Azbil Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Azbil Bundle

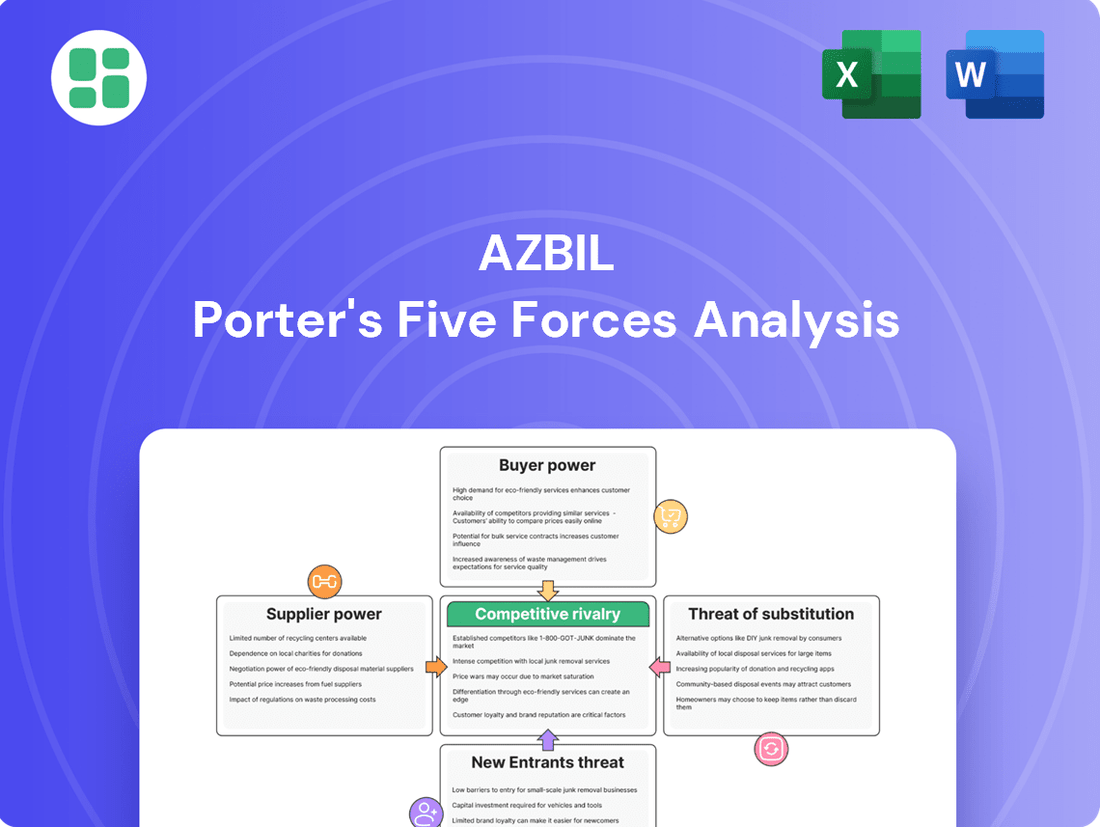

Azbil's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate the automation and control industry. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Azbil’s competitive dynamics, market pressures, and strategic advantages in detail, gaining a comprehensive view of its market position.

Suppliers Bargaining Power

Azbil's reliance on specialized, high-tech components for its sophisticated automation and control systems significantly influences supplier bargaining power. When these critical parts are proprietary or sourced from a small pool of manufacturers, these suppliers gain considerable leverage.

This dependence can translate into higher component costs for Azbil, impacting its profit margins. For instance, in 2024, the semiconductor industry, a key supplier of advanced microcontrollers and sensors, experienced continued supply chain pressures and price increases due to high global demand and geopolitical factors, directly affecting companies like Azbil that rely on these specialized inputs.

Furthermore, a limited supplier base creates potential vulnerabilities in Azbil's supply chain. Disruptions from even a single key supplier, whether due to production issues, quality control problems, or strategic shifts by the supplier, could halt Azbil's own production and delay project deliveries, underscoring the strategic importance of managing these supplier relationships.

The availability of alternative suppliers significantly impacts Azbil's bargaining power. If Azbil relies on common components with many readily available vendors, suppliers have less leverage. For instance, in 2024, the global semiconductor market, a key component for many Azbil products, saw increased production capacity from multiple foundries, potentially easing supply chain pressure for standard chips.

However, Azbil's reliance on specialized or proprietary technologies from a limited number of suppliers can shift the power balance. If Azbil sources unique sensors or control systems from just one or two vendors, those suppliers can command higher prices or more favorable terms. This is particularly relevant for Azbil's advanced building automation solutions, where specialized integrations might limit supplier options.

The cost of switching suppliers significantly impacts Azbil's bargaining power. If Azbil faces high expenses and operational disruptions, such as retooling machinery, re-certifying processes, or redesigning products to work with alternative vendors, existing suppliers gain leverage. This is particularly true for specialized components where finding and integrating a new supplier can be a complex and costly undertaking.

Supplier industry concentration

When the industry supplying Azbil is highly concentrated, meaning only a few large companies control a significant portion of the market, those suppliers gain considerable bargaining power. This concentration allows them to dictate terms and pricing more assertively, directly affecting Azbil's operational expenses and profit margins.

For instance, if Azbil relies on a limited number of specialized component manufacturers, these suppliers can leverage their market dominance. In 2024, many advanced electronics and industrial automation sectors experienced supply chain consolidation, increasing the leverage of key component providers. This situation can lead to higher input costs for Azbil, as suppliers face less competition and can command premium prices.

- Supplier Concentration: A concentrated supplier base grants significant leverage to a few dominant players.

- Pricing Power: Dominant suppliers can more easily influence and increase the prices of raw materials or components.

- Impact on Azbil: Higher input costs directly reduce Azbil's profitability and can necessitate price adjustments for its own products.

Importance of Azbil to supplier's business

The significance of Azbil as a customer directly impacts a supplier's willingness to negotiate. If Azbil constitutes a substantial portion of a supplier's overall sales, that supplier is likely more amenable to offering competitive pricing and favorable terms to retain such a valuable client. For instance, if a key component supplier reported that Azbil accounted for over 15% of their revenue in their 2024 fiscal year, Azbil would possess considerable bargaining power in that relationship.

Conversely, if Azbil represents a small fraction of a supplier's business, the supplier may have less incentive to accommodate Azbil's demands. In such scenarios, suppliers might prioritize larger, more strategic accounts, diminishing Azbil's leverage. This dynamic is common when suppliers serve a broad customer base, where a single client’s volume, even if significant in absolute terms, is relatively minor in the supplier’s overall revenue stream.

The bargaining power of suppliers to Azbil is influenced by several factors related to Azbil's importance to them:

- Revenue Dependence: Suppliers heavily reliant on Azbil for a large percentage of their revenue are more likely to concede to Azbil's demands.

- Customer Concentration: If Azbil is one of only a few major clients for a supplier, its importance and therefore its bargaining power increases.

- Switching Costs for Suppliers: High costs for a supplier to find alternative customers would strengthen Azbil's negotiating position.

- Supplier Market Share: A supplier with a dominant market share for a critical input may have less need to appease Azbil, but if Azbil is a flagship customer for that dominant supplier, the leverage can still shift.

The bargaining power of suppliers to Azbil is significantly shaped by the concentration within the supplier industries. When a few large entities dominate the market for critical components, they can exert considerable pricing and term influence. For example, in 2024, the advanced sensor market, vital for Azbil's automation solutions, saw increased consolidation among key manufacturers, leading to more assertive pricing strategies from these dominant suppliers.

This concentration directly impacts Azbil's cost structure. Suppliers in concentrated markets can more easily pass on increased production costs or simply command higher prices due to reduced competitive pressure. This can erode Azbil's profit margins if these cost increases cannot be fully offset by price adjustments or efficiency gains.

The impact of supplier concentration on Azbil's operations is substantial. Higher input costs stemming from dominant suppliers can affect the competitiveness of Azbil's final products and may necessitate strategic sourcing adjustments or investments in alternative technologies to mitigate this leverage.

| Factor | Description | Impact on Azbil | 2024 Context |

|---|---|---|---|

| Supplier Concentration | Few dominant players in a supplier industry. | Increased supplier leverage, higher prices. | Consolidation in advanced sensor and semiconductor markets noted. |

| Pricing Power | Suppliers can dictate terms and prices. | Higher input costs for Azbil. | Price increases observed for specialized electronic components. |

| Customer Dependence | Azbil's share of a supplier's revenue. | Higher dependence means more supplier willingness to negotiate. | Azbil's large orders can secure favorable terms if it represents a significant portion of a supplier's business. |

What is included in the product

Assesses the competitive intensity within Azbil's operating environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly assess competitive pressures across all five forces with a visual, easy-to-understand framework.

Customers Bargaining Power

Azbil's customer base spans building automation, industrial automation, and advanced process control. If a few major clients hold significant sway within any of these segments, their ability to negotiate lower prices or demand tailored solutions increases substantially. This concentration can directly affect Azbil's profit margins.

Customers wield greater bargaining power when they have readily available alternatives, whether from direct competitors or substitute technologies that offer similar advantages. This ease of switching significantly impacts a company's pricing and profit margins.

Azbil actively works to mitigate this by emphasizing its unique value proposition in areas like enhanced energy efficiency, robust safety features, and improved productivity. These differentiators are designed to make customers perceive Azbil's offerings as less substitutable, thereby reducing their inclination to switch to alternatives.

For instance, in the building automation sector, where Azbil operates, the availability of multiple control system providers and the increasing adoption of IoT-based solutions present a clear avenue for customers to explore alternatives. Azbil's focus on integrated solutions, as seen in its 2024 fiscal year performance where it reported strong growth in its Building Automation segment, demonstrates an effort to lock in customers through comprehensive and differentiated offerings.

In markets where products are similar or the market is well-established, customers often pay close attention to price. This heightened price sensitivity directly translates into greater bargaining power for them. For instance, in the building automation sector, while some clients prioritize advanced features, others might select providers based primarily on cost, especially for less complex installations.

Azbil addresses this by emphasizing its value-added services and customized system integrations. This strategy aims to differentiate its offerings beyond just price, fostering loyalty and reducing the likelihood of customers solely seeking the lowest bid. For example, Azbil's commitment to energy efficiency solutions for commercial buildings, which can lead to significant long-term operational savings, helps to offset initial price concerns for clients focused on total cost of ownership.

Customer's ability to integrate backwards

The bargaining power of customers increases significantly if they possess the capability to integrate backwards into Azbil's value chain. Large industrial clients or major building management entities might possess the technical expertise and financial resources to develop their own automation and control systems. This potential for in-house development directly challenges Azbil's market position, compelling the company to maintain a competitive edge through superior product features and cost-effectiveness.

For instance, a major manufacturing conglomerate could invest in developing proprietary control software or even hardware components, thereby reducing their dependence on Azbil's offerings. This threat forces Azbil to continuously innovate and optimize its cost structure to retain such significant clients. The ability of customers to replicate or substitute Azbil's core competencies is a powerful lever in price negotiations and contract terms.

Consider the trend in the industrial automation sector where many large enterprises are building internal centers of excellence for digital transformation. These centers often explore developing custom solutions. For example, in 2024, several Fortune 500 companies announced significant investments in their internal IT and engineering departments specifically to enhance their operational technology (OT) capabilities, aiming to reduce reliance on third-party vendors for critical control systems.

- Backward Integration Threat: Customers can develop in-house automation and control solutions, reducing reliance on Azbil.

- Competitive Pressure: This capability forces Azbil to compete aggressively on features and pricing.

- Client Retention: Azbil must demonstrate ongoing value to prevent clients from insourcing.

- Market Dynamics: The potential for clients to become competitors influences Azbil's strategic planning and R&D focus.

Completeness of information available to customers

Customers armed with detailed market intelligence, including pricing, competitor products, and technical specifications, gain significant leverage in negotiations. This access to information empowers them to compare offerings and demand better terms, directly impacting Azbil's pricing power and profitability.

Azbil's commitment to transparency in its product offerings and clear communication of its value proposition is paramount. By proactively managing customer expectations and clearly articulating the benefits and costs associated with its solutions, Azbil can effectively mitigate the risk of unreasonable demands stemming from information asymmetry.

- Information Accessibility: In 2024, the proliferation of online review sites, comparison platforms, and readily available technical documentation means customers have unprecedented access to information about industrial automation solutions.

- Negotiating Leverage: This heightened transparency allows customers to benchmark Azbil's pricing against competitors, potentially leading to price sensitivity and demands for concessions.

- Value Proposition Clarity: Azbil's ability to clearly articulate its unique selling points, such as advanced technology, reliability, and service support, becomes critical in justifying its pricing and retaining customers even when faced with price-driven competition.

Azbil's customers possess significant bargaining power when they have numerous alternatives or can easily switch to competitors offering similar automation solutions. This is particularly true in segments where Azbil's products are perceived as commodities or where switching costs are low. For instance, in 2024, the building automation market continued to see a steady influx of new entrants and technological advancements, increasing customer options and thus their leverage.

When customers are concentrated, meaning a few large clients represent a significant portion of Azbil's revenue, these key accounts can exert considerable pressure on pricing and terms. This concentration is evident in sectors like large-scale industrial manufacturing where a handful of global players often dictate terms. Azbil's strategy to mitigate this involves fostering strong relationships and offering integrated solutions that increase customer stickiness.

The bargaining power of Azbil's customers is also amplified when they are price-sensitive, meaning cost is a primary driver in their purchasing decisions. This is more common in less complex applications or for clients with tighter budgets. Azbil counters this by highlighting the total cost of ownership, emphasizing long-term savings through energy efficiency and reduced maintenance, as demonstrated in their 2024 fiscal year reports which noted growth in service-related revenues.

Customers can also wield greater power if they are capable of backward integration, meaning they can develop their own automation systems. This threat is more pronounced in the industrial automation sector, where large enterprises often have the resources to build internal expertise. Azbil's continuous innovation and focus on differentiated, high-value solutions are key to preventing this scenario.

| Factor | Impact on Azbil | Mitigation Strategy |

|---|---|---|

| Availability of Alternatives | Increases customer leverage, potentially lowering prices. | Emphasize unique value propositions, integrated solutions. |

| Customer Concentration | Major clients can demand better terms, impacting margins. | Build strong relationships, offer customized value. |

| Price Sensitivity | Customers prioritize cost, leading to price wars. | Focus on total cost of ownership, long-term savings. |

| Backward Integration Threat | Customers may develop in-house solutions, reducing reliance. | Continuous innovation, superior features, cost optimization. |

Same Document Delivered

Azbil Porter's Five Forces Analysis

This preview shows the exact Azbil Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It meticulously details the competitive landscape for Azbil, examining the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This comprehensive document is ready for your strategic planning and decision-making.

Rivalry Among Competitors

The automation and control solutions market is intensely competitive, with a broad range of players from global conglomerates to highly specialized firms. This crowded landscape, particularly with numerous companies holding substantial market share, fuels fierce competition for significant projects and overall market leadership.

The industry growth rate significantly impacts competitive rivalry. In markets with robust expansion, like the global industrial automation market projected to grow at a compound annual growth rate (CAGR) of approximately 8.5% from 2024 to 2030, companies can often increase sales without directly clashing over existing customers. This allows for a more collaborative or at least less confrontational environment as each player focuses on capturing new demand.

However, when growth slows, as seen in some mature segments of the building automation sector, competition intensifies. Companies then vie more aggressively for market share, which can lead to price reductions, increased promotional spending, or a greater focus on product differentiation to win over customers from rivals. For instance, in 2024, companies in the HVAC control systems market are experiencing this dynamic as the growth rate moderates.

Azbil distinguishes itself by focusing on its fundamental measurement and control technologies, coupled with solutions that offer added value to customers. This emphasis on unique capabilities is crucial in a market where competitors can easily replicate offerings.

The competitive landscape necessitates continuous investment in research and development for Azbil. For instance, in fiscal year 2023, Azbil reported R&D expenses of approximately 23 billion Japanese Yen, reflecting a commitment to innovation to stay ahead of rivals who can introduce highly differentiated or novel products.

Switching costs for customers

Low switching costs for customers generally intensify competitive rivalry, as businesses must constantly attract and retain clients. For Azbil, this means that if their offerings aren't compelling, customers can readily shift to competitors. This dynamic pressures Azbil to innovate and provide superior value to maintain its market share.

Azbil actively works to counteract this by fostering long-term customer relationships. They achieve this through the development of integrated systems that are more complex to replace and by offering comprehensive support services. This strategy aims to increase the perceived cost and effort for a customer to switch away from Azbil's ecosystem.

- Low Switching Costs: Customers can easily switch providers if they find better pricing or features elsewhere.

- Competitive Pressure: This ease of switching forces Azbil to continuously offer competitive pricing and innovative solutions.

- Azbil's Strategy: Azbil focuses on building loyalty through integrated solutions and robust after-sales support to mitigate switching.

- Customer Retention: The goal is to make the cost and complexity of switching high enough to encourage continued business with Azbil.

Exit barriers for competitors

High exit barriers in the building automation and control industry, like Azbil's substantial investment in specialized manufacturing facilities and R&D for advanced sensor technology, can trap less profitable competitors. These companies may be forced to continue operating even in challenging market conditions, thereby sustaining intense rivalry. For instance, in 2024, the global building automation market, while growing, still sees established players with significant sunk costs in proprietary hardware and software struggling to divest without substantial losses, thus prolonging competitive pressure.

These enduring competitive pressures, stemming from high exit barriers, can significantly depress overall industry profitability. Competitors unable to achieve economies of scale or innovative differentiation are often compelled to compete on price, further eroding margins for all participants. This dynamic is particularly evident in segments requiring extensive installation and maintenance networks, where early entrants have a distinct advantage that makes exiting costly.

- High Fixed Asset Investment: Companies with significant capital tied up in specialized production lines for control systems face substantial losses if forced to liquidate.

- Specialized Labor Requirements: The need for highly trained engineers and technicians in installation and support creates a human capital barrier to exit.

- Long-Term Contracts and Service Agreements: Existing commitments to customers for maintenance and upgrades can obligate companies to remain in the market.

- Brand Reputation and Customer Relationships: Established trust and ongoing service contracts make it difficult for companies to simply walk away from their customer base.

The automation and control solutions sector is characterized by intense rivalry, driven by a diverse range of competitors from large corporations to niche specialists. This crowded market, with many players holding significant market share, intensifies competition for major projects and overall industry leadership.

The industry's growth rate plays a crucial role; robust expansion, such as the global industrial automation market's projected 8.5% CAGR from 2024 to 2030, allows companies to grow without directly poaching customers. Conversely, slower growth in mature segments, like HVAC controls in 2024, forces more aggressive competition on price and differentiation.

Azbil differentiates itself through its core measurement and control technologies and value-added solutions, a necessity in a market where competitors can easily replicate offerings. Continuous investment in R&D, exemplified by Azbil's 23 billion JPY expenditure in fiscal year 2023, is vital for staying ahead of rivals introducing innovative products.

Low customer switching costs compel Azbil to constantly offer competitive pricing and innovative solutions to retain clients, as seen in the HVAC control market. Azbil counteracts this by building long-term relationships through integrated systems and comprehensive support, increasing the perceived cost of switching.

| Metric | Value | Year | Source |

| Global Industrial Automation Market CAGR | 8.5% | 2024-2030 | Market Research Reports |

| Azbil R&D Expenses | 23 billion JPY | FY2023 | Azbil Annual Report |

| Building Automation Market Growth | Moderate | 2024 | Industry Analysis |

SSubstitutes Threaten

The threat of substitutes for Azbil's automation and control solutions is amplified by the rapid emergence of alternative technologies. These new solutions can often address similar customer needs but through entirely different approaches, potentially bypassing Azbil's core offerings.

For example, the increasing sophistication of Internet of Things (IoT) platforms, particularly those focused on data analytics and cloud-based management, presents a significant substitute. Companies are increasingly adopting these platforms for monitoring and optimizing operations, which can overlap with the functions of traditional automation systems.

Furthermore, advancements in artificial intelligence (AI) are enabling AI-driven predictive maintenance solutions from non-traditional automation providers. These AI tools can forecast equipment failures and suggest maintenance schedules, offering a compelling alternative to Azbil's established control systems for certain applications. This trend is evident as global spending on industrial IoT platforms, a key area for potential substitution, was projected to reach over $150 billion in 2024.

If substitute solutions offer a comparable or superior performance at a lower cost, customers may opt for them, potentially eroding Azbil's market share. For instance, in the industrial automation sector, while Azbil offers advanced control systems, cheaper, less sophisticated alternatives might appeal to smaller businesses or those with less stringent performance requirements. This price-performance trade-off is a constant challenge.

Azbil must continuously demonstrate the long-term value, reliability, and efficiency benefits of its specialized systems to justify its pricing. For example, Azbil's focus on energy efficiency in building automation can translate to significant cost savings for clients over the system's lifecycle, a benefit that needs clear communication to counter the initial price perception of substitutes.

Customers' willingness to switch to alternative solutions is influenced by how risky, easy to adopt, and familiar they are with current offerings. For Azbil, this means highlighting the clear advantages and straightforward integration of its advanced automation and control systems to overcome any hesitation.

Azbil must actively engage its market, demonstrating the tangible benefits of its comprehensive, integrated solutions. For instance, by showcasing how its building automation systems can reduce energy consumption by up to 20% compared to standalone controls, as reported in industry studies by 2024, Azbil can directly address customer concerns about switching costs and perceived complexity.

Development of in-house solutions by customers

Large industrial and commercial clients increasingly possess the technical expertise and resources to develop their own automation and control systems. This trend is fueled by the availability of modular hardware and open-source software, allowing them to bypass specialized providers like Azbil. For instance, in 2024, a significant number of manufacturing firms reported increased internal R&D spending on bespoke digital solutions, with some allocating up to 15% of their IT budgets to such initiatives.

This in-house development becomes a potent substitute when the perceived complexity and cost of external, integrated solutions from companies like Azbil are deemed too high. Clients can leverage readily available components and software frameworks to create tailored systems that meet their specific operational needs, potentially at a lower long-term cost and with greater control over intellectual property.

- Customer-driven innovation: Clients are shifting from passive consumers to active developers of their automation infrastructure.

- Cost-benefit analysis: The decision to develop in-house is often driven by a direct comparison of internal development costs versus the lifetime cost of third-party solutions.

- Technological accessibility: Advances in modular hardware and open-source software have lowered the barrier to entry for creating custom automation systems.

- Market trends: By 2024, it's estimated that over 30% of large enterprises are exploring or actively implementing in-house automation solutions, a notable increase from previous years.

Regulatory or technological shifts favoring alternatives

Changes in industry regulations or significant technological breakthroughs can make alternative, simpler, or more standardized solutions more attractive or even compulsory. For Azbil, this means staying vigilant about these evolving trends to adjust its product and service portfolio proactively. For instance, in 2024, increased governmental focus on energy efficiency standards in building automation could push demand towards more modular or off-the-shelf control systems, potentially impacting Azbil's customized solutions.

These shifts can significantly alter the competitive landscape by lowering switching costs for customers who might find readily available, less integrated alternatives more appealing. Azbil must therefore continually assess how emerging technologies and evolving compliance requirements might enable new substitute offerings to gain traction.

- Regulatory shifts favoring interoperability: New mandates for open standards in building management systems could empower third-party providers offering simpler, component-based solutions.

- Technological advancements in IoT: The proliferation of affordable, smart IoT devices presents a growing substitute for integrated building automation systems, particularly for smaller or less complex facilities.

- Emergence of AI-driven optimization: Advancements in artificial intelligence are enabling sophisticated energy management through software alone, potentially reducing reliance on hardware-centric automation.

- Standardization of building components: A move towards more standardized, plug-and-play building components could simplify installations and maintenance, making alternatives more accessible.

The threat of substitutes for Azbil's offerings is substantial due to evolving technologies and customer capabilities. The rise of sophisticated IoT platforms and AI-driven solutions provides alternative methods for achieving operational optimization and predictive maintenance, often at competitive price points. For instance, global spending on industrial IoT platforms was projected to exceed $150 billion in 2024, highlighting the growing adoption of these substitute technologies.

Furthermore, some large clients are increasingly developing their own automation systems in-house, leveraging modular hardware and open-source software. This trend, with an estimated 30% of large enterprises exploring or implementing such solutions by 2024, signifies a direct challenge to specialized providers like Azbil.

Regulatory changes and technological breakthroughs can also favor simpler, more standardized alternatives, potentially reducing the need for Azbil's integrated systems. For example, increased governmental focus on energy efficiency standards in 2024 might boost demand for modular building automation components.

| Substitute Category | Key Technologies | Impact on Azbil | Market Trend Example (2024) |

|---|---|---|---|

| Technological Alternatives | IoT Platforms, AI-driven Analytics | Can perform similar functions, potentially at lower cost | Industrial IoT spending > $150 billion |

| In-house Development | Modular Hardware, Open-Source Software | Reduces reliance on external providers | 30% of large enterprises exploring in-house solutions |

| Standardized/Simpler Solutions | Off-the-shelf components, basic controls | Appeals to smaller clients or specific needs | Increased focus on energy efficiency standards |

Entrants Threaten

The automation and control industry demands substantial upfront investment. Companies need significant capital for research and development to innovate, sophisticated manufacturing plants to produce complex systems, and broad sales and service networks to reach global customers. For instance, developing a new industrial automation platform can easily cost hundreds of millions of dollars.

These high capital requirements act as a formidable barrier to entry. Potential new competitors are often dissuaded by the sheer financial commitment needed to establish a foothold and compete effectively. This protects existing players, like Azbil, by limiting the influx of new rivals who lack the necessary financial muscle.

Azbil’s strong brand loyalty and established reputation act as a significant deterrent to new entrants. Existing customers trust Azbil's reliability and innovative solutions, making it difficult for newcomers to gain market acceptance. For instance, Azbil’s commitment to quality in the industrial automation sector, a key area for the company, means new players must overcome years of proven performance to even be considered.

Azbil's core measurement and control technologies, honed over decades, are a significant deterrent to new entrants. These proprietary advancements are likely safeguarded by a robust portfolio of patents and intellectual property, making it exceedingly difficult for newcomers to replicate Azbil's specialized solutions.

This deep well of protected knowledge acts as a formidable barrier, as replicating Azbil's sophisticated offerings would require substantial investment in research and development, as well as navigating complex patent landscapes. For instance, Azbil's commitment to innovation is reflected in its consistent R&D spending, which in fiscal year 2023 amounted to approximately 8.5% of its net sales, a testament to its focus on maintaining technological leadership.

Access to distribution channels

The threat of new entrants is significantly influenced by the difficulty of accessing established distribution channels. For a company like Azbil, which operates in complex global and specialized markets, building an effective sales network and service infrastructure is a monumental task. This process is not only time-consuming but also requires substantial capital investment.

Newcomers often find it challenging to replicate the extensive networks that incumbents have spent years developing. This barrier is particularly high in industries where customer relationships and trust are paramount, such as building automation and industrial control systems. Azbil's established presence and long-standing partnerships provide a considerable advantage, making it difficult for new players to gain market traction.

- Distribution Channel Access: New entrants face significant hurdles in establishing robust sales and service networks.

- Incumbent Advantage: Companies like Azbil benefit from years of investment in building these critical infrastructures.

- Market Entry Barriers: The complexity and cost associated with creating these channels act as a strong deterrent to new competitors.

- Customer Relationships: Trust and established relationships in specialized markets further solidify the advantage of existing players.

Regulatory hurdles and industry standards

The industrial and building automation sectors are heavily regulated, posing a significant barrier for new companies. For instance, compliance with standards like ISO 9001 for quality management or specific environmental regulations can demand substantial upfront investment and expertise. In 2024, many jurisdictions continued to tighten building codes and energy efficiency standards, requiring new entrants to dedicate resources to understanding and meeting these evolving requirements.

Navigating these complex compliance landscapes is a time-consuming and costly endeavor. New entrants must invest in certifications, testing, and potentially redesigning products to meet safety, environmental, and performance mandates. The global building automation market, valued at approximately $82.6 billion in 2023, is expected to see continued growth, but this growth is tempered by the need for new players to demonstrate robust compliance from the outset.

- Stringent Safety Regulations: Compliance with standards like UL or CE marking adds cost and time to market entry.

- Environmental Compliance: Meeting regulations such as RoHS or REACH requires careful material sourcing and product design.

- Industry-Specific Performance Standards: Adherence to standards like ASHRAE for HVAC systems necessitates specialized knowledge and testing.

- Certification Costs: Obtaining necessary certifications can range from thousands to hundreds of thousands of dollars, depending on the product and region.

The threat of new entrants into Azbil's markets is generally low due to several significant barriers. High capital requirements for R&D and manufacturing, coupled with the need for extensive sales and service networks, deter many potential competitors. Azbil's established brand loyalty and proprietary technologies, protected by patents, further solidify its position.

Regulatory compliance and the difficulty of accessing established distribution channels also create substantial hurdles. For instance, in 2024, evolving building codes and energy efficiency standards in the global building automation market, valued at approximately $82.6 billion in 2023, demanded significant upfront investment and expertise from newcomers. Azbil’s consistent R&D spending, around 8.5% of net sales in fiscal year 2023, underscores its commitment to maintaining a technological edge.

| Barrier Type | Description | Impact on New Entrants | Example for Azbil's Markets |

| Capital Requirements | High investment needed for R&D, manufacturing, and distribution. | Deters new entrants lacking substantial funding. | Developing new industrial automation platforms can cost hundreds of millions of dollars. |

| Brand Loyalty & Reputation | Established trust and proven performance. | Makes market acceptance difficult for newcomers. | Azbil's long history of reliability in industrial automation. |

| Proprietary Technology & Patents | Unique, protected technological advancements. | Requires significant R&D investment and patent navigation for replication. | Azbil's protected measurement and control technologies. |

| Distribution Channels | Access to established sales and service networks. | Challenging and costly for new players to replicate. | Azbil's global sales and service infrastructure. |

| Regulatory Compliance | Adherence to safety, environmental, and performance standards. | Demands upfront investment in certifications and expertise. | Meeting evolving building codes and energy efficiency standards in 2024. |

Porter's Five Forces Analysis Data Sources

Our Azbil Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Azbil's annual reports, investor presentations, and industry-specific market research from firms like IDC and Gartner. We also incorporate data from regulatory filings and macroeconomic indicators to provide a comprehensive view of the competitive landscape.