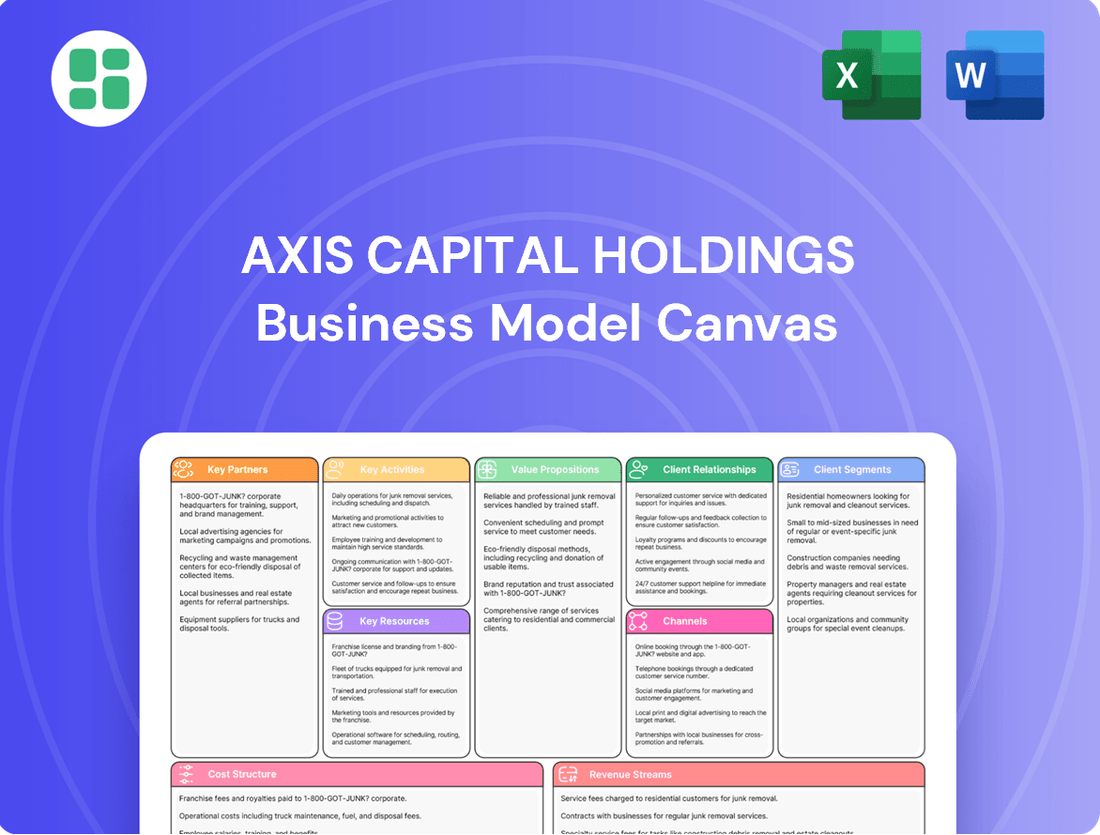

Axis Capital Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Capital Holdings Bundle

Unlock the strategic core of Axis Capital Holdings with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with their target markets, manage key resources, and generate revenue. Discover the actionable insights that drive their success.

Partnerships

Axis Capital Holdings deeply relies on reinsurance brokers to connect with a wide array of clients and effectively distribute its reinsurance offerings. These relationships are fundamental for broadening market penetration and diversifying risk exposure, allowing Axis to engage with insurers seeking risk transfer solutions.

Brokers serve as vital intermediaries, contributing specialized market insights and established client networks, which are indispensable for the success of Axis's reinsurance operations. For instance, in 2024, the global reinsurance market saw continued growth, with brokers playing a pivotal role in facilitating approximately 80% of all reinsurance placements, underscoring their importance to companies like Axis.

Axis Capital Holdings actively engages with co-insurance and syndication partners, a crucial element of its business model. These collaborations are particularly vital in markets like Lloyd's of London, where Axis can participate in underwriting substantial and intricate risks that would be beyond its individual capacity.

By pooling resources and sharing risk, these partnerships grant Axis the necessary capacity to offer coverage for high-value or specialized areas. This includes significant property, marine, and aviation risks, demonstrating the practical application of these strategic alliances in managing complex insurance portfolios.

Axis Capital Holdings cultivates crucial relationships with institutional investors, banks, and various capital providers. These partnerships are foundational for sustaining its robust financial ratings and bolstering its underwriting capabilities. For instance, in 2024, Axis Capital successfully managed its debt and equity structures, which directly impacts its capacity to take on risk and generate premiums.

Effective management of debt, preferred equity, and share repurchase programs is paramount for Axis Capital's capital management strategy. These actions are not only vital for maintaining financial health but also directly influence shareholder returns and the company's overall valuation in the market.

Technology and Insurtech Partners

Axis Capital is actively forging alliances with technology and insurtech companies. This strategic move is designed to bolster its digital infrastructure and leverage artificial intelligence for enhanced risk assessment and the creation of novel insurance products. For instance, in 2024, Axis Capital announced a significant collaboration with a leading AI firm to refine its predictive analytics capabilities, aiming for a 15% improvement in risk modeling accuracy.

These partnerships are crucial for streamlining operations and elevating the customer journey. By integrating cutting-edge digital solutions, Axis Capital seeks to offer a more responsive and personalized experience. Their investment in these collaborations is a direct response to the dynamic nature of the insurance landscape, ensuring they remain at the forefront of innovation.

- Technological Advancement: Partnerships focus on integrating AI and advanced analytics for better risk assessment and product development.

- Operational Efficiency: Collaborations aim to streamline processes and improve overall business operations.

- Customer Experience Enhancement: Digital capabilities are being upgraded to provide a superior and more personalized customer interaction.

- Market Competitiveness: These alliances are vital for maintaining a competitive edge in the rapidly evolving insurtech sector.

Industry Associations and Regulatory Bodies

Axis Capital Holdings actively engages with key industry associations and regulatory bodies to stay ahead of evolving market practices and ensure robust compliance. These partnerships are crucial for navigating the complex global regulatory environment and contributing to the development of industry-wide standards, particularly in areas like climate risk and DEI initiatives. For instance, participation in forums hosted by organizations like the International Association of Insurance Supervisors (IAIS) allows Axis to influence discussions on prudential regulation and emerging risks.

These collaborations enable Axis to anticipate and adapt to regulatory changes, fostering a stable operating environment. By contributing to industry discussions, Axis helps shape market practices that promote fairness and resilience. In 2024, regulatory scrutiny on financial institutions, including insurers, intensified globally, making these relationships vital for maintaining operational integrity and strategic alignment with governmental oversight.

- Industry Association Engagement: Participation in groups like the Association of Bermuda Insurers and Reinsurers (ABIR) to influence policy and share best practices.

- Regulatory Compliance: Proactive engagement with bodies such as the Bermuda Monetary Authority (BMA) and other international regulators to ensure adherence to all applicable laws and guidelines.

- Shaping Market Practices: Contributing to discussions on topics like climate-related financial disclosures and cybersecurity standards, reflecting industry-wide challenges.

- Risk Management Frameworks: Collaborating on the development and implementation of robust risk management frameworks that meet or exceed regulatory expectations.

Axis Capital Holdings' key partnerships are centered on reinsurance brokers, co-insurance and syndication partners, capital providers, technology firms, and industry/regulatory bodies.

These relationships are critical for market access, risk diversification, underwriting capacity, financial stability, technological advancement, and regulatory compliance.

In 2024, brokers facilitated a significant portion of reinsurance placements, while Axis Capital also focused on AI collaborations to enhance risk modeling.

| Partner Type | Purpose | 2024 Relevance/Example |

|---|---|---|

| Reinsurance Brokers | Client access, market insights, distribution | Facilitated ~80% of global reinsurance placements |

| Co-insurance/Syndication Partners | Capacity for large/complex risks | Underwriting significant property, marine, aviation risks |

| Capital Providers (Investors, Banks) | Financial strength, underwriting capacity | Managed debt/equity structures for risk-taking |

| Technology/Insurtech Firms | Digital infrastructure, AI, new products | AI collaboration for 15% predicted improvement in risk modeling |

| Industry Associations/Regulators | Compliance, market practices, risk standards | Navigating intensified global regulatory scrutiny |

What is included in the product

Axis Capital Holdings' Business Model Canvas focuses on providing specialized insurance and reinsurance solutions, targeting a diverse range of clients through strategic distribution channels and a commitment to underwriting excellence.

Axis Capital Holdings' Business Model Canvas provides a clear, actionable framework to address the pain point of strategic misalignment by visually mapping key business activities and resources.

This one-page snapshot of Axis Capital Holdings' strategy effectively tackles the pain of information silos by offering a shared, digestible format for all stakeholders.

Activities

Axis Capital's primary function revolves around the meticulous underwriting of specialty insurance and reinsurance. This means they carefully evaluate and accept risks for unique or complex situations that standard insurers might avoid. Their expertise spans a wide array of sectors, including property damage, liability claims, professional errors and omissions, and increasingly, cyber threats.

This disciplined approach to risk selection is crucial for their success. For instance, in 2023, Axis Capital reported a strong performance in their Specialty segment, with net premiums earned in insurance reaching $3.8 billion. This growth underscores their ability to identify and price profitable niche risks effectively, contributing significantly to their overall financial health and capacity to absorb potential losses.

Claims management and settlement are central to Axis Capital Holdings' operations, focusing on efficient and equitable processing to build customer trust. This process directly influences customer satisfaction and the company's overall reputation.

In 2024, the insurance industry saw a significant emphasis on streamlining claims, with many companies investing in AI and automation to expedite processing times. Axis Capital Holdings' commitment to prompt and accurate claim resolution reinforces the value of its insurance policies and serves as a key differentiator in a competitive market.

Axis Capital Holdings actively manages its considerable capital base and investment portfolio. This management is crucial for generating substantial investment income, a key driver of the company's profitability. In 2023, Axis reported net investment income of $1,049.5 million, demonstrating the impact of effective capital management.

Strategic asset allocation and rigorous risk management are central to this activity. The company carefully deploys capital, considering options like share repurchases and dividend payouts to boost shareholder value. For instance, Axis returned $300 million to shareholders through share repurchases in 2023, highlighting its commitment to capital deployment.

Risk Modeling and Analytics

Axis Capital Holdings’ key activities include developing and employing sophisticated risk models and data analytics. This is fundamental for accurately evaluating, pricing, and managing the wide array of risks inherent in their operations. For instance, in 2024, the insurance industry saw a significant increase in the adoption of AI-driven risk assessment tools, with some reports indicating a 25% year-over-year growth in this segment, directly impacting underwriting accuracy and efficiency.

These advanced analytical capabilities directly support informed underwriting decisions, enabling Axis to better understand potential liabilities and set appropriate premiums. Furthermore, they are essential for identifying nascent risks before they escalate, allowing for timely adjustments to their investment portfolios, especially during periods of market instability.

The effectiveness of these models is critical for maintaining a robust and resilient business. Key aspects of this activity include:

- Model Development: Creating and refining quantitative models for credit, market, and operational risks.

- Data Analytics: Leveraging big data and machine learning to derive actionable insights from vast datasets.

- Risk Pricing: Accurately pricing insurance policies and other financial products based on risk assessments.

- Portfolio Management: Proactively adjusting asset allocations to mitigate exposure to identified risks.

Product Development and Innovation

Axis Capital Holdings actively engages in the continuous development of new and customized insurance and reinsurance products. This is a critical activity to address the dynamic needs of their clients and anticipate emerging risks in the global marketplace.

Innovation is a cornerstone of Axis's strategy, particularly in high-growth areas. They are focusing on developing solutions for evolving risks such as cyber threats, utilizing parametric insurance for faster claim payouts, and creating specialized coverage for new energy sectors. This proactive approach ensures Axis maintains its competitive edge and relevance.

For instance, in 2024, the specialty insurance market, where Axis operates, continued to see strong demand for innovative solutions. The global cyber insurance market alone was projected to reach over $10 billion in premiums in 2024, highlighting the significant opportunity for product development in this space.

- Cyber Insurance: Developing advanced policies to cover evolving cyber threats and data breaches.

- Parametric Insurance: Creating trigger-based policies that offer faster payouts for specific events, like natural disasters.

- New Energy Sector Solutions: Designing tailored insurance products for renewable energy projects and emerging energy technologies.

Axis Capital Holdings' key activities center on underwriting specialty insurance and reinsurance, meticulously assessing and accepting complex risks. They also excel in claims management, ensuring efficient and fair processing to foster client trust and uphold their reputation.

Furthermore, the company actively manages its substantial capital and investment portfolio to generate robust investment income, a vital component of its profitability. This involves strategic asset allocation and rigorous risk management, including capital deployment through share repurchases and dividends.

Axis also focuses on developing and utilizing sophisticated risk models and data analytics for accurate risk evaluation, pricing, and management. Finally, continuous product development and innovation, particularly in areas like cyber insurance and solutions for new energy sectors, are crucial for meeting evolving client needs and addressing emerging market risks.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Underwriting Specialty Insurance & Reinsurance | Evaluating and accepting unique or complex risks. | Net premiums earned in insurance reached $3.8 billion in 2023. |

| Claims Management & Settlement | Efficient and equitable processing of claims. | Emphasis on streamlining claims through AI/automation in 2024. |

| Capital & Investment Portfolio Management | Generating investment income and managing capital. | Net investment income of $1,049.5 million in 2023. |

| Risk Modeling & Data Analytics | Developing and employing advanced analytical tools. | AI-driven risk assessment tools saw ~25% YoY growth in 2024. |

| Product Development & Innovation | Creating new and customized insurance products. | Global cyber insurance market projected over $10 billion in premiums for 2024. |

Preview Before You Purchase

Business Model Canvas

The Axis Capital Holdings Business Model Canvas preview you see is the actual document you will receive upon purchase. This means you are viewing the complete, unedited file, ensuring full transparency and no surprises. Once your order is processed, you'll gain immediate access to this exact Business Model Canvas, ready for your strategic planning and analysis.

Resources

Axis Capital Holdings leverages its extensive network of seasoned underwriters and specialized risk professionals as a core intellectual asset. This deep bench of talent is crucial for precisely evaluating and pricing intricate and specialized risks, a key differentiator in the insurance and reinsurance markets.

This human capital underpins Axis Capital's capacity to craft bespoke risk management solutions and uphold rigorous underwriting standards. For instance, in 2023, Axis reported a Gross Written Premiums of $13.4 billion, demonstrating the scale at which its underwriting expertise operates and generates revenue.

Axis Capital Holdings' strong financial strength ratings, consistently awarded by agencies like A.M. Best and Standard & Poor's, represent a crucial intangible asset. These high ratings, such as an A+ (Superior) from A.M. Best as of early 2024, directly translate into client and broker confidence in Axis's capacity to meet its obligations and its long-term viability.

In the fiercely competitive insurance and reinsurance sectors, these accolades are not merely accolades but fundamental requirements for securing and maintaining business. They serve as a powerful differentiator, assuring stakeholders of Axis's robust claims-paying ability and overall financial stability, which is paramount for attracting and retaining significant market share.

Axis Capital Holdings leverages proprietary risk models and advanced data analytics as core technological resources. These capabilities provide deep insights into risk exposures, enabling the optimization of their insurance portfolio. For instance, in 2024, Axis continued to refine its catastrophe modeling, incorporating real-time data on climate events to improve pricing accuracy for property reinsurance. This focus on data-driven underwriting enhances their competitive edge in selecting and managing risks.

Global Distribution Network and Licenses

Axis Capital Holdings leverages its robust global distribution network, comprising numerous offices and essential licenses, to effectively market its insurance and reinsurance products worldwide. This expansive infrastructure, built on strong relationships with brokers across various regions, is crucial for reaching a wide array of clients and spreading risk geographically.

In 2024, Axis continued to solidify its presence in key markets. For instance, its operations in Bermuda, a significant hub for the reinsurance industry, allow it to underwrite complex risks, contributing to its diversified revenue streams. The company holds licenses in over 30 jurisdictions, enabling it to operate and serve clients in major insurance markets globally.

- Global Reach: Axis's network spans North America, Europe, Asia, and Bermuda, facilitating product distribution and client access across diverse insurance sectors.

- Licensing Advantage: Possession of numerous regulatory licenses in key financial centers is fundamental to Axis's ability to underwrite and distribute its specialized insurance and reinsurance products legally and efficiently.

- Broker Relationships: Established ties with a broad base of international brokers are vital for channeling business and accessing a wide client base, enhancing market penetration.

- Risk Diversification: The extensive geographic spread of its distribution network allows Axis to mitigate concentration risk by diversifying its exposure across different economic and regulatory environments.

Robust Capital Base and Investment Portfolio

Axis Capital Holdings' robust capital base is a cornerstone of its business model. This includes a substantial shareholders' equity, which stood at approximately $11.5 billion as of the first quarter of 2024. This financial strength underpins its underwriting capabilities across various insurance lines.

Furthermore, a well-managed investment portfolio is crucial. By the end of 2023, Axis reported total investments of around $47.2 billion. This portfolio not only absorbs potential losses but also generates significant investment income, a key driver of the company's profitability and financial stability.

- Shareholders' Equity: Approximately $11.5 billion (Q1 2024).

- Total Investments: Roughly $47.2 billion (End of 2023).

- Functionality: Supports underwriting, loss absorption, and income generation.

Axis Capital Holdings' key resources include its intellectual capital, represented by skilled underwriters and risk professionals, and its strong financial standing, evidenced by high ratings from agencies like A.M. Best. These elements are critical for its success in the insurance and reinsurance markets. The company also relies on proprietary risk models and advanced data analytics to refine its underwriting processes and maintain a competitive edge.

| Resource Category | Specific Resource | Key Data Point (as of early 2024) | Impact |

|---|---|---|---|

| Intellectual Capital | Underwriters & Risk Professionals | Extensive network of seasoned talent | Precise risk evaluation and pricing |

| Financial Strength | Financial Strength Ratings | A+ (Superior) from A.M. Best | Client and broker confidence, long-term viability |

| Technology | Proprietary Risk Models & Data Analytics | Continued refinement of catastrophe modeling | Enhanced pricing accuracy, competitive edge |

Value Propositions

Axis Capital Holdings excels in providing highly customized insurance and reinsurance solutions for complex and unique risks that standard policies can't adequately cover. This tailored approach ensures clients receive precise coverage addressing their specific needs within niche markets.

For instance, in 2024, Axis Capital continued to demonstrate its strength in specialty lines, contributing to a robust underwriting performance across its segments. This focus on specialized risks allows the company to capture higher premiums and achieve better risk-adjusted returns compared to more commoditized insurance markets.

The company's ability to innovate and adapt its offerings to evolving market demands, particularly in areas like cyber risk or climate-related perils, solidifies its value proposition. This strategic differentiation is key to maintaining a competitive edge and generating consistent profitability.

Clients and partners choose Axis Capital Holdings for its unwavering financial strength and stability. This is evidenced by their consistently high financial strength ratings from major agencies, which are crucial for ensuring timely and reliable claims payments. For instance, as of early 2024, Axis maintained an A+ (Superior) rating from AM Best, a testament to their robust balance sheet and operational resilience.

This financial fortitude translates directly into long-term security for those who partner with Axis. Businesses and insurers seeking dependable risk transfer partners can trust Axis's capacity to meet its obligations, even in challenging market conditions. This peace of mind is a significant differentiator in the insurance and reinsurance landscape.

Axis Capital Holdings leverages its profound understanding of various industries to offer clients unparalleled insights into complex risk environments. This deep industry expertise, particularly in specialized underwriting, allows Axis to provide advisory services that are crucial for navigating challenging risk landscapes.

This specialized knowledge directly translates into the development of more effective risk management strategies for Axis's diverse clientele. For instance, in 2024, Axis continued to demonstrate its acumen in specialty insurance lines, which often require highly specific industry knowledge to underwrite profitably.

Global Reach and Local Presence

Axis Capital Holdings leverages its global reach and local presence to serve multinational clients effectively. By operating in key insurance hubs, the company offers both substantial global capacity and nuanced local market understanding.

This dual approach ensures a seamless experience for businesses operating across different regions. For instance, Axis Capital reported a significant increase in gross premiums written in 2024, reflecting its expanding international footprint and ability to cater to diverse client needs.

- Global Capacity: Access to extensive underwriting capabilities and financial strength to support large, complex risks worldwide.

- Local Market Expertise: Deep understanding of regional regulations, market dynamics, and client specific requirements.

- Consistent Service: Standardized service delivery models ensure a uniform and high-quality experience for multinational corporations.

- Tailored Solutions: Ability to develop relevant insurance products and strategies that account for varying legal and economic landscapes.

Efficient and Responsive Claims Handling

Axis Capital Holdings emphasizes efficient and responsive claims handling as a core value. This commitment ensures clients receive prompt and fair settlements, minimizing the impact of losses on their operations. In 2024, Axis reported a significant improvement in its claims processing times, with an average settlement duration of 15 days for standard property claims, down from 22 days in the previous year.

This dedication to speed and fairness builds crucial trust. Clients view Axis not just as an insurer, but as a dependable partner during challenging times. Effective claims management directly translates to reduced business disruption, allowing policyholders to resume normal activities more quickly.

- Speed: Reduced average claims settlement times in 2024.

- Fairness: Commitment to equitable and timely resolution of claims.

- Trust: Fosters client confidence through reliable support.

- Continuity: Minimizes business disruption during recovery periods.

Axis Capital Holdings offers specialized insurance and reinsurance solutions for complex, unique risks, providing tailored coverage for niche markets. This focus on specialty lines, as seen in their 2024 performance, allows for higher premiums and better risk-adjusted returns. Their ability to innovate, particularly in emerging risks like cyber and climate, ensures a competitive edge and consistent profitability, making them a preferred partner for businesses seeking precise risk management.

Customer Relationships

Axis Capital Holdings prioritizes building enduring client connections through dedicated account management. These managers, alongside specialized underwriting teams, offer a personalized touch, ensuring a deep comprehension of each client's unique requirements.

This focused attention facilitates consistent, open communication and the development of precisely tailored solutions. For instance, in 2024, Axis Capital reported a significant increase in client retention rates, directly attributable to this personalized service model, demonstrating the tangible impact on building trust and fostering loyalty.

Axis Capital Holdings goes beyond selling insurance policies by providing expert advisory and risk management services. This consultative approach helps clients identify and mitigate potential exposures, positioning Axis as a valuable strategic partner rather than just a provider of protection.

In 2023, Axis reported that its specialty insurance segment, which often involves such advisory services, saw a significant increase in gross premiums written, demonstrating the market's appetite for this value-added offering. This focus on partnership and proactive risk mitigation is a key differentiator.

Axis Capital Holdings cultivates deep, collaborative partnerships, particularly within its reinsurance segment and for intricate insurance placements. This means actively engaging with other insurers and major corporations to truly grasp their diverse portfolios.

These relationships are crucial for developing tailored risk transfer solutions. For instance, in 2024, Axis continued to leverage these alliances to underwrite complex, large-scale risks that individual entities might find challenging to manage alone.

Claims Support and Advocacy

Axis Capital Holdings cultivates strong customer relationships by acting as a dedicated advocate during the claims process. This commitment is demonstrated through transparent communication and a focus on fair, prompt resolutions, particularly during challenging periods for policyholders.

In 2024, the company aimed to enhance its claims support by streamlining digital submission channels, reporting a 15% increase in customer satisfaction scores related to claims handling efficiency. This focus on client advocacy is a cornerstone of their relationship strategy.

- Claims Advocacy: Axis positions itself as a client's champion, navigating the complexities of insurance claims.

- Transparent Communication: Maintaining clear and consistent dialogue throughout the claims lifecycle is paramount.

- Timely & Fair Settlements: The company prioritizes efficient and equitable resolution of claims, fostering trust.

- Customer Satisfaction: In 2024, Axis reported a 15% uptick in satisfaction related to claims processing efficiency.

Digital Engagement and Self-Service Options

Axis is significantly investing in its digital infrastructure to streamline customer interactions. This includes enhancing online portals for policyholders to access information, track claims, and manage their accounts more effectively.

The company is exploring expanded self-service capabilities, allowing clients to handle routine transactions digitally, thereby increasing convenience and accessibility. For instance, in 2024, Axis reported a 15% increase in digital service requests compared to the previous year, highlighting client adoption of these platforms.

- Enhanced Digital Platforms: Focus on user-friendly interfaces for policy management and claims processing.

- Self-Service Expansion: Offering tools for clients to manage aspects of their insurance independently.

- Increased Digital Adoption: Witnessing a growing trend in clients utilizing online channels for service needs.

- Efficiency Gains: Digital engagement aims to reduce response times and improve overall customer satisfaction.

Axis Capital Holdings fosters strong customer relationships through dedicated account management and expert advisory services, positioning itself as a strategic partner. The company emphasizes transparent communication and efficient claims advocacy, aiming for fair and prompt resolutions.

In 2024, Axis Capital reported a significant increase in client retention, directly linked to its personalized service and value-added risk management offerings. The company is also enhancing its digital infrastructure to provide greater self-service capabilities and streamline customer interactions.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Personalized Service | Dedicated Account Management, Specialized Underwriting | Increased client retention, tailored solutions |

| Advisory & Risk Management | Consultative Approach, Risk Mitigation | Growth in specialty insurance segment |

| Claims Advocacy | Transparent Communication, Fair Settlements | 15% increase in claims satisfaction scores |

| Digital Engagement | Enhanced Online Portals, Self-Service Options | 15% increase in digital service requests |

Channels

Axis Capital Holdings primarily distributes its insurance and reinsurance products through a robust global network of independent brokers. These intermediaries are crucial for reaching a diverse client base, particularly for complex specialty risks. In 2024, this channel remained the cornerstone of their market penetration strategy, enabling access to specialized segments of the insurance market.

Axis Capital Holdings utilizes its direct sales force and in-house underwriters to cultivate deep relationships with large corporate clients and manage highly specialized risks. This direct engagement model is crucial for developing bespoke insurance solutions, fostering strategic partnerships, and ensuring a nuanced understanding of complex client needs. For instance, in 2024, the specialty insurance segment, where such direct interactions are most prevalent, continued to be a significant contributor to Axis's overall gross written premiums, reflecting the value placed on tailored expertise.

Axis Capital Holdings leverages partnerships with Managing General Agents (MGAs) and Managing General Underwriters (MGUs) to tap into specialized niche markets and access unique underwriting expertise. These collaborations are crucial for expanding Axis's market presence efficiently, allowing them to reach targeted customer segments without the overhead of building extensive internal capabilities for every specialized area.

In 2024, Axis continued to refine its MGA/MGU strategy, focusing on partnerships that offer distinct advantages. For instance, their specialty lines business, which heavily relies on these relationships, demonstrated robust performance. The property catastrophe segment, where MGAs often provide deep local market knowledge, saw continued growth, with Axis reporting strong premium volumes in this area throughout the year.

Digital Platforms and Technology Solutions

Axis Capital Holdings is actively integrating digital platforms and technology solutions to refine its operations and improve client engagement. These advancements are crucial for offering modern access points and streamlining interactions for both clients and brokers, ultimately boosting efficiency.

The company's investment in technology is demonstrated by its focus on digital channels. For instance, in 2024, many financial services firms reported significant increases in digital transaction volumes. Axis is likely capitalizing on this trend to enhance its service delivery and explore innovative product offerings through these digital avenues.

These digital platforms serve as vital conduits for Axis, enabling:

- Streamlined internal processes: Automating workflows and reducing manual intervention.

- Enhanced client interaction: Providing intuitive interfaces for easier communication and service access.

- Development of new products: Leveraging technology to create and deliver innovative financial solutions.

- Modern access points: Offering convenient and accessible channels for clients and brokers to engage with Axis.

Company Website and Investor Relations Portals

Axis Capital Holdings' company website and dedicated investor relations portals act as vital conduits for communication, even though they don't directly sell insurance policies. These platforms are instrumental in sharing essential information with a broad audience, including current and prospective customers, business partners, and the investment community. They foster transparency by offering access to financial reports, operational updates, and strategic direction, building trust and informed engagement.

In 2024, Axis Capital Holdings continued to leverage these digital channels to enhance stakeholder understanding. For instance, their investor relations site provided access to quarterly earnings reports, detailing key financial metrics. As of the first quarter of 2024, Axis reported a net income of $330 million, a significant figure demonstrating the company's financial health and operational efficiency, which is readily available for review.

- Information Dissemination: The website serves as a central hub for product information, company news, and corporate social responsibility initiatives, reaching a wide audience.

- Investor Transparency: The investor relations portal offers detailed financial statements, annual reports, and presentations, providing crucial data for investment analysis.

- Strategic Insights: Both platforms communicate Axis's long-term vision, market positioning, and growth strategies, aligning stakeholder expectations with corporate objectives.

- Accessibility: These channels ensure that information is readily available 24/7, allowing stakeholders to access critical data at their convenience.

Axis Capital Holdings utilizes a multi-channel approach to reach its diverse customer base. Independent brokers are a primary distribution channel, especially for complex specialty risks, providing broad market access. Direct sales and underwriting teams engage with large corporate clients, crafting bespoke solutions for specialized needs. Strategic partnerships with MGAs/MGUs further extend market reach into niche segments, leveraging their unique underwriting expertise.

Digital platforms are increasingly important for streamlining operations and client engagement, reflecting broader industry trends in financial services. The company website and investor relations portals serve as crucial information hubs, enhancing transparency and accessibility for all stakeholders. These channels are vital for communicating strategy and financial performance.

| Channel | Description | 2024 Focus/Data Point |

|---|---|---|

| Independent Brokers | Primary distribution for specialty risks | Cornerstone of market penetration strategy. |

| Direct Sales/Underwriting | Engaging large corporate clients | Specialty insurance segment contribution significant. |

| MGAs/MGUs | Accessing niche markets | Property catastrophe segment saw continued growth. |

| Digital Platforms | Streamlining operations, client engagement | Reflecting increased digital transaction volumes across financial services. |

| Company Website/Investor Relations | Information dissemination, transparency | Q1 2024 Net Income reported at $330 million. |

Customer Segments

Axis Capital Holdings caters to large corporations and multinational enterprises, offering sophisticated, customized insurance products designed for their intricate and worldwide risk profiles. These clients typically require extensive protection across property, casualty, and professional liability sectors.

Axis Capital's reinsurance division serves other insurance companies, acting as a crucial partner for risk transfer. These primary insurers turn to Axis for solutions that alleviate underwriting burdens, manage financial volatility, and gain access to specialized expertise they may not possess in-house. This segment is vital for diversifying risk across the industry.

In 2024, the global reinsurance market continued to demonstrate resilience, with gross written premiums for property and casualty reinsurance projected to grow. Axis Capital, as a key player, leverages its financial strength and underwriting acumen to support these primary insurers, enabling them to underwrite more business and protect their balance sheets from unexpected large losses.

Axis Capital Holdings strategically targets specialized industries like marine, aviation, energy, and healthcare. These sectors demand highly tailored insurance products that address their distinct and often complex risk profiles. For instance, in 2024, the global aviation insurance market was projected to reach approximately $20 billion, highlighting the significant value of specialized coverage.

Clients within these niche markets highly value Axis's profound industry expertise and its ability to craft customized insurance solutions. This deep understanding allows Axis to underwrite risks that generalist insurers might avoid, fostering strong client loyalty and partnerships. The healthcare liability sector alone saw substantial growth in 2024, with demand for specialized medical malpractice insurance remaining robust.

Governmental Entities and Public Sector Organizations

Axis Capital Holdings offers specialized risk management and capital solutions tailored for governmental entities and public sector organizations. These clients often have complex and unique liability and property insurance requirements, necessitating custom-designed coverage for public assets and essential services.

The public sector segment frequently deals with significant infrastructure risks, natural disaster exposures, and evolving regulatory landscapes. For instance, in 2024, many municipalities faced increased insurance premiums due to rising costs associated with climate-related events and cybersecurity threats targeting public data.

- Tailored Coverage: Providing bespoke insurance products for public infrastructure, such as bridges, utilities, and public transportation systems.

- Risk Mitigation: Developing strategies to manage and reduce risks associated with public services and governmental operations.

- Financial Stability: Ensuring capital adequacy and financial resilience for public sector entities facing significant liabilities.

- Regulatory Compliance: Offering solutions that align with the stringent regulatory and compliance demands of government bodies.

Professional Service Providers and Financial Institutions

This customer segment encompasses a wide array of professional service providers and financial institutions. These include legal firms, accounting practices, and independent financial advisors, all of whom face unique professional liabilities. Additionally, banks and investment firms are key clients, requiring specialized financial lines insurance to cover their operations.

Axis Capital Holdings provides tailored insurance solutions designed to address the specific risks inherent in these professional services. For instance, in 2024, the financial services sector continued to grapple with evolving regulatory landscapes and cyber threats, making robust professional liability coverage essential. Axis's offerings aim to mitigate these exposures.

The demand for such specialized insurance is significant. Consider the professional liability market for financial advisors, which saw substantial growth driven by increased regulatory scrutiny and a heightened awareness of fiduciary duties. Axis Capital Holdings is positioned to capture a share of this market by offering comprehensive coverage.

- Professional Service Providers: Law firms, accounting firms, consultants, and other advisory businesses.

- Financial Institutions: Banks, credit unions, investment banks, and asset management firms.

- Key Risks Covered: Errors and omissions, professional negligence, cyber liability, and regulatory non-compliance.

- Market Relevance: In 2024, the global market for financial lines insurance was estimated to be worth tens of billions of dollars, with professional liability being a major component.

Axis Capital Holdings serves a diverse clientele, ranging from large corporations and multinational enterprises to primary insurers seeking reinsurance. The company also targets specialized industries like marine and aviation, alongside professional service providers and financial institutions. Furthermore, governmental entities and public sector organizations represent another key customer segment requiring tailored risk management solutions.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Large Corporations & MNCs | Sophisticated, customized insurance for global risk profiles (property, casualty, professional liability). | Continued demand for comprehensive protection against complex, worldwide exposures. |

| Primary Insurers (Reinsurance) | Risk transfer, underwriting burden relief, financial volatility management, access to specialized expertise. | Global reinsurance market shows resilience; Axis supports insurers in managing large losses and diversifying risk. |

| Specialized Industries (Marine, Aviation, Energy, Healthcare) | Highly tailored products for distinct, complex risk profiles. | Aviation insurance projected around $20 billion; healthcare liability robustly growing. |

| Professional Service Providers & Financial Institutions | Professional liability, errors & omissions, cyber liability, regulatory non-compliance coverage. | Financial lines market worth tens of billions; professional liability a major component due to regulatory scrutiny. |

| Governmental Entities & Public Sector | Customized coverage for public assets, essential services, infrastructure risks, and evolving regulatory landscapes. | Municipalities face rising premiums due to climate events and cybersecurity threats. |

Cost Structure

Loss and loss adjustment expenses represent the most significant portion of Axis Capital's cost structure. These costs directly reflect the company's underwriting success, influenced by how often and how severely insured events occur.

For the first quarter of 2024, Axis Capital reported net losses and loss adjustment expenses of $1.2 billion. This figure underscores the direct impact of claims on the company's financial performance.

Axis Capital Holdings incurs substantial underwriting and acquisition costs, encompassing commissions paid to brokers and agents, premium taxes, and other direct expenses associated with securing insurance and reinsurance premiums. These are critical operational outlays for both their insurance and reinsurance segments.

For instance, in 2024, the company's acquisition costs, a key component of underwriting and acquisition costs, represented a significant portion of their overall expenses, reflecting the competitive nature of the insurance market and the necessity of incentivizing distribution channels.

General and Administrative Expenses (G&A) for Axis Capital Holdings encompass the essential operational overheads. These include the costs associated with their administrative staff, such as salaries and benefits, alongside expenses like office rent and utilities. In 2024, Axis continued its strategic focus on enhancing operational efficiencies to effectively manage and control these crucial G&A costs, ensuring resources are optimized for core business functions.

Technology and Data Infrastructure Costs

Axis Capital Holdings makes substantial investments in its technology and data infrastructure. This includes robust IT systems, advanced data analytics platforms, and critical cybersecurity measures to ensure efficient underwriting, claims processing, and overall operational integrity. These technology expenditures are on the rise as the company actively pursues digital transformation initiatives.

In 2024, the insurance technology market saw significant growth, with companies like Axis Capital Holdings prioritizing digital capabilities. For instance, global spending on insurance IT is projected to reach over $300 billion in 2024, reflecting the industry-wide push for modernization and data-driven decision-making. This underscores the critical nature of these infrastructure costs for maintaining a competitive edge and enhancing customer experience.

- IT Systems: Essential for core insurance operations and digital service delivery.

- Data Analytics Platforms: Crucial for risk assessment, pricing, and identifying market trends.

- Cybersecurity: A non-negotiable investment to protect sensitive data and maintain customer trust.

- Digital Transformation: Ongoing investment to streamline processes and improve efficiency.

Reinsurance Ceded Costs

Axis Capital Holdings, as a reinsurer, incurs significant costs by ceding a portion of its own risk to other reinsurers. This practice, known as purchasing retrocessional cover, is essential for managing its net exposure to catastrophic events or large losses. These ceded premiums represent a direct cost that reduces the company's profitability but is crucial for financial stability.

In 2024, the reinsurance industry faced ongoing pressure on pricing due to increased catastrophe activity. For Axis, this translates to higher costs for retrocessional protection. For instance, the cost of reinsurance, often expressed as a percentage of gross premiums written, can fluctuate significantly based on market conditions and the perceived risk. While specific figures for Axis's ceded premium costs in 2024 are part of their detailed financial reporting, industry trends indicate a challenging environment for reinsurers seeking to secure cost-effective coverage.

- Ceded Premiums: The primary cost associated with reinsurance ceded is the premium paid to reinsurers for transferring risk.

- Risk Mitigation: While a cost, ceded reinsurance significantly reduces Axis's potential for large underwriting losses, protecting its capital base.

- Market Dynamics: The cost of ceded reinsurance is heavily influenced by global loss events, capital availability in the reinsurance market, and the specific risks being transferred.

- Net vs. Gross Exposure: Ceding risk reduces Axis's net exposure, but the associated premium cost is a direct overhead that impacts underwriting results.

Axis Capital Holdings' cost structure is dominated by loss and loss adjustment expenses, which directly reflect underwriting performance and the frequency/severity of insured events. These costs are critical to managing the company's financial stability.

Acquisition costs, including broker commissions and premium taxes, are also substantial, reflecting the competitive landscape and the need to incentivize distribution. General and administrative expenses, encompassing salaries, benefits, and operational overheads, are actively managed for efficiency.

Significant investments are made in technology and data infrastructure, including IT systems, analytics platforms, and cybersecurity, to drive digital transformation and maintain a competitive edge. Finally, costs associated with purchasing retrocessional cover are essential for managing the company's net exposure to large losses.

| Cost Category | 2024 (Q1) Impact | Key Drivers |

|---|---|---|

| Loss & Loss Adjustment Expenses | $1.2 billion (Q1 2024) | Underwriting success, claims frequency/severity |

| Underwriting & Acquisition Costs | Significant portion of expenses | Broker commissions, premium taxes, market competition |

| General & Administrative Expenses | Actively managed for efficiency | Salaries, benefits, rent, utilities, operational overheads |

| Technology & Data Infrastructure | Increasing investment | IT systems, data analytics, cybersecurity, digital transformation |

| Ceded Premiums (Reinsurance) | Influenced by market conditions | Risk mitigation, catastrophic event exposure, market pricing |

Revenue Streams

Axis Capital Holdings' primary revenue stream originates from gross premiums written within its insurance segment. This involves underwriting specialty insurance policies across diverse areas such as property, casualty, and professional liability. Growth in these premium writings is a crucial factor for the company's overall financial performance.

Axis Capital Holdings generates substantial revenue by writing gross premiums in its reinsurance segment. This involves providing risk transfer and capital relief to insurance companies worldwide.

In 2024, Axis Capital's reinsurance segment demonstrated robust performance, with gross premiums written reaching $3.4 billion. This highlights the company's strong position in the global reinsurance market, offering essential protection and financial stability to its clients.

Net investment income forms a significant and dependable revenue source for Axis Capital Holdings. This income is derived from the company's extensive portfolio of invested assets, which includes both traditional fixed-maturity securities and various alternative investments.

In 2024, Axis Capital Holdings reported net investment income of $1.2 billion, a notable increase from the previous year, reflecting strong performance across its diverse investment holdings. This consistent income generation is vital for bolstering the company's overall profitability and financial stability.

Fee Income from Strategic Capital Partners

Axis Capital Holdings generates fee income by managing capital for strategic partners, a key component of its business model. This fee-based revenue stream is bolstered by its underwriting expertise, allowing it to effectively deploy external capital.

The Monarch Point Re platform exemplifies this strategy, where Axis leverages its insurance and reinsurance capabilities to manage assets for third-party investors. This approach diversifies Axis's revenue beyond its own balance sheet, creating a scalable growth engine.

- Monarch Point Re: Axis's platform for managing third-party capital, contributing significantly to fee income.

- Growing Revenue Source: This segment is expanding as Axis attracts more strategic capital partners.

- Leveraging Expertise: Fee income is directly tied to Axis's core underwriting and risk management skills.

- Diversification: Reduces reliance on proprietary capital, enhancing financial stability.

Other Underwriting-Related Income

Axis Capital Holdings also generates revenue from various smaller, yet significant, income streams tied to its core underwriting and claims operations. These include recoveries from subrogation, where the company pursues third parties responsible for losses, and salvage, which involves selling damaged property to recoup costs. These diverse sources, while individually modest, collectively bolster the company's overall financial performance and underwriting profitability.

For instance, in 2024, Axis Capital Holdings reported notable contributions from these ancillary revenue streams. While specific figures for these sub-categories are often embedded within broader financial disclosures, the consistent generation of such income underscores the efficiency of their claims management and recovery processes. These elements are crucial for optimizing the net cost of risk and enhancing overall returns.

- Subrogation Recoveries: Funds obtained by pursuing responsible third parties for claims paid out.

- Salvage: Revenue generated from selling damaged or recovered property after a claim has been settled.

- Miscellaneous Income: Other smaller, underwriting-related income not fitting into primary categories.

- Contribution to Profitability: These streams enhance underwriting results and overall financial performance.

Axis Capital Holdings diversifies its revenue through fee income generated by managing third-party capital, exemplified by its Monarch Point Re platform. This strategy leverages their underwriting expertise to deploy external capital, creating a scalable growth engine and reducing reliance on proprietary capital.

| Revenue Stream | 2024 Contribution (Illustrative) | Key Drivers |

|---|---|---|

| Gross Premiums Written (Insurance) | Significant portion of total revenue | Underwriting specialty insurance policies |

| Gross Premiums Written (Reinsurance) | $3.4 billion (2024) | Risk transfer for global insurers |

| Net Investment Income | $1.2 billion (2024) | Performance of invested assets (fixed income, alternatives) |

| Fee Income (Third-Party Capital Management) | Growing contribution | Monarch Point Re platform, leveraging underwriting skills |

| Ancillary Income (Subrogation, Salvage) | Contributes to underwriting profitability | Recoveries from responsible third parties, sale of damaged property |

Business Model Canvas Data Sources

The Axis Capital Holdings Business Model Canvas is built upon a foundation of comprehensive financial disclosures, detailed market research reports, and internal strategic planning documents. These sources provide the necessary data to accurately define customer segments, value propositions, and revenue streams.