to invest in compliance and adapt its systems accordingly.

This reliance on adhering to regulatory frameworks means B3 often engages specialized legal and consulting firms. These niche service providers can wield some bargaining power due to their expertise in navigating complex and evolving compliance landscapes, impacting B3's operational costs and strategic flexibility.

- Regulatory Influence: Central Bank of Brazil and CVM set operational standards for B3.

- Compliance Costs: B3 incurs costs to adapt to new resolutions and regulations.

- Niche Supplier Leverage: Specialized legal and consulting services gain leverage through compliance expertise.

Real Estate and Energy Providers

B3's extensive data centers and operational infrastructure depend heavily on consistent, high-capacity energy and strategically located real estate. When the market for these essential inputs is concentrated, suppliers can wield significant bargaining power, directly influencing B3's operational costs.

- Energy Supply: In 2024, the global data center industry faced rising energy costs, with some regions experiencing price hikes of over 15% due to increased demand and grid strain.

- Real Estate Availability: Prime industrial real estate suitable for large-scale data center operations remains a scarce commodity in many key markets, with vacancy rates for specialized facilities often below 5% in 2024.

- Supplier Concentration: In certain geographic areas, a limited number of energy providers or specialized real estate developers can create local monopolies, allowing them to dictate terms and increase prices.

The bargaining power of suppliers for B3 is a critical factor impacting its operational costs and strategic flexibility. Providers of specialized technology, data, and connectivity services hold significant sway due to the intricate nature of their offerings and the high switching costs involved.

In 2024, B3's ongoing investments in AI and data analytics aim to reduce its dependence on external technology providers, potentially softening their future leverage. However, the continued demand for robust digital infrastructure means that established network providers remain indispensable, with global IT service spending projected to reach trillions.

Furthermore, the scarcity of specialized talent in areas like cybersecurity and quantitative analysis grants these professionals and their employers considerable bargaining power, driving up B3's operational expenses.

Regulatory bodies, while not commercial suppliers, exert substantial influence, necessitating investments in compliance and system adaptations. This, in turn, empowers niche legal and consulting firms with expertise in navigating these complex regulatory landscapes.

| Supplier Category | Bargaining Power Factor | 2024 Impact/Trend |

|---|---|---|

| Technology Providers | Proprietary systems, high switching costs | Moderate to High; B3 investing to reduce dependence |

| Data & Connectivity Providers | Essential for operations, high switching costs | High; critical for market access and reliability |

| Specialized Talent Providers | Scarcity of skills (cybersecurity, quant analysis) | Moderate to High; impacts operational costs |

| Energy & Real Estate Providers | Concentration in certain areas, rising costs | Moderate; influenced by regional supply and demand |

| Regulatory Compliance Services | Niche expertise in complex regulations | Moderate; driven by evolving compliance needs |

What is included in the product

Analyzes the five competitive forces impacting B3's industry: threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

B3's primary direct customers are major financial institutions like banks, brokerage houses, and asset managers, who are crucial for driving trading volumes and require advanced services. In 2023, these entities were responsible for a substantial portion of B3's listed equities trading revenue, underscoring their importance.

While these institutions are large individually, their collective dependence on B3 as the primary market infrastructure in Brazil somewhat tempers their direct bargaining power over core service fees. This reliance means B3 can maintain a degree of pricing stability for its essential services.

Corporate issuers looking to list their securities on B3, Brazil's stock exchange, generally have limited bargaining power. Their primary need is access to the domestic public capital markets and the liquidity that B3 provides.

While international listings offer an alternative, B3's dominant position within Brazil means issuers have few options for accessing local investors. This reliance translates into lower bargaining power regarding listing fees and the array of services offered by the exchange. For instance, in 2023, B3 reported a 9.5% increase in its net income, reaching R$5.7 billion, showcasing its robust market position which further solidifies its pricing power.

Indirect retail investors engage with B3 primarily through brokerage houses, meaning their collective bargaining power is channeled through these intermediaries. While the surge in retail investor participation, evidenced by a significant increase in individual accounts on B3 in recent years, boosts market liquidity, these investors have little direct sway over B3's pricing or service development. Their individual impact is diluted, as brokerage firms are the ones negotiating terms and advocating for their clients' needs.

Market Data Consumers

Financial data vendors, analytical firms, and media outlets are key consumers of B3's market data. Because B3 is the main provider of Brazilian market information, these businesses rely heavily on its proprietary data, giving them significant leverage in price negotiations. In 2023, B3 reported revenue of R$10.2 billion, with a substantial portion derived from data and information services, highlighting the critical nature of this data for its customers.

The bargaining power of these market data consumers is amplified by their collective importance to B3's revenue stream. While B3 holds a near-monopoly on certain Brazilian market data, the concentration of these data consumers means they can exert pressure on pricing and service terms. For instance, major financial news agencies often bundle B3 data into broader subscription packages, influencing how the end-user perceives its value.

- B3's Data Dependency: Financial data providers and analysts are fundamentally reliant on B3 for real-time and historical trading information for the Brazilian market.

- Price Sensitivity: These consumers operate in competitive markets themselves and are sensitive to the cost of data, which directly impacts their own profit margins.

- Alternative Data Sources (Limited): While B3 is primary, some consumers may explore alternative, albeit less comprehensive, data sources or develop proprietary analytics, creating a slight counter-pressure.

- Consolidation Among Consumers: If major data consumers consolidate, their combined purchasing power increases, potentially leading to more favorable terms from B3.

Global Fund Managers and Institutional Investors

Global fund managers and institutional investors are significant players in the Brazilian market, driving capital inflow and providing essential liquidity. While they possess the flexibility to shift investments to other emerging markets, B3 offers them unparalleled direct access to Brazilian listed securities. This unique position somewhat mitigates their bargaining power, as B3 remains a critical gateway for their specific allocation strategies.

In 2024, foreign direct investment (FDI) into Brazil showed resilience, with significant portions flowing into the financial sector. For instance, data from the Central Bank of Brazil indicated a notable increase in portfolio investment by foreign entities in Brazilian equities and fixed income throughout the first half of 2024, underscoring their reliance on B3’s infrastructure.

- Limited Negotiation Leverage: Despite global mobility, institutional investors need B3 for direct Brazilian market access, curbing their ability to dictate terms.

- Capital Inflow Dependence: Brazil relies on these international players for market liquidity and capital, creating a symbiotic relationship where B3’s offerings are valued.

- Market Access Advantage: B3’s established infrastructure and regulatory framework make it the primary channel for foreign participation in Brazilian listed companies.

B3's customers, particularly major financial institutions and corporate issuers, generally exhibit low bargaining power. Their reliance on B3 for market access and liquidity in Brazil, coupled with B3's dominant position, limits their ability to negotiate fees or service terms. Even with increasing retail participation, individual investors' influence is indirect, channeled through intermediaries.

However, financial data vendors and analytical firms, as key consumers of B3's proprietary information, possess greater leverage. Their dependence on this data for their own revenue streams, combined with their collective importance, allows them to exert pressure on pricing and service agreements, as evidenced by B3's significant data revenue in 2023.

Global fund managers also have limited direct bargaining power due to B3's role as the primary gateway to Brazilian securities. While they can shift investments, the specific access B3 provides is crucial for their Brazil-focused strategies, a reliance highlighted by the strong foreign portfolio investment in Brazilian financial sectors during early 2024.

| Customer Segment | Bargaining Power Level | Key Factors |

|---|---|---|

| Major Financial Institutions (Banks, Brokers) | Low to Moderate | Dependence on B3 for trading volumes; collective reliance tempers individual power. |

| Corporate Issuers | Low | Need for access to Brazilian public capital markets and B3's liquidity. |

| Financial Data Vendors & Analytical Firms | Moderate to High | Critical reliance on B3's proprietary market data; price sensitivity. |

| Retail Investors (Indirect) | Very Low | Influence is channeled through intermediaries (brokerages). |

| Global Fund Managers | Low | Need for direct access to Brazilian securities; B3 is a critical gateway. |

Same Document Delivered

B3 Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis, offering a thorough examination of competitive forces within an industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises. You can confidently download and utilize this comprehensive strategic tool the moment your transaction is complete.

Rivalry Among Competitors

B3's position as the primary exchange in Brazil for listed securities and derivatives creates a near-monopoly domestically. This means there's very little direct competition from other Brazilian exchanges for these core services, giving B3 a substantial competitive edge.

B3, while a dominant force, is encountering new domestic competitors eyeing specific lucrative segments. For instance, CSD BR is slated to launch by 2027, directly challenging B3's revenue streams from asset clearing services.

Furthermore, the anticipated launch of ATG by late 2025 signifies another direct threat, potentially fragmenting B3's market share in exchange operations.

While B3 operates a robust exchange, competition from over-the-counter (OTC) markets and direct bilateral trading for certain financial instruments can siphon off trading volume. This indirect competition means some transactions occur outside B3's centralized, regulated environment. For instance, in 2024, continued growth in the Brazilian fixed income market, much of which can be traded bilaterally, poses a challenge.

B3 is strategically addressing this by actively expanding its own fixed income and OTC derivatives segments. By offering more competitive platforms and services for these types of trades, B3 aims to retain and attract volume that might otherwise go to purely OTC channels. This focus is crucial for maintaining market share and providing a comprehensive trading ecosystem.

Global Exchanges for Listings and Derivatives

Large Brazilian corporations have the option to list their shares on major international exchanges, such as the New York Stock Exchange (NYSE) or Nasdaq, through American Depositary Receipts (ADRs) or Global Depositary Receipts (GDRs). This provides them with access to a broader investor base and potentially greater liquidity. For instance, in 2023, the total value of ADRs traded on U.S. exchanges reached trillions of dollars, indicating the significant scale of this alternative.

Furthermore, global derivatives exchanges, like the CME Group or Eurex, actively compete for trading specific derivative contracts that might otherwise be listed on B3. This competition intensifies as financial markets become more interconnected. B3's CEO, Gilson Fink, has publicly acknowledged this global competitive landscape, highlighting B3's strategic focus on maintaining its strong reputation and investing heavily in technological advancements to remain competitive.

- Global Listing Alternatives: Brazilian companies can list ADRs/GDRs on exchanges like NYSE and Nasdaq, accessing international capital markets.

- Derivatives Competition: Global derivatives exchanges present an alternative for trading contracts, challenging B3's market share in certain areas.

- B3's Competitive Strategy: B3's leadership emphasizes reputation and technological investment as key differentiators against global rivals.

Rivalry in Technology and Data Services

B3 faces intense rivalry beyond its traditional exchange operations from FinTech firms and data analytics specialists. These competitors offer comparable market infrastructure, data solutions, and software, directly challenging B3’s service offerings.

To counter this, B3 has strategically acquired companies like Neoway and Neurotech. These acquisitions are designed to bolster B3's capabilities in data analytics and technology, enhancing its competitive stance in this evolving market.

- FinTech and Data Analytics Competition: B3 competes with specialized firms offering advanced trading platforms, data visualization tools, and AI-driven analytics.

- Strategic Acquisitions: B3's 2023 acquisition of Neoway, a data analytics company, and its investment in Neurotech aim to integrate cutting-edge technology and data capabilities.

- Market Share Dynamics: While B3 dominates Brazil's stock exchange, the FinTech sector is highly fragmented, with numerous agile players constantly innovating.

B3's competitive rivalry is shaped by its dominant position in Brazil, yet faces emerging domestic and international threats. New exchanges like CSD BR and ATG are poised to challenge B3's market share in specific segments by 2025-2027.

Indirect competition from over-the-counter (OTC) markets, particularly in fixed income, continues to be a factor, as evidenced by the growing bilateral trading in 2024. Global exchanges also present a challenge for derivatives trading.

B3 is actively investing in technology and strategic acquisitions, such as Neoway in 2023, to bolster its data analytics and service offerings against FinTech competitors.

| Competitor Type | Specific Competitor/Market | Year of Impact/Launch | B3's Response/Strategy |

|---|---|---|---|

| Domestic Exchange | CSD BR | Slated for 2027 | Strengthening core exchange services |

| Domestic Exchange | ATG | Late 2025 | Investing in technological advancements |

| OTC Markets | Brazilian Fixed Income | Ongoing (2024) | Expanding own fixed income and OTC derivatives segments |

| Global Exchanges | CME Group, Eurex | Ongoing | Focusing on reputation and technology investment |

| FinTech/Data Analytics | Specialized Firms | Ongoing | Acquisition of Neoway (2023), investment in Neurotech |

SSubstitutes Threaten

The emergence of decentralized finance (DeFi) platforms, particularly blockchain-based decentralized exchanges (DEXs), represents a nascent but potentially significant threat to traditional exchanges like B3. These platforms facilitate peer-to-peer trading of digital assets, offering an alternative that bypasses centralized intermediaries. While currently a low threat, their long-term impact could grow as the digital asset space matures.

B3 is proactively addressing this evolving landscape by exploring the introduction of crypto derivatives. This strategic move aims to integrate digital assets into its existing offerings, thereby adapting to market trends and mitigating the long-term threat posed by DeFi. For instance, the global cryptocurrency market capitalization, while volatile, has seen significant growth, indicating a growing investor interest in digital assets that DeFi platforms cater to.

Over-the-counter (OTC) markets represent a significant threat of substitutes for B3's exchange-traded products, particularly for bespoke financial instruments, large block trades, and less liquid securities. These direct, bilateral transactions occur outside the regulated exchange environment, offering tailored solutions but often at the cost of reduced transparency and liquidity compared to B3. For instance, the global OTC derivatives market, a key area of substitution, saw its notional outstanding value reach $711 trillion by the end of 2023, according to the Bank for International Settlements, highlighting the substantial volume of business that bypasses traditional exchanges.

The rise of direct investment platforms, such as crowdfunding and peer-to-peer lending, presents a significant threat of substitution for traditional stock exchange services. These platforms allow companies to raise capital directly from investors, bypassing the need for public listings on exchanges like B3. For instance, in 2023, the global crowdfunding market was valued at approximately $20 billion, demonstrating a growing appetite for alternative funding sources.

Furthermore, the expansion of private markets, including private equity and venture capital, offers companies another avenue to secure funding without going public. As of the first half of 2024, global private equity deal value remained robust, with significant capital deployed into private companies. This trend can reduce the pool of companies seeking to list on public exchanges, thereby diminishing demand for B3's core services.

Foreign Exchanges for Brazilian Assets

Investors looking for Brazilian exposure have readily available alternatives outside of direct B3 trading. They can opt for American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs) listed on major international exchanges, or invest in broad-based global exchange-traded funds (ETFs) that include Brazilian equities. This accessibility provides a significant substitute, especially for international capital seeking entry into the Brazilian market.

The availability of these substitutes means that B3's market share and pricing power can be influenced by opportunities elsewhere. For instance, as of late 2024, global ETFs tracking emerging markets, many with substantial Brazilian allocations, saw continued inflows, demonstrating a preference for diversified, easily accessible international exposure over direct engagement with a single domestic exchange.

- ADRs/GDRs: Allow foreign investors to trade shares of Brazilian companies on exchanges like the NYSE or London Stock Exchange, bypassing direct B3 access.

- Global ETFs: Provide diversified exposure to Brazilian assets within broader emerging market or Latin America-focused portfolios, reducing the need for individual stock selection on B3.

- International Market Dynamics: The attractiveness and liquidity of foreign exchanges and global investment products directly impact the demand for trading Brazilian assets on B3.

Alternative Investment Vehicles and Products

The rise of alternative investment vehicles poses a significant threat to B3. As more investors turn to options like alternative investment funds (AIFs) and private credit, which often bypass traditional stock exchanges, the trading volume on B3 for these segments can decrease. This shift diverts capital and reduces the overall market share B3 commands for certain investor types.

For instance, the global alternative investment market was projected to reach $22.6 trillion in assets under management by 2026, demonstrating a strong appetite for these non-traditional products. This growth directly impacts B3 by offering investors viable substitutes for exchange-traded securities.

- Growing AUM in Alternatives: Global AUM in alternative investments is on a strong upward trajectory, potentially diverting significant capital away from traditional exchange-traded markets.

- Private Credit Expansion: The increasing accessibility and popularity of private credit funds offer a direct substitute for fixed-income investments typically traded on exchanges.

- Specialized Investment Products: Niche investment products outside of B3's core offerings can attract specific investor segments, fragmenting the market and reducing overall exchange activity.

The threat of substitutes for B3 stems from various alternative investment avenues that bypass traditional exchange trading. These include decentralized finance platforms, over-the-counter markets, direct investment platforms, private markets, and alternative investment vehicles.

These substitutes offer tailored solutions, direct access, or diversified exposure, potentially diverting capital and reducing B3's market share. For example, the global OTC derivatives market's notional outstanding value reached $711 trillion by the end of 2023, illustrating a substantial alternative to exchange-traded products.

The global alternative investment market's projected growth to $22.6 trillion in assets under management by 2026 further highlights the significant capital that could be diverted from traditional exchanges like B3.

| Substitute Category | Key Characteristics | Impact on B3 | Relevant Data Point (2023/2024) |

|---|---|---|---|

| Decentralized Finance (DeFi) | Peer-to-peer trading, bypasses intermediaries | Nascent threat, potential long-term impact | Global crypto market cap shows growing investor interest |

| Over-the-Counter (OTC) Markets | Bilateral transactions, bespoke solutions | Significant threat for large trades, less liquid securities | Global OTC derivatives market: $711 trillion notional outstanding (end 2023) |

| Direct Investment Platforms (Crowdfunding, P2P Lending) | Direct capital raising for companies | Reduces need for public listings | Global crowdfunding market: approx. $20 billion (2023) |

| Private Markets (Private Equity, Venture Capital) | Funding without public listing | Diminishes pool of potential listed companies | Robust global private equity deal value (H1 2024) |

| International Market Access (ADRs, ETFs) | Diversified, accessible global exposure | Provides alternative for Brazilian asset investment | Continued inflows into emerging market ETFs with Brazilian allocations (late 2024) |

| Alternative Investment Vehicles (AIFs, Private Credit) | Non-traditional investment options | Diverts capital, reduces exchange trading volume | Global alternative investment market projected to reach $22.6 trillion AUM by 2026 |

Entrants Threaten

The threat of new entrants to Brazil's stock exchange market is significantly diminished by high regulatory and licensing barriers. Establishing a new exchange requires navigating complex approval processes and meeting rigorous capital requirements mandated by bodies like the Central Bank of Brazil and the CVM (Comissão de Valores Mobiliários). These stringent requirements, including extensive operational and technological compliance, make the initial investment exceptionally high and the timeline for entry lengthy, effectively deterring most potential new players.

The sheer scale of investment needed to establish operations in the Brazilian stock exchange (B3) presents a formidable barrier to new entrants. Building the necessary technological backbone, encompassing high-frequency trading platforms, sophisticated clearing and settlement systems, and secure data centers, demands billions of dollars. For instance, significant upgrades to trading infrastructure are continually undertaken, with B3 investing heavily in technology to maintain its competitive edge and meet evolving market demands. This substantial capital outlay effectively deters smaller players or those without deep financial backing from entering the market.

New stock exchanges face a significant hurdle in achieving critical mass and liquidity. B3, like other established exchanges, benefits immensely from strong network effects; more buyers and sellers attract even more participants, creating a virtuous cycle.

A new entrant would find it incredibly difficult to attract enough liquidity, meaning a sufficient number of buyers and sellers, to become a viable trading venue. For instance, in 2023, B3's trading volumes reached R$12.7 trillion in equities, a testament to its deep liquidity pool.

This established liquidity pool is a powerful self-reinforcing advantage for B3, making it exceedingly challenging for any newcomer to replicate the necessary depth and breadth of market participants to compete effectively.

Established Trust and Brand Reputation of Incumbent

B3 benefits from decades of established trust, reliability, and brand recognition within the Brazilian financial ecosystem. This deep-seated credibility is a significant barrier for any potential new entrant aiming to disrupt the market.

A new exchange or financial services provider would face a substantial challenge in building comparable credibility and confidence among market participants, including investors, issuers, and intermediaries. For instance, as of early 2024, B3's market capitalization stood at over R$60 billion, reflecting its established position and investor confidence.

- Established Trust: B3's long history of operation fosters a sense of security and dependability among its users.

- Brand Recognition: The B3 brand is synonymous with the Brazilian stock market, making it the default choice for many.

- Credibility Gap: New entrants would need to invest heavily in marketing and demonstrate exceptional performance to overcome B3's established reputation.

- Regulatory Hurdles: Gaining the necessary regulatory approvals and demonstrating compliance, a process B3 has navigated over many years, adds further complexity for newcomers.

B3's Diversified Business Model and Innovation

B3's strategic diversification across fixed income, derivatives, and burgeoning technology/data services significantly elevates the barrier to entry for new competitors. This multi-faceted approach, which saw B3's net revenue grow by 12.7% in 2023 to R$11.2 billion, creates a robust and resilient business model that is difficult for a newcomer to replicate.

Furthermore, B3's consistent investment in innovation, including advancements in artificial intelligence and the introduction of new products such as cryptocurrency futures, continually pushes the industry's technological and service standards. This proactive development ensures that any new entrant would face a highly sophisticated and rapidly evolving market landscape, demanding substantial capital and expertise to compete effectively.

- Diversified Revenue Streams: B3's presence in equities, fixed income, derivatives, and technology services provides financial stability and reduces reliance on any single market segment.

- Innovation Investment: Continuous spending on AI and new product development, like crypto futures, sets a high technological bar for potential entrants.

- Market Leadership: B3's established position and brand recognition in Brazil create significant customer loyalty and distribution advantages.

- Regulatory Environment: Navigating Brazil's financial regulations requires specialized knowledge and compliance infrastructure, posing a hurdle for new players.

The threat of new entrants to B3 is significantly low due to substantial barriers. High capital requirements for technology and operations, coupled with stringent regulatory approvals from entities like the CVM, demand immense investment and time. For instance, B3's 2023 net revenue of R$11.2 billion highlights its established scale.

B3 benefits from strong network effects and deep liquidity, evidenced by R$12.7 trillion in equity trading volume in 2023, making it difficult for newcomers to attract sufficient participants. Furthermore, decades of established trust and brand recognition, reflected in its market capitalization of over R$60 billion as of early 2024, create a significant credibility gap for any new exchange.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High investment needed for technology, infrastructure, and compliance. | Deters smaller players; requires significant financial backing. |

| Regulatory Hurdles | Complex approval processes and licensing from CVM and Central Bank. | Lengthy timelines and specialized expertise needed for compliance. |

| Network Effects & Liquidity | Established participant base attracts more participants, creating deep liquidity. | Challenging for new entrants to achieve critical mass and attract traders. |

| Brand & Trust | Decades of operation build strong credibility and market recognition. | New entrants face a substantial challenge in building comparable trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and publicly available financial statements. These sources provide critical insights into market dynamics, competitive landscapes, and the bargaining power of suppliers and buyers.