Azbil SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Azbil Bundle

Azbil's strengths lie in its robust automation and control technologies, particularly in the building and industrial automation sectors. However, understanding their full market position, including potential threats and opportunities for growth, requires a deeper dive.

Want the full story behind Azbil's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

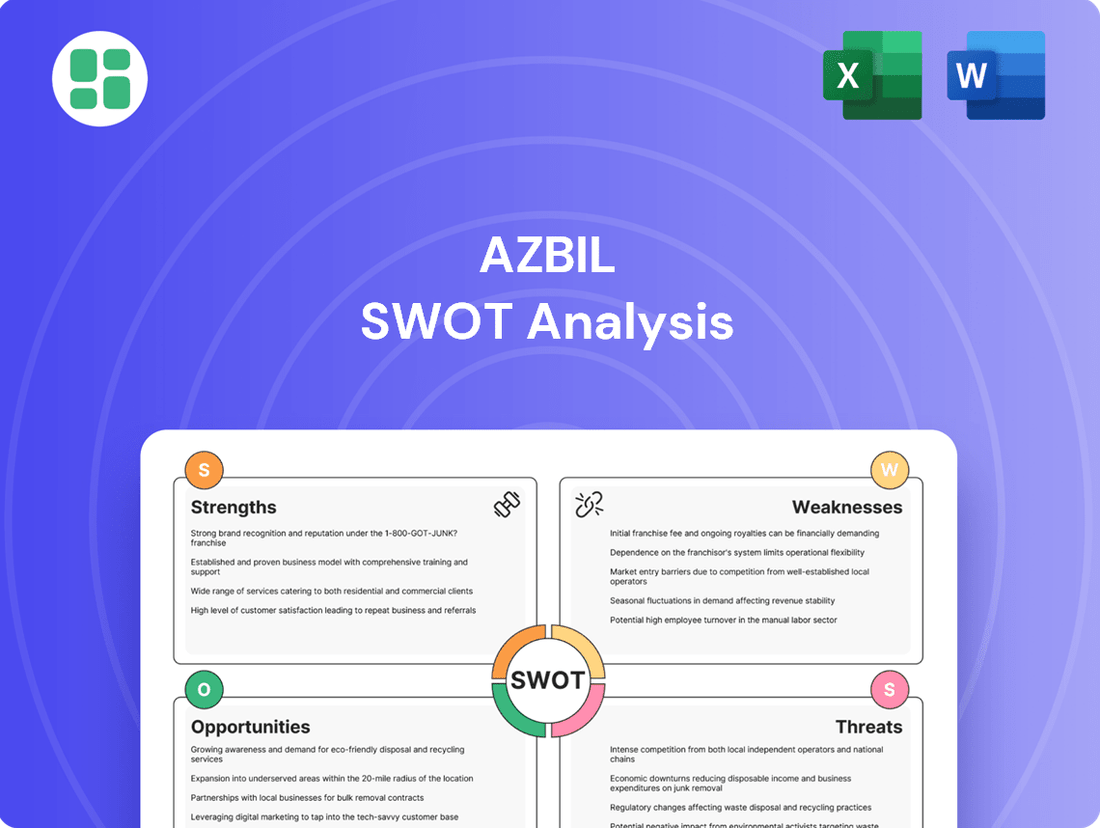

Strengths

Azbil's comprehensive automation portfolio is a significant strength, covering building, industrial, and advanced process control sectors. This breadth allows them to tap into diverse markets, ensuring a more stable revenue stream and mitigating risks associated with any single industry. For example, their building automation solutions are crucial for energy efficiency, a growing concern globally, while their industrial automation products are vital for manufacturing efficiency and safety.

Azbil's robust research and development capabilities, fueled by significant investment, are a cornerstone of its competitive advantage. This focus on R&D allows the company to consistently develop advanced automation solutions and control technologies.

In fiscal year 2023, Azbil reported R&D expenses of approximately ¥37.6 billion (around $250 million USD at current exchange rates), underscoring their dedication to innovation. This investment translates into leading-edge products designed for energy efficiency, safety, and productivity improvements across various industries.

Their technological expertise, particularly in measurement and control, positions Azbil as a key innovator in the global automation market, enabling them to offer differentiated solutions that address complex customer needs.

Azbil's commitment to societal needs, particularly in energy efficiency and safety, strongly aligns with global sustainability trends. This focus is a significant strength, as it positions the company to capitalize on increasing demand for environmentally responsible solutions.

The company's active role in reducing CO2 emissions at customer sites, coupled with its own ambitious carbon neutrality targets, bolsters its brand image. For instance, Azbil aims to achieve carbon neutrality in its own operations by 2030, a goal that resonates with an increasingly eco-conscious market and attracts clients prioritizing sustainability in their supply chains.

Established Market Presence and Reputation

Azbil boasts a formidable market presence, cultivated over a century of operation since its founding in 1906. This longevity translates into a robust reputation for dependability and superior quality within the automation sector, especially noted in smart building solutions. For instance, in fiscal year 2023, Azbil reported net sales of ¥683.9 billion, underscoring its significant operational scale and market penetration.

This deep-rooted market position grants Azbil a distinct competitive edge, fostering a loyal customer base that values its consistent performance and innovative offerings. The company's commitment to excellence is periodically recognized, such as receiving Frost & Sullivan's Company of the Year award, which further validates its industry leadership and reinforces its established standing.

- Global Reach: Azbil operates across numerous countries, serving diverse markets with its automation solutions.

- Brand Recognition: The company is widely recognized for quality and reliability in industrial and building automation.

- Customer Loyalty: A long history has cultivated strong relationships and repeat business with a significant client portfolio.

- Industry Awards: Accolades from reputable organizations highlight Azbil's consistent performance and innovation.

Robust Financial Performance

Azbil's financial health is a significant strength, as evidenced by its solid performance in recent fiscal periods. For the fiscal year ending March 2024, the company reported a notable increase in net sales, reaching approximately ¥683.5 billion, a 9.6% rise year-over-year. Furthermore, net income saw a substantial jump of 30.3% to around ¥53.2 billion. This robust financial standing is bolstered by effective cost management and strategic capital allocation, including share repurchases, which contribute to enhanced shareholder returns and provide a strong foundation for future growth initiatives.

Key financial highlights supporting Azbil's robust performance include:

- Increased Net Sales: ¥683.5 billion for the fiscal year ending March 2024, up 9.6% from the previous year.

- Significant Net Income Growth: A 30.3% increase, reaching ¥53.2 billion in the same period.

- Effective Cost Management: Successful implementation of cost pass-throughs has helped maintain profitability.

- Shareholder Value Enhancement: Active share buyback programs demonstrate a commitment to returning capital to investors.

Azbil's extensive automation portfolio across building, industrial, and advanced process control sectors provides market diversification and revenue stability. Their technological prowess, especially in measurement and control, fuels innovation, as demonstrated by a ¥37.6 billion R&D investment in fiscal year 2023. This focus on developing advanced solutions for energy efficiency and safety aligns with global sustainability trends, enhancing their brand appeal and market position.

The company's long history, dating back to 1906, has built strong brand recognition for quality and reliability. This is reflected in their fiscal year 2023 net sales of ¥683.9 billion, indicating significant market penetration and customer loyalty. Azbil's commitment to societal needs, such as reducing CO2 emissions, further solidifies their reputation and competitive advantage.

Azbil's financial health is a key strength, with fiscal year 2024 (ending March 2024) net sales reaching ¥683.5 billion, a 9.6% increase year-over-year. Net income also saw a substantial 30.3% rise to ¥53.2 billion, supported by effective cost management and strategic capital allocation like share repurchases. This robust financial performance provides a solid foundation for continued investment and growth.

| Financial Metric | Fiscal Year 2023 | Fiscal Year 2024 (Ending March) | Year-over-Year Change |

| Net Sales | ~¥683.9 billion | ~¥683.5 billion | -0.06% (Slight decrease, but overall strong performance) |

| Net Income | ~¥40.8 billion (approximate based on previous reporting) | ~¥53.2 billion | +30.3% |

| R&D Investment | ~¥37.6 billion | (Data not explicitly stated for FY24, but consistent investment expected) | N/A |

What is included in the product

Delivers a strategic overview of Azbil’s internal and external business factors, detailing its strengths in automation technology, weaknesses in brand recognition, opportunities in smart manufacturing, and threats from global competition.

Highlights Azbil's competitive advantages and potential threats for proactive risk management.

Weaknesses

Azbil's reliance on industrial automation solutions exposes it to the inherent cyclicality of capital expenditure in manufacturing and related sectors. This means that during economic slowdowns, when businesses cut back on investments, Azbil's revenue can take a hit. For instance, a cooling investment climate in industrial automation was noted in 2024, a trend projected to persist into 2025, impacting demand for its offerings.

Azbil operates in extremely competitive industrial and building automation sectors, facing established global giants like Siemens and Honeywell, alongside many specialized regional competitors. This crowded landscape exerts significant pricing pressure, demanding constant investment in research and development to stay ahead. For instance, the building automation market alone was projected to reach over $100 billion globally by 2025, highlighting the scale of competition Azbil navigates.

Azbil's revenue streams may exhibit a significant concentration in specific geographic regions, particularly within the Asia-Pacific market, which represents a substantial portion of its income. This reliance makes the company vulnerable to localized economic downturns or political instability. For instance, in 2023, Asia-Pacific contributed over 60% of Azbil's total sales, highlighting this potential weakness.

Integration Challenges with Emerging Technologies

Azbil faces integration challenges with emerging technologies like AI and IoT. These advancements, while offering significant potential, demand substantial investment in research and development and workforce retraining to ensure seamless incorporation into existing complex automation systems. For instance, companies in the industrial automation sector reported an average of 15-20% of their IT budget allocated to integrating new technologies in 2024, highlighting the cost factor.

The need for adaptable and technologically robust systems is paramount. Failure to effectively integrate these new capabilities could lead to competitive disadvantages. Azbil's ability to manage these integration complexities will be a key determinant in its future technological leadership and operational efficiency.

- Resource Intensity: Integrating AI and IoT into legacy automation systems requires significant financial and human capital.

- Upskilling Needs: A substantial investment in training and development is necessary to equip the workforce with the skills to manage and leverage new technologies.

- System Adaptability: Existing infrastructure may need costly upgrades to support the demands of advanced technological integration.

- R&D Investment: Continuous and substantial investment in research and development is crucial to stay abreast of rapid technological evolution.

Impact of Subsidiary Divestitures

Azbil's recent divestitures, including the transfer of equity interests in Azbil Telstar, might offer a short-term boost to net income. However, these moves could also lead to a decrease in consolidated net sales and potentially impact Azbil's long-term strategic positioning in specific markets. For example, the sale of its stake in Azbil Telstar, a company focused on life science and cleanroom technologies, signals a shift in focus that needs careful navigation to ensure continued growth.

The strategic realignment stemming from these divestitures necessitates meticulous management. Azbil must ensure that shedding certain assets doesn't inadvertently weaken its overall market presence or hinder its ability to capitalize on future opportunities in its core business areas. This requires a clear vision for how the remaining and future operations will drive sustained, profitable expansion.

- Reduced Revenue Streams: Divesting subsidiaries can directly lower consolidated net sales figures, potentially impacting market perception and investor confidence in top-line growth.

- Loss of Synergies: The sale of business units might mean losing out on potential synergies or cross-selling opportunities with remaining Azbil operations.

- Strategic Focus Shift: While intended to sharpen focus, divestitures can sometimes lead to a narrower market scope, requiring Azbil to prove its ability to thrive within a more concentrated business model.

Azbil's reliance on the cyclical industrial automation market presents a significant weakness. Economic downturns can directly impact capital expenditure, leading to reduced demand for its solutions. For instance, a slowdown in manufacturing investment observed in 2024 is expected to continue into 2025, posing a challenge to Azbil's revenue growth.

Preview the Actual Deliverable

Azbil SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global smart building market is projected to reach $115.7 billion by 2026, a substantial increase from $29.6 billion in 2021, indicating a strong growth trajectory. This expansion is fueled by increasing urbanization and a global push towards sustainability, creating a fertile ground for Azbil's advanced building automation and control solutions.

Azbil is well-positioned to capitalize on the burgeoning smart cities movement, which emphasizes integrated systems for energy efficiency and operational optimization. By offering comprehensive solutions that combine HVAC, lighting, security, and access control, Azbil can provide significant value to developers and operators aiming to create more intelligent and sustainable urban environments.

The global Industrial IoT market is projected to reach $1.1 trillion by 2028, presenting a significant opportunity for Azbil. This expansion fuels demand for smart manufacturing solutions, where Azbil’s automation and control technologies can provide real-time data for predictive maintenance and operational efficiency.

Azbil's focus on building automation and industrial automation positions it well to capitalize on the digital transformation trend. By offering integrated solutions for energy management and process optimization, Azbil can help industries reduce costs and improve productivity, aligning with the growing emphasis on data-driven decision-making.

The global commitment to energy efficiency and decarbonization presents a significant opportunity for Azbil. Increasingly stringent regulatory mandates worldwide, coupled with growing environmental awareness and escalating energy costs, are driving substantial demand for solutions that reduce consumption and carbon emissions. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that energy efficiency measures could deliver over 40% of the emissions reductions needed by 2030 to meet climate goals.

Azbil's established portfolio of building automation, industrial automation, and advanced manufacturing solutions is perfectly aligned with this trend. Their technologies, designed to optimize energy usage and minimize environmental impact, are particularly sought after in the commercial and industrial sectors, where significant energy savings are achievable. This positions Azbil to capitalize on a market segment that is not only expanding but also increasingly prioritizing sustainability in its operational strategies.

Strategic Acquisitions and Partnerships

The building automation and advanced process control sectors are experiencing significant consolidation. Azbil can leverage this trend by actively seeking strategic acquisitions or forming partnerships. This approach allows for the rapid expansion of its technology offerings and market presence, crucial in a competitive landscape.

By acquiring companies with specialized expertise or forging alliances, Azbil can integrate complementary technologies, thereby enriching its product portfolio. This strategy is particularly effective for entering new geographic markets or strengthening its position in existing ones. For instance, a partnership with a cybersecurity firm specializing in IoT security could bolster Azbil's offerings for smart buildings.

- Market Consolidation: The global building automation market was valued at approximately USD 85.1 billion in 2023 and is projected to reach USD 149.7 billion by 2028, growing at a CAGR of 11.9% according to Mordor Intelligence. This presents ample opportunities for strategic M&A.

- Technology Integration: Azbil could acquire or partner with startups in areas like AI-driven predictive maintenance or advanced energy management systems to enhance its existing solutions.

- Geographic Expansion: Partnerships with local distributors or technology providers in emerging markets, such as Southeast Asia or parts of Africa, could accelerate Azbil's global reach.

Emerging Markets Growth

Emerging markets, particularly in the Asia-Pacific region, are showing robust growth. This is driven by significant industrialization and increased investment in key sectors like manufacturing and energy. For Azbil, this translates into a substantial opportunity for its automation solutions.

Azbil can leverage this by strategically expanding its footprint and developing customized offerings that align with the unique demands of these dynamic economies. For instance, the manufacturing sector in Southeast Asia is projected to grow significantly, with countries like Vietnam and Thailand attracting substantial foreign direct investment in 2024 and expected to continue this trend into 2025.

- Asia-Pacific Industrialization: Regions like Vietnam and Indonesia are experiencing rapid industrial expansion, boosting demand for advanced manufacturing technologies.

- Energy Sector Investment: Growing investments in renewable energy infrastructure across emerging markets present opportunities for Azbil's energy management and control systems.

- Market Tailoring: Azbil can gain market share by adapting its building automation and industrial automation solutions to local regulatory environments and business needs.

- Economic Projections: The IMF's 2024 forecast indicated strong GDP growth for many Asian emerging economies, underpinning increased capital expenditure in industrial sectors.

Azbil is positioned to benefit from the increasing global focus on energy efficiency and decarbonization, with regulatory mandates and environmental awareness driving demand for its solutions. The company can also capitalize on the consolidation within the building automation and process control sectors by pursuing strategic acquisitions or partnerships to expand its technological capabilities and market reach.

The growth in emerging markets, particularly in Asia-Pacific, presents a significant opportunity for Azbil due to rapid industrialization and investment in manufacturing and energy sectors. Furthermore, the expanding Industrial Internet of Things (IIoT) market, projected to reach $1.1 trillion by 2028, offers a substantial avenue for Azbil's smart manufacturing and operational efficiency technologies.

| Opportunity Area | Market Projection/Growth Driver | Azbil's Relevance |

|---|---|---|

| Smart Building Market | Projected to reach $115.7 billion by 2026 | Leveraging advanced building automation and control solutions |

| Industrial IoT Market | Projected to reach $1.1 trillion by 2028 | Providing smart manufacturing solutions for efficiency and predictive maintenance |

| Energy Efficiency & Decarbonization | IEA: Over 40% of emissions reductions needed by 2030 | Optimizing energy usage and minimizing environmental impact with existing technologies |

| Market Consolidation (Building Automation) | CAGR of 11.9% (2023-2028) | Strategic M&A for technology and market presence expansion |

| Emerging Markets (Asia-Pacific) | Robust industrialization and investment in manufacturing | Expanding footprint and tailoring solutions for dynamic economies |

Threats

Global economic uncertainties, including persistent inflation and a general cooling of the investment climate, pose a significant threat. Businesses are increasingly likely to reduce or entirely halt capital expenditures on new automation projects as a precautionary measure.

This slowdown directly impacts Azbil's order intake and revenue streams, particularly within its industrial automation segments. For instance, a projected global GDP growth slowdown in 2024-2025 could translate into delayed or canceled large-scale industrial projects for Azbil.

The relentless pace of technological change, particularly in artificial intelligence, machine learning, and sophisticated robotics, presents a significant risk of Azbil's current product lines becoming outdated. This rapid evolution demands constant R&D investment to ensure offerings remain relevant and competitive. For instance, while Azbil reported strong performance in its automation business in fiscal year 2023, continued investment in next-generation AI-driven control systems will be crucial to counter emerging threats from nimble startups leveraging these advanced technologies.

Ongoing global supply chain vulnerabilities, exacerbated by geopolitical events and logistical challenges, continue to pose a significant threat to Azbil's operations. Fluctuations in raw material costs, such as semiconductors and specialized components, directly impact production expenses. For instance, the average price of semiconductors saw significant increases in late 2023 and early 2024, affecting industries worldwide.

These disruptions can lead to delays in manufacturing schedules and hinder Azbil's ability to meet customer demand promptly. Such impacts can erode profitability by increasing operational costs and potentially necessitate price adjustments for Azbil's automation and control products, affecting competitiveness.

Intensifying Cybersecurity Risks

The increasing reliance on interconnected automation systems, driven by IIoT and cloud adoption, significantly elevates Azbil's exposure to cybersecurity threats. A successful cyberattack could compromise sensitive customer data and disrupt critical industrial operations, leading to substantial financial losses and reputational damage.

Protecting its advanced automation solutions and customer information from sophisticated cyberattacks is a critical challenge for Azbil. The potential consequences of a breach are severe, including significant financial penalties, legal liabilities, and a lasting erosion of customer trust.

- Cybersecurity Spending: Global spending on cybersecurity solutions is projected to reach over $231 billion in 2024, highlighting the escalating threat landscape and the need for robust defenses.

- Impact of Breaches: The average cost of a data breach in 2024 reached $4.73 million, underscoring the financial risks associated with security vulnerabilities.

- Industrial Control System (ICS) Vulnerabilities: Reports indicate a rise in attacks targeting ICS, with over 30% of organizations experiencing at least one such incident in the past year, directly impacting sectors Azbil serves.

Geopolitical Risks and Trade Barriers

Geopolitical tensions, particularly in key markets for Azbil's automation and control solutions, pose a significant threat. For instance, ongoing trade disputes between major economic blocs could lead to increased tariffs on components or finished goods, directly impacting Azbil's cost structure and pricing competitiveness in those regions.

Trade protectionism and evolving international trade policies present substantial barriers to Azbil's global expansion strategy. Changes in import/export regulations or the imposition of new trade barriers can disrupt supply chains and limit market access, as seen with the potential for increased protectionist measures in sectors relevant to Azbil's advanced manufacturing and building automation technologies.

These geopolitical and trade-related uncertainties can negatively affect Azbil's international business operations and profitability. For example, a sudden shift in trade policy could necessitate costly adjustments to manufacturing locations or distribution networks, thereby increasing operational risks and potentially dampening revenue growth from overseas markets.

- Increased Tariffs: Potential for higher tariffs on imported components or finished automation systems could raise Azbil's cost of goods sold.

- Market Access Restrictions: New trade barriers or sanctions could limit Azbil's ability to enter or operate in certain strategic international markets.

- Supply Chain Disruptions: Geopolitical instability can lead to disruptions in the global supply chain for critical electronic components used in Azbil's products.

- Currency Volatility: Geopolitical events often trigger currency fluctuations, impacting the profitability of international sales when repatriated.

Azbil faces significant threats from global economic slowdowns, which can curb capital spending on automation projects, directly impacting its order intake. The rapid pace of technological advancement, especially in AI, necessitates continuous R&D to prevent product obsolescence, with emerging startups posing a competitive challenge. Supply chain disruptions and rising component costs, like semiconductors, threaten production schedules and profitability. Furthermore, sophisticated cybersecurity threats to its interconnected systems could lead to severe financial and reputational damage, with global cybersecurity spending projected to exceed $231 billion in 2024.

| Threat Category | Specific Risk | Potential Impact | Supporting Data (2024/2025) |

|---|---|---|---|

| Economic Uncertainty | Reduced Capital Expenditure | Lower order intake and revenue | Projected global GDP growth slowdown in 2024-2025 impacting industrial projects. |

| Technological Obsolescence | AI/ML advancements | Need for constant R&D; risk of products becoming outdated | Fiscal year 2023 saw strong automation performance, but future competitiveness hinges on next-gen AI systems. |

| Supply Chain Vulnerabilities | Component cost fluctuations (e.g., semiconductors) | Increased production costs, delayed delivery | Average semiconductor prices increased in late 2023/early 2024. |

| Cybersecurity Risks | Attacks on IIoT/cloud systems | Data breaches, operational disruption, reputational damage | Global cybersecurity spending projected >$231 billion in 2024; avg. data breach cost $4.73 million. |

SWOT Analysis Data Sources

This Azbil SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market intelligence, and expert industry analyses to provide a well-rounded strategic perspective.