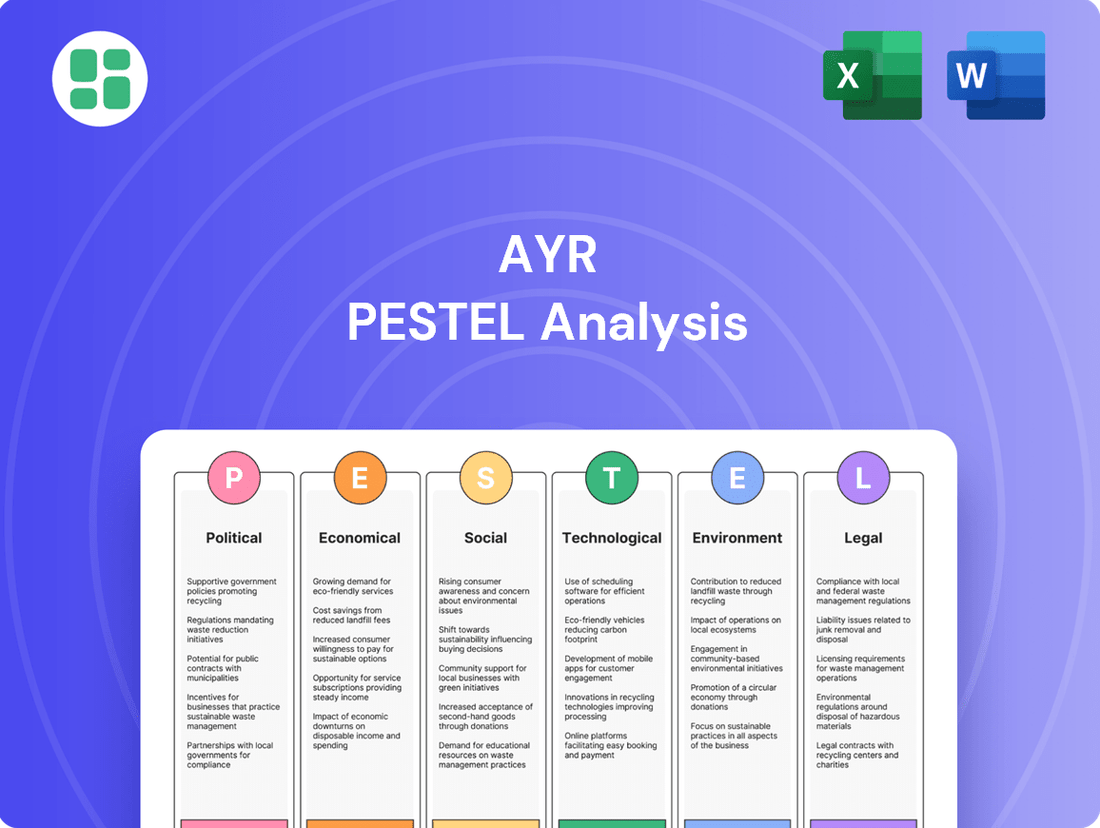

Ayr PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayr Bundle

Navigate the complex external landscape shaping Ayr's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Gain a strategic advantage by leveraging these expertly curated insights. Download the full PESTLE analysis now to unlock actionable intelligence and sharpen your decision-making.

Political factors

Federal discussions around reclassifying cannabis from Schedule I to Schedule III could significantly benefit AYR Wellness. This potential rescheduling, possibly by late 2025, may allow cannabis businesses to deduct ordinary business expenses, a relief from the current IRS Section 280E limitations. Such a change could substantially boost AYR's profitability and ease its access to conventional banking and financial services.

AYR Wellness navigates a complex landscape of state-level cannabis regulations, a key political factor. While states like Florida and Ohio are expanding medical and recreational access, other states have seen legalization efforts falter in 2024, creating a fragmented market. This necessitates a deep understanding of diverse licensing, operational, and tax structures across AYR's operating states including Nevada, New Jersey, and Pennsylvania.

Political pressure and government initiatives focused on social equity in the cannabis sector directly shape licensing, market entry, and how the public views companies like AYR Wellness. For instance, by late 2024, states like Illinois have continued to refine their social equity programs, allocating significant funding for technical assistance and licensing support for those impacted by prior prohibition policies.

AYR Wellness might find itself needing to engage with or support these social equity initiatives. This could involve partnerships with social equity license holders or contributions to community development funds, potentially influencing AYR's expansion strategies and its standing within local communities.

Political Stability and Election Outcomes

The 2024 US federal election cycle, including the presidential race and congressional elections, carries substantial implications for the cannabis industry. Potential shifts in federal policy could impact banking access and interstate commerce for companies like AYR Wellness. Similarly, state-level elections in 2024 and 2025 will determine the regulatory environment in key markets where AYR operates, influencing licensing, taxation, and operational flexibility.

Political stability and election outcomes directly influence the regulatory framework governing the cannabis sector. For instance, the 2024 elections could lead to legislative action on issues such as the SAFE Banking Act, which would significantly ease financial operations for cannabis businesses. Conversely, a less favorable political climate could slow or halt progress on federal reforms, creating ongoing uncertainty for strategic investments and growth plans.

- 2024 US Federal Elections: Potential impact on banking reform and federal cannabis policy.

- State-Level Elections (2024-2025): Influence on state-specific regulations affecting AYR's operational markets.

- Legislative Changes: New administrations may accelerate or impede cannabis descheduling and banking access.

- Investor Confidence: Political uncertainty can create volatility and affect long-term strategic planning for cannabis companies.

International Cannabis Policy Trends

While Ayr Wellness focuses on the U.S. market, shifts in international cannabis policy are noteworthy. Germany's declassification of cannabis from a narcotic in 2024, for instance, represents a significant step towards broader global acceptance. This trend can influence investor sentiment and highlight potential future market expansion or increased competition on a global scale.

These international developments, though not directly impacting Ayr Wellness's current U.S. operations, provide valuable context for the industry's long-term trajectory. For example, the global legal cannabis market was projected to reach over $100 billion by 2025, indicating substantial growth potential.

- Global Acceptance: Germany's policy change in 2024 signals a growing international trend towards normalizing cannabis.

- Market Signals: Such shifts can influence investor perceptions of the cannabis sector's viability and future growth.

- Competitive Landscape: Evolving international regulations may eventually create new competitive dynamics for U.S.-based operators.

Federal discussions around reclassifying cannabis from Schedule I to Schedule III could significantly benefit AYR Wellness, potentially by late 2025. This rescheduling could allow cannabis businesses to deduct ordinary business expenses, a relief from IRS Section 280E limitations, boosting profitability and easing access to conventional banking.

State-level regulations remain a critical political factor, with states like Florida and Ohio expanding access while others saw legalization efforts falter in 2024, creating a fragmented market. AYR must navigate diverse licensing, operational, and tax structures across its operating states. The 2024 US federal election cycle and state-level elections in 2024-2025 will significantly influence federal policy, banking access, interstate commerce, and state-specific regulations in key markets.

Political pressure for social equity in cannabis, exemplified by Illinois's refined programs in late 2024 allocating significant funding, directly shapes market entry and public perception. AYR may need to engage with or support these initiatives through partnerships or community contributions, influencing expansion and local standing. Global policy shifts, like Germany's declassification of cannabis in 2024, signal growing international acceptance and can influence investor sentiment and future market dynamics, with the global legal cannabis market projected to exceed $100 billion by 2025.

| Political Factor | Impact on AYR Wellness | Key Data/Events |

|---|---|---|

| Federal Cannabis Reclassification (Schedule III) | Potential for tax relief (deducting business expenses) and improved banking access. | Discussions ongoing; potential by late 2025. |

| State-Level Legalization & Regulation | Navigating fragmented markets with diverse licensing, operational, and tax rules. | Florida & Ohio expanding; some states saw faltering efforts in 2024. |

| Social Equity Programs | Requirement to engage with or support initiatives, influencing expansion and community relations. | Illinois allocated significant funding for technical assistance in late 2024. |

| Elections (Federal & State 2024-2025) | Potential shifts in federal policy (banking, interstate commerce) and state-specific regulations. | 2024 US federal elections; state elections in AYR's key markets. |

| International Policy Shifts | Context for industry growth and potential future competition/expansion. | Germany declassified cannabis in 2024; global market projected >$100B by 2025. |

What is included in the product

The Ayr PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the Ayr's operating landscape, providing a comprehensive overview of external macro-environmental influences.

The Ayr PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, reducing confusion and saving valuable time.

Economic factors

The U.S. cannabis market is poised for continued expansion, with revenue projections for 2025 signaling robust growth. AYR Wellness operates within this dynamic landscape, where combined medical and recreational sales are anticipated to reach tens of billions of dollars, offering significant opportunities.

Beyond direct sales, the economic ripple effect is substantial. The regulated marijuana industry is forecast to contribute over $123.6 billion to the U.S. economy in 2025, highlighting the sector's increasing importance and market potential.

Cannabis companies, including AYR Wellness, continue to navigate a challenging landscape regarding access to capital and financial services. Despite the industry's expansion, federal prohibition creates significant hurdles in securing traditional banking relationships and loans. This often forces companies to rely on less conventional and more expensive financing methods.

The potential enactment of the SAFER Banking Act in late 2024 or early 2025 could dramatically alter this situation. Passage would allow cannabis businesses to access services like checking accounts, loans, and insurance from federally insured financial institutions. This would likely reduce operational costs, improve access to credit for expansion, and attract a broader range of investors, directly benefiting AYR Wellness's growth prospects.

AYR Wellness's recent debt restructuring, announced in early 2024, underscores the financial pressures within the sector. The company successfully refinanced approximately $275 million of its existing debt, extending maturity dates and improving its liquidity. This move is critical for managing its financial obligations and providing the stability needed to pursue strategic initiatives in a capital-constrained environment.

Consumer spending habits significantly influence AYR Wellness's financial performance, especially as competition intensifies in state-legal cannabis markets. Shifts in consumer purchasing power, like reduced spending or smaller average purchases, directly impact the company's top and bottom lines, creating margin pressures. For instance, in 2023, AYR Wellness noted challenges related to decreased consumer spending in certain regions.

The competitive landscape, particularly in established markets such as New Jersey, presents a formidable challenge. Increased competition can dilute AYR Wellness's market share and compel strategic adjustments to pricing and product assortments to remain competitive. This dynamic requires continuous adaptation to consumer preferences and competitor actions to maintain profitability.

Operational Costs and Profit Margins

Rising operational costs, particularly for labor, energy, and regulatory compliance, are a significant concern for cannabis cultivators and retailers, directly impacting their profit margins. For instance, the U.S. cannabis industry faced an average effective federal tax rate of 28% in 2023 due to Section 280E of the IRS tax code, a substantial burden that limits reinvestment and profitability. AYR Wellness is actively addressing these pressures through a strategic focus on disciplined cost reductions, operational streamlining, and enhanced execution to foster sustained growth and improved profitability.

To combat these increasing expenses, AYR Wellness is making key investments in operational efficiencies and supply chain improvements. These efforts are crucial for mitigating the impact of rising costs and maintaining healthy profit margins in a competitive market. In 2023, AYR reported a gross margin of 31.3%, highlighting the ongoing challenge of cost management within the sector.

- Labor Costs: Wages and benefits represent a substantial portion of operational expenses for cannabis businesses.

- Energy Consumption: Cultivation facilities, especially indoor grows, are energy-intensive, leading to high utility bills.

- Compliance Expenses: Adhering to stringent state and local regulations incurs significant costs related to licensing, security, and testing.

- Supply Chain Efficiency: Optimizing the supply chain can reduce waste and transportation costs, thereby improving margins.

Illicit Market Competition

The persistent existence of illicit cannabis markets continues to present significant economic hurdles for legal operators like AYR Wellness. These unregulated markets can offer substantially lower prices due to their avoidance of compliance costs, taxes, and quality control measures, directly impacting the pricing strategies and market share of licensed businesses. For instance, in markets where illicit sales remain prevalent, legal dispensaries often struggle to compete on price, potentially alienating price-sensitive consumers.

This illicit competition can erode the profitability of legitimate cannabis businesses. While specific data for AYR Wellness's direct impact from illicit markets is proprietary, broader industry reports from 2024 indicate that states with robust illicit markets often see slower growth and lower average retail prices in their legal sectors. This dynamic forces legal operators to invest more in marketing and customer loyalty to differentiate themselves beyond price.

However, there's a projected shift as regulatory frameworks mature and markets stabilize. By 2025, many analysts anticipate a better balance between supply and demand in established legal markets. This stabilization, coupled with increased enforcement against illicit operations, is expected to mitigate the competitive pressure from illegal sales, allowing legal businesses to operate on a more even playing field.

- Illicit markets offer lower prices by bypassing taxes and regulatory compliance.

- This competition directly affects pricing strategies and market share for legal cannabis companies.

- Industry reports in 2024 highlighted slower legal market growth in states with significant illicit activity.

- Market maturation and enhanced enforcement are anticipated to reduce illicit market influence by 2025.

The U.S. cannabis industry is a significant economic contributor, projected to generate over $123.6 billion in economic impact by 2025. AYR Wellness operates within this expanding sector, where consumer spending patterns directly influence its financial performance. Rising operational costs, including labor and energy, alongside a substantial tax burden due to Section 280E, challenge profit margins, with the industry facing an average effective federal tax rate of 28% in 2023.

| Economic Factor | 2023/2024 Data | 2025 Projection | Impact on AYR Wellness |

|---|---|---|---|

| Total U.S. Economic Impact | Not specified | $123.6 billion | Indicates market growth potential |

| Effective Federal Tax Rate (Section 280E) | 28% (average) | Likely to persist without legislative change | Reduces reinvestment and profitability |

| Consumer Spending Trends | Challenges noted in certain regions (2023) | Continued influence on sales and margins | Requires adaptation to purchasing power shifts |

| Operational Costs (Labor, Energy) | Increasing | Continued pressure expected | Drives focus on operational efficiencies |

Same Document Delivered

Ayr PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ayr PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the region.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this detailed PESTLE analysis for Ayr, providing valuable insights for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. Our Ayr PESTLE analysis is meticulously researched and presented for your immediate use.

Sociological factors

Public attitudes toward cannabis are undergoing a significant transformation, with a notable increase in support for legalization across the United States. This evolving perception, particularly strong among younger demographics like millennials and Gen Z, who are key consumers, directly fuels market demand and diminishes the social stigma surrounding cannabis use.

This growing societal acceptance is a powerful tailwind for companies like AYR Wellness. As AYR expands its retail presence and diversifies its product portfolio, it is well-positioned to capture this expanding consumer base, directly benefiting from the reduced social barriers to cannabis consumption.

Consumers are increasingly seeking cannabis products that align with health and wellness goals. This includes a strong preference for specific cannabinoid profiles, such as those high in CBD for its perceived calming effects, and a rising interest in cannabis-infused beverages as a more discreet and convenient consumption method. AYR Wellness can leverage this by developing innovative product lines that cater to these diverse wellness applications, potentially expanding their offerings to include more targeted tinctures, edibles, and beverages designed for specific health benefits.

Social equity programs are actively working to rectify past harms caused by cannabis prohibition, with a particular focus on including communities that were disproportionately affected. AYR Wellness's involvement in these initiatives, such as collaborating with social equity partners or supporting legal aid for record expungement, can significantly boost its reputation for corporate social responsibility and cultivate deeper relationships within the local communities where it operates.

Workforce Development and Employment Trends

The burgeoning legal cannabis industry is a significant job creator, supporting an estimated 440,000 full-time equivalent positions across the United States in 2024. This rapid expansion presents both opportunities and hurdles for companies like AYR Wellness, a multi-state operator, in sourcing and developing a competent workforce.

Attracting and retaining talent in this relatively new and dynamic sector requires strategic workforce development initiatives. AYR Wellness, like its peers, must navigate the challenges of training new employees and ensuring compliance with evolving regulations, all while competing for skilled labor.

- Job Creation: The legal cannabis sector is projected to support over 440,000 jobs in 2024.

- AYR's Role: As a major MSO, AYR Wellness is a key contributor to this employment growth.

- Talent Acquisition: The industry faces challenges in attracting and retaining skilled workers.

- Training Needs: Developing a trained workforce is crucial for AYR's operational success and compliance.

Consumer Education and Awareness

As the cannabis market evolves, consumer education is becoming paramount. AYR Wellness recognizes this, actively working to inform customers about product safety, responsible usage, and the diverse range of cannabis products available. This focus on education is vital for fostering trust and encouraging informed purchasing decisions, which directly impacts customer retention and the overall growth of the market.

The increasing availability of cannabis products necessitates clear guidance on dosage, potential effects, and legal regulations. AYR Wellness's commitment to providing accessible and accurate information helps consumers navigate these complexities. For instance, in states where AYR operates, like Pennsylvania, educational materials on product testing and cannabinoid profiles are readily available, empowering consumers to make choices aligned with their needs and preferences.

- Consumer Education: AYR Wellness prioritizes educating consumers on product safety, responsible consumption, and the variety of cannabis experiences.

- Trust Building: Providing accurate information is key for AYR to build trust and foster long-term customer loyalty in a maturing market.

- Informed Choices: Empowering consumers to make informed decisions contributes to a healthier and more sustainable cannabis industry.

- Market Development: Increased consumer awareness and education are crucial drivers for the continued development and acceptance of the cannabis market.

Societal shifts are profoundly impacting the cannabis industry, with growing public acceptance and a focus on wellness driving demand for diverse products. AYR Wellness is strategically positioned to capitalize on these trends by emphasizing consumer education and responsible consumption, fostering trust and loyalty.

Technological factors

Technological innovations are significantly boosting cannabis cultivation efficiency and yield. Precision agriculture, AI-powered monitoring, smart climate control, and vertical farming are transforming how cannabis is grown, leading to better resource management and higher quality products.

AYR Wellness, being a vertically integrated operator, is well-positioned to adopt these advancements. By integrating technologies like automated nutrient delivery and advanced LED lighting systems, AYR can optimize its cultivation processes, aiming to reduce operational expenses and improve overall product consistency.

For instance, companies utilizing vertical farming reported yield increases of up to 20% in 2024 compared to traditional greenhouses, alongside a 15% reduction in water usage. AYR's investment in such technologies could translate to significant cost savings and a more reliable supply chain for its diverse product offerings.

Technological advancements in cannabis extraction and formulation are continuously expanding the product landscape, with innovations yielding a wider array of concentrates, edibles, and infused beverages. This evolution directly impacts AYR Wellness's ability to innovate and diversify its offerings, thereby meeting shifting consumer demands and carving out a distinct market position. For instance, AYR Wellness reported a 12% increase in its branded product sales in Q1 2024, highlighting the success of its product development initiatives.

The cannabis industry is seeing a significant surge in e-commerce and digital platform adoption. This trend is reshaping how consumers discover, purchase, and interact with cannabis products. Digital tools are becoming crucial for enhancing customer experience, offering everything from tailored product suggestions to efficient inventory tracking.

While direct online sales of cannabis are still navigating complex regulatory landscapes, the underlying digital infrastructure is undeniably powerful. For instance, the U.S. legal cannabis market's online sales component, though often indirect through pickup orders, is projected to grow substantially. By mid-2024, various reports indicated a significant portion of cannabis sales were influenced by online research and pre-ordering.

AYR Wellness can strategically harness these digital advancements to broaden its customer base and refine its operations. Implementing robust digital strategies can lead to more streamlined ordering, improved customer engagement, and ultimately, stronger brand loyalty, all while operating within the established legal parameters.

Supply Chain Management and Traceability

The cannabis industry, including companies like Ayr Wellness, is increasingly leveraging blockchain and digital tools to enhance supply chain management and traceability. This technology offers unprecedented transparency, tracking products from cultivation through to the end consumer, which is vital for regulatory adherence and quality assurance. For AYR Wellness, robust traceability builds consumer confidence by detailing product origins and cultivation methods.

The push for enhanced supply chain visibility is driven by evolving regulations and consumer demand for verifiable product information. For instance, by 2024, many jurisdictions are expected to have stricter mandates for seed-to-sale tracking. This technological integration allows AYR Wellness to:

- Ensure regulatory compliance through detailed record-keeping.

- Maintain high product quality by monitoring every stage of the supply chain.

- Build brand loyalty by offering consumers verifiable product provenance.

- Streamline operations and reduce potential for diversion or counterfeiting.

Data Analytics and Business Intelligence

The increasing sophistication of data analytics and business intelligence tools is transforming how companies like Ayr Wellness operate. By leveraging advanced analytics and artificial intelligence, Ayr can meticulously collect and analyze data across its entire value chain – from cultivation practices to sales figures and consumer behavior. This granular insight is invaluable for making informed, data-driven decisions.

These insights directly translate into tangible improvements. For instance, Ayr can optimize cultivation processes by identifying patterns in yield and quality linked to specific environmental controls or nutrient mixes. In 2024, the cannabis industry saw a significant push towards data-driven cultivation, with companies reporting up to a 15% increase in yield efficiency through AI-powered analytics.

Furthermore, robust business intelligence empowers Ayr to refine inventory management, reducing waste and ensuring product availability where demand is highest. Marketing strategies can be precisely targeted based on consumer preferences and purchasing habits, leading to more effective campaigns. Identifying emerging market trends and untapped opportunities becomes more straightforward, allowing Ayr to proactively adapt and expand its reach.

- Data-driven cultivation optimization: Ayr can analyze environmental data, nutrient inputs, and genetic strains to maximize crop yields and quality.

- Enhanced inventory management: Predictive analytics help forecast demand, minimizing overstocking and stockouts across dispensaries.

- Targeted marketing strategies: Consumer purchase history and demographic data inform personalized marketing campaigns, boosting engagement.

- Identification of new market opportunities: Analysis of sales trends and competitor activity can reveal underserved markets or product niches.

Technological advancements are revolutionizing cannabis cultivation, extraction, and distribution, directly impacting AYR Wellness. Innovations in precision agriculture, AI, and vertical farming are enhancing efficiency and product quality. For example, vertical farming adoption led to a reported 20% yield increase and 15% water reduction in 2024.

AYR Wellness is leveraging data analytics and AI to optimize operations, from cultivation to marketing. This data-driven approach, which saw a 15% yield efficiency increase in the industry in 2024 via AI, helps refine inventory and target consumers more effectively.

The company is also enhancing supply chain transparency through blockchain technology, ensuring regulatory compliance and building consumer trust. This focus on traceability is crucial as jurisdictions move towards stricter seed-to-sale tracking mandates by 2024.

The digital transformation in cannabis retail, including e-commerce and online ordering, is critical for AYR Wellness to expand its customer reach and improve engagement. While direct online sales face regulatory hurdles, the influence of online research and pre-ordering on sales was significant by mid-2024.

Legal factors

The federal classification of cannabis as a Schedule I controlled substance directly triggers IRS Section 280E. This legislation prevents cannabis businesses, including AYR Wellness, from deducting ordinary business expenses like rent, salaries, and marketing, effectively doubling or tripling their tax burden compared to other industries.

For AYR Wellness, this means a significant portion of their revenue is subject to taxation at corporate rates, severely limiting reinvestment and growth opportunities. In 2023, AYR Wellness reported a net loss of $105.4 million, a figure exacerbated by the inability to offset profits with standard operating costs due to 280E.

A potential rescheduling of cannabis to Schedule III under federal law would offer substantial tax relief. This change would allow AYR Wellness to deduct typical business expenses, potentially improving profitability and cash flow, which could then be directed towards expanding operations or reducing debt.

AYR Wellness operates in a highly regulated industry, necessitating strict adherence to state-specific licensing, cultivation, manufacturing, and retail rules across its various markets. This legal patchwork demands constant attention to detail and significant investment in compliance efforts.

For instance, in 2024, states like New Jersey continue to refine their cannabis regulations, impacting everything from packaging to marketing, which AYR must navigate. Failure to comply with these ever-evolving legal frameworks can result in substantial fines or even the loss of operating licenses, underscoring the critical importance of robust legal and compliance teams.

Federal prohibition continues to restrict cannabis companies like Ayr Wellness (AYR) from accessing conventional banking, leading to a reliance on cash transactions. This creates significant operational risks, including security vulnerabilities and inefficiencies. For instance, in 2023, the cannabis industry reported billions in cash transactions, highlighting the scale of this challenge.

However, legislative advancements, such as the potential passage of the SAFER Banking Act, offer a pathway to de-risk AYR's financial landscape. This act aims to provide legal protections for financial institutions that serve state-legal cannabis businesses, potentially unlocking access to essential banking services and reducing the reliance on cash.

Product Liability and Consumer Safety Regulations

AYR Wellness, operating as a cultivator, manufacturer, and retailer, navigates a complex landscape of product liability and consumer safety regulations. These laws mandate rigorous testing for contaminants like heavy metals and pesticides, ensuring accurate product labeling, and upholding strict quality control standards throughout the production process. For instance, as of early 2024, many U.S. states with legal cannabis markets require independent laboratory testing for potency and purity, with results often needing to be displayed on packaging. Failure to comply can lead to significant financial penalties, brand damage, and potential legal action.

Maintaining unwavering adherence to these regulations is paramount for AYR Wellness. It directly impacts consumer trust and safety, shielding the company from potential lawsuits stemming from adverse product reactions or misrepresentation. For example, a product recall due to contamination could result in millions of dollars in lost revenue and costly legal battles, as seen in past incidents within the broader consumer goods sector. Proactive compliance, therefore, is not just a legal obligation but a critical business strategy for long-term sustainability and reputation management.

- Mandatory Testing: AYR Wellness must ensure all products undergo comprehensive testing for contaminants, including microbial, heavy metal, and pesticide analysis, as mandated by state-specific cannabis regulations.

- Accurate Labeling: Regulations require precise labeling of cannabinoid content (THC, CBD), ingredients, warnings, and manufacturing dates, with significant fines for inaccuracies.

- Quality Control: Implementing robust quality control measures from cultivation to retail is essential to meet Good Manufacturing Practices (GMP) and prevent product defects that could lead to liability claims.

- Consumer Safety: The overarching goal is to protect consumers from harm, with regulatory bodies actively monitoring compliance and imposing penalties for violations that compromise public health.

Intellectual Property Protection

Protecting intellectual property, like proprietary cannabis strains and unique cultivation methods, is increasingly critical for AYR Wellness in the dynamic cannabis market. The challenge lies in navigating the patchwork of state-level regulations and the absence of federal cannabis legalization, which complicates the process of securing and enforcing patents, trademarks, and trade secrets. This legal landscape directly impacts AYR's ability to safeguard its innovations and maintain a distinct market position against competitors.

In 2024, the cannabis industry continued to grapple with IP enforcement. For instance, while specific AYR Wellness IP enforcement actions are not publicly detailed, companies in the sector have faced disputes over brand names and patented strains. The U.S. Patent and Trademark Office (USPTO) has granted trademarks for cannabis-related businesses, but patents for the plant itself remain complex due to its federal Schedule I status. This creates a significant hurdle for companies like AYR seeking robust protection for their most valuable assets.

- Brand Protection: Securing trademarks for brand names and logos is essential to prevent consumer confusion and unauthorized use.

- Strain Patents: While challenging, obtaining patents for unique cannabis strains and their genetic markers offers strong protection against replication.

- Trade Secrets: Protecting proprietary cultivation techniques and recipes as trade secrets requires stringent internal security measures.

- Enforcement Challenges: The evolving legal framework necessitates proactive legal strategies to enforce IP rights across various jurisdictions.

The ongoing federal prohibition of cannabis, classifying it as a Schedule I substance, directly impacts AYR Wellness through IRS Section 280E. This legislation prevents the deduction of ordinary business expenses, significantly increasing the company's tax burden. For example, in 2023, AYR Wellness reported a net loss of $105.4 million, a figure heavily influenced by these tax limitations.

Navigating state-specific regulations across its operational footprint is a constant legal challenge for AYR. These rules govern cultivation, manufacturing, and retail, demanding continuous adaptation. For instance, evolving regulations in markets like New Jersey in 2024 necessitate ongoing compliance efforts to avoid penalties.

The lack of federal banking access forces AYR Wellness to operate largely on a cash basis, creating security and efficiency risks. The SAFER Banking Act, if passed, could provide much-needed access to traditional financial services, de-risking operations and potentially improving financial management.

AYR Wellness must also adhere to stringent product liability and consumer safety laws, including mandatory testing for contaminants and accurate labeling. As of early 2024, many states require independent lab testing for potency and purity, with non-compliance leading to significant penalties and reputational damage.

Environmental factors

AYR Wellness, like many in the cannabis sector, operates an energy and water-intensive business, especially with indoor cultivation. By 2024, the industry is seeing a significant push towards sustainability, with companies like AYR facing growing regulatory demands to implement eco-friendly methods. This includes adopting smart irrigation, water recycling, and energy-saving technologies such as LED lighting and efficient HVAC systems.

These changes are crucial for AYR to reduce its environmental impact and also to cut down on operational expenses. For instance, a transition to LED lighting alone can lead to substantial energy savings, potentially reducing electricity consumption by up to 50% compared to traditional high-intensity discharge (HID) lighting systems. This focus on resource management is becoming a key differentiator and a necessity for long-term viability in the evolving cannabis market.

The cannabis industry, including AYR Wellness, faces significant waste challenges, largely driven by stringent packaging mandates. These regulations often require child-resistant and opaque materials, contributing to a substantial environmental footprint. For instance, in 2023, the U.S. cannabis market generated an estimated 1.3 billion plastic containers, highlighting the scale of the issue.

AYR Wellness must proactively manage this waste by exploring sustainable packaging alternatives. This includes investigating recyclable materials, biodegradable options, and strategies for reducing overall plastic consumption. Meeting evolving environmental regulations and appealing to environmentally conscious consumers, who increasingly factor sustainability into purchasing decisions, will be key to long-term success.

Indoor cannabis cultivation is notoriously energy-intensive, with lighting and climate control systems being significant contributors to greenhouse gas emissions. For AYR Wellness, this presents a key environmental challenge. For instance, a 2023 report indicated that cannabis cultivation can account for up to 1% of a state's total electricity consumption in some regions.

AYR Wellness can proactively address this by investing in renewable energy solutions, such as on-site solar installations, to power its facilities. Optimizing energy efficiency through advanced, automated climate control systems can also drastically reduce consumption. Furthermore, exploring participation in carbon offset programs can help mitigate unavoidable emissions, aligning with a growing trend as some states, like Colorado and California, are starting to mandate sustainability plans that require detailed tracking of energy and water usage by cannabis cultivators.

Climate Change and Agricultural Resilience

While AYR Wellness primarily focuses on indoor cultivation, climate change poses indirect risks to its supply chain and any potential outdoor operations. Extreme weather events, such as droughts or floods, could disrupt the availability and cost of agricultural inputs like soil, nutrients, and even energy sources, impacting AYR's operational stability.

Water scarcity, a growing concern in many agricultural regions, could also affect the sourcing of raw materials or increase operational costs if water-intensive processes are involved in their supply chain. Changes in broader agricultural conditions due to shifting climate patterns might necessitate adaptations in sourcing strategies or lead to price volatility for essential commodities.

Building resilience is therefore crucial for AYR Wellness's long-term success. This could involve diversifying suppliers, exploring drought-resistant or climate-resilient input sources, and optimizing logistics to mitigate the impact of weather-related disruptions. For instance, the agricultural sector globally faced significant challenges in 2024 due to widespread extreme weather, with the UN reporting increased food price volatility impacting supply chains.

- Supply Chain Vulnerability: Extreme weather events in 2024 impacted agricultural output globally, potentially affecting AYR's raw material sourcing.

- Input Cost Volatility: Climate-induced agricultural disruptions can lead to unpredictable price fluctuations for essential cultivation inputs.

- Operational Adaptation: Investing in resilient supply chain strategies and exploring alternative sourcing methods is key for AYR's stability.

Environmental Reporting and Corporate Social Responsibility

Environmental reporting and corporate social responsibility (CSR) are increasingly vital for companies like AYR Wellness. Regulators, investors, and consumers are demanding greater transparency about a company's environmental footprint. For instance, in 2024, a significant percentage of institutional investors globally incorporated ESG (Environmental, Social, and Governance) factors into their investment decisions, signaling a clear trend toward sustainability-focused capital allocation. This heightened scrutiny means AYR Wellness must actively report on its environmental performance to meet expectations.

By embracing robust environmental reporting and demonstrating strong CSR, AYR Wellness can significantly boost its brand image. This commitment helps attract and retain environmentally conscious stakeholders, including customers and investors. For example, companies with strong sustainability reports often see improved brand loyalty and a competitive edge in attracting talent. AYR Wellness can leverage this by highlighting its sustainability initiatives, such as waste reduction programs or energy efficiency improvements, in its public communications and annual reports.

AYR Wellness's proactive approach to sustainability can translate into tangible business benefits. Beyond brand enhancement, it can lead to operational efficiencies and cost savings. For example, investments in renewable energy sources can reduce long-term energy expenditures. In 2025, the cannabis industry, where AYR operates, is facing particular pressure to adopt more sustainable cultivation and packaging practices, with some states implementing stricter environmental regulations for cultivators. Demonstrating leadership in this area positions AYR Wellness favorably.

- Regulatory Pressure: Growing environmental regulations in key AYR markets (e.g., Massachusetts, Pennsylvania) are pushing for reduced energy consumption and waste in cannabis cultivation.

- Investor Demand: In 2024, ESG-focused funds saw continued inflows, with many explicitly seeking companies with strong environmental disclosures, impacting AYR's access to capital.

- Consumer Preferences: Surveys in 2024 indicated that over 60% of consumers are more likely to purchase from brands with visible sustainability commitments.

- Brand Reputation: AYR's commitment to reporting on initiatives like water conservation or sustainable packaging can differentiate it from competitors and build trust.

AYR Wellness faces increasing scrutiny regarding its environmental impact, particularly concerning energy and water consumption in cultivation. By 2025, regulatory bodies in key AYR markets are expected to tighten standards on waste management and emissions, pushing companies towards more sustainable practices.

Companies like AYR are investing in energy-efficient technologies, such as LED lighting, which can reduce electricity usage by up to 50%. Furthermore, sustainable packaging solutions are becoming paramount, as the U.S. cannabis market generated an estimated 1.3 billion plastic containers in 2023 alone, presenting a significant waste challenge.

Addressing these environmental factors is not just about compliance; it's a strategic imperative. In 2024, a substantial portion of institutional investors globally integrated ESG criteria into their decisions, highlighting the financial benefits of strong environmental performance for companies like AYR Wellness.

| Environmental Factor | Impact on AYR Wellness | 2024/2025 Data/Trend |

|---|---|---|

| Energy Consumption | High operational costs and carbon footprint from indoor cultivation. | Cannabis cultivation can account for up to 1% of a state's total electricity consumption (2023 estimate). Push for LED lighting adoption to cut energy use by up to 50%. |

| Water Usage | Resource-intensive cultivation processes. | Growing concerns over water scarcity may impact sourcing and operational costs. |

| Waste Management | Significant waste from packaging mandates. | U.S. cannabis market generated ~1.3 billion plastic containers in 2023. Demand for recyclable and biodegradable packaging is rising. |

| Climate Change | Supply chain disruptions and potential impact on input availability. | Extreme weather events in 2024 impacted global agriculture, leading to input cost volatility. |

| Environmental Reporting & CSR | Investor and consumer demand for transparency and sustainability. | Over 60% of consumers in 2024 favored brands with visible sustainability commitments. ESG-focused funds saw continued inflows. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Ayr is meticulously constructed using data from government regulatory bodies, industry-specific market research reports, and reputable economic forecasting agencies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Ayr's operations.