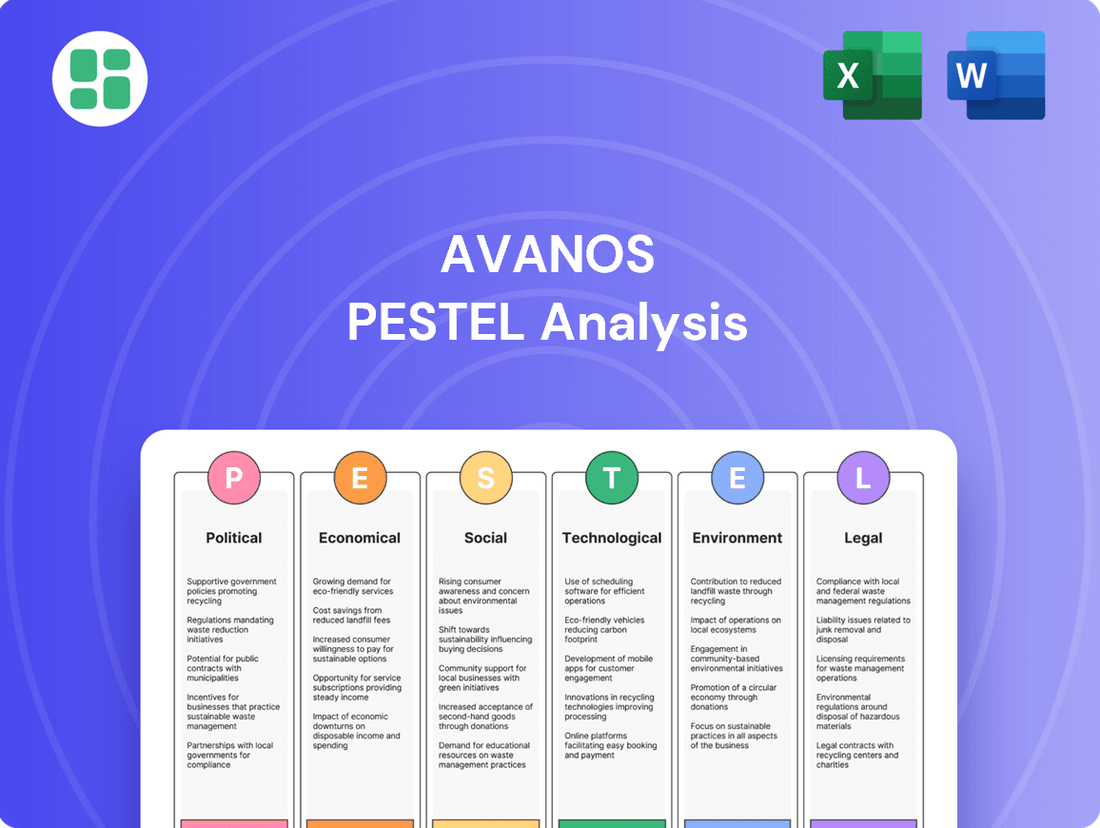

Avanos PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avanos Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Avanos’s trajectory. Our meticulously researched PESTLE analysis offers a clear roadmap to understanding these external forces. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full analysis now and gain a decisive competitive advantage.

Political factors

Government healthcare policies and reimbursement rates are critical for medical device firms like Avanos. For instance, shifts in regulations, such as the evolving European Medical Device Regulation (MDR) or U.S. FDA guidelines, can directly influence product approval timelines, market entry strategies, and overall operational expenditures. These regulatory landscapes are constantly being shaped, impacting how new devices reach patients and how existing ones are maintained in the market.

Avanos actively participates in policy discussions, often through industry groups like AdvaMed. This engagement aims to influence legislation, such as the NOPAIN Act, which seeks to mitigate the opioid crisis. Such advocacy is vital for ensuring that policies support innovation while also addressing public health needs, directly affecting Avanos's product development and market positioning.

Global trade policies, including tariffs and trade agreements, significantly influence Avanos's operational costs and market access. For instance, tariffs imposed on key medical supplies manufactured in China have presented challenges, although specific exemptions, such as for ENFit syringes vital for neonatal and pediatric care, have been extended until January 2026. This highlights the critical need for robust supply chain diversification and adaptable pricing strategies to navigate the complexities of international trade.

Global regulatory bodies like the International Medical Device Regulators Forum (IMDRF) are actively pursuing harmonization of medical device regulations. This trend aims to create more consistent standards worldwide, but it also means that a compliance issue in one major market could have ripple effects across a company's global operations.

For Avanos, this means a heightened need for robust compliance frameworks that can adapt to evolving international requirements. For instance, the European Union's Medical Device Regulation (MDR), fully implemented in 2021, has set a high bar for market access, influencing regulatory approaches in other regions and requiring significant investment in compliance infrastructure.

Government Spending on Healthcare

Government spending on healthcare significantly shapes the market for medical devices like those Avanos provides. Higher national health expenditures generally translate to a larger market and increased demand from healthcare providers. Global healthcare spending is expected to continue its upward trajectory, with projections indicating it could reach approximately $11.9 trillion by 2027, up from an estimated $9.8 trillion in 2023.

These spending patterns directly affect the purchasing power of hospitals and clinics, influencing their ability to acquire new technologies and consumables. For instance, the U.S. Centers for Medicare & Medicaid Services (CMS) projected that national health expenditures would grow by 5.4% in 2024. Understanding these dynamics is vital for Avanos's strategic planning and sales forecasting.

- Global healthcare spending is projected to surpass $11.9 trillion by 2027.

- U.S. national health expenditures saw an estimated growth of 5.4% in 2024.

- Increased government health spending can boost demand for medical devices.

Political Stability and Geopolitical Events

Political instability and ongoing conflicts, such as those impacting Russia, Ukraine, and the Middle East, pose significant risks to global supply chains and market demand. These geopolitical events can lead to material disruptions, affecting the availability and cost of raw materials and finished goods. For instance, the ongoing conflict in Ukraine has continued to strain global energy and agricultural markets throughout 2024, indirectly influencing transportation costs and input prices for various industries, including medical device manufacturers like Avanos.

Avanos explicitly recognizes these geopolitical factors as potential risks that could negatively impact the demand for its products and its overall financial performance. The company's 2024 investor reports have highlighted the need to monitor and manage these external volatilities. For example, increased energy costs stemming from geopolitical tensions can directly affect manufacturing expenses and logistics, potentially squeezing profit margins if not effectively hedged or passed on to consumers.

In response to these volatile environments, maintaining a robust risk management strategy is paramount. This includes diversifying supply chains to reduce reliance on single regions, exploring alternative sourcing options, and implementing flexible pricing mechanisms. The ability to adapt quickly to changing political landscapes and economic conditions is crucial for sustained operational resilience and financial stability.

Key considerations for Avanos in managing political risks include:

- Supply Chain Resilience: Proactively identifying and mitigating single-source dependencies exacerbated by geopolitical events. For example, in 2024, many companies continued to re-evaluate their Asian supply chain dependencies due to regional political considerations.

- Market Demand Volatility: Assessing how regional conflicts and economic sanctions impact healthcare spending and access to medical procedures in affected areas.

- Regulatory and Trade Policy Changes: Anticipating and adapting to potential shifts in international trade agreements, tariffs, and regulatory standards driven by political realignments.

- Operational Continuity: Developing contingency plans to ensure uninterrupted production and distribution in the face of localized or widespread political instability.

Government healthcare policies and reimbursement rates are critical for medical device firms like Avanos. Shifts in regulations, such as the evolving European Medical Device Regulation (MDR) or U.S. FDA guidelines, directly influence product approval timelines and market entry. Global healthcare spending is projected to exceed $11.9 trillion by 2027, with U.S. national health expenditures growing by an estimated 5.4% in 2024, directly impacting demand for medical devices.

Political instability and ongoing conflicts pose significant risks to global supply chains and market demand for companies like Avanos. Geopolitical events can disrupt material availability and increase costs, with ongoing conflicts continuing to strain global energy and agricultural markets throughout 2024, indirectly influencing transportation costs and input prices.

Avanos actively engages in policy discussions to influence legislation, such as the NOPAIN Act, aiming to ensure policies support innovation and public health needs. Global trade policies, including tariffs, also significantly influence operational costs and market access, with specific exemptions for vital supplies like ENFit syringes extended until January 2026, highlighting the need for supply chain diversification.

International regulatory harmonization efforts, like those by the IMDRF, aim for consistent global standards, but compliance issues in one market can impact others. The EU's MDR, fully implemented in 2021, has set a high bar, influencing regulatory approaches elsewhere and requiring significant investment in compliance infrastructure for companies like Avanos.

| Factor | Impact on Avanos | 2024/2025 Data/Projection |

| Healthcare Policy & Reimbursement | Influences product approval, market access, and operational costs. | EU MDR fully implemented 2021; U.S. CMS projected 5.4% growth in national health expenditures for 2024. |

| Government Spending | Directly affects purchasing power of healthcare providers. | Global healthcare spending projected to reach $11.9 trillion by 2027. |

| Geopolitical Instability | Disrupts supply chains, impacts market demand, and increases costs. | Ongoing conflicts strain energy/agricultural markets, affecting transportation and input prices in 2024. |

| Trade Policies | Affects operational costs and market access. | Tariff exemptions for ENFit syringes extended until January 2026. |

What is included in the product

This Avanos PESTLE analysis examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the business landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining discussions on external factors impacting Avanos.

Economic factors

Global medical costs are on a significant upward trajectory, with projections indicating an average increase of 10.4% in 2025. This persistent rise is largely fueled by rapid advancements in medical technologies and the development of new, often expensive, pharmaceuticals.

These escalating costs directly impact the financial planning and operational budgets of healthcare providers worldwide. Consequently, it shapes their procurement strategies, particularly when evaluating new medical devices and equipment.

For companies like Avanos, this economic environment necessitates a clear demonstration of the cost-effectiveness and tangible value proposition of their innovative medical solutions. Proving that their products deliver superior outcomes or efficiencies is crucial for maintaining competitiveness in a market where every dollar is scrutinized.

Inflationary pressures and rising interest rates present significant challenges for Avanos. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year as of April 2024, impacting the cost of raw materials and manufacturing. This directly translates to higher operational expenses for Avanos, affecting everything from production to the logistics of getting its medical devices to market.

Furthermore, the Federal Reserve's monetary policy, aimed at curbing inflation, has led to elevated interest rates. The Fed funds rate, while subject to change, has remained in a higher range throughout 2024, increasing Avanos's borrowing costs for capital expenditures and strategic investments. This can make funding new projects or expanding operations more expensive, potentially slowing growth initiatives.

These macroeconomic shifts also influence demand. Higher inflation can erode the purchasing power of both consumers and healthcare providers. If healthcare systems face tighter budgets due to economic conditions, they may delay or reduce spending on certain elective procedures or new equipment, which could dampen demand for some of Avanos's product lines.

National health spending in the U.S. is projected to grow at an average annual rate of 5.4% from 2023 to 2032, reaching $1.8 trillion by 2032, according to CMS projections. This growth outpaces anticipated GDP growth, with medical price increases being a significant contributing factor. For companies like Avanos, this trend means a larger overall market but also increased pressure on pricing and reimbursement.

Changes in reimbursement levels from Medicare, Medicaid, and private insurers directly impact the profitability of medical device manufacturers. For instance, shifts in coding, coverage decisions, or payment rates can significantly alter revenue streams for specific product categories. Avanos's financial performance is therefore closely tied to its ability to navigate these evolving reimbursement policies, requiring proactive engagement with payors and a strategic approach to adapting to new payment models.

Currency Fluctuations

Currency fluctuations significantly influence Avanos's financial performance due to its extensive international presence. Changes in foreign exchange rates can directly alter the value of revenues and profits earned in different currencies when translated back into its reporting currency. This volatility necessitates careful management to maintain financial stability.

Avanos has proactively signaled potential challenges from currency movements. For instance, the company has indicated expectations of currency headwinds impacting its reported revenue in 2025. This forward-looking statement highlights the importance of robust financial planning and risk mitigation strategies.

- Impact on Revenue: A stronger USD relative to other operating currencies can reduce the reported value of foreign sales.

- Profitability Concerns: Unfavorable currency shifts can erode profit margins on goods manufactured in one currency and sold in another.

- 2025 Outlook: Avanos anticipates currency headwinds, underscoring the need for proactive hedging or market diversification.

- Mitigation Strategies: Companies like Avanos often employ financial instruments or operational adjustments to offset currency risks.

Market Growth in Medical Device Industry

The global medical device market is on a strong upward trajectory, expected to grow from an estimated $551 billion in 2024 to $586 billion in 2025. This expansion is a significant tailwind for companies like Avanos, signaling robust demand for innovative healthcare solutions.

Key drivers behind this market growth include rapid technological advancements and evolving demographic trends, such as an aging global population. These factors create substantial opportunities for Avanos to capitalize on emerging areas.

- Projected Market Size: Expected to reach $586 billion by 2025, up from $551 billion in 2024.

- Long-Term Outlook: The market is anticipated to surpass $1 trillion by 2034.

- Growth Catalysts: Technological innovation and shifting demographics are primary drivers.

- Avanos Opportunity: Significant potential exists in high-growth segments like digital health and patient-centric solutions.

The global medical device market's robust growth, projected to reach $586 billion in 2025, presents a significant opportunity for Avanos. This expansion is driven by technological advancements and demographic shifts, such as an aging population, creating demand for innovative healthcare solutions.

However, rising global medical costs, anticipated to increase by 10.4% in 2025, alongside persistent inflation and higher interest rates, pose financial challenges. These factors increase operational expenses and borrowing costs for Avanos, potentially impacting investment in growth initiatives.

Navigating evolving reimbursement policies from payers like Medicare and Medicaid is critical, as changes can directly affect revenue streams for specific product categories. Furthermore, currency fluctuations present a notable risk, with Avanos expecting headwinds in 2025 due to foreign exchange rate volatility.

| Economic Factor | Data Point/Projection | Implication for Avanos |

|---|---|---|

| Global Medical Cost Increase | Projected 10.4% in 2025 | Increases pressure on healthcare providers' budgets, impacting procurement decisions. |

| U.S. Inflation (CPI) | 3.4% year-over-year (April 2024) | Raises raw material and manufacturing costs, increasing operational expenses. |

| Federal Funds Rate | Elevated range throughout 2024 | Increases borrowing costs for capital expenditures and strategic investments. |

| U.S. National Health Spending Growth | Projected 5.4% annually (2023-2032) | Indicates a larger market but also intensified pricing and reimbursement pressures. |

| Global Medical Device Market Growth | $551 billion (2024) to $586 billion (2025) | Signals strong demand for Avanos's innovative solutions. |

| Currency Impact | Anticipated headwinds in 2025 | Can reduce reported foreign sales value and erode profit margins. |

Same Document Delivered

Avanos PESTLE Analysis

The preview shown here is the exact Avanos PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers all key political, economic, social, technological, legal, and environmental factors impacting Avanos, providing valuable insights for strategic planning.

Sociological factors

The world's population is getting older, and this trend is a major boost for medical technology companies like Avanos. As people age, they often need more healthcare, driving up demand for services and devices, especially for managing long-term conditions, pain, and digestive issues. For instance, the World Health Organization projects that by 2030, one in six people globally will be over 60 years old, highlighting a substantial and growing market.

Avanos's product lines, which are designed to help patients recover more quickly and avoid complications, are a perfect fit for this demographic shift. Their focus on areas like advanced wound care and gastrointestinal health directly addresses the needs of an aging population, who are more susceptible to these types of conditions.

Patients are increasingly taking charge of their well-being, driving demand for solutions that support personalized health management and remote care. This shift means companies like Avanos need to offer intuitive, user-friendly devices that empower individuals in their daily health routines. For instance, the global digital health market was valued at over $200 billion in 2023 and is projected to grow significantly, indicating a strong consumer appetite for these advancements.

The increasing global incidence of lifestyle diseases and chronic conditions, such as diabetes and cardiovascular issues, fuels a significant demand for continuous healthcare services and advanced medical equipment. This trend is projected to continue, with the World Health Organization estimating that non-communicable diseases will account for 75% of all deaths globally by 2030.

Avanos's strategic positioning in key healthcare segments, including pain management, respiratory support, and digestive health solutions, directly aligns with the need to address these escalating health challenges. For instance, the company's offerings in wound care and digestive health are crucial for managing chronic conditions that affect millions worldwide.

Public Perception and Trust in Medical Devices

Public perception and trust are cornerstones for medical device companies like Avanos, directly impacting market acceptance and sales. Concerns about patient safety, device effectiveness, and the ethical sourcing of materials heavily shape this perception. For instance, in 2023, the FDA issued numerous recalls for various medical devices, highlighting the constant scrutiny these products face from both regulators and the public. Avanos's commitment to rigorous quality control and transparent communication about its manufacturing processes is therefore paramount to building and sustaining this trust.

Negative press, such as product recalls or adverse event reports, can erode consumer confidence and lead to significant financial repercussions. A 2024 report indicated that companies experiencing major product recalls saw an average decline of 10-15% in stock value within the first month post-announcement. This underscores the critical need for Avanos to proactively manage its reputation by ensuring product reliability and addressing any emerging issues swiftly and transparently.

Maintaining high standards of quality and ethical manufacturing is not just a regulatory requirement but a strategic imperative for Avanos to foster positive public perception. The company's investment in robust research and development, coupled with adherence to stringent regulatory frameworks like ISO 13485, directly contributes to building this trust. Furthermore, clear communication about the benefits and potential risks associated with their medical devices is essential for informed decision-making by healthcare providers and patients alike.

- Product Safety: Public trust hinges on the demonstrated safety of medical devices, with recalls significantly damaging reputation.

- Efficacy and Performance: Patients and healthcare professionals expect devices to perform as intended, directly influencing adoption rates.

- Ethical Manufacturing: Transparency in sourcing and production practices is increasingly important to consumers and regulatory bodies.

- Reputational Impact: Negative publicity, such as recalls, can lead to substantial financial losses and a decline in market share.

Healthcare Access and Equity

Societal emphasis on enhancing healthcare access and equity, particularly in underserved areas, presents significant market opportunities for companies like Avanos. This focus drives demand for innovative solutions that can reach a broader patient population.

Avanos's commitment to delivering clinically superior products worldwide, coupled with efforts to improve affordability and accessibility, directly addresses these societal trends. For instance, in 2023, Avanos continued its global expansion, reaching new markets and demonstrating its dedication to equitable healthcare distribution.

- Global Health Initiatives: Avanos actively participates in programs aimed at widening access to essential medical technologies, aligning with the growing societal demand for equitable healthcare.

- Product Affordability: The company explores strategies to make its advanced medical devices more accessible in low and middle-income countries, reflecting a commitment to addressing healthcare disparities.

- Clinical Impact: By providing products that improve patient outcomes, Avanos contributes to the broader societal goal of better health for all, strengthening its market position and reputation.

The aging global population is a significant driver for Avanos, as older individuals often require more healthcare services and devices. The World Health Organization projects that by 2030, one in six people globally will be over 60, indicating a substantial and growing market for Avanos's specialized products.

Patients are increasingly seeking greater control over their health, boosting the demand for user-friendly, personalized health management solutions. The global digital health market, valued at over $200 billion in 2023, illustrates this trend and the consumer appetite for accessible health technologies.

The rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, necessitates continuous healthcare and advanced medical equipment. The World Health Organization estimates that by 2030, non-communicable diseases will cause 75% of all global deaths, underscoring the ongoing need for solutions like those Avanos provides in pain management and digestive health.

Public trust is paramount for medical device companies, directly influencing market acceptance and sales. Concerns about product safety and efficacy are critical, especially after instances like the FDA's numerous medical device recalls in 2023. Avanos's commitment to quality control and transparent communication is vital for maintaining this trust, as negative publicity can lead to significant financial impacts, with reports showing stock value declines of 10-15% after major recalls.

| Sociological Factor | Impact on Avanos | Supporting Data/Trend |

|---|---|---|

| Aging Population | Increased demand for healthcare and medical devices | WHO: 1 in 6 globally over 60 by 2030 |

| Patient Empowerment & Digital Health | Demand for user-friendly, personalized health solutions | Global digital health market >$200 billion (2023) |

| Chronic Disease Prevalence | Sustained need for advanced medical equipment and care | WHO: NCDs to cause 75% of global deaths by 2030 |

| Public Perception & Trust | Crucial for market acceptance; recalls damage reputation | FDA recalls in 2023; 10-15% stock drop post-recall |

Technological factors

Artificial intelligence and machine learning are fundamentally changing how medical devices diagnose conditions and support clinical decisions. These technologies offer the potential for significantly more accurate and efficient healthcare delivery.

AI-driven systems are proving invaluable in tailoring treatment plans to individual patients, minimizing diagnostic errors, and optimizing clinical workflows. For companies like Avanos, this represents a critical frontier for developing next-generation medical technologies.

The global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to reach around $190.1 billion by 2030, demonstrating a compound annual growth rate of over 40%, according to recent market analyses.

The health tech market is booming, with AI-powered wearables and remote monitoring devices becoming increasingly popular for managing chronic conditions and facilitating home care. By 2024, the global wearable technology market was valued at over $130 billion, with a significant portion dedicated to health and fitness applications.

Avanos can capitalize on this by integrating its medical devices with these advanced technologies. This move would allow for real-time patient data collection, leading to more personalized treatment plans and improved patient outcomes, especially for those managing long-term illnesses.

Avanos's commitment to innovation in pain management and digestive health is a key technological driver. The company consistently invests in developing advanced medical devices designed to enhance patient recovery times and reduce post-procedural complications. For instance, their offerings in minimally invasive surgical tools and advanced wound care solutions directly address the need for improved clinical outcomes, a critical factor in healthcare technology adoption.

Cybersecurity and Data Security in Connected Devices

The increasing interconnectedness of medical devices and digital health platforms places a significant emphasis on cybersecurity and data privacy for companies like Avanos. Manufacturers bear the responsibility of safeguarding sensitive patient information and securing the entire network of connected devices. This necessitates the implementation of robust cybersecurity protocols and adherence to ever-evolving data protection regulations.

The threat landscape for connected medical devices is substantial. For instance, a 2024 report indicated that healthcare organizations experienced an average of 1,249 cyberattacks per week, a 71% increase from 2023. Avanos must invest heavily in advanced security measures to protect against breaches that could compromise patient safety and trust. This includes end-to-end encryption, regular vulnerability assessments, and secure software development lifecycles for their product portfolio.

- 2024 Healthcare Cyberattack Increase: Healthcare organizations faced an average of 1,249 weekly cyberattacks, up 71% from 2023.

- Regulatory Compliance: Adherence to regulations like HIPAA in the US and GDPR in Europe is critical for data security.

- Patient Data Protection: Companies like Avanos must ensure the confidentiality, integrity, and availability of patient data.

3D Printing and Advanced Manufacturing Techniques

3D printing is revolutionizing medical device manufacturing, allowing for highly personalized implants and prosthetics. This means patients can receive devices tailored precisely to their anatomy, potentially leading to better outcomes and reduced recovery times. For instance, in 2024, the global 3D printing in healthcare market was valued at approximately $2.5 billion, with significant growth projected as adoption increases.

This advanced manufacturing capability also provides Avanos with the agility to rapidly prototype new products and scale production efficiently. Companies are leveraging 3D printing to create on-demand components, which can bolster supply chain resilience, especially in light of recent global disruptions. The ability to quickly iterate designs and bring them to market faster is a key competitive advantage in the medical technology sector.

The impact on patient care is substantial:

- Personalized Fit: 3D printed medical devices offer unparalleled customization for improved patient comfort and efficacy.

- Reduced Wait Times: On-demand production can shorten lead times for critical medical equipment and implants.

- Supply Chain Resilience: Localized 3D printing capabilities can mitigate risks associated with global supply chain disruptions.

- Accelerated Innovation: Rapid prototyping speeds up the development cycle for new medical solutions.

Technological advancements in AI and machine learning are transforming medical diagnostics and treatment personalization, with the AI in healthcare market expected to surge from $15.4 billion in 2023 to $190.1 billion by 2030. The increasing use of AI-powered wearables, a market valued over $130 billion in 2024 for health applications, allows for real-time patient data collection, enhancing personalized care and outcomes. Furthermore, 3D printing is revolutionizing medical device manufacturing, enabling customized implants and prosthetics, with the market valued at approximately $2.5 billion in 2024, improving patient fit and accelerating innovation. However, the rise of connected devices necessitates robust cybersecurity, especially given the 71% increase in weekly cyberattacks on healthcare organizations in 2024, averaging 1,249 per week.

| Technology | 2024 Market Value (Approx.) | Projected Growth Driver | Key Impact for Avanos |

|---|---|---|---|

| AI in Healthcare | N/A (Significant Growth) | Improved diagnostics, personalized treatment | Next-gen device development, enhanced patient outcomes |

| Wearable Technology (Health) | $130+ billion | Remote monitoring, chronic condition management | Real-time data integration, personalized care plans |

| 3D Printing in Healthcare | $2.5 billion | Customized implants, rapid prototyping | Agile product development, supply chain resilience |

| Cybersecurity (Healthcare) | N/A (Critical Investment Area) | Protecting patient data, device integrity | Ensuring patient safety and trust, regulatory compliance |

Legal factors

The EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) are imposing more rigorous requirements on medical device manufacturers like Avanos. These regulations focus on enhanced safety, quality, and ongoing surveillance of devices after they reach the market. Failure to comply can result in significant penalties and loss of market access within the European Union, impacting Avanos's European sales which represented a substantial portion of its global revenue in recent years.

Avanos's Quality Management System (QMS) must be meticulously updated to meet these evolving EU standards. This includes implementing features like unique device identification (UDI) for better traceability and establishing robust processes for notifying authorities about supply chain disruptions. For instance, the MDR mandates a UDI system that allows for clear identification and tracking of devices throughout their lifecycle, a critical component for ensuring patient safety and regulatory oversight.

The U.S. Food and Drug Administration (FDA) is continuously updating its regulations, impacting areas like medical product approvals, laboratory-developed tests, and the use of artificial intelligence in medical devices. These changes can influence product development timelines and market access for companies such as Avanos.

For fiscal year 2025, manufacturers will face new medical device user fees. These fees affect the costs associated with product registrations and submission processes, necessitating careful financial planning for companies like Avanos to manage these increased operational expenses.

Global efforts to harmonize medical device regulations, spearheaded by the International Medical Device Regulators Forum (IMDRF), present both opportunities and challenges for companies like Avanos. While aiming for consistency, the reality is a complex patchwork of evolving national laws that require careful navigation.

Avanos must remain vigilant regarding regulatory updates in key markets such as the UK, China, Japan, India, and Canada. For instance, in 2024, the UK's Medicines and Healthcare products Regulatory Agency (MHRA) continued its transition to the UK Medical Devices Regulations (UK MDR), diverging from EU standards, which impacts market access and compliance strategies.

Navigating these diverse legal frameworks is crucial for Avanos's global operations. Understanding and adapting to the specific requirements in each region ensures continued market access and avoids costly penalties or product recalls, especially as many nations are updating their frameworks to align with international best practices while retaining unique national nuances.

Product Liability and Consumer Protection Laws

Manufacturers like Avanos are under growing pressure regarding product liability and consumer protection, particularly with evolving regulations such as the EU's updated Product Liability Directive, which came into effect in mid-2024. This means stringent quality control and proactive risk management across the entire product lifecycle are crucial to prevent significant financial penalties and reputational damage.

The focus on transparency in reporting adverse events is paramount. For instance, in 2024, regulatory bodies globally have increased fines for non-compliance in medical device reporting, with some settlements reaching tens of millions of dollars. Avanos must maintain robust systems for tracking and reporting any issues to ensure adherence to these stringent consumer protection mandates.

- Increased Regulatory Scrutiny: New directives and laws globally are enhancing consumer rights and manufacturer responsibilities.

- Product Safety Standards: Adherence to evolving safety standards is non-negotiable to avoid legal repercussions.

- Adverse Event Reporting: Timely and accurate reporting of product malfunctions or side effects is critical for compliance.

- Financial Penalties: Non-compliance can lead to substantial fines, impacting profitability and market standing.

Data Privacy and Cybersecurity Regulations (e.g., GDPR, HIPAA)

Avanos, like all medical device companies, faces stringent legal requirements regarding data privacy and cybersecurity. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States mandate how patient data must be collected, stored, and protected. These laws, along with evolving cybersecurity legislation, create a significant compliance burden.

Failure to adhere to these regulations can result in substantial penalties. For instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. HIPAA violations can lead to fines ranging from $100 to $50,000 per violation, with annual caps. Avanos must therefore invest heavily in robust cybersecurity measures and comprehensive data governance frameworks to safeguard sensitive patient information and avoid costly legal repercussions and reputational damage.

- GDPR fines can reach up to 4% of global annual turnover or €20 million.

- HIPAA violations can incur fines from $100 to $50,000 per incident.

- Avanos must maintain strong data governance to ensure compliance.

- Cybersecurity investments are critical to avoid legal and financial penalties.

Global regulatory landscapes for medical devices are becoming increasingly complex, with significant implications for companies like Avanos. The EU's MDR and IVDR, for example, demand heightened product safety and post-market surveillance, impacting market access and operational costs.

In the US, the FDA's ongoing regulatory updates, including new user fees for fiscal year 2025, directly affect product development timelines and financial planning for manufacturers. Navigating these evolving requirements across key markets like the UK, China, and Japan necessitates continuous adaptation of compliance strategies.

The legal ramifications of non-compliance are substantial, ranging from significant financial penalties, as seen with GDPR fines up to 4% of global turnover, to reputational damage. Avanos must prioritize robust quality management systems and meticulous adherence to data privacy laws like GDPR and HIPAA to mitigate these risks.

| Regulation | Key Impact on Avanos | Potential Financial Consequence (Example) |

|---|---|---|

| EU MDR/IVDR | Stricter safety & surveillance, UDI implementation | Loss of EU market access, significant fines |

| US FDA User Fees (FY2025) | Increased costs for product submissions | Higher operational expenses |

| GDPR | Data privacy & cybersecurity compliance | Fines up to 4% of global turnover or €20 million |

| HIPAA | Patient data protection | Fines from $100 to $50,000 per violation |

Environmental factors

The medical device sector, including companies like Avanos, is placing a growing emphasis on sustainability and Environmental, Social, and Governance (ESG) objectives. This translates into a drive for more efficient manufacturing, less waste, and better energy usage across operations.

Avanos's commitment to corporate responsibility is demonstrated through initiatives focused on health, safety, and environmental stewardship at its various manufacturing sites. For instance, their 2023 Corporate Citizenship Report detailed progress in reducing greenhouse gas emissions by 10% compared to a 2020 baseline.

This focus on ESG is becoming a critical factor for investors and consumers alike, influencing purchasing decisions and capital allocation. Companies that effectively integrate sustainability into their manufacturing and business practices are often viewed as more resilient and better positioned for long-term growth.

Medical device companies like Avanos face increasingly stringent regulations regarding waste management and disposal. These rules cover both hazardous waste and regulated medical waste, impacting how companies handle byproducts from manufacturing and product use.

Key mandates include specific protocols for managing chemical waste and a strict prohibition against flushing pharmaceutical waste down sewer systems. For instance, the U.S. Environmental Protection Agency (EPA) continuously updates its Resource Conservation and Recovery Act (RCRA) regulations, which govern hazardous waste. In 2023, enforcement actions related to improper medical waste disposal continued to be a focus, with significant fines levied against non-compliant facilities.

Avanos must ensure its global operations, from product development to end-of-life management, align with these diverse and evolving environmental standards. Failure to comply can lead to substantial penalties, reputational damage, and operational disruptions.

Environmental concerns are increasingly shaping supply chains, pushing companies like Avanos to prioritize ethical sourcing and minimize the carbon footprint of their logistics operations. This focus is crucial for maintaining brand reputation and meeting evolving regulatory demands.

Avanos demonstrates its commitment to responsible supply chain management through its Supplier Social Compliance Standards, which explicitly address human rights and environmental principles. This framework guides their engagement with suppliers, ensuring alignment with sustainability goals.

Climate Change and Resource Scarcity Impacts

Climate change and the potential for resource scarcity pose significant challenges to medical device manufacturers like Avanos. Fluctuations in energy availability and cost, driven by climate events or policy shifts, can disrupt production schedules and increase operational expenses. For instance, extreme weather events in 2024 continued to highlight vulnerabilities in global energy grids, impacting manufacturing hubs.

Water usage is another critical factor, especially for sterilization and manufacturing processes. Regions experiencing drought or increased water stress, a growing concern in many of Avanos' operating areas, could lead to higher water costs or even restrictions, affecting output. The availability and cost of essential raw materials, such as specific polymers or metals, can also be impacted by climate-related disruptions to mining or agricultural supply chains.

To mitigate these risks, companies are increasingly focusing on sustainable resource management and supply chain resilience. This includes:

- Diversifying energy sources: Exploring renewable energy options to reduce reliance on fossil fuels and hedge against price volatility.

- Optimizing water usage: Implementing water-saving technologies and recycling processes within manufacturing facilities.

- Securing raw material supply: Developing stronger relationships with suppliers and exploring alternative material sourcing to ensure consistent availability.

- Building resilient supply chains: Mapping and understanding climate-related risks throughout the entire supply chain to proactively address potential disruptions.

Compliance with Environmental Health and Safety Standards

Avanos prioritizes adherence to occupational health and safety standards, which inherently encompass environmental protection. This commitment is crucial for maintaining operational integrity and demonstrating corporate responsibility. The company actively fosters a safety-first culture across its global operations, recognizing the interconnectedness of employee well-being and environmental stewardship.

Avanos has reported strong safety performance metrics at its production facilities, underscoring its dedication to minimizing environmental impact and ensuring a secure working environment. For instance, in their 2023 sustainability report, Avanos highlighted a reduction in recordable incidents, reflecting their proactive approach to safety management which extends to environmental health and safety protocols.

- Safety-First Culture: Avanos cultivates an environment where safety is paramount for both employees and the surrounding environment.

- Environmental Health & Safety (EHS) Standards: Strict adherence to EHS regulations is a core operational principle.

- Performance Metrics: The company consistently tracks and reports on safety performance, demonstrating tangible progress in its EHS initiatives.

- Commitment to Well-being: Avanos's focus on safety reflects a broader commitment to the well-being of its workforce and the communities in which it operates.

Environmental regulations are increasingly stringent for medical device companies like Avanos, particularly concerning waste management and disposal. For example, the U.S. EPA's RCRA regulations, updated through 2023, impose strict protocols for handling chemical and medical waste, with significant penalties for non-compliance.

Climate change impacts supply chains and operations, affecting energy costs and raw material availability. Avanos's 2023 report noted a 10% reduction in greenhouse gas emissions from a 2020 baseline, demonstrating a proactive approach to mitigating these environmental risks.

Sustainability is a key investor and consumer focus, influencing purchasing and capital allocation. Avanos's commitment to ESG, including responsible sourcing and minimizing its carbon footprint, is vital for long-term resilience and growth.

| Environmental Factor | Impact on Avanos | Mitigation Strategy/Action |

|---|---|---|

| Waste Management Regulations | Increased compliance costs, potential fines for non-compliance | Adherence to EPA RCRA, strict disposal protocols |

| Climate Change & Resource Scarcity | Volatile energy costs, potential raw material shortages | Diversifying energy sources, securing raw material supply |

| Supply Chain Sustainability | Reputational risk, regulatory pressure | Supplier Social Compliance Standards, ethical sourcing |

| Greenhouse Gas Emissions | Operational efficiency, investor scrutiny | 10% reduction from 2020 baseline (as of 2023 report) |

PESTLE Analysis Data Sources

Our Avanos PESTLE Analysis is informed by a comprehensive blend of data sources, including official government publications, reputable industry analysis firms, and leading economic indicators. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and credible information.