Azbil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Azbil Bundle

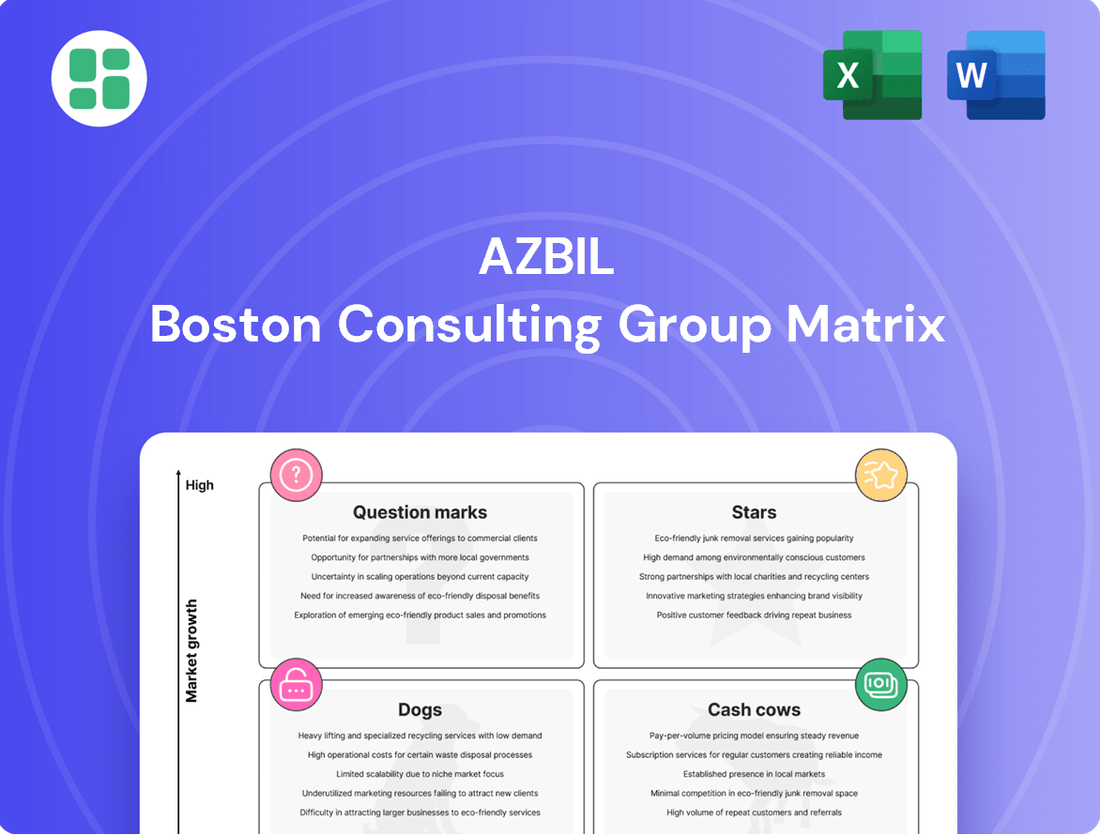

Uncover the strategic positioning of Azbil's product portfolio with our comprehensive BCG Matrix analysis. See which offerings are poised for growth, which are generating stable returns, and which may require a second look.

This snapshot is just the beginning. Purchase the full Azbil BCG Matrix report to gain detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your investments and product strategy.

Stars

Azbil's smart building solutions, including their integrated building management systems (IBMS) and chiller plant digital twin (CPDT), are capitalizing on the increasing demand for energy efficiency and carbon neutrality. These advanced offerings, powered by AI and IoT, deliver real-time optimization and predictive insights, setting Azbil apart in this expanding market.

The company's commitment to innovation is evident in its consistent recognition, such as the Frost & Sullivan Southeast Asia Company of the Year Award for Smart Building Solutions. This award highlights Azbil's strong market standing and its capability to provide cutting-edge solutions that meet evolving industry needs.

Azbil's AI and IoT-driven advanced automation solutions are a significant growth engine, tapping into the burgeoning demand for smart industrial operations. These technologies enable real-time monitoring and predictive maintenance, crucial for optimizing efficiency in sectors like manufacturing and energy. For instance, the global industrial automation market was projected to reach over $200 billion by 2024, with AI and IoT playing increasingly pivotal roles.

Azbil's dedication to green transformation (GX) and achieving carbon neutrality is a significant driver for their business. They offer solutions designed to help clients slash CO2 emissions and seamlessly incorporate renewable energy sources, positioning them strongly in a high-growth market. This focus directly addresses escalating global environmental regulations and the increasing emphasis on corporate ESG performance.

A prime example of Azbil's innovative stride in sustainability is their Demand Response Monitor. This technology plays a crucial role in facilitating electricity services by actively contributing to the delicate balance between energy supply and demand. Such offerings underscore Azbil's commitment to pioneering solutions within the expanding environmental technology sector.

Solutions for High-Growth Industrial Sectors

Azbil is focusing on high-growth sectors like semiconductors and data centers, recognizing the need for advanced automation solutions driven by technological progress and environmental concerns. By developing specialized products and services for these dynamic markets, the company aims to secure a substantial presence where investment and innovation are accelerating. This strategy leverages Azbil's expertise in control technology for emerging, high-potential applications.

For instance, the global semiconductor market is projected to reach $1 trillion by 2030, a significant increase from its estimated $600 billion valuation in 2023, highlighting the immense growth potential Azbil is targeting. Similarly, the data center market is experiencing robust expansion, with global spending expected to exceed $300 billion in 2024, driven by the insatiable demand for cloud computing and AI infrastructure.

- Semiconductor Manufacturing: Azbil's advanced control systems are crucial for optimizing complex processes in chip fabrication, ensuring precision and yield.

- Data Center Efficiency: The company provides solutions for energy management and environmental control within data centers, addressing the critical issue of high power consumption.

- Industry 4.0 Integration: Azbil's offerings support the digital transformation of these sectors, enabling smart factories and intelligent infrastructure.

- Market Expansion: This strategic pivot allows Azbil to capitalize on the rapid technological advancements and increasing demand for automation in these key industrial areas.

Overseas Expansion of Core Businesses

Azbil's strategy involves aggressively expanding its core building and advanced automation businesses globally. The company aims to replicate its domestic success in new markets, fostering local leadership to adapt offerings to regional needs. This international push is key to driving future growth beyond Japan's established markets.

In 2024, Azbil continued to emphasize overseas expansion as a primary growth driver. The company reported that its building automation and advanced automation segments were central to this global push, targeting increased sales in regions like North America and Asia. This focus aims to leverage Azbil's technological strengths in diverse international environments.

- Global Sales Target: Azbil has set ambitious targets to significantly increase the proportion of overseas sales in its total revenue, aiming for a substantial portion to come from international markets by the late 2020s.

- Regional Adaptation: The company is investing in locally managed operations to better tailor its building and advanced automation solutions to the specific demands and regulations of different countries.

- Growth Engine: Overseas expansion is viewed as the critical engine for Azbil's sustained high growth, compensating for the maturity of its domestic market.

- Competitive Advantage: By successfully applying its proven business models internationally, Azbil seeks to build a robust global competitive advantage.

Azbil's smart building solutions and advanced automation technologies are positioned as Stars in the BCG matrix due to their high growth potential and strong market position. These offerings, driven by AI and IoT, cater to the increasing demand for energy efficiency, carbon neutrality, and industrial digitalization.

The company's focus on sectors like semiconductors and data centers, which are experiencing rapid expansion and technological advancement, further solidifies their Star status. Azbil's commitment to green transformation and global expansion also supports this classification.

The global industrial automation market, projected to exceed $200 billion by 2024, is a key indicator of the growth environment for Azbil's advanced automation solutions. Similarly, the semiconductor market's projected growth to $1 trillion by 2030 and the data center market's expected spending over $300 billion in 2024 highlight the significant opportunities Azbil is targeting.

| Category | Growth Rate | Market Share | Azbil's Position |

| Smart Building Solutions | High | Strong | Star |

| Advanced Automation (AI/IoT) | High | Strong | Star |

| Semiconductor Automation | Very High | Growing | Star |

| Data Center Solutions | Very High | Growing | Star |

What is included in the product

The Azbil BCG Matrix categorizes business units by market share and growth rate.

It guides investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

Azbil BCG Matrix offers a clear, actionable overview of your portfolio, simplifying strategic decisions.

Cash Cows

Azbil's established Building Automation (BA) systems, a cornerstone of their operations, represent a classic Cash Cow. This segment, covering network systems, wide-area management, and traditional HVAC controls, consistently delivers significant cash flow. For instance, in fiscal year 2023, Azbil reported building automation revenue of ¥184.3 billion, demonstrating the substantial economic activity within this mature business.

The enduring strength of Azbil's BA business is fueled by consistent demand, particularly in the refurbishment of existing buildings. Projects focused on energy savings and CO2 reduction are driving this demand, alongside stable, multi-year service contracts that provide a predictable revenue stream. This recurring revenue model is key to its Cash Cow status, offering a reliable income even as new construction markets mature.

Azbil's core industrial process automation products, particularly within its Advanced Automation segment, are strong cash cows. These established control systems and instruments are vital for the continuous operation of plants, ensuring steady demand and a robust market position.

The process automation (PA) market, where these products are dominant, offers consistent profitability. This segment's stability helps offset any volatility seen in other areas, like factory automation, contributing significantly to Azbil's financial stability.

Azbil's traditional field instruments and controllers, including sensors and single-loop controllers, are firmly established in their markets. These are mature products with a significant market share, benefiting from consistent demand across diverse industries. Their reliability has built a strong reputation, reducing the need for extensive promotional spending.

These instruments act as Azbil's cash cows, generating steady revenue and profit. Their established market presence means they require minimal new investment to maintain their competitive standing. For instance, in the fiscal year ending March 2024, Azbil reported solid performance in its "Products" segment, which encompasses these types of offerings, indicating continued financial strength from these core businesses.

Maintenance and Lifecycle Services for Automation Systems

Azbil's maintenance and lifecycle services for automation systems are a strong cash cow, generating consistent revenue. These services, spanning both Building Automation and Advanced Automation, benefit from long-term contracts that ensure a steady income for system upkeep and upgrades.

The profitability of these services is further bolstered by cost pass-throughs within maintenance contracts. This model allows Azbil to maintain healthy margins on its installed base, ensuring reliable cash generation.

- Stable Recurring Revenue: Long-term contracts for maintenance and lifecycle services provide predictable income.

- High Profitability: Cost pass-throughs on maintenance contracts enhance profit margins.

- Installed Base Monetization: Services leverage Azbil's existing automation systems for ongoing revenue.

- Demand for Efficiency: Continuous need for system upkeep and efficiency improvements drives service utilization.

Safety and Combustion Control Equipment

Azbil's safety and combustion control equipment represents a classic cash cow. These are mature products, holding a significant and stable market share due to stringent regulatory mandates and the absolute necessity of operational safety in industrial environments.

These instruments, often critical for preventing hazardous incidents, benefit from long product lifecycles and recurring revenue streams through essential maintenance and upgrades. This consistent demand, coupled with established customer trust, ensures a reliable and predictable cash flow for Azbil, even in markets with modest growth potential.

- Stable Market Share: Azbil's safety and combustion control solutions are recognized for their high and stable market share, a testament to their reliability and adherence to safety standards.

- Regulatory Driven Demand: The non-negotiable need for regulatory compliance and operational safety in industries like petrochemicals, power generation, and manufacturing fuels consistent demand.

- Long Product Lifecycles and Recurring Revenue: These products typically have extended lifecycles, generating ongoing revenue from maintenance contracts, spare parts, and periodic system updates.

Azbil's established Building Automation (BA) systems, a cornerstone of their operations, represent a classic Cash Cow. This segment, covering network systems, wide-area management, and traditional HVAC controls, consistently delivers significant cash flow. For instance, in fiscal year 2023, Azbil reported building automation revenue of ¥184.3 billion, demonstrating the substantial economic activity within this mature business.

The enduring strength of Azbil's BA business is fueled by consistent demand, particularly in the refurbishment of existing buildings. Projects focused on energy savings and CO2 reduction are driving this demand, alongside stable, multi-year service contracts that provide a predictable revenue stream. This recurring revenue model is key to its Cash Cow status, offering a reliable income even as new construction markets mature.

Azbil's core industrial process automation products, particularly within its Advanced Automation segment, are strong cash cows. These established control systems and instruments are vital for the continuous operation of plants, ensuring steady demand and a robust market position.

The process automation (PA) market, where these products are dominant, offers consistent profitability. This segment's stability helps offset any volatility seen in other areas, like factory automation, contributing significantly to Azbil's financial stability.

Azbil's traditional field instruments and controllers, including sensors and single-loop controllers, are firmly established in their markets. These are mature products with a significant market share, benefiting from consistent demand across diverse industries. Their reliability has built a strong reputation, reducing the need for extensive promotional spending.

These instruments act as Azbil's cash cows, generating steady revenue and profit. Their established market presence means they require minimal new investment to maintain their competitive standing. For instance, in the fiscal year ending March 2024, Azbil reported solid performance in its "Products" segment, which encompasses these types of offerings, indicating continued financial strength from these core businesses.

Azbil's maintenance and lifecycle services for automation systems are a strong cash cow, generating consistent revenue. These services, spanning both Building Automation and Advanced Automation, benefit from long-term contracts that ensure a steady income for system upkeep and upgrades.

The profitability of these services is further bolstered by cost pass-throughs within maintenance contracts. This model allows Azbil to maintain healthy margins on its installed base, ensuring reliable cash generation.

Azbil's safety and combustion control equipment represents a classic cash cow. These are mature products, holding a significant and stable market share due to stringent regulatory mandates and the absolute necessity of operational safety in industrial environments.

These instruments, often critical for preventing hazardous incidents, benefit from long product lifecycles and recurring revenue streams through essential maintenance and upgrades. This consistent demand, coupled with established customer trust, ensures a reliable and predictable cash flow for Azbil, even in markets with modest growth potential.

| Business Segment | Product Category | BCG Matrix Classification | Key Characteristics | FY2023 Revenue (¥ billion) |

|---|---|---|---|---|

| Building Automation (BA) | Network Systems, Wide-Area Management, HVAC Controls | Cash Cow | Established market, consistent demand, service contracts | 184.3 |

| Advanced Automation (AA) | Process Control Systems, Instruments | Cash Cow | Vital for plant operations, stable demand, robust market position | N/A (part of larger segments) |

| Products (Field Instruments) | Sensors, Single-Loop Controllers | Cash Cow | Mature products, high market share, minimal new investment required | N/A (part of larger segments) |

| Services | Maintenance & Lifecycle Services (BA & AA) | Cash Cow | Long-term contracts, cost pass-throughs, leverages installed base | N/A (part of larger segments) |

| Safety & Combustion Control | Safety Instruments, Combustion Controls | Cash Cow | Regulatory driven, long product lifecycles, recurring revenue from maintenance | N/A (part of larger segments) |

Preview = Final Product

Azbil BCG Matrix

The Azbil BCG Matrix preview you are currently viewing is the identical, fully comprehensive document you will receive upon purchase. This means you're seeing the actual strategic analysis, complete with all data and formatting, ready for immediate application within your business planning. Rest assured, there are no hidden limitations or demo content; what you see is precisely what you get to leverage for informed decision-making and competitive advantage.

Dogs

Azbil's Life Science Engineering business, operated by Azbil Telstar S.L.U., was divested on October 31, 2024. This strategic move, aimed at restructuring the portfolio and enhancing capital efficiency, clearly positions this segment as a 'Dog' within Azbil's Boston Consulting Group (BCG) matrix. The divestiture signals that this area, particularly in the European market, experienced significant industry shifts and economic headwinds, resulting in diminished profitability and growth potential for Azbil.

Legacy/Outdated Product Lines in Mature Markets, often categorized as Dogs in the Azbil BCG Matrix, represent older offerings in industrial or building automation that haven't kept pace with technological advancements. These products, like specific legacy sensors or control valves, operate in saturated or declining markets and have seen minimal digital integration. For instance, Azbil's traditional pneumatic control systems, while still functional, face stiff competition from more advanced digital alternatives and are likely candidates for this category.

Low-market-share niche products within Azbil's portfolio, particularly those in stable but competitive sectors, are classified as Dogs. These products, lacking significant market traction, may only cover their costs or yield minimal profits. For instance, if Azbil had a specialized sensor line facing established players without unique selling points, it would fit this category.

These offerings don't contribute substantially to Azbil's overall growth strategy. For example, if a particular industrial automation component in a mature market only achieved a 1% market share, it would likely be considered a Dog. Such products might be candidates for Azbil to consider divesting or discontinuing if efforts to improve their market position are unlikely to succeed.

Underperforming Regional Operations

Underperforming regional operations within Azbil’s portfolio, characterized by low growth and low market share, fall into the Dogs category of the BCG Matrix. These segments demand significant resources, such as management attention and capital, without generating substantial returns or contributing meaningfully to Azbil's overall strategic objectives. For instance, if a specific regional office in a developing market, despite years of operation, only captured 2% market share and experienced a mere 1% annual revenue growth in 2024, it would exemplify a Dog.

The continued investment in these Dog segments can divert crucial resources away from more promising ventures, potentially hindering Azbil's global expansion and innovation efforts. A critical assessment of these underperforming areas is necessary to determine whether to divest, harvest, or attempt a turnaround strategy. In 2023, Azbil reported that certain smaller European market operations contributed less than 0.5% to its total global revenue, highlighting the potential for such underperforming segments.

- Low Market Share: Regions where Azbil holds a minimal presence, often below 5% of the total market share.

- Slow Growth: Areas experiencing annual revenue growth rates significantly below the company's average or industry benchmarks, potentially in the low single digits.

- Unprofitability: Operations that consistently fail to achieve profitability targets, possibly due to high operational costs or insufficient sales volume.

- Resource Drain: Segments requiring disproportionate management focus and investment without a clear path to improved performance.

Non-Core Business Ventures with Limited Synergy

Azbil's non-core business ventures with limited synergy would reside in the 'Dogs' quadrant of the BCG matrix. These are typically smaller ventures or services that lack a strong connection to Azbil's core automation and control businesses. They often exhibit low market share and slow growth, consuming resources without contributing significantly to overall profitability or strategic advancement.

These ventures might represent past experimental efforts that didn't gain traction or acquisitions that struggled with integration. For instance, if Azbil had a minor venture into a niche industrial component unrelated to its primary control systems, and this venture reported minimal revenue growth, perhaps less than 2% annually, and held a market share below 5% in its specific segment, it would likely be classified as a Dog. Such ventures tie up capital and management attention without offering a clear path to future growth or synergy with the company's main strengths.

- Low Market Share: Ventures with less than 5% market share in their respective segments.

- Slow Growth: Businesses experiencing annual revenue growth below 3%.

- Limited Synergy: Operations that do not leverage or enhance Azbil's core automation and control technologies.

- Capital Drain: Initiatives that consume resources without clear strategic benefits or profitability.

Dogs in Azbil's BCG Matrix represent business units or products with low market share in slow-growing industries. These segments often consume resources without generating significant returns, potentially hindering overall company growth. Identifying and managing these 'Dogs' is crucial for effective capital allocation and strategic focus.

The divestiture of Azbil Telstar S.L.U.'s Life Science Engineering business on October 31, 2024, clearly places this segment in the 'Dog' category. This move underscores the segment's diminished profitability and growth potential, likely due to significant industry shifts and economic challenges, particularly in the European market.

Legacy product lines, such as Azbil's traditional pneumatic control systems, also fall into the 'Dog' quadrant. These offerings operate in saturated markets and face intense competition from more advanced digital alternatives, indicating a low market share and slow growth trajectory.

Underperforming regional operations, exemplified by Azbil's smaller European market segments that contributed less than 0.5% to total global revenue in 2023, are also classified as Dogs. These segments require significant investment and management attention but yield minimal returns.

| Category | Characteristics | Azbil Example | 2024 Data Implication |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Divested Life Science Engineering business (Azbil Telstar S.L.U.) | Signals diminished profitability and growth potential. |

| Dogs | Low Market Share, Low Growth | Legacy pneumatic control systems | Face competition from advanced digital alternatives in saturated markets. |

| Dogs | Low Market Share, Low Growth | Underperforming European regional operations | Contributed <0.5% to global revenue in 2023; resource drain. |

Question Marks

Azbil's strategic investments, such as its participation in DNX Ventures' US Fund IV, highlight a focused effort to acquire cutting-edge technologies addressing climate change and artificial intelligence. These investments are directed towards high-growth potential sectors where Azbil is actively building its market presence and refining its automation solutions.

The company is prioritizing areas like advanced AI for automation and novel IoT applications, recognizing their significant potential for future expansion. These emerging niches represent opportunities for Azbil to establish a strong foothold, though they currently demand substantial research and development to foster scalable and market-leading offerings.

These initiatives are crucial for Azbil's long-term growth strategy, aiming to transform nascent technologies into future Stars within its portfolio. The success of these ventures hinges on continued investment and strategic development to solidify market share and achieve robust scalability.

Azbil's focus on 'Human-Centered Automation' for smart cities and rural urbanization, as showcased at Expo 2025, places these initiatives squarely in the Question Mark quadrant of the Azbil BCG Matrix. These are emerging, high-potential markets where Azbil is likely investing to develop and refine its offerings.

The rapid growth and evolving demands of smart city and rural development present significant opportunities, but also challenges for market penetration. Azbil's current market share in these broad, early-stage applications is probably modest, requiring considerable R&D and market development investment to capture future growth.

Azbil's advanced digital transformation (DX) offerings, particularly cloud-based solutions and sophisticated data analytics that extend beyond core systems, are positioned as question marks within the BCG matrix. These innovative services tap into a rapidly expanding technological frontier, promising significant future growth.

While the potential is high, these offerings necessitate substantial effort in educating the market and fostering customer adoption to capture significant market share. For example, Azbil has been actively investing in its DX initiatives, with a focus on building out cloud platforms and AI-driven analytics capabilities to address evolving customer needs in areas like predictive maintenance and operational efficiency.

New Energy Management Systems for Complex Grids

Azbil's advanced energy management systems are positioned to address the burgeoning demand for sophisticated grid solutions, particularly as renewable energy integration and smart grid technologies accelerate. These systems are designed for complex, evolving energy landscapes, targeting a market segment poised for significant expansion due to global decarbonization initiatives.

The market for these new energy management systems is experiencing robust growth. For instance, the global smart grid market was valued at approximately USD 35.7 billion in 2023 and is projected to reach USD 109.7 billion by 2030, growing at a compound annual growth rate of 17.4% during this period. This indicates a substantial opportunity for Azbil's offerings.

- High Growth Potential: The increasing complexity of grids due to renewable energy sources and the push for decarbonization create a fertile ground for advanced energy management systems.

- Intense Competition: While the market is growing, Azbil faces significant competition from established players and emerging technology providers, necessitating continuous innovation and strategic market penetration.

- R&D and Market Development: Securing a dominant position will require substantial investment in research and development, alongside effective market development strategies to showcase the unique value proposition of their complex systems.

- Star Potential: The ultimate success and classification of these systems as Stars within Azbil's portfolio will hinge on their capacity to capture significant market share and demonstrate sustained leadership in this dynamic sector.

Solutions for Specific, High-Tech Manufacturing Processes

Azbil is actively exploring expansion into specialized high-tech manufacturing sectors, moving beyond its established factory automation base. This includes integrating advanced robotics and developing sophisticated control systems for next-generation production lines.

These emerging areas, such as semiconductor fabrication or advanced materials processing, represent high-growth opportunities. For instance, the global industrial robotics market was projected to reach $79.4 billion by 2028, growing at a CAGR of 14.5% according to some 2024 market reports.

Azbil's strategy likely involves targeted investments and strategic collaborations to gain traction in these niche, rapidly evolving markets. Key focus areas could include:

- Advanced semiconductor manufacturing automation: Addressing the intricate precision and cleanroom requirements of chip production.

- Specialized controls for additive manufacturing: Enhancing the reliability and scalability of 3D printing for industrial applications.

- Integrated solutions for biopharmaceutical production: Providing automation for complex, highly regulated processes in life sciences.

Azbil's ventures into smart cities, rural urbanization, and advanced digital transformation solutions are positioned as Question Marks. These areas represent high-growth potential but require significant investment in research, development, and market education to establish a strong market share.

The company's focus on new energy management systems and specialized high-tech manufacturing also falls under this category. While these sectors are experiencing rapid expansion, Azbil faces intense competition and needs to continually innovate to secure a leading position.

Success in these Question Mark areas is contingent on Azbil's ability to effectively navigate market development challenges and convert nascent technologies into future market leaders, ultimately aiming to transition them into the Star quadrant.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth forecasts, to accurately position each business unit.