Avanos Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avanos Bundle

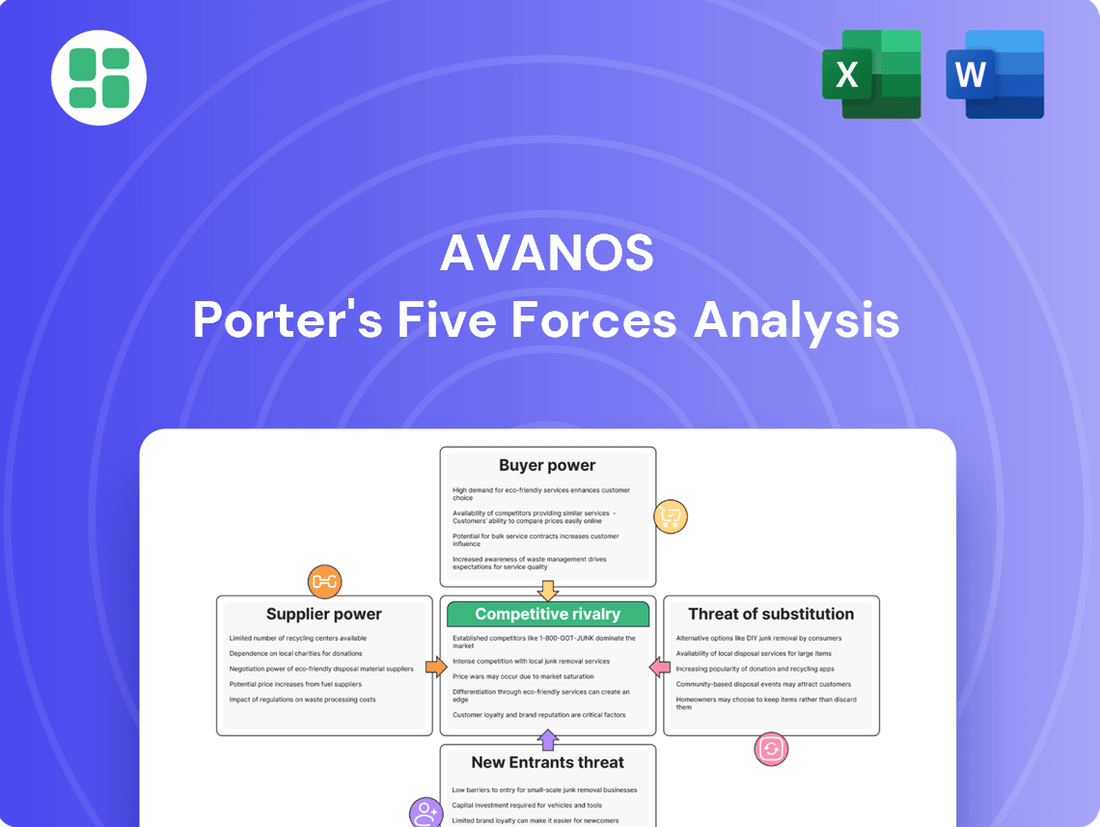

Avanos faces a dynamic competitive landscape, with each of Porter's Five Forces playing a crucial role in shaping its market position. Understanding the intensity of buyer power, the threat of new entrants, and the bargaining power of suppliers is key to navigating this environment.

The complete Porter's Five Forces Analysis unlocks a deeper understanding of Avanos's strategic advantages and the external pressures it contends with. Gain actionable insights to drive smarter decision-making and stay ahead of the curve.

Suppliers Bargaining Power

Avanos's reliance on a concentrated group of suppliers for specialized medical-grade materials and patented components grants these suppliers significant bargaining power. This concentration means fewer alternatives for Avanos, potentially driving up costs for critical inputs. For instance, if a particular biocompatible polymer used in Avanos's devices is only produced by one or two highly specialized firms, those suppliers can dictate terms.

The bargaining power of suppliers for Avanos is significantly influenced by switching costs. If Avanos faces substantial hurdles when changing suppliers, such as the need for extensive requalification of medical devices or obtaining new regulatory approvals for alternative materials, this dependency strengthens the suppliers' position. For instance, if a new supplier requires a lengthy FDA approval process for a critical component, Avanos would be reluctant to switch, granting that supplier greater leverage.

The threat of forward integration by suppliers is a significant concern for Avanos. If key suppliers possess the capability and motivation to manufacture similar medical devices themselves, they could directly enter Avanos's market, effectively bypassing Avanos as a customer.

This potential shift dramatically amplifies a supplier's bargaining power. For instance, if a critical component supplier for Avanos's surgical drainage products also has the expertise and resources to produce these devices, they could leverage this threat to demand more favorable terms from Avanos or even cease supplying them altogether.

In 2024, the medical device industry saw increased consolidation and investment in direct-to-provider models. This trend suggests that suppliers with strong technological foundations and market insights are more likely to consider forward integration, thereby increasing their leverage over companies like Avanos that rely on their components.

Uniqueness and Importance of Supplier Inputs

The uniqueness and criticality of the inputs Avanos sources significantly influence supplier bargaining power. If suppliers offer highly specialized, patented, or absolutely essential components that are difficult for Avanos to replicate or substitute, their leverage increases considerably. This is particularly true for medical devices where specific materials or technologies are integral to product performance and regulatory approval.

For instance, consider the reliance on advanced polymers or biocompatible materials. If only a few suppliers can meet the stringent quality and performance specifications required for Avanos's surgical or pain management devices, these suppliers hold considerable sway. In 2024, the global market for advanced medical-grade polymers saw continued growth, with demand driven by innovation in implantable devices and minimally invasive surgical tools, highlighting the potential for supplier concentration in critical input areas.

- Criticality of Inputs: Suppliers providing unique, patented, or essential components for Avanos's differentiated medical devices possess significant bargaining power.

- Specialized Materials: Reliance on specialized, high-performance materials like advanced polymers or biocompatible compounds can concentrate supply and increase supplier leverage.

- Market Dynamics (2024): The growing demand for innovative medical technologies in 2024 further emphasizes the importance of securing reliable and specialized input suppliers.

Volume of Purchase from Suppliers

The volume of products Avanos purchases from individual suppliers significantly shapes the suppliers' bargaining power. If Avanos buys in large quantities, it naturally gains some leverage. However, this is counterbalanced if a supplier serves many clients and Avanos's business constitutes only a minor fraction of their total revenue. In such scenarios, the supplier might retain considerable power due to their diversified customer base.

For instance, in 2024, a key factor for suppliers is their reliance on specific customers. If a supplier's product is critical to Avanos's operations and Avanos is not a dominant client for that supplier, the supplier can dictate terms more effectively. This dynamic is crucial in assessing the overall supplier power within the medical device industry.

- Volume of Purchases: Avanos's purchasing volume directly impacts its negotiation strength with suppliers.

- Supplier Diversification: If suppliers have many customers, Avanos's individual purchase volume may have less influence.

- Supplier Dependence: Suppliers who are less reliant on Avanos for their revenue tend to hold more bargaining power.

- Industry Dynamics: In 2024, the medical supply chain emphasizes supplier resilience, which can bolster their negotiating position.

Suppliers of specialized medical-grade materials and patented components hold significant bargaining power over Avanos due to the critical nature and uniqueness of their offerings. This power is amplified when switching costs are high, such as the need for extensive requalification of medical devices or new regulatory approvals for alternative materials. The threat of forward integration by these suppliers, where they might enter Avanos's market directly, further strengthens their position.

In 2024, the medical device industry experienced increased consolidation, which has bolstered the negotiating position of key suppliers, especially those with proprietary technologies or essential inputs. For example, the global market for advanced medical-grade polymers, crucial for many medical devices, continued to grow, increasing the leverage of suppliers in this niche. Avanos's reliance on a limited number of these specialized suppliers means they have fewer alternatives, potentially leading to higher input costs.

| Factor | Impact on Avanos | 2024 Relevance |

|---|---|---|

| Uniqueness of Inputs | High supplier power | Continued demand for innovative materials |

| Switching Costs | Increased supplier leverage | Regulatory hurdles for material changes |

| Forward Integration Threat | Potential market disruption | Industry consolidation trends |

| Supplier Diversification | Depends on supplier's client base | Suppliers with broad client reach have more power |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Avanos, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats with a visual breakdown of supplier and buyer power, ready for immediate strategic action.

Customers Bargaining Power

Avanos's customer base is largely composed of global healthcare providers, such as hospitals and extensive healthcare systems. The concentration of these customers significantly influences their bargaining power.

When a few large purchasing organizations or group purchasing organizations (GPOs) represent a substantial percentage of Avanos's revenue, their ability to negotiate price concessions and favorable terms increases dramatically due to the sheer volume of their orders.

Customer switching costs significantly influence the bargaining power of healthcare providers in the medical device industry. If Avanos's products require substantial retraining for staff or complex integration with existing hospital IT infrastructure, providers face higher hurdles to switch to a competitor. For example, in 2023, the global medical device market saw many companies investing heavily in user-friendly interfaces and seamless integration to lower these very costs for their customers.

Well-informed healthcare providers, armed with transparent pricing and performance data for competing medical devices, can significantly increase their bargaining power against Avanos. This access allows them to more effectively negotiate terms and potentially seek out lower-cost alternatives.

Hospitals are facing mounting financial pressures, and the healthcare industry's increasing focus on value-based care models amplifies customer price sensitivity. This means buyers are meticulously evaluating the cost-benefit ratio of medical devices, scrutinizing every purchase to ensure it aligns with economic and clinical objectives.

Threat of Backward Integration by Customers

The bargaining power of customers, specifically the threat of backward integration, is a nuanced factor for Avanos. While large healthcare systems or Group Purchasing Organizations (GPOs) possess the financial clout to consider developing their own medical devices, this is a highly improbable scenario for complex, specialized products like those offered by Avanos.

Even though the likelihood of customers backward integrating into the manufacturing of advanced medical devices is extremely low, the mere theoretical possibility can subtly influence pricing and contract negotiations. For instance, if a major hospital system were to explore in-house production for a less complex component, it might leverage that potential to seek more favorable terms on Avanos's more sophisticated offerings.

In 2023, the medical device industry saw continued consolidation among GPOs, with some of the largest entities managing billions in healthcare spending. This concentration of buyer power, while not directly translating to backward integration for complex devices, does mean these large customers can exert significant pressure on suppliers like Avanos through volume commitments and stringent pricing demands.

- Low Likelihood of Complex Device Integration: Customers are unlikely to develop their own specialized medical devices due to high R&D costs and technical expertise required.

- Theoretical Influence on Negotiations: The remote possibility of backward integration can still empower customers in price discussions.

- Customer Consolidation: The trend of healthcare systems and GPOs consolidating increases their collective bargaining power.

Product Differentiation and Importance to Customer Outcomes

Avanos's ability to differentiate its products significantly impacts customer bargaining power. When its medical devices, such as those for digestive health or pain management, offer unique features or demonstrably improve patient outcomes, customers (hospitals, clinics) are less likely to switch based on price alone. For instance, if a particular Avanos product is critical for a high-volume, revenue-generating procedure with limited viable substitutes, its importance to the customer's operations strengthens Avanos's position.

Conversely, if Avanos's offerings become more commoditized, meaning they are similar to those of competitors and easily replaceable, customers gain leverage. This is particularly relevant in markets where purchasing decisions are heavily influenced by cost. For example, if the market for certain wound care dressings becomes saturated with similar products, buyers can more readily demand lower prices or better terms.

The criticality of Avanos's products to specific patient outcomes is a key factor. In 2023, the global medical devices market was valued at approximately $520 billion, with segments like surgical instruments and patient monitoring experiencing strong demand. If Avanos holds a leading position in a niche segment where its technology directly impacts patient recovery or reduces hospital readmissions, its pricing power is enhanced.

- Product Differentiation: Avanos's focus on specialized medical devices, such as its digestive health products, aims to create unique value propositions that reduce customer price sensitivity.

- Importance to Customer Outcomes: Products that are vital for specific patient treatments or procedural success, like those used in critical care settings, grant Avanos greater pricing power.

- Market Competition: The bargaining power of customers increases if Avanos faces intense competition from companies offering similar, undifferentiated products, particularly in segments like basic wound care.

- Switching Costs: High switching costs for customers, stemming from the need for retraining, new infrastructure, or regulatory approvals, further diminish customer bargaining power.

The bargaining power of Avanos's customers is influenced by their concentration and the criticality of the products. Large healthcare systems and GPOs, representing significant purchasing volume, can negotiate more aggressively. For example, in 2023, the medical device market saw continued consolidation among GPOs, increasing their collective leverage.

| Factor | Impact on Customer Bargaining Power | Example for Avanos |

|---|---|---|

| Customer Concentration | Increases Power | Large GPOs negotiating volume discounts. |

| Switching Costs | Decreases Power | High integration costs for specialized medical devices. |

| Product Differentiation | Decreases Power | Unique features in digestive health products. |

| Price Sensitivity | Increases Power | Value-based care models driving cost scrutiny. |

Same Document Delivered

Avanos Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You are looking at the complete Avanos Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the company. This professionally formatted report is ready for your immediate use upon purchase.

Rivalry Among Competitors

The medical device sector, where Avanos operates, is quite crowded. Think about areas like pain management, breathing support, and digestive care. In 2024, this market sees a mix of big, well-known companies and smaller, agile startups all vying for market share. This means Avanos is up against a wide variety of competitors, from giants with broad product lines to focused companies that excel in specific niches.

The medical technology (MedTech) industry generally experiences healthy growth, but this can vary significantly across different product categories. When a particular segment matures or slows down, companies often intensify their competition for existing market share. This dynamic can lead to increased pricing pressure and innovation efforts.

For instance, the digestive health products market is anticipated to see robust expansion, with some projections indicating a compound annual growth rate (CAGR) of over 7% in the coming years. Such attractive growth rates can indeed draw in new entrants and spur more aggressive strategies from established players, intensifying rivalry.

Avanos's competitive edge hinges on its capacity to differentiate its medical devices through demonstrable clinical superiority and cutting-edge innovation. Proprietary technologies, such as their advanced wound care solutions or digestive health products, create a moat against direct imitation. For instance, in 2024, Avanos continued to invest heavily in R&D, with a focus on developing next-generation therapies that offer improved patient outcomes and procedural efficiencies, thereby reducing reliance on price wars.

Switching Costs for Customers Among Competitors

If healthcare providers find it simple and affordable to switch between different medical device suppliers, the competition among these companies intensifies. This forces manufacturers to engage in more aggressive pricing strategies, enhance their customer service, and continuously innovate product features to keep their existing clientele.

For instance, in the orthopedic implant market, while initial setup and physician training can represent some switching costs, the availability of comparable products from multiple vendors can lower the overall barrier. In 2024, the global orthopedic devices market was valued at approximately $50 billion, indicating a highly competitive landscape where customer retention is paramount.

- Low Switching Costs: When medical device switching costs are minimal, providers can easily move to competitors, increasing rivalry.

- Price and Feature Competition: Companies must compete on price, service, and product innovation to retain customers in low-switching-cost environments.

- Market Dynamics: The $50 billion orthopedic devices market in 2024 exemplifies a sector where ease of switching fuels intense competition.

Exit Barriers and Industry Consolidation

High exit barriers in the medical technology (MedTech) sector, including significant investments in specialized equipment and research and development, along with stringent regulatory approvals, can trap companies in the market. This means even struggling firms might continue operations, adding to competitive pressure. For instance, the significant capital expenditure required for advanced manufacturing facilities in MedTech often makes exiting prohibitively expensive.

The MedTech industry has experienced notable consolidation, which directly impacts competitive rivalry. Larger, merged entities often possess greater market power and resources, intensifying competition for smaller players. In 2023, for example, there were several significant mergers and acquisitions within the MedTech space, such as Johnson & Johnson's acquisition of Abiomed for $16.6 billion, which consolidated market share in the cardiovascular device sector.

- High Capital Investment: Specialized manufacturing equipment and R&D in MedTech represent substantial sunk costs, making it difficult for companies to divest easily.

- Regulatory Hurdles: The extensive and costly process of gaining regulatory approval for medical devices acts as a significant barrier to exiting the market.

- Industry Consolidation: Strategic acquisitions, like the aforementioned J&J-Abiomed deal, reshape competition by creating larger, more dominant players.

Avanos operates in a dynamic and competitive medical device market, facing pressure from both established giants and nimble startups. The ease with which healthcare providers can switch between suppliers, often due to comparable product offerings, forces companies like Avanos to compete fiercely on price, service, and continuous product innovation. This dynamic is evident in markets like orthopedic devices, valued at approximately $50 billion in 2024, where customer retention is a key battleground.

The intense rivalry is further fueled by high exit barriers, such as substantial investments in R&D and specialized manufacturing, which keep even struggling firms in the market. Moreover, industry consolidation, exemplified by major acquisitions in 2023, creates larger competitors with greater resources, intensifying the competitive landscape for all players.

| Factor | Impact on Avanos | 2024 Market Context |

|---|---|---|

| Number of Competitors | High, including large diversified companies and specialized niche players | Crowded medical device sector (pain management, breathing support, digestive care) |

| Switching Costs for Customers | Low, enabling easy shifts between suppliers | Drives competition on price, service, and innovation |

| Product Differentiation | Crucial for retaining customers and avoiding price wars | Avanos focuses on clinical superiority and R&D for next-gen therapies |

| Industry Consolidation | Creates larger, more powerful competitors | Significant M&A activity in 2023, e.g., J&J's $16.6B acquisition of Abiomed |

SSubstitutes Threaten

The threat of substitutes for medical devices like those Avanos offers is substantial, stemming from alternative treatments or technologies that can address similar patient needs. For example, advancements in less invasive surgical techniques or new pharmacological interventions could potentially reduce the reliance on certain devices. In 2024, the global market for minimally invasive surgery was projected to reach over $20 billion, indicating a strong and growing preference for alternatives that may bypass traditional device-dependent procedures.

The threat of substitutes for Avanos's medical technologies hinges significantly on the price-performance trade-off. If alternative solutions, perhaps from emerging biotech firms or even simpler, less technologically advanced methods, can achieve comparable patient outcomes at a substantially lower cost, customers, particularly healthcare providers and payers, will be strongly incentivized to switch. This dynamic is amplified in a market where cost containment is a persistent concern.

For instance, in the digestive health segment, while Avanos offers advanced enteral feeding systems, the availability of more basic, gravity-fed feeding options or even alternative nutritional delivery methods presents a tangible substitute. If these alternatives can adequately meet a patient's nutritional needs without the higher capital expenditure or disposable costs associated with Avanos's specialized pumps and sets, their appeal grows. This is particularly relevant as healthcare systems globally grapple with budget constraints; by the end of 2024, many hospital systems reported increased pressure to reduce supply chain costs, making lower-cost substitutes a more attractive proposition.

Rapid advancements in artificial intelligence and digital health platforms are creating new substitutes for traditional medical devices. For instance, AI-powered predictive analytics can forecast patient deterioration, potentially reducing the need for continuous monitoring devices. In 2024, the digital health market was valued at over $300 billion, highlighting the significant growth and potential of these non-device solutions.

Customer Propensity to Adopt Substitutes

The willingness of healthcare providers and patients to adopt new substitute technologies or treatment modalities is a key factor in assessing the threat of substitutes for Avanos. This propensity is shaped by several elements, including the availability and strength of clinical evidence supporting new treatments, the clarity and generosity of reimbursement policies from payers, and the practical ease with which new solutions can be integrated into existing clinical workflows. Patient preferences also play a significant role, as individuals increasingly seek minimally invasive or more convenient options.

For instance, in areas where Avanos offers solutions, the emergence of advanced wound care dressings that promote faster healing with fewer changes could present a substitute threat. If these new dressings demonstrate superior clinical outcomes in trials and are favorably reimbursed by major insurers, adoption rates among healthcare providers could accelerate. By mid-2024, the global advanced wound care market was projected to reach over $12 billion, indicating a strong demand for innovative solutions, which also highlights the potential for disruptive substitutes.

- Clinical Evidence: The robustness of studies demonstrating the efficacy and safety of substitute treatments directly impacts adoption.

- Reimbursement Policies: Favorable coverage decisions by payers can significantly lower the financial barrier for adopting alternatives.

- Ease of Adoption: Simplicity in integrating new technologies into existing healthcare systems and practices encourages uptake.

- Patient Preferences: Growing patient demand for less invasive, more comfortable, or faster-healing options can drive the acceptance of substitutes.

Regulatory and Reimbursement Landscape for Substitutes

Changes in healthcare regulations and reimbursement policies can significantly influence the viability and adoption of substitutes for Avanos' products. For instance, shifts in Medicare or Medicaid reimbursement rates for specific procedures or medical devices could make alternative treatments more or less attractive to providers and patients. In 2024, ongoing reviews of medical device reimbursement codes and potential policy adjustments by bodies like the Centers for Medicare & Medicaid Services (CMS) could directly impact the competitive landscape for wound care and digestive health solutions.

Policies favoring certain treatment approaches or technologies over others can increase or decrease the threat of substitution. For example, if regulatory bodies approve and subsequently incentivize the use of minimally invasive techniques or novel biomaterials over traditional methods, this would bolster the threat of substitutes. The increasing focus on value-based care models in the U.S. healthcare system, which began gaining more traction in the mid-2010s and continues to evolve, encourages the adoption of cost-effective and outcome-improving alternatives, potentially impacting Avanos’ market share.

- Regulatory Scrutiny: Heightened regulatory scrutiny on medical device safety and efficacy can lead to longer approval timelines for new substitutes, potentially delaying their market entry.

- Reimbursement Policies: Shifts in reimbursement policies, such as changes to DRG (Diagnosis-Related Group) payments or CPT (Current Procedural Terminology) codes, can directly affect the profitability of using substitute products. For example, a reduction in reimbursement for a procedure where a substitute product is commonly used would increase the threat.

- Value-Based Purchasing: The growing emphasis on value-based purchasing in healthcare systems incentivizes providers to adopt solutions that demonstrate superior patient outcomes and cost-effectiveness, thereby increasing the competitive pressure from effective substitutes.

- Government Health Initiatives: Government-led health initiatives or mandates, such as those promoting digital health solutions or specific chronic disease management protocols, can inadvertently create or strengthen markets for substitute products.

The threat of substitutes for Avanos's medical devices is influenced by the development of alternative treatments and technologies that can fulfill similar patient needs, often with improved cost-effectiveness or patient experience. For instance, advancements in regenerative medicine or novel drug therapies could potentially displace certain device-dependent treatments by offering comparable or superior outcomes with reduced invasiveness.

The competitive landscape for Avanos is shaped by the availability of lower-cost alternatives that deliver comparable patient outcomes. In 2024, the global medical device market continued to see pressure from generic manufacturers and emerging markets offering more budget-friendly options, particularly in areas like ostomy care and respiratory support, where simpler, less technologically advanced products can still meet basic patient needs.

The adoption of substitutes is significantly driven by clinical evidence, reimbursement policies, and patient preferences. For example, if new wound care technologies demonstrate faster healing times and are favorably reimbursed, they can pose a substantial threat to existing device-based solutions. By mid-2024, the advanced wound care market was valued at over $12 billion, indicating a robust demand for innovative solutions that could also represent substitutes.

| Substitute Category | Example | 2024 Market Impact | Key Driver |

|---|---|---|---|

| Alternative Therapies | Regenerative Medicine | Growing interest, potential to reduce device reliance | Clinical efficacy, patient outcomes |

| Lower-Cost Devices | Generic ostomy bags | Significant price pressure on branded products | Cost-effectiveness |

| Digital Health Solutions | AI-driven patient monitoring | Emerging threat to continuous monitoring devices | Convenience, predictive analytics |

| Advanced Dressings | Hydrogel dressings | Increasing adoption in wound care | Faster healing, reduced application frequency |

Entrants Threaten

The medical device sector, particularly for specialized products similar to Avanos' offerings, demands significant upfront capital. Companies looking to enter this space must be prepared to invest heavily in research and development, navigate rigorous clinical trials, establish state-of-the-art manufacturing capabilities, and ensure strict adherence to regulatory standards. For instance, the average cost to bring a new medical device to market can range from millions to tens of millions of dollars, a substantial hurdle for aspiring competitors.

The medical device industry faces significant barriers to entry due to stringent regulatory requirements. Agencies like the U.S. Food and Drug Administration (FDA) and international bodies impose complex standards, such as the EU Medical Device Regulation (MDR) and ISO 13485 for quality management systems. Navigating these approval processes is a lengthy and costly endeavor, often requiring substantial investment in research, development, and compliance documentation.

Avanos's robust portfolio of existing patents and proprietary technologies, particularly in areas like advanced wound care and digestive health, presents a significant hurdle for potential new entrants. For instance, their commitment to innovation is reflected in their substantial R&D investments, which are crucial for developing comparable or superior products. Developing such advanced technologies from scratch or acquiring necessary licenses is a substantial financial and time commitment, making market entry challenging.

Access to Distribution Channels and Established Relationships

New entrants often struggle to build effective global distribution networks, a critical hurdle when competing with established companies like Avanos. These established players have spent years developing sophisticated supply chains and logistics, making it difficult for newcomers to match their reach and efficiency.

Accessing established relationships with key customers, such as hospitals, clinics, and group purchasing organizations (GPOs), presents another significant barrier. These relationships are built on trust, reliability, and often long-term contracts, which are hard-won and not easily transferred to new market participants.

For instance, in 2024, the medical device distribution landscape continues to be dominated by a few large players who control significant market share through these entrenched relationships. New entrants may find it prohibitively expensive and time-consuming to replicate these networks, limiting their ability to get products to market effectively.

- Distribution Network Barriers: New entrants face significant capital investment and time requirements to establish global distribution capabilities comparable to those of established players like Avanos.

- Customer Relationship Hurdles: Gaining access to established relationships with hospitals, clinics, and GPOs, crucial for market penetration, is a protracted and challenging process for new entrants.

- Market Inertia: Existing contracts and supplier agreements with healthcare providers create inertia, making it difficult for new entrants to displace incumbent suppliers even with potentially superior products.

Brand Loyalty and Reputation in Healthcare

In the healthcare sector, brand loyalty and reputation are incredibly powerful barriers to entry. Established companies like Avanos have spent years building trust with healthcare professionals through consistent product performance and robust clinical evidence. For instance, Avanos's commitment to innovation in areas like wound care and digestive health has cultivated a strong reputation, making it challenging for newcomers to displace their established relationships and market share.

New entrants face a significant hurdle in replicating the deep-seated trust that brands like Avanos have earned. Healthcare providers often prioritize reliability and proven efficacy, which translates into a preference for well-known and validated products. This loyalty is not easily swayed by price alone, as the stakes in patient care are too high.

The difficulty for new entrants is further amplified by the extensive regulatory and clinical validation processes inherent in the healthcare industry. Companies must not only develop effective products but also navigate complex approval pathways and demonstrate superior outcomes compared to existing solutions. This lengthy and costly process acts as a substantial deterrent.

Avanos, for example, has a portfolio of products that have undergone rigorous testing and gained the confidence of clinicians. This established credibility means that a new competitor would need to offer a demonstrably better or significantly cheaper alternative, a difficult proposition given the existing market dynamics and the established brand equity of companies like Avanos.

- Brand Loyalty: Healthcare professionals often stick with brands they trust due to the critical nature of patient outcomes.

- Reputation: A strong reputation built on clinical validation and consistent performance is a major deterrent for new entrants.

- Switching Costs: For providers, the cost and effort associated with switching to a new, unproven product can be substantial.

- Clinical Evidence: New entrants must provide robust clinical data to challenge established brands like Avanos, a process that requires significant investment and time.

The threat of new entrants for Avanos is relatively low, primarily due to the substantial capital requirements and complex regulatory landscape in the medical device sector. For instance, developing and gaining approval for a new medical device can easily cost tens of millions of dollars. This high barrier to entry, combined with the need for extensive R&D and manufacturing capabilities, deters many potential competitors.

Furthermore, established players like Avanos benefit from strong patent protection and proprietary technologies, making it difficult for newcomers to replicate their product offerings. The significant investment required to overcome these technological and intellectual property hurdles, alongside the need to build global distribution networks and secure customer relationships, further limits the threat of new market participants.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront investment for R&D, manufacturing, and regulatory compliance. | Significant financial hurdle, limiting the number of potential entrants. |

| Regulatory Hurdles | Stringent FDA, EMA, and other health authority approvals. | Lengthy and costly processes, requiring specialized expertise. |

| Intellectual Property | Existing patents and proprietary technologies. | Makes product replication or development difficult and expensive. |

| Distribution & Relationships | Established global networks and entrenched customer loyalty. | Challenging to replicate reach and gain access to key healthcare providers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Avanos leverages data from company annual reports, investor presentations, and SEC filings to understand their financial health and strategic positioning. We also incorporate industry-specific market research reports and trade publications to assess competitive dynamics and market trends.