Avanos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avanos Bundle

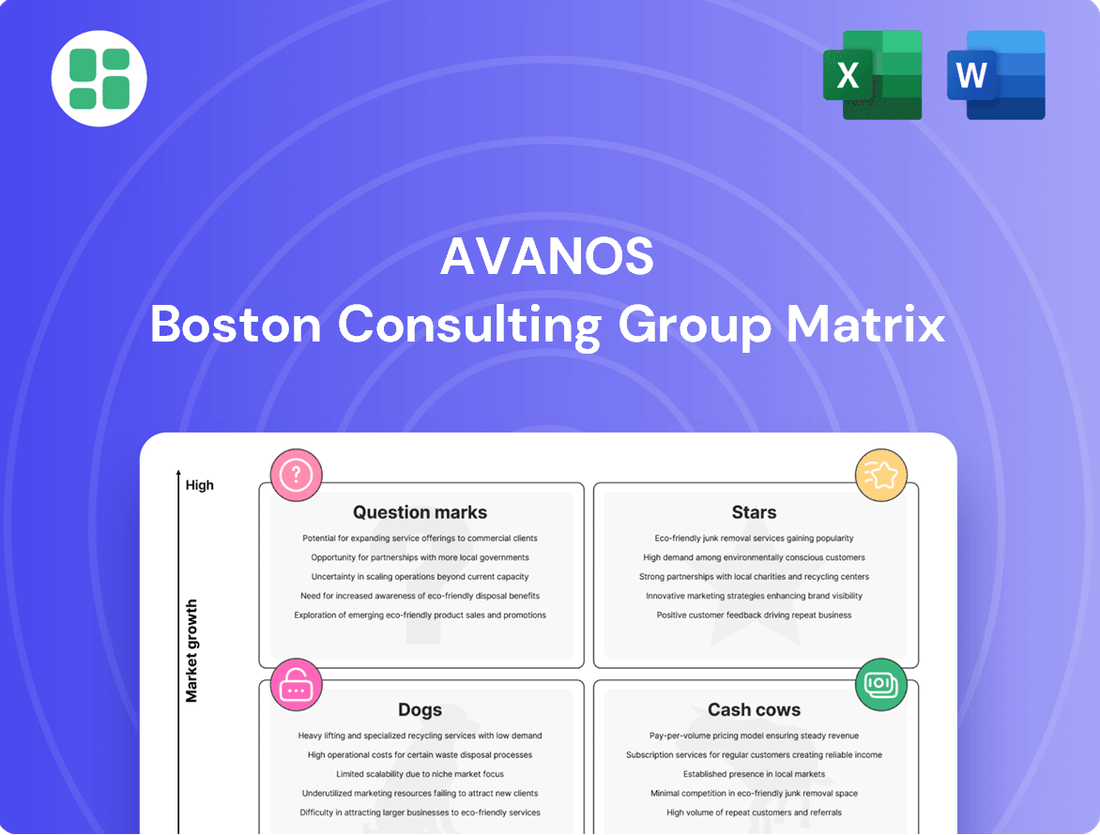

Uncover the strategic positioning of each product within the company's portfolio using the BCG Matrix. See which are poised for growth and which may require a strategic shift. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your product strategy.

Stars

NeoMed Neonatal and Pediatric Feeding Solutions represent a strong performer for Avanos, fitting squarely into the Star quadrant of the BCG matrix. This product line is characterized by its high market share within the burgeoning neonatal and pediatric digestive health sector, a segment experiencing consistent volume growth. Avanos' strategic focus on this niche is a testament to its commitment to capitalizing on significant market demand.

The continued investment in innovation and market penetration for NeoMed is a primary engine driving Avanos' overall growth. For instance, the global pediatric feeding tubes market was valued at approximately $1.2 billion in 2023 and is projected to grow at a CAGR of over 6% through 2030, highlighting the substantial opportunity NeoMed is positioned to capture.

Avanos's Radiofrequency Ablation (RFA) products, including those from the acquired Diros Technology, are a significant growth driver, reflecting the company's strategic push into interventional pain management. Generator sales are particularly strong, indicating an increase in RFA procedures and a positive market reception for these minimally invasive solutions.

The Diros acquisition in 2022, for instance, bolstered Avanos's offerings in this burgeoning field. This segment is crucial for Avanos's portfolio optimization, addressing unmet healthcare needs with effective pain relief technologies.

The ON-Q and ambIT Infusion Pumps are poised for significant growth following the NOPAIN Act's expanded reimbursement, effective January 1, 2025. This policy shift specifically targets non-opioid pain management solutions, directly benefiting these Avanos products. Avanos anticipates increased adoption due to this favorable regulatory environment, reinforcing their commitment to clinically superior, opioid-sparing alternatives.

Strategic Tuck-in Acquisitions in Specialty Nutrition Systems (SNS)

Avanos is strategically employing tuck-in acquisitions within its Specialty Nutrition Systems (SNS) segment. This move signifies a deliberate effort to bolster its market position by acquiring high-growth products and technologies. The company aims to rapidly integrate innovative solutions that complement its existing strengths and expand its reach in the dynamic nutrition market.

These targeted acquisitions are crucial for accelerating Avanos's path to market leadership. By focusing on synergistic additions, the company can enhance its product portfolio and cater to evolving consumer demands in the specialty nutrition sector. This strategy is designed to unlock new revenue streams and deliver superior value to stakeholders.

Avanos's commitment to tuck-in acquisitions in SNS is a key component of its growth strategy. For instance, in 2024, the company has been actively evaluating opportunities that align with its innovation pipeline and market expansion goals. This proactive approach allows Avanos to stay ahead of market trends and solidify its competitive advantage.

- Tuck-in acquisitions target high-growth products in SNS.

- Strategy aims to accelerate market leadership and expand share.

- Integration of innovative solutions is a key focus.

- Investments designed to enhance value in the growing nutrition space.

New Product Development in Pain Management & Recovery

Avanos is heavily investing in new product development within its Pain Management & Recovery segment. This strategic push is centered on creating non-opioid alternatives, addressing a significant market demand. In 2024, the company continued to allocate substantial resources to R&D, aiming to launch next-generation solutions that improve patient outcomes and provider efficiency.

The focus on innovation is critical for Avanos to solidify its position in the rapidly expanding pain management sector. By introducing novel products, Avanos seeks to capture market share and capitalize on trends favoring less invasive and non-addictive pain relief methods. This proactive approach ensures the company remains competitive.

- Focus on Non-Opioid Solutions: Avanos' R&D pipeline prioritizes alternatives to opioids, aligning with global healthcare trends.

- Market Growth: The pain management market is a high-growth area, with analysts projecting continued expansion through 2027.

- Competitive Edge: New product introductions are vital for maintaining market leadership and differentiating from competitors.

- Patient & Provider Needs: Development efforts are guided by the evolving requirements of both patients seeking better recovery and providers needing effective tools.

Avanos's Stars are products with high market share in high-growth industries. These are the company's current growth engines, requiring significant investment to maintain their leading positions and capitalize on market expansion opportunities. The NeoMed Neonatal and Pediatric Feeding Solutions and the Radiofrequency Ablation (RFA) products, particularly from Diros Technology, exemplify this category for Avanos.

The continued investment in innovation and market penetration for NeoMed is a primary engine driving Avanos's overall growth. For instance, the global pediatric feeding tubes market was valued at approximately $1.2 billion in 2023 and is projected to grow at a CAGR of over 6% through 2030, highlighting the substantial opportunity NeoMed is positioned to capture. Similarly, the strong performance of RFA generator sales indicates a growing adoption of these minimally invasive pain management solutions.

The ON-Q and ambIT Infusion Pumps are also poised for significant growth, especially with the expanded reimbursement for non-opioid pain management solutions under the NOPAIN Act, effective January 1, 2025. This regulatory tailwind is expected to drive increased adoption of Avanos's opioid-sparing alternatives.

| Product Line | BCG Category | Key Growth Drivers | Market Context (2023/2024 Data) | Strategic Focus |

|---|---|---|---|---|

| NeoMed Neonatal & Pediatric Feeding Solutions | Star | High market share in growing niche, consistent volume growth | Global pediatric feeding tubes market ~ $1.2 billion (2023), 6%+ CAGR projected through 2030 | Continued innovation and market penetration |

| Radiofrequency Ablation (RFA) Products (incl. Diros) | Star | Strong generator sales, increasing RFA procedures, effective pain management | Growing interventional pain management sector | Bolstering offerings, capitalizing on minimally invasive trends |

| ON-Q and ambIT Infusion Pumps | Potential Star (due to upcoming tailwinds) | Expanded reimbursement (NOPAIN Act from Jan 1, 2025), focus on non-opioid alternatives | Increasing demand for opioid-sparing pain management solutions | Leveraging regulatory changes for increased adoption |

What is included in the product

The Avanos BCG Matrix categorizes business units by market share and growth rate.

It guides strategic decisions on investment, divestment, or divestment.

Avanos BCG Matrix provides a clear, visual overview of your portfolio, easing the pain of strategic uncertainty.

Cash Cows

Established enteral feeding tubes, like Avanos' MIC-KEY and CORPAK brands, are solid cash cows. These products are in a mature market where Avanos has a significant presence. They consistently bring in substantial cash because they are widely used and essential for patients. In 2024, the global enteral feeding market was valued at approximately $5.5 billion, with a steady growth rate projected.

Avanos focuses its investments on maintaining the efficiency and quality of these established products. Efforts are also directed towards expanding direct sales channels to reach more healthcare providers and patients. This strategy ensures these vital lifelines continue to serve their purpose reliably and profitably.

Percutaneous Endoscopic Gastrostomy (PEG) tubes are a cornerstone of Avanos's enteral feeding portfolio, representing a classic Cash Cow. This product line boasts high market penetration and consistent demand from healthcare facilities, ensuring a stable and predictable revenue stream.

The mature nature of the PEG tube market, characterized by low growth, translates into strong profit margins and minimal need for significant promotional spending. Avanos can therefore leverage these products for robust cash generation, supporting investments in other areas of the business.

In 2024, the global market for enteral feeding devices, including PEG tubes, was valued at approximately $4.5 billion, with a projected compound annual growth rate of around 5% through 2030. This indicates the continued stability and essential role of PEG tubes in patient care.

Long-standing surgical pain pumps, like those offered by Avanos, often represent established products within the Pain Management & Recovery segment. These devices have likely achieved significant market penetration and are recognized for their reliable revenue generation. For instance, in 2023, Avanos reported that its Chronic Pain segment, which includes some of these mature pain pumps, contributed substantially to its overall revenue.

These mature pain pumps are considered cash cows because they typically require minimal investment for growth, allowing them to generate consistent profits. Their widespread adoption means they are a stable, predictable income stream for the company, supporting investments in more innovative areas of the business. Avanos's focus on optimizing its supply chain for these established products in 2024 underscores their role as reliable contributors.

Ancillary Enteral Feeding Accessories (e.g., ANCORIS* Tube Anchor Set)

Ancillary enteral feeding accessories, like the ANCORIS* Tube Anchor Set, are classic cash cows for Avanos. These items are essential companions to their main feeding tubes, ensuring secure placement and patient comfort. This means they benefit from consistent, repeat purchases from existing customers who already rely on Avanos' core products.

The market for these accessories is stable and mature. They don't require significant investment to grow, yet they generate substantial, high-margin profits. This reliability makes them a key contributor to Avanos' overall financial health, providing predictable cash flow that can be reinvested elsewhere in the company.

Their integration with established enteral feeding solutions fosters strong customer loyalty. By offering a complete ecosystem of products, Avanos strengthens its relationship with healthcare providers and patients alike. This synergy ensures a steady stream of revenue, reinforcing their position as a dependable cash generator.

- Recurring Revenue: Ancillary products like tube anchors are consumables that need regular replacement, creating a predictable revenue stream.

- High Margins: These accessories typically have higher profit margins compared to the core feeding tubes themselves, boosting overall profitability.

- Customer Loyalty: Offering a full suite of accessories enhances the value proposition of Avanos' primary feeding tubes, encouraging continued use and reducing customer churn.

Direct Sales & Distribution of MIC-KEY in the UK

Avanos's decision to handle MIC-KEY enteral feeding product sales directly in the UK from July 2025 positions it as a cash cow. This move leverages the product's high market share within a mature market, aiming to boost profitability and operational control. The strategy focuses on optimizing an already successful product for increased cash generation.

By taking direct control, Avanos anticipates streamlining its distribution network, which is crucial for mature products like MIC-KEY. This efficiency gain is expected to directly translate into improved cash flow. For instance, in 2024, the global enteral feeding market was valued at approximately $11.5 billion, with the UK representing a significant portion, underscoring the potential for direct sales to capture greater value from this established segment.

- Product Maturity: MIC-KEY operates in a well-established enteral feeding market.

- Market Share: The product holds a strong position, indicating high demand.

- Strategic Shift: Direct sales in the UK aim to maximize profit extraction.

- Financial Goal: Enhance cash flow by optimizing distribution and sales processes.

Avanos's established enteral feeding tubes, like the MIC-KEY and CORPAK brands, are prime examples of cash cows within the BCG matrix. These products benefit from a mature market where Avanos holds a significant share, consistently generating substantial cash due to their widespread use and essential nature in patient care. The global enteral feeding market was valued at approximately $11.5 billion in 2024, with these established products forming a stable revenue base.

Avanos strategically invests in maintaining the efficiency and quality of these mature products, while also expanding direct sales channels to enhance reach and profitability. This focused approach ensures these vital medical devices continue to provide reliable patient support and contribute significantly to the company's cash flow, supporting investments in other growth areas.

Percutaneous Endoscopic Gastrostomy (PEG) tubes are a cornerstone of Avanos's enteral feeding portfolio and a classic cash cow. Their high market penetration and consistent demand from healthcare facilities provide a stable, predictable revenue stream. The mature PEG tube market, with its low growth, translates into strong profit margins and reduced promotional spending, allowing these products to generate robust cash for the company.

In 2024, the global market for enteral feeding devices, including PEG tubes, was valued at approximately $4.5 billion, with a projected compound annual growth rate of around 5% through 2030, highlighting the continued stability and essential role of PEG tubes.

| Product Category | BCG Status | Market Characteristic | Revenue Contribution | Strategic Focus |

|---|---|---|---|---|

| Enteral Feeding Tubes (MIC-KEY, CORPAK) | Cash Cow | Mature, High Market Share | Substantial & Stable | Efficiency, Quality, Direct Sales Expansion |

| PEG Tubes | Cash Cow | Mature, Consistent Demand | Predictable Revenue Stream | Profit Margin Optimization, Cash Generation |

| Surgical Pain Pumps | Cash Cow | Mature, High Penetration | Consistent Profitability | Supply Chain Optimization |

| Ancillary Enteral Feeding Accessories | Cash Cow | Stable, Mature, Consumable | High-Margin, Repeat Purchases | Customer Loyalty, Ecosystem Integration |

What You’re Viewing Is Included

Avanos BCG Matrix

The Avanos BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, ensuring you get a professional and actionable strategic tool right away. The insights and analysis presented here are complete and ready for your business planning needs. You can confidently proceed with your purchase, knowing that the file delivered will be exactly as you see it, enabling you to drive informed decisions and optimize your product portfolio.

Dogs

The divested Respiratory Health Business, encompassing brands like Ballard, Microcuff, and Endoclear, was categorized as a low-margin, low-growth segment within Avanos's portfolio. Avanos strategically exited this non-core area in late 2023 through a sale to SunMed Group Holdings, a move designed to streamline operations and reallocate resources.

This divestiture, completed in Q4 2023 for $130 million, allowed Avanos to shed a business unit that was likely underperforming in terms of profitability and future expansion potential. The capital freed from this sale is intended to fuel investments in higher-growth, higher-margin areas of the company's business.

Hyaluronic Acid (HA) pain relief injection products are positioned as a 'Dog' in the Avanos BCG Matrix. These products have encountered substantial headwinds, with unfavorable pricing and reduced demand impacting performance throughout 2024 and projected into 2025.

This market segment is characterized by intense competition and a declining trajectory, where Avanos currently holds a weak or shrinking market position. The company's decision to revise revenue and margin projections downwards for this product line underscores its status as a potential cash trap, requiring ongoing investment without commensurate returns.

Game Ready Cold Compression Systems, within Avanos' Pain Management & Recovery segment, faced a notable dip in sales volume during Q4 2024. This performance suggests potential challenges in retaining market share or operating within a slower-growth niche of the broader pain management industry.

The observed underperformance of Game Ready, despite its placement within a key portfolio, signals a need for strategic review. It raises questions about its future investment allocation and market positioning, potentially marking it for a re-evaluation of its role within Avanos' product offerings.

Certain Discontinued Product Lines (from SKU Rationalization)

Avanos has been strategically streamlining its product portfolio through SKU rationalization, a process aimed at divesting underperforming and low-margin offerings. These discontinued product lines, though not specifically identified, represent categories that were not contributing significantly to growth or profitability and were deemed non-strategic for future development.

The company's focus on exiting these segments aligns with its broader transformation efforts to enhance operational efficiency and resource allocation. In 2023, Avanos reported a net sales decline of 2.6% to $777.9 million, partly influenced by these strategic product exits.

- SKU Rationalization: Avanos's ongoing effort to simplify its product catalog by removing less profitable or non-essential items.

- Strategic Focus: The discontinuation of these product lines allows Avanos to concentrate resources on higher-growth, more profitable areas of its business.

- Financial Impact: While specific figures for discontinued lines aren't itemized, the overall sales performance in 2023, which saw a slight decrease, reflects the impact of these strategic decisions.

- Future Investment: By shedding these underperforming assets, Avanos frees up capital and management attention for investments in core and emerging product categories.

Legacy/Undifferentiated Pain Management Products

Legacy/Undifferentiated Pain Management Products represent older offerings within Avanos' Pain Management & Recovery segment that haven't experienced recent innovation or substantial market growth. These products may be facing reduced market share due to heightened competition or shifts in clinical practices.

These products are often characterized by a lack of distinct competitive advantages, making them vulnerable to newer, more advanced solutions. For instance, if a legacy product is a basic pain relief cream facing competition from advanced topical formulations with enhanced delivery systems, its market position would likely weaken.

- Declining Market Share: Products in this category may see a steady decrease in their share of the pain management market. For example, a product that once held 15% of a specific market segment might now be down to 5% due to newer entrants.

- Limited Innovation: Lack of significant research and development investment means these products are not keeping pace with evolving medical needs and patient expectations.

- Potential for Divestiture or Discontinuation: Avanos may consider divesting or phasing out these products to reallocate resources towards more promising areas, such as their innovative neurolytic agents or advanced wound care solutions.

- Strategic Focus Shift: As of 2024, the company's strategic emphasis is on high-growth areas, making legacy products less of a priority for future investment.

Hyaluronic Acid (HA) pain relief injections are firmly in the 'Dog' category for Avanos. This means they have a low market share in a slow-growing industry. The company has seen unfavorable pricing and reduced demand for these products throughout 2024, with projections indicating this trend will continue into 2025.

Legacy/Undifferentiated Pain Management Products also fit the 'Dog' profile, lacking significant innovation and facing increased competition. Game Ready Cold Compression Systems experienced a sales volume dip in Q4 2024, suggesting challenges in maintaining market position within its niche.

Avanos's strategy involves SKU rationalization, actively divesting underperforming and low-margin products to focus on growth areas. This aligns with their 2024 focus on high-growth segments, making these 'Dog' products less of a priority for future investment.

The divestiture of the Respiratory Health Business in late 2023 for $130 million exemplifies shedding non-core, low-growth assets. This move frees up capital for investment in more promising segments of Avanos's portfolio.

| Product Category | BCG Classification | Market Trend | Avanos Performance Indicators | Strategic Outlook |

|---|---|---|---|---|

| Hyaluronic Acid (HA) Pain Relief Injections | Dog | Slow Growth / Declining | Unfavorable pricing, reduced demand (2024-2025) | Potential cash trap, re-evaluation |

| Legacy/Undifferentiated Pain Management | Dog | Slow Growth / Declining | Weak market position, limited innovation | Divestiture or discontinuation likely |

| Game Ready Cold Compression Systems | Potential Dog / Question Mark | Slower Growth Niche | Sales volume dip (Q4 2024) | Strategic review needed |

Question Marks

Avanos launched several new products globally in 2024, aiming to tap into emerging market opportunities. While these innovations represent potential growth areas, their current market share is minimal, placing them squarely in the Question Mark category of the BCG Matrix. Detailed financial performance data for these specific launches is still emerging, making it difficult to assess their immediate impact.

The success of these new offerings hinges on aggressive marketing strategies and swift customer adoption. Without significant investment and a rapid increase in market penetration, these products risk transitioning into the Dog quadrant. For instance, if a new medical device faces slow reimbursement pathways or limited physician uptake, its trajectory could be negatively impacted.

Avanos is likely exploring emerging technologies in interventional pain, such as neuromodulation devices or advanced biologic therapies, which represent high-growth but currently low-market-share opportunities. These nascent technologies require significant investment in clinical validation and market development to transition into Stars within the BCG matrix.

Avanos’s digital health solutions for patient recovery and nutrition could be positioned as Question Marks in the BCG matrix. While the digital health market is experiencing robust growth, projected to reach over $678 billion globally by 2030, Avanos's current footprint in this area may be nascent, indicating a low market share.

These initiatives would necessitate significant investment in research and development, as well as aggressive marketing to gain traction against established players. The potential for high future growth exists, but the significant upfront capital and strategic focus required to cultivate these offerings are characteristic of Question Mark products.

Future M&A Opportunities in SNS/PM&R

Avanos is strategically eyeing future mergers and acquisitions within its key Digestive Health and Pain Management & Recovery (PM&R) segments. These targets are envisioned as high-potential businesses or product lines where Avanos currently holds a smaller market presence, fitting the profile of question marks in a BCG matrix.

The company's approach involves identifying these promising entities and then investing resources to nurture their growth, aiming to transform them into market-leading Stars. This strategy is crucial for sustained expansion and market share consolidation in these vital areas.

- Digestive Health: Avanos seeks to acquire companies with innovative solutions for gastrointestinal disorders, potentially targeting areas like advanced diagnostics or novel therapeutic delivery systems.

- Pain Management & Recovery (PM&R): Opportunities exist in acquiring businesses focused on non-opioid pain relief, advanced wound care technologies, or innovative rehabilitation equipment.

- Growth Prospects: The global digestive health market was projected to reach over $70 billion by 2024, while the PM&R sector, including physical therapy and sports medicine, is also experiencing robust growth, driven by an aging population and increased focus on active lifestyles.

- Strategic Fit: Acquisitions would complement Avanos' existing portfolio, offering synergistic benefits and expanding its reach into underserved or rapidly developing niches within these core categories.

Products in Under-Penetrated International Markets

Avanos's strategy involves identifying products that are performing well domestically but have limited penetration in promising international markets. These markets, often characterized by emerging economies or underserved patient populations, represent a key area for growth. For instance, while Avanos's surgical instrumentation might be a Star in North America, it could be a Question Mark in Southeast Asia, where healthcare infrastructure is still developing.

These under-penetrated international markets are ripe for expansion, but they demand a tailored approach. Avanos must invest in understanding local healthcare needs, building robust distribution networks, and navigating complex regulatory landscapes. A successful transition from Question Mark to Star in these regions hinges on strategic, localized investments. For example, in 2024, Avanos might have allocated significant capital to establish a direct sales force in India to promote its pain management solutions, a market where its current share is minimal but the demand for advanced therapies is growing rapidly.

- Low Market Share in High-Growth Regions: Products with strong domestic performance but minimal presence in international markets like parts of Asia or Africa.

- Significant Growth Potential: These markets offer substantial opportunities due to increasing healthcare spending and unmet medical needs.

- Investment Required: Success necessitates dedicated resources for localized marketing, distribution channel development, and regulatory compliance.

- Strategic Focus: Converting these Question Marks into Stars requires patient capital and a deep understanding of regional market dynamics.

Question Marks represent products or business units within Avanos that have low market share but operate in high-growth industries. These are often new product launches or ventures into emerging markets where significant investment is required to gain traction. Avanos's strategy involves carefully selecting these Question Marks, often through targeted acquisitions or internal R&D, with the aim of nurturing them into Stars.

For example, Avanos's exploration of digital health solutions for patient recovery and nutrition in 2024 exemplifies a Question Mark. While the digital health sector is booming, with global market projections exceeding $678 billion by 2030, Avanos's current presence in this specific niche is likely nascent. Similarly, new product launches in interventional pain, such as neuromodulation devices, are high-growth but currently low-market-share opportunities requiring substantial R&D and market development investment.

The company's focus on potential mergers and acquisitions in Digestive Health and Pain Management & Recovery (PM&R) also highlights its approach to Question Marks. By targeting companies with innovative solutions and smaller current market shares in these growing sectors—the digestive health market was projected to exceed $70 billion by 2024—Avanos aims to invest resources to transform them into market leaders.

Furthermore, products performing well domestically but having limited penetration in promising international markets, such as surgical instrumentation in Southeast Asia, are also classified as Question Marks. Avanos's 2024 allocation of capital to establish a direct sales force in India for pain management solutions underscores the strategic investment needed to convert these low-share, high-potential ventures into future Stars.

| Category | Example within Avanos | Market Growth | Current Market Share | Strategic Action |

| New Product Launches | Neuromodulation devices in interventional pain (2024) | High | Low | Aggressive marketing, clinical validation, market development |

| Emerging Technologies | Digital health solutions for patient recovery/nutrition | High (Global market >$678B by 2030) | Low | Significant R&D, market penetration investment |

| International Expansion | Surgical instrumentation in Southeast Asia | High | Low | Localized marketing, distribution network development, regulatory navigation |

| Acquisition Targets | Innovative GI disorder solutions (Digestive Health) | High (Digestive Health market >$70B by 2024) | Low | Capital investment, integration for growth |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including company financial reports, market growth rates, and competitive landscape analysis, to provide actionable strategic insights.