Ayr Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayr Bundle

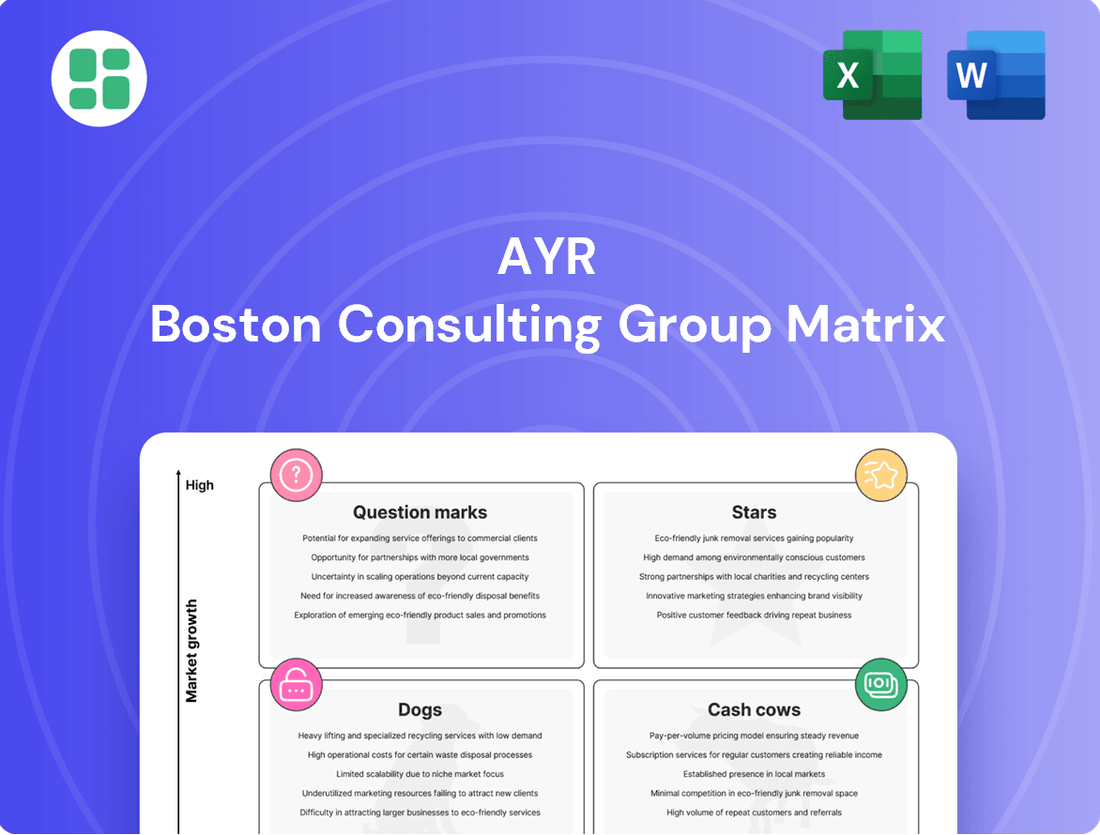

The Boston Consulting Group (BCG) Matrix is a powerful tool for analyzing a company's product portfolio. It categorizes products into four quadrants: Stars, Cash Cows, Question Marks, and Dogs, based on their market growth rate and relative market share.

Understanding where each of your products falls within this matrix is crucial for making informed strategic decisions about resource allocation and future investments. This preview offers a glimpse into its potential, but the true strategic advantage lies in a comprehensive analysis.

Purchase the full BCG Matrix report to gain a detailed breakdown of your company's product positioning, actionable insights for each quadrant, and a clear roadmap for optimizing your business strategy and maximizing profitability.

Stars

Florida represents a significant growth opportunity for Ayr Wellness, underscored by substantial investments in its cultivation infrastructure. The company's new Ocala facility, set to more than double flower production by mid-2025, positions it to capitalize on the state's robust medical cannabis market.

The potential for adult-use legalization in Florida, despite the 2024 Amendment 3 setback, continues to make these assets highly valuable. This forward-looking strategy, coupled with enhanced cultivation capabilities, positions Ayr Wellness for substantial market gains.

Ohio's adult-use cannabis market is a prime example of a high-growth opportunity for AYR Wellness. The company has strategically positioned itself with multiple adult-use dispensaries already operational in the state. This early mover advantage is anticipated to drive substantial growth in both retail and wholesale revenue streams for AYR Wellness.

Pennsylvania stands as a vital market for AYR Wellness, particularly given its significant potential for a transition to adult-use cannabis. This anticipated shift is a major driver for the state's cannabis industry.

AYR Wellness has established a strong retail presence across Pennsylvania. This footprint is a key asset, underscoring the strategic value of its operations in a market characterized by substantial size and promising future expansion.

The company's continued investment in Pennsylvania reflects the market's strategic importance, even as AYR navigates broader financial considerations. For example, AYR reported $322 million in revenue for the fiscal year 2023, with Pennsylvania playing a significant role in their overall performance.

Virginia Vertically Integrated License

AYR Wellness’s acquisition of Virginia’s final vertically integrated medical marijuana license in 2024 is a significant strategic move, placing them at the forefront of a burgeoning market. This permit allows AYR to control the entire cannabis supply chain, from cultivation to retail, a crucial advantage in a state still defining its cannabis regulations.

The long-term value of this license is substantial, especially as Virginia’s market evolves. AYR is well-positioned to capitalize on potential future adult-use legalization, leveraging their established infrastructure. For instance, in 2023, the Virginia medical cannabis market saw significant patient growth, indicating a strong demand base.

- Secured last vertically integrated medical license in Virginia.

- Controls entire cannabis supply chain in a developing market.

- Positions AYR for future growth and potential adult-use expansion.

- License represents a key, long-term strategic asset.

Core Branded Product Portfolio

AYR Wellness is strategically focusing on its core branded product portfolio, which includes established names like Kynd and Haze, alongside newer offerings such as the Later Days vape collection. This consolidation is a key part of their business strategy, aiming to build strong market recognition and consumer loyalty.

These core brands are instrumental in AYR's growth, particularly in driving wholesale revenue. The company's commitment to quality and market acceptance for these products is evident in their ongoing investment and marketing efforts. For instance, in the first quarter of 2024, AYR reported a 3% increase in revenue to $132.5 million, with their branded products playing a significant role in this expansion.

- Kynd: Known for its premium flower and concentrates, Kynd continues to be a top performer in AYR's portfolio.

- Haze: This brand targets a broader market with its accessible and popular vape products and edibles.

- Later Days: A newer entrant, this vape collection is designed to capture emerging consumer preferences for specific flavor profiles and experiences.

- Market Share: AYR aims to leverage these brands to increase its share in high-demand cannabis product categories across its operating states.

Stars in the BCG Matrix represent high-growth, high-market-share businesses or products. AYR Wellness's strategic focus on states like Florida and Ohio, with their rapidly expanding adult-use markets, positions them to capture significant market share. The company's investments in cultivation and retail infrastructure in these regions are designed to meet burgeoning demand and solidify their leadership.

Florida's medical market, coupled with the potential for adult-use, makes it a prime star candidate for AYR. Similarly, Ohio's early adult-use market allows AYR to leverage its existing dispensaries for substantial growth. These markets are critical for AYR's future revenue generation and overall portfolio strength.

| Market | Growth Potential | AYR's Position | Key Initiatives |

|---|---|---|---|

| Florida | High (Medical, potential Adult-Use) | Significant investment in cultivation (Ocala facility) | Double flower production by mid-2025 |

| Ohio | High (Adult-Use) | Multiple operational adult-use dispensaries | Leveraging early mover advantage for retail and wholesale growth |

| Pennsylvania | High (Potential Adult-Use) | Strong retail presence | Continued investment despite financial considerations; $322M 2023 revenue |

| Virginia | High (Medical, potential Adult-Use) | Secured last vertically integrated medical license (2024) | Full supply chain control; 2023 saw significant patient growth |

What is included in the product

The Ayr BCG Matrix categorizes business units by market share and growth, guiding investment decisions.

Ayr BCG Matrix provides a clear, visual overview of your portfolio, relieving the pain of uncertainty about where to allocate resources.

Cash Cows

AYR Wellness's established Florida medical market operations, with its substantial footprint of 67 dispensaries, likely functioned as a cash cow before recent strategic shifts. These locations have historically tapped into a large and consistent patient base, ensuring steady revenue streams even within a maturing market. This mature segment has been a reliable income generator for the company.

AYR Wellness's acquisition of Garden State Dispensary gave them a substantial head start in New Jersey's cannabis sector, securing some of the initial medical dispensaries that later shifted to adult-use sales. This established retail footprint, prior to recent market shifts, would have generated steady revenue and strong profit margins, benefiting from early market entry and established brand loyalty.

These types of mature retail operations generally necessitate reduced marketing expenditures once they are up and running. For instance, in 2023, AYR Wellness reported that its New Jersey operations contributed significantly to its overall revenue, reflecting the ongoing strength of its early market positioning.

AYR's wholesale distribution of established brands, including Kynd and Haze, has demonstrated resilience with a notable year-over-year revenue increase in 2024. This segment represents a stable cash flow generator for the company, benefiting from existing distribution networks and brand recognition.

Despite AYR's broader financial challenges, these wholesale operations historically offered consistent returns with comparatively lower overheads than ventures into new retail territories, positioning them as a potential cash cow within the BCG matrix.

Nevada Retail Operations

Nevada's retail cannabis operations, particularly those within Ayr Wellness's portfolio, represent a potential cash cow scenario. The state boasts a mature adult-use market, which typically translates to stable consumer demand and predictable revenue streams. If Ayr Wellness has secured a significant market share in this established environment, these operations could reliably generate consistent cash flow, even if the market's growth rate has moderated.

The stability offered by mature markets like Nevada's is a key characteristic of cash cows. These businesses, while perhaps not experiencing rapid expansion, contribute significantly to a company's overall financial health through their dependable earnings. This reliability allows for reinvestment in other areas of the business or distribution to shareholders.

- Market Maturity: Nevada's adult-use cannabis market has been operational for several years, indicating a stable demand profile.

- Revenue Stability: Mature markets often provide consistent revenue, making them reliable cash generators.

- Potential for Strong Market Share: If Ayr Wellness holds a dominant position, these operations are prime candidates for cash cow status.

Optimized Cultivation Assets (Prior to Restructuring)

Before its significant restructuring and facility closures, Ayr Wellness likely possessed cultivation assets in established markets that were performing exceptionally well. These operations were probably characterized by efficient production processes and a low cost of goods sold, allowing them to consistently supply both retail and wholesale customers.

These highly optimized facilities would have been the engine of Ayr's profitability, generating substantial cash flow and healthy profit margins due to their mature production capabilities. For example, in 2024, Ayr reported significant revenue contributions from its existing operations, with certain mature cultivation sites acting as key profit drivers.

- Mature Market Dominance: Cultivation sites in states like Massachusetts and Pennsylvania, prior to restructuring, likely served as key revenue generators.

- Cost Efficiency: These facilities would have benefited from economies of scale, leading to lower per-gram production costs compared to newer or less optimized sites.

- Consistent Cash Flow: The reliable output from these "cash cow" assets provided a stable source of funds for operations and strategic investments.

Cash cows represent mature, highly profitable business segments within a company that generate more cash than they consume. For AYR Wellness, these are likely established retail operations in states with stable, adult-use markets, or efficient wholesale distribution of popular brands. These segments require minimal investment to maintain their market position, providing a steady stream of funds that can be used to support other, less mature parts of the business.

AYR's Florida dispensaries, with their extensive reach of 67 locations, exemplify a cash cow. This mature market offers consistent patient demand, ensuring reliable revenue. Similarly, early entry into New Jersey’s market, with its transition to adult-use sales, provided a strong foundation for consistent profit margins, as evidenced by significant revenue contributions reported in 2023.

The wholesale distribution of AYR's established brands, such as Kynd and Haze, also functions as a cash cow, showing a notable year-over-year revenue increase in 2024. These operations benefit from existing networks and brand recognition, offering stable cash flow with lower overheads compared to new market entries.

Nevada's mature adult-use cannabis market, where AYR Wellness operates, also presents a strong case for cash cow status. The predictable consumer demand in such markets translates into stable revenue streams. If AYR has secured a significant market share, these operations can reliably generate consistent cash flow, even if market growth has slowed.

Preview = Final Product

Ayr BCG Matrix

The preview you see is the complete and final Ayr BCG Matrix document you will receive upon purchase, offering a clear and actionable framework for your business strategy. This isn't a demo or a partial view; it's the fully formatted, analysis-ready report designed for immediate application. You can confidently use this preview as a direct representation of the professional-grade document that will be yours to edit, present, or integrate into your strategic planning. No hidden elements or watermarks will be present in the purchased version, ensuring a seamless transition to utilizing this valuable business tool.

Dogs

AYR Wellness is strategically divesting its four Illinois dispensaries, signaling these operations are likely Stars or Question Marks that have not achieved their full potential, or perhaps Cash Cows with declining returns. This move aligns with a BCG matrix analysis, where underperforming or resource-intensive assets are candidates for divestiture to free up capital for more promising ventures. The company's decision suggests these Illinois locations are not generating sufficient returns or market share to justify continued investment, making them prime candidates for divestiture to reduce cash drain and improve overall portfolio performance.

AYR Wellness's decision to close its large cultivation facility in Milford, Massachusetts, a move that led to significant layoffs, clearly places this asset in the 'Dog' category of the BCG Matrix. This action suggests the facility was a substantial drain on resources without delivering proportionate returns.

The Milford closure, impacting approximately 120 employees, underscores the facility's likely high operational expenses and its failure to generate sufficient revenue or profit to justify its continued operation. This divestment is a strategic move to cease a cash-consuming operation.

AYR Wellness's broader strategy, as indicated by this closure and other cost-saving measures, aims to streamline operations and improve profitability. The company reported a net loss of $15.3 million in the first quarter of 2024, highlighting the need for such decisive actions to shed underperforming assets and reduce operational burdens.

Underperforming retail locations within Ayr's portfolio would be categorized as Dogs in the BCG Matrix. These dispensaries consistently exhibit low sales volume and a small market share in their local areas, demanding significant operational resources without commensurate returns. For example, if a particular Ayr dispensary in a competitive market only captured 1% of sales in 2024, compared to a market leader's 15%, it would likely fall into this category.

These "Dog" locations often represent a drain on capital and management attention, acting as cash traps. Ayr's strategy for these outlets typically involves either divesting them to focus resources on more promising ventures or implementing significant operational overhauls to improve their performance. In 2024, Ayr Wellness reported closing several underperforming dispensaries as part of its ongoing portfolio optimization efforts.

Non-Core or Liquidated Assets

AYR Wellness is strategically divesting its non-core and liquidated assets as part of a broader restructuring initiative. This involves the orderly sale or wind-down of assets not central to its core operations. These are typically items with low market share and limited growth potential, deemed non-essential or unprofitable.

The primary goal of liquidating these assets is to strengthen AYR's financial position by satisfying creditors and reducing overall liabilities. This move is crucial for streamlining operations and focusing resources on more promising areas of the business.

- Divestment of Non-Core Assets: AYR is actively selling off assets not integral to its primary business, aiming to improve financial flexibility.

- Focus on Profitable Operations: The strategy prioritizes shedding underperforming or non-essential business segments to concentrate on core, revenue-generating activities.

- Liability Management: The proceeds from these sales are earmarked to address outstanding debts and minimize the company's financial obligations.

- Strategic Realignment: This process is a key component of AYR's plan to optimize its portfolio and enhance its competitive standing in the market.

Obsolete or Unpopular Product Lines

Obsolete or unpopular product lines represent the 'Dogs' in Ayr's BCG Matrix. These are cannabis products or strains that haven't resonated with consumers or have been surpassed by newer, more popular options in the fast-paced cannabis market. For instance, if Ayr Wellness (AYR) had a specific line of edibles that saw declining sales throughout 2023 and early 2024, it would likely fall into this category.

These underperforming offerings typically hold a low market share and contribute very little to the company's overall revenue. They can also be a drain on resources, tying up inventory and production capacity without generating adequate returns. Ayr's strategic emphasis on streamlining its brand portfolio indicates a proactive approach to identifying and discontinuing such products.

- Low Market Share: Products that haven't gained significant consumer adoption, leading to minimal sales.

- Resource Drain: Inventory and production tied up in slow-moving or outdated items.

- Strategic Pruning: Ayr's focus on rationalizing its brand portfolio aims to eliminate these 'Dog' products.

- Declining Revenue Contribution: These items contribute minimally to overall financial performance.

Dogs in AYR Wellness's BCG Matrix are assets with low market share and low growth potential, often representing a drain on resources. These could include underperforming dispensaries or obsolete product lines. For example, a dispensary with consistently low sales in 2024, capturing a minimal percentage of its local market, would be a prime candidate for this category.

AYR's strategy for these 'Dogs' typically involves divestiture or discontinuation to free up capital and management focus for more promising ventures. The company's reported net loss of $15.3 million in Q1 2024 underscores the necessity of shedding such underperforming assets.

The closure of the Milford, Massachusetts cultivation facility, impacting around 120 employees, exemplifies a significant 'Dog' asset being divested due to high operational costs and insufficient returns.

Similarly, product lines with declining sales, such as a specific edible range that saw reduced consumer interest throughout 2023 and early 2024, would also be classified as Dogs, tying up inventory and production capacity without generating adequate profit.

| Asset Type | BCG Category | Rationale | 2024 Example/Indicator |

| Underperforming Dispensary | Dog | Low sales volume, small market share, high operational costs | Dispensary with <1% market share in a competitive region |

| Obsolete Product Line | Dog | Declining sales, low consumer resonance, inventory drain | Edible line with reduced sales throughout 2023-2024 |

| Underutilized Cultivation Facility | Dog | High operational expenses, insufficient revenue generation | Milford, MA facility closure |

Question Marks

AYR Wellness is actively engaged in Connecticut's burgeoning cannabis market, with operations spanning cultivation and retail. This strategic positioning in a developing region aligns with the characteristics of a Question Mark in the BCG Matrix, signifying high growth potential but currently uncertain market share.

Connecticut's cannabis industry is experiencing significant growth, projected to reach an estimated $1.2 billion by 2025, according to industry analysts. AYR's presence in this expanding market, while promising, likely represents a smaller slice of the pie at this early stage, underscoring its Question Mark status.

To elevate its Connecticut operations from a Question Mark to a more dominant position like a Star or Cash Cow, AYR Wellness will need to deploy substantial capital for expansion and refine its market strategy. Success hinges on capturing a larger market share amidst increasing competition and evolving regulations.

The launch of new product variations, like the 2g size of Later Days vapes in New Jersey and Massachusetts in early 2025, fits squarely into the Question Mark category of the BCG Matrix. These products are entering markets that are showing growth, but they face intense competition. The key challenge is to quickly capture consumer interest and build a significant market presence.

Significant investment in marketing and distribution will be necessary to give these new vapes a fighting chance. While the potential for high returns exists, it's not guaranteed from the outset, making them a classic Question Mark requiring careful monitoring and strategic decisions. For instance, the overall US vape market was projected to reach $19.5 billion in 2024, highlighting the competitive landscape these new products are entering.

Ayr Wellness is actively expanding its cultivation footprint in new states, a move that aligns with the question marks in the BCG matrix. These early-stage facilities, such as those in Pennsylvania and Massachusetts, represent significant investments where production is still scaling. For instance, Ayr's Pennsylvania operations are still working to achieve optimal yield and cost efficiencies, reflecting the capital-intensive nature of building out new cultivation capacity.

These new cultivation sites are in markets with strong demand, but they require substantial upfront capital and operational refinement to reach profitability. The risk lies in the time and resources needed to ramp up production and achieve economies of scale. This is typical for early-stage expansions, where the company is betting on future market growth and its ability to execute effectively.

Developing Wholesale Relationships in Untapped Markets

Expanding wholesale distribution into new states or significantly increasing market penetration in existing states where AYR's wholesale presence is currently limited can be viewed as a Question Mark in the BCG Matrix. This is because the cannabis market, while experiencing substantial growth, presents challenges in establishing robust wholesale relationships and securing significant market share against established competitors, necessitating considerable investment and strategic effort. For example, in 2024, the U.S. legal cannabis market was projected to reach over $35 billion, indicating a ripe opportunity but also intense competition for distribution networks.

Building these crucial wholesale connections in underserved or emerging markets requires a strategic approach. AYR would need to dedicate resources to market research, identifying key potential partners, and developing tailored sales strategies. The success hinges on understanding local regulations, consumer preferences, and the competitive landscape within each target state.

- Market Penetration: Increasing sales within existing markets where AYR has a limited wholesale footprint.

- Geographic Expansion: Entering new states with developing or underdeveloped wholesale cannabis markets.

- Investment Requirement: Significant capital needed for sales teams, marketing, and logistical support in new territories.

- Competitive Landscape: Facing established players who already have strong wholesale distribution channels.

Assets in States with Uncertain Regulatory Futures

AYR Wellness's operations in states with uncertain regulatory futures, such as potentially Pennsylvania or New Jersey as their market structures evolve, could be categorized as Question Marks in the BCG Matrix. These markets offer significant upside if legislative changes prove favorable, but AYR's current limited market share means these ventures consume capital without guaranteed returns.

The decision for AYR is whether to increase investment to capture potential growth or to divest from these markets to conserve cash. For instance, if a state like Pennsylvania were to shift its regulatory framework to allow for more retail dispensaries or expand product offerings, AYR's existing cultivation and processing assets could become much more valuable. However, if regulations remain restrictive or shift unfavorably, these assets could represent a drain on resources.

- Uncertain Regulatory Landscape: Markets where the legal status or operational rules for cannabis are still in flux.

- Limited Market Foothold: AYR's current low market share in these specific states.

- High Growth Potential: The possibility of substantial returns if regulations become more permissive.

- Cash Consumption: These operations require ongoing investment with an uncertain future payoff.

Question Marks in the BCG Matrix represent business units or products in high-growth markets with low market share. For AYR Wellness, these are often new market entries or product launches where significant investment is required to gain traction. The key is to determine if these ventures can capture enough market share to become Stars or if they will drain resources.

AYR's expansion into new states like Pennsylvania and Massachusetts, while promising due to market growth, exemplifies Question Marks. These operations demand substantial capital for cultivation build-out and market penetration, facing intense competition. For example, the U.S. cannabis market was projected to exceed $35 billion in 2024, but AYR's share in these nascent markets is still developing.

The company's strategy must focus on increasing market share through targeted marketing, efficient operations, and strategic partnerships. Failure to do so could result in these ventures becoming Dogs, consuming capital without generating sufficient returns. The success of these Question Marks is crucial for AYR's overall portfolio growth and market positioning.

AYR Wellness's new product launches, such as the 2g vapes in early 2025, are also classic Question Marks. These products enter a growing but highly competitive sector, with the U.S. vape market projected at $19.5 billion for 2024. Significant investment in marketing and distribution is essential to carve out a market presence and avoid becoming obsolete.

| AYR Wellness BCG Matrix: Question Marks | Market Growth | Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| New State Expansion (e.g., PA, MA) | High | Low | High (Cultivation, Operations) | Star or Dog |

| New Product Launches (e.g., 2g Vapes) | High | Low | High (Marketing, Distribution) | Star or Dog |

| Wholesale Distribution Expansion | High | Low | High (Sales, Logistics) | Star or Dog |

| Uncertain Regulatory Markets | High Potential | Low | Medium to High (Strategic Bets) | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from company financial reports, extensive market research, and industry growth projections to provide a robust strategic overview.