Ayr SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayr Bundle

Ayr's current market position is defined by its robust brand recognition and expanding product lines, showcasing significant strengths. However, understanding the full scope of its competitive landscape, potential regulatory hurdles, and emerging market threats requires a deeper dive.

Want to truly grasp Ayr's strategic advantages and potential vulnerabilities? Purchase the complete SWOT analysis to unlock a professionally crafted, editable report filled with actionable insights and expert commentary, perfect for informing your next strategic move.

Strengths

AYR Wellness’s vertical integration, spanning cultivation through retail, provides significant control over product quality and consistency. This seed-to-sale model allows them to manage the entire supply chain, from growing cannabis to its final sale. This comprehensive oversight is a key strength, ensuring adherence to quality standards at every step.

This operational control translates into enhanced supply chain efficiency and cost management. By owning each stage of production, AYR can optimize processes and potentially reduce overheads, contributing to a stronger financial performance. For instance, in Q1 2024, AYR reported a gross margin of 51%, reflecting the benefits of their integrated model.

AYR Wellness commands an impressive retail footprint, operating 97 dispensaries across eight states as of the fourth quarter of 2024. This extensive network includes recent strategic expansions into Connecticut and active participation in Ohio's burgeoning adult-use cannabis market.

This broad geographic diversification across multiple states significantly reduces AYR's dependence on any single market, creating a more resilient revenue stream. It also provides a distinct competitive edge within the often-fragmented U.S. cannabis sector, allowing the company to leverage its operational expertise across various regulatory environments and capitalize on emerging state-level legalization opportunities.

AYR Wellness is strategically investing in its cultivation infrastructure, with a significant 98,000 sq ft indoor facility in Florida slated for a second-half 2025 operational launch. This expansion underscores a commitment to producing high-quality indoor flower, a crucial element for differentiating in competitive markets.

The company's focus on continuous product innovation, including refreshing its genetics and strengthening its brand strategy, is designed to address supply chain inefficiencies and elevate the customer experience. These efforts are vital for fostering customer loyalty and capturing greater market share.

Proactive Debt Restructuring and Financial Management

AYR's proactive approach to debt management is a significant strength. In early 2024, the company successfully retired or deferred approximately $400 million in debt maturities, pushing them to 2026. This strategic move aimed to alleviate immediate financial pressure.

Further demonstrating this strength, AYR entered into a Restructuring Support Agreement with its senior noteholders in July 2025. This agreement is a key component of a broader plan to address its leveraged balance sheet and secure operational liquidity.

These financial maneuvers are supported by concrete actions, including securing a $50 million bridge facility and a plan to divest assets across six states. Such steps underscore AYR's commitment to stabilizing its financial standing and ensuring operational continuity.

- Debt Maturity Management: Successfully retired or deferred nearly $400 million in debt maturities to 2026 in early 2024.

- Restructuring Agreement: Entered into a Restructuring Support Agreement with senior noteholders in July 2025.

- Liquidity Enhancement: Secured a $50 million bridge facility and planned asset sales in six states to improve liquidity.

- Financial Stabilization: Actions demonstrate a clear strategy to address a highly leveraged balance sheet and enhance long-term viability.

Streamlined Operations and Leadership Realignment

Ayr Wellness has recently undertaken significant leadership realignments, including the promotion of key executives to President and co-Chief Revenue Officer roles. These changes are designed to sharpen the company's operational focus and improve its responsiveness in a dynamic market. The goal is to foster better collaboration between revenue-driving teams and the supply chain, ensuring a more integrated approach to business.

Looking ahead to 2025, Ayr is prioritizing operational streamlining. This initiative aims to unlock cost efficiencies by identifying and eliminating redundancies across the organization. A more agile operational structure is anticipated to accelerate decision-making processes, which is crucial for navigating current market challenges and positioning the company for sustained growth.

- Leadership Restructuring: Promotions to President and co-Chief Revenue Officers signal a strategic shift towards enhanced operational synergy.

- 2025 Vision: Streamlining operations is a core objective to boost cost efficiencies and agility.

- Synergy Focus: Creating greater alignment between revenue generation and supply chain functions is a key driver of these changes.

- Market Adaptability: Internal improvements are vital for responding effectively to market pressures and achieving long-term growth.

AYR Wellness's vertically integrated model, from cultivation to retail, offers robust control over product quality and supply chain efficiency. This comprehensive oversight, evident in their Q1 2024 51% gross margin, allows for cost optimization and consistent product standards.

The company boasts an extensive retail presence with 97 dispensaries across eight states as of Q4 2024, including recent expansions into Connecticut and active engagement in Ohio's adult-use market, diversifying revenue streams and reducing single-market dependency.

Strategic investments in cultivation, such as a new 98,000 sq ft Florida facility set to launch in H2 2025, highlight a commitment to high-quality indoor flower and market differentiation.

AYR has proactively managed its debt, deferring approximately $400 million in maturities to 2026 in early 2024 and securing a Restructuring Support Agreement with senior noteholders in July 2025, bolstered by a $50 million bridge facility and planned asset divestitures.

| Metric | Q1 2024 | Q4 2024 | H2 2025 Projection |

|---|---|---|---|

| Gross Margin | 51% | N/A | N/A |

| Dispensaries | N/A | 97 | N/A |

| Debt Maturities Deferred | ~$400M to 2026 | N/A | N/A |

| Florida Facility Size | N/A | N/A | 98,000 sq ft |

What is included in the product

Delivers a strategic overview of Ayr’s internal capabilities and external market dynamics.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential threats into opportunities.

Weaknesses

AYR Wellness faced financial headwinds in late 2024, reporting flat year-over-year revenue for Q4 and a notable decline in adjusted EBITDA. The company anticipates this revenue dip to continue into Q1 2025, signaling persistent challenges in boosting sales and preserving profitability within a competitive landscape.

AYR Strategies operates with a significant debt burden, a key weakness that impacts its financial stability. Despite restructuring, the company's balance sheet remains highly leveraged.

As of the end of 2024, AYR reported $358 million in debt maturing in 2026. This substantial obligation, coupled with a notable decrease in its cash balance during the same period, highlights the precariousness of its financial position.

The heavy debt load restricts AYR's ability to pursue new investments and has even led its auditor to express 'going concern' doubts about the company's future viability.

AYR Wellness is undergoing significant operational streamlining, which includes closing cultivation facilities and laying off over 200 employees in Massachusetts and Nevada. This restructuring also involves asset sales across six states. These moves are designed to improve efficiency and reduce financial burdens.

While these steps aim to create a more focused and financially stable company, they represent a reduction in AYR's operational reach. The closures and sales could potentially affect the company's ability to meet demand and maintain its market share in the impacted areas, highlighting past difficulties in managing its widespread operations effectively.

Regulatory and Filing Compliance Issues

Ayr Wellness (AYR) has faced significant regulatory hurdles, notably a failure-to-file cease-trade order from the Ontario Securities Commission due to delays in filing its Q1 2025 interim financial statements. This non-compliance has led to a trading suspension of AYR's securities in Canadian markets, directly impacting investor confidence and limiting the company's ability to access capital. Such regulatory issues can often indicate deeper financial or operational challenges within the organization.

The implications of these filing delays are substantial:

- Trading Suspension: AYR's securities are currently suspended from trading in Canada, hindering liquidity for existing shareholders and deterring new investment.

- Investor Confidence Erosion: Delays in financial reporting can signal potential financial instability or internal control weaknesses, which typically erodes investor trust.

- Operational Impact: Continued regulatory non-compliance could lead to further penalties or restrictions, potentially impacting day-to-day operations and strategic initiatives.

Market Price Compression and Intense Competition

AYR Wellness is grappling with significant market price compression, a trend that has directly eroded its gross margins and overall profitability. This is a critical challenge in the current cannabis landscape.

The cannabis sector is characterized by fierce competition, with a multitude of multi-state operators and smaller, localized businesses all vying for a piece of the market. This crowded field intensifies the pressure.

In established markets like Massachusetts and Florida, this intense competition is particularly acute. The constant pressure on pricing requires AYR Wellness to be exceptionally agile and adaptive just to remain competitive.

- Price Compression: AYR Wellness has seen average selling prices decline by approximately 15% year-over-year in key adult-use markets as of late 2024, impacting gross profit margins.

- Intense Competition: The number of licensed dispensaries in Florida alone has grown by over 40% since 2022, increasing competitive density.

- Market Saturation: Mature markets such as Massachusetts are experiencing oversupply in certain product categories, leading to aggressive promotional activity and further price erosion.

AYR Wellness's substantial debt load remains a critical weakness, with $358 million in debt maturing in 2026 as of the close of 2024. This high leverage limits strategic flexibility and has even prompted auditor concerns about the company's future viability. The company's recent operational streamlining, including facility closures and layoffs, while intended to improve efficiency, also signifies a reduction in its market presence and potential capacity in certain regions.

Full Version Awaits

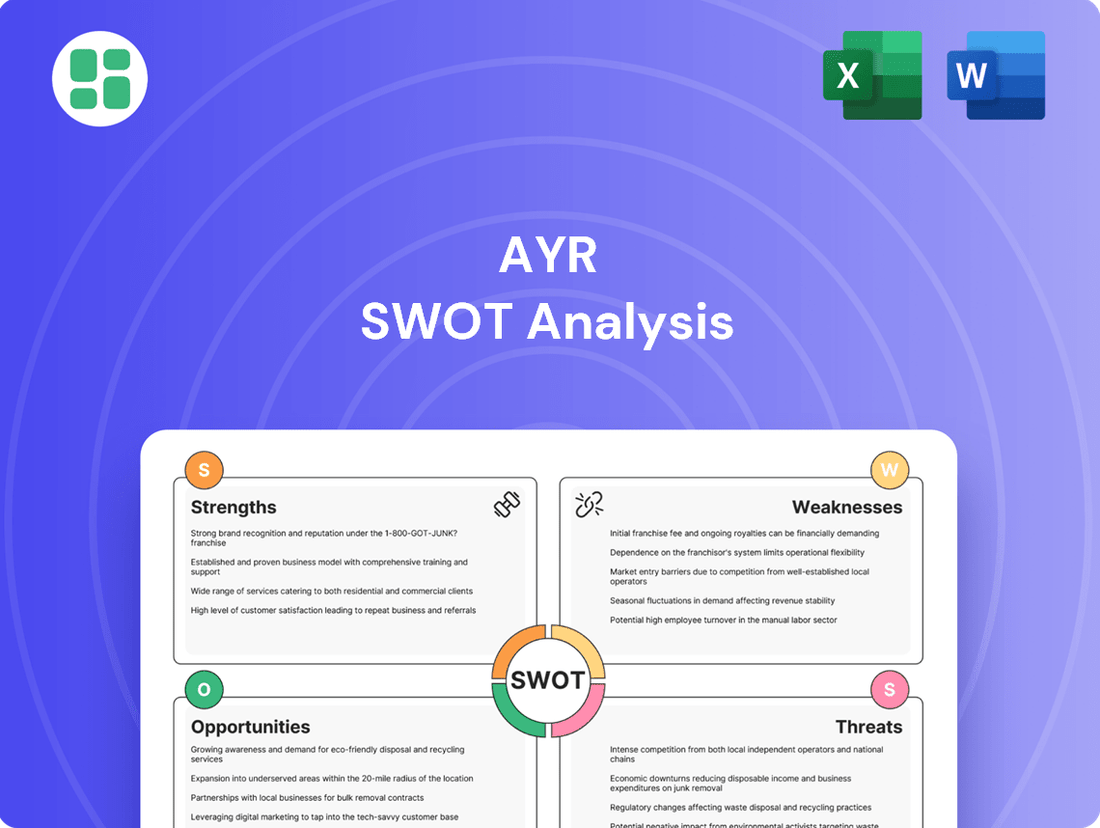

Ayr SWOT Analysis

This is the actual Ayr SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Federal regulatory reform presents a significant tailwind for AYR Wellness. The potential rescheduling of cannabis from Schedule I to Schedule III by the DEA, anticipated by many to occur in 2024 or early 2025, could be a game-changer. This reclassification would likely nullify the impact of IRS Section 280E, a major hurdle for cannabis companies, allowing AYR to deduct standard business expenses and thereby boosting its net income. For instance, in 2023, the cannabis industry lost billions in potential tax savings due to 280E, a burden AYR could shed.

Further bolstering these opportunities is the potential passage of the SAFER Banking Act. This legislation would grant AYR Wellness access to conventional banking services, a critical step away from its current reliance on cash-heavy operations. This not only mitigates the significant security risks associated with handling large amounts of cash but also streamlines financial management, reducing operational inefficiencies and associated costs.

The continuing wave of state-level adult-use cannabis legalization offers substantial avenues for expansion. AYR Wellness is strategically positioned to benefit from these market shifts, notably in Ohio where it was part of the initial adult-use rollout. The company also holds conditional licenses or is preparing for potential adult-use conversions in key markets like Pennsylvania and Virginia.

Entering these larger recreational markets is projected to significantly boost AYR Wellness's revenue. This growth is anticipated without a proportional increase in the company's fixed operational expenses, suggesting a favorable impact on profitability. For instance, Pennsylvania's adult-use market, projected to reach $1.7 billion by 2025 according to industry analysts, represents a considerable opportunity for AYR.

AYR Strategies is actively optimizing its asset portfolio through a strategic review and restructuring plan. This involves divesting assets in six states to sharpen its focus on core, profitable markets.

By shedding underperforming or non-strategic assets, AYR can better allocate capital and resources to high-potential states such as Florida, Ohio, New Jersey, and Pennsylvania. This strategic pivot is designed to boost operational efficiency and foster more sustainable growth in its key operational regions.

Enhanced Cultivation and Product Innovation

AYR's strategic investment in a new, advanced indoor cultivation facility in Florida, slated for operation in the latter half of 2025, is poised to significantly bolster its supply chain. This development is anticipated to elevate product quality and consistency, directly addressing a key operational need.

Furthermore, AYR's commitment to ongoing innovation in both genetics and branded product development offers a crucial avenue for market differentiation. By staying ahead of evolving consumer tastes and preferences, the company can cultivate stronger customer loyalty and expand its market share.

- Florida Cultivation Facility: Expected to be operational in H2 2025, enhancing supply chain and product quality.

- Product Innovation: Continuous development in genetics and branded offerings to meet consumer demand.

- Market Differentiation: Innovation strategies aim to set AYR apart in a competitive cannabis market.

- Customer Loyalty: Improved product consistency and new offerings are designed to increase repeat business.

Industry Maturation and Stabilization

The cannabis industry is moving towards a more stable and predictable future. As regulations become clearer, we anticipate reduced price fluctuations and more reliable supply chains. This maturation is a positive sign for companies like AYR Wellness that are focused on operational efficiency.

AYR Wellness is well-positioned to benefit from this industry stabilization. By successfully managing current complexities, the company can capitalize on the increased investor confidence and more professionalized market landscape that is emerging.

For instance, the U.S. cannabis market is projected to reach $71 billion by 2030, indicating significant growth potential within a maturing framework. AYR Wellness’s strategic positioning in key markets like Massachusetts and Pennsylvania, which saw combined adult-use sales exceeding $3 billion in 2023, underscores its ability to navigate and thrive in this evolving environment.

- Stabilizing Regulations: Expect clearer rules and fewer arbitrary changes, reducing operational uncertainty.

- Predictable Market Conditions: A move away from extreme price swings will allow for better financial planning and forecasting.

- Enhanced Investor Confidence: A more mature industry attracts greater investment, potentially lowering capital costs for companies like AYR.

- Streamlined Operations: AYR's focus on efficiency will pay dividends as the industry standardizes practices.

Federal regulatory reform, particularly the potential rescheduling of cannabis to Schedule III, could significantly reduce AYR Wellness's tax burden by nullifying IRS Section 280E, a move that could boost net income. The SAFER Banking Act would provide crucial access to traditional financial services, mitigating security risks and operational inefficiencies associated with cash-heavy operations.

Expansion into new state-level adult-use markets, such as Ohio, Pennsylvania, and Virginia, presents substantial revenue growth opportunities. AYR's strategic divestment of non-core assets allows for focused investment in high-potential states, optimizing its operational footprint for sustainable growth.

Investment in a new Florida cultivation facility, expected operational in H2 2025, will enhance supply chain capabilities and product quality, while ongoing product innovation in genetics and branding will drive market differentiation and customer loyalty.

Threats

The U.S. cannabis sector is a crowded space, with many companies vying for market share. This fierce competition is forcing prices down, which directly affects AYR Wellness's ability to generate profits. For example, in Massachusetts, a market AYR operates in, high dispensary density exacerbates this price pressure.

Despite ongoing discussions about federal reform, the cannabis sector continues to grapple with significant regulatory uncertainty. Judicial hurdles in rescheduling efforts by the DEA and the patchwork of state-specific laws create a challenging environment for multi-state operators. For instance, the legal status of hemp-derived THC products remains in flux across various states, adding layers of complexity to compliance for companies like AYR Wellness.

The divergence in state regulations, coupled with potential new restrictions and evolving data privacy mandates, imposes substantial compliance burdens. This inconsistency directly impacts AYR Wellness's ability to achieve seamless national expansion and streamlined operations, as navigating these varied legal landscapes requires significant resources and strategic adaptation.

AYR Wellness is actively engaged in a significant debt restructuring, which includes selling off assets and potentially liquidating remaining holdings under court supervision. This complex process introduces considerable risks, such as further reductions in asset values and substantial dilution for current shareholders.

The restructuring efforts may not entirely fix AYR's financial issues, potentially leaving lingering doubts about the company's ability to continue operating as a going concern. For instance, as of the first quarter of 2024, AYR reported a net loss of $10.8 million, highlighting ongoing financial pressures despite restructuring moves.

Macroeconomic Headwinds and Consumer Spending Shifts

AYR Wellness has publicly acknowledged that persistent macroeconomic pressures are affecting its revenue and profitability. These pressures can significantly impact discretionary spending, a key factor for cannabis products, potentially leading to reduced sales volumes and increased price competition.

Economic downturns or noticeable shifts in consumer spending habits pose a direct threat to AYR. When consumers tighten their belts, purchases of non-essential items, like cannabis, are often among the first to be cut back. This directly translates to lower sales for AYR.

The broader economic climate, characterized by factors such as inflation and potential recessionary fears, presents a challenging external environment. This makes AYR's ongoing financial recovery and future growth plans considerably more difficult to achieve.

For instance, in early 2024, consumer spending data indicated a slowdown in non-essential goods across various sectors. While specific cannabis consumer spending figures for AYR are proprietary, the general trend suggests a cautious consumer base, impacting companies like AYR.

Supply Chain and Operational Execution Challenges

AYR Strategies' supply chain and operational execution present significant threats. Despite plans for new cultivation facilities, the company has encountered difficulties, especially in producing premium flower in Florida. For instance, AYR reported in its Q1 2024 earnings that while revenue increased, gross profit margins were impacted by operational inefficiencies and higher cost of goods sold in certain markets, including Florida.

Operational hiccups in cultivation, manufacturing, or distribution can directly translate into increased expenses, stockouts, or compromised product quality. These issues can erode customer loyalty and hinder AYR's overall market standing. The recent closure of cultivation facilities in certain regions, such as the cessation of operations at their Warren, Ohio facility in late 2023, underscores past operational challenges that need to be rigorously addressed to prevent recurrence.

- Florida Premium Flower Production: AYR continues to face hurdles in scaling premium flower output in Florida, a key growth market.

- Cost of Goods Sold (COGS): Q1 2024 results indicated that COGS, influenced by operational costs, remained a pressure point, impacting profitability.

- Facility Closures: Past operational missteps, like the Warren, Ohio facility closure, highlight the risk of inefficient resource allocation and execution.

Intense competition within the U.S. cannabis market, particularly in states like Massachusetts where AYR operates, continues to drive down prices, directly impacting AYR's revenue and profitability. This price pressure is further amplified by the ongoing regulatory uncertainty at the federal level, with the DEA's rescheduling process and varying state laws creating significant compliance challenges for multi-state operators like AYR.

AYR's substantial debt restructuring introduces considerable risks, including potential asset value reductions and shareholder dilution, with a Q1 2024 net loss of $10.8 million underscoring persistent financial pressures. Macroeconomic headwinds, such as inflation and potential shifts in consumer spending, also pose a threat, as consumers may cut back on non-essential items like cannabis, further impacting AYR's sales volumes and profitability.

Operational execution remains a critical threat, with AYR encountering difficulties in scaling premium flower production in Florida and managing its cost of goods sold. For instance, Q1 2024 results highlighted that COGS, influenced by operational costs, impacted profitability, and past facility closures, like the Warren, Ohio site, demonstrate the risk of inefficient resource allocation.

| Threat Category | Specific Challenge | Impact on AYR | Relevant Data/Example |

|---|---|---|---|

| Market Competition | Price Compression | Reduced Revenue & Profitability | High dispensary density in MA |

| Regulatory Uncertainty | Patchwork of State Laws | Compliance Burden & Hindered Expansion | Flux in hemp-derived THC legality |

| Financial Restructuring | Debt Burden & Asset Sales | Shareholder Dilution & Operational Risk | Q1 2024 Net Loss: $10.8M |

| Macroeconomic Factors | Consumer Spending Shifts | Lower Sales Volumes | General slowdown in non-essential spending (early 2024) |

| Operational Execution | Cultivation & COGS | Impacted Profit Margins | Florida premium flower production hurdles, Q1 2024 COGS pressure |

SWOT Analysis Data Sources

This SWOT analysis for Ayr is built upon a robust foundation of data, including Ayr's official financial filings, comprehensive market research reports, and expert industry commentary to ensure a well-informed and accurate assessment.