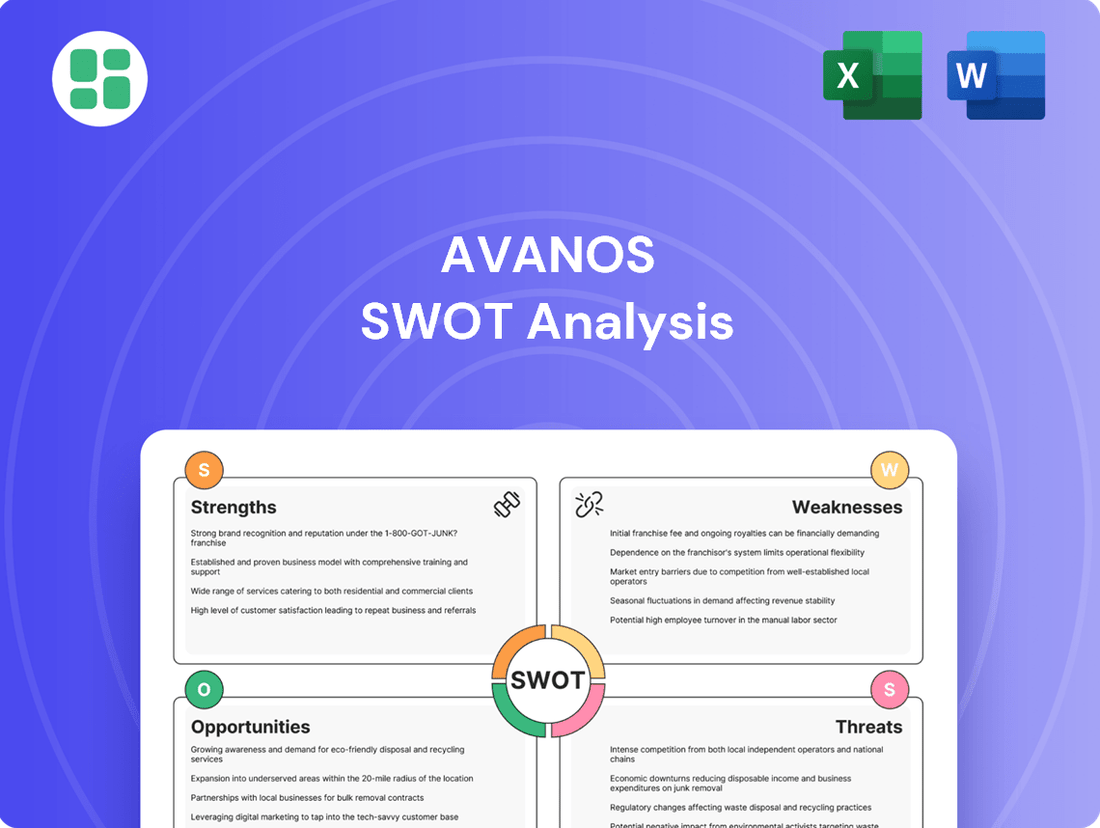

Avanos SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avanos Bundle

Avanos's market position is defined by its strong brand recognition and innovative product pipeline, but it faces challenges from intense competition and evolving industry regulations.

Want to fully understand Avanos's strategic advantages and potential pitfalls? Purchase the complete SWOT analysis to unlock detailed insights, actionable strategies, and a clear roadmap for navigating the competitive landscape.

Strengths

Avanos Medical's strength lies in its clinically superior products and a well-differentiated portfolio, particularly in pain management and digestive health. These specialized offerings are designed to improve patient outcomes and recovery times, addressing critical healthcare needs.

The company boasts globally recognized brands that underscore its commitment to innovation. For instance, their offerings in chronic pain management, like the COOLIEF* Cooled Radiofrequency System, have shown significant efficacy in clinical studies, contributing to their market position.

Avanos's focus on areas such as respiratory health, with products like their respiratory care solutions, further strengthens their specialized approach. This targeted strategy allows them to develop and market products that provide distinct advantages over competitors.

Avanos' Specialty Nutrition Systems (SNS) segment stands out as a significant strength, consistently exhibiting robust demand and impressive volume growth. This performance is particularly evident in their enteral feeding and neonate solutions, which have outperformed the market in recent quarters. For instance, in Q1 2024, the company reported a 7% increase in revenue for the SNS segment, driven by strong volume in their enteral feeding products.

Avanos has demonstrated strong financial discipline through effective cost management, notably reducing operating expenses. This focus on efficiency has directly contributed to a healthier financial picture.

The company's free cash flow generation has seen significant improvement, with robust performance in 2024 and continued positive cash flow in the first quarter of 2025. This trend highlights enhanced operational efficiency and a stronger ability to generate cash.

Strategic Transformation Initiatives Underway

Avanos is in the crucial final year of its three-year strategic transformation, a process initiated in 2023 and set to conclude in 2025. This comprehensive plan is geared towards refining its product offerings and boosting operational profit margins.

The core of this strategic shift involves shedding underperforming product lines, specifically those characterized by lower margins or sluggish growth. By divesting these segments, Avanos can sharpen its focus on areas with demonstrably higher return potential.

These strategic maneuvers are designed to foster greater transparency across the business. This enhanced clarity is intended to facilitate more informed and efficient internal capital allocation decisions, ultimately driving better financial outcomes.

- Strategic Realignment: Avanos is executing a three-year transformation (2023-2025) to optimize its product portfolio and enhance operating profitability.

- Divestment Strategy: The company is divesting from low-margin or low-growth product categories to concentrate on high-return segments.

- Improved Capital Allocation: Initiatives aim to increase transparency and guide internal capital allocation more effectively.

New Leadership with Extensive Industry Experience

Avanos has appointed Dave Pacitti as its new CEO, a move expected to invigorate the company's strategic direction. Pacitti brings a wealth of commercial expertise and deep industry knowledge, honed through years of experience in the healthcare sector.

This leadership transition is seen as a significant catalyst for advancing Avanos' key priorities and identifying untapped growth avenues. Pacitti's proven track record suggests a strong potential to drive transformation and enhance performance across the organization.

- New CEO Dave Pacitti possesses extensive commercial and industry experience.

- Leadership change expected to accelerate strategic initiatives.

- Pacitti's background is anticipated to unlock new growth opportunities.

- Focus on driving transformation and enhancing organizational performance.

Avanos's strength is rooted in its clinically superior, differentiated product portfolio, particularly in pain management and digestive health, which improves patient outcomes. Their globally recognized brands, like the COOLIEF* Cooled Radiofrequency System, highlight their innovative edge in chronic pain management, supported by strong clinical efficacy. The Specialty Nutrition Systems (SNS) segment is a major contributor, consistently showing robust demand and volume growth, with Q1 2024 revenue up 7% driven by enteral feeding products.

| Segment | Q1 2024 Revenue Growth | Key Products |

|---|---|---|

| Specialty Nutrition Systems (SNS) | 7% | Enteral feeding, neonate solutions |

| Pain Management | N/A | COOLIEF* Cooled Radiofrequency System |

| Digestive Health | N/A | Specialized offerings |

What is included in the product

Delivers a strategic overview of Avanos’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses and threats.

Weaknesses

Avanos has faced significant financial headwinds, reporting substantial net losses for its full-year 2024 results, with the trend continuing into the second quarter of 2025. These considerable losses are largely a consequence of substantial non-cash goodwill and intangible asset impairment charges.

These impairment charges, totaling a significant portion of their reported earnings, indicate a downward adjustment in the perceived value of certain company assets. Such re-evaluations directly impact the company's bottom line, creating a negative impression on investors and potentially affecting future financing capabilities.

Avanos has experienced significant pricing pressures, particularly impacting its Hyaluronic Acid (HA) offerings. This trend extends to certain surgical pain and recovery products as well, creating a challenging environment for revenue generation.

These unfavorable pricing dynamics have directly contributed to a noticeable contraction in the company's gross margins. For instance, in the first quarter of 2024, the gross margin for the company stood at 58.3%, a decrease from 61.4% in the prior year period, reflecting these pricing headwinds.

Such persistent pricing challenges can significantly erode overall profitability, even when the company actively works to refine and optimize its product portfolio. This makes maintaining healthy profit margins a constant battle.

The Pain Management & Recovery (PM&R) segment at Avanos presents a mixed picture. While its radiofrequency ablation (RFA) offerings are performing well, the surgical pain and recovery products have seen reduced sales volumes and inconsistent demand throughout 2024.

This underperformance is further impacted by negative currency fluctuations and deliberate strategic decisions to reduce revenue in certain areas, creating challenges for predictable growth in this crucial segment. The company is working to navigate these headwinds, but a clear path to sustained improvement in surgical pain and recovery remains a key focus for 2025.

Impact of Tariffs on Profitability

Avanos anticipates substantial additional expenses in 2025 stemming from tariffs, especially on products imported from China. These tariff-related cost increases have prompted the company to lower its adjusted earnings per share projections.

- Tariff Impact: Avanos expects significant incremental costs in 2025 due to tariffs on goods sourced from China.

- Revised Guidance: The company has revised its adjusted earnings per share guidance downward as a result of these tariff impacts.

- Financial Challenge: Effectively managing and mitigating these tariff-related pressures presents a critical challenge to Avanos's financial performance and outlook.

Operational Complexities from Transformation and Divestitures

Avanos's ongoing three-year transformation, involving strategic divestitures and product line exits, while aimed at long-term benefits, currently creates significant operational hurdles. This transitional phase, acknowledged by the company as leading to uneven performance, demands careful navigation to avoid disruptions.

The complexity of executing these large-scale changes presents a key weakness. Successfully managing the integration of divested assets and the rationalization of product lines without impacting ongoing business operations is a considerable challenge for the company.

- Ongoing Transformation: The multi-year process of divesting non-core assets and exiting certain product lines introduces inherent operational complexities.

- Uneven Performance: Management has cited 'uneven performance' as a direct result of these transitional activities, indicating challenges in maintaining consistent operational momentum.

- Execution Risk: The successful execution of these substantial strategic shifts without significant disruption to day-to-day business remains a critical area of focus and potential vulnerability.

Avanos's financial health has been significantly impacted by substantial net losses, exacerbated by considerable goodwill and intangible asset impairment charges throughout 2024 and into the first half of 2025. This indicates a revaluation of assets, negatively affecting investor perception and potential future financing.

Pricing pressures, particularly on Hyaluronic Acid (HA) and certain surgical pain products, have led to a notable decline in gross margins. For example, the Q1 2024 gross margin dropped to 58.3% from 61.4% year-over-year, making sustained profitability a constant challenge despite portfolio optimization efforts.

The Pain Management & Recovery segment faces headwinds from reduced sales volumes and inconsistent demand in surgical pain and recovery products, further compounded by negative currency fluctuations and strategic revenue reductions in specific areas, hindering predictable growth for 2025.

Anticipated tariff increases on products imported from China in 2025 are projected to drive significant additional expenses, prompting a downward revision of adjusted earnings per share guidance, posing a direct financial challenge.

Avanos's ongoing three-year transformation, involving divestitures and product line exits, creates operational complexities and has resulted in management-cited uneven performance, highlighting execution risks during this transitional phase.

| Financial Metric | 2024 (Full Year) | Q1 2025 (Projected/Actual) | Key Impact |

|---|---|---|---|

| Net Loss | Substantial | Continuing Trend | Goodwill/Intangible Asset Impairments |

| Gross Margin | 58.3% (Q1 2024) | Declining Trend | Pricing Pressures (HA, Surgical Pain) |

| Adjusted EPS Guidance | Revised Downward | Impacted by Tariffs | Tariffs on China Imports |

Full Version Awaits

Avanos SWOT Analysis

The preview you see is the actual Avanos SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of Avanos's strategic position. Unlock the full, in-depth analysis by completing your purchase.

Opportunities

The market for non-opioid pain management is expanding rapidly, presenting a substantial opportunity for companies like Avanos. This growth is fueled by a societal shift away from opioid reliance and increasing patient demand for safer alternatives.

Legislation such as the NOPAIN Act directly supports this trend by enhancing reimbursement for non-opioid pain solutions. This policy change is expected to boost the adoption of products like Avanos' ON-Q and ambIT infusion pumps, aligning with the company's strategic focus on opioid reduction and improved patient recovery pathways.

The Specialty Nutrition Systems (SNS) segment, featuring key products such as NeoMed neonatal and pediatric feeding solutions, is showing robust demand and increasing market share. This presents a continued opportunity for Avanos to deepen its presence in these critical and expanding sectors.

Avanos can leverage its strong position in neonatal and pediatric feeding to capture further market share. For instance, in 2023, the SNS segment was a significant contributor to Avanos's overall revenue, underscoring the growth potential within these specialized markets.

Continued investment in product innovation and a focused strategy within the enteral feeding and neonatal markets are poised to be significant growth drivers for Avanos in the coming years.

Avanos is actively seeking strategic mergers and acquisitions that meet its stringent return on investment benchmarks, signaling a deliberate strategy for growth. This proactive stance aims to enhance its product offerings, integrate novel technologies, and penetrate new market segments. For instance, in 2023, Avanos completed the acquisition of Theragenics Corporation for $135 million, a move expected to bolster its urology portfolio.

Successful integration of acquired entities can significantly accelerate Avanos's expansion, diversify its revenue generation, and solidify its competitive standing in the healthcare sector. The company's disciplined approach to M&A suggests a focus on targets that offer clear synergies and a strong potential for value creation, critical for navigating the dynamic medical device landscape.

Innovation and New Product Development

Avanos shows a strong commitment to innovation, aiming to develop next-generation healthcare solutions. This focus on research and development for clinically superior products creates significant opportunities for launching novel products and accessing untapped market segments. For instance, the company's investment in R&D, which saw an increase in their 2024 fiscal year, directly fuels this pipeline of innovation.

These advancements are strategically designed to enhance patient outcomes and accelerate recovery times, a key driver for market adoption. By prioritizing these improvements, Avanos can differentiate its offerings and capture market share in a competitive landscape. The company's pipeline includes several promising developments in areas like pain management and wound care, expected to contribute to revenue growth in the coming years.

Key opportunities stemming from this innovation drive include:

- Launching next-generation medical devices that offer improved patient care and clinical efficacy.

- Penetrating new market niches by addressing unmet clinical needs with specialized solutions.

- Enhancing competitive positioning through a portfolio of clinically superior and differentiated products.

- Driving revenue growth by capitalizing on successful new product introductions and market expansions.

Leveraging Global Footprint and Market Leadership

Avanos's expansive reach, touching over 90 countries, coupled with its dominant market share in key product segments, presents a significant opportunity. This global footprint allows for the reinforcement of its leadership position and the strategic exploitation of growth potential in emerging economies and less penetrated markets.

By refining its international sales infrastructure, Avanos can unlock substantial revenue gains. For instance, in 2023, the company reported approximately 55% of its revenue originating from outside the United States, highlighting the critical role of its global operations in its financial performance.

- Global Reach: Operations in over 90 countries.

- Market Leadership: Leading positions in several product categories.

- Growth Potential: Opportunity to capitalize on emerging and underserved markets.

- Revenue Optimization: Enhancing international sales channels for increased revenue.

The growing demand for non-opioid pain management solutions offers a significant avenue for Avanos. Legislation like the NOPAIN Act further supports this, encouraging the adoption of products such as the ON-Q and ambIT infusion pumps, which align with the company's strategy to reduce opioid reliance and improve patient recovery.

Avanos's Specialty Nutrition Systems (SNS) segment, particularly its NeoMed neonatal and pediatric feeding solutions, is experiencing strong market demand and increasing share. This segment was a considerable contributor to Avanos's revenue in 2023, indicating substantial growth potential.

The company's strategic approach to mergers and acquisitions, exemplified by the $135 million acquisition of Theragenics Corporation in 2023, aims to bolster its product portfolio and market presence. Continued investment in R&D is also a key opportunity, with a focus on developing next-generation medical devices that enhance patient care and clinical efficacy.

Avanos's global presence, operating in over 90 countries, presents an opportunity to leverage its market leadership and expand into emerging economies. In 2023, approximately 55% of Avanos's revenue was generated internationally, underscoring the importance of optimizing its global sales infrastructure.

| Opportunity Area | Key Products/Segments | Supporting Data/Facts |

|---|---|---|

| Non-Opioid Pain Management | ON-Q, ambIT infusion pumps | Expanding market driven by societal shift away from opioids; NOPAIN Act supports reimbursement. |

| Specialty Nutrition Systems (SNS) | NeoMed neonatal and pediatric feeding solutions | Robust demand and increasing market share; significant revenue contributor in 2023. |

| Strategic Acquisitions | Theragenics Corporation (acquired 2023) | $135 million acquisition to bolster urology portfolio; disciplined M&A strategy for growth. |

| Product Innovation | Next-generation medical devices | Increased R&D investment in FY2024; focus on improved patient outcomes and recovery. |

| Global Market Expansion | Operations in over 90 countries | 55% of 2023 revenue from outside the US; opportunity to capitalize on emerging markets. |

Threats

The medical device sector is notoriously competitive, with a crowded field of players constantly pushing for market dominance. This intense rivalry often translates into significant pricing pressures, compelling companies like Avanos to innovate relentlessly to justify their value propositions.

In 2023, the global medical device market was valued at approximately $500 billion, with projections indicating continued growth. This expansion, however, also attracts new entrants and intensifies the battle for market share, forcing established companies to continuously invest in research and development to maintain a competitive edge and avoid commoditization.

The healthcare industry's stringent regulatory environment presents a significant threat to Avanos. Evolving legislation, like the EU Medical Device Regulation (EU MDR), demands substantial investment in compliance, potentially delaying product launches and impacting market access. For instance, companies in the medtech space reported an average of 10-20% increase in compliance costs following the implementation of stricter regulations in recent years, a trend Avanos likely faces.

Avanos is susceptible to supply chain disruptions, potentially leading to shortages of essential raw materials or finished drugs vital for its product manufacturing. This vulnerability was highlighted in early 2024 as global supply chains continued to grapple with post-pandemic adjustments and increased demand.

Escalating input costs present a significant threat. Rising prices for raw materials, energy, and transportation, amplified by persistent global inflation, directly impact manufacturing expenses. For instance, the cost of key chemical inputs saw an average increase of 5-8% in the first half of 2024, squeezing profit margins.

Geopolitical instability further compounds these risks, creating unpredictable fluctuations in supply and cost. Trade tensions and regional conflicts can disrupt the flow of goods and materials, adding another layer of uncertainty for Avanos's operational planning and financial performance.

Macroeconomic Headwinds and Pricing Pressures

Global economic slowdowns present a significant threat to Avanos. Weakening demand, coupled with healthcare providers' intensified focus on cost containment, can directly impact sales volumes and the pricing power of Avanos' medical devices and solutions. For instance, persistent inflation throughout 2023 and into 2024 has squeezed hospital budgets, making them more resistant to price increases.

Furthermore, macroeconomic instability, including rising interest rates and volatile currency exchange rates, poses additional challenges. These factors can increase borrowing costs for Avanos and negatively affect the profitability of its international operations. As of early 2024, many major economies are still navigating higher interest rate environments, which dampens consumer and business spending, including in the healthcare sector.

- Economic Slowdown: Global GDP growth forecasts for 2024, while showing some resilience, remain below pre-pandemic averages, indicating continued economic headwinds.

- Healthcare Cost Pressures: Hospitals are reporting tighter margins, leading to increased scrutiny on supplier pricing and a preference for value-based purchasing.

- Interest Rate Environment: Central banks in key markets like the US and Europe maintained higher interest rates through much of 2023 and early 2024, increasing the cost of capital.

- Currency Volatility: Fluctuations in major currencies like the Euro and Yen against the US Dollar can impact the reported value of international sales for US-based companies like Avanos.

Goodwill Impairment and Market Valuation Pressure

Avanos has faced significant challenges with goodwill impairment, notably recording a substantial charge of $265.7 million in the fourth quarter of 2023. This impairment directly reflects a downward pressure on the company's market valuation, signaling investor concerns about its future revenue-generating capabilities.

These impairment charges can erode investor confidence, negatively impacting stock performance and potentially hindering Avanos' capacity to secure capital or pursue strategic growth opportunities such as mergers and acquisitions. For instance, the market's reaction to such impairments can lead to a higher cost of capital, making future investments more expensive.

- Goodwill Impairment Charge: Avanos reported a $265.7 million goodwill impairment charge in Q4 2023.

- Market Valuation Impact: This charge directly correlates with decreased market capitalization and investor skepticism.

- Investor Confidence: Such impairments can reduce investor confidence, affecting stock price and access to capital.

- Strategic Initiatives: Difficulty in raising capital could impede the execution of strategic M&A activities.

Intense competition in the medical device sector exerts significant pricing pressure, requiring continuous innovation from Avanos to maintain its market position. The global medical device market's continued expansion, projected to grow further beyond its 2023 valuation of approximately $500 billion, also invites new competitors, intensifying the struggle for market share and necessitating ongoing R&D investment.

The stringent regulatory landscape, exemplified by the EU MDR, demands substantial compliance investments, potentially delaying product launches and impacting market access. Companies in this sector have reported compliance cost increases of 10-20% in recent years, a trend Avanos must navigate.

Supply chain vulnerabilities, highlighted by post-pandemic adjustments and increased demand in early 2024, pose a risk of raw material or finished product shortages. Escalating input costs, with key chemical inputs seeing 5-8% increases in early 2024, further squeeze profit margins, compounded by geopolitical instability and global economic slowdowns that reduce healthcare provider spending power.

Macroeconomic instability, including higher interest rates and currency volatility, increases borrowing costs and negatively impacts international operations, with many key economies maintaining elevated interest rates through early 2024.

| Threat Factor | Description | 2024/2025 Impact |

|---|---|---|

| Intense Competition | Crowded medical device market, pricing pressures. | Requires continuous innovation and cost management. |

| Regulatory Burden | Evolving regulations (e.g., EU MDR) increase compliance costs. | Potential for delayed product approvals and increased operational expenses. |

| Supply Chain Disruptions | Vulnerability to shortages of raw materials or finished goods. | Risk of production delays and increased logistics costs. |

| Rising Input Costs | Increases in raw materials, energy, and transportation expenses. | Direct impact on manufacturing costs and profit margins. |

| Economic Slowdown | Weakening demand and cost containment by healthcare providers. | Potential for reduced sales volumes and pricing power. |

| Macroeconomic Instability | Higher interest rates, currency volatility. | Increased cost of capital and negative impact on international earnings. |

SWOT Analysis Data Sources

This Avanos SWOT analysis is built upon a foundation of robust data, including official financial filings, comprehensive market intelligence reports, and expert industry evaluations. These sources ensure a thorough and accurate assessment of the company's current standing and future potential.