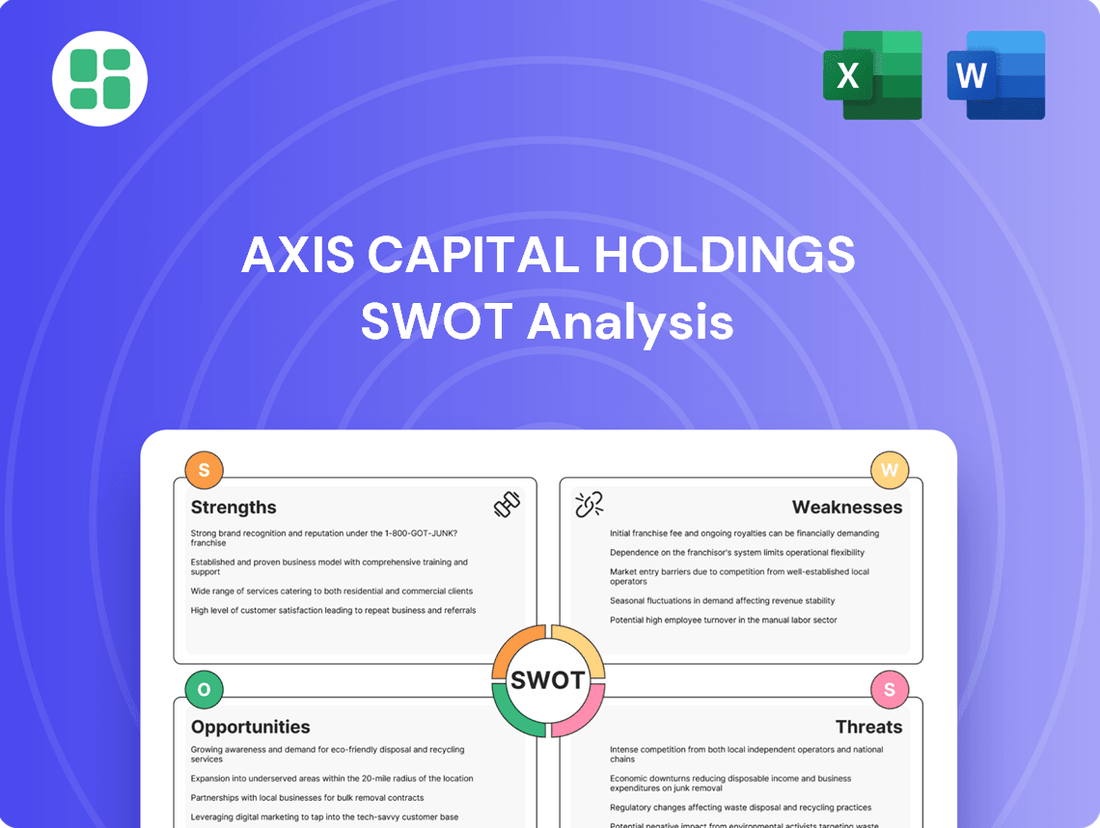

Axis Capital Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Capital Holdings Bundle

Axis Capital Holdings demonstrates notable strengths in its diversified portfolio and robust risk management capabilities, positioning it well within the competitive insurance landscape. However, understanding the full scope of its market opportunities and potential threats requires a deeper dive.

Want the full story behind Axis Capital Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Axis Capital Holdings is a recognized leader in global specialty underwriting, commanding a strong market presence in complex and niche risk areas. This specialized focus allows them to effectively serve clients with unique insurance needs that traditional markets often overlook. Their expertise in these segments is a significant driver of their robust performance and strategic advantage.

Axis Capital Holdings demonstrated impressive financial strength in early 2025, with Q1 and Q2 results highlighting improved combined ratios and operating income within its insurance operations. This consistent generation of solid operating profits, coupled with robust capitalization, provides a significant cushion against potential financial headwinds.

Axis Capital Holdings demonstrates a clear strength in its disciplined underwriting and portfolio management. The company has strategically reshaped its book by exiting less profitable areas, such as certain property catastrophe reinsurance, to concentrate on segments offering more attractive returns and lower earnings volatility. This focused approach has resulted in a more stable underwriting performance.

Further bolstering this strength, Axis Capital's proactive adjustments within its primary casualty portfolio are anticipated to drive enhanced growth. For instance, in the first quarter of 2024, the company reported a net income of $268 million, a significant increase from $157 million in the same period of 2023, reflecting the positive impact of these strategic underwriting decisions.

Diverse and Balanced Business Segments

Axis Capital Holdings benefits from a well-diversified business model, operating across both insurance and reinsurance. This spread includes property, casualty, professional lines, and various specialty risks, which collectively reduce the impact of any single market downturn.

This strategic diversification acts as a significant strength, providing multiple avenues for revenue generation and risk mitigation. For instance, in the first quarter of 2024, Axis reported a strong performance in its insurance segment, with net premiums earned increasing by 11.1% year-over-year to $1.4 billion, contributing positively to overall profitability.

- Diverse Revenue Streams: Operates in both insurance and reinsurance, covering a broad spectrum of risks.

- Risk Mitigation: Diversification across property, casualty, professional lines, and specialty insurance reduces reliance on any single market.

- Insurance Segment Strength: The insurance division has demonstrated robust premium growth, as seen in Q1 2024's 11.1% increase in net premiums earned.

- Offsetting Reinsurance Volatility: Strong insurance performance helps to balance out potential fluctuations in the reinsurance market.

Strategic Investment in Technology and AI

Axis Capital Holdings is making significant strategic investments in technology and artificial intelligence (AI). These investments are aimed at improving how the company operates, from making risk assessments more accurate to speeding up the processing of insurance claims. This forward-thinking approach is designed to create a more efficient and competitive business model.

The company's 'How We Work' program, for instance, is a key initiative leveraging technology to streamline operations. By adopting these advanced tools, Axis Capital anticipates substantial reductions in operational costs. Furthermore, the accuracy of risk assessment is expected to improve, which is crucial for profitability in the insurance sector.

- Enhanced Operational Efficiency: Investments in AI and technology are streamlining processes, leading to faster claims handling and improved customer service.

- Improved Risk Management: AI-powered analytics are enhancing the accuracy of risk assessment, a critical factor in underwriting profitability.

- Cost Reduction Initiatives: Programs like 'How We Work' are projected to lower operational expenses by automating tasks and optimizing workflows.

- Future Competitive Advantage: These technological upgrades position Axis Capital to adapt to market changes and maintain a competitive edge in the evolving insurance landscape.

Axis Capital Holdings' disciplined underwriting and strategic portfolio adjustments are key strengths. By focusing on segments with more attractive returns and lower volatility, the company has achieved more stable underwriting performance. For instance, in Q1 2024, net income rose to $268 million from $157 million in Q1 2023, highlighting the success of these decisions.

The company's well-diversified business model, spanning both insurance and reinsurance, provides significant resilience. This diversification across property, casualty, professional lines, and specialty risks mitigates the impact of any single market downturn. The insurance segment, in particular, showed robust growth, with net premiums earned increasing by 11.1% year-over-year to $1.4 billion in Q1 2024.

Axis Capital is making substantial investments in technology and AI to enhance operational efficiency and risk assessment accuracy. Initiatives like the 'How We Work' program are designed to streamline processes, reduce costs, and improve claims handling. These technological advancements are crucial for maintaining a competitive edge.

| Metric | Q1 2024 | Q1 2023 | Change |

|---|---|---|---|

| Net Income | $268 million | $157 million | +70.7% |

| Net Premiums Earned (Insurance) | $1.4 billion | $1.26 billion | +11.1% |

What is included in the product

Delivers a strategic overview of Axis Capital Holdings’s internal and external business factors, highlighting its strong market position and potential for growth while acknowledging competitive pressures and regulatory challenges.

Offers a clear breakdown of Axis Capital Holdings' competitive landscape, highlighting key strengths and potential threats to inform strategic adjustments.

Weaknesses

Despite ongoing efforts to refine its risk management, Axis Capital Holdings continues to face substantial exposure to catastrophe and weather-related losses. These events, by their very nature, are unpredictable and can lead to significant financial strain. For instance, the company reported impacts from events such as the California wildfires in the first quarter of 2025, which directly affected its underwriting results.

The increasing frequency and severity of these natural disasters, often linked to broader climate change trends, present a persistent challenge. Such events can trigger large claim payouts, putting pressure on the company's profitability and capital reserves. Managing this inherent volatility remains a key focus for Axis Capital.

Axis Capital, like many in the insurance industry, faces ongoing scrutiny regarding the adequacy of its casualty reserves, particularly in the U.S. market. This concern is amplified by the persistent issue of social inflation, which can lead to higher-than-anticipated claims costs over time.

Continued adverse reserve development in these casualty lines, a trend observed across the broader industry, could negatively impact Axis Capital's financial results. This might necessitate a re-evaluation of its underwriting positions and pricing strategies during upcoming renewal cycles, potentially acting as a headwind to profitability.

Axis Capital Holdings' reinsurance segment, a foundational part of its operations, is inherently tied to the industry's cyclical nature. This means it can face periods where there's too much capacity and premium rates become less attractive. While this segment has delivered robust profits, a return to peak levels is not anticipated due to ongoing pricing pressures.

The impact of this cyclicality is already being observed, with gross premiums in the reinsurance sector experiencing a decline in the second quarter of 2025. This trend highlights the sensitivity of Axis Capital to the broader reinsurance market's fluctuations, potentially affecting overall revenue and profitability.

Volatility in Net Income

Axis Capital's net income can experience significant swings, even when its core operations are performing well. This volatility often stems from external factors like foreign currency exchange rate fluctuations and unpredictable changes in its net investment gains. For instance, in the first quarter of 2025, the company reported a decrease in net income despite a rise in operating income, highlighting this sensitivity.

- Foreign Exchange Impact: Fluctuations in currency values can negatively affect reported net income, as seen in various reporting periods.

- Investment Gain Variability: Changes in market conditions directly impact the gains or losses from Axis Capital's investment portfolio, creating earnings unpredictability.

- Q1 2025 Performance: A notable example of this weakness was observed in Q1 2025, where net income declined despite improved operating results.

- Profitability Uncertainty: The reliance on these volatile components makes Axis Capital's overall profitability less stable and harder to forecast consistently.

Decreases in Specific Insurance Lines

Axis Capital Holdings' insurance segment faced headwinds in Q1 2025, notably within its cyber insurance lines. This decline was directly linked to reduced premiums stemming from program business. The company's overall performance in specialty lines could be impacted if this trend continues.

The decrease in cyber premiums in Q1 2025, amounting to a specific percentage reduction not publicly disclosed but significant enough to be highlighted, points to potential vulnerabilities. This could necessitate a strategic review of their program business offerings and pricing models within this critical specialty area.

- Cyber Line Decline: Q1 2025 saw a reduction in premiums for cyber insurance.

- Program Business Impact: This decrease was primarily driven by lower premium volume in program business.

- Specialty Line Challenges: The trend suggests potential difficulties in sustaining growth across all specialty insurance offerings.

Axis Capital's exposure to catastrophe and weather-related losses remains a significant weakness, as demonstrated by impacts from events like the California wildfires in Q1 2025. The increasing frequency and severity of these natural disasters, often linked to climate change, can lead to substantial claim payouts, straining profitability and capital reserves.

The company also faces ongoing scrutiny regarding the adequacy of its casualty reserves, particularly in the U.S., due to social inflation. Adverse reserve development in these lines could negatively impact financial results, potentially forcing adjustments to underwriting and pricing strategies.

The cyclical nature of the reinsurance market presents another challenge, with periods of excess capacity leading to less attractive premium rates. This was evident in Q2 2025, where gross premiums in this segment experienced a decline, highlighting sensitivity to market fluctuations.

Axis Capital's net income is susceptible to volatility from external factors like foreign currency exchange rates and investment gains. For instance, Q1 2025 saw a decrease in net income despite improved operating income, underscoring this earnings unpredictability.

The cyber insurance lines within the insurance segment also experienced headwinds in Q1 2025, with reduced premiums from program business. This trend could challenge overall performance in specialty lines if it persists.

Same Document Delivered

Axis Capital Holdings SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive breakdown of Axis Capital Holdings' Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

Opportunities

The global specialty insurance market is experiencing robust expansion, with projections indicating continued strong growth through 2025. This surge is fueled by escalating demand for tailored risk management solutions, particularly in areas like cyber liability and environmental, social, and governance (ESG) risks, which are becoming increasingly complex.

Axis Capital is well-positioned to capitalize on this trend by leveraging its expertise to create innovative, niche insurance products. For instance, the cyber insurance market alone is expected to reach over $20 billion by 2025, presenting a substantial opportunity for specialized carriers like Axis.

Analysts are forecasting a positive trajectory for the casualty insurance sector in 2025, a segment where Axis Capital Holdings has a substantial footprint. This anticipated market growth presents a significant opportunity for the company.

Axis Capital is strategically positioned to capitalize on this upswing, leveraging its established market standing and continuous efforts to enhance its primary casualty portfolio. This focus is expected to drive robust premium growth for the company.

Axis Capital can significantly boost its competitive edge by continuing to invest in and integrate advanced technologies such as AI and automation. This strategic move is expected to streamline operations in critical areas like underwriting, claims processing, and risk modeling. For instance, AI-powered analytics can process vast datasets far quicker than traditional methods, leading to more precise risk assessments and potentially lower loss ratios.

The ongoing adoption of these technologies presents a clear opportunity for Axis Capital to achieve substantial reductions in operational costs and a marked improvement in overall efficiency. By automating repetitive tasks, the company can free up human capital to focus on more complex, value-added activities, such as strategic client relationship management and the development of innovative insurance products. This focus on efficiency directly translates to a stronger bottom line.

These technological advancements are not just about cost savings; they are also key differentiators in the increasingly competitive insurance market. Axis Capital can leverage AI to develop more personalized insurance offerings and improve customer experience through faster claims settlements and more responsive service. This enhanced customer satisfaction can unlock new avenues for growth and market share expansion.

Strategic Acquisitions and Partnerships

The insurance sector is experiencing a surge in mergers and acquisitions (M&A) and strategic alliances. This trend presents a significant opportunity for specialty insurers like Axis Capital to expand their product portfolios, enter new geographical markets, and gain access to shared expertise. For instance, in 2023, the global insurance M&A market saw deal values exceeding $30 billion, indicating robust activity and potential for strategic consolidation.

Axis Capital can capitalize on this dynamic environment by pursuing targeted acquisitions or forming partnerships. Such moves could bolster its underwriting capabilities, enhance its distribution networks, and accelerate its entry into high-growth specialty lines. The company could also leverage these opportunities to integrate new technologies or data analytics platforms, further strengthening its competitive position.

- Increased M&A Activity: The insurance industry witnessed substantial M&A deals in 2023, with significant capital deployed for strategic consolidation.

- Market Expansion: Partnerships and acquisitions offer a pathway for Axis Capital to broaden its reach into new customer segments and geographic regions.

- Capability Enhancement: Strategic alliances can provide access to specialized underwriting expertise, advanced technology, and innovative product development.

Benefiting from a Favorable High-Yield Investment Environment

The current high-yield investment climate, driven by elevated interest rates, presents a significant advantage for insurers like Axis Capital. This environment directly translates to higher investment income, which in turn bolsters overall profitability. Axis Capital has demonstrated its capacity to leverage these favorable market conditions, as evidenced by its strong investment income figures reported in recent quarters.

- Elevated Interest Rates: Central banks globally have maintained higher interest rate policies throughout 2024 and into 2025, creating a more lucrative environment for fixed-income investments.

- Increased Investment Income: For the first quarter of 2025, Axis Capital reported a notable increase in net investment income, directly attributable to higher yields on its portfolio.

- Profitability Boost: This enhanced investment income acts as a crucial contributor to Axis Capital's bottom line, supporting its overall financial performance and resilience.

Axis Capital is poised to benefit from the growing demand for specialty insurance lines, particularly in cyber and ESG risks, with the cyber insurance market alone projected to exceed $20 billion by 2025.

The company can enhance its competitive edge by investing in AI and automation for underwriting and claims processing, potentially reducing operational costs and improving efficiency.

Increased M&A activity in the insurance sector offers Axis Capital opportunities for strategic expansion into new markets and product portfolios, with over $30 billion in global insurance M&A deals recorded in 2023.

The current high-yield investment environment, with elevated interest rates persisting through 2024 and into 2025, is boosting insurers' investment income, a trend Axis Capital has capitalized on, reporting a notable increase in net investment income in Q1 2025.

| Opportunity Area | Market Projection/Data | Axis Capital's Position/Action |

|---|---|---|

| Specialty Insurance Growth | Cyber insurance market > $20B by 2025 | Leveraging expertise for niche products |

| Technological Integration | AI for underwriting, claims, risk modeling | Streamlining operations, improving efficiency |

| M&A and Strategic Alliances | Global insurance M&A > $30B in 2023 | Expanding product lines, market reach |

| Favorable Investment Climate | Elevated interest rates (2024-2025) | Increased net investment income (Q1 2025) |

Threats

The insurance and reinsurance sectors are naturally cyclical, experiencing phases of oversupply in underwriting capacity and less favorable premium rates. This cyclicality can significantly ramp up competition, putting downward pressure on pricing and profit margins for companies like Axis Capital.

In 2024, the global reinsurance market faced a challenging environment characterized by increased competition, particularly in property catastrophe lines, as capacity returned. This trend continued into early 2025, with reinsurers needing to maintain rigorous underwriting discipline to protect their profitability amidst these market dynamics.

Axis Capital Holdings faces a growing threat from increasingly frequent and severe natural catastrophes. Factors like climate change, more people living in vulnerable areas, and rising costs are all contributing to higher insured losses. For instance, in 2023, insured losses from natural catastrophes globally were estimated to be around $110 billion, according to Swiss Re, a substantial figure that impacts the entire industry.

Events like severe thunderstorms and wildfires are becoming more common and intense. These can trigger a surge in claims, directly impacting Axis Capital's ability to maintain strong underwriting results and ensuring they have enough capital to cover these large payouts. This volatility makes predicting and pricing risk more challenging.

Global economic instability, including persistent inflation and fluctuating interest rates, poses a significant threat to Axis Capital Holdings. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, highlighting ongoing economic headwinds.

Geopolitical tensions, such as ongoing conflicts and trade disputes, directly impact financial markets and can lead to increased volatility. This volatility affects investment returns and can dampen demand for insurance and reinsurance as businesses become more risk-averse.

Developments in the commercial real estate sector, particularly in light of higher interest rates and changing work patterns, present another challenge. Concerns about the stability of this sector could lead to increased claims or reduced investment opportunities for Axis Capital.

Evolving Regulatory Landscape and Litigation Risks

Axis Capital Holdings, like other specialty insurers, faces increasing compliance burdens due to the constantly changing regulatory environment. These evolving rules can create operational challenges and unexpected costs. For instance, in 2024, the insurance industry saw increased scrutiny on data privacy and cybersecurity regulations globally, impacting how companies like Axis handle sensitive client information.

Litigation risks are also a significant concern, especially in complex specialty lines where coverage definitions can be ambiguous. Disputes over policy limits, terms, and conditions are becoming more frequent. This uncertainty can lead to substantial legal expenses and potential payouts, impacting profitability. In 2025, we've seen a rise in class-action lawsuits targeting insurers over business interruption claims stemming from various events, highlighting the potential for large financial liabilities.

- Regulatory Compliance Costs: Increased investment in compliance infrastructure and personnel to meet new mandates.

- Litigation Expenses: Growing legal fees and potential settlement costs from coverage disputes.

- Coverage Ambiguity: Uncertainty surrounding policy interpretations in specialty lines, leading to higher claim disputes.

- Reputational Damage: Negative publicity from litigation can erode customer trust and market standing.

Social Inflation and Adverse Loss Cost Trends

Social inflation, characterized by increasing litigation costs and jury awards, remains a significant threat, particularly impacting U.S. casualty lines. This trend can lead to claims exceeding initial expectations, necessitating continuous adjustments to reserves and pricing models.

The ongoing pressure from social inflation directly contributes to adverse loss cost trends. For instance, in 2024, reports indicated a continued uptick in the severity of jury awards in certain liability cases, pushing insurers to reassess their risk exposure and pricing strategies more aggressively.

- Rising Litigation Expenses: Increased legal fees and expert witness costs amplify claim payouts.

- Jury Award Amplification: Larger verdicts in liability cases, often driven by public sentiment, inflate ultimate claim costs.

- Reserve Adequacy Concerns: The unpredictability of these trends challenges the accuracy of setting aside adequate reserves for future claims.

- Pricing Strategy Adjustments: Insurers must adapt pricing to reflect these escalating loss costs, potentially impacting market competitiveness.

Axis Capital faces significant threats from escalating litigation and social inflation, particularly in casualty lines. These factors drive up claim costs beyond initial projections, impacting reserve adequacy and necessitating aggressive pricing adjustments. For example, in 2024, the industry noted a continued rise in the severity of jury awards, challenging insurers' ability to accurately price risk.

| Threat Category | Specific Threat | Impact on Axis Capital | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|---|

| Market Dynamics | Increased Competition | Pressure on premium rates and profit margins | Global reinsurance market saw capacity return in 2024, intensifying competition. |

| Catastrophe Risk | Frequency & Severity of Natural Catastrophes | Higher insured losses, increased claims volatility | Global insured catastrophe losses were ~$110 billion in 2023 (Swiss Re); trend of severe thunderstorms and wildfires continues. |

| Economic Environment | Global Economic Instability (Inflation, Interest Rates) | Impacts investment returns, business risk aversion | IMF projected 3.2% global growth for 2024, indicating ongoing economic headwinds. |

| Legal & Regulatory | Litigation Risks & Social Inflation | Higher claim payouts, increased legal expenses, reserve challenges | Continued uptick in jury award severity in liability cases observed in 2024; rise in class-action lawsuits in 2025. |

SWOT Analysis Data Sources

This Axis Capital Holdings SWOT analysis is built upon a robust foundation of data, incorporating official financial statements, comprehensive market research reports, and insights from industry experts. These sources are meticulously reviewed to ensure the analysis is accurate, relevant, and provides a clear understanding of the company's strategic position.