Avis Budget Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avis Budget Group Bundle

Navigate the complex external forces impacting Avis Budget Group with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the rental car industry. This in-depth report provides actionable intelligence to anticipate challenges and capitalize on opportunities.

Unlock a deeper understanding of the technological advancements and environmental regulations affecting Avis Budget Group's operations. Equip yourself with the knowledge to make informed strategic decisions and gain a competitive advantage. Purchase the full PESTLE analysis now for immediate access to expert insights.

Political factors

Avis Budget Group navigates a complex web of government regulations impacting its operations globally. These include stringent vehicle safety standards, evolving emissions mandates, and recurring vehicle inspection requirements that vary significantly by country and even by state or province. For instance, in 2024, many regions continued to tighten emissions standards, pushing rental companies towards newer, more fuel-efficient fleets, which can increase capital expenditure.

International trade policies, encompassing tariffs and trade barriers, significantly affect Avis Budget Group's vehicle acquisition costs and availability. For example, tariffs imposed on vehicles or parts imported from major manufacturing hubs can directly inflate fleet expenses. In 2024, ongoing trade negotiations and potential adjustments to existing agreements, such as those involving automotive import duties, continue to create uncertainty for global supply chains, impacting companies like Avis Budget Group.

Government policies directly shape Avis Budget Group's approach to electric vehicle (EV) fleet expansion. For instance, the US Inflation Reduction Act of 2022 provides significant tax credits for EV purchases, encouraging companies like Avis to invest more heavily in electric vehicles for their rental fleets. This policy aims to accelerate EV adoption across the nation.

These incentives are crucial for managing the upfront cost of transitioning to an electric fleet. While the long-term operational savings of EVs are attractive, the initial purchase price can be a barrier. Government support, therefore, plays a vital role in making these investments financially viable for rental companies.

Conversely, any reduction in government support for EV charging infrastructure could pose challenges. Avis Budget Group relies on accessible and widespread charging solutions to effectively manage its EV fleet and meet customer demand for electric rentals. A slowdown in charging infrastructure development could limit the practical usability of their EV investments.

Political Stability and Travel Policies

Geopolitical stability and national travel policies significantly influence the demand for car rental services. For Avis Budget Group, disruptions like new travel bans or stricter visa enforcement can directly curb international arrivals, impacting high-value rental segments in crucial markets. For instance, in 2024, ongoing geopolitical tensions in Eastern Europe continued to create uncertainty for European travel, potentially affecting inbound tourism and car rental demand in affected regions.

The car rental industry is particularly sensitive to shifts in international travel sentiment and government regulations. Negative perceptions of certain destinations due to political instability can lead to a noticeable drop in bookings. Avis Budget Group, with its global presence, must navigate these fluctuating travel policies, which can present immediate operational and revenue challenges.

Consider the impact of these factors:

- Reduced international tourism: Stricter visa requirements or travel advisories can decrease the number of foreign visitors, a key demographic for car rental companies.

- Impact on business travel: Political instability can also deter corporate travel, affecting demand for rentals by business professionals.

- Fluctuating demand in key markets: Changes in travel policies can lead to unpredictable swings in rental demand, making forecasting and resource allocation more difficult for Avis Budget Group.

Regulatory Upheaval in Finance

The vehicle rental industry, including Avis Budget Group, is navigating a period of significant regulatory flux. Potential changes to motor finance commissions and broader financial regulations could impose new compliance costs and affect the expense of acquiring new vehicle fleets. For instance, in 2024, discussions around consumer protection in financial services continued, with regulators scrutinizing commission structures across various sectors, which could extend to rental agreements offering financing options.

These evolving financial regulations present a dynamic challenge for Avis Budget Group. Adapting to new compliance requirements and potential shifts in commission structures necessitates ongoing vigilance and strategic adjustments to ensure sustained profitability. The group's ability to anticipate and respond to these changes will be crucial for managing its cost of capital and maintaining a competitive edge in fleet management.

Key areas of regulatory focus impacting the sector include:

- Motor Finance Commission Scrutiny: Regulators are increasingly examining commission arrangements in consumer finance, potentially impacting revenue streams for rental companies offering add-on financial products.

- Data Privacy and Security: Stricter regulations around customer data handling, such as updates to GDPR or similar frameworks in 2024 and anticipated in 2025, add compliance overhead and risk.

- Environmental, Social, and Governance (ESG) Reporting: Growing mandates for ESG disclosures, including those expected to be more stringent by 2025, require robust data collection and reporting processes, influencing operational costs and investor relations.

Government policies heavily influence Avis Budget Group's operational landscape, from vehicle emissions standards to incentives for electric vehicle adoption. For instance, the push for greener fleets in 2024 saw many regions tightening emissions mandates, directly impacting fleet acquisition costs and strategies for companies like Avis. Furthermore, shifts in international trade policies and tariffs can significantly alter vehicle procurement expenses, creating ongoing financial considerations.

Geopolitical stability and national travel regulations directly impact rental demand. In 2024, ongoing geopolitical tensions in regions like Eastern Europe continued to create uncertainty for European travel, potentially affecting inbound tourism and car rental demand. Stricter visa requirements or travel advisories can also decrease foreign visitors, a key demographic for rental companies.

Financial regulations, including scrutiny of motor finance commissions and data privacy laws, add compliance overhead and can affect revenue streams. As of 2024, regulators continued to examine commission structures, potentially impacting rental companies offering financing options. Anticipated stricter ESG reporting mandates by 2025 also necessitate robust data collection, influencing operational costs.

What is included in the product

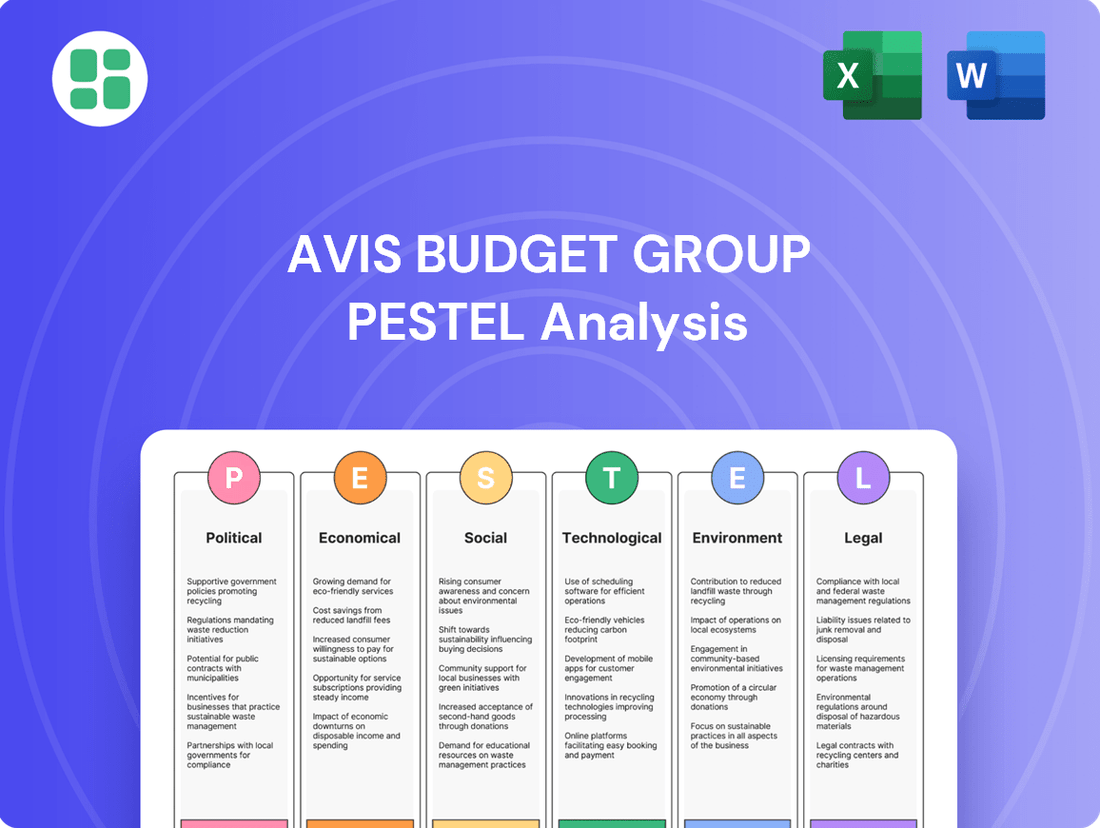

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal forces impacting Avis Budget Group, offering a comprehensive view of the external landscape.

It provides actionable insights for strategic decision-making by identifying key trends and potential challenges within the global mobility sector.

A clear, actionable PESTLE analysis for Avis Budget Group, presented in a concise format, helps alleviate the pain of navigating complex external factors by providing focused insights for strategic decision-making and risk mitigation.

Economic factors

Global economic conditions, including growth rates and disposable income, significantly impact travel and car rental demand for Avis Budget Group. A robust economy typically fuels more leisure and business trips, increasing rental volumes. For instance, in early 2024, many developed economies showed resilient growth, supporting travel spending.

Conversely, economic downturns can dampen travel enthusiasm and strain consumer budgets, directly affecting Avis Budget Group's revenue. A slowdown in key markets like Europe or North America in late 2024 or early 2025 could lead to fewer rentals and lower average transaction prices.

Avis Budget Group, like its competitors, is feeling the pinch of inflation, which is driving up operating expenses. The cost of buying new vehicles, keeping them in good shape, and paying employees has all gone up. For instance, the average transaction price for new vehicles in the US saw significant increases throughout 2023 and into early 2024, impacting fleet acquisition costs. This rise in essential costs directly squeezes profit margins.

To navigate this, Avis Budget Group needs to keep a sharp eye on these escalating costs. Adjusting pricing strategies and finding efficiencies in maintenance and labor are crucial. The company's ability to manage these inflationary pressures will be key to maintaining profitability across its diverse regional operations, especially as consumer spending habits shift in response to higher prices.

The wholesale used vehicle market significantly influences Avis Budget Group's bottom line. Fluctuations in depreciation and resale values directly affect profitability, as the group relies on selling vehicles to refresh its fleet. For instance, in early 2024, the Manheim Used Vehicle Value Index showed continued volatility, though some segments saw stabilization.

While a return to pre-pandemic used vehicle market conditions is projected for mid-2025 through 2027, short-term inventory constraints could keep used car prices elevated. This means Avis Budget Group might face higher acquisition costs for new vehicles or lower proceeds from selling older ones in the immediate future.

To navigate these economic currents, Avis Budget Group must employ agile fleet rotation strategies. Effectively managing the timing and pricing of vehicle disposals is key to mitigating depreciation impacts and safeguarding profit margins amidst market uncertainty.

Intensified Market Competition and Pricing Pressures

The car rental industry, particularly in the US, is shifting from its post-pandemic surge towards a more mature market. Following robust growth, the US market experienced a slight contraction in 2024, signaling a stabilization. This environment naturally breeds intensified competition among established players.

Consequently, pricing pressures are mounting. Rental rates are expected to remain stable or even decline in 2025 as companies vie for market share. Avis Budget Group, like its competitors, must pivot its strategy, emphasizing operational efficiency and strategic customer acquisition over broad market expansion.

- Market Stabilization: US car rental market contracting slightly in 2024 after post-pandemic boom.

- Increased Competition: Mature market phase intensifies rivalry among rental companies.

- Pricing Pressure: Expect stable to declining rental rates in 2025 due to competition.

- Strategic Shift: Focus on optimization and market share capture becomes critical for survival and growth.

Interest Rate and Cash Flow Pressures

Higher interest rates directly impact Avis Budget Group by increasing the cost of financing its extensive vehicle fleet. For instance, if Avis has significant variable-rate debt, a 1% increase in interest rates could translate to millions in additional annual interest expense, squeezing cash flow. This financial pressure is particularly acute as the company manages substantial capital expenditures for fleet acquisition and maintenance.

The vehicle rental sector is anticipating a demanding 2025, with projections indicating rising operational costs, including energy prices and vehicle depreciation. These macroeconomic headwinds necessitate robust financial planning. For example, if fuel costs rise by 10% in 2025, it will directly increase operating expenses for Avis.

- Interest Rate Impact: A hypothetical 1% increase in interest rates on Avis's outstanding debt could add an estimated $20-30 million to annual interest expenses, based on typical fleet financing structures.

- 2025 Sector Outlook: Industry analysts forecast a 5-7% increase in operational costs for rental car companies in 2025, driven by inflation and supply chain issues affecting vehicle availability.

- Cash Flow Management: Strategic debt reduction and optimized capital expenditure cycles are crucial for maintaining liquidity and financial flexibility amidst these rising interest rate and cost pressures.

Global economic conditions, including growth rates and disposable income, significantly impact travel and car rental demand for Avis Budget Group. A robust economy typically fuels more leisure and business trips, increasing rental volumes. For instance, in early 2024, many developed economies showed resilient growth, supporting travel spending.

Conversely, economic downturns can dampen travel enthusiasm and strain consumer budgets, directly affecting Avis Budget Group's revenue. A slowdown in key markets like Europe or North America in late 2024 or early 2025 could lead to fewer rentals and lower average transaction prices.

Avis Budget Group, like its competitors, is feeling the pinch of inflation, which is driving up operating expenses. The cost of buying new vehicles, keeping them in good shape, and paying employees has all gone up. For instance, the average transaction price for new vehicles in the US saw significant increases throughout 2023 and into early 2024, impacting fleet acquisition costs. This rise in essential costs directly squeezes profit margins.

To navigate this, Avis Budget Group needs to keep a sharp eye on these escalating costs. Adjusting pricing strategies and finding efficiencies in maintenance and labor are crucial. The company's ability to manage these inflationary pressures will be key to maintaining profitability across its diverse regional operations, especially as consumer spending habits shift in response to higher prices.

The wholesale used vehicle market significantly influences Avis Budget Group's bottom line. Fluctuations in depreciation and resale values directly affect profitability, as the group relies on selling vehicles to refresh its fleet. For instance, in early 2024, the Manheim Used Vehicle Value Index showed continued volatility, though some segments saw stabilization.

While a return to pre-pandemic used vehicle market conditions is projected for mid-2025 through 2027, short-term inventory constraints could keep used car prices elevated. This means Avis Budget Group might face higher acquisition costs for new vehicles or lower proceeds from selling older ones in the immediate future.

To navigate these economic currents, Avis Budget Group must employ agile fleet rotation strategies. Effectively managing the timing and pricing of vehicle disposals is key to mitigating depreciation impacts and safeguarding profit margins amidst market uncertainty.

The car rental industry, particularly in the US, is shifting from its post-pandemic surge towards a more mature market. Following robust growth, the US market experienced a slight contraction in 2024, signaling a stabilization. This environment naturally breeds intensified competition among established players.

Consequently, pricing pressures are mounting. Rental rates are expected to remain stable or even decline in 2025 as companies vie for market share. Avis Budget Group, like its competitors, must pivot its strategy, emphasizing operational efficiency and strategic customer acquisition over broad market expansion.

- Market Stabilization: US car rental market contracting slightly in 2024 after post-pandemic boom.

- Increased Competition: Mature market phase intensifies rivalry among rental companies.

- Pricing Pressure: Expect stable to declining rental rates in 2025 due to competition.

- Strategic Shift: Focus on optimization and market share capture becomes critical for survival and growth.

Higher interest rates directly impact Avis Budget Group by increasing the cost of financing its extensive vehicle fleet. For instance, if Avis has significant variable-rate debt, a 1% increase in interest rates could translate to millions in additional annual interest expense, squeezing cash flow. This financial pressure is particularly acute as the company manages substantial capital expenditures for fleet acquisition and maintenance.

The vehicle rental sector is anticipating a demanding 2025, with projections indicating rising operational costs, including energy prices and vehicle depreciation. These macroeconomic headwinds necessitate robust financial planning. For example, if fuel costs rise by 10% in 2025, it will directly increase operating expenses for Avis.

- Interest Rate Impact: A hypothetical 1% increase in interest rates on Avis's outstanding debt could add an estimated $20-30 million to annual interest expenses, based on typical fleet financing structures.

- 2025 Sector Outlook: Industry analysts forecast a 5-7% increase in operational costs for rental car companies in 2025, driven by inflation and supply chain issues affecting vehicle availability.

- Cash Flow Management: Strategic debt reduction and optimized capital expenditure cycles are crucial for maintaining liquidity and financial flexibility amidst these rising interest rate and cost pressures.

Consumer spending habits are undergoing a notable shift due to economic pressures. In 2024, many consumers demonstrated increased price sensitivity, leading to a greater focus on value-for-money options. This trend directly influences Avis Budget Group's ability to maintain rental rates and attract customers, especially in the leisure segment.

Disposable income levels are a critical determinant of travel and rental demand. While some economies showed resilience in early 2024, potential economic slowdowns in late 2024 or early 2025 could reduce discretionary spending on travel. For instance, a 2% dip in average household disposable income in a key market could translate to a 1-1.5% decrease in rental demand for Avis.

The company must adapt its pricing and service offerings to align with evolving consumer preferences and income levels. This includes exploring flexible rental options and loyalty programs to retain customers during periods of economic uncertainty.

Inflationary pressures continue to impact Avis Budget Group's operational costs. In 2024, the cost of vehicle maintenance, parts, and labor saw an average increase of 5-8% across the industry. These rising expenses directly affect profit margins and necessitate careful cost management and strategic price adjustments.

| Economic Factor | Impact on Avis Budget Group | Data/Trend (2024-2025) |

| Global Economic Growth | Influences travel demand; robust growth boosts rentals. | Resilient growth in developed economies early 2024; potential slowdown late 2024/early 2025. |

| Inflation | Increases operating expenses (vehicles, maintenance, labor). | Average transaction prices for new vehicles up; 5-8% increase in maintenance/parts/labor costs in 2024. |

| Used Vehicle Market | Affects fleet depreciation and resale values. | Continued volatility in Manheim Used Vehicle Value Index early 2024; stabilization expected mid-2025. |

| Interest Rates | Increases cost of financing the vehicle fleet. | A 1% rate hike could add $20-30 million in annual interest expense. |

| Consumer Spending & Disposable Income | Drives discretionary travel spending. | Increased price sensitivity; potential reduction in disposable income impacting travel budgets. |

Preview the Actual Deliverable

Avis Budget Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Avis Budget Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping the car rental industry and Avis Budget Group's position within it.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights to help you make informed business decisions regarding Avis Budget Group.

Sociological factors

Consumer preferences are increasingly leaning towards flexible mobility solutions over traditional car ownership, a significant shift impacting companies like Avis Budget Group. This move is driven by a desire for convenience and a reluctance to shoulder the costs and responsibilities of owning a vehicle, especially among younger demographics.

Millennials and Gen Z, in particular, are embracing car rentals and car-sharing services. For instance, a 2024 study indicated that over 60% of Gen Z adults in urban areas consider car-sharing a viable alternative to owning a car. This demographic values the pay-as-you-go model and the ability to access a vehicle only when needed.

To address this evolving landscape, Avis Budget Group needs to diversify its offerings. Expanding options to include hourly rentals, subscription models, and flexible long-term leases will be crucial to capture this market segment. In 2024, Avis Budget Group reported a 15% increase in demand for their flexible rental options, signaling the growing importance of this strategy.

A growing wave of environmentally aware consumers is actively seeking out sustainable and eco-friendly travel choices. This trend is directly fueling a greater demand for greener vehicle options within the rental market.

In response, Avis Budget Group has been strategically expanding its fleet to include more fuel-efficient, hybrid, and electric vehicles. This initiative is crucial for reducing the company's overall carbon footprint. By 2024, Avis Budget Group aimed to have 10% of its fleet be electric, with plans to significantly increase this percentage by 2030, reflecting a commitment to sustainability.

Offering 'green certified' vehicles is a key strategy to attract this expanding customer segment. It not only caters to their preferences but also demonstrates the company's alignment with increasingly important societal values around environmental responsibility.

Customers now demand swift, convenient, and contactless service, a trend amplified by evolving post-pandemic expectations. This translates to a desire for seamless digital booking, self-service options for vehicle pickup and return, and accessible remote customer support.

Avis Budget Group's strategic imperative is to embrace technology to optimize operations and elevate customer satisfaction. By streamlining processes and minimizing physical touchpoints, the company can effectively cater to these heightened digital and contactless service expectations. For instance, in 2024, digital channels accounted for over 70% of Avis bookings, highlighting the critical need for robust online and app-based solutions.

Impact of Business and Leisure Travel Trends

The car rental sector, including Avis Budget Group, is significantly influenced by evolving travel patterns. Leisure travel has shown robust recovery, with many analysts projecting it to exceed pre-pandemic volumes in 2024 and 2025. For instance, travel analytics firm ForwardKeys reported international tourist arrivals were up 9% in early 2024 compared to 2019 levels.

Business travel, while also recovering, presents a more nuanced picture. While essential business trips are back, the frequency of corporate travel may not fully rebound to 2019 levels due to increased adoption of virtual meetings. Avis Budget Group's strategy must balance capitalizing on strong leisure demand with adapting to the evolving needs of business travelers, potentially through flexible rental options and corporate partnerships.

- Leisure Travel Dominance: Continued strong demand for leisure travel offers a significant revenue stream for Avis Budget Group.

- Business Travel Adaptation: Companies need to adjust to potentially lower but still significant business travel volumes, focusing on value and convenience.

- Hybrid Work Impact: The rise of hybrid work models may influence the frequency and nature of business-related car rentals.

- Segment Diversification: Avis Budget Group's success hinges on its ability to cater to diverse traveler needs across both leisure and business segments.

Workforce Challenges and Staffing Shortages

The car rental sector, including Avis Budget Group, grapples with persistent workforce challenges. High employee turnover remains a significant hurdle, impacting operational efficiency and service consistency. For instance, in 2024, the broader hospitality and leisure sector, which shares many labor dynamics with car rentals, experienced turnover rates often exceeding 50% annually, a trend mirrored in car rental operations.

These staffing shortages directly affect the ability to manage fleet turnarounds, a critical component of the rental business. When there aren't enough employees to clean, maintain, and reposition vehicles, it can lead to fewer available cars and longer wait times for customers. This operational strain can diminish customer satisfaction and revenue potential.

Avis Budget Group must therefore prioritize robust workforce strategies. This includes investing in better training programs to improve employee retention and skill development, offering competitive compensation and benefits to attract and keep talent, and exploring technology solutions that can automate certain tasks, thereby alleviating some of the pressure on existing staff. For example, implementing advanced fleet management software can streamline vehicle processing, reducing the reliance on manual labor for certain steps.

- High Turnover Rates: The car rental industry, like many service-based sectors, faces significant employee churn, often driven by demanding physical work and variable schedules.

- Staffing Shortages Impact: Lack of adequate staffing directly impedes efficient fleet turnaround, leading to potential revenue loss and decreased customer service.

- Strategic Workforce Investment: Avis Budget Group needs to focus on retention through competitive pay, benefits, and enhanced training to build a reliable and skilled workforce.

- Operational Efficiency Gains: Investing in workforce development and potentially technology can mitigate the impact of shortages and improve overall operational performance.

Societal shifts towards convenience and flexibility are reshaping car rental demand, with younger generations favoring pay-as-you-go models over ownership. This trend is underscored by a 2024 study showing over 60% of urban Gen Z adults view car-sharing as a viable alternative. Avis Budget Group's response includes expanding flexible rental options, which saw a 15% demand increase in 2024.

Environmental consciousness is another key driver, boosting demand for greener vehicle choices. Avis Budget Group is actively expanding its electric and hybrid fleet, aiming for 10% electric vehicles by 2024, aligning with growing consumer preference for sustainable options.

Customer expectations for swift, contactless service are paramount, with digital channels dominating bookings. In 2024, over 70% of Avis bookings were made through digital means, highlighting the necessity for robust online and app-based solutions.

Workforce challenges, particularly high employee turnover, impact operational efficiency and service quality in the car rental sector. The leisure and hospitality sector, mirroring car rental dynamics, saw turnover rates exceeding 50% annually in 2024, directly affecting fleet management and customer experience.

Technological factors

Avis Budget Group is accelerating its integration of electric vehicles (EVs) into its global fleet, a move that signifies a significant shift in the rental car industry. By 2024, the company had already committed to expanding its EV offerings, aiming to have thousands of EVs available across its brands.

These substantial investments extend beyond just acquiring EVs, encompassing the critical development of charging infrastructure at rental locations worldwide. This strategic pivot is driven by both environmental considerations and the evolving demands of consumers who are increasingly seeking sustainable transportation options.

While the transition presents hurdles such as higher upfront EV purchase costs and educating customers on EV usage and charging, Avis is positioning itself for long-term benefits. These include potential reductions in fuel and maintenance expenses, alongside enhanced brand reputation as an environmentally conscious provider. For instance, by the end of 2024, Avis planned to have over 50,000 EVs operational in the US and Europe, a testament to their commitment.

Autonomous vehicle (AV) technology is set to reshape car rentals, boosting safety and efficiency. While widespread adoption in rental fleets is still developing, AVs offer the potential for fewer accidents and smarter fleet operations through constant monitoring.

This technological shift necessitates that Avis Budget Group adapt its operational strategies and invest in employee training to leverage these advanced capabilities. By 2024, AV testing has expanded significantly, with companies like Waymo and Cruise logging millions of miles, indicating a tangible pathway toward integration.

Connected vehicle technology and telematics are increasingly vital for Avis Budget Group's fleet management. These systems offer real-time insights into vehicle location, health, and usage patterns, crucial for efficient operations. For instance, by mid-2024, a significant portion of Avis's fleet is expected to be equipped with advanced telematics, allowing for proactive maintenance scheduling and reducing downtime.

This data-driven approach directly translates to enhanced operational efficiency and customer satisfaction. Predictive maintenance, powered by telematics, can foresee potential mechanical issues, preventing costly breakdowns and ensuring vehicles are available when customers need them. This optimization is projected to contribute to a 5-7% reduction in fleet maintenance costs by the end of 2025.

Digitalization of Rental Processes

The car rental industry is rapidly embracing full digitalization, transforming how customers interact with rental services. Mobile apps and smart rental systems are now central to streamlining operations, making the entire process more efficient.

Avis Budget Group is actively investing in its digital user experience, introducing features that cater to modern convenience. These include the ability to select vehicles remotely, contactless pick-up and drop-off procedures, and the implementation of digital keys, all designed to enhance customer ease.

This digital shift significantly boosts both customer convenience and operational efficiency for Avis Budget Group. By aligning with contemporary consumer expectations for seamless digital interactions, the company is better positioned for success in the evolving market.

Key digital advancements impacting Avis Budget Group include:

- Mobile App Integration: Enhanced functionality for booking, vehicle selection, and account management.

- Contactless Solutions: Streamlined pick-up and drop-off processes reducing wait times and physical touchpoints.

- Digital Keys: Allowing renters to access and start vehicles using their smartphones.

- Data Analytics: Leveraging digital touchpoints to gather insights for personalized offers and improved service delivery.

Adoption of AI and Big Data Analytics

Avis Budget Group is significantly integrating artificial intelligence and big data analytics to refine its operations. These technologies are key to optimizing fleet management, enabling dynamic pricing strategies, and crafting more personalized customer interactions. For instance, AI algorithms help predict maintenance needs, reducing downtime and operational costs, while big data analytics inform real-time pricing adjustments based on demand, seasonality, and competitor pricing, as seen in their ongoing digital transformation initiatives aiming to boost efficiency and customer satisfaction.

The company's strategic investment in these areas is designed to create a more agile and responsive business model. By leveraging AI for predictive maintenance, Avis can proactively address vehicle servicing, ensuring a higher availability of its fleet. Big data analytics allows for granular insights into customer behavior and market trends, facilitating targeted marketing campaigns and service offerings. This data-centric approach is projected to enhance revenue streams through optimized pricing and improved customer loyalty, with digital investments in 2024 and 2025 expected to further accelerate these benefits.

- Fleet Optimization: AI-powered route planning and predictive maintenance reduce operational costs and improve vehicle utilization.

- Dynamic Pricing: Real-time data analysis enables price adjustments to maximize revenue based on demand and market conditions.

- Personalized Customer Experience: Big data analytics helps tailor offers and services to individual customer preferences, enhancing loyalty.

- Operational Efficiency: Streamlined processes through AI and data analytics contribute to better resource allocation and service delivery.

Technological advancements are fundamentally reshaping Avis Budget Group's operations and customer engagement. The company's aggressive rollout of electric vehicles (EVs) and exploration of autonomous vehicle (AV) technology are key strategic priorities, aiming to align with sustainability trends and future mobility solutions.

Connected vehicle technology and advanced telematics are now integral to fleet management, providing real-time data for predictive maintenance and operational efficiency. By mid-2024, a substantial portion of Avis's fleet was equipped with telematics, projecting a 5-7% reduction in maintenance costs by the end of 2025.

Digitalization permeates the customer experience, with enhanced mobile app functionality, contactless services, and digital keys streamlining rental processes. Furthermore, Avis is leveraging AI and big data analytics for dynamic pricing, personalized customer interactions, and optimized fleet management, with significant digital investments planned for 2024-2025 to drive these improvements.

| Technology Area | Key Developments | Impact on Avis Budget Group | Data/Projections |

|---|---|---|---|

| Electric Vehicles (EVs) | Fleet expansion and charging infrastructure development | Sustainability, reduced fuel/maintenance costs, enhanced brand image | Over 50,000 EVs planned by end of 2024 (US/Europe) |

| Autonomous Vehicles (AVs) | Testing and development for potential fleet integration | Increased safety, operational efficiency, reduced accidents | Millions of miles logged in AV testing by industry leaders |

| Connected Vehicles & Telematics | Real-time data for fleet monitoring and maintenance | Proactive maintenance, reduced downtime, operational cost savings | 5-7% reduction in fleet maintenance costs projected by end of 2025 |

| Digitalization & AI/Big Data | Mobile apps, contactless services, digital keys, AI-driven analytics | Enhanced customer experience, dynamic pricing, personalized offers, fleet optimization | Ongoing digital transformation initiatives |

Legal factors

Avis Budget Group operates within a highly regulated transportation sector, facing a patchwork of rules across different countries. These regulations cover everything from stringent vehicle safety standards and emissions controls to operational licensing and regular vehicle inspections. For instance, in the European Union, directives like the General Safety Regulation (GSR) mandate advanced driver-assistance systems in new vehicles, impacting fleet procurement and maintenance costs.

Failure to comply with these diverse transportation laws can result in substantial fines, suspension of operating licenses, and significant reputational damage. In 2023, the US Department of Transportation reported over $5 billion in fines and penalties across various transportation sectors for regulatory non-compliance, highlighting the financial risks involved. Avis Budget Group must therefore maintain a sophisticated legal and compliance infrastructure to navigate these requirements effectively and avoid costly disruptions.

The growing number of connected vehicles presents complex data privacy hurdles for Avis Budget Group. Compliance with regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), alongside emerging state-specific US privacy laws, is crucial. Failure to adhere could result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Avis Budget Group must meticulously manage the collection, storage, usage, and sharing of personal data derived from these connected vehicles. This includes ensuring customer consent and transparency in data handling practices to prevent legal repercussions. The company's approach to data management directly impacts its ability to maintain customer trust and avoid costly litigation.

Avis Budget Group, as a global employer, must meticulously adhere to a patchwork of labor and employment laws in each of its operating regions. This includes ensuring fair wages, safe working conditions, and non-discriminatory practices, all while respecting a wide array of employee rights. For instance, in 2024, the company’s commitment to compliance is tested by varying minimum wage laws and overtime regulations across the US states and international territories where it operates.

The financial implications of legal compliance are significant, encompassing potential fines for violations and the costs associated with robust HR infrastructure. Managing a workforce that, as of early 2025, experiences a notable employee turnover rate, adds another layer of complexity to maintaining consistent legal adherence and managing associated risks.

Vehicle Safety and Product Liability

Avis Budget Group operates within a highly regulated environment concerning vehicle safety. Failure to meet these standards, which are continually updated by bodies like the National Highway Traffic Safety Administration (NHTSA), can result in significant fines and reputational damage. For instance, in 2024, recalls for safety defects across the automotive industry impacted thousands of vehicles, underscoring the constant vigilance required.

Product liability is a critical concern, as the company can be held responsible for accidents caused by vehicle defects or improper maintenance. Managing this risk involves rigorous inspection protocols and robust insurance coverage, especially as the fleet ages or incorporates advanced driver-assistance systems (ADAS). The potential for lawsuits stemming from accidents remains a persistent legal challenge.

The increasing integration of autonomous driving technologies introduces novel legal complexities. Determining liability in the event of an accident involving a vehicle with semi-autonomous features, for example, is an evolving area of law. As of early 2025, regulatory frameworks for fully autonomous vehicles are still being developed globally, creating uncertainty for fleet operators.

- Regulatory Compliance: Adherence to evolving vehicle safety standards set by agencies like NHTSA is a continuous operational requirement.

- Product Liability Exposure: The risk of legal claims arising from vehicle malfunctions or defects necessitates comprehensive risk management strategies.

- Emerging Technologies: The introduction of autonomous and semi-autonomous features presents new legal frontiers in determining fault and ensuring passenger safety.

Anti-Trust and Competition Laws

Avis Budget Group operates in a highly competitive global car rental market, necessitating strict adherence to anti-trust and competition laws. These regulations are designed to prevent monopolistic practices and ensure fair play among industry participants. As the mobility sector evolves with new entrants and innovative service models, regulatory bodies are likely to maintain or even increase their scrutiny of market share consolidation and aggressive competitive tactics.

The potential for increased legal challenges arises as the industry matures and competition intensifies. For instance, in 2024, the European Union's Directorate-General for Competition continues to monitor mergers and acquisitions within various sectors, including transportation and travel services, to safeguard consumer interests and market dynamism. Avis Budget Group's strategic moves, such as fleet acquisitions or partnerships, will be evaluated against these competition frameworks.

- Regulatory Scrutiny: Increased focus on market share and competitive strategies by global competition authorities.

- Compliance Costs: Potential for higher legal and compliance expenses related to anti-trust reviews and potential litigation.

- Market Dynamics: Evolving mobility solutions may trigger new interpretations and applications of existing competition laws.

Avis Budget Group faces significant legal challenges related to data privacy, especially with the rise of connected vehicles. Compliance with regulations like GDPR and CCPA is paramount, with potential fines reaching up to 4% of global annual revenue for breaches. The company must ensure transparent data handling and customer consent to avoid litigation and maintain trust.

The transportation sector is heavily regulated, covering vehicle safety, emissions, and operational licensing. Non-compliance can lead to substantial fines, license suspension, and reputational harm. For example, the US Department of Transportation reported over $5 billion in fines across transportation sectors in 2023 for non-compliance, underscoring the financial risks.

Labor laws and product liability are also critical legal considerations for Avis Budget Group. Adhering to fair wage laws, safe working conditions, and non-discriminatory practices across its global operations is essential. Furthermore, the company must manage product liability risks stemming from vehicle defects or maintenance issues, which can result in costly lawsuits.

The evolving landscape of autonomous driving technologies introduces new legal complexities regarding liability determination. As of early 2025, regulatory frameworks for these advanced systems are still developing, creating an uncertain legal environment for fleet operators.

Environmental factors

Avis Budget Group is actively working towards a 30% reduction in greenhouse gas emissions by 2030, aligning with the broader goal of net-zero emissions by 2050. This commitment necessitates substantial investments in a fleet that increasingly includes fuel-efficient, hybrid, and electric vehicles.

Navigating increasingly stringent emissions regulations, such as the Zero Emission Vehicle (ZEV) Mandate, presents both operational challenges and financial considerations for Avis. For instance, the ZEV mandate in California, a key market, requires manufacturers to sell a certain percentage of zero-emission vehicles, influencing fleet acquisition costs and availability.

Avis Budget Group is actively embedding sustainability into its operations, a key component of its Environmental, Social, and Governance (ESG) framework. This commitment extends beyond just electrifying its fleet, aiming to offer more eco-friendly mobility options.

The company is also focused on reducing its operational footprint by cutting energy and water usage at its locations and improving its waste diversion rates. These efforts underscore a holistic approach to environmental responsibility.

Transparency is a priority, with Avis Budget Group publishing annual ESG reports. These reports detail their progress and future commitments, providing stakeholders with clear insights into their sustainability journey.

The increasing preference for sustainable travel is a significant environmental factor for Avis Budget Group. Consumers are actively seeking out eco-friendly choices, which directly shapes the company's fleet acquisition and how it promotes its services.

In response, Avis Budget Group has been actively expanding its fleet of electric and hybrid vehicles. For instance, by the end of 2024, the company aimed to have a substantial portion of its fleet comprised of these greener options, reflecting a commitment to reducing its carbon footprint and meeting evolving customer expectations.

This strategic shift not only addresses a growing societal concern for environmental responsibility but also positions Avis Budget Group favorably against competitors. By highlighting the environmental benefits of their electric and hybrid offerings, they can capture a larger share of the market driven by eco-conscious travelers.

Waste Management and Resource Efficiency

Avis Budget Group is actively working on enhancing its waste management and resource efficiency. A key objective is to achieve zero waste-to-landfill for certain vehicle components by 2030, which includes the responsible handling of items like tires, windshields, motor oils, and car batteries.

These initiatives are part of a broader environmental strategy. For instance, the company is also focused on reducing its consumption of water and energy within its maintenance facilities, further demonstrating its commitment to environmental responsibility.

In 2023, Avis Budget Group reported progress in its sustainability efforts, with specific metrics often detailed in their annual sustainability reports. While exact figures for waste diversion rates or energy savings in maintenance facilities can fluctuate, the company's stated goals indicate a significant focus on operational improvements. For example, efforts to extend vehicle lifecycles and implement more efficient cleaning processes contribute to resource conservation.

- Zero Waste Goal: Targeting zero waste-to-landfill for specific vehicle components by 2030.

- Resource Focus: Responsible disposal of tires, windshields, motor oils, and car batteries.

- Operational Efficiency: Reducing water and energy consumption in maintenance facilities.

Climate Change Adaptation and Resilience

Beyond direct emissions, Avis Budget Group faces significant environmental factors stemming from climate change. Extreme weather events, such as hurricanes and floods, pose a direct threat to operational continuity and can lead to substantial asset damage, impacting fleet availability and repair costs. For instance, the increasing frequency and intensity of such events globally, as documented by organizations like the IPCC, necessitate robust contingency planning and insurance strategies.

Avis Budget Group's long-term strategy actively addresses these challenges by prioritizing the advancement of low-carbon transportation solutions, including expanding its electric vehicle (EV) fleet. This commitment not only aligns with regulatory pressures but also contributes to community resilience by offering sustainable mobility options. By investing in cleaner technologies and adapting its infrastructure, the company aims to mitigate climate-related risks and foster a more sustainable future for the entire mobility sector.

The company's efforts are underscored by tangible actions and targets:

- Fleet Electrification: Avis Budget Group has set ambitious goals for EV adoption, aiming for a significant portion of its fleet to be electric by 2030. In 2024, the company continued to expand its EV offerings across key markets, responding to growing customer demand for sustainable rental options.

- Operational Resilience: Investments are being made in climate-resilient infrastructure at key rental locations, particularly in areas prone to severe weather. This includes flood defenses and backup power solutions to ensure service continuity.

- Supply Chain Adaptation: The company is working with suppliers to assess and adapt to climate-related supply chain disruptions, ensuring a stable flow of vehicles and parts.

- Community Engagement: Avis Budget Group participates in initiatives that promote climate adaptation and resilience within the communities it serves, supporting local sustainability efforts.

Environmental factors significantly influence Avis Budget Group's strategy, particularly concerning emissions reduction and fleet composition. The company is committed to reducing greenhouse gas emissions by 30% by 2030 and achieving net-zero by 2050, driving substantial investment in electric and hybrid vehicles.

Stringent regulations, such as California's ZEV Mandate, directly impact fleet acquisition costs and availability, pushing Avis to adapt its procurement strategies. Consumer preference for sustainable travel is also a key driver, compelling Avis to expand its eco-friendly rental options and highlight their environmental benefits to attract environmentally conscious customers.

Avis is also focused on operational sustainability, aiming for zero waste-to-landfill for specific vehicle components by 2030 and reducing water and energy usage in its facilities. Climate change itself presents risks, with extreme weather events necessitating robust contingency planning and investments in climate-resilient infrastructure.

| Environmental Focus | Target/Action | Year | Status/Notes |

|---|---|---|---|

| Greenhouse Gas Emissions Reduction | 30% reduction | 2030 | Ongoing progress |

| Fleet Electrification | Significant portion of fleet to be electric | 2030 | Expansion of EV offerings in 2024 |

| Zero Waste to Landfill | Specific vehicle components | 2030 | Responsible handling of tires, batteries, etc. |

| Operational Energy Consumption | Reduction in maintenance facilities | Ongoing | Focus on resource efficiency |

PESTLE Analysis Data Sources

Our PESTLE analysis for Avis Budget Group is built upon a robust foundation of data, drawing from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the car rental industry.