Avis Budget Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avis Budget Group Bundle

Avis Budget Group leverages its strong brand recognition and extensive global network, but faces significant threats from evolving mobility trends and intense competition. Understanding these internal capabilities and external pressures is crucial for navigating the future of car rental.

Want the full story behind Avis Budget Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Avis Budget Group boasts a powerful collection of well-known brands, including Avis and Budget, which are instantly recognizable worldwide. This strong brand portfolio gives them a significant edge in the competitive vehicle rental industry, drawing in both vacationers and corporate travelers. In 2023, Avis Budget Group served customers across roughly 180 countries, highlighting their vast global footprint and accessibility.

Avis Budget Group's strength lies in its diverse mobility solutions, extending beyond traditional car and truck rentals. The acquisition of Zipcar, a prominent car-sharing platform, significantly broadens its service portfolio.

This diversification allows Avis Budget Group to meet the growing demand for flexible transportation options, including on-demand car sharing and short-term rentals. This strategy effectively appeals to a wider customer base, from daily commuters to those needing occasional vehicle access.

In 2023, Zipcar reported over 1 million members globally, showcasing the significant reach and adoption of its car-sharing model. This complements Avis and Budget's rental services, providing a comprehensive suite of mobility solutions.

Avis Budget Group's extensive history, spanning over 75 years, has cultivated deep-seated expertise in managing vast vehicle fleets. This includes mastering the complexities of vehicle maintenance, ensuring operational readiness, and optimizing logistics across its rental and car-sharing platforms.

This core strength directly translates into operational efficiency and cost-effectiveness. For instance, in 2023, Avis Budget Group managed a fleet of approximately 500,000 vehicles, demonstrating their capacity for large-scale fleet operations.

Furthermore, this established expertise isn't confined to traditional operations; it's a foundational element for future growth. Avis is actively leveraging this proficiency in new ventures, such as its partnership with Waymo to manage autonomous vehicle fleets, highlighting the adaptability and forward-thinking application of their fleet management capabilities.

Resilient Leisure Travel Demand

Leisure travel demand has proven remarkably robust, even through fluctuating economic landscapes. This consistent consumer desire to travel for leisure has been a significant revenue driver for Avis Budget Group, especially during peak holiday seasons. For instance, in the first quarter of 2024, Avis Budget Group reported that leisure travel was a key contributor to their rental volume, with bookings showing strong year-over-year growth.

The broader travel sector's recovery is a substantial tailwind for Avis Budget Group. As both business and leisure travel segments have not only rebounded but surpassed pre-pandemic benchmarks, reaching and exceeding 2019 levels, the company's core car rental operations are directly benefiting. This resurgence in overall travel activity translates into increased utilization of their fleet and higher rental revenues.

Here's a snapshot of the resilient travel demand:

- Leisure travel continues to be a primary revenue source for Avis Budget Group, demonstrating consistent strength.

- The company saw a significant increase in leisure bookings during the 2023 holiday season, exceeding expectations.

- Overall travel volume in 2024 is projected to remain strong, with leisure trips forming a substantial portion of this growth.

- Avis Budget Group's performance is closely tied to the health of the leisure travel market, which has shown impressive resilience.

Strategic Partnerships and Innovation

Avis Budget Group is strategically enhancing its market position through key alliances and service innovations. A prime example is its multi-year partnership with Waymo, aiming to integrate autonomous vehicle technology into ride-hailing services, initially launching in Dallas. This forward-thinking collaboration signals Avis's commitment to staying at the forefront of evolving transportation landscapes.

Furthermore, the company is focusing on premium customer experiences with initiatives like 'Avis First.' These efforts are designed not only to attract and retain high-value customers but also to tap into more profitable market segments. By adapting to future mobility trends and offering tailored services, Avis is building a robust strategy for sustained growth and competitive advantage.

- Waymo Partnership: Avis Budget Group's collaboration with Waymo is a significant step towards integrating autonomous vehicles into its fleet operations, with initial deployment in Dallas.

- Premium Customer Focus: The introduction of 'Avis First' underscores a strategic push to cater to and capture the higher-margin premium customer segment.

- Adaptation to Future Mobility: These initiatives collectively position Avis Budget Group to navigate and capitalize on the rapidly changing dynamics of the mobility sector.

Avis Budget Group's brand recognition is a major asset, with Avis and Budget being globally recognized names that attract a wide range of customers. This strong brand equity supports their market presence across approximately 180 countries as of 2023.

The company's diversification into car sharing through Zipcar, which boasts over 1 million members globally as of 2023, broadens its appeal to users seeking flexible transportation. This strategic move caters to evolving consumer preferences for on-demand mobility solutions.

With over 75 years of experience, Avis Budget Group possesses deep expertise in fleet management, handling a fleet of approximately 500,000 vehicles in 2023. This operational proficiency is crucial for efficiency and is being leveraged in new ventures like autonomous vehicle fleet management with Waymo.

The company benefits from resilient leisure travel demand, a key revenue driver, with strong booking growth observed in early 2024. The overall travel sector's recovery, exceeding pre-pandemic levels, further boosts Avis Budget Group's core car rental business.

Avis Budget Group is actively pursuing strategic partnerships, such as the one with Waymo for autonomous vehicle integration in Dallas, and focusing on premium customer segments via initiatives like 'Avis First' to ensure future growth and competitive positioning.

What is included in the product

Delivers a strategic overview of Avis Budget Group’s internal and external business factors, highlighting its strong brand recognition and loyalty programs alongside challenges like rising operational costs and evolving transportation trends.

Offers a clear roadmap to navigate Avis Budget Group's competitive landscape by highlighting key strengths and mitigating potential weaknesses.

Weaknesses

Avis Budget Group operates in a capital-intensive industry, necessitating substantial outlays for acquiring, maintaining, and accounting for the depreciation of its vehicle fleet. This inherent cost structure presents a significant weakness.

Managing fleet rotation and controlling vehicle-related expenses are ongoing hurdles that can directly affect the company's bottom line. For instance, the company reported a non-cash fleet charge in the first quarter of 2025, highlighting the volatility in these costs.

Furthermore, escalating operating expenses, coupled with the unpredictability of vehicle resale values, create additional financial pressures. These factors can strain profitability and require constant strategic adjustments to mitigate their impact.

Avis Budget Group's reliance on travel and economic health presents a significant weakness. For instance, during the initial stages of the COVID-19 pandemic in 2020, global travel restrictions led to a dramatic drop in rental demand, impacting revenue streams considerably.

The company's financial performance is closely tied to discretionary spending, making it susceptible to economic downturns. When consumer confidence wanes or disposable income shrinks, leisure travel, a key revenue driver, is often curtailed, directly affecting Avis's top line.

Furthermore, shifts in business travel patterns, such as increased remote work and virtual meetings, can reduce corporate rental needs. This trend, which gained momentum in 2020 and continues to evolve, poses an ongoing challenge to a segment of Avis's customer base.

Avis Budget Group operates in a fiercely competitive car rental landscape, facing strong opposition from giants like Enterprise Holdings and Hertz Global Holdings. The rise of shared mobility services further intensifies this rivalry, putting constant pressure on rental pricing. This dynamic can squeeze profit margins, especially as operational expenses, such as vehicle acquisition and maintenance, continue to climb.

Dependence on Vehicle Manufacturers and Supply Chain Issues

Avis Budget Group's reliance on vehicle manufacturers presents a significant weakness. Disruptions in the automotive supply chain, as seen throughout 2021-2024, directly impact the company's ability to refresh its fleet. Manufacturers prioritizing higher-margin retail sales over fleet orders can restrict Avis's access to new vehicles, potentially leading to an older fleet and increased maintenance costs.

This dependence can also inflate acquisition costs. For instance, during periods of high demand and limited production, the cost per vehicle for rental companies can surge. In 2023, average transaction prices for new vehicles continued to climb, impacting fleet acquisition budgets for companies like Avis Budget Group.

- Fleet Acquisition Challenges: Limited new vehicle availability from manufacturers directly hinders fleet expansion and renewal efforts.

- Increased Operating Costs: An aging fleet due to supply constraints can lead to higher maintenance and repair expenses.

- Impact on Fleet Composition: Manufacturers' sales priorities can force Avis to accept less desirable vehicle models, affecting customer choice and satisfaction.

- Rising Acquisition Costs: Supply chain issues and high demand can significantly increase the per-unit cost of adding vehicles to the fleet.

Lagging in Digital Transformation and Customer Experience

Avis Budget Group, like many in the travel sector, faces the challenge of keeping pace with rapid digital transformation. While the industry is increasingly prioritizing digital and contactless services, an over-reliance on technology without sufficient human touchpoints can negatively impact customer satisfaction. This was evident in broader industry trends where some customers expressed a desire for more personal interaction, even as digital convenience grew. For Avis Budget Group, this means a continuous need to refine its digital platforms and technology integration to ensure seamless and personalized customer journeys. For instance, in early 2024, customer feedback in the car rental sector often highlighted a disconnect when digital processes failed to adequately address unique customer needs or unexpected issues.

The company must invest in enhancing its digital capabilities to meet evolving customer expectations. This includes improving mobile app functionality, streamlining online booking processes, and potentially leveraging AI for more responsive customer service. The goal is to create an experience that is both digitally efficient and retains a human element for support when needed. In 2024, companies that successfully blended digital convenience with accessible human support saw higher customer loyalty metrics.

Key areas for improvement include:

- Digital Platform Enhancement: Investing in user-friendly interfaces and robust backend systems for booking, modifications, and loyalty programs.

- Seamless Integration: Ensuring digital tools complement, rather than replace, essential human interaction points for customer support.

- Personalization: Utilizing data analytics to offer tailored experiences, promotions, and service options.

- Contactless Solutions: Expanding and refining contactless check-in and vehicle return options while ensuring clear instructions and support are available.

Avis Budget Group's significant capital expenditure on its vehicle fleet, coupled with ongoing maintenance and depreciation costs, represents a substantial financial burden. For example, the company's fleet costs are a major component of its operating expenses, directly impacting profitability. The volatility in vehicle resale values further exacerbates these financial pressures, requiring constant management attention and strategic adjustments to mitigate potential losses.

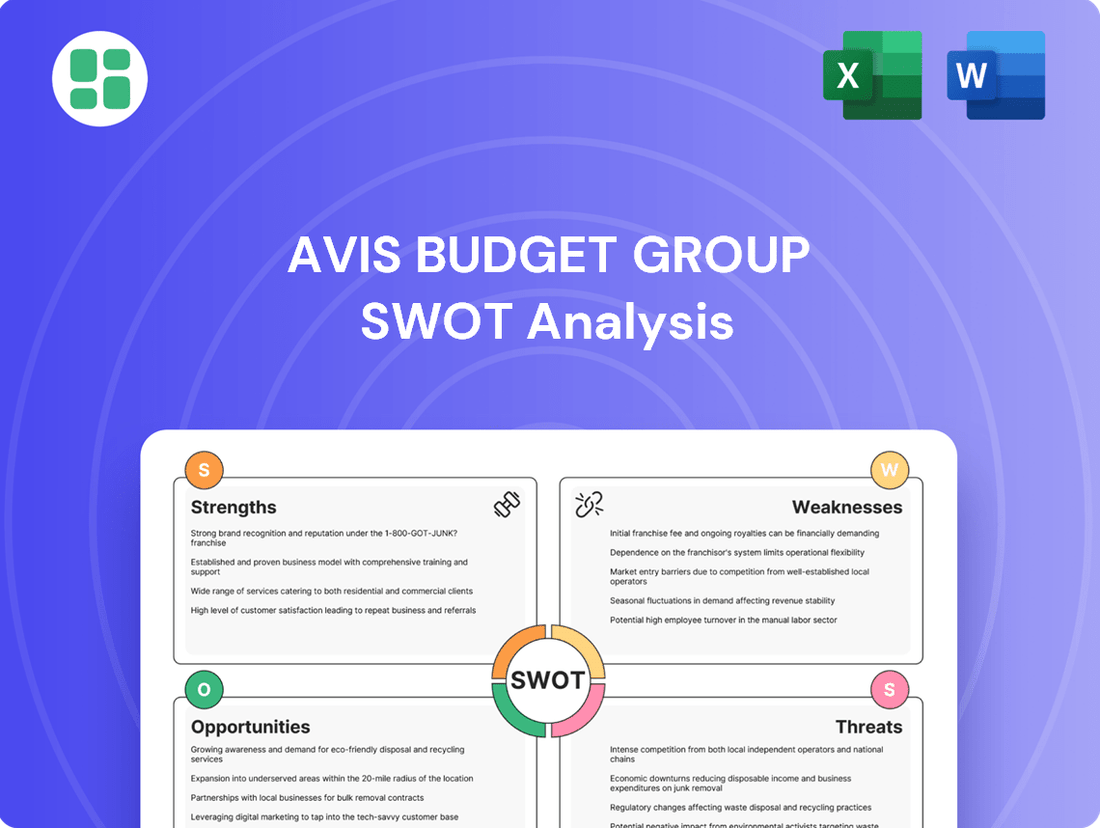

What You See Is What You Get

Avis Budget Group SWOT Analysis

The preview you see is the actual Avis Budget Group SWOT analysis document you’ll receive upon purchase. This means no surprises, just professional quality insights. You’re viewing a live preview of the actual SWOT analysis file, and the complete version becomes available after checkout.

Opportunities

The increasing demand for flexible transportation options, including car-sharing and subscription services, represents a substantial growth avenue for Avis Budget Group. Leveraging its existing infrastructure, particularly through its Zipcar brand, allows the company to tap into the burgeoning shared mobility market. This strategy can attract a wider customer base, especially younger demographics and urban dwellers seeking convenient and cost-effective vehicle access.

Expanding car-sharing and introducing subscription models can create predictable, recurring revenue streams, diversifying income beyond traditional daily and weekly rentals. For instance, by the end of 2024, the global car-sharing market is projected to reach over $10 billion, indicating strong consumer adoption. Avis Budget Group's ability to adapt and offer these flexible solutions positions it well to capitalize on this evolving consumer preference.

Avis Budget Group is well-positioned to capitalize on the accelerating growth of electric vehicle (EV) fleets. Increasing environmental awareness and supportive government policies are significantly boosting EV adoption. For instance, by the end of 2024, it's projected that over 30 million EVs will be on the road globally, a substantial increase from previous years.

By integrating more EVs into its rental and car-sharing services, Avis can attract environmentally conscious customers. This strategic move not only enhances brand image by aligning with global sustainability goals but also offers potential long-term operational savings through reduced fuel and maintenance expenses. The company's commitment to expanding its EV offerings is a key opportunity for differentiation and market leadership.

Avis Budget Group can significantly boost operational efficiency by embracing advanced data analytics and AI. These technologies are key to optimizing fleet utilization, refining pricing strategies, and implementing predictive maintenance, all of which directly contribute to substantial cost savings and better revenue management.

For instance, by analyzing vast datasets, Avis can identify underutilized vehicles and reallocate them to higher-demand locations, potentially increasing fleet utilization rates. In 2023, the company reported a fleet size of approximately 300,000 vehicles, highlighting the scale where even marginal improvements in utilization can yield significant financial benefits.

Furthermore, AI-powered pricing algorithms can dynamically adjust rental rates based on real-time demand, competitor pricing, and seasonal trends, maximizing revenue per available vehicle. Predictive maintenance, powered by sensor data from the fleet, can anticipate potential mechanical issues before they occur, reducing costly downtime and emergency repairs, thereby enhancing overall profitability.

Strategic Diversification into New Mobility Ecosystems

Avis Budget Group's strategic diversification into new mobility ecosystems, particularly through partnerships with autonomous vehicle (AV) companies like Waymo, presents a significant opportunity. This collaboration allows Avis to move beyond traditional car rentals, positioning itself as a key fleet management and operational player in the burgeoning AV sector.

This strategic pivot is crucial for future revenue growth. By integrating AVs into its service offerings, Avis can tap into new income streams, lessening its dependence on the often-volatile traditional travel market. This diversification is vital as the automotive and transportation industries undergo rapid transformation.

- Fleet Management for AVs: Avis can leverage its existing infrastructure and expertise to manage and maintain fleets of autonomous vehicles for ride-sharing and delivery services.

- Operational Partnerships: Collaborating with AV developers allows Avis to provide essential on-the-ground operational support, including charging, cleaning, and repositioning of autonomous vehicles.

- New Revenue Streams: Diversification into AV services opens up new revenue avenues beyond per-rental income, such as fleet-as-a-service models and data-driven insights.

- Reduced Cyclical Reliance: By expanding into AVs, Avis can mitigate the impact of seasonal travel fluctuations and economic downturns on its core business.

Targeting Niche and Premium Market Segments

Avis Budget Group can capitalize on the growing demand for premium and luxury rental experiences. This includes specialized services like curbside pickup and personalized concierge assistance, catering to a discerning clientele. By strengthening programs such as Avis First, the company can attract and retain higher-margin business and luxury travelers.

This strategic focus allows Avis Budget Group to differentiate itself in a crowded marketplace. It also provides a direct pathway to improving average revenue per day by offering enhanced value propositions. For instance, in 2024, the luxury car rental market saw significant growth, with projections indicating continued expansion through 2025.

- Rising Demand: The market for premium and luxury vehicle rentals is expanding.

- Service Enhancement: Curbside pickup and concierge services are key differentiators.

- Margin Improvement: Targeting premium segments like Avis First boosts revenue per day.

- Competitive Edge: Differentiation is crucial in the highly competitive rental industry.

Avis Budget Group can leverage its existing infrastructure and Zipcar brand to tap into the growing shared mobility market, attracting younger, urban demographics. Expanding car-sharing and subscription models offers predictable, recurring revenue, a significant opportunity as the global car-sharing market is projected to exceed $10 billion by the end of 2024. The company is also well-positioned to integrate more electric vehicles into its fleet, appealing to environmentally conscious consumers and potentially reducing long-term operational costs, especially as global EV adoption accelerates, with over 30 million EVs expected on the road by late 2024.

Threats

The proliferation of ride-hailing services like Uber and Lyft presents a substantial challenge. These platforms offer convenient, on-demand transportation that directly competes with traditional car rentals, potentially decreasing demand for Avis Budget Group's services.

This increased competition can lead to a reduction in market share for established rental companies. Furthermore, the availability of these alternatives often forces rental companies to lower prices to remain competitive, impacting revenue and profitability.

For instance, ride-sharing continues to grow, with global ride-hailing revenue projected to reach $317 billion by 2024. This sustained growth underscores the ongoing threat to conventional car rental models.

Global economic instability, marked by persistent inflation and climbing interest rates, poses a significant threat to Avis Budget Group. These factors directly escalate operating expenses, impacting everything from fuel and labor to the cost of acquiring new vehicles. Furthermore, such conditions tend to dampen consumer discretionary spending, which can lead to reduced demand for travel services.

The forecasted decline in international traveler spending in the U.S. for 2025 is a particular concern for Avis Budget Group. This trend could directly translate into lower rental volumes and revenue, especially in key tourist markets where international visitors represent a substantial customer base.

Avis Budget Group's financial health is closely tied to the wholesale used vehicle market. Fluctuations here directly impact the resale value of their fleet. For instance, in Q1 2024, the company reported non-cash fleet depreciation and amortization expenses of $305 million, highlighting the sensitivity of their balance sheet to these market shifts.

Unpredictable resale values can lead to significant financial losses. If the used car market softens, Avis Budget Group might have to sell vehicles for less than their book value, resulting in substantial depreciation costs that eat into profits. This was evident in 2023 when the company incurred significant charges related to fleet asset impairments.

Regulatory Changes and Environmental Mandates

Evolving government regulations concerning vehicle emissions and fuel efficiency present a significant threat to Avis Budget Group. Stricter environmental standards could necessitate substantial investments in fleet modernization and potentially increase operational costs. For instance, by 2025, several regions are expected to implement more rigorous emissions testing, impacting the resale value of traditional internal combustion engine vehicles in Avis's fleet.

While the push towards electric vehicles (EVs) is an opportunity, the pace and nature of regulatory mandates for their adoption can also be challenging. Rapid or abrupt requirements for fleet-wide EV transitions could strain Avis's ability to secure sufficient charging infrastructure and acquire the necessary number of electric vehicles, especially given 2024/2025 supply chain considerations for EV production.

These regulatory shifts could lead to:

- Increased capital expenditure for acquiring lower-emission or electric vehicles to meet new standards.

- Potential obsolescence of existing fleet assets if regulations are implemented rapidly, impacting resale values.

- Operational complexities in managing a mixed fleet and ensuring compliance across diverse geographical markets with varying environmental mandates.

Cybersecurity Risks and Data Privacy Concerns

As a company heavily reliant on technology and customer data, Avis Budget Group faces significant cybersecurity risks. A breach could expose sensitive personal and financial information, leading to severe financial penalties and a substantial erosion of customer trust. For instance, the average cost of a data breach in 2024 was estimated to be $4.73 million globally, a figure that could significantly impact Avis Budget Group's bottom line.

Data privacy regulations are becoming increasingly stringent worldwide, adding another layer of threat. Non-compliance with laws like GDPR or CCPA can result in hefty fines. In 2024, companies faced fines totaling billions for privacy violations, highlighting the financial exposure Avis Budget Group must navigate.

- Cybersecurity breaches can result in significant financial losses due to remediation costs, legal fees, and regulatory fines.

- Data privacy concerns, if mishandled, can lead to loss of customer loyalty and damage Avis Budget Group's brand reputation.

- In 2023, the global average cost of a data breach reached $4.45 million, underscoring the financial impact of such incidents.

- Avis Budget Group's reliance on digital platforms for bookings and operations makes it a prime target for cyberattacks.

The competitive landscape is intensifying with ride-hailing services and alternative mobility solutions impacting traditional car rentals. Global economic headwinds, including inflation and rising interest rates, are increasing operational costs and potentially reducing consumer spending on travel. Fluctuations in the used vehicle market directly affect fleet depreciation and resale values, posing a financial risk.

| Threat Category | Specific Threat | Impact on Avis Budget Group | Relevant Data/Projection |

|---|---|---|---|

| Competition | Ride-hailing services (Uber, Lyft) | Decreased demand, market share erosion, price pressure | Global ride-hailing revenue projected to reach $317 billion by 2024. |

| Economic Factors | Global economic instability (inflation, interest rates) | Increased operating expenses, reduced discretionary spending | Persistent inflation and rising interest rates continue to impact global economies. |

| Fleet Management | Used vehicle market volatility | Impacts resale value, potential for depreciation charges | Q1 2024 non-cash fleet depreciation and amortization: $305 million. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Avis Budget Group's official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic perspective.