Axis Capital Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Capital Holdings Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Axis Capital Holdings's trajectory. Our PESTLE analysis provides a comprehensive overview, equipping you with the foresight needed to navigate market complexities and identify emerging opportunities. Empower your strategic decisions by downloading the full, actionable report today.

Political factors

Governments globally are consistently evaluating and modifying insurance and reinsurance laws. Axis Capital Holdings must stay vigilant, adapting to evolving solvency standards, capital adequacy mandates, and market conduct rules across its various operational regions to maintain compliance and its licenses.

For instance, in 2024, the International Association of Insurance Supervisors (IAIS) continued its work on the Insurance Capital Standard (ICS), aiming for a globally consistent approach to capital requirements, which could impact Axis Capital's capital management strategies.

Changes in data privacy regulations, such as updates to GDPR in Europe or similar legislation in other key markets where Axis operates, also necessitate continuous adaptation in how customer data is handled and protected.

Global political instability, including ongoing conflicts and rising nationalism, presents significant challenges for Axis Capital. For instance, the prolonged conflict in Eastern Europe and its ripple effects on energy markets and supply chains, as observed throughout 2024, directly influence insurance and reinsurance pricing and demand. The potential for new trade disputes or the escalation of existing ones, such as those impacting critical technology sectors, could disrupt international investment flows and affect the company's global asset allocation strategies.

International sanctions, whether imposed due to geopolitical tensions or other reasons, can directly impact Axis Capital's ability to operate in certain regions or invest in specific entities. For example, sanctions related to cybersecurity or financial market access could limit investment opportunities or increase compliance costs. Effectively underwriting risks requires a deep understanding of these evolving political landscapes and the potential for sudden shifts in international relations, which could lead to unexpected claims or market volatility for Axis Capital’s diverse portfolio.

Government policies addressing specialty risks like cyber warfare, terrorism, and climate resilience significantly shape the market for insurers like Axis Capital. For instance, in 2024, governments globally continued to invest in cybersecurity infrastructure, potentially influencing the demand for cyber insurance. Similarly, increased focus on natural disaster mitigation through updated building codes and infrastructure spending in 2025 could alter the risk landscape for property and casualty insurers.

Trade Agreements and Tariffs

Trade agreements and shifts in tariff policies significantly shape the international business landscape, directly impacting the demand for trade credit insurance and political risk coverage. Axis Capital must closely monitor how these evolving trade dynamics affect its clients' global operations and, by extension, their insurance requirements.

For instance, the renegotiation of trade pacts or the imposition of new tariffs can create uncertainty, prompting businesses to seek greater protection against payment defaults or political disruptions. In 2024, ongoing trade tensions between major economies continue to influence supply chains and cross-border transactions, underscoring the relevance of robust insurance solutions.

- Impact on Trade Flows: Changes in trade agreements can alter import/export volumes, affecting the total value of insured trade credit.

- Tariff Volatility: Increased tariffs can raise the cost of goods, potentially straining buyer capacity and increasing credit risk for policyholders.

- Geopolitical Realignment: New trade blocs or the dissolution of existing ones can create new markets and risks, requiring adaptable insurance products.

- Regulatory Compliance: Adherence to varying trade regulations and compliance requirements across different jurisdictions is crucial for clients and impacts their insurance needs.

Taxation Policies

Changes in corporate tax rates, premium taxes, or other fiscal policies in the countries where Axis Capital operates directly influence its profitability and capital allocation strategies. For instance, a significant shift in the corporate tax landscape, such as a reduction in rates, could boost net income, while an increase in premium taxes might necessitate adjustments to pricing or product offerings. Axis Capital must remain agile, closely monitoring tax reforms to maintain an optimized financial structure and ensure compliance across its global operations.

The company's financial performance is sensitive to evolving tax regulations. For example, in 2024, several jurisdictions considered or implemented tax adjustments affecting financial services. Staying informed about these changes is crucial for effective financial planning.

- Corporate Tax Rate Fluctuations: Shifts in corporate tax rates in key operating regions directly impact Axis Capital's bottom line.

- Premium Tax Adjustments: Changes to premium taxes can affect the competitiveness of its insurance products.

- Fiscal Policy Impact: Broader fiscal policies influence investment returns and the overall economic environment in which Axis Capital operates.

- Strategic Financial Planning: Proactive adaptation to tax reforms is essential for optimizing capital allocation and maintaining profitability.

Governments worldwide are continually updating insurance and reinsurance regulations, requiring Axis Capital Holdings to adapt to evolving solvency standards and market conduct rules across its operating regions. For instance, the International Association of Insurance Supervisors continued its work on the Insurance Capital Standard in 2024, aiming for global consistency in capital requirements.

Political instability, including ongoing conflicts and trade disputes observed throughout 2024, directly influences insurance and reinsurance pricing and demand, impacting Axis Capital's global asset allocation strategies. International sanctions can also limit investment opportunities or increase compliance costs, demanding a deep understanding of shifting international relations for effective risk underwriting.

Government policies on specialty risks like cyber warfare and climate resilience shape the market for insurers. In 2024, government investments in cybersecurity infrastructure influenced cyber insurance demand, while 2025's focus on natural disaster mitigation through infrastructure spending could alter property and casualty risk landscapes.

Changes in corporate tax rates and fiscal policies directly influence Axis Capital's profitability and capital allocation. For example, tax adjustments considered or implemented in various jurisdictions during 2024 necessitate agile monitoring of tax reforms for optimized financial structures and compliance.

What is included in the product

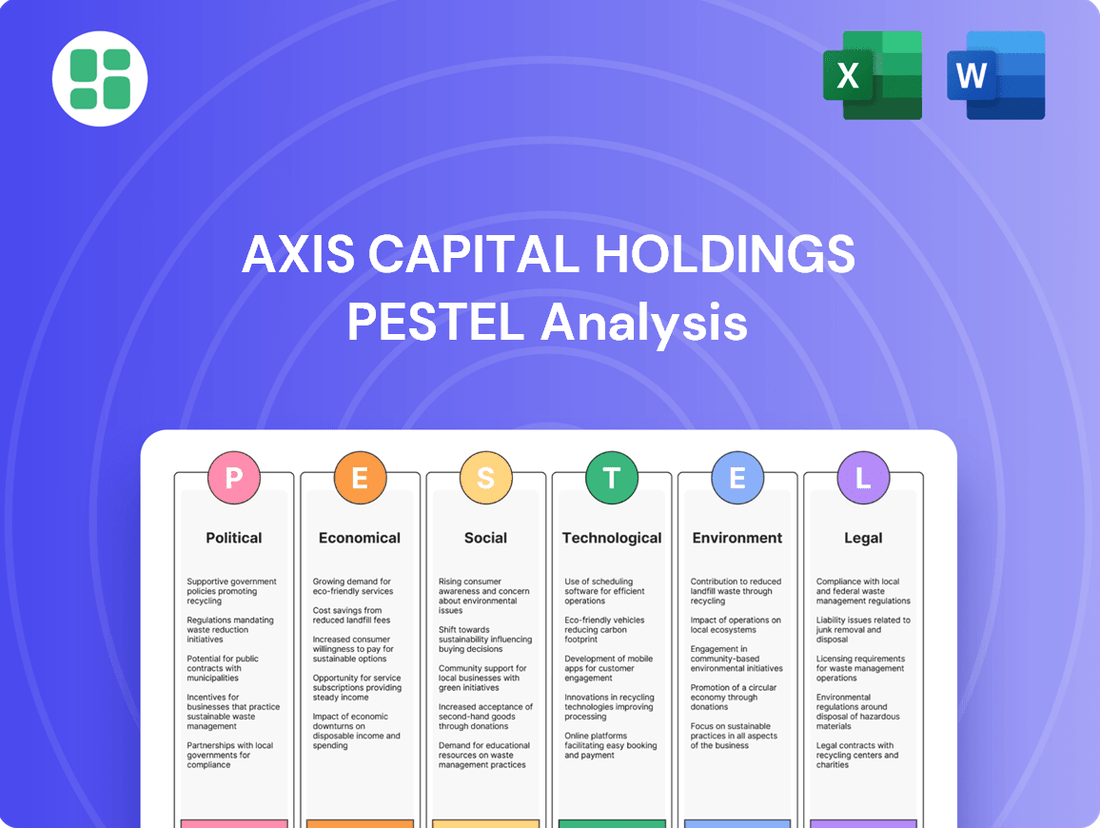

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Axis Capital Holdings, providing a comprehensive overview of the external landscape.

It offers actionable insights into how these macro-environmental forces present both challenges and strategic opportunities for Axis Capital Holdings.

A concise PESTLE analysis for Axis Capital Holdings that clearly outlines external factors impacting the company, serving as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Global economic growth is projected to be moderate in 2024, with the IMF forecasting a 3.2% expansion, a slight slowdown from 2023. This directly impacts Axis Capital by influencing demand for its specialty insurance and reinsurance. Stronger growth typically means more business expansion and thus higher demand for risk management solutions.

However, recession risks remain a concern, particularly in major economies. For instance, while the US economy showed resilience in early 2024, indicators suggest a potential cooling. A downturn would likely reduce insurable exposures and premium volumes for Axis Capital, as businesses cut back on spending and operations.

The interplay between growth and recessionary pressures creates a dynamic environment for Axis Capital. While robust economic activity boosts premium income, a contractionary period could lead to reduced underwriting profitability and increased claims frequency in certain lines of business.

The prevailing interest rate environment is a critical factor for Axis Capital Holdings, directly influencing the income generated from its significant investment portfolio. For instance, as of early 2024, the US Federal Reserve maintained a target range for the federal funds rate between 5.25% and 5.50%, a level that generally supports higher investment yields for companies like Axis.

A sustained period of elevated interest rates, as seen through much of 2023 and into 2024, can translate into increased investment income for Axis Capital. This boost to returns allows for greater profitability and potentially more competitive pricing on its insurance and reinsurance products. Conversely, a projected decline in rates, perhaps anticipated for late 2024 or 2025, would necessitate strategic adjustments to preserve earnings, potentially through shifts in asset allocation or a review of premium structures.

Inflationary pressures present a significant challenge for Axis Capital Holdings. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, impacting the cost of goods and services the company utilizes.

This rise in costs directly affects claims payouts and operational expenses, potentially squeezing underwriting profits if premium adjustments lag behind. Axis Capital needs to meticulously incorporate these inflationary trends into its pricing strategies and reserve calculations to ensure sustained profitability and robust capital adequacy.

Capital Market Volatility

Fluctuations in global capital markets directly influence the valuation of Axis Capital Holdings' investment portfolio and its capacity to secure additional funding. For instance, in early 2024, major indices like the S&P 500 experienced significant swings, with periods of rapid growth followed by sharp corrections, impacting the underlying assets held by insurers.

Periods of heightened market volatility can lead to substantial shifts in asset valuations. This means that the value of Axis Capital's holdings, which include equities and fixed income, can decrease rapidly, potentially resulting in investment losses and necessitating adjustments to their capital reserves to maintain solvency ratios.

The ability to raise capital is also intrinsically linked to market sentiment. During volatile times, investor confidence often wanes, making it more challenging and expensive for companies like Axis Capital to issue new debt or equity. For example, the cost of issuing corporate bonds can surge when markets are uncertain, increasing financing costs.

- Impact on Investment Portfolio: Volatility can cause rapid devaluations in Axis Capital's investment assets, affecting reported earnings and capital adequacy.

- Capital Raising Challenges: Increased market uncertainty can widen credit spreads, making it more costly for Axis Capital to issue new debt or equity.

- Risk Management Costs: Insurers often need to increase hedging activities during volatile periods, leading to higher operational expenses.

- Economic Uncertainty: Broad capital market instability often reflects underlying economic concerns, which can also depress demand for insurance products.

Currency Exchange Rate Fluctuations

Axis Capital Holdings, operating across numerous international markets, faces significant exposure to currency exchange rate fluctuations. As premiums are collected and claims are paid in various currencies, adverse movements can directly affect reported earnings and the valuation of its global assets and liabilities. For instance, a stronger US dollar against the Euro could reduce the reported value of European operations when translated back into dollars.

The volatility of exchange rates presents a material risk. Consider the impact on a company like Axis Capital: if a substantial portion of its business is in the UK and the Pound Sterling weakens significantly against the US Dollar, the sterling-denominated profits and assets will translate into fewer dollars, impacting the company's consolidated financial statements. This dynamic is crucial for investors to monitor.

- Impact on Earnings: A depreciating foreign currency can lower the dollar value of foreign-earned profits.

- Asset Valuation: Fluctuations affect the reported book value of international subsidiaries and investments.

- Hedging Strategies: Companies often employ hedging instruments to mitigate these risks, though these also carry costs and complexities.

- Competitive Landscape: Exchange rates can also influence the pricing competitiveness of Axis Capital's products in different markets.

Global economic growth is projected to be moderate in 2024, with the IMF forecasting a 3.2% expansion, a slight slowdown from 2023. This directly impacts Axis Capital by influencing demand for its specialty insurance and reinsurance. Stronger growth typically means more business expansion and thus higher demand for risk management solutions.

The prevailing interest rate environment is a critical factor for Axis Capital Holdings, directly influencing the income generated from its significant investment portfolio. For instance, as of early 2024, the US Federal Reserve maintained a target range for the federal funds rate between 5.25% and 5.50%, a level that generally supports higher investment yields for companies like Axis.

Inflationary pressures present a significant challenge for Axis Capital Holdings. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, impacting the cost of goods and services the company utilizes.

Fluctuations in global capital markets directly influence the valuation of Axis Capital Holdings' investment portfolio and its capacity to secure additional funding. For instance, in early 2024, major indices like the S&P 500 experienced significant swings, with periods of rapid growth followed by sharp corrections, impacting the underlying assets held by insurers.

Axis Capital Holdings, operating across numerous international markets, faces significant exposure to currency exchange rate fluctuations. As premiums are collected and claims are paid in various currencies, adverse movements can directly affect reported earnings and the valuation of its global assets and liabilities. For instance, a stronger US dollar against the Euro could reduce the reported value of European operations when translated back into dollars.

Preview Before You Purchase

Axis Capital Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Axis Capital Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning. Gain actionable insights into the external landscape shaping Axis Capital Holdings' future.

Sociological factors

Societal awareness of risks like climate change and cyber threats is significantly influencing demand for specialized insurance. For instance, the global cyber insurance market is projected to reach $20.8 billion by 2025, up from $10.1 billion in 2022, highlighting a clear trend.

Axis Capital Holdings needs to continually adapt its product portfolio to meet these evolving client concerns and shifting risk appetites. This means developing innovative solutions that address emerging threats, ensuring the company remains competitive.

Global population is projected to reach 8.5 billion by 2030, a significant increase that directly impacts insurance demand and risk profiles. Axis Capital must consider how this growth, coupled with aging demographics in many developed nations, alters the concentration and types of property, casualty, and health risks it underwrites.

Urbanization, with over half the world's population now living in cities, concentrates populations and assets, amplifying potential losses from events like natural disasters or pandemics. This trend necessitates careful underwriting strategies for Axis Capital, particularly in densely populated urban centers facing heightened exposure to various perils.

Societal views on who should bear responsibility for managing risks are shifting. There's a growing expectation for corporations to proactively address and mitigate potential disruptions, influencing demand for comprehensive insurance and risk management services.

As a result, a heightened focus on organizational resilience and preparedness is driving greater adoption of sophisticated risk solutions. For instance, in 2024, the global cyber insurance market alone was projected to reach over $10 billion, reflecting this trend towards preparedness.

Workforce Dynamics and Talent Acquisition

Axis Capital Holdings' success hinges on access to specialized talent. The insurance sector, particularly for a company like Axis, requires professionals skilled in underwriting, actuarial science, sophisticated data analytics, and cutting-edge technology. The global shortage of actuaries, for instance, continues to be a significant challenge, with demand often outstripping supply.

Societal shifts are reshaping how companies attract and keep employees. The increasing acceptance of remote and hybrid work models, driven by employee demand for flexibility, directly influences Axis Capital's recruitment and retention strategies. In 2024, surveys indicated that over 70% of employees desired some form of remote work option, a trend Axis must navigate to secure top talent.

The evolving expectations of the workforce also play a critical role. Beyond compensation, employees increasingly prioritize company culture, opportunities for professional development, and a commitment to diversity and inclusion. Axis Capital's ability to adapt its employee value proposition to meet these modern expectations will be key to its long-term talent acquisition success.

- Talent Dependency: Axis Capital relies heavily on a specialized workforce in underwriting, actuarial science, data analytics, and technology.

- Remote Work Impact: Societal acceptance of remote and hybrid work models significantly affects Axis's recruitment and retention efforts.

- Evolving Employee Expectations: Modern employees prioritize flexibility, culture, and development, influencing Axis's employer brand.

Public Trust and Reputation

Public trust is paramount in the insurance sector, directly influencing client loyalty and brand perception. Axis Capital's ability to demonstrate its role in societal resilience, particularly through efficient claims processing during challenging times, significantly bolsters its reputation. For instance, in 2024, customer satisfaction surveys for major insurers often highlighted prompt and fair claims settlements as key drivers of trust. Ethical conduct and transparency in all dealings are therefore non-negotiable for maintaining a strong public image.

Axis Capital's proactive engagement in corporate social responsibility (CSR) initiatives is a critical component of building and sustaining client trust. By investing in community programs and demonstrating a commitment to environmental, social, and governance (ESG) principles, the company can enhance its brand reputation. Reports from 2024 indicated that companies with strong ESG scores often experienced higher customer retention rates and a more positive public image compared to their peers.

- Public perception of insurance companies impacts client trust and brand loyalty.

- Axis Capital's commitment to ethical practices, including transparent claims handling, is crucial.

- Corporate social responsibility efforts enhance public perception and brand reputation.

- In 2024, prompt and fair claims handling was a significant factor in customer satisfaction surveys within the insurance industry.

Societal awareness of emerging risks, such as climate change and cyber threats, directly fuels demand for specialized insurance products, a trend Axis Capital must address. The global cyber insurance market, for example, was projected to exceed $10 billion in 2024, underscoring this growing concern and the need for tailored coverage. This heightened risk consciousness also influences how individuals and businesses view corporate responsibility, expecting proactive risk mitigation from companies like Axis.

| Societal Factor | Impact on Axis Capital | Relevant Data (2024/2025 Projections) |

|---|---|---|

| Risk Awareness (Climate, Cyber) | Drives demand for specialized insurance products. | Global cyber insurance market projected over $10 billion in 2024. |

| Demographic Shifts | Alters risk profiles and insurance needs. | Global population projected to reach 8.5 billion by 2030. |

| Urbanization | Concentrates risk exposure in densely populated areas. | Over half the world's population lives in cities. |

| Employee Expectations | Influences recruitment, retention, and company culture. | Over 70% of employees desired remote work options in 2024. |

| Public Trust & CSR | Affects brand reputation and client loyalty. | Companies with strong ESG scores often show higher customer retention. |

Technological factors

Axis Capital's embrace of digital platforms for underwriting, claims, and client interactions is a significant technological driver. This digitalization promises to boost efficiency and elevate the customer experience. For instance, in 2024, the insurance industry saw a surge in AI adoption for claims processing, with estimates suggesting it could reduce processing times by up to 30%.

Investing in a strong digital infrastructure is crucial for Axis Capital to streamline its internal workflows and achieve substantial operational cost reductions. By 2025, it's projected that digital transformation initiatives in the financial services sector will drive billions in cost savings globally, primarily through automation and improved data management.

Axis Capital Holdings can leverage advanced data analytics and AI/ML to significantly enhance its operational efficiency and competitive positioning. By harnessing big data, artificial intelligence, and machine learning, the company can refine its risk assessment processes, leading to more accurate pricing for its insurance products. This technological adoption is crucial for staying ahead in a market where understanding and mitigating complex risks are paramount.

The implementation of AI and machine learning directly impacts fraud detection capabilities, reducing potential losses and improving profitability. Furthermore, predictive modeling powered by these technologies allows Axis Capital to anticipate market trends and customer behavior, enabling proactive strategic adjustments. For instance, in 2024, the global insurance sector saw significant investment in AI for claims processing, with some firms reporting up to a 30% reduction in processing times.

Axis Capital, like all financial institutions, operates in an environment where cybersecurity threats are escalating. The increasing reliance on digital platforms makes it a prime target for sophisticated cyberattacks aiming to compromise sensitive client data and disrupt operations. A significant rise in ransomware attacks against financial services globally underscores this vulnerability, with reports indicating a substantial increase in the average cost of a data breach in 2024.

InsurTech Innovation and Partnerships

The insurance industry is witnessing a significant transformation driven by InsurTech innovation. These agile companies are introducing novel business models, direct-to-consumer distribution channels, and cutting-edge solutions that challenge traditional insurance providers. For instance, by mid-2024, InsurTech funding globally reached $15 billion, signaling robust growth and a heightened focus on technological advancement within the sector.

Axis Capital Holdings can strategically navigate this evolving landscape by forging partnerships with established InsurTech firms or by investing in its own technological capabilities. This approach allows Axis Capital to tap into new customer segments and enhance its product offerings. By Q1 2025, it's projected that InsurTech platforms will account for over 25% of new policy sales in certain specialty lines, highlighting their growing market penetration.

- InsurTech funding: Global InsurTech funding surpassed $15 billion by mid-2024.

- Market penetration: InsurTech platforms are expected to capture over 25% of new specialty line policy sales by Q1 2025.

- Partnership benefits: Collaborations can unlock access to new distribution channels and customer bases.

- Competitive advantage: Developing proprietary InsurTech solutions can create a distinct market position.

Automation and Robotics

Automation and robotics are transforming the insurance sector, directly impacting companies like Axis Capital Holdings. By automating repetitive tasks such as data entry, policy administration, and initial claims processing, efficiency gains are substantial, and the risk of human error is minimized. This allows Axis Capital to reallocate its workforce to more complex, value-added activities, enhancing overall service quality and innovation.

The adoption of Robotic Process Automation (RPA) is a key driver. For instance, in 2024, the global RPA market was projected to reach over $13 billion, indicating widespread investment in these technologies. Axis Capital can leverage RPA to streamline back-office operations, leading to faster turnaround times for policy issuance and claims settlement.

- Increased Operational Efficiency: RPA can process tasks at a much faster rate than humans, reducing operational costs.

- Reduced Error Rates: Automation minimizes the potential for manual data entry mistakes, improving data accuracy.

- Enhanced Employee Focus: Freeing up employees from mundane tasks allows them to concentrate on customer service and strategic initiatives.

- Scalability: Automated processes can be easily scaled up or down to meet fluctuating business demands without significant increases in headcount.

Technological advancements are reshaping the insurance landscape, with Axis Capital Holdings needing to adapt to remain competitive. The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) is a prime example, enhancing risk assessment and fraud detection. By mid-2024, global InsurTech funding had already surpassed $15 billion, highlighting the sector's rapid technological evolution and the imperative for established players to integrate these innovations.

Axis Capital's strategic investment in digital infrastructure and automation, particularly through Robotic Process Automation (RPA), is crucial for operational efficiency and cost reduction. The global RPA market's projected growth to over $13 billion in 2024 underscores the widespread adoption of these technologies for streamlining back-office functions and improving turnaround times.

The rise of InsurTech firms presents both challenges and opportunities, with these agile companies expected to capture over 25% of new specialty line policy sales by Q1 2025. Axis Capital can leverage partnerships or develop its own InsurTech capabilities to access new distribution channels and enhance its product offerings in this dynamic market.

| Technology Area | Impact on Axis Capital | Industry Trend (2024-2025) |

|---|---|---|

| AI & Machine Learning | Enhanced risk assessment, improved fraud detection, personalized pricing | Significant investment in AI for claims processing, reducing times by up to 30% |

| Digitalization & Automation (RPA) | Streamlined operations, cost reduction, faster processing times | Global RPA market projected to exceed $13 billion in 2024; billions in cost savings from digital transformation |

| InsurTech Innovation | New business models, direct-to-consumer channels, competitive pressure | InsurTech funding surpassed $15 billion by mid-2024; projected to capture >25% of new specialty line policies by Q1 2025 |

Legal factors

Axis Capital Holdings navigates a complex global regulatory landscape, facing stringent insurance and reinsurance laws. These include solvency requirements, licensing procedures, and consumer protection mandates across its operating regions. For instance, in 2024, the International Association of Insurance Supervisors (IAIS) continued to emphasize robust capital standards, impacting how companies like Axis manage their reserves and risk exposure.

Adherence to these varied legal frameworks is critical for Axis Capital's continued market access and operational integrity. Failure to comply with regulations, such as those concerning data privacy or anti-money laundering, could lead to significant fines and reputational damage. The ongoing evolution of these regulations, particularly in areas like cybersecurity and climate risk disclosure, demands continuous adaptation and investment in compliance infrastructure.

Axis Capital Holdings, like all financial institutions, must navigate a complex web of global data privacy and protection laws. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose stringent requirements on how client data is collected, stored, and processed. For instance, GDPR, which came into full effect in 2018, introduced significant penalties, with fines potentially reaching up to 4% of annual global turnover or €20 million, whichever is higher.

Adherence to these data privacy mandates is not merely a compliance issue; it's critical for maintaining client trust and avoiding substantial financial penalties. Axis Capital must invest in and maintain robust data governance frameworks, ensuring secure data handling practices and transparent communication with clients about data usage. Failure to comply can lead to significant reputational damage and direct financial losses, impacting the company's bottom line and market standing.

The insurance and reinsurance industry fundamentally relies on intricate contractual agreements. Axis Capital Holdings, like its peers, must meticulously adhere to contractual law, as any deviations or disputes can lead to significant legal entanglements.

Potential litigation stemming from claims disputes, differing interpretations of policy terms, or breaches of contract poses a substantial risk. For instance, in 2024, the global insurance litigation market saw a notable increase in complex disputes, with some major carriers reporting significant financial provisions for ongoing legal battles, impacting their profitability.

These legal challenges can directly affect Axis Capital's financial performance through legal fees, settlement costs, and potential damage awards. Furthermore, adverse litigation outcomes can severely damage the company's reputation, influencing client trust and market standing.

Anti-Money Laundering (AML) and Sanctions Laws

Axis Capital Holdings, as a global financial services entity, operates under a complex web of Anti-Money Laundering (AML) and sanctions regulations. These laws are critical in preventing the financial system from being exploited for illicit purposes, such as terrorist financing or organized crime. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, influencing national legislation worldwide, which Axis must meticulously adhere to. Failure to comply can result in severe financial penalties and reputational damage.

Maintaining robust compliance programs is not merely a legal obligation but a strategic imperative for Axis Capital. These programs are designed to identify, assess, and mitigate risks associated with money laundering and terrorist financing. This involves implementing sophisticated transaction monitoring systems and conducting thorough customer due diligence. In 2023, global AML fines reached substantial figures, underscoring the high stakes involved.

- Regulatory Scrutiny: Axis Capital faces ongoing scrutiny from regulators like the Financial Conduct Authority (FCA) in the UK and the Securities and Exchange Commission (SEC) in the US, who enforce AML and sanctions compliance.

- Sanctions Enforcement: The Office of Foreign Assets Control (OFAC) in the US, for example, imposes broad sanctions on various countries and individuals, requiring strict adherence to prevent any facilitation of prohibited transactions.

- Technological Investment: Significant investment in RegTech solutions is necessary for effective detection and reporting of suspicious activities, with spending on AML software projected to grow steadily through 2025.

- Global Harmonization Efforts: Axis must navigate varying international AML standards and sanctions regimes, necessitating a flexible yet comprehensive compliance framework.

Competition Law and Antitrust Regulations

Axis Capital Holdings must navigate a complex web of competition and antitrust regulations across its global operations. These laws are designed to prevent anti-competitive behavior, such as price-fixing or market allocation, ensuring a level playing field for all participants. For instance, the European Union's robust competition framework, enforced by the European Commission, scrutinizes mergers and acquisitions to prevent undue market concentration.

The impact of these regulations is significant, directly influencing Axis Capital's strategic decisions regarding market entry, potential mergers, and collaborations. Failure to comply can result in substantial fines and reputational damage. In 2023, the U.S. Department of Justice and the Federal Trade Commission continued their aggressive enforcement, with a particular focus on the technology and financial services sectors, signaling a heightened regulatory environment for companies like Axis Capital.

- Regulatory Scrutiny: Axis Capital faces ongoing review of its business practices to ensure compliance with antitrust laws in key markets like the US, UK, and EU.

- Merger Control: Anticipated M&A activity by Axis Capital will be subject to pre-merger notification and approval processes in various jurisdictions, impacting deal timelines and feasibility.

- Market Conduct: Adherence to regulations preventing monopolistic practices and ensuring fair competition is paramount for Axis Capital's long-term market access and profitability.

- Enforcement Trends: Increased global enforcement actions, as seen with significant fines levied in 2023, underscore the importance of proactive compliance for Axis Capital.

Axis Capital Holdings operates within a framework of evolving legal and regulatory requirements globally, impacting its insurance and reinsurance operations. Compliance with solvency standards, licensing, and consumer protection laws is paramount. For instance, the International Association of Insurance Supervisors (IAIS) continued its focus on robust capital standards in 2024, influencing how Axis manages its reserves and risk exposure.

Adherence to these varied legal frameworks is critical for Axis Capital's market access and operational integrity. Non-compliance with regulations, such as those concerning data privacy or anti-money laundering, can lead to substantial fines and reputational damage. The dynamic nature of these regulations, particularly concerning cybersecurity and climate risk disclosure, necessitates continuous adaptation and investment in compliance infrastructure.

Axis Capital Holdings must navigate complex data privacy laws like GDPR and CCPA, which mandate strict protocols for client data handling. GDPR, for example, imposes significant penalties, potentially reaching up to 4% of global annual turnover or €20 million. Maintaining robust data governance is crucial for client trust and avoiding financial penalties, with global spending on data privacy compliance expected to rise through 2025.

The company is also subject to Anti-Money Laundering (AML) and sanctions regulations, with global AML fines reaching substantial figures in 2023. The Financial Action Task Force (FATF) continuously updates its recommendations, influencing national legislation that Axis must follow. Investment in RegTech solutions for AML compliance is projected for steady growth through 2025.

| Legal Factor | Description | 2024/2025 Relevance | Potential Impact on Axis Capital |

| Regulatory Compliance | Adherence to insurance, reinsurance, and financial services laws. | Continued emphasis on capital standards (IAIS) and evolving cyber/climate risk regulations. | Operational costs, risk management strategies, market access. |

| Data Privacy Laws | Compliance with GDPR, CCPA, and similar global data protection mandates. | Increasing enforcement and potential for significant fines for non-compliance. | Investment in data governance, reputational risk, client trust. |

| AML & Sanctions | Following Anti-Money Laundering and international sanctions regulations. | Ongoing updates from FATF, high global AML fines in 2023, projected growth in RegTech investment. | Compliance program costs, risk of penalties, reputational damage. |

Environmental factors

The escalating frequency and intensity of climate-related natural disasters pose a significant challenge for Axis Capital, particularly impacting its property and casualty reinsurance operations. For instance, in 2023, insured losses from natural catastrophes globally reached an estimated $110 billion, according to Swiss Re, highlighting the substantial financial exposure.

Axis Capital's ability to accurately model and price these increasingly volatile risks is paramount for maintaining underwriting profitability and ensuring its long-term solvency. The reinsurer must adapt its risk assessment frameworks to account for evolving climate patterns and their associated impacts on insured events.

Axis Capital, like many in the financial sector, faces increasing ESG pressures. Investors, regulators, and the public are demanding greater accountability for environmental, social, and governance impacts. This trend is reshaping investment strategies and underwriting guidelines, with a growing emphasis on sustainability and responsible business practices.

For instance, the sustainable investment market is booming. Globally, sustainable investment assets reached an estimated $37.8 trillion in 2024, according to the Global Sustainable Investment Alliance. This surge highlights the financial imperative for companies like Axis Capital to integrate ESG factors into their core operations and disclosures to remain competitive and attract capital.

Axis Capital, like other financial institutions, faces increasing pressure from emerging sustainability regulations. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) framework, widely adopted by major economies, mandates detailed reporting on climate risks. In 2024, a significant portion of global publicly traded companies were expected to align with TCFD recommendations, a trend that will undoubtedly continue to influence the insurance and reinsurance sectors.

These evolving requirements mean Axis Capital must bolster its transparency concerning environmental exposures within its underwriting and investment portfolios. Demonstrating robust efforts to mitigate climate-related risks is no longer optional; it's crucial for maintaining investor confidence and a strong regulatory standing in 2025.

Resource Scarcity and Supply Chain Disruptions

Resource scarcity, such as water shortages, and increasingly frequent extreme weather events pose significant threats to global supply chains. These disruptions can lead to heightened business interruption claims for insurers like Axis Capital Holdings. For instance, the severe drought in parts of the US in 2023 impacted agricultural output, affecting various downstream industries and their insurance needs.

Axis Capital must proactively assess these indirect environmental impacts on its insured portfolio. This involves understanding how climate change-related events can create cascading effects, from raw material shortages to transportation delays, all of which can trigger insurance payouts. The company's risk modeling needs to incorporate these evolving environmental factors to accurately price policies and manage potential liabilities.

- Water Scarcity: Affects industries reliant on water, from agriculture to manufacturing, increasing operational risk and potential business interruption.

- Extreme Weather: Events like floods and hurricanes disrupt logistics and damage physical assets, leading to higher claims.

- Supply Chain Fragility: Globalized supply chains are vulnerable to localized environmental shocks, creating widespread economic impacts.

- Indirect Claims: Insurers face claims not just from direct property damage but also from consequential losses due to supply chain breakdowns.

Pollution and Environmental Liability

Axis Capital, as a provider of environmental liability insurance, is directly influenced by shifts in environmental regulations and the growing emphasis on pollution cleanup. Stricter environmental protection laws, for instance, can elevate the need for comprehensive coverage, potentially boosting demand for Axis Capital's policies. Conversely, a less stringent regulatory environment might dampen this demand.

The financial implications for Axis Capital are significant. An increase in environmental claims or the cost of remediation efforts, driven by new regulations or heightened public awareness, could lead to higher premiums for policyholders. For example, the U.S. Environmental Protection Agency (EPA) continues to enforce the Superfund program, which addresses the cleanup of hazardous waste sites, indicating an ongoing need for liability coverage in this sector.

Understanding and adapting to evolving environmental risks is therefore a critical component of Axis Capital's strategy in this segment. This includes staying abreast of scientific advancements in pollution detection and control, as well as anticipating potential future liabilities arising from emerging contaminants or climate change impacts.

- Increased regulatory scrutiny: Changes in environmental protection laws, such as stricter emissions standards or expanded definitions of hazardous substances, directly impact the potential for environmental claims and thus the demand for liability insurance.

- Pollution remediation costs: The rising costs associated with cleaning up contaminated sites, whether driven by government mandates or corporate social responsibility, influence the pricing and availability of environmental insurance products.

- Emerging environmental risks: Axis Capital must monitor and underwrite new types of environmental exposures, such as those related to PFAS (per- and polyfluoroalkyl substances) or microplastics, which are gaining regulatory and public attention.

- Climate change impact: The physical and transitional risks associated with climate change can create new or exacerbate existing environmental liabilities, requiring insurers to adapt their risk assessment models and product offerings.

Axis Capital's exposure to climate-related events remains a key concern, with insured losses from natural catastrophes in 2023 reaching an estimated $110 billion globally. The reinsurer must adapt its risk assessment to account for evolving climate patterns, as shown by the increasing frequency of extreme weather events impacting supply chains and leading to business interruption claims.

The growing demand for sustainable investments, estimated at $37.8 trillion globally in 2024, underscores the financial imperative for companies like Axis Capital to integrate ESG factors. Furthermore, the widespread adoption of frameworks like the TCFD in 2024 by publicly traded companies signals an intensifying regulatory landscape for environmental risk disclosure.

Axis Capital's environmental liability insurance segment is directly influenced by regulatory shifts. Stricter environmental protection laws, exemplified by the EPA's ongoing enforcement of the Superfund program, can boost demand for coverage, though rising remediation costs may necessitate higher premiums.

| Environmental Factor | Impact on Axis Capital | Supporting Data/Trend |

|---|---|---|

| Climate Change & Natural Catastrophes | Increased property and casualty reinsurance claims; need for advanced risk modeling. | Global insured losses from natural catastrophes estimated at $110 billion in 2023 (Swiss Re). |

| ESG Investment Trends | Pressure to integrate sustainability into operations and attract capital. | Global sustainable investment assets reached an estimated $37.8 trillion in 2024 (GSIA). |

| Regulatory Compliance (e.g., TCFD) | Requirement for enhanced transparency on environmental exposures. | Significant portion of global public companies expected to align with TCFD in 2024. |

| Resource Scarcity & Supply Chain Disruptions | Higher business interruption claims due to indirect environmental impacts. | Droughts in 2023 impacted agricultural output and downstream industries, affecting insurance needs. |

| Environmental Liability & Pollution Cleanup | Potential for increased demand for environmental insurance; rising remediation costs. | Ongoing EPA Superfund program enforcement indicates continued need for liability coverage. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Axis Capital Holdings is meticulously constructed using data from reputable financial news outlets, regulatory filings, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the insurance and reinsurance sectors.