Ayr Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayr Bundle

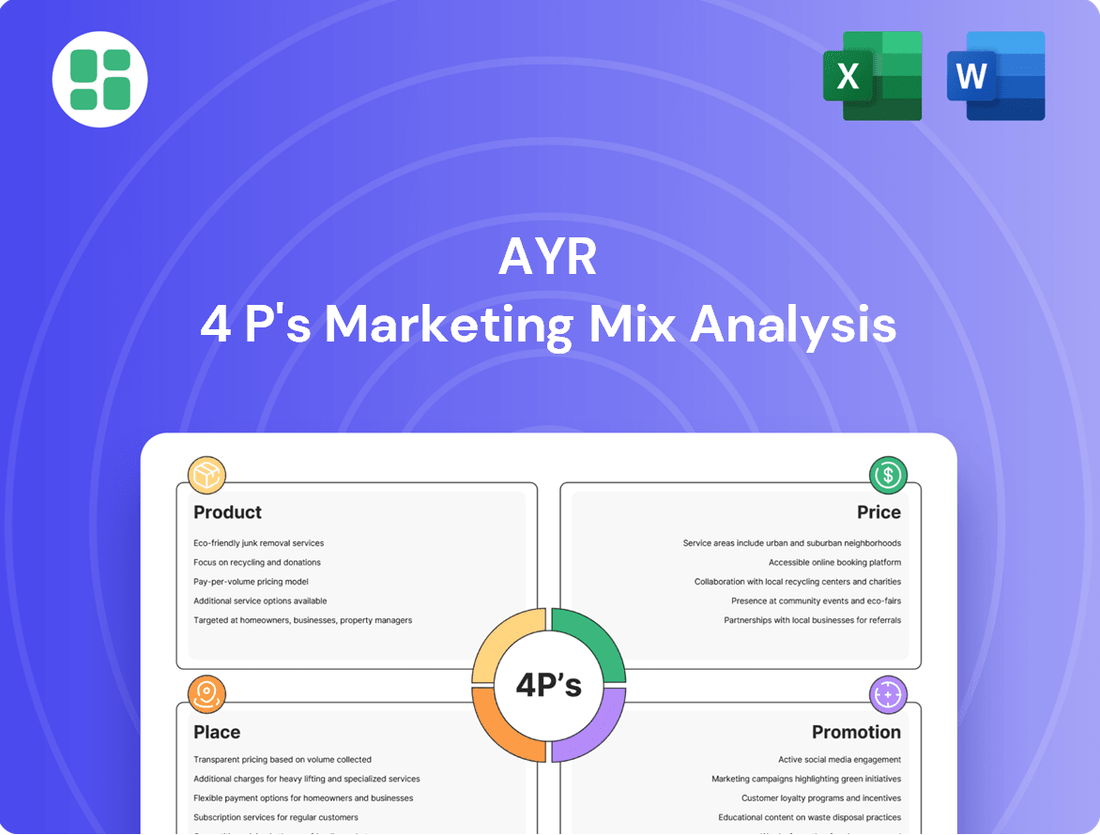

Uncover the strategic brilliance behind Ayr's market dominance by diving deep into their Product, Price, Place, and Promotion. This comprehensive analysis reveals how each element is meticulously crafted to resonate with their target audience and drive exceptional results.

Go beyond the surface-level understanding of Ayr's marketing efforts. Our full 4Ps analysis provides actionable insights, real-world examples, and a structured framework that you can adapt for your own business strategies.

Save valuable time and gain a competitive edge. Access this expertly written, editable report to understand Ayr's success and elevate your own marketing planning.

Product

AYR Wellness's product strategy has pivoted to a controlled liquidation of its cannabis portfolio, encompassing flower, edibles, concentrates, and vapes from brands like Kynd and Levia. This move is a critical component of their restructuring efforts to address creditor obligations.

The company is actively divesting these product assets, aiming for an orderly transfer to new owners. This process necessitates maintaining the quality and availability of current inventory throughout the transition, ensuring business continuity.

As of Q1 2024, AYR Wellness reported $105.7 million in revenue, with the portfolio liquidation expected to streamline operations and improve their financial standing by reducing unsold inventory and associated carrying costs.

Ayr Wellness's brand names, including Kynd, Haze, and Later Days, are significant assets being liquidated, representing considerable intellectual property and established market recognition. These brands are being sold to realize their residual value, a common strategy during liquidation rather than focusing on future brand development.

The sale of these brands is intrinsically linked to Ayr's vertically integrated operations. The liquidation process includes the transfer of the entire supply chain capabilities, from cultivation through manufacturing, which underpins the value and market presence of these established brand names.

AYR Wellness is prioritizing product quality maintenance, even amidst financial challenges and liquidation proceedings. This focus aims to enhance the value of assets being divested and facilitate a seamless handover to potential acquirers. By efficiently managing ongoing cultivation and manufacturing, AYR ensures its products meet regulatory compliance and consumer standards during this transitional phase.

Discontinued Development

Ayr Wellness has significantly scaled back its new product development and innovation initiatives. The company's strategic pivot prioritizes managing current inventory and divesting existing assets over launching new offerings. This approach reflects a shift from expansion to optimizing its current operational footprint.

Investment in future growth, such as the planned cultivation facility in Florida, originally slated for H2 2025 contributions, is now being re-evaluated as assets available for transfer or sale. This indicates a move away from capital expenditure on new projects towards realizing value from existing holdings.

The company's focus has clearly shifted from pursuing aggressive growth strategies to a more conservative approach centered on asset realization and financial deleveraging. This change in strategy is evident in the cessation of new product development pipelines and the repositioning of previously planned investments.

- Discontinued Innovation: New product development has largely ceased.

- Asset Focus: Efforts are directed towards managing inventory and asset sales.

- Florida Facility Re-evaluation: The Florida cultivation project, expected in H2 2025, is now considered an asset for transfer or sale.

- Strategic Shift: The company is prioritizing asset realization over growth.

Customer Experience Consistency

Even as Ayr Wellness navigates its strategic wind-down, ensuring a consistent customer experience across its remaining dispensaries is paramount for maximizing the value of its retail assets. This focus directly impacts customer loyalty, which can then be transferred to potential new operators.

Maintaining a diverse selection of cannabis products and experiences remains critical in the states where Ayr continues to operate. For instance, as of early 2024, the legal cannabis market in states like Massachusetts and Pennsylvania, where Ayr has a significant presence, continues to see strong consumer demand for a variety of product types, from flower to edibles and concentrates.

- Product Availability: Ensuring shelves are stocked with popular and diverse cannabis options is key to retaining customers during this transition period.

- Service Quality: Consistent, knowledgeable customer service at the point of sale helps maintain brand perception and customer satisfaction.

- Brand Experience: Even with a shrinking footprint, the overall Ayr brand experience needs to remain positive to preserve goodwill and transferable customer relationships.

AYR Wellness's product strategy centers on the controlled liquidation of its existing cannabis portfolio, including flower, edibles, concentrates, and vapes under brands like Kynd and Levia. This approach aims to realize value from these assets while streamlining operations. The company is focused on maintaining product quality during the divestment process to ensure a smooth handover to potential acquirers.

The liquidation includes established brand names such as Kynd and Haze, representing significant intellectual property being sold to realize residual value. This strategic shift prioritizes asset realization over new product development or future growth initiatives, such as the re-evaluation of the Florida cultivation facility planned for H2 2025.

Ayr Wellness reported $105.7 million in revenue for Q1 2024, and this liquidation is expected to improve its financial standing by reducing inventory and associated costs. The company is ensuring a consistent customer experience in its remaining dispensaries to maximize the value of its retail assets and preserve customer relationships.

| Product Category | Brand Examples | Strategy | Financial Impact (Q1 2024 Revenue) |

|---|---|---|---|

| Flower, Edibles, Concentrates, Vapes | Kynd, Levia | Controlled Liquidation | $105.7 million (Total AYR Revenue) |

| Intellectual Property | Kynd, Haze, Later Days | Divestment for Residual Value | N/A (IP Value Realized through Brand Sale) |

| Future Growth Projects | Florida Cultivation Facility | Re-evaluation for Transfer/Sale | N/A (Capital Expenditure Deferred) |

What is included in the product

This analysis provides a comprehensive breakdown of Ayr's marketing strategies, examining its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for focused decision-making.

Place

AYR Wellness is strategically divesting its retail dispensary network across multiple states, including Florida, Ohio, Nevada, New Jersey, Pennsylvania, and Virginia. This move is a key component of its restructuring efforts, primarily to address obligations with senior noteholders.

The company has already begun listing some Illinois dispensaries for sale, signaling a significant contraction of its retail footprint. This divestiture process is expected to streamline operations and improve financial flexibility as of early 2024.

AYR Wellness is strategically closing cultivation facilities as part of a broader wind-down, notably impacting operations in Massachusetts and Nevada. This move includes significant workforce reductions, underscoring the company's effort to cut operational expenses and optimize its asset portfolio for divestiture.

The closures are a direct consequence of Ayr's decision to dismantle its vertically integrated 'seed to sale' model. This means the entire cannabis supply chain, from cultivation to retail, is being broken down and sold off in parts. For instance, the Massachusetts cultivation facility closure represents a significant reduction in the company's growing capacity in a key market.

Ayr Wellness is strategically exiting certain markets to streamline operations and bolster its financial position. This includes divesting assets in Illinois and closing dispensaries, such as the one in Key West, Florida. The company is prioritizing markets where it can achieve the highest returns on its assets, a move designed to address outstanding debt and enhance its core business.

Reduced Operational Footprint

Ayr Wellness's 'place' strategy in 2024 and early 2025 reflects a significant contraction, shifting from a multi-state operator with a substantial retail footprint. The company has been actively liquidating its holdings, a move that has reduced its physical presence considerably.

This strategic contraction means the focus is on efficiently completing asset transactions rather than expanding its operational footprint. Ayr's approach to 'place' is centered on divestment and streamlining its market presence.

As of late 2024, Ayr Wellness has been working through the sale of various assets, reducing its number of retail locations. For instance, the company has been divesting operations in states like Pennsylvania and Ohio, aiming to exit markets where it doesn't see a clear path to profitability or strategic advantage. This pivot means remaining dispensaries and facilities are primarily managed with the intent of preparing them for transfer or sale, rather than for ongoing operational growth.

- Asset Divestment: Ayr has been actively selling off assets, a key component of its reduced operational footprint strategy.

- Market Contraction: The company's 'place' strategy is characterized by a move away from multi-state expansion towards consolidation and liquidation.

- Focus on Efficiency: The primary objective for remaining locations is efficient preparation for sale or transfer, not expansion.

Transition of Distribution Channels

Ayr Wellness is actively transitioning its distribution channels, encompassing both retail stores and wholesale operations, to new ownership as part of its strategic asset sales. This move aims to facilitate a smooth handover of existing inventory and maintain crucial customer relationships. The company's capacity to continue distributing its proprietary house brands, such as Kynd, Haze, and Later Days, hinges directly on the specific terms negotiated during these asset sales and the distribution capabilities of the entities acquiring these assets.

The implications for brand distribution are significant. For instance, if a buyer of Ayr's retail footprint lacks robust wholesale capabilities, the reach of Kynd or Haze into new markets could be curtailed. Conversely, a buyer with strong wholesale networks might expand the presence of these house brands. Ayr's 2024 financial reports indicate a strategic shift towards optimizing its operational footprint, with asset sales expected to streamline operations and potentially improve cash flow, directly impacting how its brands reach consumers in 2025.

Key considerations for the transition include:

- Inventory Management: Ensuring that remaining inventory is efficiently transferred to new owners to minimize write-offs and maximize recovery value.

- Customer Continuity: Maintaining a positive customer experience during the ownership change, especially for loyalty program members and wholesale clients.

- Brand Visibility: Securing agreements that allow for continued or expanded visibility of Ayr's house brands through the new distribution networks.

- Regulatory Approvals: Navigating the necessary state-level regulatory approvals for the transfer of licenses and operational control within the cannabis sector.

AYR Wellness's 'place' strategy in 2024 and early 2025 signifies a substantial reduction in its physical footprint, moving away from a broad multi-state operator model. The company has been actively divesting retail dispensaries and closing cultivation facilities across states like Florida, Ohio, Nevada, New Jersey, Pennsylvania, and Virginia. This strategic contraction is primarily aimed at streamlining operations and addressing financial obligations, with a focus on efficiently completing asset transactions rather than expanding its market presence.

| State | Action | Impact on Footprint |

|---|---|---|

| Florida | Dispensary divestment (e.g., Key West) | Reduced retail locations |

| Ohio | Asset sales | Decreased operational presence |

| Nevada | Cultivation facility closure | Lowered growing capacity |

| Pennsylvania | Divesting operations | Exit from market segment |

| Massachusetts | Cultivation facility closure | Reduced cultivation capacity |

What You Preview Is What You Download

Ayr 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Ayr 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version you'll download, ensuring you get precisely what you need to strategize.

Promotion

With Ayr's asset sale promotion, marketing activities are significantly scaled back. Remaining efforts are directed towards investor relations, specifically addressing the restructuring and the systematic liquidation of company assets. This shift means traditional marketing, designed to boost consumer interest in products, is no longer the priority.

Communication now primarily focuses on Ayr's financial standing and the ongoing process of selling off its assets. For instance, during the second quarter of 2024, as Ayr navigated its financial restructuring, marketing expenditures were minimized to conserve capital. The company's investor relations team was central to disseminating updates on asset sales, aiming to provide transparency to stakeholders.

Ayr Wellness's brand equity, exemplified by its Kynd and Haze product lines, acts as a significant promotional leverage during divestment. This established brand recognition directly enhances the perceived value of the licenses and operational assets being sold, making them more appealing to prospective acquirers.

The company's prior investments in brand building translate into tangible market presence and a loyal customer base, crucial factors that attract buyers seeking established operations. Showcasing this existing market traction is key to a successful liquidation of these assets.

Ayr's promotional focus for investors and creditors centers on transparent updates regarding its restructuring support agreement and ongoing debt negotiations. For instance, in early 2024, the company provided detailed financial filings outlining progress on its debt reduction strategy, aiming to reassure stakeholders about its path forward.

Key communication channels include press releases and dedicated investor calls, ensuring timely dissemination of information about the projected timeline for asset sales and liquidation processes. This proactive approach is crucial for managing expectations and maintaining confidence amidst significant financial restructuring efforts.

Operational Continuity Messaging

For Ayr's remaining operational dispensaries, promotional messaging will focus on ensuring customers are aware of continued service and product availability. This is vital for maintaining customer traffic, especially as some locations might be transitioning to new ownership. The goal is to communicate any changes clearly and minimize disruption for existing clientele.

Messaging will highlight what remains stable for customers. For instance, if a dispensary is under new ownership, communications will inform customers about the transition and any potential benefits or changes to their experience. This transparency is key to retaining customer loyalty during periods of change.

- Continued Service Assurance: Messaging confirms ongoing operations, reassuring customers that their usual purchasing channels remain open.

- Product Availability Updates: Information on stocked items and any new product lines will be shared to drive traffic.

- Ownership Transition Clarity: For dispensaries changing hands, clear communication about the new ownership and any associated changes is paramount.

- Minimizing Customer Disruption: The overall aim is to ensure a smooth experience for patrons, maintaining the perceived value of the assets.

Public Relations Management

Public relations in this context are crucial for managing the narrative around Ayr Wellness's financial challenges and liquidation. The focus is on projecting corporate responsibility and transparency during this difficult phase.

Key PR efforts include addressing news of facility closures and layoffs. For instance, Ayr Wellness announced the closure of its Massachusetts cultivation facility in early 2024, impacting approximately 50 employees, a situation requiring careful communication.

The strategy involves clearly communicating the strategic reasoning behind the restructuring. This aims to mitigate negative public perception and maintain stakeholder confidence, even as the company navigates liquidation proceedings.

- Narrative Management: Controlling the story around financial distress and liquidation.

- Transparency: Openly addressing news of facility closures and layoffs.

- Strategic Rationale: Explaining the reasons behind restructuring decisions.

- Perception Mitigation: Reducing negative public sentiment during a challenging period.

Ayr's promotional strategy has pivoted dramatically from consumer-focused marketing to investor and creditor relations, emphasizing asset sales and financial restructuring. This shift means traditional advertising is sidelined, with communication channels like press releases and investor calls now prioritizing updates on debt negotiations and liquidation timelines.

The company's brand equity, particularly its Kynd and Haze lines, is leveraged to enhance the value of divested assets, attracting buyers by showcasing established market presence. For remaining dispensaries, promotions focus on reassuring customers about continued service and product availability during ownership transitions, aiming to retain loyalty.

Public relations efforts are concentrated on managing the narrative surrounding financial challenges, with transparency regarding facility closures and layoffs being key. For example, Ayr Wellness closed its Massachusetts cultivation facility in early 2024, impacting around 50 employees, a situation requiring careful public communication to mitigate negative perception.

| Marketing Focus Shift | Key Communication Channels | Brand Leverage | PR Objective |

|---|---|---|---|

| From Consumer to Investor/Creditor Relations | Press Releases, Investor Calls | Kynd & Haze Lines | Narrative Management, Transparency |

| Asset Sale & Restructuring Emphasis | Financial Filings, Debt Negotiation Updates | Enhancing Asset Value | Mitigating Negative Perception |

| Minimizing Traditional Advertising | Liquidation Timeline Dissemination | Showcasing Market Traction | Maintaining Stakeholder Confidence |

Price

AYR Wellness's pricing strategy has shifted to asset valuation for liquidation, prioritizing creditor recovery. This means assessing the market worth of their dispensaries, cultivation sites, and existing product lines to manage a structured sale.

The objective is to secure fair market value for each asset as they are transferred to new ownership. For instance, in late 2024, the cannabis industry saw fluctuating asset values, with cultivation facilities in mature markets potentially fetching lower multiples compared to prime retail dispensaries in high-traffic areas.

This approach aims to ensure that all assets are sold at a price that reflects their current market conditions, ultimately maximizing the return for stakeholders involved in the liquidation process.

Ayr Wellness's substantial debt load and its recent restructuring support agreement are key drivers behind its pricing strategies. The company's need to generate proceeds to satisfy lenders, particularly with a $50 million bridge loan and the conversion of senior notes into equity, directly impacts how it prices its products. This financial imperative often translates into pricing that prioritizes immediate cash flow and debt reduction.

Even with Ayr Wellness's liquidation process underway, the broader cannabis market is still seeing significant price drops. This means the actual worth of Ayr's assets and current stock is lower than it might have been. For instance, in early 2024, average cannabis flower prices in key markets like Massachusetts and Michigan saw declines of 15-20% year-over-year, a trend that directly impacts how much Ayr can realistically get for its remaining products and real estate.

This persistent price compression forces Ayr to adopt very practical pricing for everything it needs to sell, whether it's inventory or physical locations. The company understands that this industry-wide pressure is a reality that inevitably influences its financial outcomes, making it crucial to price competitively to move assets efficiently during this transition.

No Long-Term Pricing Strategy

AYR Wellness has shifted away from long-term pricing strategies, focusing instead on tactical approaches to manage its remaining assets. This change reflects the company's current objective of asset divestment and winding down operations.

Any pricing decisions for existing products are now primarily aimed at clearing inventory or sustaining sales during this transition phase. For instance, in the first quarter of 2024, AYR Wellness reported a net loss, underscoring the need for efficient inventory management.

Discounts or special promotions are implemented to accelerate sales rather than to build or maintain market share. This strategy prioritizes liquidity and the orderly disposition of assets over long-term market positioning.

- Asset Divestment Focus: AYR Wellness is no longer pursuing long-term pricing for market growth, prioritizing asset sales.

- Tactical Pricing: Current pricing is designed to clear inventory and maintain sales during the winding-down process.

- Inventory Clearance: Discounts are strategic tools to accelerate sales and manage remaining stock efficiently.

Focus on Cash Flow and Creditor Returns

The core pricing strategy for Ayr Wellness (AYRWF) in its current phase centers on generating robust cash flow from asset sales to satisfy significant liabilities, particularly for senior noteholders. This objective dictates how remaining inventory is priced and how properties are valued as part of the restructuring process.

For instance, Ayr's recent financial reports highlight the critical need to liquidate assets efficiently. As of the first quarter of 2024, the company reported total debt of approximately $550 million, underscoring the urgency of its cash flow generation strategy. The success of these sales directly impacts the financial viability of the new entity, 'NewCo,' that will emerge from any restructuring.

- Asset Sale Focus: Pricing decisions are driven by the need to maximize cash from selling off assets to cover debt.

- Creditor Returns: The primary goal is to ensure senior noteholders receive the best possible return given the circumstances.

- Inventory Valuation: Even remaining inventory is priced with the overarching goal of cash generation for debt repayment.

- Property Valuations: Real estate assets are being valued and priced to contribute significantly to liability reduction.

AYR Wellness's pricing strategy has fundamentally shifted to asset valuation for liquidation, prioritizing creditor recovery over market share. This means assessing the market worth of their dispensaries, cultivation sites, and existing product lines to manage a structured sale, aiming to secure fair market value for each asset as they are transferred to new ownership.

This approach is heavily influenced by Ayr's substantial debt load and its recent restructuring support agreement. The company's need to generate proceeds to satisfy lenders, particularly with a $50 million bridge loan and the conversion of senior notes into equity, directly impacts how it prices its remaining assets. For instance, in early 2024, average cannabis flower prices in key markets like Massachusetts and Michigan saw declines of 15-20% year-over-year, a trend that directly impacts how much Ayr can realistically get for its remaining products and real estate.

The core pricing strategy for Ayr Wellness in its current phase centers on generating robust cash flow from asset sales to satisfy significant liabilities, particularly for senior noteholders. As of the first quarter of 2024, the company reported total debt of approximately $550 million, underscoring the urgency of its cash flow generation strategy.

| Asset Type | Valuation Driver | Pricing Objective | Market Context (Early 2024) | Impact on AYR |

|---|---|---|---|---|

| Dispensaries | Location, Foot Traffic, Licensing | Maximize Sale Proceeds | High-traffic retail locations retain value. | Key revenue source for debt reduction. |

| Cultivation Facilities | Capacity, Technology, Location | Liquidation Value | Mature markets may see lower multiples. | Pricing reflects industry-wide price compression. |

| Existing Inventory | Product Type, Shelf Life, Demand | Accelerate Sales, Generate Cash | Average flower prices down 15-20% YoY in some markets. | Discounts used to clear stock efficiently. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.