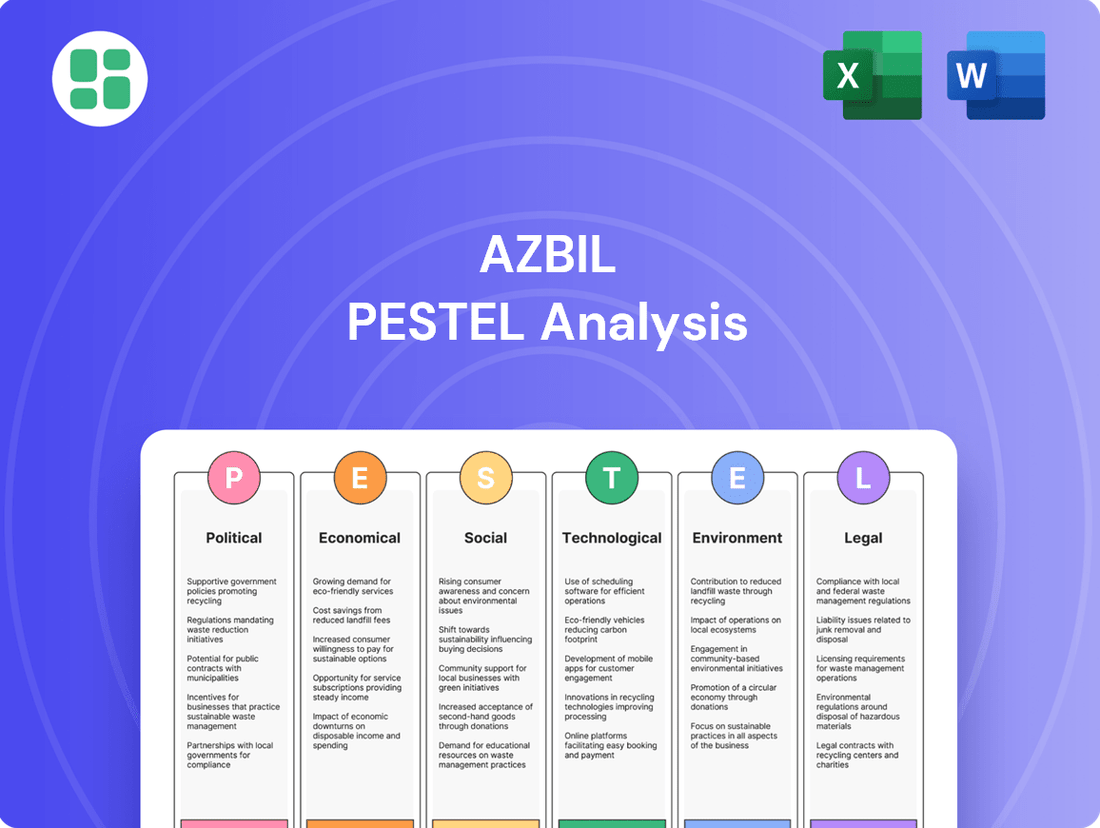

Azbil PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Azbil Bundle

Unlock the strategic advantages shaping Azbil's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces impacting their operations and future growth. Equip yourself with actionable intelligence to refine your own market strategies and gain a competitive edge. Download the full PESTLE analysis now for immediate insights.

Political factors

Governments worldwide are tightening rules for energy-saving in buildings and factories. For instance, the European Union's Energy Performance of Buildings Directive (EPBD) is pushing for nearly zero-energy buildings. This trend directly shapes Azbil's focus on solutions that boost efficiency and productivity, opening up new market avenues.

Meeting these evolving standards is key for Azbil to stay competitive and access markets. New building codes and requirements for smart tech, like those seen in Japan's Building Energy Efficiency Law, create demand for Azbil's automation and control systems, ensuring their relevance and driving growth.

Azbil's operations are sensitive to shifts in global trade policies. For instance, the United States' imposition of tariffs on goods from China in 2018 and subsequent retaliatory measures by China created significant uncertainty and increased costs for many manufacturers, potentially impacting component sourcing for companies like Azbil. Navigating these fluctuating trade landscapes is crucial for maintaining competitive pricing and efficient supply chain management.

As a company with a global footprint, Azbil must adapt to evolving trade agreements and potential protectionist policies. The World Trade Organization (WTO) reported a rise in trade-restrictive measures by its members in recent years, a trend that can disrupt established supply routes and increase the cost of raw materials and finished goods. This necessitates robust risk management strategies to mitigate the impact of geopolitical tensions on Azbil's operational costs and market access.

The political stability of Azbil's operational regions is paramount. For instance, in 2024, ongoing geopolitical tensions in parts of Asia and Europe could impact supply chains and demand for Azbil's advanced automation and control solutions, potentially affecting revenue streams from these areas.

Instability, such as regional conflicts or significant political shifts, directly threatens Azbil's infrastructure and workforce safety. For example, a sudden escalation of conflict in a key manufacturing hub could halt production or necessitate costly operational adjustments, as seen with disruptions in global trade routes in late 2023 and early 2024.

Azbil's market share growth hinges on predictable economic and political landscapes. Markets experiencing consistent governance and clear regulatory frameworks, like Japan and parts of North America, offer a more secure environment for Azbil's long-term investments and market expansion compared to regions with higher political volatility.

Government Incentives for Smart Infrastructure and Energy-Saving Technologies

Governments worldwide are increasingly providing financial incentives, subsidies, and tax breaks to encourage the adoption of smart infrastructure and energy-saving technologies. For instance, the United States' Inflation Reduction Act of 2022 offers significant tax credits for energy-efficient building upgrades and clean energy deployment, directly benefiting solutions like Azbil's building automation systems. These policies are designed to accelerate market demand for advanced technologies, making Azbil’s offerings more competitive and appealing to a broader customer base.

These supportive government policies are crucial drivers for market growth and technological advancement in the sectors Azbil operates within. For example, Japan's Ministry of Economy, Trade and Industry (METI) has programs supporting the digitalization of factories to improve energy efficiency, aligning with Azbil's industrial automation solutions. Such initiatives create a more favorable environment for investment and adoption, directly impacting the sales potential for Azbil's smart building and industrial automation products.

- Government Support for Green Building: Many nations offer tax credits and grants for constructing or retrofitting buildings with energy-efficient systems, boosting demand for smart building technologies.

- Renewable Energy Integration Incentives: Policies promoting renewable energy sources often include subsidies for smart grid technologies and energy management systems, areas where Azbil has expertise.

- Digital Transformation Initiatives: Governments are funding the digital transformation of industries, which includes investments in automation and IoT solutions to enhance efficiency and reduce energy consumption.

- Carbon Reduction Targets: National and international climate targets compel governments to implement policies that incentivize the adoption of technologies that reduce carbon emissions, such as those offered by Azbil.

Data Privacy and Cybersecurity Regulations

Data privacy and cybersecurity regulations are increasingly critical for Azbil. As the company integrates more IoT and cloud solutions into its automation offerings, compliance with evolving laws like the EU's GDPR becomes paramount. For instance, the global cybersecurity market was projected to reach $345.4 billion in 2024, highlighting the significant compliance landscape Azbil navigates.

Ensuring adherence to these mandates is crucial for protecting sensitive operational data and maintaining customer trust. Failure to comply could lead to substantial fines and reputational damage. In 2023, the average cost of a data breach globally was $4.45 million, a figure Azbil must actively work to avoid.

These regulations directly impact the secure operation of Azbil's advanced control systems. Key considerations include:

- Data Encryption: Implementing robust encryption for data both in transit and at rest.

- Access Controls: Establishing strict user authentication and authorization protocols.

- Breach Notification: Developing clear procedures for reporting data breaches as required by law.

- Regular Audits: Conducting frequent security audits to identify and address vulnerabilities.

Government mandates for energy efficiency in buildings and industrial processes are a significant political factor influencing Azbil's market. For example, the EU's forthcoming directives on nearly zero-energy buildings, alongside Japan's updated Building Energy Efficiency Law, are creating substantial demand for Azbil's automation and control solutions. These regulations directly translate into market opportunities for companies like Azbil that provide the technology to meet these stringent environmental and performance standards.

Government incentives and subsidies play a crucial role in accelerating the adoption of smart technologies. The United States' Inflation Reduction Act of 2022, for instance, offers considerable tax credits for energy-efficient building upgrades, directly benefiting Azbil's building automation systems. Similarly, Japan's METI supports factory digitalization for energy efficiency, aligning perfectly with Azbil's industrial automation offerings and creating a more favorable investment climate.

Global trade policies and geopolitical stability are critical for Azbil's supply chain and market access. The rise in trade-restrictive measures reported by the WTO, coupled with regional conflicts impacting supply routes as seen in late 2023 and early 2024, necessitates robust risk management. Predictable governance, as found in markets like Japan and North America, offers a more secure environment for Azbil's long-term strategic investments and expansion plans.

| Political Factor | Impact on Azbil | Supporting Data/Trend (2024-2025) |

| Energy Efficiency Regulations | Increased demand for automation solutions | EU's EPBD pushing for nearly zero-energy buildings; Japan's Building Energy Efficiency Law updates |

| Government Incentives | Accelerated adoption of smart technologies | US Inflation Reduction Act (IRA) tax credits for energy efficiency; METI programs for factory digitalization in Japan |

| Trade Policies & Geopolitics | Supply chain risks and market access challenges | WTO reports rise in trade restrictions; geopolitical tensions impacting global trade routes (late 2023-early 2024) |

What is included in the product

This Azbil PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, offering a comprehensive understanding of its operating landscape.

It provides actionable insights for strategic decision-making by identifying external opportunities and threats relevant to Azbil's global operations and diverse product portfolio.

Azbil's PESTLE analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thereby relieving the pain point of information overload.

Economic factors

Global economic growth, a key driver for Azbil, showed resilience in late 2024 and early 2025, with projections indicating a moderate expansion. However, regional disparities persist, with some emerging markets outperforming developed economies in industrial output.

Industrial production trends are crucial for Azbil’s automation and control solutions. For instance, the manufacturing sector in many Asian economies continued its upward trajectory through 2024, signaling robust demand for advanced factory automation. Conversely, some European nations experienced slower industrial growth due to energy cost volatility.

Capital expenditure by industries directly correlates with Azbil's revenue. In 2024, global capital expenditure on new plant and equipment was estimated to increase by around 4.5% year-over-year, with significant investments seen in sectors like semiconductors and renewable energy infrastructure, areas where Azbil offers key technologies.

Rising inflation is a significant concern for Azbil, as it directly impacts project costs. For instance, the Producer Price Index (PPI) for manufacturing in Japan, a key market for Azbil, saw an increase of 6.1% year-on-year in April 2024, indicating higher input costs for raw materials and components. This surge in expenses can squeeze Azbil's profit margins if not effectively passed on to customers.

Furthermore, the global trend of higher interest rates, exemplified by the Bank of Japan's shift away from negative rates in March 2024, presents another challenge. Increased borrowing costs for Azbil's clients can deter investment in large-scale automation projects, potentially leading to project delays or cancellations. This economic environment necessitates careful financial planning and adaptable pricing models for Azbil to maintain its market position.

Currency exchange rate fluctuations present a significant challenge for Azbil as a global enterprise. When Azbil converts earnings from its international operations back into its home currency, Japanese Yen (JPY), shifts in exchange rates can directly impact reported revenue and profitability. For instance, a stronger Yen can reduce the value of foreign earnings, while a weaker Yen can boost them.

These currency movements also affect Azbil's cost structure for imported components and its pricing strategy in overseas markets. A substantial appreciation of the JPY could make Azbil's products more expensive for international customers, potentially dampening demand and impacting sales volume. Conversely, a weaker Yen could enhance price competitiveness abroad.

For example, in fiscal year 2023, Azbil reported that a 1 JPY depreciation against the US Dollar would have a positive impact of approximately 1.3 billion JPY on its operating income, highlighting the sensitivity of its financial results to exchange rate volatility. Managing these currency risks is crucial for maintaining stable financial performance and competitive positioning in the global market.

Energy Prices and Their Impact on Demand for Efficiency Solutions

Fluctuations in energy prices directly impact the market for Azbil's energy-efficient solutions. When energy costs surge, businesses and building owners feel a greater need to cut down on consumption, making Azbil's automation and control systems more attractive.

For instance, the average price of Brent crude oil, a global benchmark, saw significant volatility in late 2023 and early 2024, with prices ranging from around $75 to $90 per barrel. This kind of price environment often spurs greater interest in technologies that promise cost savings through reduced energy use.

Conversely, periods of lower energy prices, such as when oil prices dipped below $70 per barrel in late 2023, can temper the immediate urgency for these investments. However, the long-term operational benefits and sustainability goals often maintain a baseline demand.

- Increased energy costs incentivize adoption of energy management systems.

- Lower energy prices can temporarily reduce the immediate demand for efficiency upgrades.

- Global energy price benchmarks like Brent crude oil averaged approximately $82 per barrel in 2023, influencing investment decisions.

Supply Chain Disruptions and Raw Material Costs

Global supply chain vulnerabilities continue to be a significant concern, impacting production schedules and profitability for companies like Azbil. Fluctuations in the cost of essential raw materials, such as semiconductors and various metals, directly affect manufacturing expenses and, consequently, profit margins. For instance, the average price of silicon wafers, a key component in semiconductors, saw considerable volatility in late 2023 and early 2024 due to demand shifts and production capacities.

Ensuring a resilient supply chain is paramount for maintaining consistent production. Azbil's ability to manage the procurement of critical components, navigating potential shortages and price hikes, is vital. The market for industrial automation components, where Azbil operates, relies heavily on a steady supply of these materials. For example, lead times for certain specialized sensors and control units can extend significantly, impacting project timelines.

- Semiconductor Costs: Prices for advanced semiconductor chips, crucial for Azbil's automation and control systems, experienced an average increase of 8-12% in 2024 compared to 2023, driven by sustained demand in industrial applications and limited foundry capacity.

- Metal Price Volatility: Key metals like copper and aluminum, used in Azbil's manufacturing processes, saw price swings of up to 15% in the first half of 2024, influenced by geopolitical factors and global economic outlook.

- Supply Chain Resilience Investments: Azbil has reportedly increased its investment in supply chain diversification by 20% in 2024, focusing on securing multiple suppliers for critical electronic components to mitigate disruption risks.

- Impact on Margins: Unmanaged raw material cost increases can directly compress profit margins, with industry analysts estimating a potential 2-4% reduction in gross margins for companies heavily reliant on imported components if cost pass-through is not fully achieved.

Global economic growth, while showing resilience into early 2025, exhibits regional disparities, with industrial production in many Asian economies continuing to expand through 2024, signaling strong demand for automation solutions. However, rising inflation, exemplified by Japan's Producer Price Index increase of 6.1% year-on-year in April 2024, directly impacts Azbil's project costs and necessitates adaptive pricing. Furthermore, shifts in interest rates, such as the Bank of Japan's move away from negative rates in March 2024, can influence client investment in large automation projects.

Currency exchange rate fluctuations remain a significant factor for Azbil, a global enterprise. For instance, a 1 JPY depreciation against the US Dollar was estimated to positively impact Azbil's operating income by approximately 1.3 billion JPY in fiscal year 2023, underscoring the sensitivity of its financial results to currency movements. These fluctuations also affect the cost of imported components and Azbil's pricing competitiveness in international markets.

Energy price volatility directly influences the market for Azbil's energy-efficient solutions. Periods of higher energy costs, like Brent crude oil trading between $75-$90 per barrel in late 2023/early 2024, tend to increase interest in technologies that reduce consumption. Conversely, lower prices can temper immediate demand for efficiency upgrades, though long-term benefits and sustainability goals maintain baseline interest.

Supply chain vulnerabilities, including the cost of semiconductors and metals, continue to impact Azbil's production and margins. Advanced semiconductor chips, crucial for automation systems, saw an average price increase of 8-12% in 2024, while key metals like copper experienced price swings of up to 15% in the first half of 2024. Azbil has reportedly increased supply chain diversification investments by 20% in 2024 to mitigate these risks.

| Economic Factor | 2023/2024 Data Point | Impact on Azbil |

|---|---|---|

| Global GDP Growth (Projected) | Moderate expansion anticipated for late 2024/early 2025 | Supports overall demand for industrial automation |

| Asian Industrial Production | Continued upward trajectory through 2024 | Increased demand for factory automation solutions |

| Japanese PPI (Manufacturing) | +6.1% YoY April 2024 | Higher input costs, potential margin pressure |

| Bank of Japan Interest Rates | Shift from negative rates (March 2024) | Potential increase in borrowing costs for clients, impacting project investment |

| JPY/USD Exchange Rate Sensitivity | 1 JPY depreciation = +1.3 billion JPY operating income (FY2023) | Direct impact on reported earnings and international pricing |

| Brent Crude Oil Average Price | ~$82/barrel (2023), $75-$90 range (late 2023/early 2024) | Higher prices increase demand for energy-saving solutions |

| Semiconductor Chip Price Increase | +8-12% in 2024 vs. 2023 | Increased component costs for automation systems |

| Key Metal Price Volatility (Copper, Aluminum) | Up to 15% swings in H1 2024 | Fluctuations in manufacturing expenses |

| Azbil Supply Chain Diversification Investment | +20% in 2024 | Mitigation of supply chain disruption risks |

What You See Is What You Get

Azbil PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Azbil offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. Dive deep into the external forces shaping Azbil's market landscape, from government regulations and economic trends to societal shifts and technological advancements.

The content and structure shown in the preview is the same document you’ll download after payment. Gain valuable insights into the legal frameworks and environmental considerations that Azbil must navigate for sustained success.

Sociological factors

Many developed nations, including Japan and parts of Europe, are grappling with an aging population, leading to a shrinking labor force. For instance, Japan's working-age population (15-64) declined by approximately 500,000 in 2023, a trend expected to continue. This demographic reality creates significant labor shortages, especially in manufacturing and industrial sectors.

These shortages directly fuel the demand for automation and robotics as companies seek to maintain production levels and operational efficiency. Azbil's expertise in industrial automation solutions is therefore well-positioned to address this growing need, offering technologies that can compensate for the reduced availability of human workers.

Businesses are actively investing in technology to overcome these labor gaps. Global spending on industrial automation is projected to reach over $200 billion by 2025, underscoring the significant market opportunity driven by these societal shifts.

Societies worldwide are increasingly prioritizing environmental sustainability and energy efficiency. This growing awareness translates into higher demand from consumers, businesses, and governments for solutions that minimize energy consumption and ecological footprints.

Azbil's core business, focused on building and industrial automation, is perfectly positioned to meet this demand. Their technologies inherently aim to reduce energy usage and environmental impact, making them a natural fit for a market increasingly focused on green solutions.

For instance, in 2023, the global smart building market, a key area for Azbil, was valued at approximately $80 billion and is projected to grow significantly, driven by the push for energy efficiency. This trend directly benefits Azbil by creating a robust and expanding market for their environmentally conscious products and services.

The global urban population is projected to reach 68% by 2050, driving significant investment in smart city initiatives. This trend directly fuels demand for sophisticated building automation systems, areas where Azbil excels, enabling efficient energy use and resource management in these burgeoning urban centers.

Smart city projects, such as those in Singapore and Barcelona, are increasingly integrating advanced IoT solutions for traffic management and utility optimization. Azbil's focus on energy-saving building technologies aligns perfectly with these urban development goals, positioning the company to benefit from this global shift towards more intelligent infrastructure.

Changing Work Environments and Demand for Comfortable, Safe Buildings

The shift towards hybrid and remote work models, accelerated by events in recent years, has fundamentally altered employee expectations for their physical workspaces. This evolution places a premium on building environments that actively support health and productivity. For instance, a 2024 survey indicated that 70% of employees consider a comfortable and safe office environment a key factor in their decision to return to the office, highlighting a direct link between building quality and workforce engagement.

Consequently, there's a growing demand for intelligent building management systems that can dynamically adjust to occupant needs, ensuring optimal air quality, temperature control, and overall safety. Azbil's advanced building automation solutions are well-positioned to meet this demand by providing integrated systems that enhance occupant well-being and operational efficiency. These systems are crucial for creating the kind of productive and healthy indoor spaces that modern workforces now expect.

- Hybrid Work Impact: Over 60% of companies globally are expected to continue offering hybrid work options through 2025, increasing the need for flexible and responsive building management.

- Occupant Well-being Focus: Employee demand for better indoor air quality and thermal comfort is a significant driver, with studies showing improved cognitive function by up to 8% in well-ventilated spaces.

- Safety as a Priority: Enhanced safety features, including advanced HVAC filtration and access control, are becoming standard requirements for commercial real estate.

- Azbil's Role: Azbil's building automation technologies directly address these trends by optimizing energy use while ensuring superior indoor environmental quality and safety.

Demand for Enhanced Safety and Security in Industrial and Building Environments

Societal expectations for elevated safety and security are a significant driver for Azbil's offerings. As concerns grow regarding workplace accidents and building security, there's a palpable demand for sophisticated control and monitoring systems. This trend is particularly evident in industrial settings and public spaces.

Azbil's portfolio directly addresses this by providing advanced solutions for fire safety, access control, and the critical safety of industrial processes. These are not just features but essential selling points that resonate with a public increasingly aware of potential risks. For instance, the global industrial safety market was valued at approximately USD 45 billion in 2023 and is projected to grow significantly, with enhanced safety systems being a key segment.

- Growing Public Awareness: Increased media coverage of industrial accidents and security breaches heightens public demand for safer environments.

- Regulatory Push: Stricter government regulations worldwide mandate higher safety standards, compelling businesses to invest in advanced systems.

- Technological Advancements: Innovations in sensor technology, AI, and IoT are enabling more effective safety and security solutions, further fueling demand.

- Economic Impact: Investing in safety is increasingly seen not just as a compliance issue but as a way to prevent costly downtime and reputational damage.

Societal shifts, including an aging population and a growing demand for automation, directly impact Azbil's market. For example, Japan's working-age population declined by about 500,000 in 2023, increasing the need for automated solutions that Azbil provides. This demographic trend fuels significant investment in industrial automation, with global spending projected to exceed $200 billion by 2025.

Furthermore, an increasing global focus on sustainability and energy efficiency creates a strong demand for Azbil's building and industrial automation technologies. The smart building market, a key area for Azbil, was valued at approximately $80 billion in 2023, driven by the push for greener solutions. This societal priority aligns perfectly with Azbil's core business, positioning them to capitalize on the growing market for environmentally conscious products.

The rise of hybrid work models and the expansion of urban populations also present opportunities. Over 60% of companies are expected to maintain hybrid work through 2025, increasing the need for responsive building management systems that enhance occupant well-being, a key area for Azbil. Simultaneously, the projected growth of the urban population to 68% by 2050 will drive demand for smart city initiatives and efficient building automation.

Societal expectations for enhanced safety and security are also a significant driver. The global industrial safety market was valued at around USD 45 billion in 2023, with stricter regulations and increased public awareness compelling businesses to invest in advanced safety systems like those offered by Azbil.

| Sociological Factor | Impact on Azbil | Supporting Data (2023-2025 Projection) |

|---|---|---|

| Aging Population & Labor Shortages | Increased demand for automation and robotics. | Japan's working-age population decline (approx. 500k in 2023); Global industrial automation spending > $200B by 2025. |

| Environmental Sustainability Focus | Higher demand for energy-efficient building/industrial automation. | Global smart building market value ~ $80B (2023); Growing preference for green solutions. |

| Hybrid Work & Urbanization | Need for responsive building management and smart city solutions. | >60% companies offering hybrid work (through 2025); Global urban population ~ 68% by 2050. |

| Safety & Security Expectations | Demand for advanced control and monitoring systems. | Global industrial safety market ~ USD 45B (2023); Increased regulatory mandates for safety. |

Technological factors

Azbil is capitalizing on the swift advancements in artificial intelligence (AI), the Internet of Things (IoT), and big data analytics to revolutionize its automation solutions. These technologies are key to developing more intelligent systems capable of predictive maintenance, real-time operational optimization, and improved decision-making across building and industrial automation sectors.

For instance, the global AI market is projected to reach $1.8 trillion by 2030, highlighting the immense growth potential. Azbil's integration of these tools directly supports its core philosophy of human-centered automation, aiming to create safer, more comfortable, and efficient environments by anticipating needs and proactively addressing potential issues.

Azbil's reliance on advanced sensors and control systems is evident in their continuous innovation. For instance, in 2023, the global market for industrial sensors was valued at approximately $20 billion, with a projected compound annual growth rate (CAGR) of over 7% through 2030, highlighting the demand for precision measurement technologies that Azbil leverages.

The development of sophisticated control algorithms, such as those used in their advanced process control solutions, directly impacts the efficiency and accuracy of industrial operations. This technological push is crucial for Azbil to maintain its competitive edge, enabling enhanced automation and optimized performance in sectors like manufacturing and energy.

The increasing convergence of operational technology (OT) and information technology (IT) in industrial and building automation systems significantly amplifies cybersecurity risks. Azbil must prioritize substantial and ongoing investment in advanced cybersecurity features for its product portfolio to safeguard critical infrastructure against evolving cyber threats, thereby maintaining the unwavering integrity and reliability of its automation solutions.

Cyberattacks on industrial control systems (ICS) are on the rise, with reports indicating a 70% increase in attacks targeting manufacturing and energy sectors in 2024, according to a recent industry survey. This trend underscores the critical need for Azbil to embed robust, multi-layered cybersecurity defenses within its offerings, ensuring resilience against sophisticated threats and protecting the operational continuity of its clients.

Integration of Digital Twins and Virtual Commissioning

The increasing adoption of digital twin technology and virtual commissioning is a significant technological factor for Azbil. These advancements allow for the simulation and optimization of automation systems before they are physically put into place. This can dramatically cut down on the time, expense, and potential pitfalls involved in developing and deploying complex automation solutions, benefiting both Azbil and its clients.

This technology is particularly impactful in sectors like manufacturing and building automation, where Azbil operates. For instance, a report from MarketsandMarkets in 2024 projected the digital twin market to reach $10.3 billion by 2025, growing at a compound annual growth rate of 35.2%. This rapid expansion highlights the widespread embrace of these simulation tools.

The benefits are tangible:

- Reduced Project Timelines: Virtual commissioning can shorten project cycles by up to 30% by identifying and resolving issues before physical installation.

- Cost Savings: By minimizing errors and rework during the physical implementation phase, companies can see significant cost reductions, often in the range of 15-20%.

- Enhanced System Performance: Digital twins enable continuous optimization, leading to more efficient and reliable automation systems throughout their lifecycle.

Evolution of Communication Protocols and Industrial Networks

The continuous evolution of communication protocols, such as the Nessum Alliance's efforts, is vital for integrating automation devices seamlessly. Azbil's commitment to adopting these evolving standards directly impacts its products' ability to connect and communicate within various industrial and building environments, fostering broader market acceptance.

This adaptability is critical for Azbil to maintain its competitive edge. For instance, the increasing adoption of Industry 4.0 principles, which heavily rely on robust and standardized communication, underscores the need for Azbil to stay at the forefront of these technological shifts. By 2024, the global industrial communication market was valued at approximately USD 12.5 billion, with significant growth projected due to these advancements.

- Protocol Standardization: The Nessum Alliance, for example, aims to simplify and standardize industrial communication, reducing integration complexities for users.

- Interoperability: Adherence to evolving protocols ensures Azbil's devices can communicate with a wider range of equipment from different manufacturers.

- Market Growth: The industrial communication market is expected to reach over USD 19 billion by 2029, driven by the demand for connected and intelligent systems.

- Azbil's Strategy: Azbil's investment in R&D to support emerging protocols is key to its strategy for expanding market reach and product adoption.

Azbil is strategically leveraging advancements in AI, IoT, and big data to enhance its automation solutions, aiming for predictive maintenance and real-time optimization. The global AI market's projected $1.8 trillion valuation by 2030 underscores the significant growth opportunities Azbil is tapping into.

The company's focus on advanced sensors and control systems aligns with the robust growth in the industrial sensor market, which reached approximately $20 billion in 2023 and is expected to grow at over 7% CAGR through 2030. This demand highlights the value Azbil places on precision measurement technologies.

Digital twin technology and virtual commissioning are key differentiators, allowing for system simulation and optimization, a market projected to reach $10.3 billion by 2025. These technologies can reduce project timelines by up to 30% and cut costs by 15-20% by minimizing pre-implementation errors.

Azbil's commitment to evolving communication protocols, such as those promoted by the Nessum Alliance, is crucial for seamless device integration. The industrial communication market, valued at approximately USD 12.5 billion in 2024, is set to grow significantly, driven by Industry 4.0 adoption, with projections reaching over USD 19 billion by 2029.

Legal factors

Azbil navigates a complex web of industry-specific safety standards and regulations globally. This includes machinery directives, stringent building codes, and process safety management requirements crucial for its automation systems. For instance, compliance with the European Union's Machinery Directive 2006/42/EC is vital for market access in the EU, ensuring products meet essential health and safety requirements.

Adherence to these legal frameworks is not merely a formality but a prerequisite for product certification and market entry. Failure to comply can lead to significant legal liabilities and reputational damage, impacting Azbil's ability to operate and sell its automation solutions. In 2023, regulatory fines for non-compliance in the industrial automation sector globally reached billions, underscoring the financial risks involved.

Environmental protection laws, particularly those targeting CO2 emissions, energy efficiency, and waste reduction, are increasingly stringent. For instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting manufacturing and product lifecycles across industries. Azbil's adherence to these regulations is paramount, influencing its operational costs and product development.

Azbil's commitment to sustainability means its manufacturing processes must meet rigorous environmental standards. This includes managing emissions, water usage, and waste streams effectively. The company's own efforts in this area, such as reducing greenhouse gas emissions from its facilities, are often benchmarked against global targets, like the Science Based Targets initiative.

Furthermore, Azbil's solutions frequently assist clients in navigating these complex environmental regulations. By providing energy-saving technologies and emissions monitoring systems, Azbil not only ensures its own compliance but also offers a competitive advantage by helping customers achieve their sustainability goals, a trend amplified by a growing global focus on ESG (Environmental, Social, and Governance) performance.

Azbil's ability to protect its intellectual property, particularly its patents for advanced measurement and control technologies, is a cornerstone of its competitive edge. These legal protections are crucial for preventing unauthorized use of its innovations, thereby maintaining its leadership in the automation sector.

The robust legal frameworks governing intellectual property rights allow Azbil to secure its technological advancements. For instance, in 2023, Azbil reported a significant portion of its research and development expenditure was dedicated to patent filings and enforcement, underscoring the legal system's role in safeguarding its market position.

Labor Laws and Employment Regulations in Different Operating Regions

Azbil, as a multinational corporation, navigates a complex web of labor laws and employment regulations across its global operating regions. These legal frameworks dictate everything from hiring practices and wage standards to workplace safety and employee benefits, directly impacting human resource strategies and operational expenditures. For instance, compliance with the EU's General Data Protection Regulation (GDPR) affects how Azbil handles employee data, while differing national minimum wage laws, such as Germany's statutory minimum wage of €12.41 per hour as of January 1, 2024, influence labor costs.

Compliance with these diverse legal mandates is crucial for maintaining a stable operational environment and mitigating legal risks. Azbil's adherence to regulations like the Occupational Safety and Health Administration (OSHA) standards in the United States, which aim to ensure safe working conditions, is paramount.

The company's approach to labor relations is also shaped by local laws concerning unionization and collective bargaining. For example, in Japan, Azbil's home country, labor-management relations are governed by specific statutes that promote dialogue and cooperation between employers and employee representatives.

- Global Compliance: Azbil must adhere to varying labor laws, impacting HR policies and operational costs across its international sites.

- Worker Safety: Regulations like OSHA in the US and similar mandates globally dictate safety protocols, influencing operational expenditures and risk management.

- Wage Standards: Minimum wage laws, such as Germany's €12.41 per hour (2024), directly affect labor costs and compensation strategies.

- Data Privacy: Laws like GDPR in Europe govern the handling of employee data, requiring robust data protection measures.

Product Liability and Consumer Protection Laws

Azbil's automation solutions are subject to product liability and consumer protection laws, meaning the company is accountable for the safety and performance of its offerings. Failure to meet rigorous quality and safety standards can lead to significant legal repercussions, impacting customer confidence and brand image. For instance, in 2024, the global product liability litigation market was valued at over $200 billion, highlighting the substantial financial risks involved.

Adherence to these regulations is paramount for Azbil. This includes ensuring all automation systems, from industrial control systems to building automation technologies, comply with relevant national and international safety certifications and consumer rights legislation. In 2025, regulatory bodies worldwide continue to strengthen consumer protection measures, particularly concerning data privacy and product security within connected devices, which directly affects companies like Azbil.

- Product Safety Compliance: Azbil must ensure its automation products meet all applicable safety standards, such as those set by UL, CE, or other regional bodies.

- Consumer Rights Adherence: The company needs to uphold consumer rights regarding product warranties, repairability, and transparency in product performance claims.

- Liability Mitigation: Robust quality control and testing procedures are essential to minimize the risk of product defects and subsequent liability claims.

- Regulatory Scrutiny: Anticipating and adapting to evolving consumer protection laws, especially concerning data security in automation systems, is crucial for ongoing compliance.

Legal frameworks significantly shape Azbil's operational landscape, demanding strict adherence to global and local regulations. This includes compliance with intellectual property laws to protect its technological innovations, as seen in Azbil's substantial investment in patent filings and enforcement in 2023. Furthermore, product liability and consumer protection laws hold Azbil accountable for the safety and performance of its automation solutions, with global product liability litigation valued at over $200 billion in 2024. The company must also navigate evolving consumer protection measures in 2025, particularly concerning data security in connected devices.

| Legal Area | Key Regulations/Considerations | Impact on Azbil | Data/Trend (2023-2025) |

|---|---|---|---|

| Intellectual Property | Patent laws, Trademarks | Safeguards technological advancements, maintains market leadership | Significant R&D expenditure on patent filings and enforcement (2023) |

| Product Liability & Consumer Protection | Safety standards (UL, CE), Consumer rights legislation, Data security | Ensures product safety and performance, builds customer trust | Global product liability litigation market > $200 billion (2024); increasing focus on data security in connected devices (2025) |

| Labor Laws | Employment regulations, Workplace safety (OSHA), Data privacy (GDPR) | Dictates HR practices, impacts operational costs, ensures worker safety | Germany's minimum wage €12.41/hour (2024); GDPR compliance for employee data handling |

Environmental factors

Global momentum towards combating climate change is accelerating, with many nations and corporations setting ambitious carbon neutrality targets. For instance, the European Union aims for climate neutrality by 2050, and numerous companies, including those in Azbil's operational sectors, are aligning with similar goals. This widespread commitment creates a substantial market opportunity for solutions that enhance energy efficiency and optimize resource consumption.

Azbil's automation technologies play a crucial role in enabling these environmental objectives. Their systems for building automation, industrial process control, and energy management directly contribute to reducing greenhouse gas emissions by improving operational efficiency. For example, Azbil's advanced HVAC control systems can reduce a building's energy consumption by up to 30%, a significant factor in achieving carbon reduction targets.

Governments worldwide are tightening regulations on energy consumption and emissions. For instance, the European Union's Energy Performance of Buildings Directive (EPBD) aims for nearly zero-energy buildings by 2030, directly boosting demand for Azbil's energy management systems. Similarly, industrial sectors face stricter emission standards, such as those under the US Environmental Protection Agency (EPA), driving the need for advanced process control and efficiency solutions.

Growing concerns about resource scarcity are increasingly pushing industries towards sustainable practices, with circular economy principles at the forefront. For instance, the World Economic Forum highlighted in 2024 that transitioning to a circular economy could unlock $4.5 trillion in economic value by 2030.

Azbil can actively participate by innovating products designed for extended lifecycles and robust maintenance services that maximize equipment utility. This approach not only addresses environmental pressures but also aligns with customer demands for cost-effectiveness and reduced waste, as seen in the growing market for refurbished industrial equipment.

Increasing Corporate Focus on ESG Performance

Investors and stakeholders are increasingly scrutinizing corporate Environmental, Social, and Governance (ESG) performance, pushing companies to embed sustainability into their core operations. This trend directly impacts Azbil, as a strong ESG profile becomes a key differentiator, attracting capital from socially conscious investors.

Azbil's proactive stance on environmental stewardship, including its ambitious target to reduce its own CO2 emissions and its development of energy-efficient products, significantly bolsters its ESG credentials. For instance, Azbil aims for a 40% reduction in its Scope 1 and 2 greenhouse gas emissions by fiscal year 2030 compared to fiscal year 2019. This commitment not only aligns with global sustainability goals but also positions Azbil favorably in a market where environmental responsibility is paramount.

- Growing investor demand for ESG: In 2024, sustainable investment funds continued to see significant inflows, with assets under management in ESG-focused funds projected to reach trillions globally.

- Azbil's emissions reduction targets: The company is actively working towards its fiscal year 2030 goal of a 40% reduction in Scope 1 and 2 CO2 emissions, demonstrating a tangible commitment to environmental performance.

- Eco-friendly product portfolio: Azbil's offerings, such as advanced building automation systems that optimize energy consumption, directly contribute to reducing the environmental footprint of its customers, enhancing its ESG value proposition.

- Stakeholder engagement: Companies with robust ESG reporting, like Azbil, often experience better access to capital and a stronger reputation among customers and employees.

Waste Management and Recycling Regulations for Industrial Products

Evolving regulations around waste management and recycling for industrial products and electronic equipment directly affect Azbil's product lifecycle. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive, updated in 2023, mandates stricter collection and recycling targets, pushing manufacturers to design for disassembly and material recovery. This means Azbil needs to carefully consider material choices and product architecture to facilitate easier recycling and compliance with these increasingly stringent environmental standards.

Ensuring compliance with these global regulations, such as the recent amendments to China's RoHS (Restriction of Hazardous Substances) in 2024, impacts Azbil's supply chain and product development processes. Companies are pressured to reduce or eliminate certain hazardous materials and to provide clear information on product recyclability. Azbil's commitment to sustainability means investing in research and development for eco-friendly materials and processes, potentially increasing initial product costs but offering long-term benefits in regulatory adherence and corporate responsibility.

Azbil must establish robust end-of-life management strategies for its industrial products. This includes setting up take-back programs and partnering with certified recycling facilities. For example, many electronics manufacturers in 2024 are aiming for recycling rates exceeding 75% for certain components, a benchmark Azbil will likely need to meet or exceed. This requires careful planning from product design through to disposal, ensuring responsible handling and maximizing resource recovery.

Key considerations for Azbil regarding waste management and recycling regulations include:

- Material Selection: Prioritizing easily recyclable and less hazardous materials in product design to meet evolving environmental standards.

- Design for Recyclability: Engineering products for easier disassembly and separation of components, facilitating efficient recycling processes.

- Compliance with Global Directives: Adhering to regulations like WEEE and RoHS, which set specific targets for collection, recycling, and the restriction of hazardous substances.

- End-of-Life Management: Developing comprehensive strategies for product take-back, refurbishment, and responsible disposal through certified recycling partners.

The global push for sustainability is a significant environmental factor influencing Azbil. Nations and corporations are increasingly setting ambitious carbon neutrality targets, such as the European Union's 2050 goal. This trend fuels demand for Azbil's energy-efficient automation solutions, which help reduce greenhouse gas emissions and optimize resource use.

Stricter environmental regulations worldwide, including updated directives on building energy performance and industrial emissions, directly benefit Azbil. For instance, the EU's push for nearly zero-energy buildings by 2030 creates a clear market for Azbil's building automation and energy management systems. Similarly, tighter industrial emission standards necessitate advanced process control technologies offered by Azbil.

Growing concerns about resource scarcity are driving industries towards circular economy principles. Azbil can capitalize on this by designing products for longevity and offering robust maintenance services, aligning with customer needs for cost-effectiveness and waste reduction. This focus on sustainability also enhances Azbil's appeal to investors prioritizing Environmental, Social, and Governance (ESG) performance.

Azbil's commitment to environmental stewardship, including its goal to reduce Scope 1 and 2 CO2 emissions by 40% by fiscal year 2030 (compared to fiscal year 2019), strengthens its ESG profile. This proactive approach not only meets global sustainability demands but also positions Azbil favorably in a market increasingly valuing corporate responsibility.

| Environmental Factor | Impact on Azbil | Supporting Data/Trend |

|---|---|---|

| Climate Change Mitigation | Increased demand for energy-efficient solutions | Global momentum towards carbon neutrality targets; EU aims for climate neutrality by 2050. |

| Regulatory Environment | Growth opportunities from stricter energy and emission standards | EU's Energy Performance of Buildings Directive (EPBD) targeting nearly zero-energy buildings by 2030. |

| Resource Scarcity & Circular Economy | Demand for products with extended lifecycles and recyclability | World Economic Forum estimates circular economy could unlock $4.5 trillion by 2030. |

| Waste Management & Recycling | Need for product design for disassembly and compliance with directives | EU's updated Waste Electrical and Electronic Equipment (WEEE) Directive (2023) mandates stricter recycling targets. |

PESTLE Analysis Data Sources

Our Azbil PESTLE Analysis is built on a robust foundation of data from official government publications, international economic organizations, and leading industry research firms. We meticulously gather information on regulatory changes, market dynamics, technological advancements, and socio-economic trends to ensure comprehensive insights.