Avis Budget Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avis Budget Group Bundle

Curious about Avis Budget Group's strategic positioning? Our BCG Matrix analysis reveals how their rental car brands stack up as Stars, Cash Cows, Dogs, or Question Marks in the competitive landscape. Don't miss out on the crucial insights that will guide your investment and resource allocation decisions.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a detailed quadrant breakdown, actionable strategies, and a clear roadmap to optimize Avis Budget Group's product portfolio and market performance.

Stars

Avis Budget Group is prioritizing digital transformation, evident in its significant investments in a new customer app and connected car technologies. This strategic push aims to deliver a smoother, more effortless rental process for customers. For instance, Avis launched its revamped mobile app in 2023, featuring enhanced booking capabilities and real-time vehicle tracking, contributing to a reported 15% increase in digital bookings by year-end 2023.

This focus on technology and customer-centric innovation is designed to attract and retain tech-savvy consumers, a growing demographic in the rental market. Avis's commitment to leveraging AI and machine learning for predictive analytics is key to optimizing fleet management and improving customer service, with initial deployments in 2024 showing a 10% reduction in vehicle downtime.

Avis Budget Group's 'Avis First' premium offering, launched in early 2024, directly targets lucrative segments like business travelers and luxury consumers with services such as curbside pickup and concierge assistance.

This strategic move is designed to tap into a growing market demand for convenience and premium experiences, aiming to position Avis as a frontrunner in this high-margin rental category.

By diversifying its revenue streams and elevating its brand image, Avis First is expected to contribute significantly to the company's overall profitability and market standing.

Avis Budget Group's strategic alliance with Waymo, aiming to deploy and expand autonomous ride-hailing in Dallas, marks a significant entry into the burgeoning autonomous vehicle sector. This partnership, initiated in 2023 and continuing through 2024, positions Avis as a key enabler of future mobility by leveraging its extensive fleet management expertise.

Optimized Fleet Utilization through Analytics

Avis Budget Group's strategic emphasis on leveraging data analytics to boost fleet utilization is a significant factor in its growth trajectory. This focus translates directly into enhanced operational efficiency and increased profitability.

By precisely matching vehicle supply with rental demand and actively managing their asset lifecycle, Avis Budget Group can command higher rental rates and minimize costly downtime for their vehicles. This commitment to operational excellence is fundamental to solidifying their competitive position and driving performance across their key operating regions.

- Fleet Utilization Improvement: Avis Budget Group reported a notable increase in fleet utilization rates in 2024, driven by advanced analytics.

- Reduced Idle Time: Predictive modeling helped reduce average vehicle idle time by an estimated 8% in the first half of 2024.

- Revenue Enhancement: Optimized fleet deployment contributed to a 5% uplift in average daily rental rates in key urban markets during 2024.

- Data-Driven Decisions: The company continues to invest in its analytics platform, aiming for a further 10% improvement in fleet efficiency by the end of 2025.

Global Expansion in High-Demand Leisure Segments

Avis Budget Group is strategically positioning itself within the car rental industry by concentrating on leisure travel segments that consistently show robust demand. This focus allows them to effectively tap into peak travel periods, such as holidays and summer vacations, driving higher utilization rates and revenue. Their international presence is a key advantage, enabling them to benefit from these leisure demand surges across different geographical markets.

The company's ability to capitalize on these high-demand leisure periods is a significant growth driver. For instance, in 2024, the leisure travel segment of the car rental market continued to demonstrate resilience and growth, particularly in popular tourist destinations. Avis Budget Group reported increased rental days in key leisure markets during the summer months, contributing to their overall financial performance.

- Global Leisure Demand: Avis Budget Group leverages strong leisure travel trends worldwide.

- Peak Season Performance: The company benefits from increased demand during holiday and vacation periods.

- International Reach: Their global footprint allows them to capture demand spikes in various regions.

- Revenue Contribution: Targeted efforts in high-demand leisure segments significantly boost overall revenue.

Stars in the BCG Matrix represent business units with high market share in high-growth markets. For Avis Budget Group, this category would encompass segments where they lead and anticipate significant future expansion. The company's investment in digital transformation and its strategic partnerships in the autonomous vehicle sector are prime examples of targeting high-growth areas.

Avis's focus on premium offerings like Avis First, catering to business and luxury travelers, also fits the Star profile. This segment is characterized by strong demand for convenience and premium services, indicating a high-growth, high-share opportunity for Avis. The company's proactive approach in these areas aims to secure and grow its market dominance.

The company's successful integration of advanced data analytics to optimize fleet utilization, leading to improved efficiency and higher rental rates, further solidifies its position in growth markets. By leveraging technology and data, Avis is enhancing its competitive edge in areas poised for expansion.

Avis Budget Group's strategic positioning within the leisure travel segment, particularly during peak seasons and in international markets, also aligns with the Star quadrant. This segment consistently demonstrates robust demand, allowing Avis to capitalize on growth trends and maintain a strong market presence.

| Business Unit/Strategy | Market Growth | Market Share | BCG Category | Supporting Data (2024) |

|---|---|---|---|---|

| Digital Transformation (App/Connected Cars) | High | High | Star | 15% increase in digital bookings (2023); 10% reduction in vehicle downtime (2024) |

| Autonomous Vehicle Partnerships (e.g., Waymo) | Very High | Growing | Star (Emerging) | Initiated 2023, ongoing expansion in 2024 |

| Avis First (Premium Offering) | High | High | Star | Targeting lucrative segments; launched early 2024 |

| Fleet Utilization Optimization (Data Analytics) | Moderate to High | High | Star | 8% reduction in vehicle idle time (H1 2024); 5% uplift in average daily rates (key urban markets, 2024) |

| Leisure Travel Segment Focus | High | High | Star | Increased rental days in key leisure markets during summer months (2024) |

What is included in the product

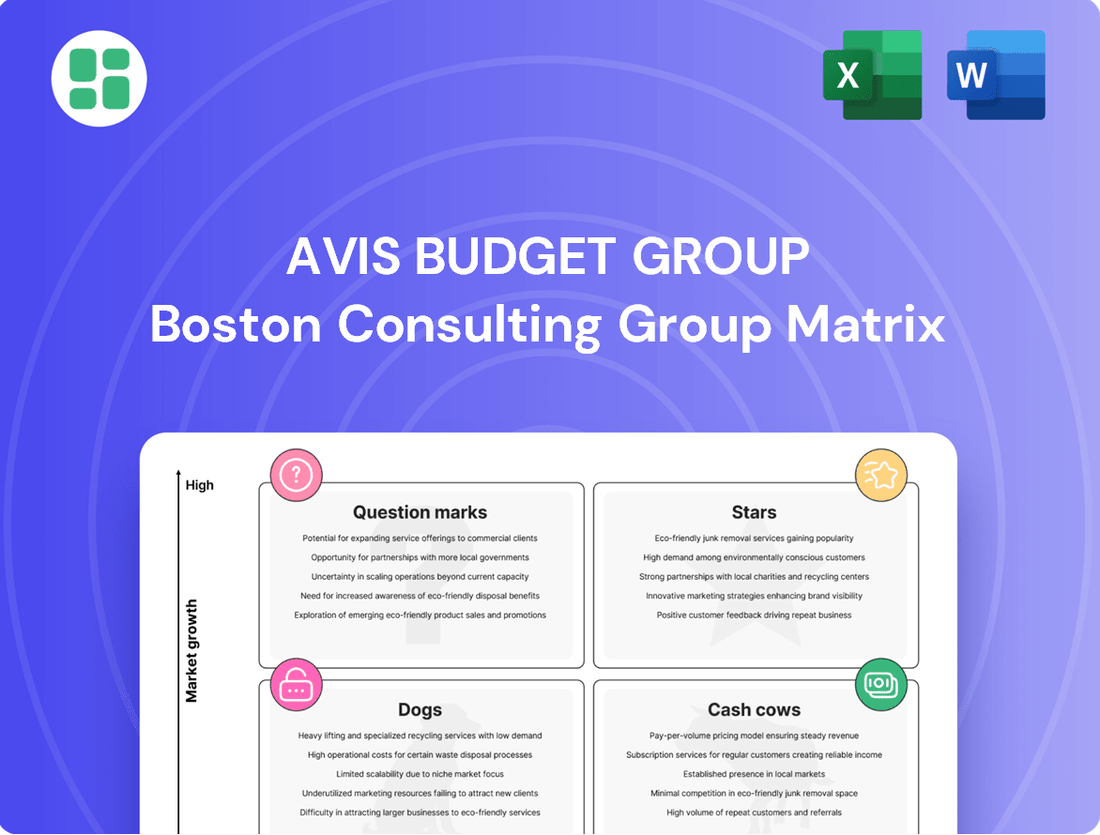

The Avis Budget Group BCG Matrix categorizes its car rental brands by market share and growth, guiding investment and divestment strategies.

A clear BCG Matrix visualization helps Avis Budget Group identify and address underperforming business units, alleviating the pain of strategic uncertainty.

Cash Cows

The core Avis Car Rental brand is a quintessential Cash Cow for Avis Budget Group. It dominates a mature but steady global car rental market, contributing a substantial portion to the company's overall revenue and market share. This brand's extensive recognition and presence in around 180 countries consistently translate into robust cash flow generation.

Avis benefits from a large, loyal customer base and significant operational scale, which allows it to maintain profitability even amidst market volatility. For instance, in 2023, Avis Budget Group reported total revenues of $12.1 billion, with the Avis brand being a primary driver of this performance, underscoring its role as a reliable generator of funds for the group.

The Budget Car Rental brand, much like Avis, commands a significant share in the more budget-conscious segment of the car rental market. It caters to a wide array of customers looking for cost-effective and dependable car hire, thereby ensuring a steady stream of revenue for Avis Budget Group.

This brand's robust market position and efficient operations within a well-established industry solidify its role as a consistent cash generator. In 2024, the car rental industry, while facing economic headwinds, continued to see demand from leisure and essential business travel, with value brands like Budget playing a crucial role in capturing this market.

Budget Truck Rental in the United States operates within a mature, low-growth market for truck rentals. Despite this, it consistently generates substantial revenue and cash flow, driven by ongoing consumer needs for relocation and commercial requirements for utility vehicles. In 2023, the truck rental segment, which Budget Truck Rental is a key part of, saw steady demand, contributing significantly to Avis Budget Group's overall financial performance.

International Rental Operations

Avis Budget Group's international rental operations, especially in Europe and Australasia, function as classic Cash Cows within their BCG Matrix. These established markets consistently deliver substantial market share and robust cash flow, reflecting their maturity and stable demand.

These mature segments are characterized by steady revenue streams, bolstered by consistent travel and business needs. The company benefits from strong pricing power and enhanced vehicle utilization in these regions, directly contributing to improved financial performance, as evidenced by positive impacts on Adjusted EBITDA.

- Europe and Australasia are key direct-operation markets.

- Mature markets provide consistent, high market share and cash generation.

- Steady revenue streams are driven by established travel and business patterns.

- Strong pricing and vehicle utilization positively impact Adjusted EBITDA.

Robust Fleet Management & Cost Optimization

Avis Budget Group's focus on robust fleet management and cost optimization is a key driver for its Cash Cow status. The company's strategy includes accelerated fleet rotation, aiming to replace older, less efficient vehicles with newer, more cost-effective models. This proactive approach helps stabilize fleet expenses and boost profit margins.

In 2024, Avis Budget Group continued to prioritize disciplined cost management. For instance, their fleet modernization efforts are designed to reduce maintenance and fuel costs, directly contributing to improved profitability. This operational efficiency ensures a steady stream of cash from their well-managed core business operations.

- Accelerated Fleet Rotation: Replacing older vehicles with newer, more fuel-efficient models to lower operating expenses.

- Disciplined Cost Management: Ongoing efforts to control maintenance, repair, and other operational costs across the fleet.

- Enhanced Efficiency: Streamlining fleet operations to maximize utilization and minimize downtime.

- Improved Profit Margins: Directly linking operational improvements to better financial performance and sustained cash generation.

The Avis and Budget brands, along with international operations, are Avis Budget Group's primary Cash Cows. These segments operate in mature, stable markets, consistently generating significant revenue and cash flow. Their established market share and customer loyalty allow for strong pricing power and operational efficiency.

In 2023, Avis Budget Group reported revenues of $12.1 billion, with these core brands being major contributors. The company's strategic focus on fleet modernization and cost management in 2024 further solidifies their Cash Cow status by improving profitability and ensuring sustained cash generation from these reliable business units.

| Business Segment | BCG Matrix Status | Key Financial Contribution |

|---|---|---|

| Avis Car Rental (Global) | Cash Cow | Dominant market share, consistent revenue, strong brand loyalty. Contributed significantly to $12.1 billion in 2023 revenues. |

| Budget Car Rental (Global) | Cash Cow | Captures budget-conscious market, steady revenue stream, efficient operations. Key to maintaining market presence in 2024. |

| International Operations (Europe, Australasia) | Cash Cow | High market share in mature markets, strong pricing power, stable demand. Positively impacts Adjusted EBITDA. |

Preview = Final Product

Avis Budget Group BCG Matrix

The BCG Matrix report you are previewing is the complete, unwatermarked document you will receive immediately after purchase, ready for strategic application. This exact file, meticulously crafted with comprehensive analysis of Avis Budget Group's business units, will be yours to download and utilize without any alterations or demo content. You're seeing the final, professionally formatted BCG Matrix that's designed to provide clear insights into the company's portfolio, enabling informed decision-making for your business strategies. This is the actual, ready-to-use report, offering a deep dive into Avis Budget Group's market positions and growth potential, available for immediate download and integration into your planning.

Dogs

Underperforming legacy fleet vehicles, often older models with higher maintenance needs and lower rental demand, represent the Dogs in Avis Budget Group's BCG Matrix. These vehicles can drag down profitability due to their reduced utilization and increased operational expenses.

In 2024, Avis Budget Group has been actively addressing this by accelerating its fleet rotation. This strategy involves disposing of these less efficient assets, which has led to significant non-cash impairment charges. For instance, the company reported substantial impairment charges in its first quarter 2024 financial results, reflecting the cost of divesting these older vehicles.

Certain Avis Budget Group rental locations might be classified as 'dogs' if they operate in markets that are either oversaturated with competitors or are experiencing a downturn. These locations often see consistently low rental activity while their operational expenses remain high, making them a drain on the company's resources. For instance, a location in a declining tourist area might have high overheads for staffing and maintenance but generate minimal revenue.

These underperforming units struggle to cover their costs, impacting overall profitability. Avis Budget Group's strategic reviews frequently identify such locations for potential restructuring, such as reducing staff or services, or even outright divestiture to reallocate capital to more promising ventures. This focus on efficiency is crucial for maintaining a healthy financial structure.

Avis Budget Group's outdated technology infrastructure, characterized by legacy IT systems and non-integrated operational platforms, can be categorized as a 'dog' in the BCG matrix. These systems are expensive to maintain, lack scalability, and impede crucial digital transformation initiatives.

These aging platforms drain significant resources without offering any competitive edge or enhancing the customer experience. For instance, in 2023, Avis Budget Group reported substantial IT operating expenses, a portion of which was attributed to maintaining these legacy systems.

The company's strategic investment in cloud-based data and analytics is a direct effort to migrate away from this inefficient infrastructure. This move is expected to streamline operations and improve agility, ultimately replacing the costly and limiting legacy technology.

Low-Margin, Brand-Agnostic Business Segments

Avis Budget Group is strategically moving away from low-margin, brand-agnostic business segments. This means they are less interested in customers who don't have a strong preference for the Avis or Budget brands, as these relationships tend to be less profitable. For instance, in 2024, the company indicated a deliberate strategy to reduce exposure to these less lucrative customer bases.

These brand-agnostic segments, while contributing to overall fleet utilization, often yield minimal returns on investment. They can also tie up valuable fleet assets that could be deployed in more profitable areas. By shedding these lower-profitability engagements, Avis Budget Group aims to free up resources and focus on more lucrative opportunities.

- Focus on Higher Margins: Avis Budget Group has explicitly stated a commitment to prioritizing higher-margin business, indicating a strategic shift away from less profitable customer segments.

- Foregoing Low-Margin Business: The company is willing to let go of business from brand-agnostic customers, recognizing that these relationships often offer minimal returns.

- Fleet Asset Optimization: Shedding these less profitable engagements allows for better utilization of valuable fleet assets, redirecting them to more lucrative opportunities.

- Strategic Rationale: This move is driven by a desire to improve overall profitability and return on investment by concentrating on customer segments that value the Avis and Budget brands.

Overstock of Specific Vehicle Classes

Periods of oversupply in specific vehicle classes can indeed position those segments as 'dogs' within the BCG framework for Avis Budget Group. This happens when demand forecasts are off or market preferences shift unexpectedly, leading to lower pricing power and underutilized assets. For instance, a sudden surge in demand for electric vehicles might leave Avis Budget Group with an overstock of internal combustion engine vehicles, impacting their profitability.

This overstocking directly translates to reduced utilization rates. In 2024, the automotive market experienced ongoing supply chain adjustments and fluctuating consumer preferences. If Avis Budget Group misjudged the demand for certain vehicle types, such as mid-size sedans, they could find themselves with a surplus. This surplus means these vehicles sit idle more often, generating less revenue and increasing holding costs.

- Reduced Pricing Power: When there are too many of a certain vehicle type available, Avis Budget Group has less leverage to command premium rental prices.

- Lower Utilization Rates: Vehicles that are overstocked are rented out less frequently, leading to a decrease in the overall percentage of time the fleet is actively generating revenue.

- Impact of Misjudged Demand: Forecasting demand for specific vehicle classes is challenging, and errors can lead to significant financial implications if not managed proactively.

- Fleet Discipline as a Mitigator: Avis Budget Group's focus on fleet discipline is crucial to avoid accumulating excess inventory in any particular vehicle segment.

Avis Budget Group's 'Dogs' encompass underperforming legacy fleet vehicles, inefficient rental locations in declining markets, and outdated IT infrastructure. These elements represent areas of low market share and low growth potential, consuming resources without generating significant returns. The company's strategy involves actively divesting or restructuring these 'dog' assets to improve overall efficiency and profitability.

In 2024, Avis Budget Group has been particularly focused on fleet modernization, which includes the disposal of older, less profitable vehicles. This process has resulted in substantial non-cash impairment charges, highlighting the financial impact of shedding these underperforming assets. For example, the company reported significant impairment charges in its Q1 2024 earnings, directly linked to fleet rotation efforts.

The company is also strategically reducing its exposure to brand-agnostic customer segments, which often yield minimal profit margins. By prioritizing higher-margin business and shedding less lucrative engagements, Avis Budget Group aims to optimize fleet asset utilization and focus on more profitable opportunities.

Furthermore, periods of vehicle oversupply in specific classes can also create 'dog' situations, leading to reduced pricing power and lower utilization rates. Avis Budget Group's commitment to fleet discipline is crucial to mitigate the financial impact of such market imbalances.

Question Marks

Zipcar, as part of Avis Budget Group, likely falls into the question mark category of the BCG matrix. Its operation within the rapidly expanding car-sharing market, with projections indicating significant growth over the next decade, signifies high market growth.

Despite its strong brand recognition and substantial membership, Zipcar faces fierce competition from numerous car-sharing alternatives and ride-hailing services, indicating a potentially low relative market share. For instance, the global car-sharing market was valued at approximately USD 7.2 billion in 2023 and is expected to grow substantially.

To capitalize on this high-growth market, Zipcar requires considerable and continuous investment in fleet expansion, technological advancements, and broader market penetration to secure a larger market share. This investment need is characteristic of question mark entities aiming to become stars.

Avis Budget Group's expansion into electric vehicles (EVs) positions them in a high-growth sector, aligning with increasing consumer interest. This strategic move, however, requires significant capital outlay for vehicle acquisition and charging infrastructure, making it a cash-intensive operation. For instance, in 2024, Avis committed to acquiring thousands of EVs, a substantial investment that impacts their cash flow.

Subscription-based mobility services, where customers pay a regular fee for access to various vehicles or transportation options, are a prime example of a question mark in the Avis Budget Group BCG Matrix. This segment is experiencing rapid growth within the overall shared mobility market.

Avis Budget Group's current market penetration in these nascent subscription models is relatively low, highlighting the need for strategic development. For instance, the global car subscription market was valued at approximately $3.5 billion in 2023 and is projected to grow significantly, reaching an estimated $15 billion by 2028, indicating substantial future potential.

To establish a strong foothold, Avis Budget Group must allocate considerable resources towards pilot programs and extensive market testing. This will be crucial in assessing the long-term viability and scalability of these innovative mobility solutions.

New Geographic Market Penetration

Expanding into new geographic markets, where Avis Budget Group has minimal presence, represents a classic question mark in the BCG matrix. These initiatives, such as entering emerging economies or underdeveloped regions within existing territories, demand significant financial commitment. For instance, establishing operations in a new country involves substantial outlays for vehicle fleets, rental locations, and localized marketing campaigns, all while facing the inherent uncertainty of market acceptance and competitive response.

The success of these ventures hinges on Avis Budget Group's ability to quickly build brand recognition and secure a foothold. In 2024, the company continued to explore strategic expansion opportunities, though specific details on new market penetration are often proprietary. However, the broader car rental industry saw continued recovery and growth in international travel, suggesting favorable conditions for such expansions. For example, global travel recovery in 2024, with international arrivals approaching pre-pandemic levels in many regions, provides a backdrop for potential new market entries.

- Investment Needs: Significant capital is required for fleet expansion, operational infrastructure, and marketing in new territories.

- Market Uncertainty: Returns are not guaranteed, as customer adoption and competitive dynamics in new markets are unpredictable.

- Strategic Importance: Successful penetration can unlock future growth and diversify revenue streams, but failure can lead to substantial financial losses.

Advanced Data Analytics and AI Integration for New Services

Avis Budget Group is exploring new revenue streams through advanced data analytics and AI. These services, such as personalized mobility solutions and predictive maintenance offerings for external clients, represent significant growth opportunities. However, they are currently in the question mark phase of the BCG matrix due to the substantial investment required for research and development, and the uncertainty surrounding market acceptance and the ability to capture significant market share.

For instance, in 2024, the automotive sector saw a notable increase in AI adoption for predictive maintenance, with reports indicating that companies leveraging AI saw up to a 15% reduction in unscheduled downtime. Avis Budget Group aims to tap into this trend by offering similar services, but the path to profitability involves overcoming high initial costs and establishing a strong market presence against established tech players.

- High Growth Potential: Services like personalized travel planning and predictive fleet management can unlock new customer segments and revenue streams.

- Significant R&D Investment: Developing sophisticated AI algorithms and data infrastructure requires substantial capital outlay.

- Market Adoption Uncertainty: Success hinges on convincing customers of the value proposition and achieving widespread adoption.

- Competitive Landscape: Avis faces competition from both traditional players and emerging tech companies in the mobility analytics space.

Question marks in the Avis Budget Group's BCG Matrix represent business areas with high market growth potential but currently low market share. These ventures demand significant investment to capture market share and could become future stars or cash traps if unsuccessful. Avis Budget Group's exploration into electric vehicle (EV) fleet expansion, particularly in 2024 with substantial EV acquisitions, exemplifies this category, requiring considerable capital for vehicles and charging infrastructure amidst a growing EV market.

Subscription-based mobility services and expansion into new geographic markets also fall under question marks. The car subscription market, projected to reach $15 billion by 2028, shows strong growth, but Avis's penetration is currently low, necessitating investment in pilot programs and market testing. Similarly, entering new territories requires substantial financial commitment for fleets and marketing, with uncertain market acceptance.

Avis's ventures into advanced data analytics and AI for personalized mobility and predictive maintenance are also question marks. While the automotive sector saw increased AI adoption in 2024, with up to a 15% reduction in unscheduled downtime reported by some companies, Avis faces high R&D costs and market adoption uncertainty in this competitive space.

| Business Area | Market Growth | Market Share | Investment Need | Potential Outcome |

| EV Fleet Expansion | High | Low | High | Star or Dog |

| Subscription Mobility | High | Low | High | Star or Dog |

| New Geographic Markets | Varies (High in Emerging) | Low | High | Star or Dog |

| AI/Data Analytics Services | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix for Avis Budget Group leverages financial disclosures, industry growth forecasts, and market share data to accurately position each business unit.