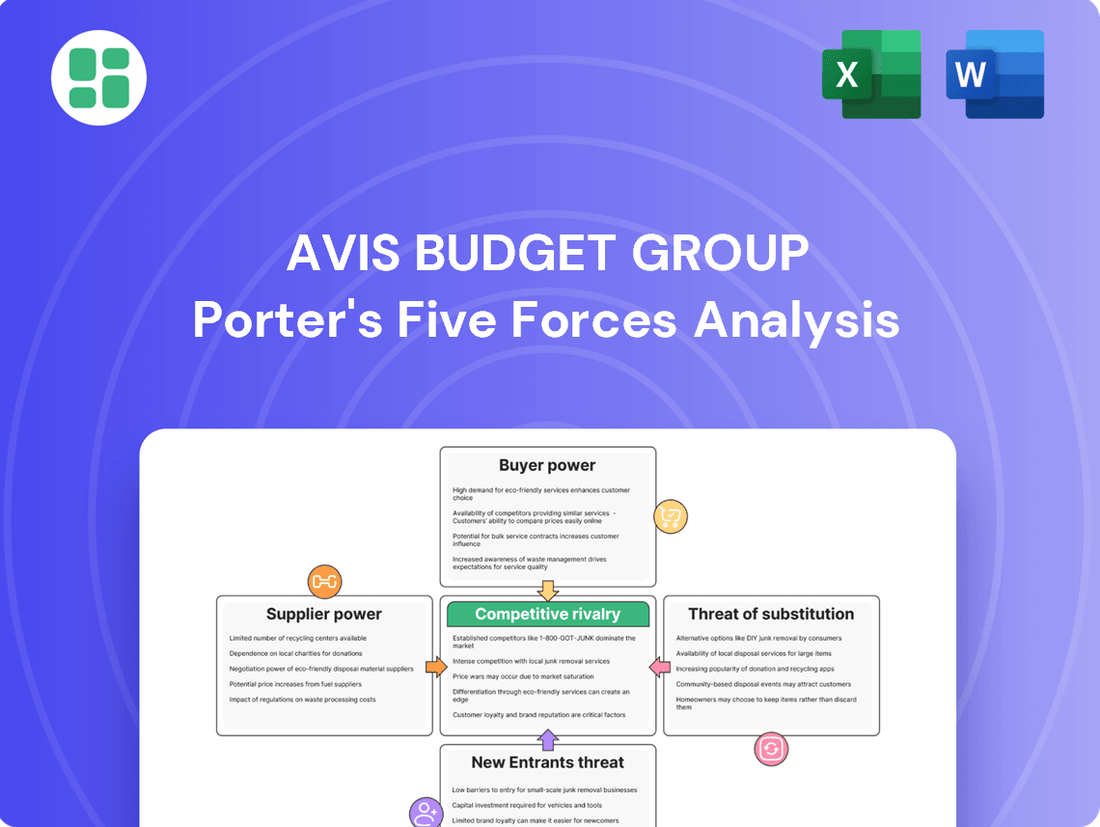

Avis Budget Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avis Budget Group Bundle

Avis Budget Group faces significant competitive pressures, particularly from the threat of new entrants and the bargaining power of buyers. Understanding these forces is crucial for navigating the car rental landscape. The full analysis reveals the real forces shaping Avis Budget Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Avis Budget Group's reliance on vehicle manufacturers for its fleet significantly influences supplier bargaining power. Recent automotive industry challenges, including persistent supply chain disruptions and elevated production costs throughout 2023 and into early 2024, have amplified the leverage of these suppliers. For instance, in 2023, average transaction prices for new vehicles in the US remained elevated, a trend that impacts fleet acquisition costs for rental companies.

Technology providers offering specialized fleet management software, AI-driven customer service, and contactless rental solutions are gaining significant bargaining power. As companies like Avis Budget Group increasingly rely on these advanced digital tools to improve operational efficiency and customer experience, the unique nature of these technologies can strengthen supplier leverage. For instance, Avis Budget's strategic investments in digital transformation, aiming for enhanced customer engagement and streamlined operations, highlight their growing dependence on these tech partners.

Fuel suppliers hold considerable bargaining power over Avis Budget Group, as fuel is a critical and ongoing operational expense. For instance, in 2023, the average price of gasoline in the US saw significant volatility, impacting the cost of maintaining a large fleet of traditional vehicles. While Avis Budget can adjust rental prices, rapid and substantial increases in fuel costs from suppliers can squeeze profit margins.

Maintenance and Repair Services

Avis Budget Group relies heavily on maintenance and repair services to keep its vast fleet operational. Suppliers of specialized parts and authorized service centers possess a degree of bargaining power because of the technical expertise required for vehicle upkeep and the critical need for prompt repairs to minimize downtime. This is particularly true for specialized vehicle types within their fleet.

The automotive repair sector, like many skilled trades, has faced challenges with labor shortages and high employee turnover. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 3% job growth for automotive service technicians and mechanics, which, while positive, still indicates a competitive labor market. This scarcity can amplify the bargaining power of these service providers, allowing them to potentially negotiate higher prices or more favorable terms with fleet operators like Avis Budget Group.

- Specialized Parts: Suppliers of unique or proprietary vehicle parts can command higher prices due to limited alternatives.

- Timely Service Needs: The imperative to minimize vehicle downtime grants leverage to service providers who can offer rapid and efficient repairs.

- Labor Shortages: A constrained supply of qualified mechanics and technicians in 2024 empowers existing service centers and their pricing.

- Fleet Complexity: Maintaining a diverse fleet necessitates specialized knowledge, increasing reliance on and thus supplier power from specific repair shops.

Real Estate and Airport Authorities

Avis Budget Group's reliance on prime airport and city center locations grants significant leverage to real estate owners and airport authorities. These entities control access to high-traffic areas essential for Avis's customer reach. For instance, in 2024, airport car rental concession fees can represent a substantial operating cost, directly impacting profitability.

The bargaining power of these suppliers stems from their ability to dictate rental agreements, concession fees, and operational terms. For Avis, securing and retaining these strategic spots is paramount for maintaining market presence and customer accessibility. Failure to negotiate favorable terms can lead to increased operating expenses or even loss of prime locations.

- High Demand for Airport Locations: Airports are critical access points for travelers, making rental space there highly sought after.

- Concession Fees: Airport authorities often charge significant concession fees, which are a direct cost for Avis.

- Operational Regulations: Airport authorities can impose specific operational rules that may increase costs or limit flexibility for Avis.

- Lease Agreements: The terms of long-term lease agreements for prime city locations also give landlords considerable bargaining power.

Vehicle manufacturers wield substantial bargaining power over Avis Budget Group, particularly given ongoing supply chain volatility and elevated new vehicle prices. In 2023, average transaction prices for new vehicles in the U.S. continued to reflect these pressures, directly impacting Avis Budget's fleet acquisition costs. This reliance on a limited number of major manufacturers for fleet replenishment means suppliers can influence pricing and delivery schedules.

| Supplier Type | Bargaining Power Factor | Impact on Avis Budget Group |

|---|---|---|

| Vehicle Manufacturers | Supply Chain Disruptions & Production Costs | Increased fleet acquisition costs, potential delays in fleet renewal. |

| Technology Providers | Unique Digital Solutions & Integration | Higher software licensing fees, dependence on specific vendors for operational efficiency. |

| Fuel Suppliers | Essential Commodity & Price Volatility | Direct impact on operating expenses, potential margin squeeze from rising fuel costs. |

| Maintenance & Repair Services | Specialized Parts & Skilled Labor Shortages | Elevated service costs, potential for longer vehicle downtime if specialized services are delayed. |

| Real Estate Owners/Airport Authorities | Prime Location Access & Concession Fees | Significant operating expenses, potential for lease renewal challenges or increased rental rates. |

What is included in the product

This analysis unpacks the competitive intensity within the car rental industry, focusing on Avis Budget Group's position relative to rivals, the power of its customers and suppliers, and the barriers to entry for new players.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on Avis Budget Group's market landscape.

Customers Bargaining Power

Customers, encompassing both leisure and business travelers, wield considerable bargaining power. This strength stems from the abundance of car rental competitors and the availability of alternative transport like ride-sharing services and public transit. The ease of comparing prices online empowers customers to readily switch to providers offering better value or service, putting pressure on Avis Budget Group's pricing strategies.

In the first quarter of 2025, Avis Budget Group experienced a 2% year-over-year decrease in pricing, a clear indicator of how customer price sensitivity and the ability to shop around directly influence rental rates. This dynamic means Avis Budget must continually focus on competitive pricing and service excellence to retain its customer base.

The Budget brand, part of Avis Budget Group, actively courts value-conscious customers. These individuals are keenly aware of price differences and actively seek out the most affordable rental options. In 2024, the average daily rental rate for economy cars, a segment Budget heavily targets, remained a critical decision factor for many consumers, reflecting this sensitivity.

This strong emphasis on price among Budget's core demographic significantly amplifies their bargaining power. Customers in this segment are not loyal to a specific brand if a competitor offers a lower price for a comparable service. This necessitates that Avis Budget Group carefully manage its pricing strategies to remain competitive without sacrificing profitability.

Zipcar users, seeking flexible, short-term mobility, possess significant bargaining power. Their ability to switch to numerous competing car-sharing services or ride-hailing platforms like Uber and Lyft, which are increasingly prevalent, means Zipcar must offer competitive pricing and convenient access to retain them. For instance, in 2024, the global car-sharing market was projected to reach over $12 billion, indicating a highly competitive landscape where customer loyalty is earned through value and service.

Corporate Clients

Corporate clients, particularly business travelers, wield significant bargaining power with Avis Budget Group. This power stems from negotiated rates and long-term contracts, driven by the volume of rentals they commit to. For instance, in 2024, many large corporations continue to leverage their purchasing power to secure favorable pricing, a trend that intensified as business travel rebounded from pandemic lows, though with some sectors showing more cautious recovery.

Avis Budget must actively manage these relationships by offering competitive terms and ensuring reliable service to retain these valuable accounts. Failure to do so could lead to these clients seeking alternatives, especially as the business travel landscape evolves.

- Negotiated Rates: Corporate clients often secure discounts below standard retail prices.

- Volume Commitments: Large companies commit to significant rental volumes, increasing their leverage.

- Contractual Agreements: Long-term contracts lock in terms and pricing, providing stability but also buyer power.

- Service Expectations: Consistent and high-quality service is a key factor in retaining corporate business.

Demand for Digital and Contactless Experiences

Customers increasingly demand digital and contactless experiences, pushing rental companies to innovate. This shift means that firms like Avis Budget Group must invest in mobile check-ins, keyless entry, and digital payment options to remain competitive. Failure to meet these evolving expectations can directly impact customer loyalty and market share, highlighting the significant bargaining power customers wield through their preferences for technological convenience.

- Digital Expectations: A significant portion of travelers, estimated to be over 70% by early 2024, now expect to manage their bookings and vehicle access digitally.

- Contactless Preference: Post-pandemic, the demand for contactless interactions in travel services remains high, with many customers prioritizing safety and efficiency.

- Competitive Pressure: Companies not offering advanced digital solutions risk losing customers to those that do, as seen in the growing market share of rental services with robust mobile apps.

Customers, both leisure and business, hold substantial bargaining power due to numerous competitors and readily available alternatives like ride-sharing. The ease of online price comparison allows customers to easily switch providers, pressuring Avis Budget Group’s pricing. In Q1 2025, Avis Budget saw a 2% year-over-year price decrease, directly reflecting this customer influence.

| Customer Segment | Bargaining Power Drivers | Impact on Avis Budget Group |

|---|---|---|

| Leisure Travelers | Price sensitivity, availability of alternatives, online comparison | Pressure on pricing, need for competitive offers |

| Budget Brand Customers | High price consciousness, focus on affordability | Intensified price competition, need for value-driven strategies |

| Zipcar Users | Availability of car-sharing and ride-hailing, demand for flexibility | Need for competitive pricing and convenient access |

| Corporate Clients | Volume commitments, negotiated rates, long-term contracts | Need to offer favorable terms and reliable service to retain business |

Same Document Delivered

Avis Budget Group Porter's Five Forces Analysis

This preview shows the exact Avis Budget Group Porter's Five Forces analysis you'll receive immediately after purchase, providing a comprehensive overview of competitive forces within the car rental industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing players. This detailed document is ready for your immediate use, offering actionable intelligence for strategic decision-making.

Rivalry Among Competitors

The global car rental arena is a battleground dominated by a handful of major international companies. Enterprise Holdings, Hertz Corporation, and Avis Budget Group are the key players, constantly vying for market share. This intense rivalry means constant pressure on pricing and service innovation.

As of 2024, Enterprise holds a significant 15% of the global market. Avis Budget Group and Toyota Rent-a-Car are close behind, each commanding a 12% share. This concentration among the top players highlights a mature market where differentiation and operational efficiency are crucial for survival and growth.

The U.S. car rental market is notably saturated, with a high density of rental vehicles relative to the population. This oversupply directly translates into considerable pricing pressures. For instance, in 2024, the average daily rental rate for a standard car in major U.S. cities remained competitive, with some reports indicating slight declines compared to previous years due to this saturation.

This intense competition is projected to persist, potentially leading to stable or even decreasing prices through 2025. Companies are actively competing for market share, which often means offering more attractive pricing to capture customer loyalty in a market where options are plentiful and switching costs are relatively low.

Competitive rivalry in fleet management and utilization is intense, driven by the need for efficient operations and cost control. Avis Budget Group, like its peers, faces pressure from rising vehicle acquisition and depreciation expenses, a trend particularly evident in 2024. Companies are prioritizing rapid fleet turnarounds and strategic vehicle rotations to boost profitability in this demanding environment.

Technological Innovation and Customer Experience

Competitive rivalry in the car rental sector is intensifying, with companies like Avis Budget Group increasingly differentiating themselves through technological innovation and a focus on customer experience. This means a constant push to integrate advanced solutions like AI-powered chatbots for customer service, sophisticated mobile applications for seamless booking and vehicle management, and streamlined, user-friendly digital platforms.

The strategic imperative is to strike a delicate balance between automation and personalized human interaction, ensuring customer satisfaction remains paramount. Companies that fail to continuously innovate in these areas risk falling behind in a market where digital convenience and efficient service are becoming key differentiators. For instance, the adoption of contactless rental options and advanced telematics to improve vehicle availability and maintenance is becoming standard practice.

- Technological Differentiation: Competitors are investing heavily in AI for customer service and mobile app functionality.

- Customer Experience Focus: Blending automation with human touch is crucial for satisfaction and loyalty.

- Innovation Imperative: Continuous technological advancement is necessary to maintain a competitive edge.

- Market Trends: Contactless rentals and telematics are becoming industry standards, driven by innovation.

Expansion into New Mobility Solutions

The competitive rivalry within the car rental industry is intensifying as major players, including Avis Budget Group, strategically expand beyond traditional rental services. They are venturing into diverse mobility solutions like long-term vehicle lending, flexible car subscription programs, and peer-to-peer car-sharing platforms. This diversification aims to create new revenue streams and foster greater customer loyalty in a rapidly evolving market.

This expansion significantly broadens the competitive landscape, pitting traditional car rental companies against a wider array of mobility providers. Avis Budget Group's own Zipcar brand exemplifies this shift towards alternative mobility models, while competitors are also actively embracing subscription-based services. For instance, Hertz has been investing in its own subscription offerings, aiming to capture a segment of the market seeking more flexible vehicle access.

- Diversification of Services: Major rental companies are moving into car subscriptions, long-term rentals, and car-sharing to capture a broader customer base.

- Increased Competition: This expansion brings new types of competitors into play, challenging traditional rental models.

- Customer Retention Strategies: Offering diverse mobility options helps retain customers by meeting various transportation needs beyond short-term rentals.

- Market Evolution: The industry is shifting from pure rental to comprehensive mobility solutions, reflecting changing consumer preferences.

Competitive rivalry in the car rental sector is fierce, with Avis Budget Group facing intense pressure from global giants like Enterprise Holdings and Hertz Corporation. This intense competition is driven by a saturated U.S. market, where oversupply leads to significant pricing challenges, as evidenced by stable or declining average daily rental rates in 2024.

Companies are actively differentiating through technological innovation, focusing on AI-driven customer service and advanced mobile applications to enhance user experience. The industry is also seeing a strategic shift towards diversified mobility solutions, including car subscriptions and car-sharing, to capture a broader market and foster customer loyalty.

The pressure to maintain efficient operations and control costs, particularly vehicle acquisition and depreciation expenses, remains high. Avis Budget Group, like its competitors, must navigate these dynamics by prioritizing rapid fleet turnarounds and strategic vehicle rotation to ensure profitability in this highly competitive environment.

| Competitor | Estimated 2024 Global Market Share | Key Competitive Strategy |

|---|---|---|

| Enterprise Holdings | 15% | Broad fleet, extensive network, strong corporate relationships |

| Avis Budget Group | 12% | Technological innovation, customer experience, diversified mobility (Zipcar) |

| Hertz Corporation | 12% | Fleet modernization, subscription services, brand revitalization |

SSubstitutes Threaten

For shorter trips and within urban areas, public transportation like buses and trains offers a compelling alternative to car rentals. In 2024, cities with robust public transit systems, such as New York or London, saw continued high ridership, demonstrating its appeal as a cost-effective and often time-saving option for local travel.

The convenience and lower price point of public transit can directly chip away at demand for car rentals, particularly for leisure travelers or individuals who don't require the flexibility of a personal vehicle for their specific journeys. This is especially true for short-distance rentals where the cost of renting a car can outweigh the expense of multiple public transport tickets.

Ride-hailing services like Uber and Lyft present a notable threat to Avis Budget Group. These platforms offer convenient, on-demand transportation, particularly for shorter trips and within urban environments, directly competing with Avis's core short-term rental business. For instance, in 2024, ride-sharing services continued to see robust usage in major metropolitan areas, with millions of rides completed daily, making them a readily available alternative for many travelers who might otherwise rent a car.

While ride-hailing may not perfectly replace car rentals for extended travel or specific vehicle requirements, their growing accessibility and user-friendliness significantly impact demand for short-term rentals. The ease of booking and often lower per-trip cost for single journeys makes them an attractive substitute, especially for spontaneous travel needs or when a rental car is not perceived as essential.

For many individuals, owning a personal car is the default and preferred method of transportation, directly impacting the demand for car rental services. This is particularly true for daily commuting and regular, predictable travel needs, where the convenience and availability of a personal vehicle often outweigh the benefits of renting.

The choice between renting and owning hinges on individual circumstances, primarily travel frequency and duration. While renting can be cost-effective for infrequent or short-term needs, the established infrastructure and perceived value of personal car ownership make it a formidable substitute for rental companies like Avis Budget Group. In 2024, the average cost of owning a new car in the US was estimated to be over $10,000 annually, encompassing depreciation, insurance, fuel, and maintenance, a figure that influences the rental vs. ownership calculation for consumers.

Car-Sharing Services (Non-Avis Budget)

Beyond Avis Budget's own Zipcar, the threat of substitutes from non-Avis Budget car-sharing services is significant. Platforms like Turo and Getaround enable peer-to-peer car rentals, allowing individuals to rent vehicles directly from private owners. This offers a highly flexible and often more localized alternative to traditional car rental companies.

These peer-to-peer services can present a diverse range of vehicles, from economy cars to luxury models, often at competitive price points. For instance, Turo reported a significant increase in bookings and hosts in 2023, indicating growing consumer adoption of this model. This directly challenges the traditional car rental market by providing a readily available and often cheaper substitute for many consumers' transportation needs.

- Peer-to-Peer Platforms: Services like Turo and Getaround allow individuals to rent cars from private owners, offering a direct substitute.

- Flexibility and Localization: These platforms provide convenient, localized rental options that can be more appealing than traditional rental counters.

- Vehicle Diversity and Pricing: A wide array of vehicles and competitive pricing structures make these services attractive alternatives.

- Market Growth: The increasing popularity of peer-to-peer car sharing signals a growing threat to established rental businesses like Avis Budget.

Bike Rentals and Micro-mobility

Bike rentals and micro-mobility options like e-scooters present a growing threat, particularly in urban and tourist areas. These alternatives cater to short-distance travel needs, appealing to environmentally aware individuals and those preferring active transport. For instance, the global micro-mobility market was valued at approximately $48.4 billion in 2023 and is projected to reach $117.3 billion by 2030, indicating significant growth and potential displacement of traditional car rentals for certain trips.

This segment directly competes with Avis Budget Group for shorter rental periods. While not a complete replacement for longer journeys or family travel, these services chip away at the convenience and necessity of car rentals for quick errands or sightseeing. The increasing adoption of these services, driven by sustainability trends and urban congestion, means a portion of the short-term rental market is vulnerable.

- Market Share Erosion: In cities like Paris or Amsterdam, bike and scooter usage for short trips can significantly reduce demand for car rentals.

- Environmental Appeal: A growing consumer preference for eco-friendly transportation options favors micro-mobility.

- Cost-Effectiveness: For very short durations, micro-mobility can be more economical than a car rental.

- Accessibility: Many micro-mobility services are easily accessible via smartphone apps, offering on-demand convenience.

The threat of substitutes for Avis Budget Group is multifaceted, encompassing public transportation, ride-hailing, personal vehicle ownership, peer-to-peer car sharing, and micro-mobility. These alternatives directly compete for different segments of the transportation market, particularly for shorter trips and urban travel.

In 2024, the continued strength of public transit in major cities and the widespread adoption of ride-sharing services like Uber and Lyft demonstrated their significant impact on car rental demand. Personal car ownership remains a primary substitute, especially for regular commuters, with the annual cost of owning a new car in the US exceeding $10,000 in 2024. Peer-to-peer platforms such as Turo have also seen substantial growth, offering a flexible and often cheaper alternative to traditional rentals.

| Substitute Type | Key Characteristics | Impact on Avis Budget | 2024/Recent Data Point |

| Public Transportation | Cost-effective, convenient for short urban trips | Reduces demand for short-term rentals | High ridership in cities with robust transit systems |

| Ride-Hailing (Uber, Lyft) | On-demand, convenient for short trips | Direct competitor for urban and leisure travel | Millions of rides completed daily in major metros |

| Personal Car Ownership | Ultimate convenience, always available | Primary substitute for daily/frequent travel | Annual ownership cost over $10,000 in US |

| Peer-to-Peer Car Sharing (Turo) | Flexible, diverse vehicle options, competitive pricing | Offers localized and often cheaper alternatives | Significant increase in bookings and hosts |

| Micro-mobility (E-scooters, Bikes) | Eco-friendly, ideal for very short distances | Erodes demand for extremely short rentals | Global market valued at ~$48.4 billion in 2023 |

Entrants Threaten

The car rental sector demands significant upfront capital for fleet purchases, ongoing maintenance, and building a broad network of rental locations. This substantial financial commitment acts as a considerable barrier, deterring new entrants from easily challenging established companies like Avis Budget Group.

Established brands like Avis and Budget have cultivated deep customer loyalty and recognition over many years. This significant brand equity acts as a substantial hurdle for newcomers. For instance, in 2023, Avis Budget Group reported a brand value of approximately $4.8 billion, underscoring the immense asset this loyalty represents.

New entrants would require substantial financial resources and considerable time to replicate the trust and brand awareness that Avis and Budget currently command. This investment in marketing and brand building is a critical barrier to entry, making it difficult for new players to gain traction quickly in the competitive car rental market.

The sheer operational complexity of managing a global fleet, encompassing intricate logistics, rigorous maintenance schedules, seamless technology integration, and high-touch customer service across thousands of locations, acts as a formidable barrier. New entrants simply cannot replicate the established infrastructure, deep-rooted supply chain relationships, and hard-won operational expertise that incumbents like Avis Budget Group possess, making entry exceptionally difficult.

Regulatory Hurdles and Insurance

The car rental industry faces substantial regulatory hurdles and intricate insurance requirements that act as a significant deterrent to new entrants. Companies must navigate a complex web of licensing, safety standards, and environmental regulations, which can be costly and time-consuming to comply with, especially when operating across different jurisdictions. For instance, in 2024, the cost of obtaining and maintaining necessary permits and licenses can range from thousands to tens of thousands of dollars per location, depending on the specific region.

Furthermore, securing adequate and appropriate insurance coverage is a critical barrier. The car rental business inherently involves significant risk, from vehicle damage and theft to third-party liability. New companies often struggle to obtain favorable insurance terms and rates compared to established players with proven track records and robust risk management systems. This disparity in insurance costs can severely impact a new entrant's profitability and competitive pricing strategies.

- Regulatory Compliance Costs: New car rental businesses must budget for licensing, permits, and adherence to safety and environmental standards, which can be substantial.

- Insurance Premium Disparities: Established companies often secure lower insurance premiums due to their operating history and risk mitigation efforts, disadvantaging newcomers.

- Geographic Regulatory Complexity: Operating in multiple states or countries requires understanding and complying with diverse and often overlapping regulatory frameworks, increasing the barrier to entry.

Access to Vehicle Supply Chains

Newcomers face significant hurdles in securing vehicle supply chains. Building robust relationships with automotive manufacturers for fleet purchases, particularly for new vehicles at competitive prices, is a considerable challenge. Established companies like Avis Budget Group leverage their long-standing partnerships and substantial purchasing power to secure preferential access and pricing.

These economies of scale allow incumbents to acquire diverse and cost-effective fleets, creating a barrier for new entrants. For instance, in 2024, major rental companies continued to negotiate large volume discounts with manufacturers, a benefit not readily available to smaller, newer operations. This access to consistent and competitively priced inventory is crucial for operational viability.

- Established relationships with manufacturers grant preferential pricing and early access to new models.

- Economies of scale in fleet purchasing provide a significant cost advantage for incumbents.

- New entrants struggle to match the volume and negotiation power of established players in vehicle acquisition.

The threat of new entrants in the car rental sector remains moderate due to high capital requirements for fleet acquisition and operational infrastructure. Established brand loyalty and extensive location networks also present significant barriers, making it difficult for newcomers to gain immediate market share. For example, in 2023, Avis Budget Group's brand value was estimated at $4.8 billion, reflecting years of customer trust.

Regulatory compliance and insurance costs are substantial deterrents, with licensing and permits potentially costing tens of thousands of dollars per location in 2024. New entrants also struggle to match the economies of scale in vehicle purchasing that incumbents like Avis Budget Group enjoy, which can lead to significant cost advantages.

| Barrier | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|

| Capital Investment | High (fleet, locations, technology) | Fleet acquisition costs can run into millions for a modest start. |

| Brand Loyalty & Recognition | Significant | Avis Budget Group brand value: ~$4.8 billion (2023) |

| Operational Complexity | High (logistics, maintenance, customer service) | Managing thousands of vehicles and locations requires extensive expertise. |

| Regulatory & Insurance Costs | Substantial | Permits/licenses: $10k+ per location (2024); insurance premiums higher for new firms. |

| Supply Chain Access | Challenging | Established players secure volume discounts from manufacturers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Avis Budget Group is built upon a foundation of extensive research, drawing from the company's annual reports and SEC filings, alongside industry-specific publications and market research databases.